Key Insights

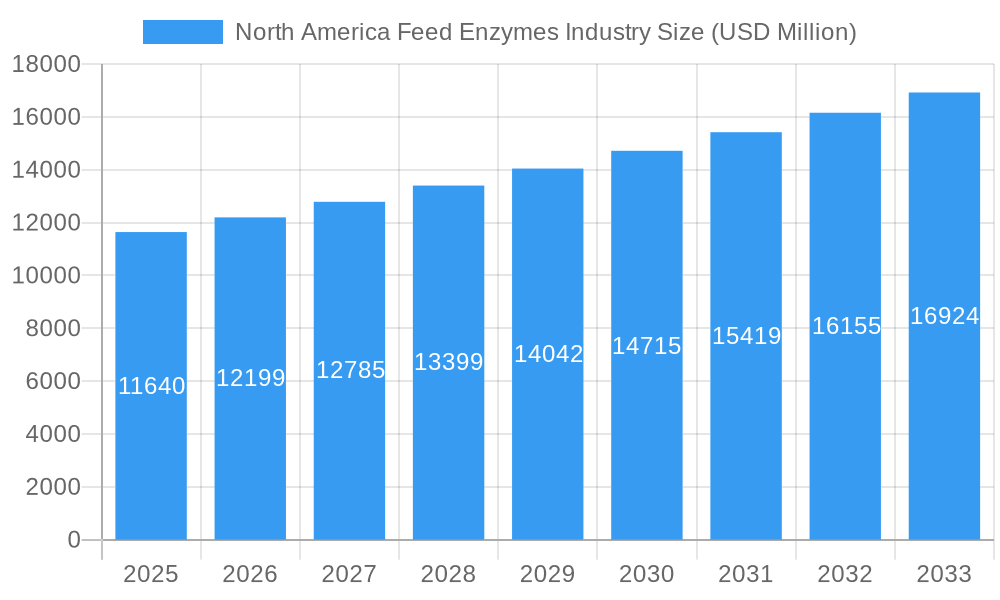

The North American feed enzymes market is poised for robust growth, projected to reach an estimated $11.64 billion in 2025. This expansion is driven by a CAGR of 4.8% over the forecast period of 2025-2033. Key growth catalysts include the increasing demand for improved animal nutrition and feed efficiency, the growing global protein consumption, and the rising awareness among livestock producers about the benefits of feed enzymes in enhancing animal health and reducing environmental impact. The poultry segment is anticipated to lead the market, owing to its significant contribution to overall meat production and the high adoption rates of feed enzymes to optimize growth and reduce feed costs. Furthermore, the aquaculture segment is emerging as a significant growth area, propelled by the expansion of fish and shrimp farming to meet escalating seafood demand. The market is also witnessing a growing preference for enzyme cocktails that offer synergistic benefits, improving overall feed digestibility and nutrient absorption across various animal species.

North America Feed Enzymes Industry Market Size (In Billion)

The market's trajectory is further shaped by ongoing research and development efforts focused on discovering novel enzymes with enhanced efficacy and stability. While growth is substantial, certain restraints, such as the fluctuating raw material costs for enzyme production and the initial investment required for enzyme incorporation, could pose challenges. However, the sustained innovation in enzyme technology, coupled with supportive regulatory landscapes and increasing government initiatives promoting sustainable animal agriculture, are expected to outweigh these constraints. Major players in the North American market are actively investing in expanding their production capacities, forging strategic partnerships, and introducing advanced enzyme formulations to cater to diverse animal feed requirements. The continuous drive towards precision nutrition and the imperative to reduce the environmental footprint of livestock farming will continue to fuel the demand for innovative feed enzyme solutions in North America.

North America Feed Enzymes Industry Company Market Share

North America Feed Enzymes Industry Report: Unlocking Growth and Innovation

This comprehensive report, "North America Feed Enzymes Industry Market Analysis: 2019–2033," provides an in-depth examination of the rapidly evolving feed enzymes market across North America. Leveraging a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, this report offers critical insights for stakeholders. It meticulously analyzes market structure, dynamics, dominant regions, product innovations, key drivers, challenges, emerging opportunities, and the competitive landscape. The report includes detailed segmentation by enzyme type (Carbohydrases, Phytases, Other Enzymes) and animal type (Aquaculture, Poultry, Ruminants, Swine, Other Animals), with specific sub-segments for each. For all monetary values, this report uses billions.

North America Feed Enzymes Industry Market Structure & Innovation Trends

The North America feed enzymes industry exhibits a moderately concentrated market structure, with a few key players holding significant market share. This concentration is driven by substantial R&D investments, the need for specialized manufacturing capabilities, and strong established distribution networks. Innovation is a primary driver, fueled by increasing demand for sustainable animal nutrition, improved feed efficiency, and reduced environmental impact from livestock farming. Regulatory frameworks, particularly concerning animal health, feed safety, and environmental sustainability, play a crucial role in shaping market entry and product development. Potential product substitutes, such as alternative feed additives or improved feed formulations, are continuously being explored, necessitating ongoing innovation from feed enzyme manufacturers. End-user demographics are shifting towards larger, more integrated animal production operations that prioritize technological advancements for enhanced productivity and profitability. Merger and acquisition (M&A) activities are prevalent as companies seek to expand their product portfolios, gain market access, and consolidate their positions. For instance, the acquisition of Agrivida by Novus International in January 2023 signifies strategic moves to enhance R&D capabilities. M&A deal values are expected to contribute billions to market consolidation over the forecast period.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized enzyme producers.

- Innovation Drivers: Sustainability, feed efficiency, gut health, reduced antibiotic use, and environmental compliance.

- Regulatory Frameworks: FDA regulations, environmental protection agencies, and industry-specific quality standards.

- Product Substitutes: Probiotics, prebiotics, organic acids, and advanced feed formulations.

- End-User Demographics: Growing preference for large-scale, technologically advanced, and sustainability-focused animal husbandry operations.

- M&A Activities: Strategic acquisitions and partnerships to enhance market reach and technological capabilities.

North America Feed Enzymes Industry Market Dynamics & Trends

The North America feed enzymes industry is experiencing robust growth, with an estimated compound annual growth rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is primarily propelled by the escalating global demand for animal protein, coupled with an increasing awareness among livestock producers regarding the multifaceted benefits of incorporating feed enzymes into animal diets. These benefits include enhanced nutrient digestibility, improved feed conversion ratios (FCR), and a significant reduction in feed costs, directly impacting the profitability of animal operations. Technological advancements are a cornerstone of market dynamics, with continuous research and development leading to the introduction of novel enzyme formulations tailored to specific animal needs and feed ingredients. For example, the development of multi-enzyme complexes that can degrade a broader range of anti-nutritional factors in plant-based feedstuffs is gaining traction. Consumer preferences are increasingly steering towards products derived from animals raised with sustainable practices and without the routine use of antibiotics, further bolstering the demand for feed enzymes as natural growth promoters and immune boosters. The competitive landscape is intensifying, characterized by strategic collaborations, product innovation, and an emphasis on providing comprehensive animal nutrition solutions. Companies are investing heavily in R&D to develop enzymes that address emerging challenges such as climate change adaptation in livestock and the utilization of alternative feed ingredients like insect protein. Market penetration is steadily increasing across all animal segments, with poultry and swine leading the adoption due to their high feed intake and rapid growth cycles. The economic viability of feed enzymes, demonstrated through improved FCR and reduced waste, makes them an indispensable tool for modern animal agriculture. Furthermore, the growing concern over the environmental footprint of livestock farming, including greenhouse gas emissions and nutrient runoff, is driving the adoption of enzymes that improve nutrient utilization and reduce waste excretion. The expansion of aquaculture, driven by increasing demand for seafood, also presents a significant growth avenue for specialized feed enzymes. The strategic investment by Cargill in its Global Animal Nutrition Center in April 2022, focusing on a new dairy innovation unit and R&D, underscores the industry's commitment to innovation and addressing specific regional animal production needs. This sustained focus on R&D and market expansion is expected to maintain the industry's upward trajectory.

Dominant Regions & Segments in North America Feed Enzymes Industry

The United States stands as the dominant region within the North America feed enzymes industry, driven by its large-scale animal production, significant agricultural output, and strong emphasis on technological adoption. Its extensive livestock and poultry sectors, coupled with a robust R&D infrastructure and a receptive market for innovative feed solutions, solidify its leading position. Within the United States, the Poultry segment, particularly Broiler production, consistently exhibits the highest demand for feed enzymes. This dominance is attributed to the high feed intake and rapid growth cycles of broilers, where even marginal improvements in feed efficiency translate into substantial cost savings and increased profitability. Carbohydrases and phytases are particularly crucial for poultry diets, breaking down anti-nutritional factors in common feed ingredients like corn and soybeans.

Key Drivers of Dominance in the United States:

- Economic Policies: Government support for agriculture, research grants, and favorable trade policies.

- Infrastructure: Advanced transportation networks, large-scale feed mills, and well-established animal husbandry operations.

- R&D Investment: Significant private and public sector investments in animal nutrition research.

- Consumer Demand: Growing demand for animal protein and an increasing preference for sustainably produced meat, eggs, and dairy.

Within the enzyme segments, Phytases are a cornerstone of the feed enzyme market due to their critical role in improving phosphorus availability and reducing phosphorus excretion, thereby mitigating environmental pollution. The Poultry segment heavily relies on phytases for optimal growth and bone development.

In the Animal segmentation, beyond Poultry, the Swine sector also represents a significant and growing market for feed enzymes. Swine producers benefit immensely from enzymes that enhance the digestibility of proteins and carbohydrates, leading to improved growth rates and reduced feed conversion ratios. The expansion of the Aquaculture segment, particularly Fish and Shrimp farming, presents a rapidly growing opportunity, with specialized enzymes being developed to optimize nutrient utilization in aquatic feed formulations. The Ruminant segment, encompassing Beef Cattle and Dairy Cattle, is also witnessing increased enzyme adoption, with focus on enzymes that improve fiber digestion and overall gut health, leading to higher milk yields and better animal performance.

- Leading Enzyme Sub-Additive: Phytases, owing to their environmental and nutritional benefits.

- Dominant Animal Segment: Poultry (Broilers), due to high volume and efficiency demands.

- Emerging Animal Segments: Aquaculture (Fish, Shrimp) and advanced Ruminant nutrition.

North America Feed Enzymes Industry Product Innovations

Product innovations in the North America feed enzymes industry are primarily focused on enhancing the efficacy and specificity of enzymes. This includes the development of multi-enzyme cocktails that address a wider range of anti-nutritional factors and substrate types in diverse feed ingredients. Thermostable enzymes, capable of withstanding feed processing temperatures, are crucial for maintaining their activity. Furthermore, advancements in enzyme delivery systems, such as encapsulation technologies, are improving their stability and targeted release within the animal's digestive tract. The focus is also shifting towards enzymes that promote gut health, reduce inflammation, and bolster the immune response, thereby decreasing the reliance on antibiotics. This innovation drive is supported by significant R&D investments from key players like DSM Nutritional Products AG and BASF SE, who are continuously introducing novel solutions that offer improved performance and sustainability benefits to the animal nutrition sector.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the North America Feed Enzymes Industry, segmented across key areas.

Sub Additive Segmentation:

- Carbohydrases: Focuses on enzymes like xylanases and beta-glucanases, crucial for breaking down non-starch polysaccharides in grains, particularly relevant for poultry and swine diets. Growth projections indicate sustained demand due to their role in improving feed digestibility and reducing viscosity.

- Phytases: Analyzes the market for enzymes that unlock phosphorus from phytate, a critical factor in animal nutrition and environmental sustainability. This segment is expected to witness robust growth driven by regulatory pressures and the economic benefits of reduced phosphorus supplementation.

- Other Enzymes: Encompasses a range of enzymes such as proteases, lipases, and cellulases, catering to specific nutritional needs and feed ingredients across various animal species. This segment offers significant growth potential as specialized enzyme solutions become more prevalent.

Animal Segmentation:

- Aquaculture: Analyzes the growing demand for enzymes in fish and shrimp feed, focusing on improving digestion and growth rates in aquatic species. This segment is projected for high growth due to increasing seafood consumption.

- Poultry: Details the significant market for enzymes in broiler and layer diets, driven by the need for enhanced feed efficiency, reduced costs, and improved bird health. This segment is expected to maintain strong, consistent growth.

- Ruminants: Examines the increasing adoption of enzymes in beef and dairy cattle feed, targeting improved fiber digestion and nutrient utilization. This segment shows promising growth as producers seek to optimize herd performance.

- Swine: Highlights the substantial market for enzymes in piglet and finishing pig diets, focusing on improving protein and carbohydrate digestibility. This segment is a key driver of overall market expansion.

- Other Animals: Covers niche applications and emerging markets for feed enzymes in various animal species.

Key Drivers of North America Feed Enzymes Industry Growth

The North America feed enzymes industry is experiencing significant growth fueled by several interconnected factors.

- Growing Demand for Animal Protein: A burgeoning global population and rising disposable incomes are escalating the demand for meat, dairy, and eggs, directly increasing the need for efficient animal feed.

- Technological Advancements: Continuous R&D is yielding more effective, stable, and targeted enzyme solutions, improving feed conversion ratios and nutrient utilization.

- Focus on Sustainability: Feed enzymes contribute to a reduced environmental footprint by improving nutrient absorption, decreasing waste, and potentially lowering greenhouse gas emissions from livestock.

- Cost Optimization: Enhanced feed efficiency achieved through enzymes directly translates to lower feed costs for producers, a critical factor in an industry with tight margins.

- Animal Health and Welfare: Enzymes improve gut health, reduce the incidence of digestive disorders, and can lessen the reliance on antibiotic growth promoters, aligning with consumer concerns and regulatory trends.

Challenges in the North America Feed Enzymes Industry Sector

Despite its promising growth, the North America feed enzymes industry faces several challenges that can hinder its full potential.

- Regulatory Hurdles: Navigating complex and varying regulatory approval processes for new enzyme products across different regions and countries can be time-consuming and costly.

- Supply Chain Volatility: Disruptions in raw material availability or logistics can impact production and the consistent supply of enzymes to end-users.

- Perceived Cost vs. Value: Some producers may still be hesitant to adopt enzymes due to upfront costs, requiring greater education and demonstration of long-term return on investment.

- Development of Resistance/Inertia: While less common, the possibility of gut microbes adapting to specific enzymes over extended periods could necessitate ongoing innovation and product diversification.

- Competition from Alternatives: The continuous development of alternative feed additives and nutritional strategies could pose a competitive threat, requiring feed enzyme manufacturers to remain at the forefront of innovation.

Emerging Opportunities in North America Feed Enzymes Industry

The North America feed enzymes industry is ripe with emerging opportunities that can drive further growth and market expansion.

- Novel Enzyme Applications: Development of enzymes targeting specific health challenges, such as reducing inflammation, improving immune response, or enhancing nutrient absorption in stressed animals, presents significant untapped potential.

- Sustainable Feed Ingredients: As the industry explores alternative and sustainable feed sources (e.g., insect protein, algae), there is a growing need for enzymes that can efficiently break down these novel ingredients and unlock their nutritional value.

- Precision Nutrition: Advancements in diagnostics and data analytics are paving the way for precision feeding strategies, where enzymes can be tailored and dosed precisely based on individual animal needs and feed compositions.

- Expansion in Under-penetrated Segments: While poultry and swine are dominant, there is substantial room for growth in aquaculture and ruminant nutrition as awareness and adoption rates increase.

- Geographic Expansion: Exploring and developing markets in emerging economies within North America that are experiencing growth in their livestock sectors.

Leading Players in the North America Feed Enzymes Industry Market

- Brenntag SE

- DSM Nutritional Products AG

- Elanco Animal Health Inc

- Novus International Inc

- Archer Daniel Midland Co

- BASF SE

- Alltech Inc

- Cargill Inc

- IFF (Danisco Animal Nutrition)

- Adisseo

Key Developments in North America Feed Enzymes Industry Industry

- January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives, indicating a strategic move to bolster its R&D capabilities and expand its product portfolio in innovative feed solutions.

- June 2022: Brenntag established a new office in the United States to operate in North and South American markets. This expansion aims to consolidate various functional teams, foster collaboration, and boost innovation across its extensive distribution network.

- April 2022: Cargill expanded its Global Animal Nutrition Center in the United States with an investment of USD 50 million. This expansion includes the development of a new dairy innovation unit and a Research and Development (R&D) center, signifying a commitment to advanced solutions for the animal nutrition sector.

Future Outlook for North America Feed Enzymes Industry Market

The future outlook for the North America feed enzymes industry is exceptionally promising, poised for sustained and robust growth. The increasing emphasis on sustainable animal agriculture, driven by both consumer demand and regulatory pressures, will continue to be a primary growth accelerator. Innovations in enzyme technology, leading to more effective and targeted solutions for improved nutrient utilization, gut health, and reduced environmental impact, will further solidify the market's expansion. The growing adoption of enzymes in under-penetrated segments like aquaculture and ruminant nutrition presents significant untapped potential. Furthermore, the trend towards precision nutrition, enabled by advancements in data analytics and animal health monitoring, will create opportunities for highly customized enzyme applications. Strategic partnerships and M&A activities are expected to continue, fostering market consolidation and driving technological advancements. Overall, the industry is on a trajectory to become an indispensable component of modern animal husbandry, contributing billions to economic growth while promoting healthier animals and a more sustainable food system.

North America Feed Enzymes Industry Segmentation

-

1. Sub Additive

- 1.1. Carbohydrases

- 1.2. Phytases

- 1.3. Other Enzymes

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

North America Feed Enzymes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Feed Enzymes Industry Regional Market Share

Geographic Coverage of North America Feed Enzymes Industry

North America Feed Enzymes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Feed Enzymes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Carbohydrases

- 5.1.2. Phytases

- 5.1.3. Other Enzymes

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Brenntag SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DSM Nutritional Products AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elanco Animal Health Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novus International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniel Midland Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alltech Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cargill Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Brenntag SE

List of Figures

- Figure 1: North America Feed Enzymes Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Feed Enzymes Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Feed Enzymes Industry Revenue undefined Forecast, by Sub Additive 2020 & 2033

- Table 2: North America Feed Enzymes Industry Revenue undefined Forecast, by Animal 2020 & 2033

- Table 3: North America Feed Enzymes Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Feed Enzymes Industry Revenue undefined Forecast, by Sub Additive 2020 & 2033

- Table 5: North America Feed Enzymes Industry Revenue undefined Forecast, by Animal 2020 & 2033

- Table 6: North America Feed Enzymes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Feed Enzymes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Feed Enzymes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Feed Enzymes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Feed Enzymes Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the North America Feed Enzymes Industry?

Key companies in the market include Brenntag SE, DSM Nutritional Products AG, Elanco Animal Health Inc, Novus International Inc, Archer Daniel Midland Co, BASF SE, Alltech Inc, Cargill Inc, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the North America Feed Enzymes Industry?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives.June 2022: Brenntag established a new office in the United States to operate in North and South American markets. The new corporate office will combine the many functional teams and boost innovation.April 2022: Cargill expanded its Global Animal Nutrition Center in the United States with an investment of USD 50 million to develop a new dairy innovation unit and a Research and Development (R&D) center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Feed Enzymes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Feed Enzymes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Feed Enzymes Industry?

To stay informed about further developments, trends, and reports in the North America Feed Enzymes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence