Key Insights

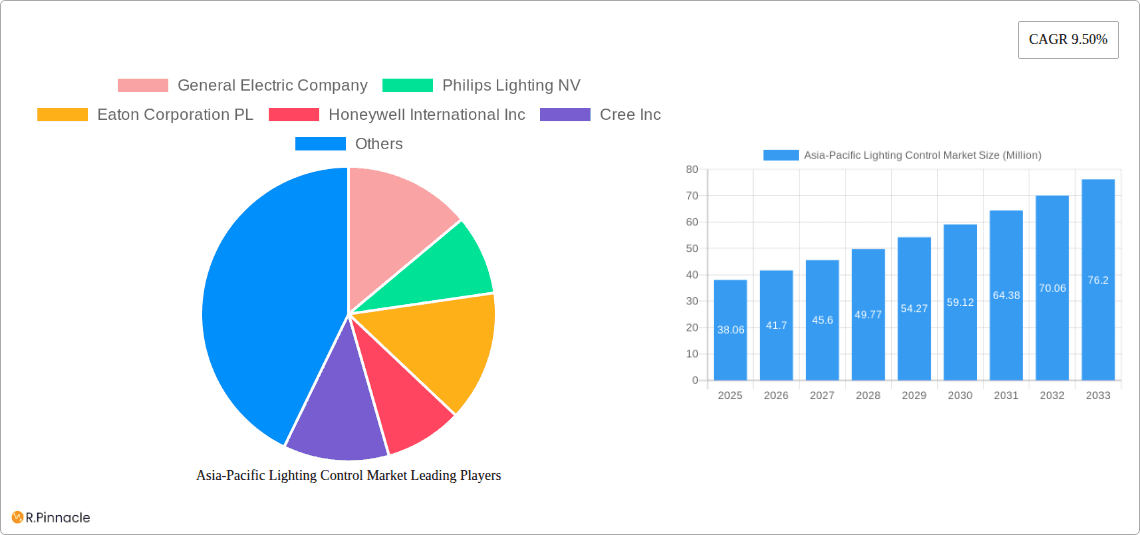

The Asia-Pacific lighting control market is experiencing robust expansion, projected to reach USD 38.06 Million by 2025 and is poised for significant growth at a Compound Annual Growth Rate (CAGR) of 9.50% during the forecast period of 2025-2033. This dynamic growth is fueled by a confluence of factors, including increasing governmental initiatives promoting energy efficiency and smart city development across nations like China, Japan, and India. The escalating adoption of LED lighting, which inherently requires sophisticated control systems for optimal performance and energy savings, serves as a primary catalyst. Furthermore, the burgeoning demand for intelligent and automated building management systems, driven by the need to reduce operational costs and enhance occupant comfort, is a key determinant of market expansion. The widespread integration of smart technologies in both residential and commercial sectors, coupled with a growing awareness of environmental sustainability, further bolsters the adoption of advanced lighting control solutions. The hardware segment, particularly LED drivers, sensors, switches, and gateways, is expected to witness substantial growth due to the increasing deployment of smart lighting infrastructure.

Asia-Pacific Lighting Control Market Market Size (In Million)

The market's trajectory is also significantly influenced by the widespread adoption of wireless communication protocols, offering greater flexibility and ease of installation compared to traditional wired systems. Applications in indoor environments, such as smart homes, offices, and retail spaces, are dominating the market, driven by the convenience and energy-saving benefits they offer. However, the outdoor segment is also gaining traction with the rise of smart street lighting and the implementation of intelligent infrastructure in urban areas. Key players are investing heavily in research and development to introduce innovative products and solutions that cater to the evolving needs of the market. While the market is experiencing strong growth, potential restraints such as the initial cost of advanced lighting control systems and the need for skilled labor for installation and maintenance might pose challenges. Nevertheless, the long-term outlook for the Asia-Pacific lighting control market remains exceptionally positive, driven by technological advancements and a sustained focus on energy conservation.

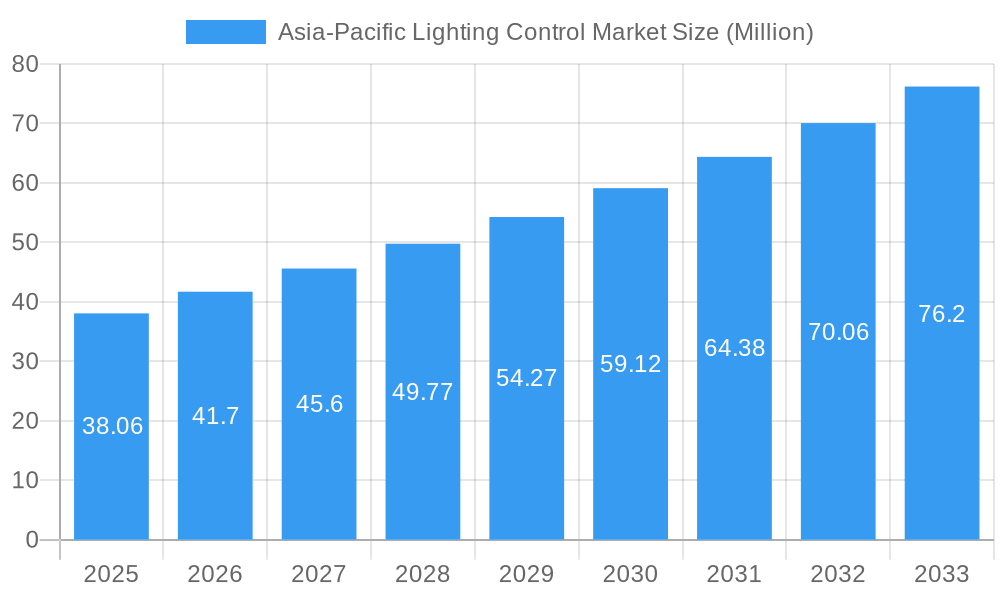

Asia-Pacific Lighting Control Market Company Market Share

Asia-Pacific Lighting Control Market: Unlocking Smart Illumination Growth (2024-2033)

This comprehensive report delivers an in-depth analysis of the Asia-Pacific Lighting Control Market, offering critical insights for stakeholders navigating the evolving landscape of intelligent illumination. With a focus on market structure, dynamics, dominant regions, product innovations, and strategic opportunities, this report is your essential guide to understanding and capitalizing on the rapid expansion of smart lighting solutions across the APAC region. Explore key trends, competitive strategies, and future outlooks to inform your business decisions.

Asia-Pacific Lighting Control Market Market Structure & Innovation Trends

The Asia-Pacific lighting control market is characterized by a moderately concentrated structure, with a blend of large multinational corporations and agile regional players vying for market share. Innovation is a primary driver, fueled by advancements in IoT, AI, and energy-efficient lighting technologies. Regulatory frameworks, particularly those promoting energy conservation and smart city initiatives, are increasingly influencing market development. The presence of readily available and cost-effective product substitutes, primarily basic manual controls, presents a challenge, though the superior functionality and energy savings of advanced lighting control systems are steadily displacing them. End-user demographics are shifting towards a greater demand for integrated smart home and smart building solutions, particularly in urban centers. Mergers and acquisitions are a significant aspect of the market's evolution, with strategic deals aimed at expanding technological capabilities and geographical reach. For instance, several notable M&A activities are anticipated to occur within the forecast period, with estimated deal values reaching into the hundreds of millions. Key players are actively consolidating their positions through acquisitions of innovative technology providers and specialized solution developers.

Asia-Pacific Lighting Control Market Market Dynamics & Trends

The Asia-Pacific lighting control market is experiencing robust growth, driven by a confluence of technological advancements, escalating energy efficiency mandates, and a burgeoning demand for smart, connected environments. The Compound Annual Growth Rate (CAGR) is projected to be significant, estimated between 12-15% over the forecast period of 2025-2033. This expansion is propelled by increasing urbanization and a growing awareness among consumers and businesses about the economic and environmental benefits of intelligent lighting systems. Technological disruptions, such as the widespread adoption of LED technology and the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in lighting solutions, are fundamentally reshaping the market. Smart sensors, advanced dimming capabilities, and wireless communication protocols are becoming standard features, enabling greater control, automation, and energy savings. Consumer preferences are increasingly leaning towards convenience, personalization, and energy consciousness. Homeowners are seeking to enhance their living spaces with intuitive lighting systems that can adapt to various moods and activities, while commercial and industrial sectors are prioritizing operational efficiency and reduced energy expenditures. The competitive landscape is dynamic, with established players and emerging innovators constantly introducing new products and services. Companies are investing heavily in research and development to create more sophisticated and user-friendly lighting control solutions, including advanced software platforms and seamless integration capabilities with other smart devices. The market penetration of sophisticated lighting control systems is steadily rising, particularly in developed economies within the APAC region. Government initiatives supporting green building standards and smart city development further bolster the market's upward trajectory. The increasing adoption of cloud-based platforms for lighting management also contributes to enhanced scalability and remote monitoring capabilities, attracting a wider range of applications and users. The demand for customized lighting solutions that cater to specific industry needs, such as retail, hospitality, and healthcare, is also a significant trend.

Dominant Regions & Segments in Asia-Pacific Lighting Control Market

Within the Asia-Pacific lighting control market, China stands out as the dominant region, driven by its massive manufacturing capabilities, extensive infrastructure development, and proactive government support for smart technologies and energy efficiency. The nation's rapid urbanization, coupled with substantial investments in smart city projects and green building initiatives, creates a fertile ground for the widespread adoption of advanced lighting control systems. Economic policies that encourage technological innovation and energy conservation further bolster China's leadership.

- Leading Region: China

- Key Drivers in China:

- Massive urbanization and smart city development

- Strong government support for energy efficiency and green buildings

- Extensive manufacturing ecosystem for lighting control components

- Growing consumer demand for smart home solutions

- Increasing adoption in commercial and industrial sectors

The Hardware segment, particularly LED Drivers and Sensors, is experiencing significant growth and is expected to hold a substantial market share. LED drivers are critical for the efficient operation of modern LED lighting systems, ensuring optimal performance and longevity. The increasing penetration of LED lighting across all applications necessitates a parallel growth in the demand for sophisticated LED drivers. Sensors, including occupancy, daylight, and motion sensors, are fundamental to achieving smart and energy-efficient lighting control. Their ability to automate lighting based on real-time conditions drives significant energy savings and enhances user experience.

- Dominant Segment (Type): Hardware (LED Drivers, Sensors)

- Key Drivers for Hardware Dominance:

- Ubiquitous adoption of LED lighting technology

- Critical role in enabling energy efficiency and automation

- Continuous innovation in sensor technology for improved accuracy and functionality

- Integration with smart building and IoT platforms

The Wireless communication protocol segment is outpacing its wired counterpart due to its inherent flexibility, ease of installation, and cost-effectiveness, especially in retrofitting existing infrastructure. Technologies like Zigbee, Z-Wave, and Bluetooth Low Energy (BLE) are facilitating seamless connectivity and interoperability among lighting devices and other smart home/building systems.

- Dominant Segment (Communication Protocol): Wireless

- Key Drivers for Wireless Dominance:

- Ease of installation and flexibility

- Cost-effectiveness for retrofitting

- Growing ecosystem of wireless IoT devices

- Enhanced interoperability with smart home platforms

In terms of application, Indoor lighting controls are currently leading due to the high concentration of smart building initiatives, office retrofits, and the burgeoning smart home market in developed APAC economies. However, the Outdoor lighting control segment is poised for significant growth, driven by smart city projects focusing on street lighting, public spaces, and infrastructure.

- Dominant Segment (Application): Indoor (with strong growth potential in Outdoor)

- Key Drivers for Indoor Dominance:

- Smart building automation and energy management in commercial spaces

- Growth of the smart home market

- Demand for improved comfort and functionality in residential and office environments

Asia-Pacific Lighting Control Market Product Innovations

Product innovations in the Asia-Pacific lighting control market are centered on enhancing connectivity, intelligence, and energy efficiency. Advanced LED drivers with integrated smart features, sophisticated sensor arrays capable of detecting multiple environmental parameters, and intuitive software platforms offering seamless control and analytics are at the forefront. Companies are developing integrated lighting solutions that combine illumination with other functionalities, such as security and communication. Competitive advantages are being built on ease of integration with existing smart home and building management systems, advanced cybersecurity features, and AI-powered predictive maintenance and optimization capabilities. The focus is on delivering user-centric solutions that offer personalized lighting experiences, significant energy savings, and simplified management.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific Lighting Control Market segmented by Type: Hardware (LED Drivers, Sensors, Switches and Dimmers, Relay Units, Gateways), Software, Communication Protocol: Wired, Wireless, and Application: Indoor, Outdoor. The Hardware segment, particularly LED Drivers and Sensors, is projected to witness substantial market growth due to the widespread adoption of LED technology and the increasing demand for energy-efficient solutions. Software solutions are expected to experience a high CAGR as more intelligent features and analytics are integrated into lighting control systems. The Wireless communication protocol segment will continue to dominate over Wired due to its flexibility and ease of installation. The Indoor application segment currently holds the largest market share, driven by smart buildings and homes, while the Outdoor segment shows significant growth potential with the rise of smart cities.

Key Drivers of Asia-Pacific Lighting Control Market Growth

The Asia-Pacific lighting control market's growth is primarily fueled by several key drivers. Technological advancements, particularly the proliferation of IoT, AI, and sophisticated sensor technologies, enable more intelligent and automated lighting solutions. Government initiatives promoting energy efficiency, smart cities, and sustainable development create a favorable regulatory environment and encourage adoption. Increasing energy costs globally are compelling businesses and consumers to seek energy-saving solutions, with intelligent lighting control being a primary beneficiary. Furthermore, the growing demand for smart homes and buildings driven by evolving consumer preferences for convenience, comfort, and connectivity is a significant market accelerator. The expanding commercial and industrial sectors are also adopting these technologies to optimize operational efficiency and reduce utility expenses.

Challenges in the Asia-Pacific Lighting Control Market Sector

Despite the robust growth, the Asia-Pacific lighting control market faces several challenges. High initial investment costs for advanced systems can be a barrier for some small and medium-sized enterprises and residential consumers. Interoperability issues among different brands and platforms can create complexity for users seeking integrated solutions. Cybersecurity concerns related to connected devices are also a growing apprehension, requiring robust security measures. Furthermore, a lack of awareness and understanding about the full benefits of intelligent lighting control among certain consumer segments can slow adoption. Fragmented regulatory landscapes across different countries within the APAC region can also present hurdles for market expansion. Supply chain disruptions and the availability of skilled labor for installation and maintenance also pose potential restraints.

Emerging Opportunities in Asia-Pacific Lighting Control Market

The Asia-Pacific lighting control market is ripe with emerging opportunities. The rapid expansion of smart city initiatives across the region presents a massive opportunity for intelligent street lighting, public space illumination, and infrastructure management. The increasing adoption of 5G technology will further enable more robust and responsive wireless lighting control networks. The growing focus on human-centric lighting (HCL) in workplaces and healthcare facilities, which optimizes lighting for well-being and productivity, is creating new product development avenues. The integration of lighting control systems with other smart building technologies, such as HVAC and security systems, offers significant potential for creating holistic smart environments. The development of energy-harvesting technologies for sensors and the use of AI for predictive maintenance of lighting infrastructure are also promising areas for innovation and market penetration.

Leading Players in the Asia-Pacific Lighting Control Market Market

- General Electric Company

- Philips Lighting NV

- Eaton Corporation PL

- Honeywell International Inc

- Cree Inc

- Lutron Electronics Co Inc

- Leviton Manufacturing Company Inc

- WAGO Corporation

- Infineon Technologies

- Schneider Electric

- Cisco Systems Inc

- Taiwan Semiconductor

- Toshiba

Key Developments in Asia-Pacific Lighting Control Market Industry

- May 2024: Advanced Illumination announced the release of a new series of LED lighting controllers, specifically designed as central hubs for connectivity between cameras, lights, and I/O devices. The HCS-150-ZEB is intended for use with Zebra Technologies’ Iris GTX Smart Camera, powering it while facilitating communication and control between light sources, cameras, and other I/O devices.

- March 2024: Marelli developed an innovative automotive lighting domain control unit platform in China, capable of controlling front lights, rear lights, and new 360° lighting features of vehicles. This platform is slated for presentation at the Beijing International Automotive Exhibition, showcasing advanced technology for next-generation vehicles.

Future Outlook for Asia-Pacific Lighting Control Market Market

The future outlook for the Asia-Pacific lighting control market is exceptionally promising, driven by an accelerating demand for energy efficiency, smart technologies, and enhanced user experiences. Continued advancements in AI and IoT will lead to more sophisticated autonomous lighting systems capable of adapting to complex environmental and behavioral patterns. The expansion of smart city projects will significantly boost demand for outdoor lighting controls, while the burgeoning smart home market will sustain growth in the residential sector. Government policies favoring sustainability and technological innovation will continue to be key enablers. Strategic partnerships and mergers will likely shape the competitive landscape, fostering greater integration and innovation. The market is poised for sustained double-digit growth, offering significant strategic opportunities for players who can deliver integrated, intelligent, and user-centric lighting control solutions.

Asia-Pacific Lighting Control Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. LED Drivers

- 1.1.2. Sensors

- 1.1.3. Switches and Dimmers

- 1.1.4. Relay Units

- 1.1.5. Gateways

- 1.2. Software

-

1.1. Hardware

-

2. Communication Protocol

- 2.1. Wired

- 2.2. Wireless

-

3. Application

- 3.1. Indoor

- 3.2. Outdoor

Asia-Pacific Lighting Control Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

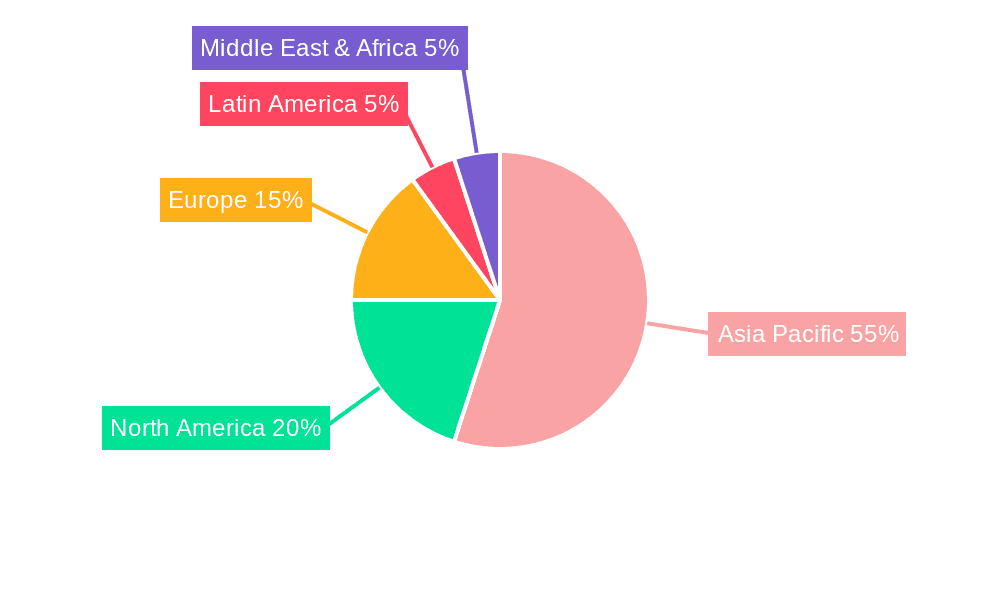

Asia-Pacific Lighting Control Market Regional Market Share

Geographic Coverage of Asia-Pacific Lighting Control Market

Asia-Pacific Lighting Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Smart City Projects in Developing Countries; Increasing Investments in Infrastructure Developments

- 3.3. Market Restrains

- 3.3.1. Rising Smart City Projects in Developing Countries; Increasing Investments in Infrastructure Developments

- 3.4. Market Trends

- 3.4.1. Growing Modernization and Infrastructural Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Lighting Control Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. LED Drivers

- 5.1.1.2. Sensors

- 5.1.1.3. Switches and Dimmers

- 5.1.1.4. Relay Units

- 5.1.1.5. Gateways

- 5.1.2. Software

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Indoor

- 5.3.2. Outdoor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Electric Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Philips Lighting NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eaton Corporation PL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cree Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lutron Electronics Co Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leviton Manufacturing Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WAGO Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Infineon Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Schneider Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cisco Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Taiwan Semiconductor

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Toshib

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 General Electric Company

List of Figures

- Figure 1: Asia-Pacific Lighting Control Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Lighting Control Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 4: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Communication Protocol 2020 & 2033

- Table 5: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 12: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Communication Protocol 2020 & 2033

- Table 13: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Lighting Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Lighting Control Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Lighting Control Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Lighting Control Market?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the Asia-Pacific Lighting Control Market?

Key companies in the market include General Electric Company, Philips Lighting NV, Eaton Corporation PL, Honeywell International Inc, Cree Inc, Lutron Electronics Co Inc, Leviton Manufacturing Company Inc, WAGO Corporation, Infineon Technologies, Schneider Electric, Cisco Systems Inc, Taiwan Semiconductor, Toshib.

3. What are the main segments of the Asia-Pacific Lighting Control Market?

The market segments include Type, Communication Protocol, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Smart City Projects in Developing Countries; Increasing Investments in Infrastructure Developments.

6. What are the notable trends driving market growth?

Growing Modernization and Infrastructural Development.

7. Are there any restraints impacting market growth?

Rising Smart City Projects in Developing Countries; Increasing Investments in Infrastructure Developments.

8. Can you provide examples of recent developments in the market?

May 2024: Advanced Illumination announced the release of a new series of LED lighting controllers, which have been specifically designed to act as a central hub for connectivity between cameras, lights, and I/O devices. The first product in this line, the HCS-150-ZEB, is intended for use with Zebra Technologies’ Iris GTX Smart Camera. This innovative light hub is capable of powering a connected Zebra Iris GTX smart camera while also facilitating communication and control between the light source, camera, and any other connected I/O devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Lighting Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Lighting Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Lighting Control Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Lighting Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence