Key Insights

The Asia-Pacific (APAC) hydropower market is projected for significant expansion, driven by escalating energy needs, a firm commitment to renewable energy to address climate change, and supportive government policies for sustainable power generation. Valued at approximately $98.5 billion in 2023, the market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 12.1%. Key growth factors include the critical requirement for grid stability, the decreasing costs of renewable energy technologies, and substantial untapped hydropower potential across numerous nations. China and India are at the forefront of this development, supported by large-scale infrastructure projects and a strategic aim to reduce dependence on fossil fuels. Advancements in turbine efficiency and dam construction are further enhancing market momentum, making even smaller hydropower projects economically feasible.

APAC Hydropower Industry Market Size (In Billion)

The APAC hydropower market confronts certain challenges. These encompass substantial initial capital investment, rigorous environmental regulations and lengthy permitting procedures that can impede project timelines, and potential socio-ecological consequences, including community displacement and alterations to riverine ecosystems. While large-scale hydropower projects currently dominate, particularly in countries like China, there is an emerging trend towards small hydropower development, catering to regions with smaller water bodies and decentralized energy demands. The competitive environment features a blend of major state-owned enterprises and international corporations competing for market share. Continued investment in hydropower infrastructure is vital for APAC to meet its clean energy objectives and secure energy for its growing populations.

APAC Hydropower Industry Company Market Share

APAC Hydropower Industry Market Outlook: Growth Drivers, Innovations, and Leading Players (2019-2033)

This comprehensive market research report provides an in-depth analysis of the APAC Hydropower Industry, covering market size, segmentation, key trends, drivers, challenges, and a detailed future outlook. Leveraging high-ranking keywords such as "Asia Pacific Hydropower," "Renewable Energy APAC," "Hydropower Market Size," and "Hydropower Development," this report is meticulously crafted to boost search visibility and offer actionable insights for industry professionals, investors, and policymakers. Our extensive study period of 2019–2033, with a base year of 2025, offers robust historical context and forward-looking projections. The report delves into the intricate market dynamics, showcasing the significant CAGR projected for the sector and pinpointing emerging opportunities for sustainable growth.

APAC Hydropower Industry Market Structure & Innovation Trends

The APAC Hydropower Industry exhibits a moderately consolidated market structure, with a significant presence of state-owned enterprises and multinational corporations driving innovation and large-scale projects. Market concentration is influenced by government policies and the capital-intensive nature of hydropower development. Key innovation drivers include advancements in turbine efficiency, smart grid integration, and the development of smaller-scale, decentralized hydropower solutions to complement large-scale infrastructure. Regulatory frameworks are crucial, with many nations actively promoting renewable energy targets, including hydropower, through supportive policies and incentives. Product substitutes, such as solar and wind power, are increasingly competitive, necessitating continuous innovation in hydropower technology to maintain its market share. End-user demographics are diverse, ranging from national grids seeking stable baseload power to rural communities benefiting from localized energy solutions. Mergers and acquisition (M&A) activities, while not as frequent as in other sectors, are strategically focused on acquiring technological capabilities or expanding geographical reach. For instance, major M&A deals within the historical period of 2019–2024 have been observed to consolidate market leadership and secure project pipelines, with estimated deal values often in the hundreds of Million. The Forecast Period of 2025–2033 is expected to see continued strategic investments, particularly in regions with high untapped hydropower potential.

APAC Hydropower Industry Market Dynamics & Trends

The APAC Hydropower Industry is poised for substantial growth, driven by an escalating demand for clean and reliable energy across the region. The CAGR for the Forecast Period of 2025–2033 is projected to be robust, significantly exceeding xx%, indicating a strong upward trajectory. This expansion is fueled by a confluence of factors, including the imperative to meet rising energy consumption due to rapid industrialization and urbanization, coupled with a global push towards decarbonization and reducing reliance on fossil fuels. Technological disruptions are playing a pivotal role, with innovations in turbine design, dam construction materials, and digital monitoring systems enhancing efficiency, safety, and environmental sustainability. For example, advancements in pumped-storage hydropower are opening new avenues for grid stability and energy storage solutions, crucial for integrating intermittent renewable sources like solar and wind.

Consumer preferences are increasingly leaning towards sustainable energy sources, making hydropower an attractive option due to its low operational emissions and long lifespan. Governments across APAC are actively supporting this shift through favorable policies, subsidies, and renewable energy mandates, thereby increasing hydropower's market penetration. The competitive dynamics within the industry are characterized by a mix of established players with extensive experience and new entrants focusing on niche segments or innovative technologies. Competition is intensifying, particularly in the small and micro hydropower segments, where localized solutions are gaining traction. The Estimated Year of 2025 market size is expected to reach an impressive figure, reflecting the sustained investment and development activities. The continuous evolution of energy markets and the growing awareness of climate change impacts are further solidifying hydropower's position as a cornerstone of the APAC energy transition.

Dominant Regions & Segments in APAC Hydropower Industry

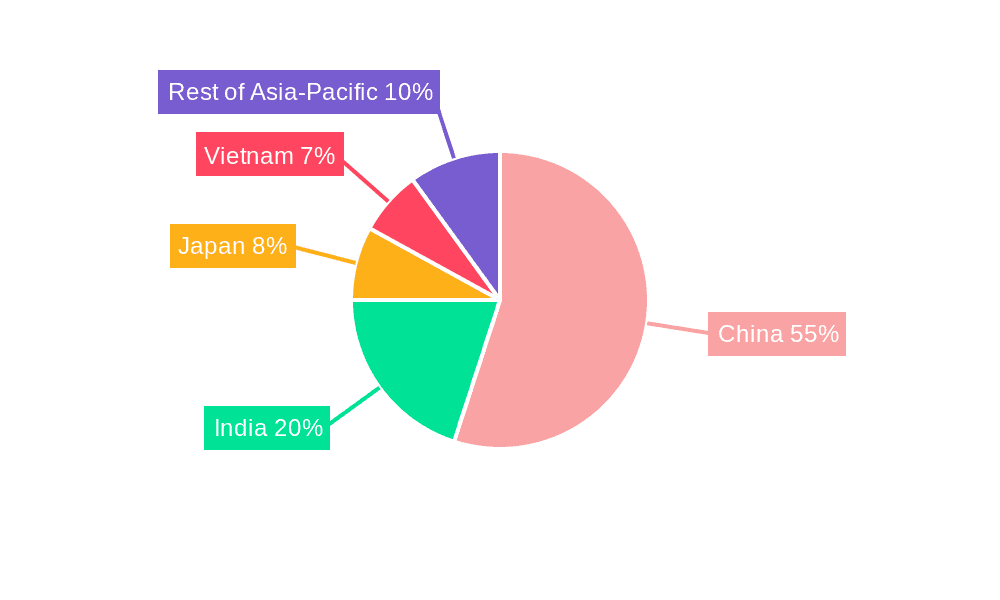

China stands out as the dominant region in the APAC Hydropower Industry, spearheading development with a combination of massive Large Hydropower projects and a growing portfolio of smaller installations. Its unparalleled geographical advantage, abundant water resources, and strong government backing have cemented its leading position. India follows closely, with significant investments in both large-scale and small hydropower to meet its vast and growing energy demands. Japan, while a mature market, continues to focus on modernizing existing facilities and exploring niche hydropower opportunities. Vietnam is emerging as a key growth market, leveraging its river systems to expand its renewable energy capacity. The Rest of Asia-Pacific encompasses a diverse range of countries with varying levels of hydropower development, presenting both challenges and opportunities.

Within the segmentation by Size, Large Hydropower projects continue to dominate in terms of installed capacity and investment value, primarily driven by national energy security goals and the need for baseload power. However, Small Hydropower is witnessing considerable growth, fueled by the increasing demand for decentralized power solutions, rural electrification initiatives, and a more streamlined regulatory approval process in many countries. Other Sizes, encompassing micro and mini hydropower, are also gaining traction for their applicability in remote areas and their lower environmental impact.

- China:

- Key Drivers: Ambitious renewable energy targets, massive investment in infrastructure, technological prowess in dam construction and turbine manufacturing.

- Dominance: Leads in installed capacity, number of large-scale projects, and technological innovation in hydropower.

- India:

- Key Drivers: Growing energy demand, government initiatives to boost renewable energy, significant untapped hydropower potential.

- Dominance: Second largest market for hydropower, with substantial ongoing and planned projects.

- Japan:

- Key Drivers: Focus on energy security, modernization of aging infrastructure, development of pumped-storage hydropower for grid stability.

- Dominance: Mature market with a strong emphasis on efficiency and advanced technologies.

- Vietnam:

- Key Drivers: Abundant river systems, increasing electricity demand, supportive government policies for renewable energy.

- Dominance: Rapidly growing market with significant potential for new hydropower projects.

- Rest of Asia-Pacific:

- Key Drivers: Diverse economic growth, varying levels of policy support, unique geographical and hydrological conditions.

- Dominance: Presents varied opportunities across countries like Indonesia, the Philippines, and Thailand, each with specific development focuses.

APAC Hydropower Industry Product Innovations

Product innovations in the APAC Hydropower Industry are increasingly focused on enhancing efficiency, environmental compatibility, and grid integration. Turbine designs are evolving to optimize energy generation across a wider range of water flows, including variable and low-head conditions prevalent in many small hydropower applications. Advanced materials are being utilized to improve durability and reduce maintenance requirements. Smart grid technologies are being integrated to enable real-time monitoring, predictive maintenance, and seamless interaction with other renewable energy sources. The development of modular and scalable hydropower systems is also a key trend, allowing for quicker deployment and adaptability to specific site requirements. These innovations aim to reduce the levelized cost of electricity from hydropower, making it more competitive and expanding its applicability across diverse geographical and economic landscapes.

Report Scope & Segmentation Analysis

This report meticulously segments the APAC Hydropower Industry across key dimensions, providing granular insights into market dynamics and growth trajectories. The segmentation by Size includes Large Hydropower, characterized by substantial installed capacity and significant investment, driving the bulk of the region's hydropower generation. Small Hydropower represents a rapidly growing segment, focusing on decentralized energy solutions and rural electrification, with projected market sizes expected to see a significant increase in the forecast period. Other Sizes, encompassing micro and mini hydropower, cater to niche applications and remote areas, offering localized and sustainable energy. Geographically, the report analyzes the China market as a dominant force, followed by India, both exhibiting strong growth potential. Japan represents a mature market with a focus on modernization and efficiency, while Vietnam emerges as a rapidly expanding market. The Rest of Asia-Pacific segment captures the collective opportunities and challenges across diverse economies, each contributing uniquely to the overall market landscape and future competitive dynamics.

Key Drivers of APAC Hydropower Industry Growth

The APAC Hydropower Industry is propelled by several interconnected growth drivers. Foremost is the burgeoning energy demand across the region, driven by rapid economic development and increasing industrialization. Governments are actively pursuing renewable energy targets to combat climate change and ensure energy security, with hydropower being a reliable and established source. Technological advancements in turbine efficiency, dam construction, and grid integration are making projects more viable and cost-effective. Furthermore, the declining costs of renewable energy, coupled with supportive policy frameworks such as feed-in tariffs and tax incentives, are attracting significant investment. The inherent advantages of hydropower, including its long lifespan, dispatchability, and low operational carbon footprint, further solidify its role in the region's energy mix.

Challenges in the APAC Hydropower Industry Sector

Despite its growth potential, the APAC Hydropower Industry faces several significant challenges. Environmental and social concerns, including potential impacts on ecosystems, fish migration, and local communities, often lead to lengthy approval processes and public opposition. High upfront capital costs and long gestation periods for large-scale projects present financial hurdles for developers. Regulatory complexities and inconsistencies across different countries can create uncertainty and deter investment. Geopolitical risks and water resource variability due to climate change can impact project viability and operational reliability. Additionally, competition from other renewable energy sources like solar and wind, which have seen significant cost reductions, presents a competitive pressure. Supply chain disruptions and the availability of skilled labor can also pose localized challenges.

Emerging Opportunities in APAC Hydropower Industry

Emerging opportunities within the APAC Hydropower Industry lie in several key areas. The expansion of pumped-storage hydropower (PSH) presents a significant opportunity for grid stabilization and large-scale energy storage, crucial for integrating intermittent renewables. There is also a growing market for the modernization and upgrade of existing hydropower facilities, enhancing their efficiency and extending their operational life. The development of small and micro hydropower projects in rural and remote areas offers a sustainable solution for energy access and economic development. Furthermore, innovations in digitalization and smart hydropower solutions, including advanced monitoring and predictive maintenance, are creating new avenues for operational efficiency and cost reduction. Cross-border hydropower projects and regional cooperation frameworks also represent untapped potential for shared resource utilization and enhanced energy security.

Leading Players in the APAC Hydropower Industry Market

- PowerChina

- PT Perusahaan Listrik Negara

- General Electric Company (GE Renewable Energy)

- China Yangtze Power Co Ltd

- Electricity Generating Authority of Thailand

- Aboitiz Power Corporation

- NTPC Limited

- NHPC Ltd

- Tenaga Nasional Berhad

- Tokyo Electric Power Company Holdings Inc

Key Developments in APAC Hydropower Industry Industry

- July 2022: The Development Bank of the Philippines (DBP) approved USD 11.7 million in funding to support the development of the 4.6 MW Dupinga Mini Hydropower project in Gabaldon, Nueva Ecija, in the Philippines. The DBP's financing of the Dupinga Project will help the government reach its 30% renewable energy goal by 2030.

- March 2022: International technology Group ANDRITZ and the Electricity Generating Authority of Thailand (EGAT) signed a Memorandum of Understanding (MoU) to expand and explore business opportunities for hydropower projects in Thailand and surrounding countries.

Future Outlook for APAC Hydropower Industry Market

The future outlook for the APAC Hydropower Industry is overwhelmingly positive, driven by an accelerating transition towards sustainable energy solutions. The Forecast Period of 2025–2033 is expected to witness significant growth, fueled by governmental commitments to decarbonization and the increasing demand for reliable power. Innovations in pumped-storage hydropower will be crucial for grid stability as renewable energy penetration increases. Investments in modernizing existing infrastructure and developing new, environmentally conscious projects will continue. The sector's ability to provide baseload power, coupled with its low operational carbon footprint, positions it as a vital component of the region's future energy mix. Strategic partnerships, technological advancements, and supportive regulatory environments will be key accelerators in unlocking the full potential of hydropower across the diverse economies of Asia Pacific.

APAC Hydropower Industry Segmentation

-

1. Size

- 1.1. Large Hydropower

- 1.2. Small Hydropower

- 1.3. Other Sizes

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Vietnam

- 2.5. Rest of Asia-Pacific

APAC Hydropower Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Vietnam

- 5. Rest of Asia Pacific

APAC Hydropower Industry Regional Market Share

Geographic Coverage of APAC Hydropower Industry

APAC Hydropower Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Small Hydropower Segment Anticipated to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Hydropower Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Large Hydropower

- 5.1.2. Small Hydropower

- 5.1.3. Other Sizes

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. Vietnam

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Vietnam

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. China APAC Hydropower Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Large Hydropower

- 6.1.2. Small Hydropower

- 6.1.3. Other Sizes

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. Vietnam

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. India APAC Hydropower Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Large Hydropower

- 7.1.2. Small Hydropower

- 7.1.3. Other Sizes

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. Vietnam

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Japan APAC Hydropower Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Large Hydropower

- 8.1.2. Small Hydropower

- 8.1.3. Other Sizes

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Vietnam

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Vietnam APAC Hydropower Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Large Hydropower

- 9.1.2. Small Hydropower

- 9.1.3. Other Sizes

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. Vietnam

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Rest of Asia Pacific APAC Hydropower Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Large Hydropower

- 10.1.2. Small Hydropower

- 10.1.3. Other Sizes

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. Vietnam

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PowerChina

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PT Perusahaan Listrik Negara

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Electric Company (GE Renewable Energy)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Yangtze Power Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Electricity Generating Authority of Thailand

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aboitiz Power Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NTPC Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NHPC Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tenaga Nasional Berhad

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tokyo Electric Power Company Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PowerChina

List of Figures

- Figure 1: Global APAC Hydropower Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global APAC Hydropower Industry Volume Breakdown (terawatt, %) by Region 2025 & 2033

- Figure 3: China APAC Hydropower Industry Revenue (billion), by Size 2025 & 2033

- Figure 4: China APAC Hydropower Industry Volume (terawatt), by Size 2025 & 2033

- Figure 5: China APAC Hydropower Industry Revenue Share (%), by Size 2025 & 2033

- Figure 6: China APAC Hydropower Industry Volume Share (%), by Size 2025 & 2033

- Figure 7: China APAC Hydropower Industry Revenue (billion), by Geography 2025 & 2033

- Figure 8: China APAC Hydropower Industry Volume (terawatt), by Geography 2025 & 2033

- Figure 9: China APAC Hydropower Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China APAC Hydropower Industry Volume Share (%), by Geography 2025 & 2033

- Figure 11: China APAC Hydropower Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: China APAC Hydropower Industry Volume (terawatt), by Country 2025 & 2033

- Figure 13: China APAC Hydropower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: China APAC Hydropower Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: India APAC Hydropower Industry Revenue (billion), by Size 2025 & 2033

- Figure 16: India APAC Hydropower Industry Volume (terawatt), by Size 2025 & 2033

- Figure 17: India APAC Hydropower Industry Revenue Share (%), by Size 2025 & 2033

- Figure 18: India APAC Hydropower Industry Volume Share (%), by Size 2025 & 2033

- Figure 19: India APAC Hydropower Industry Revenue (billion), by Geography 2025 & 2033

- Figure 20: India APAC Hydropower Industry Volume (terawatt), by Geography 2025 & 2033

- Figure 21: India APAC Hydropower Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 22: India APAC Hydropower Industry Volume Share (%), by Geography 2025 & 2033

- Figure 23: India APAC Hydropower Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: India APAC Hydropower Industry Volume (terawatt), by Country 2025 & 2033

- Figure 25: India APAC Hydropower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: India APAC Hydropower Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Japan APAC Hydropower Industry Revenue (billion), by Size 2025 & 2033

- Figure 28: Japan APAC Hydropower Industry Volume (terawatt), by Size 2025 & 2033

- Figure 29: Japan APAC Hydropower Industry Revenue Share (%), by Size 2025 & 2033

- Figure 30: Japan APAC Hydropower Industry Volume Share (%), by Size 2025 & 2033

- Figure 31: Japan APAC Hydropower Industry Revenue (billion), by Geography 2025 & 2033

- Figure 32: Japan APAC Hydropower Industry Volume (terawatt), by Geography 2025 & 2033

- Figure 33: Japan APAC Hydropower Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 34: Japan APAC Hydropower Industry Volume Share (%), by Geography 2025 & 2033

- Figure 35: Japan APAC Hydropower Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Japan APAC Hydropower Industry Volume (terawatt), by Country 2025 & 2033

- Figure 37: Japan APAC Hydropower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Japan APAC Hydropower Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Vietnam APAC Hydropower Industry Revenue (billion), by Size 2025 & 2033

- Figure 40: Vietnam APAC Hydropower Industry Volume (terawatt), by Size 2025 & 2033

- Figure 41: Vietnam APAC Hydropower Industry Revenue Share (%), by Size 2025 & 2033

- Figure 42: Vietnam APAC Hydropower Industry Volume Share (%), by Size 2025 & 2033

- Figure 43: Vietnam APAC Hydropower Industry Revenue (billion), by Geography 2025 & 2033

- Figure 44: Vietnam APAC Hydropower Industry Volume (terawatt), by Geography 2025 & 2033

- Figure 45: Vietnam APAC Hydropower Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Vietnam APAC Hydropower Industry Volume Share (%), by Geography 2025 & 2033

- Figure 47: Vietnam APAC Hydropower Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Vietnam APAC Hydropower Industry Volume (terawatt), by Country 2025 & 2033

- Figure 49: Vietnam APAC Hydropower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Vietnam APAC Hydropower Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Hydropower Industry Revenue (billion), by Size 2025 & 2033

- Figure 52: Rest of Asia Pacific APAC Hydropower Industry Volume (terawatt), by Size 2025 & 2033

- Figure 53: Rest of Asia Pacific APAC Hydropower Industry Revenue Share (%), by Size 2025 & 2033

- Figure 54: Rest of Asia Pacific APAC Hydropower Industry Volume Share (%), by Size 2025 & 2033

- Figure 55: Rest of Asia Pacific APAC Hydropower Industry Revenue (billion), by Geography 2025 & 2033

- Figure 56: Rest of Asia Pacific APAC Hydropower Industry Volume (terawatt), by Geography 2025 & 2033

- Figure 57: Rest of Asia Pacific APAC Hydropower Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 58: Rest of Asia Pacific APAC Hydropower Industry Volume Share (%), by Geography 2025 & 2033

- Figure 59: Rest of Asia Pacific APAC Hydropower Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Rest of Asia Pacific APAC Hydropower Industry Volume (terawatt), by Country 2025 & 2033

- Figure 61: Rest of Asia Pacific APAC Hydropower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Rest of Asia Pacific APAC Hydropower Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Hydropower Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 2: Global APAC Hydropower Industry Volume terawatt Forecast, by Size 2020 & 2033

- Table 3: Global APAC Hydropower Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Hydropower Industry Volume terawatt Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Hydropower Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global APAC Hydropower Industry Volume terawatt Forecast, by Region 2020 & 2033

- Table 7: Global APAC Hydropower Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 8: Global APAC Hydropower Industry Volume terawatt Forecast, by Size 2020 & 2033

- Table 9: Global APAC Hydropower Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Hydropower Industry Volume terawatt Forecast, by Geography 2020 & 2033

- Table 11: Global APAC Hydropower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global APAC Hydropower Industry Volume terawatt Forecast, by Country 2020 & 2033

- Table 13: Global APAC Hydropower Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 14: Global APAC Hydropower Industry Volume terawatt Forecast, by Size 2020 & 2033

- Table 15: Global APAC Hydropower Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Hydropower Industry Volume terawatt Forecast, by Geography 2020 & 2033

- Table 17: Global APAC Hydropower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global APAC Hydropower Industry Volume terawatt Forecast, by Country 2020 & 2033

- Table 19: Global APAC Hydropower Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 20: Global APAC Hydropower Industry Volume terawatt Forecast, by Size 2020 & 2033

- Table 21: Global APAC Hydropower Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Global APAC Hydropower Industry Volume terawatt Forecast, by Geography 2020 & 2033

- Table 23: Global APAC Hydropower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global APAC Hydropower Industry Volume terawatt Forecast, by Country 2020 & 2033

- Table 25: Global APAC Hydropower Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 26: Global APAC Hydropower Industry Volume terawatt Forecast, by Size 2020 & 2033

- Table 27: Global APAC Hydropower Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global APAC Hydropower Industry Volume terawatt Forecast, by Geography 2020 & 2033

- Table 29: Global APAC Hydropower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global APAC Hydropower Industry Volume terawatt Forecast, by Country 2020 & 2033

- Table 31: Global APAC Hydropower Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 32: Global APAC Hydropower Industry Volume terawatt Forecast, by Size 2020 & 2033

- Table 33: Global APAC Hydropower Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Global APAC Hydropower Industry Volume terawatt Forecast, by Geography 2020 & 2033

- Table 35: Global APAC Hydropower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global APAC Hydropower Industry Volume terawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Hydropower Industry?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the APAC Hydropower Industry?

Key companies in the market include PowerChina, PT Perusahaan Listrik Negara, General Electric Company (GE Renewable Energy), China Yangtze Power Co Ltd, Electricity Generating Authority of Thailand, Aboitiz Power Corporation, NTPC Limited, NHPC Ltd, Tenaga Nasional Berhad, Tokyo Electric Power Company Holdings Inc.

3. What are the main segments of the APAC Hydropower Industry?

The market segments include Size, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Small Hydropower Segment Anticipated to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In July 2022, the Development Bank of the Philippines (DBP) approved USD 11.7 million in funding to support the development of the 4.6 MW Dupinga Mini Hydropower project in Gabaldon, Nueva Ecija, in the Philippines. The DBP's financing of the Dupinga Project will help the government reach its 30% renewable energy goal by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in terawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Hydropower Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Hydropower Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Hydropower Industry?

To stay informed about further developments, trends, and reports in the APAC Hydropower Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence