Key Insights

The Asia-Pacific battery recycling market is projected for significant expansion, driven by the escalating adoption of electric vehicles (EVs) and portable electronics, alongside robust environmental regulations targeting e-waste. With a projected Compound Annual Growth Rate (CAGR) of 66.51% from 2024, the market, valued at 49.2 million in the base year 2024, demonstrates a strong upward trend. Key growth drivers include surging EV penetration in major markets like China, Japan, South Korea, and India, coupled with technological advancements enhancing the recovery of critical materials such as lithium, cobalt, and nickel. Government-led initiatives promoting sustainable waste management and resource circularity further bolster market dynamics. Prominent industry players, including Exide Industries Limited, GS Yuasa International Ltd, and Contemporary Amperex Technology Co Limited, are strategically investing in expanding recycling capabilities and pioneering novel recycling methodologies to leverage this expanding sector.

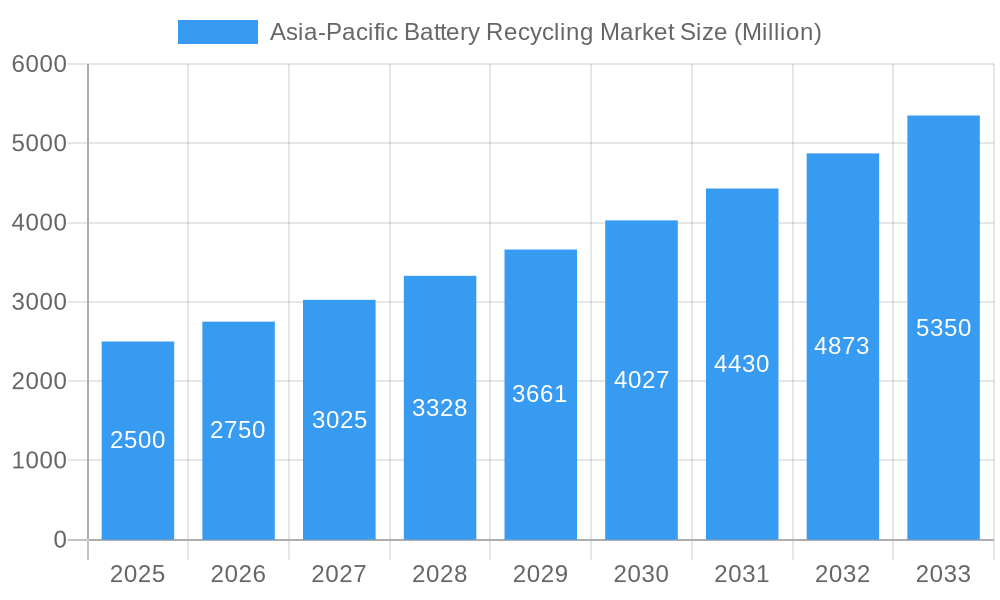

Asia-Pacific Battery Recycling Market Market Size (In Million)

Addressing challenges such as diverse battery chemistries, the demand for cost-effective recycling infrastructure, and material price volatility is crucial for sustained growth. Nevertheless, the market outlook remains highly favorable. Heightened awareness of environmental sustainability and the growing scarcity of essential battery materials are accelerating the development and implementation of advanced recycling solutions. The increasing economic viability and environmental advantages of producing secondary battery materials from recycled sources are also noteworthy. This trend is anticipated to gain momentum with improved economies of scale and technological innovation reducing recycling costs. The Asia-Pacific battery recycling market is expected to maintain robust growth through the forecast period, with a substantial market size anticipated by 2033. Growth patterns will vary regionally, with nations exhibiting high EV adoption rates and stringent environmental policies leading the expansion.

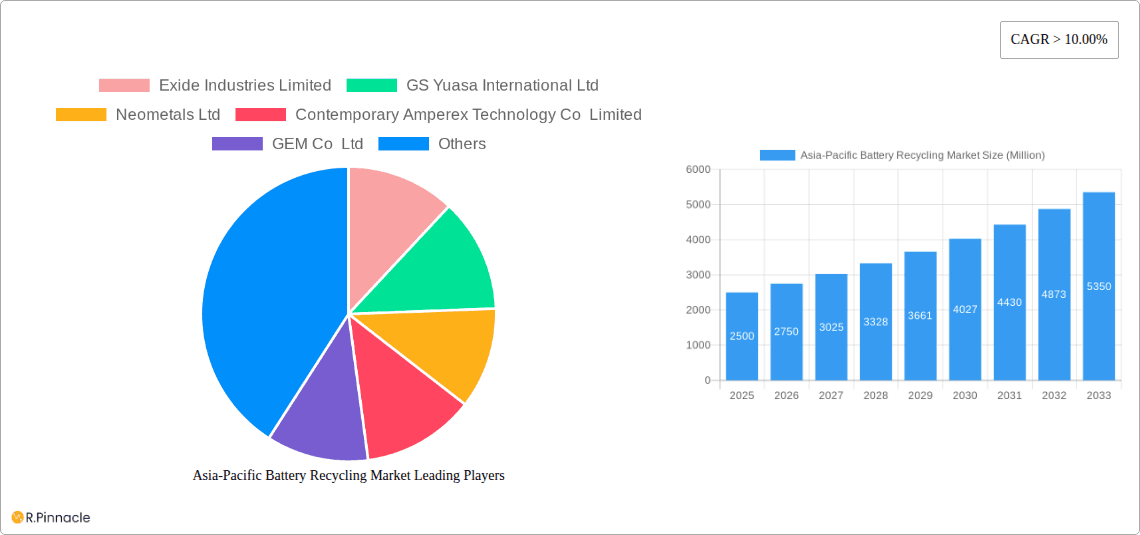

Asia-Pacific Battery Recycling Market Company Market Share

Asia-Pacific Battery Recycling Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Asia-Pacific battery recycling market, offering invaluable insights for industry professionals, investors, and strategists. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report analyzes market dynamics, leading players, emerging opportunities, and key challenges, providing actionable intelligence to navigate this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Asia-Pacific Battery Recycling Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Asia-Pacific battery recycling market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. We delve into the market share held by key players such as Exide Industries Limited, GS Yuasa International Ltd, Neometals Ltd, Contemporary Amperex Technology Co Limited, GEM Co Ltd, TES, ACS Lead Tech, Umicore Cobalt & Specialty Materials, NEC Corporation, and Nippon Recycle Center Corp. The report also examines the impact of mergers and acquisitions (M&A) on market consolidation, analyzing deal values and their influence on market dynamics. The analysis includes an assessment of the regulatory environment and its effect on innovation and market entry. The report quantifies the market share of the top 5 players at xx% and explores the average M&A deal value for the period 2019-2024 at approximately xx Million.

- Market Concentration: Highlighted by the market share of top players and analysis of Herfindahl-Hirschman Index (HHI) to understand the competitive intensity.

- Innovation Drivers: Focuses on technological advancements driving improved recycling processes and efficiency.

- Regulatory Landscape: Covers government policies, environmental regulations, and their impact on market growth.

- Product Substitutes: Explores alternative technologies and their potential impact on the market.

- End-User Demographics: Analyzes the distribution of demand across different end-use industries.

- M&A Activity: Details major mergers and acquisitions, providing deal values and their strategic implications.

Asia-Pacific Battery Recycling Market Dynamics & Trends

This section provides a comprehensive overview of the Asia-Pacific battery recycling market's dynamics and trends. We analyze factors driving market growth, including the increasing demand for electric vehicles (EVs), stringent environmental regulations, and the rising cost of raw materials. The report further explores technological disruptions, such as advancements in battery recycling technologies and the emergence of new recycling processes. Consumer preferences and shifts in environmental awareness are also evaluated. The competitive dynamics are analyzed, assessing the strategies employed by key players to maintain market share and expand their presence. The report highlights the market penetration rate for different recycling technologies and projects the compound annual growth rate (CAGR) for the forecast period.

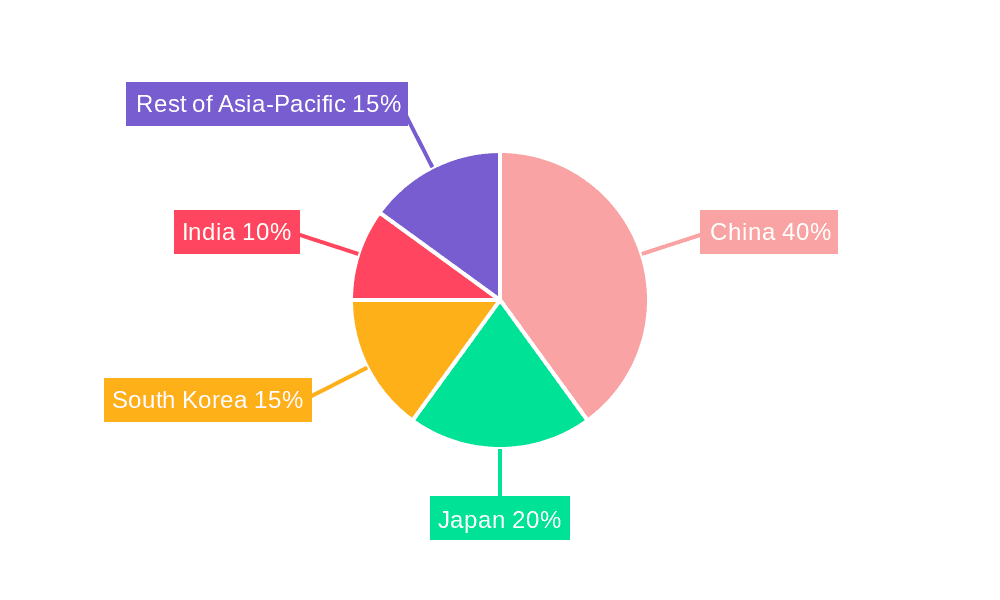

Dominant Regions & Segments in Asia-Pacific Battery Recycling Market

This section identifies the leading regions and segments within the Asia-Pacific battery recycling market. A detailed analysis will pinpoint the dominant country or region, explaining its market leadership.

- Key Drivers:

- Favorable government policies and economic incentives

- Well-developed infrastructure supporting recycling activities

- High concentration of battery manufacturing and consumption

- Strong environmental regulations

- Availability of skilled labor

The dominance analysis will consider factors such as:

- Market size and growth rate

- Technological advancements

- Regulatory environment

- Presence of key players

- Infrastructure development

Asia-Pacific Battery Recycling Market Product Innovations

This section summarizes the latest product developments, applications, and competitive advantages in the Asia-Pacific battery recycling market. It highlights technological trends, such as the development of hydrometallurgical and pyrometallurgical processes, and their market fit. The focus is on innovations improving efficiency, reducing costs, and enhancing the recovery of valuable materials.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific battery recycling market by battery type (Lithium-ion, Lead-acid, Nickel-Cadmium, etc.), recycling technology (Hydrometallurgy, Pyrometallurgy, Direct Recycling), application (EV batteries, portable electronics, etc.), and country. Each segment's growth projections, market sizes, and competitive dynamics are detailed.

Key Drivers of Asia-Pacific Battery Recycling Market Growth

The growth of the Asia-Pacific battery recycling market is propelled by several factors: increasing demand for electric vehicles, stringent environmental regulations aimed at reducing e-waste, rising raw material costs making recycling more economically viable, technological advancements enhancing recycling efficiency and recovering valuable materials, and supportive government policies and incentives promoting sustainable practices.

Challenges in the Asia-Pacific Battery Recycling Market Sector

Challenges facing the Asia-Pacific battery recycling market include inconsistent regulatory frameworks across different countries, complexities in the supply chain management for efficient recycling, technological limitations in processing certain battery types effectively, and intense competition from established players. These factors impact market growth and profitability.

Emerging Opportunities in Asia-Pacific Battery Recycling Market

The Asia-Pacific battery recycling market presents several emerging opportunities, such as advancements in battery recycling technologies, increasing demand for critical materials like lithium and cobalt, expansion into new markets with growing EV adoption, and the development of circular economy initiatives. These trends offer significant growth potential.

Leading Players in the Asia-Pacific Battery Recycling Market Market

- Exide Industries Limited

- GS Yuasa International Ltd

- Neometals Ltd

- Contemporary Amperex Technology Co Limited

- GEM Co Ltd

- TES

- ACS Lead Tech

- Umicore Cobalt & Specialty Materials

- NEC Corporation

- Nippon Recycle Center Corp

- List Not Exhaustive

Key Developments in Asia-Pacific Battery Recycling Market Industry

- July 2022: LG Energy Solution and Huayou Cobalt announce a joint venture for battery recycling in China.

- May 2022: ACE Green Recycling plans to build four new lithium-ion battery recycling facilities with a total annual capacity exceeding 30,000 tons.

Future Outlook for Asia-Pacific Battery Recycling Market Market

The Asia-Pacific battery recycling market is poised for significant growth, driven by increasing EV adoption, stricter environmental regulations, and technological advancements. Strategic opportunities exist for companies focusing on sustainable practices and innovative recycling technologies. The market's future hinges on overcoming existing challenges related to regulation and supply chain management, ensuring a robust and sustainable recycling ecosystem.

Asia-Pacific Battery Recycling Market Segmentation

-

1. Battery Type

- 1.1. Lead-Acid Battery

- 1.2. Nickel Battery

- 1.3. Lithium-ion battery

- 1.4. Other Battery Types

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia-Pacific Battery Recycling Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Battery Recycling Market Regional Market Share

Geographic Coverage of Asia-Pacific Battery Recycling Market

Asia-Pacific Battery Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 66.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead-Acid Battery

- 5.1.2. Nickel Battery

- 5.1.3. Lithium-ion battery

- 5.1.4. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. China Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 6.1.1. Lead-Acid Battery

- 6.1.2. Nickel Battery

- 6.1.3. Lithium-ion battery

- 6.1.4. Other Battery Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 7. India Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 7.1.1. Lead-Acid Battery

- 7.1.2. Nickel Battery

- 7.1.3. Lithium-ion battery

- 7.1.4. Other Battery Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 8. Japan Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 8.1.1. Lead-Acid Battery

- 8.1.2. Nickel Battery

- 8.1.3. Lithium-ion battery

- 8.1.4. Other Battery Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 9. South Korea Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 9.1.1. Lead-Acid Battery

- 9.1.2. Nickel Battery

- 9.1.3. Lithium-ion battery

- 9.1.4. Other Battery Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 10. Rest of Asia Pacific Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Battery Type

- 10.1.1. Lead-Acid Battery

- 10.1.2. Nickel Battery

- 10.1.3. Lithium-ion battery

- 10.1.4. Other Battery Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Battery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Exide Industries Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GS Yuasa International Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Neometals Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Contemporary Amperex Technology Co Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GEM Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TES

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACS Lead Tech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Umicore Cobalt & Specialty Materials

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NEC Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nippon Recycle Center Corp *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Exide Industries Limited

List of Figures

- Figure 1: Global Asia-Pacific Battery Recycling Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Battery Recycling Market Revenue (million), by Battery Type 2025 & 2033

- Figure 3: China Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 4: China Asia-Pacific Battery Recycling Market Revenue (million), by Geography 2025 & 2033

- Figure 5: China Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China Asia-Pacific Battery Recycling Market Revenue (million), by Country 2025 & 2033

- Figure 7: China Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: India Asia-Pacific Battery Recycling Market Revenue (million), by Battery Type 2025 & 2033

- Figure 9: India Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 10: India Asia-Pacific Battery Recycling Market Revenue (million), by Geography 2025 & 2033

- Figure 11: India Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India Asia-Pacific Battery Recycling Market Revenue (million), by Country 2025 & 2033

- Figure 13: India Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Japan Asia-Pacific Battery Recycling Market Revenue (million), by Battery Type 2025 & 2033

- Figure 15: Japan Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 16: Japan Asia-Pacific Battery Recycling Market Revenue (million), by Geography 2025 & 2033

- Figure 17: Japan Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Japan Asia-Pacific Battery Recycling Market Revenue (million), by Country 2025 & 2033

- Figure 19: Japan Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South Korea Asia-Pacific Battery Recycling Market Revenue (million), by Battery Type 2025 & 2033

- Figure 21: South Korea Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 22: South Korea Asia-Pacific Battery Recycling Market Revenue (million), by Geography 2025 & 2033

- Figure 23: South Korea Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: South Korea Asia-Pacific Battery Recycling Market Revenue (million), by Country 2025 & 2033

- Figure 25: South Korea Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue (million), by Battery Type 2025 & 2033

- Figure 27: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 28: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue (million), by Geography 2025 & 2033

- Figure 29: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue (million), by Country 2025 & 2033

- Figure 31: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 3: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 5: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 8: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 9: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 11: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 14: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 17: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 18: Global Asia-Pacific Battery Recycling Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Battery Recycling Market?

The projected CAGR is approximately 66.51%.

2. Which companies are prominent players in the Asia-Pacific Battery Recycling Market?

Key companies in the market include Exide Industries Limited, GS Yuasa International Ltd, Neometals Ltd, Contemporary Amperex Technology Co Limited, GEM Co Ltd, TES, ACS Lead Tech, Umicore Cobalt & Specialty Materials, NEC Corporation, Nippon Recycle Center Corp *List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Battery Recycling Market?

The market segments include Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Lithium-ion Battery Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: LG Energy Solution announced plans to establish a battery recycling joint venture in China with the Chinese new energy Li-ion battery material research and development manufacturer Huayou Cobalt. The joint venture will use the infrastructure of Huayou Cobalt to extract nickel, cobalt, and lithium from waste batteries and then supply them to the Nanjing Factory of LG Energy Solution. A post-treatment plant for processing recycled metals was to be built in Quzhou, Zhejiang Province, where Huayou Cobalt operates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Battery Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Battery Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Battery Recycling Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Battery Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence