Key Insights

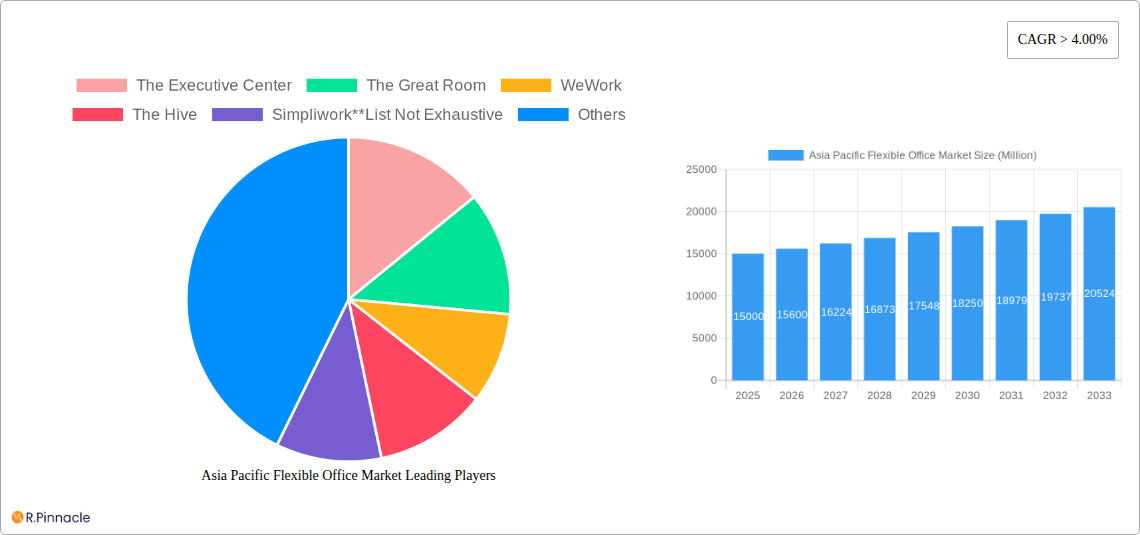

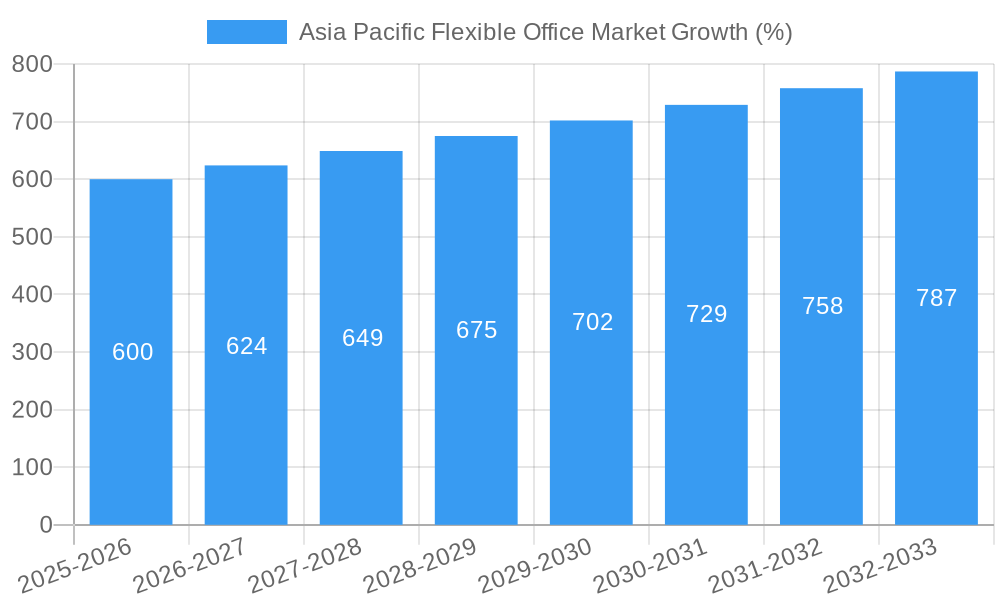

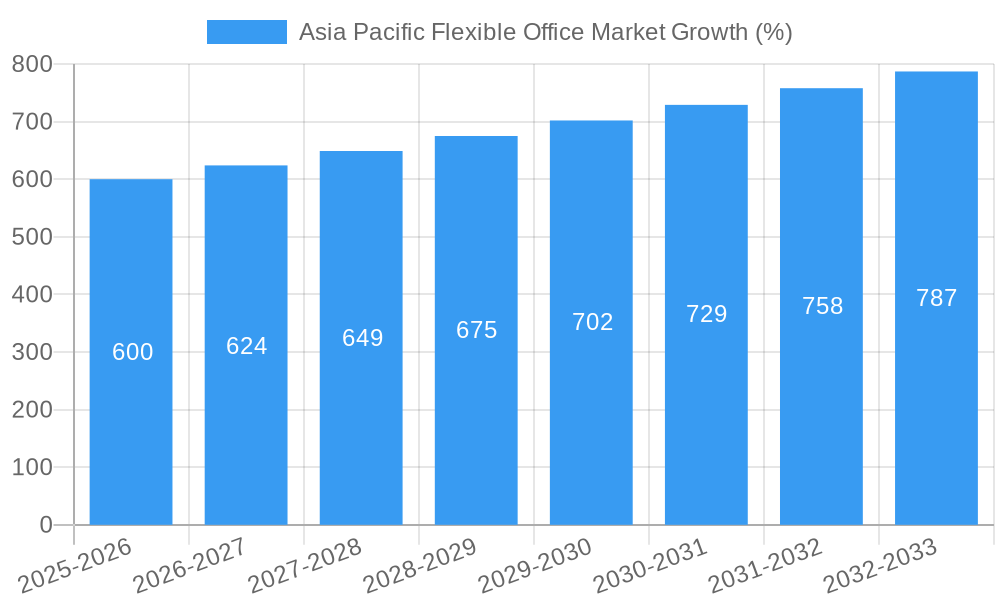

The Asia-Pacific flexible office market is experiencing robust growth, driven by the increasing adoption of hybrid work models, the rise of startups and SMEs, and a preference for cost-effective and flexible workspace solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 4% indicates a sustained expansion over the forecast period (2025-2033). Key drivers include the region's burgeoning entrepreneurial ecosystem, particularly in countries like China and India, coupled with a growing demand for technologically advanced and collaborative workspaces. The segment breakdown reveals significant traction in private offices and co-working spaces, catering to diverse business needs. While the IT and Telecommunications sector is currently a dominant vertical, growth is anticipated across various sectors including Media and Entertainment and Retail and Consumer Goods as businesses increasingly adopt agile work strategies. Geographical expansion within the Asia-Pacific region, particularly in countries experiencing rapid urbanization and economic growth, will further fuel market expansion. However, economic fluctuations and potential competition from traditional office spaces remain potential restraints. The market's competitive landscape features both international players like WeWork and Regus, alongside local operators, creating a dynamic and innovative market. This suggests significant opportunities for both established players and emerging businesses to capitalize on the increasing demand for flexible workspaces.

The projected market size for 2025 serves as a strong base for forecasting future growth. Considering the CAGR of over 4%, and factoring in regional variations in growth rates (with China and India expected to be key contributors), a reasonable estimation for future years can be made. The market segmentation offers valuable insights into the evolving preferences of businesses. The strong presence of established players combined with the emergence of new entrants indicates a healthy and competitive market environment conducive to innovation and further growth. While challenges such as economic downturns are potential restraints, the overall positive outlook for the Asia-Pacific region and the rising demand for flexible work arrangements are expected to outweigh these challenges, ensuring continued market expansion throughout the forecast period.

Asia Pacific Flexible Office Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific flexible office market, covering the period from 2019 to 2033. It offers actionable insights for industry professionals, investors, and stakeholders seeking to understand this dynamic sector's growth trajectory, key players, and future prospects. The report leverages extensive data analysis and expert forecasts to deliver a clear and concise overview of the market's current state and its anticipated evolution. The Base Year for this report is 2025, with the Estimated Year also being 2025. The Forecast Period spans 2025-2033, and the Historical Period encompasses 2019-2024.

Asia Pacific Flexible Office Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Asia Pacific flexible office market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of established global players and agile local businesses. We examine market share distribution amongst key players like WeWork, Regus Corporation, and JustCo, alongside regional leaders such as The Executive Center and The Work Project. The report analyzes the impact of technological innovations, such as smart office solutions and booking platforms, on market dynamics. Regulatory frameworks concerning flexible workspaces across different countries are also explored, highlighting their influence on market growth. Furthermore, the report assesses the impact of mergers and acquisitions (M&A) activities on market consolidation and expansion, including the deal values (in Millions) of significant transactions during the historical period. The total M&A deal value during 2019-2024 is estimated at $XX Million. Market share data for 2025 indicates that WeWork holds approximately XX% market share, followed by Regus Corporation at XX%, and JustCo at XX%.

- Market Concentration: High in major cities, fragmented in smaller markets.

- Innovation Drivers: Technological advancements, evolving work styles, and government initiatives.

- Regulatory Frameworks: Vary significantly across countries, impacting operational costs and expansion strategies.

- Product Substitutes: Traditional office spaces, home offices, and virtual assistants.

- End-User Demographics: Primarily driven by SMEs, startups, and multinational corporations.

- M&A Activities: Significant consolidation observed in the past years, with a total deal value of approximately $XX Million during 2019-2024.

Asia Pacific Flexible Office Market Dynamics & Trends

This section delves into the key drivers and trends shaping the Asia Pacific flexible office market. The market exhibits robust growth, fueled by the increasing preference for flexible work arrangements, particularly amongst younger professionals and technologically advanced companies. The COVID-19 pandemic acted as a significant catalyst, accelerating the adoption of remote and hybrid work models. We analyze the impact of technological disruptions, such as the introduction of proptech solutions and remote work tools, on market penetration. The report also examines consumer preferences, focusing on factors such as location, amenities, and pricing models, and assesses the impact of these preferences on market segmentation and growth. Competitive dynamics, including pricing strategies, brand positioning, and service offerings, are thoroughly examined. The Compound Annual Growth Rate (CAGR) for the Asia Pacific flexible office market is projected to be XX% during the forecast period (2025-2033), with a market penetration rate exceeding XX% by 2033.

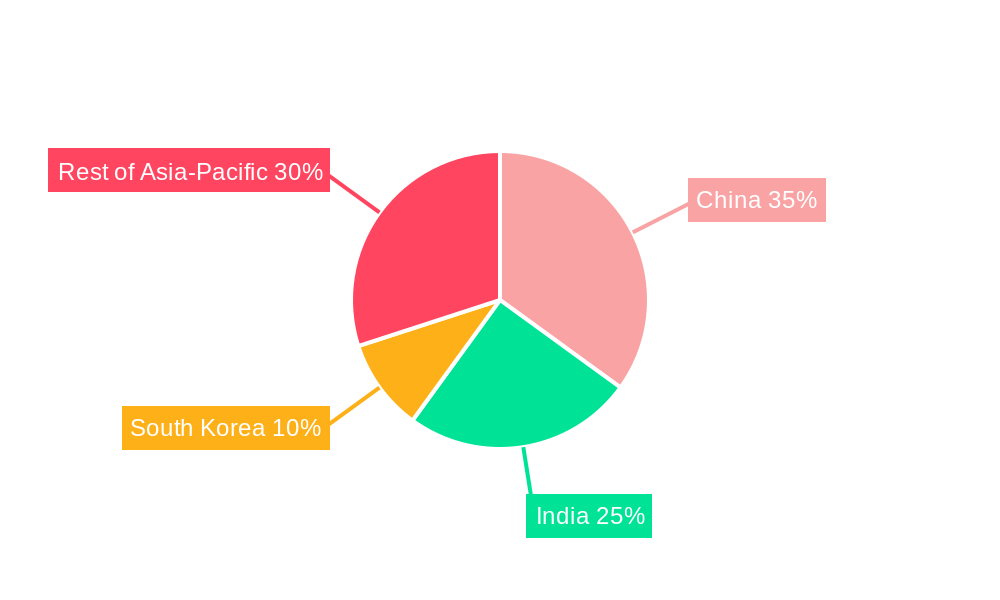

Dominant Regions & Segments in Asia Pacific Flexible Office Market

This section identifies the leading regions, countries, and segments within the Asia Pacific flexible office market. China and India stand out as dominant markets, driven by robust economic growth, expanding urban populations, and increasing demand from diverse industries. South Korea shows significant growth potential, while the 'Rest of Asia-Pacific' segment presents a mix of emerging and mature markets.

By Country:

- China: Largest market, driven by strong economic growth and technological advancement. Key drivers include supportive government policies and extensive infrastructure development.

- India: Rapidly expanding market, characterized by a large and young workforce, increasing urbanization, and rising startup activity. Key drivers include a growing IT sector and increasing disposable income.

- South Korea: Steady growth, driven by a sophisticated tech industry and high levels of digital adoption. Key drivers include a highly educated workforce and a business-friendly environment.

- Rest of Asia-Pacific: A heterogeneous segment encompassing various economies at different stages of development.

By Offering:

- Co-working Spaces: The largest segment, benefiting from scalability and affordability.

- Private Offices: Growing demand from businesses requiring more privacy and control.

- Virtual Offices: Attractive to startups and solopreneurs, offering cost-effective solutions.

By Vertical:

- IT and Telecommunications: Largest user segment, driven by the nature of the work and flexibility needs.

- Media and Entertainment: Significant growth potential due to the creative and project-based nature of work.

- Retail and Consumer Goods: Increasing adoption to support flexible staffing models.

Asia Pacific Flexible Office Market Product Innovations

The Asia Pacific flexible office market witnesses constant product innovation, primarily driven by technological advancements and evolving user preferences. This includes the integration of smart office technologies, enhanced booking platforms, and the development of flexible membership packages catering to diverse needs. These innovations aim to improve workspace efficiency, enhance user experience, and strengthen competitive advantages. The market trend is towards creating more sustainable and technologically integrated workspaces.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia Pacific flexible office market, segmented by country (China, India, South Korea, Rest of Asia-Pacific), offering (private offices, co-working spaces, virtual offices), and vertical (IT & Telecommunications, Media & Entertainment, Retail & Consumer Goods, Others). Each segment's growth projections, market size (in Millions), and competitive dynamics are detailed within the report. For instance, the co-working space segment is projected to witness significant growth in India, driven by the rising startup culture. The IT and Telecommunications vertical shows consistently strong demand across all regions.

Key Drivers of Asia Pacific Flexible Office Market Growth

The Asia Pacific flexible office market's growth is driven by several factors. Rapid urbanization and a growing young workforce create a surge in demand for flexible workspaces. The increasing adoption of technology, such as coworking management software, streamlines operations and improves efficiency. Government initiatives promoting entrepreneurship and startups further boost the market. Finally, evolving work styles, emphasizing flexibility and collaboration, strongly influence market growth.

Challenges in the Asia Pacific Flexible Office Market Sector

Despite its growth potential, the Asia Pacific flexible office market faces several challenges. Varying regulatory environments across countries create hurdles for expansion and standardization. Supply chain disruptions and rising construction costs impact operational profitability. Intense competition and fluctuating market demand pose additional challenges for businesses.

Emerging Opportunities in Asia Pacific Flexible Office Market

The Asia Pacific flexible office market presents various emerging opportunities. Expansion into secondary and tertiary cities provides substantial growth potential. The integration of advanced technologies, such as AI-powered workplace management systems, offers opportunities for efficiency gains and cost reductions. A growing focus on sustainability and wellness provides a pathway for differentiation and market positioning.

Leading Players in the Asia Pacific Flexible Office Market Market

- The Executive Center

- The Great Room

- WeWork

- The Hive

- Simpliwork

- Compass Offices

- Garage Society

- Regus Corporation

- JustCo

- The Work Project

Key Developments in Asia Pacific Flexible Office Market Industry

- January 2023: WeWork launched a new sustainability initiative across its Asia Pacific locations.

- March 2022: JustCo expanded into a new market in Vietnam.

- June 2021: Regus Corporation acquired a smaller competitor in Singapore. (Further specific examples to be added as per available data)

Future Outlook for Asia Pacific Flexible Office Market Market

The Asia Pacific flexible office market is poised for continued growth, driven by sustained urbanization, technological advancements, and evolving work styles. Strategic opportunities lie in leveraging technology, focusing on sustainability, and expanding into underserved markets. The market's long-term potential is substantial, with significant growth anticipated across various segments and regions.

Asia Pacific Flexible Office Market Segmentation

-

1. Offering

- 1.1. Private Offices

- 1.2. Co-Working Spaces

- 1.3. Virtual Offices

-

2. Vertical

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and Consumer Goods

- 2.4. Others

Asia Pacific Flexible Office Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Flexible Office Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increase in number of startups in APAC region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Private Offices

- 5.1.2. Co-Working Spaces

- 5.1.3. Virtual Offices

- 5.2. Market Analysis, Insights and Forecast - by Vertical

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. China Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Flexible Office Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 The Executive Center

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 The Great Room

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 WeWork

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Simpliwork**List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Compass Offices

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Garage Society

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Regus Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 JustCo

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 The Work Project

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 The Executive Center

List of Figures

- Figure 1: Asia Pacific Flexible Office Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Flexible Office Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Flexible Office Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Flexible Office Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Asia Pacific Flexible Office Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 4: Asia Pacific Flexible Office Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Flexible Office Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Flexible Office Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 14: Asia Pacific Flexible Office Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 15: Asia Pacific Flexible Office Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Flexible Office Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Flexible Office Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Asia Pacific Flexible Office Market?

Key companies in the market include The Executive Center, The Great Room, WeWork, The Hive, Simpliwork**List Not Exhaustive, Compass Offices, Garage Society, Regus Corporation, JustCo, The Work Project.

3. What are the main segments of the Asia Pacific Flexible Office Market?

The market segments include Offering, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Increase in number of startups in APAC region.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Flexible Office Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Flexible Office Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Flexible Office Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Flexible Office Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence