Key Insights

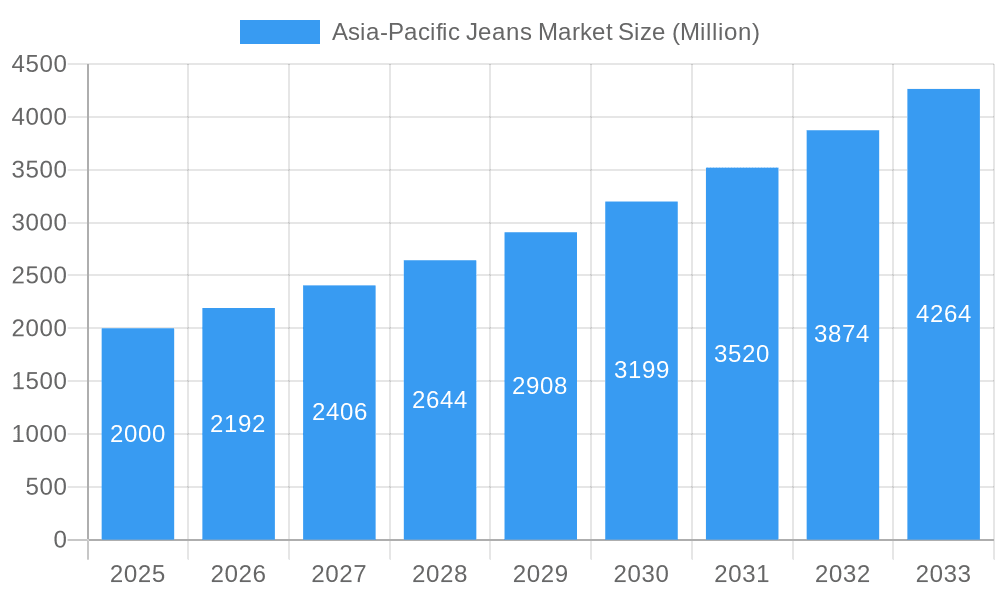

The Asia-Pacific jeans market, valued at approximately $XX million in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 9.60% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes, particularly in developing economies like India and China, are driving increased consumer spending on apparel, including jeans. The increasing adoption of western fashion trends, coupled with a growing young population, further contributes to market demand. E-commerce platforms are playing a significant role, offering convenience and expanding market reach beyond traditional retail channels such as supermarkets, hypermarkets, and specialist stores. The market is segmented by distribution channel, country, end-user (men, women, children), and category (mass, premium), with significant opportunities existing within the premium segment and online retail channels. While competition among established brands like Gap Inc., Levi Strauss & Co., and Uniqlo is fierce, the market's overall growth offers ample room for both existing players and new entrants.

Asia-Pacific Jeans Market Market Size (In Billion)

The market's growth trajectory is not without challenges. Fluctuations in raw material prices (cotton) can impact production costs and profitability. Furthermore, changing consumer preferences and the rise of sustainable and ethically sourced apparel are influencing brand strategies and product development. Brands are increasingly focusing on innovation and diversification, incorporating sustainable materials and offering more inclusive sizing and styles to cater to a broader customer base. The Asia-Pacific region's diverse demographics and varying consumer preferences necessitate a nuanced approach, requiring brands to tailor their products and marketing strategies to specific countries and target groups. Successful players will need to effectively manage supply chains, adapt to evolving consumer demands, and navigate the competitive landscape to maximize market share.

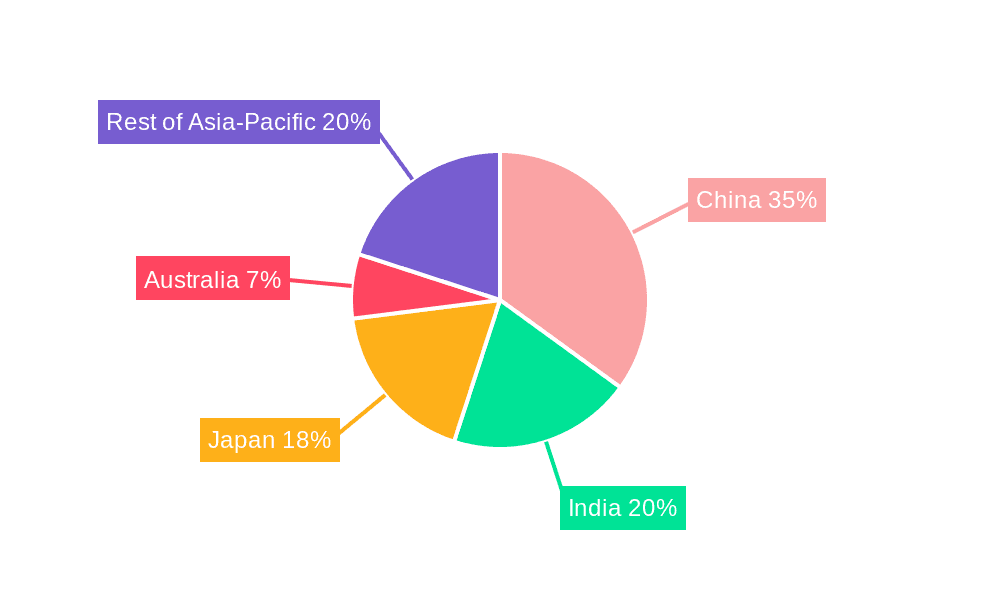

Asia-Pacific Jeans Market Company Market Share

This comprehensive report provides an in-depth analysis of the Asia-Pacific jeans market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market size, segmentation, growth drivers, challenges, and emerging opportunities across various segments. The report leverages robust data and expert analysis to offer a clear picture of the current market landscape and future projections. Expect detailed breakdowns by country, distribution channel, end-user, and product category.

Asia-Pacific Jeans Market Structure & Innovation Trends

The Asia-Pacific jeans market is characterized by a diverse landscape of established global players and emerging local brands. Market concentration is moderate, with a few dominant players holding significant market share, but a substantial number of smaller players contributing to a competitive environment. The market share of the top 5 players is estimated at xx%, indicating a relatively fragmented market structure. Key players include Gap Inc, Levi Strauss & Co, H&M Group, U S Polo Assn, PVH Corp, Edwin Co Ltd, Uniqlo Co Ltd, Diesel S p A, True Religion Brand Jeans, and VF Corporation, though the list is not exhaustive. Innovation is driven by several factors:

- Sustainable practices: Growing consumer demand for eco-friendly and ethically produced jeans is prompting innovation in materials, manufacturing processes, and water management. The recent investments by Tasuka Jeans exemplifies this trend.

- Technological advancements: Advancements in fabric technology, such as the use of innovative denim blends and finishes, are enhancing product durability, comfort, and style. The partnership between Kontoor Brands, Arvind Limited, and Cone Denim reflects the industry's focus on data-driven sustainability.

- Changing consumer preferences: Shifting fashion trends and evolving consumer demographics influence design, fit, and functionality, driving innovation across various product segments.

- Mergers and Acquisitions (M&A): While specific M&A deal values for the Asia-Pacific jeans market are unavailable (xx Million), activity in this area contributes to market consolidation and the introduction of new technologies and brands. The total value of M&A deals in the apparel sector in the region during the historical period is estimated at xx Million.

Asia-Pacific Jeans Market Dynamics & Trends

The Asia-Pacific jeans market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, exceeding the global average. This growth is fueled by:

- Rising disposable incomes: Increasing affluence in many parts of the region is boosting demand for premium and branded jeans.

- Growing urbanization: Urbanization drives increased fashion consciousness and adoption of western clothing styles, including jeans.

- E-commerce boom: Online retail channels are expanding access to a wider range of jeans styles and brands, enhancing market penetration. Online retail's share of the market is expected to reach xx% by 2033.

- Shifting consumer preferences: The growing preference for comfort, versatility, and sustainability is influencing product design and material selection.

Dominant Regions & Segments in Asia-Pacific Jeans Market

The Asia-Pacific jeans market is a dynamic landscape, with China solidifying its position as the leading market, commanding approximately xx% of the total market value in 2025. This is followed by Japan and India, each exhibiting unique characteristics and growth trajectories. Market segmentation reveals diverse opportunities and challenges.

By Country:

- China: China's dominance stems from robust economic growth, a substantial and fashion-forward population, and a sophisticated retail infrastructure. The market exhibits a diverse range of price points and styles, catering to a broad consumer base.

- Japan: A mature market characterized by a strong preference for high-quality, durable, and often branded jeans. The emphasis on craftsmanship and meticulous detailing influences consumer choices.

- India: India's burgeoning economy and expanding young population are driving significant market growth. While infrastructure limitations persist in certain regions, the increasing affordability and accessibility of jeans are fueling market expansion.

- Australia: Although a comparatively smaller market, Australia boasts a high per capita consumption of jeans, reflecting a strong preference for denim apparel among its affluent population.

- Other Southeast Asian Countries: Significant growth potential exists in other Southeast Asian nations like Vietnam, Indonesia, and the Philippines, driven by rising disposable incomes and increasing westernization of fashion trends.

By Distribution Channel: While specialist brick-and-mortar stores maintain a substantial market share, online retail channels are experiencing explosive growth, driven by increasing internet penetration and e-commerce adoption among consumers.

By End-User: The men's jeans segment remains the largest, fueled by higher purchasing power and more frequent purchases. However, the women's segment is demonstrating robust growth potential, reflecting evolving fashion trends and increased female participation in the workforce.

By Category: The mass market segment dominates in terms of volume sales. However, the premium segment shows accelerated growth, reflecting the rising disposable incomes and a growing preference for higher-quality, designer, or sustainably produced denim.

Asia-Pacific Jeans Market Product Innovations

Recent product innovations focus on sustainable materials, improved fits, and enhanced functionality. The use of recycled cotton, organic denim, and water-saving washing techniques are gaining traction. Innovations in stretch denim and functional designs cater to evolving consumer preferences. These innovations aim to meet the growing demand for eco-friendly and versatile products that offer superior comfort and style.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific jeans market by:

- Distribution Channel: Supermarkets/Hypermarkets, Specialist Stores, Online Retail Stores, Other Distribution Channels. Online retail is projected to experience the highest CAGR.

- Country: China, Japan, India, Australia, and Rest of Asia-Pacific. China will maintain its leading position.

- End-User: Men, Women, Children. The men's segment dominates, while the children's segment shows promising growth.

- Category: Mass, Premium. The premium segment is expected to exhibit faster growth.

Key Drivers of Asia-Pacific Jeans Market Growth

The Asia-Pacific jeans market growth is driven by several key factors: rising disposable incomes across the region, increasing urbanization leading to greater fashion consciousness, rapid growth of e-commerce, and evolving consumer preferences toward sustainable and functional apparel. The expansion of retail networks by major brands such as Wrangler also contributes to this growth.

Challenges in the Asia-Pacific Jeans Market Sector

Challenges include intense competition, fluctuating raw material prices, supply chain disruptions, varying levels of infrastructure development across the region, and the need to adapt to changing consumer preferences and evolving sustainability standards. These factors influence production costs and market access, impacting profitability and growth.

Emerging Opportunities in Asia-Pacific Jeans Market

Emerging opportunities lie in expanding into underserved markets, focusing on sustainable and ethically sourced products, leveraging technological advancements for improved efficiency and customization, and catering to specific niche markets such as athleisure and functional jeans. Growth in online channels also offers immense potential for new players.

Leading Players in the Asia-Pacific Jeans Market Market

- Gap Inc (Gap Inc.)

- Levi Strauss & Co (Levi Strauss & Co.)

- H&M Group (H&M Group)

- U S Polo Assn

- PVH Corp (PVH Corp)

- Edwin Co Ltd

- Uniqlo Co Ltd (Uniqlo Co Ltd)

- Diesel S p A (Diesel S p A)

- True Religion Brand Jeans

- VF Corporation (VF Corporation) *List Not Exhaustive

Key Developments in Asia-Pacific Jeans Market Industry

- July 2022: Wrangler expands its retail network in India, adding 39 stores and planning for 100 more.

- February 2022: Kontoor Brands partners with Arvind Limited and Cone Denim to improve the Higg MSI tool for sustainability.

- December 2021: Tasuka Jeans invests in eco-friendly washing machines, reducing water consumption by 40%.

Future Outlook for Asia-Pacific Jeans Market Market

The Asia-Pacific jeans market is poised for continued growth, driven by increasing disposable incomes, expanding e-commerce penetration, and growing demand for sustainable and innovative products. Strategic investments in sustainable practices, technological advancements, and efficient supply chains will be crucial for success in this dynamic and competitive market. The market is expected to witness consolidation among major players and the emergence of new niche brands.

Asia-Pacific Jeans Market Segmentation

-

1. End User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialist Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

Asia-Pacific Jeans Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Jeans Market Regional Market Share

Geographic Coverage of Asia-Pacific Jeans Market

Asia-Pacific Jeans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Smartwatches; Popularity of Luxury Watches

- 3.3. Market Restrains

- 3.3.1. Presence of Fake Brands in the Market

- 3.4. Market Trends

- 3.4.1. Rising Inclination of Customers Towards Fashionable Clothing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Jeans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialist Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gap Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Levi Strauss & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 H&M Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U S Polo Assn

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PVH Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Edwin Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Uniqlo Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Diesel S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 True Religion Brand Jeans

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VF Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gap Inc

List of Figures

- Figure 1: Asia-Pacific Jeans Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Jeans Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Jeans Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 2: Asia-Pacific Jeans Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 3: Asia-Pacific Jeans Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Asia-Pacific Jeans Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Jeans Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Asia-Pacific Jeans Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 7: Asia-Pacific Jeans Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Asia-Pacific Jeans Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Jeans Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Jeans Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Asia-Pacific Jeans Market?

Key companies in the market include Gap Inc, Levi Strauss & Co, H&M Group, U S Polo Assn, PVH Corp, Edwin Co Ltd, Uniqlo Co Ltd, Diesel S p A, True Religion Brand Jeans, VF Corporation*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Jeans Market?

The market segments include End User, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand for Smartwatches; Popularity of Luxury Watches.

6. What are the notable trends driving market growth?

Rising Inclination of Customers Towards Fashionable Clothing.

7. Are there any restraints impacting market growth?

Presence of Fake Brands in the Market.

8. Can you provide examples of recent developments in the market?

In July 2022, Wrangler, a US-based jeans giant, expanded its retail network in India by adding the 39thstore for the denim bigwig in the country. The company's CEO announced that they plan to expand the offline retail footprint by adding 100 more stores of Lee & Wrangler in the current fiscal year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Jeans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Jeans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Jeans Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Jeans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence