Key Insights

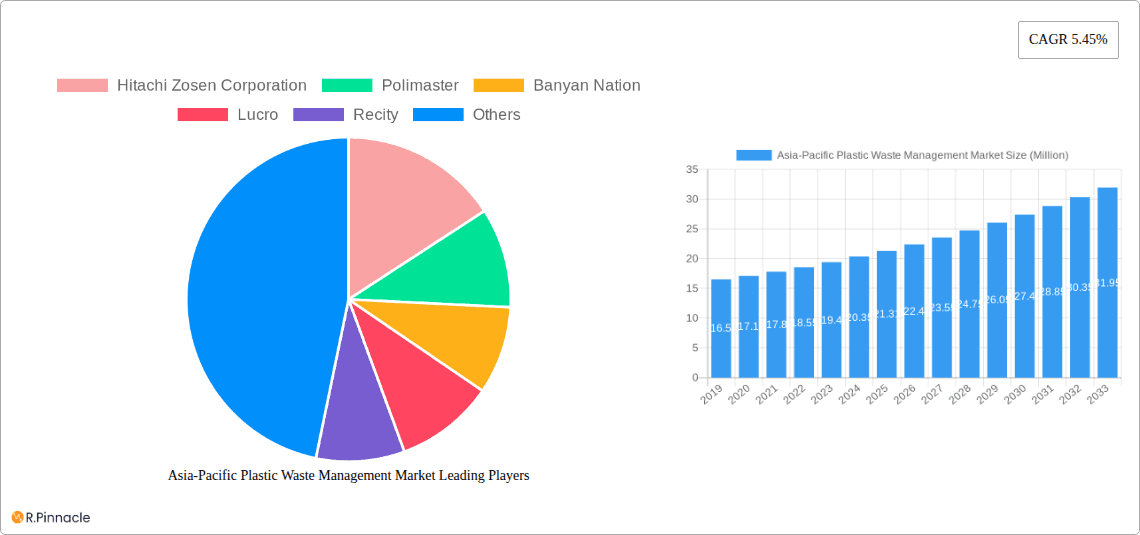

The Asia-Pacific plastic waste management market is poised for significant expansion, projected to reach an estimated USD 21.31 million by 2025, driven by a robust CAGR of 5.45% over the forecast period. This growth is primarily fueled by escalating plastic consumption across its diverse economies, coupled with increasing environmental awareness and stringent government regulations aimed at curbing plastic pollution. The market's dynamism is further propelled by the growing adoption of advanced recycling technologies, including both mechanical and chemical treatments, which are vital for diverting plastic waste from landfills. Key segments such as Polypropylene (PP) and Polyethylene (PE) represent substantial portions of the waste stream, necessitating tailored management solutions. The residential sector remains a primary source of plastic waste, though contributions from commercial and industrial activities are also significant and growing. Emerging trends like the circular economy model and the development of innovative waste-to-energy solutions are expected to further stimulate market activity.

Asia-Pacific Plastic Waste Management Market Market Size (In Million)

While the region demonstrates strong growth potential, certain restraints such as inadequate infrastructure for waste collection and processing, particularly in developing economies, and the high cost associated with advanced treatment technologies, present challenges. However, ongoing investments in technological innovation and public-private partnerships are steadily addressing these limitations. The market is witnessing a surge in companies adopting integrated waste management strategies, focusing on collection, sorting, recycling, and responsible disposal. Key players are actively investing in research and development to enhance recycling efficiency and explore novel uses for recycled plastics. Regional focus will likely remain on major economies like China and India, which generate substantial plastic waste, alongside established markets like Japan and South Korea, known for their advanced waste management practices. This collective effort is crucial for mitigating the environmental impact of plastic waste and fostering a sustainable future for the Asia-Pacific region.

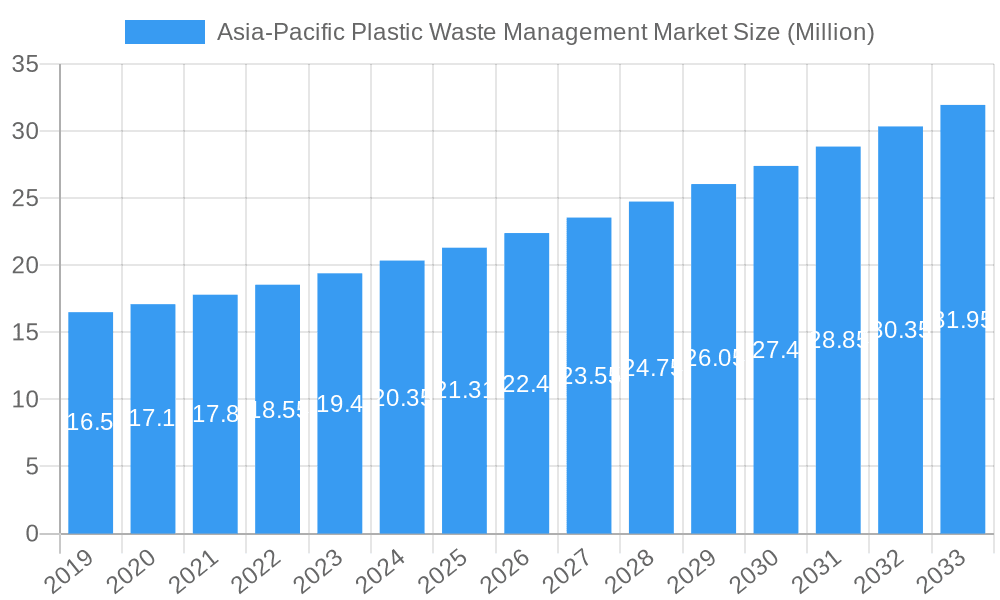

Asia-Pacific Plastic Waste Management Market Company Market Share

Here is an SEO-optimized, reader-centric report description for the Asia-Pacific Plastic Waste Management Market:

Asia-Pacific Plastic Waste Management Market: Comprehensive Industry Analysis and Growth Forecast (2019–2033)

Gain unparalleled insights into the rapidly evolving Asia-Pacific plastic waste management market. This in-depth report, spanning the historical period 2019-2024, base year 2025, and a forecast period from 2025-2033, provides strategic intelligence for stakeholders navigating this critical sector. With a projected market size reaching USD 150 Billion by 2033 and a Compound Annual Growth Rate (CAGR) of 6.2%, this analysis is essential for understanding market dynamics, key players, and future opportunities. We meticulously dissect market segmentation, regional dominance, and the impact of groundbreaking industry developments.

Asia-Pacific Plastic Waste Management Market Market Structure & Innovation Trends

The Asia-Pacific plastic waste management market is characterized by a moderately fragmented structure, with a mix of large multinational corporations and numerous regional and local players. Innovation is a key driver, fueled by increasing environmental regulations, technological advancements in recycling, and a growing consumer demand for sustainable solutions. Regulatory frameworks are becoming more stringent across the region, pushing for higher recycling rates and reduced landfill dependence. Product substitutes are emerging, such as biodegradable and compostable plastics, though their widespread adoption is still in its nascent stages. End-user demographics are diverse, encompassing households, commercial enterprises, and industrial sectors, each with unique waste generation patterns and management needs. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate their market positions, expand their service offerings, and gain access to new technologies. Notable M&A deal values are projected to exceed USD 5 Billion by 2028, indicating significant consolidation and strategic investment in the sector.

Asia-Pacific Plastic Waste Management Market Market Dynamics & Trends

The Asia-Pacific plastic waste management market is experiencing dynamic growth, propelled by a confluence of factors that are reshaping how plastic waste is handled and processed. A primary growth driver is the escalating volume of plastic waste generated due to burgeoning populations, rapid urbanization, and expanding middle-class consumption across the region. Governments are increasingly implementing robust policies and regulations, including extended producer responsibility (EPR) schemes and landfill bans on certain types of waste, directly incentivizing investment in advanced waste management infrastructure and technologies. The market penetration of sophisticated recycling techniques, such as chemical recycling and advanced mechanical recycling, is steadily increasing, offering solutions for plastics that were previously difficult to reprocess.

Technological disruptions are playing a pivotal role. Innovations in sorting technologies, including AI-powered optical sorters, are enhancing the efficiency and purity of recycled materials. Furthermore, advancements in chemical recycling processes are unlocking the potential to convert mixed plastic waste back into valuable feedstock for virgin plastic production, thereby closing the loop and reducing reliance on fossil fuels. Consumer preferences are also shifting significantly, with a growing awareness of environmental issues leading to a demand for sustainable products and services. This consumer push is compelling businesses to adopt more responsible waste management practices and invest in circular economy models.

The competitive landscape is intensifying, with established waste management giants competing alongside agile startups and specialized technology providers. This competition is driving down costs, fostering innovation, and expanding the accessibility of waste management services. The increasing focus on the circular economy is a significant trend, moving beyond linear "take-make-dispose" models to emphasize reuse, repair, and recycling, creating new business models and value chains. The market penetration of integrated waste management solutions, offering comprehensive services from collection to final processing, is a notable trend as well. Overall, the market is poised for continued expansion, driven by both regulatory imperatives and evolving societal expectations. The projected market size for the Asia-Pacific plastic waste management sector is estimated to reach USD 150 Billion by 2033, with a CAGR of 6.2% during the forecast period.

Dominant Regions & Segments in Asia-Pacific Plastic Waste Management Market

The Asia-Pacific region presents a complex and varied landscape for plastic waste management, with several countries and segments exhibiting significant dominance. China is a leading force, driven by its massive population, extensive industrial base, and substantial investments in waste management infrastructure. The Chinese government's stringent environmental policies and ambitious targets for waste reduction and recycling have propelled significant market growth. India is another pivotal market, grappling with the immense challenges of plastic pollution but also demonstrating a burgeoning awareness and commitment to improving waste management systems, with significant potential for growth in the coming years.

In terms of Polymer segmentation, Polyethylene (PE) and Polypropylene (PP) collectively represent the largest share, accounting for approximately 65% of the total plastic waste volume. This is due to their widespread use in packaging, consumer goods, and industrial applications.

- Polyethylene (PE): High demand in packaging films, bags, and containers makes it a primary focus for waste management efforts.

- Polypropylene (PP): Found in automotive parts, textiles, and rigid packaging, its management is crucial.

- Terephthalate (PET): Dominant in beverage bottles, PET recycling is relatively established, but challenges remain in managing post-consumer waste effectively.

The Residential segment is the largest source of plastic waste, contributing an estimated 40% of the total volume, driven by household consumption patterns.

- Residential: A vast and diverse stream, requiring sophisticated collection and sorting mechanisms.

- Commercial: Significant contributions from retail, hospitality, and office buildings, often with more homogenous waste streams.

- Industrial: While often more homogenous, industrial plastic waste can be complex due to specific polymer types and contaminants.

The Recycling treatment method is experiencing the most substantial growth, driven by policy mandates and technological advancements.

- Recycling: The most favored treatment method, with increasing investments in both mechanical and chemical recycling.

- Chemical Treatment: Gaining traction for complex or mixed plastic waste, offering a pathway to high-value outputs.

- Landfill: While still prevalent, landfilling is increasingly being restricted and is viewed as the least desirable option due to its environmental impact.

Key drivers for dominance in these regions and segments include supportive economic policies, substantial government funding for infrastructure development, and the presence of advanced technological solutions. For instance, initiatives like the USD 250 million IBRD loan for China's Shaanxi Province highlight significant financial backing and a strategic approach to national-level waste management improvements.

Asia-Pacific Plastic Waste Management Market Product Innovations

Product innovations in the Asia-Pacific plastic waste management market are primarily focused on enhancing recycling efficiency, expanding the range of recyclable materials, and developing novel waste-to-value solutions. Advanced sorting technologies utilizing AI and machine learning are enabling higher purity of recycled plastics. Innovations in chemical recycling are breaking down complex polymers into their constituent monomers, allowing for the creation of virgin-quality plastics from waste streams. Companies are also developing advanced additives and processing techniques that improve the properties of recycled plastics, making them suitable for higher-value applications. Furthermore, there's a growing trend towards modular and scalable waste processing units that can be deployed in diverse locations, increasing accessibility and reducing transportation costs.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia-Pacific plastic waste management market across critical dimensions. Polymer Segmentation: The analysis covers Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Terephthalate (PET), and Other Polymers. Growth projections for PE and PP are robust due to their high usage, while PET recycling remains a significant focus. Source Segmentation: Key sources include Residential, Commercial, Industrial, and Other Sources (Construction, Healthcare, etc.). The Residential segment is projected to maintain its dominance due to population growth, while Industrial sources offer opportunities for specialized waste management solutions. Treatment Segmentation: The report details the market for Recycling, Chemical Treatment, Landfill, and Other Treatments. Recycling is expected to exhibit the highest growth rate, driven by policy and technological advancements, with Chemical Treatment emerging as a crucial solution for non-recyclable plastics.

Key Drivers of Asia-Pacific Plastic Waste Management Market Growth

Several interconnected factors are propelling the growth of the Asia-Pacific plastic waste management market. Stringent government regulations, including bans on single-use plastics and mandates for increased recycling rates, are a primary catalyst. Technological advancements in sorting, recycling, and waste-to-energy solutions are making waste management more efficient and economically viable. Growing environmental awareness among consumers and corporations is creating demand for sustainable practices and products. Economic development and urbanization lead to increased waste generation, necessitating improved management systems. Furthermore, the growing adoption of circular economy principles is driving innovation and investment in solutions that recover value from plastic waste.

Challenges in the Asia-Pacific Plastic Waste Management Market Sector

Despite robust growth, the Asia-Pacific plastic waste management market faces significant challenges. Inadequate collection infrastructure, particularly in rural and developing areas, limits the effective capture of plastic waste. The presence of mixed and contaminated plastic streams poses technical difficulties for recycling processes. Evolving regulatory landscapes can create uncertainty for investors. The cost-effectiveness of advanced recycling technologies compared to virgin plastic production remains a barrier. Furthermore, a lack of public awareness and participation in waste segregation efforts in some regions hinders the efficiency of the entire value chain. Competitive pressures among waste management providers can also impact profitability and investment in new technologies.

Emerging Opportunities in Asia-Pacific Plastic Waste Management Market

The Asia-Pacific plastic waste management market presents a wealth of emerging opportunities. The development of advanced chemical recycling technologies offers a pathway to process difficult-to-recycle plastics and create high-value outputs. The growing demand for sustainable packaging solutions is creating new markets for recycled plastic content. Investments in waste-to-energy technologies provide an avenue for generating clean energy from non-recyclable plastic waste. The expansion of EPR schemes across more countries will drive demand for comprehensive waste management services. Furthermore, digitalization and the use of IoT for waste collection optimization and tracking present opportunities for enhanced efficiency and transparency.

Leading Players in the Asia-Pacific Plastic Waste Management Market Market

- Hitachi Zosen Corporation

- Polimaster

- Banyan Nation

- Lucro

- Recity

- SUEZ

- Waste Management Inc

- Cleanaway Waste Management Limited

- Plastic Bank

- Agilyx

- GreenTech Environmental Co Ltd

- List Not Exhaustive

Key Developments in Asia-Pacific Plastic Waste Management Market Industry

- April 2024: A new initiative, "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions," was introduced to combat Southeast Asia's escalating plastic pollution crisis. The project's primary goal is to chart and diminish the volume of plastic waste entering the waterways of the Mekong countries, focusing on four pilot cities: Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam). This development underscores a regional focus on tackling plastic pollution at its source.

- March 2023: The World Bank's Board of Executives approved a USD 250 million IBRD loan. This funding aims to combat plastic pollution from municipal solid waste and agricultural plastic film in rural regions of China's Shaanxi Province. It also seeks to enhance the province's plastic waste management practices to set a blueprint for national-level initiatives. This significant financial commitment highlights government and international support for comprehensive waste management strategies.

Future Outlook for Asia-Pacific Plastic Waste Management Market Market

The future outlook for the Asia-Pacific plastic waste management market is exceptionally bright, driven by a confluence of escalating environmental concerns, robust policy frameworks, and continuous technological innovation. As the region's economies continue to grow and urbanization intensifies, the volume of plastic waste will inevitably increase, creating a persistent demand for effective management solutions. Investments in advanced recycling technologies, particularly chemical recycling, are expected to surge, enabling the processing of a wider array of plastic types and contributing to a more circular economy. Furthermore, the growing consumer preference for sustainable products and the increasing corporate commitment to Environmental, Social, and Governance (ESG) principles will act as powerful accelerators for the adoption of innovative waste management practices and the development of new business models focused on resource recovery and value creation from waste streams.

Asia-Pacific Plastic Waste Management Market Segmentation

-

1. Polymer

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene (PE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Terephthalate (PET)

- 1.5. Other Polymers

-

2. Source

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Other Sources (Construction, Healthcare, etc.)

-

3. Treatment

- 3.1. Recycling

- 3.2. Chemical Treatment

- 3.3. Landfill

- 3.4. Other Treatments

Asia-Pacific Plastic Waste Management Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Plastic Waste Management Market Regional Market Share

Geographic Coverage of Asia-Pacific Plastic Waste Management Market

Asia-Pacific Plastic Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.3. Market Restrains

- 3.3.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.4. Market Trends

- 3.4.1. Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Plastic Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Terephthalate (PET)

- 5.1.5. Other Polymers

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Other Sources (Construction, Healthcare, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Treatment

- 5.3.1. Recycling

- 5.3.2. Chemical Treatment

- 5.3.3. Landfill

- 5.3.4. Other Treatments

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Zosen Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polimaster

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banyan Nation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lucro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Recity

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUEZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Management Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cleanaway Waste Management Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plastic Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agilyx

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GreenTech Environmental Co Ltd*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hitachi Zosen Corporation

List of Figures

- Figure 1: Asia-Pacific Plastic Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Plastic Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 2: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 3: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 5: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 6: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 7: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 10: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 11: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 13: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 14: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 15: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Plastic Waste Management Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Plastic Waste Management Market?

Key companies in the market include Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, Recity, SUEZ, Waste Management Inc, Cleanaway Waste Management Limited, Plastic Bank, Agilyx, GreenTech Environmental Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Plastic Waste Management Market?

The market segments include Polymer, Source, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

6. What are the notable trends driving market growth?

Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific.

7. Are there any restraints impacting market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

8. Can you provide examples of recent developments in the market?

April 2024: A new initiative, "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions," was introduced to combat Southeast Asia's escalating plastic pollution crisis. The project's primary goal is to chart and diminish the volume of plastic waste entering the waterways of the Mekong countries, focusing on four pilot cities: Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Plastic Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Plastic Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Plastic Waste Management Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Plastic Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence