Key Insights

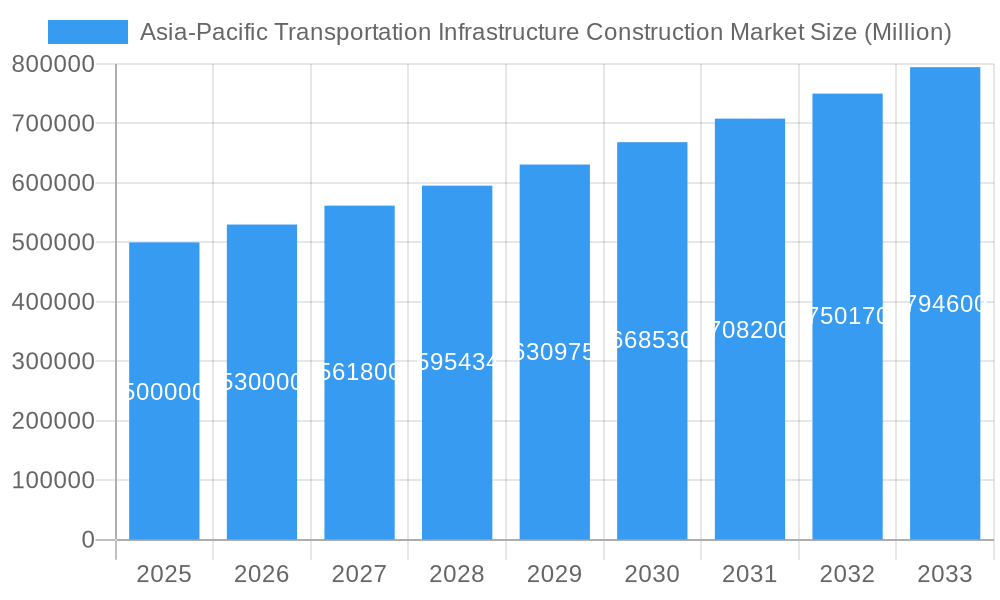

The Asia-Pacific transportation infrastructure construction market is poised for significant expansion, driven by rapid urbanization, rising disposable incomes, and strategic government investments in regional connectivity. The market, valued at $432 billion in 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% from 2024 to 2033. This growth is underpinned by substantial infrastructure projects in key economies such as China, India, and Indonesia, focusing on road networks, high-speed rail, and airport enhancements. The adoption of sustainable and advanced construction technologies further fuels this expansion. Key growth segments include road and rail construction, attracting considerable investment. Despite challenges like land acquisition and environmental considerations, strong governmental support and private sector engagement ensure a positive market outlook.

Asia-Pacific Transportation Infrastructure Construction Market Market Size (In Billion)

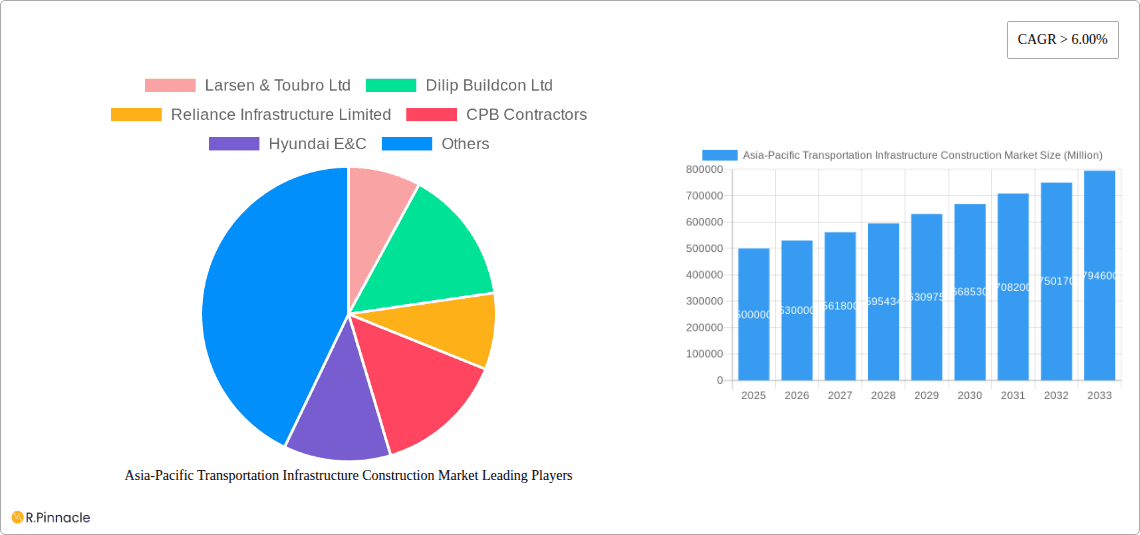

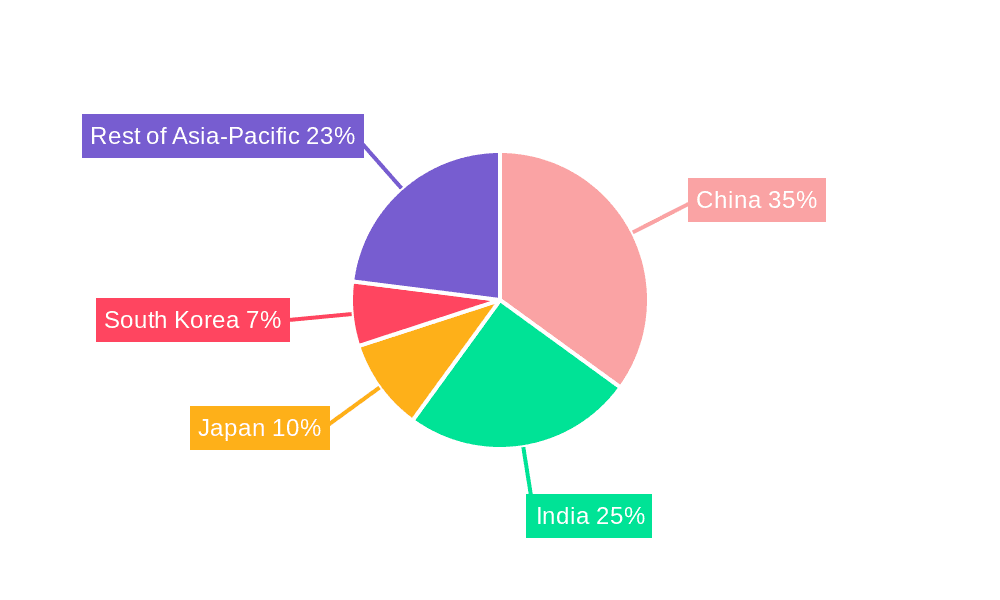

Significant regional disparities characterize the Asia-Pacific transportation infrastructure landscape. China and India lead market share due to their large populations and dynamic economies, followed by Japan, South Korea, and Vietnam, all undertaking significant infrastructure modernization. The market encompasses diverse transportation modes—roads, railways, airways, and waterways—contributing to its overall scale and complexity. Intense competition among leading firms, including Larsen & Toubro Ltd, Dilip Buildcon Ltd, CPB Contractors, and Hyundai E&C, spurs innovation and efficiency. The increasing prevalence of Public-Private Partnerships (PPPs) is expected to accelerate project development and market growth.

Asia-Pacific Transportation Infrastructure Construction Market Company Market Share

This report offers a comprehensive analysis of the Asia-Pacific transportation infrastructure construction market, providing critical insights for industry stakeholders, investors, and planners. Covering the period from 2019 to 2033, with a base year of 2024 and a forecast period of 2024-2033, it details current market dynamics and future growth trends. The market is segmented by country (China, India, Vietnam, Japan, South Korea, Indonesia, Thailand, and Rest of Asia-Pacific) and by transportation mode (Roads, Railways, Airways, and Waterways). The report's value is estimated to exceed $100 million.

Asia-Pacific Transportation Infrastructure Construction Market Market Structure & Innovation Trends

The Asia-Pacific transportation infrastructure construction market exhibits a moderately concentrated structure, with several large players holding significant market share. Key players include Larsen & Toubro Ltd, Dilip Buildcon Ltd, Reliance Infrastructure Limited, CPB Contractors, Hyundai E&C, China State Construction Engineering, China Communications Construction Company, Obayashi Corporation, Italian Thai (ITD), and China Railway Construction Corporation. However, the market also includes numerous smaller regional players, contributing to a dynamic competitive landscape. Market share data reveals China State Construction Engineering and China Communications Construction Company hold a combined market share of approximately xx%, reflecting their dominance in large-scale projects. Mergers and acquisitions (M&A) activity has been substantial, with deal values exceeding xx Million in the last five years, primarily driven by companies seeking to expand their geographic reach and service offerings. Innovation in the sector is fueled by government initiatives promoting sustainable transportation, advancements in construction technology (e.g., prefabricated components, 3D printing), and increasing demand for intelligent transportation systems (ITS). Regulatory frameworks vary across countries, impacting project timelines and costs. Product substitutes, such as improved public transportation systems, also influence market dynamics. End-user demographics are evolving, with a growing middle class driving demand for improved transportation infrastructure in urban and rural areas.

Asia-Pacific Transportation Infrastructure Construction Market Market Dynamics & Trends

The Asia-Pacific transportation infrastructure construction market is experiencing robust growth, driven by several key factors. Government investments in infrastructure development across various countries in the region are a primary driver, supported by initiatives focused on urbanization, economic development, and improved connectivity. Technological advancements, such as the adoption of Building Information Modeling (BIM) and automation, are enhancing efficiency and reducing project completion times. Changing consumer preferences, particularly in urban areas, are favoring sustainable transportation options and improved public transit systems. The competitive landscape is characterized by intense rivalry among large multinational firms and regional players, leading to innovation and price competition. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with significant penetration of new technologies and expansion into previously underserved markets.

Dominant Regions & Segments in Asia-Pacific Transportation Infrastructure Construction Market

Dominant Region: China dominates the Asia-Pacific transportation infrastructure construction market due to massive government investment in infrastructure development projects, including high-speed rail networks and extensive road expansions. Its economic strength and focus on connectivity significantly contribute to its leading position.

Dominant Country: China maintains its position as the leading country in the Asia-Pacific transportation infrastructure construction market. Key drivers include continuous government spending, ambitious infrastructure projects, and the presence of major construction firms.

Dominant Segment (By Mode): Roads remain the dominant segment within the Asia-Pacific market, fueled by increasing urbanization, the need for improved road networks, and continuous government investments in highway expansion projects.

Other Key Countries: India, experiencing rapid economic growth and urbanization, shows significant potential with large-scale projects focused on road and rail infrastructure development. Other countries such as Japan, South Korea, and Indonesia showcase growth, driven by investments in modernizing existing networks and the development of new transportation infrastructure to support national economic objectives.

Key Drivers (China): Massive government investment in infrastructure, high economic growth, large-scale projects (high-speed rail, road networks), strong domestic construction companies.

Key Drivers (India): Rapid economic growth, urbanization, government initiatives for improved connectivity (roads, railways), and foreign direct investment in infrastructure projects.

Asia-Pacific Transportation Infrastructure Construction Market Product Innovations

The Asia-Pacific transportation infrastructure construction market witnesses continuous product innovations. The integration of advanced technologies such as BIM, IoT sensors for real-time monitoring, and prefabrication methods are streamlining processes, improving quality, and reducing construction time. Sustainable construction materials and practices are gaining traction, driven by environmental concerns. The focus on developing smart infrastructure systems that incorporate digital technologies to improve efficiency and safety is further shaping market innovation. These innovations directly contribute to enhanced project management, reduced costs, and enhanced infrastructure resilience.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific transportation infrastructure construction market by both country and mode of transportation.

By Country: The report provides detailed analyses of the market in China, India, Vietnam, Japan, South Korea, Indonesia, Thailand, and the Rest of Asia-Pacific, considering factors such as government policies, economic growth, and infrastructure development plans. Growth projections and market sizes are provided for each country, alongside insights into the competitive dynamics within each region.

By Mode: The report analyzes the market for Roads, Railways, Airways, and Waterways, evaluating market size, growth projections, and competitive factors for each mode of transportation. Each segment’s analysis includes details on market size, growth projections, and key players in that specific mode.

Key Drivers of Asia-Pacific Transportation Infrastructure Construction Market Growth

Several factors drive growth in the Asia-Pacific transportation infrastructure construction market. Government investments in infrastructure projects, aimed at improving connectivity and supporting economic development, are a primary driver. The region’s rapid urbanization and economic growth significantly increase the demand for modern transportation systems. Technological advancements, including the implementation of BIM, smart technologies, and sustainable construction practices, also contribute to the industry's expansion. Favorable regulatory frameworks in several countries further encourage private sector participation and investment in infrastructure projects.

Challenges in the Asia-Pacific Transportation Infrastructure Construction Market Sector

The Asia-Pacific transportation infrastructure construction market faces several challenges, including securing funding for large-scale projects, navigating complex regulatory processes and land acquisition issues, managing supply chain disruptions, and addressing environmental concerns. Competition among construction firms can intensify, leading to pricing pressures. Project delays and cost overruns remain significant obstacles, impacting project timelines and profitability. These challenges often affect project budgets and overall market growth.

Emerging Opportunities in Asia-Pacific Transportation Infrastructure Construction Market

Emerging opportunities lie in the adoption of sustainable and eco-friendly construction practices, the increasing demand for intelligent transportation systems (ITS), and the development of high-speed rail networks. Expansion into underserved rural areas presents significant potential. The growth of the middle class and increasing urbanization provide opportunities for improving public transport systems and enhancing connectivity. The adoption of advanced technologies such as BIM, 3D printing, and automation will create new market avenues.

Leading Players in the Asia-Pacific Transportation Infrastructure Construction Market Market

- Larsen & Toubro Ltd

- Dilip Buildcon Ltd

- Reliance Infrastructure Limited

- CPB Contractors

- Hyundai E&C

- China State Construction Engineering

- China Communications Construction Company

- Obayashi Corporation

- Italian Thai (ITD)

- China Railway Construction Corporation

Key Developments in Asia-Pacific Transportation Infrastructure Construction Market Industry

January 2023: The Indo-Japan Joint Working Group (JWG) collaborated on enhancing road infrastructure in India, focusing on sustainable transportation and digital transformation through intelligent transportation systems (ITS). This collaboration marks a significant step towards improving India's transportation capabilities and introducing sustainable practices.

January 2023: China's CRRC Corporation Ltd. launched Asia's first hydrogen urban train, showcasing significant advancements in sustainable transportation technologies. This development underscores the commitment to environmentally friendly solutions and the potential for wider adoption of hydrogen-powered trains across the Asia-Pacific region.

Future Outlook for Asia-Pacific Transportation Infrastructure Construction Market Market

The Asia-Pacific transportation infrastructure construction market is poised for robust growth, driven by continuous government investments, technological advancements, and the region's expanding economy. Strategic opportunities lie in leveraging sustainable construction practices, expanding into underserved markets, and investing in technologies such as ITS and advanced construction methods. The market's future growth trajectory will be influenced by various factors such as economic growth in the region, infrastructure investment plans, and technological advancements. Significant potential exists for innovative solutions catering to evolving market demands and addressing sustainability concerns.

Asia-Pacific Transportation Infrastructure Construction Market Segmentation

-

1. Modes

- 1.1. Roads

- 1.2. Railways

- 1.3. Airways

- 1.4. Waterways

Asia-Pacific Transportation Infrastructure Construction Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of Asia-Pacific Transportation Infrastructure Construction Market

Asia-Pacific Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Government initiatives driving transport infrastructure market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Larsen & Toubro Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dilip Buildcon Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Infrastructure Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CPB Contractors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai E&C

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China State Construction Engineering

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Communications Construction Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Obayashi Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Italian Thai (ITD)**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Railway Construction Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Larsen & Toubro Ltd

List of Figures

- Figure 1: Asia-Pacific Transportation Infrastructure Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 2: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 4: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Transportation Infrastructure Construction Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Asia-Pacific Transportation Infrastructure Construction Market?

Key companies in the market include Larsen & Toubro Ltd, Dilip Buildcon Ltd, Reliance Infrastructure Limited, CPB Contractors, Hyundai E&C, China State Construction Engineering, China Communications Construction Company, Obayashi Corporation, Italian Thai (ITD)**List Not Exhaustive, China Railway Construction Corporation.

3. What are the main segments of the Asia-Pacific Transportation Infrastructure Construction Market?

The market segments include Modes.

4. Can you provide details about the market size?

The market size is estimated to be USD 432 billion as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Government initiatives driving transport infrastructure market in India.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

January 2023: The Indo-Japan Joint Working Group (JWG) will work together to provide the best road infrastructure for commuters and freight movement while also assisting India in meeting its sustainable transportation goals. The collaborative projects will lead to a massive digital transformation in the areas of intelligent transportation systems (ITS) and environmentally friendly mobility. India's strong commitment to collaboration with Japan in the areas of highway development, administration, and monitoring through the implementation of digitally enabled ITS services

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence