Key Insights

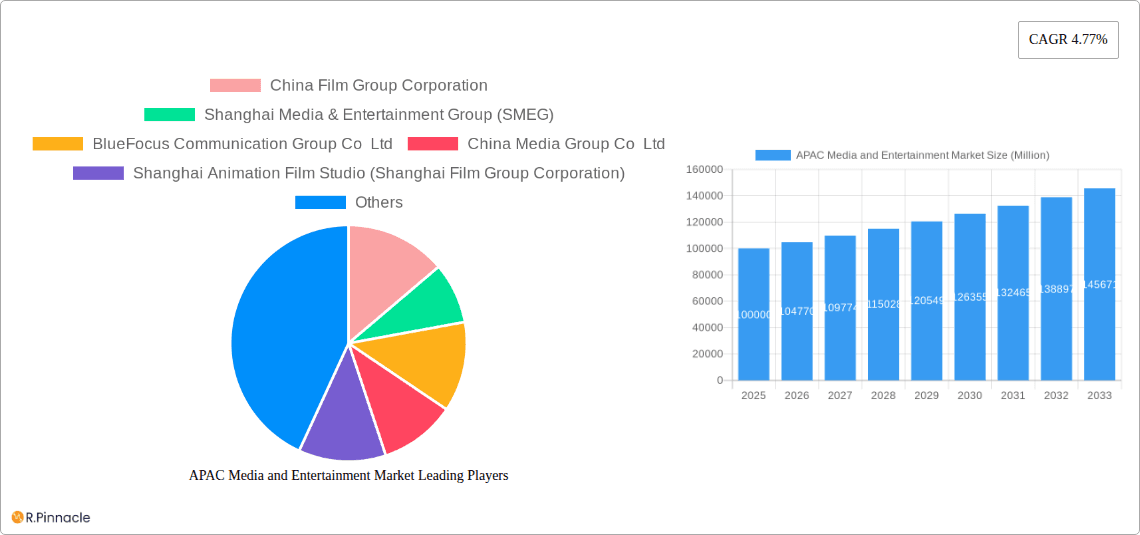

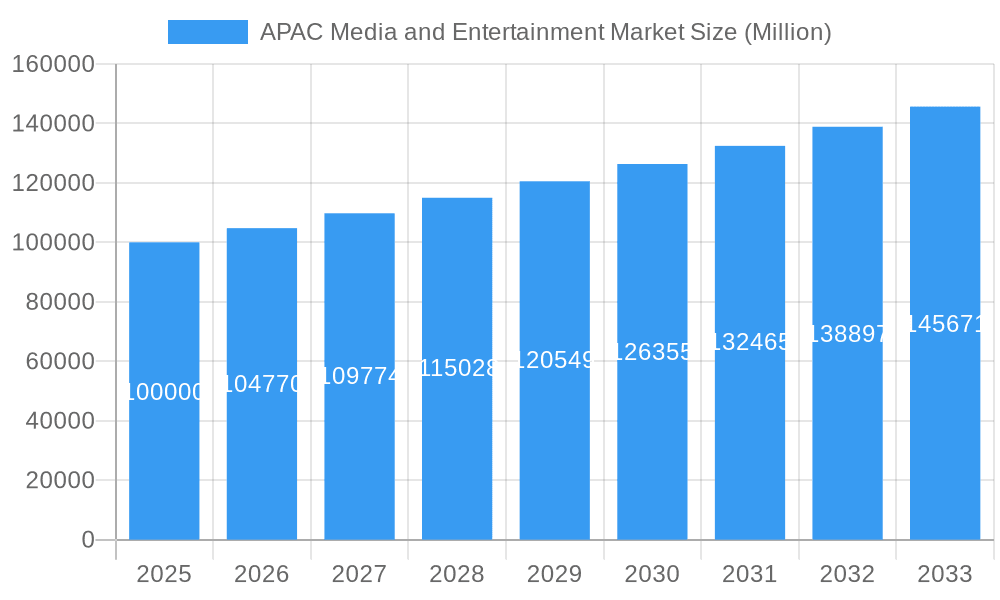

The Asia-Pacific (APAC) media and entertainment market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) of 4.77% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning middle class across major APAC economies like China, India, and South Korea is significantly increasing disposable income, leading to higher spending on entertainment and media consumption. Technological advancements, particularly the proliferation of high-speed internet and mobile devices, are facilitating access to diverse content formats, from streaming services to online gaming. Furthermore, the region's burgeoning e-sports scene and the rising popularity of online video platforms contribute significantly to market growth. While the dominance of established players like China Film Group Corporation and Zee Entertainment Enterprises Limited is undeniable, the market also witnesses a rise of smaller, niche players specializing in digital content creation and distribution.

APAC Media and Entertainment Market Market Size (In Billion)

However, the APAC media and entertainment landscape is not without its challenges. Stringent regulations concerning content and broadcasting across various countries in the region create hurdles for market expansion. Competition within the digital streaming space is fierce, with both global and regional players vying for market share. Furthermore, piracy remains a significant concern, impacting revenue generation for content creators and distributors. Despite these restraints, the long-term outlook for the APAC media and entertainment market remains positive, with sustained growth projected throughout the forecast period. The continued adoption of digital technologies and shifting consumer preferences towards on-demand content will shape the market's trajectory, creating opportunities for innovative businesses to thrive in this dynamic landscape. Understanding regional nuances, including cultural preferences and regulatory environments, will be crucial for companies seeking to successfully navigate this evolving market.

APAC Media and Entertainment Market Company Market Share

APAC Media & Entertainment Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) media and entertainment market, covering the period 2019-2033. It offers actionable insights into market dynamics, growth drivers, key players, and future trends, empowering industry professionals to make informed strategic decisions. The report leverages extensive data and analysis to provide a complete picture of this rapidly evolving landscape, with a focus on key segments and geographic regions within APAC. The Base Year is 2025, and the Estimated Year is 2025. The forecast period runs from 2025-2033, with the historical period covering 2019-2024.

APAC Media and Entertainment Market Market Structure & Innovation Trends

This section analyzes the structure of the APAC media and entertainment market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market is highly fragmented, with a diverse range of players across various segments. However, major players like China Film Group Corporation and Zee Entertainment Enterprises Limited exert significant influence in specific niches.

- Market Concentration: The market exhibits varying degrees of concentration across segments. Filmed entertainment and TV broadcasting see higher consolidation, while digital segments show greater fragmentation. The overall Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements, changing consumer preferences (streaming services, mobile consumption), and regulatory reforms are key innovation drivers. Investment in AI, VR/AR, and personalized content experiences is significantly impacting the sector.

- Regulatory Frameworks: Varying regulatory environments across APAC countries influence market dynamics. Recent changes like India's NTO 2.0 amendment (detailed later) impact TV broadcasting. Different licensing and content regulations across nations create complexities for media companies.

- Product Substitutes: Streaming platforms and digital content pose significant competition to traditional media. The rise of social media also impacts user engagement with traditional media channels.

- End-User Demographics: The young, tech-savvy population in APAC is a crucial factor driving the digital media boom. Growth in the middle class fuels increased consumption across different segments, including premium content.

- M&A Activities: The APAC media and entertainment sector has witnessed significant M&A activity in recent years, valued at approximately xx Million USD in 2024. These deals aim to consolidate market share, expand reach, and access new technologies.

APAC Media and Entertainment Market Market Dynamics & Trends

The APAC media and entertainment market is experiencing dynamic growth, driven by several factors. Technological advancements, such as streaming platforms and mobile devices, have transformed media consumption patterns. The increasing penetration of internet and mobile devices is fueling the growth of digital media, with a significant impact on traditional media. Consumer preferences are shifting toward on-demand content, personalized experiences, and interactive formats. The competitive landscape is intensifying as both established players and new entrants strive for market share.

The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Market penetration of streaming services has increased significantly, reaching approximately xx% in 2024, and is expected to further grow as affordability and accessibility improve.

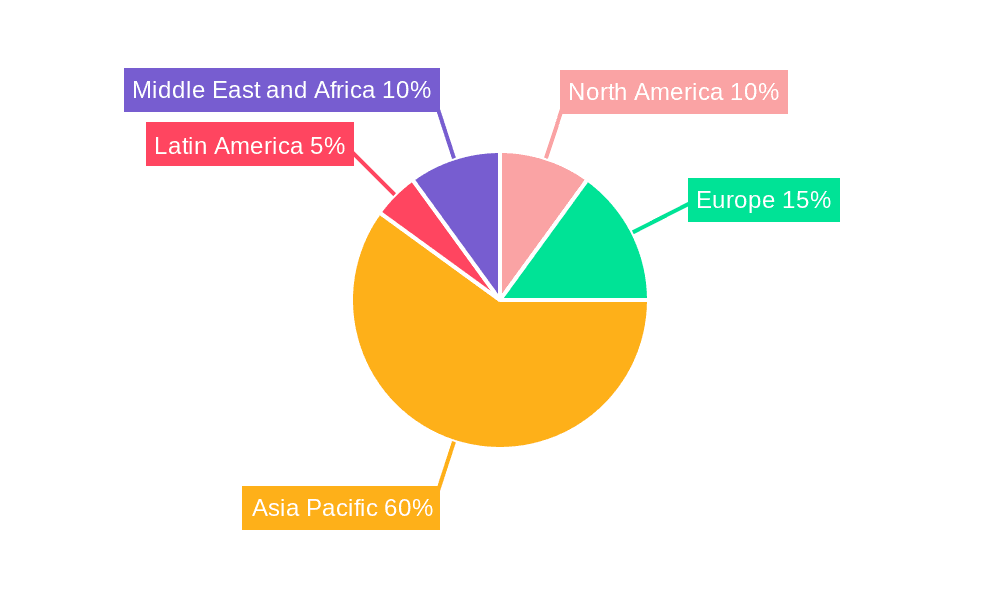

Dominant Regions & Segments in APAC Media and Entertainment Market

China and India are the dominant regions in the APAC media and entertainment market, contributing a significant share of the overall revenue. However, other countries like Japan, South Korea, and Australia are also showing notable growth. The dominance of these regions is driven by factors such as:

- China: Large population, increasing disposable income, robust domestic film industry, and a thriving digital market.

- India: Massive population, increasing digital adoption, and a rapidly growing television and streaming market.

- Japan: Strong anime and gaming industry, combined with a sophisticated television broadcasting sector.

- South Korea: A leader in K-pop and online gaming, with innovative media technology.

- Australia: Developed media infrastructure and a high per-capita media consumption.

The fastest growing segments include:

- Internet Advertising: Rapid growth in digital advertising, propelled by the rise of social media and e-commerce.

- Video Games and e-sports: The booming video game industry, fueled by mobile gaming and the popularity of e-sports.

- Streaming Services: The shift from traditional media to on-demand streaming.

APAC Media and Entertainment Market Product Innovations

The APAC media and entertainment market is witnessing a surge of innovative products and services. We are seeing a rise in interactive content, personalized recommendations, virtual reality (VR) and augmented reality (AR) experiences, and immersive storytelling. These innovations are driven by advancements in technologies like AI, cloud computing, and 5G. The focus is on enhancing user experience, delivering personalized content, and improving monetization strategies through targeted advertising and subscription models. New business models, such as freemium and subscription-based services, are gaining traction.

Report Scope & Segmentation Analysis

This report segments the APAC media and entertainment market by type and country.

By Type: Business-to-business (B2B), Book Publishing, Filmed Entertainment, Internet Access, Internet Advertising, Magazine Publishing, Music, Newspaper Publishing, Out-of-Home (OOH) Advertising, Radio, TV Advertising, TV Subscription and Licence Fees, Video Games and e-sports. Each segment is analyzed in terms of market size, growth rate, and competitive landscape.

By Country: China, India, Japan, Thailand, Malaysia, South Korea, Indonesia, Australia, and Rest of Asia-Pacific. Each country’s market is analyzed based on its specific characteristics, growth drivers, and challenges.

Growth projections, market sizes, and competitive dynamics vary significantly across segments and countries. For example, the internet advertising segment is expected to exhibit the highest growth, driven by rising digital penetration and ad spending.

Key Drivers of APAC Media and Entertainment Market Growth

The growth of the APAC media and entertainment market is fueled by several factors:

- Rising Disposable Incomes: Increasing disposable income in emerging economies leads to greater spending on entertainment.

- Technological Advancements: The rapid adoption of smartphones, internet, and streaming platforms is transforming media consumption.

- Favorable Regulatory Environment: Supportive government policies in several countries are promoting media and entertainment growth.

- Growth of Digital Media: The shift toward digital platforms creates new opportunities for media consumption and monetization.

Challenges in the APAC Media and Entertainment Market Sector

Several challenges hinder the growth of the APAC media and entertainment market:

- Stringent Regulatory Frameworks: Complex regulations and licensing requirements can impede growth in some countries.

- Content Piracy: Illegal downloads and streaming significantly affect the revenue of content creators.

- Competition: The intense competition from both established and new players puts pressure on margins.

- Infrastructure Gaps: Inadequate infrastructure in some regions limits access to digital media.

Emerging Opportunities in APAP Media and Entertainment Market

The APAC media and entertainment market presents various exciting opportunities:

- Growth in Mobile Gaming: The massive mobile gaming market presents enormous potential for revenue generation.

- Expansion of Streaming Services: The increasing demand for online streaming offers opportunities to expand market share.

- Rise of Virtual and Augmented Reality: VR and AR are opening doors to create immersive entertainment experiences.

- Development of Localized Content: Creating targeted content to resonate with the diverse cultures of APAC is crucial for success.

Leading Players in the APAC Media and Entertainment Market Market

- China Film Group Corporation

- Shanghai Media & Entertainment Group (SMEG)

- BlueFocus Communication Group Co Ltd

- China Media Group Co Ltd

- Shanghai Animation Film Studio (Shanghai Film Group Corporation)

- DB Corp Ltd

- Sun TV Network Limited

- Dish TV India Limited

- HT Media Limited

- Eros International PLC

- Zee Entertainment Enterprises Limited

Key Developments in APAC Media and Entertainment Market Industry

- November 2022: The Telecom Regulatory Authority of India (TRAI) announced amendments to the new tariff order (NTO 2.0), impacting channel bundling and pricing in the broadcasting sector. This has significantly altered the competitive landscape and pricing strategies within the Indian television market.

- October 2022: Taiwan launched its first English-language news, lifestyle, and entertainment television channel, aiming to enhance its international presence and diplomatic relations. This initiative demonstrates the ongoing efforts of Asian nations to increase their global influence through media.

Future Outlook for APAC Media and Entertainment Market Market

The future of the APAC media and entertainment market looks bright. Continued growth in digital media, rising disposable incomes, technological innovation, and strategic partnerships will drive significant expansion. The market is poised for substantial growth over the forecast period, with opportunities for players who can adapt to evolving consumer preferences and leverage technological advancements. The focus will remain on delivering high-quality, personalized content across various platforms and devices.

APAC Media and Entertainment Market Segmentation

-

1. Type

- 1.1. Business-to-business (B2B)

- 1.2. Book Publishing

- 1.3. Filmed Entertainment

- 1.4. Internet Access

- 1.5. Internet Advertising

- 1.6. Magazine Publishing

- 1.7. Music

- 1.8. Newspaper Publishing

- 1.9. Out-of-Home (OOH) Advertising

- 1.10. Radio

- 1.11. TV Advertising

- 1.12. TV Subscription and Licence Fees

- 1.13. Video Games and e-sports

APAC Media and Entertainment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Media and Entertainment Market Regional Market Share

Geographic Coverage of APAC Media and Entertainment Market

APAC Media and Entertainment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming

- 3.2.2 OTT

- 3.2.3 and Internet Advertising; Smart Utilization of Data Algorithms and AI Leading to Enhanced Digital Products and Services

- 3.3. Market Restrains

- 3.3.1. Significant Increase in Piracy Leading to Loss of Revenue

- 3.4. Market Trends

- 3.4.1. Increasing Trends Around Personalization and Increased Digitalization is expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Book Publishing

- 5.1.3. Filmed Entertainment

- 5.1.4. Internet Access

- 5.1.5. Internet Advertising

- 5.1.6. Magazine Publishing

- 5.1.7. Music

- 5.1.8. Newspaper Publishing

- 5.1.9. Out-of-Home (OOH) Advertising

- 5.1.10. Radio

- 5.1.11. TV Advertising

- 5.1.12. TV Subscription and Licence Fees

- 5.1.13. Video Games and e-sports

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Business-to-business (B2B)

- 6.1.2. Book Publishing

- 6.1.3. Filmed Entertainment

- 6.1.4. Internet Access

- 6.1.5. Internet Advertising

- 6.1.6. Magazine Publishing

- 6.1.7. Music

- 6.1.8. Newspaper Publishing

- 6.1.9. Out-of-Home (OOH) Advertising

- 6.1.10. Radio

- 6.1.11. TV Advertising

- 6.1.12. TV Subscription and Licence Fees

- 6.1.13. Video Games and e-sports

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Business-to-business (B2B)

- 7.1.2. Book Publishing

- 7.1.3. Filmed Entertainment

- 7.1.4. Internet Access

- 7.1.5. Internet Advertising

- 7.1.6. Magazine Publishing

- 7.1.7. Music

- 7.1.8. Newspaper Publishing

- 7.1.9. Out-of-Home (OOH) Advertising

- 7.1.10. Radio

- 7.1.11. TV Advertising

- 7.1.12. TV Subscription and Licence Fees

- 7.1.13. Video Games and e-sports

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Business-to-business (B2B)

- 8.1.2. Book Publishing

- 8.1.3. Filmed Entertainment

- 8.1.4. Internet Access

- 8.1.5. Internet Advertising

- 8.1.6. Magazine Publishing

- 8.1.7. Music

- 8.1.8. Newspaper Publishing

- 8.1.9. Out-of-Home (OOH) Advertising

- 8.1.10. Radio

- 8.1.11. TV Advertising

- 8.1.12. TV Subscription and Licence Fees

- 8.1.13. Video Games and e-sports

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Business-to-business (B2B)

- 9.1.2. Book Publishing

- 9.1.3. Filmed Entertainment

- 9.1.4. Internet Access

- 9.1.5. Internet Advertising

- 9.1.6. Magazine Publishing

- 9.1.7. Music

- 9.1.8. Newspaper Publishing

- 9.1.9. Out-of-Home (OOH) Advertising

- 9.1.10. Radio

- 9.1.11. TV Advertising

- 9.1.12. TV Subscription and Licence Fees

- 9.1.13. Video Games and e-sports

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Business-to-business (B2B)

- 10.1.2. Book Publishing

- 10.1.3. Filmed Entertainment

- 10.1.4. Internet Access

- 10.1.5. Internet Advertising

- 10.1.6. Magazine Publishing

- 10.1.7. Music

- 10.1.8. Newspaper Publishing

- 10.1.9. Out-of-Home (OOH) Advertising

- 10.1.10. Radio

- 10.1.11. TV Advertising

- 10.1.12. TV Subscription and Licence Fees

- 10.1.13. Video Games and e-sports

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 China Film Group Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shanghai Media & Entertainment Group (SMEG)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BlueFocus Communication Group Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Media Group Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Animation Film Studio (Shanghai Film Group Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DB Corp Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sun TV Network Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dish TV India Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HT Media Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eros International PLC*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zee Entertainment Enterprises Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 China Film Group Corporation

List of Figures

- Figure 1: Global APAC Media and Entertainment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 7: South America APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Middle East & Africa APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Media and Entertainment Market?

The projected CAGR is approximately 26.7%.

2. Which companies are prominent players in the APAC Media and Entertainment Market?

Key companies in the market include China Film Group Corporation, Shanghai Media & Entertainment Group (SMEG), BlueFocus Communication Group Co Ltd, China Media Group Co Ltd, Shanghai Animation Film Studio (Shanghai Film Group Corporation), DB Corp Ltd, Sun TV Network Limited, Dish TV India Limited, HT Media Limited, Eros International PLC*List Not Exhaustive, Zee Entertainment Enterprises Limited.

3. What are the main segments of the APAC Media and Entertainment Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming. OTT. and Internet Advertising; Smart Utilization of Data Algorithms and AI Leading to Enhanced Digital Products and Services.

6. What are the notable trends driving market growth?

Increasing Trends Around Personalization and Increased Digitalization is expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Significant Increase in Piracy Leading to Loss of Revenue.

8. Can you provide examples of recent developments in the market?

November 2022: The Telecom Regulatory Authority of India (TRAI) announced amendments to the new tariff order (NTO 2.0) in the broadcasting sector. The regulator has set a ceiling of INR 19 per MRP for TV channels that can be part of the bouquet. It is now limiting channel bundling discounts to 45%, while at the same time, it continues its restraint of MRPs for TV channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Media and Entertainment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Media and Entertainment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Media and Entertainment Market?

To stay informed about further developments, trends, and reports in the APAC Media and Entertainment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence