Key Insights

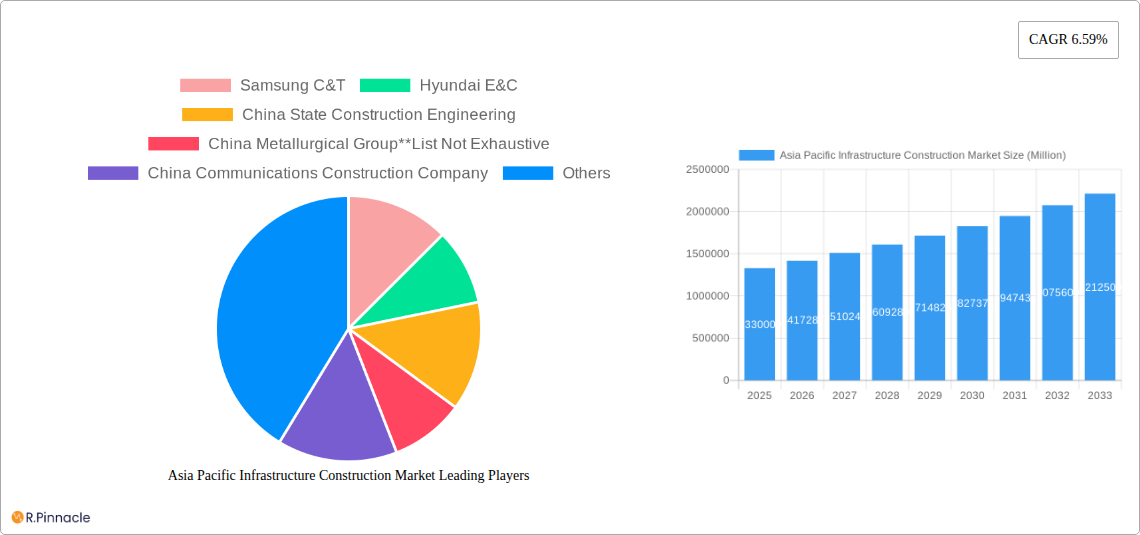

The Asia-Pacific infrastructure construction market, valued at $1.33 trillion in 2025, is projected to experience robust growth, driven by significant government investments in transportation, water management, and social infrastructure projects across the region. Countries like China, India, and Japan are leading the expansion, fueled by urbanization, increasing population density, and the need for improved connectivity and resource management. The market's Compound Annual Growth Rate (CAGR) of 6.59% from 2025 to 2033 indicates sustained momentum. Key growth drivers include large-scale national infrastructure development programs, rising private sector participation through Public-Private Partnerships (PPPs), and the increasing adoption of advanced construction technologies aimed at enhancing efficiency and sustainability. This burgeoning market presents lucrative opportunities for major players like Samsung C&T, Hyundai E&C, and China State Construction Engineering, alongside numerous other regional contractors. However, challenges such as land acquisition complexities, regulatory hurdles, and fluctuating raw material prices could potentially moderate growth in certain segments. The market segmentation reveals a strong focus on telecommunications infrastructure manufacturing, encompassing both social infrastructure and specialized areas like transportation and water resource management. The continued expansion of digital networks and the urgent need for improved water security and transportation systems across the region solidify the long-term prospects of the market. The significant investments in these areas, coupled with supportive government policies and the participation of global and regional players, are expected to maintain a consistent growth trajectory throughout the forecast period.

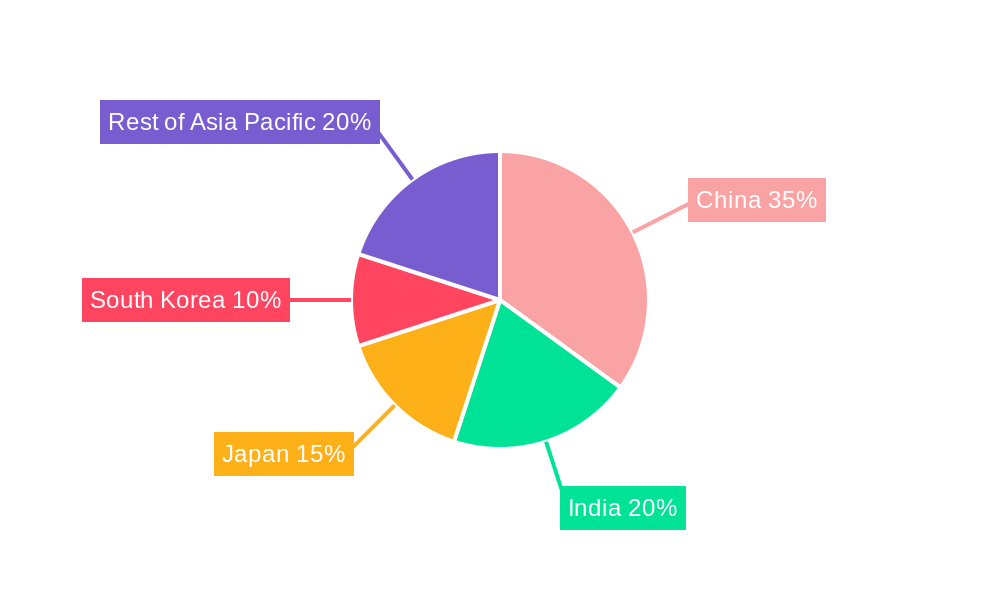

The diverse landscape of the Asia-Pacific infrastructure construction market provides numerous opportunities for companies specializing in various segments. The strong focus on both social and economic infrastructure developments suggests a diversified and resilient market poised for continued growth. While challenges related to regulatory frameworks and resource management exist, the substantial investments and proactive government policies across the region mitigate these risks, creating a favorable environment for long-term investment and expansion. The market's geographical distribution, with significant contributions from China, India, Japan, and South Korea, highlights the potential for sustained expansion throughout the forecast period. Continued technological advancements in construction methodologies and materials are anticipated to further enhance efficiency and drive market growth. This will continue to attract both domestic and international investment, leading to further development and expansion of the Asia-Pacific infrastructure construction sector.

Asia Pacific Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific infrastructure construction market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, identifies key players, and forecasts future growth trajectories. The report leverages extensive primary and secondary research to provide a robust and reliable assessment of this dynamic sector.

Asia Pacific Infrastructure Construction Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Asia Pacific infrastructure construction market. We examine market concentration, identifying leading players such as Samsung C&T, Hyundai E&C, China State Construction Engineering, China Metallurgical Group, China Communications Construction Company, L&T, Shanghai Construction Group, Obayashi Corporation, Power Construction Corporation of China, and China Petroleum Engineering Corporation (list not exhaustive). The report assesses their market share and analyzes recent M&A activities, including deal values (where available). Regulatory frameworks across different Asia-Pacific nations are examined for their impact on market growth. Furthermore, the report explores the influence of product substitutes, end-user demographics, and emerging technological innovations, providing a holistic view of the market structure and its evolution. The analysis will include metrics such as market concentration ratios and the value of significant M&A deals concluded within the study period. For example, we will explore the impact of government policies promoting sustainable infrastructure development and the role of technological advancements in driving efficiency and innovation within the sector. The xx Million value of M&A deals in the past five years will be analyzed to understand the consolidation trends within the market.

Asia Pacific Infrastructure Construction Market Market Dynamics & Trends

This section delves into the key dynamics driving the Asia Pacific infrastructure construction market's growth. We analyze market growth drivers, including increasing urbanization, rising disposable incomes, government investments in infrastructure projects (particularly in countries like China and India), and the need for improved transportation networks and digital connectivity. The report assesses the impact of technological disruptions such as the adoption of Building Information Modeling (BIM), automation, and advanced materials. Consumer preferences regarding sustainable infrastructure and the competitive dynamics between various players will be explored. Key metrics such as CAGR (Compound Annual Growth Rate) and market penetration rates will be presented and analyzed for different segments and regions. This section projects a CAGR of xx% for the forecast period (2025-2033), driven by robust government spending and a growing need for modern infrastructure across the region. The analysis further explores the market's competitive dynamics, identifying key competitive strategies and their impact on market share.

Dominant Regions & Segments in Asia Pacific Infrastructure Construction Market

This section identifies the dominant regions and segments within the Asia Pacific infrastructure construction market.

By Country: China is expected to remain the dominant market, driven by substantial government investment in infrastructure projects and rapid urbanization. India follows as a significant market, fueled by similar drivers. Japan and South Korea also represent considerable market opportunities, although their growth might be comparatively slower. The Philippines and the Rest of Asia Pacific present emerging markets with high growth potential.

By Infrastructure Segment: Transportation infrastructure (roads, railways, airports) constitutes a significant portion of the market due to the continuous need for improved connectivity. Social infrastructure (schools, hospitals) shows substantial growth potential, reflecting the region's increasing focus on improving public services. Waterways and extraction infrastructure also contribute significantly, though to a lesser extent than the above.

Telecoms: Manufacturing Infrastructure: This segment is experiencing strong growth driven by increased demand for advanced telecommunications infrastructure.

The analysis will delve into the specific economic policies, infrastructure development initiatives, and other key factors contributing to the dominance of each region and segment. The report will also examine the factors inhibiting growth in less dominant regions and segments. The report will provide a detailed analysis of the market size for each of these segments and regions, based on both historical and projected data.

Asia Pacific Infrastructure Construction Market Product Innovations

Recent advancements in construction materials (like high-performance concrete and composites), construction methodologies (like prefabrication and modular construction), and technological integration (like BIM and IoT) are transforming the infrastructure construction landscape. These innovations offer increased efficiency, reduced costs, and enhanced sustainability. The market is witnessing growing adoption of these technologies, driving competitive advantages for firms that embrace them and creating new market opportunities for suppliers of innovative products and services.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific infrastructure construction market across various parameters:

By Country: China, India, Philippines, Japan, South Korea, and Rest of Asia Pacific. Each country’s market size, growth projections, and competitive landscape are assessed individually.

By Infrastructure Segment: Social Infrastructure (including schools and hospitals), Transportation Infrastructure (roads, railways, airports, waterways), and Extraction Infrastructure (mining and oil and gas). Each segment's growth potential, market size, and competitive dynamics are analyzed.

By Telecoms: Manufacturing Infrastructure: This segment is further segmented and analyzed based on its sub-components (e.g., cellular towers, data centers). The analysis includes growth projections and market sizes for each sub-segment.

Key Drivers of Asia Pacific Infrastructure Construction Market Growth

Several factors fuel the growth of the Asia Pacific infrastructure construction market. Government initiatives promoting infrastructure development, rapid urbanization leading to increased demand for housing and public facilities, and economic growth boosting investment in infrastructure projects are key drivers. Furthermore, technological advancements, such as the adoption of BIM and advanced construction materials, enhance efficiency and reduce project timelines, further stimulating market growth.

Challenges in the Asia Pacific Infrastructure Construction Market Sector

The Asia Pacific infrastructure construction market faces challenges, including regulatory complexities and bureaucratic hurdles that can delay project approvals and increase costs. Supply chain disruptions and volatility in raw material prices impact project budgets and timelines. Intense competition, with both domestic and international players vying for projects, also poses a challenge. The impact of these factors is quantified wherever possible. For example, regulatory delays can add xx% to project timelines.

Emerging Opportunities in Asia Pacific Infrastructure Construction Market

Emerging opportunities lie in the increasing adoption of sustainable and green infrastructure practices, the expansion of digital technologies in construction management, and the growth of specialized infrastructure segments like renewable energy infrastructure. Government policies promoting sustainable development are creating opportunities for firms that offer environmentally friendly solutions. The rising demand for smart cities and improved digital connectivity creates opportunities for companies offering related infrastructure solutions.

Leading Players in the Asia Pacific Infrastructure Construction Market Market

- Samsung C&T

- Hyundai E&C

- China State Construction Engineering

- China Metallurgical Group

- China Communications Construction Company

- L&T

- Shanghai Construction Group

- Obayashi Corporation

- Power Construction Corporation of China

- China Petroleum Engineering Corporation

Key Developments in Asia Pacific Infrastructure Construction Market Industry

- 2023-06: Launch of a new prefabricated modular construction facility by Samsung C&T in South Korea.

- 2022-11: Merger between two major construction firms in India, resulting in a larger market share.

- 2021-09: Successful implementation of a large-scale smart city project in China, demonstrating the growth potential of this sector. (Further developments will be added in the final report)

Future Outlook for Asia Pacific Infrastructure Construction Market Market

The Asia Pacific infrastructure construction market exhibits strong growth potential. Continued government investments, urbanization, and technological advancements will drive market expansion. The focus on sustainable infrastructure and the adoption of digital technologies will shape the future market landscape, presenting both opportunities and challenges for industry players. Strategic partnerships and the development of innovative construction solutions will be crucial for success in this dynamic market.

Asia Pacific Infrastructure Construction Market Segmentation

-

1. Infrastructure segment

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other social infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission & Disribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other manufacturing infrastructures

-

1.1. Social Infrastructure

Asia Pacific Infrastructure Construction Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Infrastructure Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other social infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission & Disribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other manufacturing infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6. China Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Samsung C&T

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hyundai E&C

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 China State Construction Engineering

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 China Metallurgical Group**List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 China Communications Construction Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 L&T

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Shanghai Construction Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Obayashi Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Power Construction Corporation of China

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 China Petroleum Engineering Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Samsung C&T

List of Figures

- Figure 1: Asia Pacific Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 3: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 13: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Infrastructure Construction Market?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Asia Pacific Infrastructure Construction Market?

Key companies in the market include Samsung C&T, Hyundai E&C, China State Construction Engineering, China Metallurgical Group**List Not Exhaustive, China Communications Construction Company, L&T, Shanghai Construction Group, Obayashi Corporation, Power Construction Corporation of China, China Petroleum Engineering Corporation.

3. What are the main segments of the Asia Pacific Infrastructure Construction Market?

The market segments include Infrastructure segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Increasing Investments in Infrastructure Sector.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence