Key Insights

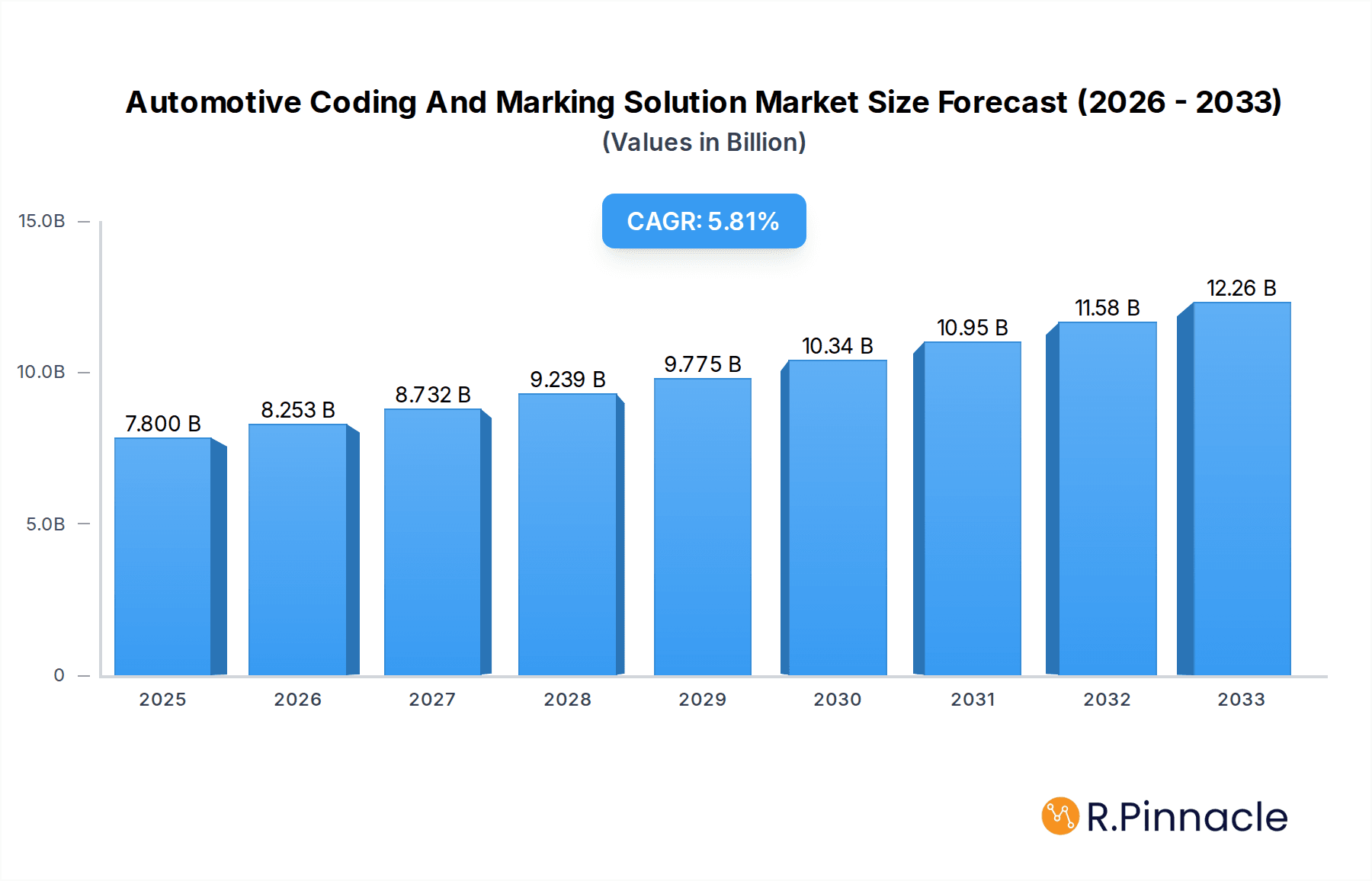

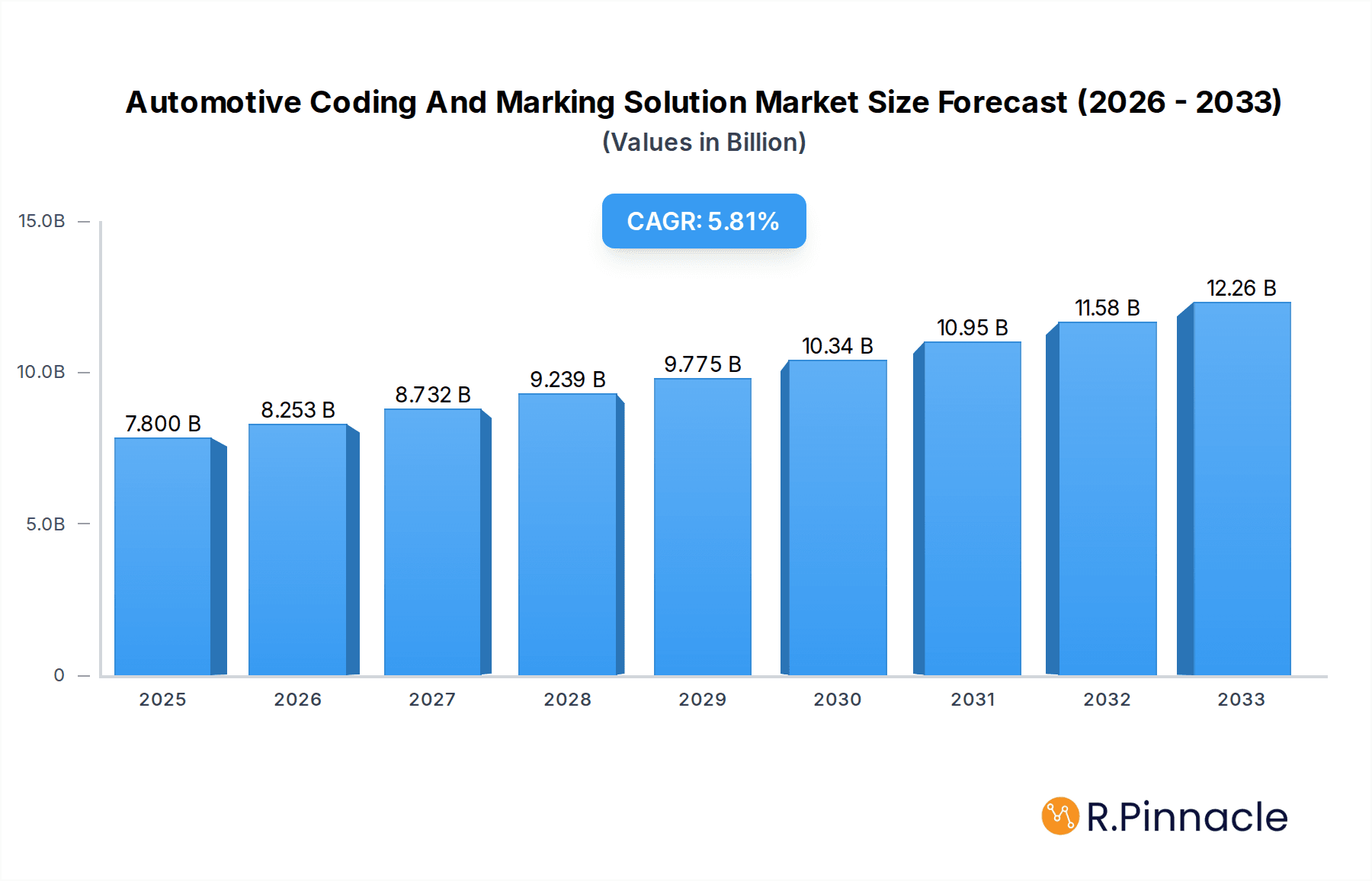

The global Automotive Coding and Marking Solution market is poised for significant expansion, projected to reach an estimated $7.8 billion in 2025. This growth is driven by an anticipated Compound Annual Growth Rate (CAGR) of 5.9% from 2019 to 2033, indicating sustained demand and increasing adoption of advanced coding and marking technologies within the automotive sector. The primary catalyst for this market surge is the escalating need for stringent traceability and compliance across the automotive supply chain. Manufacturers are increasingly reliant on robust coding and marking solutions to ensure product authenticity, facilitate recalls, and adhere to evolving regulatory standards for parts and finished vehicles. The expanding complexity of vehicle components, coupled with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), further necessitates precise and durable marking for identification and tracking throughout their lifecycle, from production to after-sales service.

Automotive Coding And Marking Solution Market Size (In Billion)

Further fueling this market's trajectory is the continuous innovation in coding and marking technologies. Companies are investing in solutions that offer higher speeds, greater accuracy, and improved durability, catering to the demanding production environments of the automotive industry. The integration of smart technologies, such as AI-powered vision systems for quality control and IoT capabilities for real-time data management, is also a significant trend enhancing the value proposition of these solutions. While the market enjoys strong growth drivers, potential restraints such as the initial capital investment for advanced equipment and the need for skilled personnel to operate and maintain them could pose challenges. However, the long-term benefits in terms of operational efficiency, reduced counterfeiting, and enhanced brand reputation are expected to outweigh these considerations, solidifying the market's upward trend for coding and marking equipment and consumables.

Automotive Coding And Marking Solution Company Market Share

Unlock critical insights into the dynamic Automotive Coding and Marking Solution market with this comprehensive, SEO-optimized report. Dive deep into market structures, growth drivers, regional dominance, and groundbreaking innovations shaping the future of automotive part traceability and identification. This report is meticulously designed for industry professionals seeking actionable intelligence to navigate evolving regulatory landscapes, technological advancements, and competitive pressures. With extensive coverage from 2019–2033, including a 2025 base year and forecast, this report provides a billion-dollar perspective on market evolution.

Automotive Coding And Marking Solution Market Structure & Innovation Trends

The Automotive Coding and Marking Solution market is characterized by a moderate to high level of concentration, with several key players dominating market share. Key innovators are continuously driving advancements in laser marking, inkjet printing, and RFID technologies to meet the stringent demands of the automotive sector. Regulatory frameworks, such as those mandating unique part identification for counterfeit prevention and supply chain transparency, are significant innovation drivers. Product substitutes are limited due to the specialized nature of automotive coding requirements, but advancements in data integration and serialization are emerging. End-user demographics span Tier 1 and Tier 2 automotive suppliers, OEMs, and aftermarket service providers, all seeking robust and compliant marking solutions. Mergers and acquisitions (M&A) activity, with reported deal values in the billions of dollars, indicate a trend towards consolidation and the acquisition of cutting-edge technologies. For instance, the acquisition of specialized marking technology firms by larger industrial conglomerates highlights a strategic push to expand capabilities and market reach, influencing market share significantly.

Automotive Coding And Marking Solution Market Dynamics & Trends

The Automotive Coding and Marking Solution market is experiencing robust growth, propelled by several key factors. The increasing complexity of automotive supply chains and the global push for enhanced traceability and anti-counterfeiting measures are primary growth drivers. Governments worldwide are implementing stricter regulations requiring unique identification of automotive components throughout their lifecycle, from manufacturing to end-of-life recycling. This has significantly increased the demand for sophisticated coding and marking equipment and consumables.

Technological disruptions are revolutionizing the market. Advances in laser marking technology offer permanent, high-resolution marking capabilities suitable for harsh automotive environments. Inkjet printing continues to evolve with faster speeds, improved ink formulations for diverse substrates (metals, plastics, rubber), and integration with vision systems for automated quality control. Furthermore, the adoption of Industry 4.0 principles is driving the integration of coding and marking systems with enterprise resource planning (ERP) and manufacturing execution systems (MES), enabling real-time data capture and analysis.

Consumer preferences, indirectly influencing the automotive industry, are also playing a role. Growing demand for connected vehicles and the increasing sophistication of vehicle electronics necessitate precise identification of individual components for diagnostics, recalls, and warranty management. This translates to a higher demand for durable, readable, and secure marking solutions.

Competitive dynamics within the market are intensifying. Established players are investing heavily in research and development to enhance their product offerings and expand their service capabilities. New entrants, often bringing innovative software solutions or specialized marking technologies, are also challenging the status quo. Strategic partnerships and collaborations between equipment manufacturers, software providers, and automotive OEMs are becoming increasingly common to deliver integrated and customized solutions. The market penetration of advanced coding and marking solutions is steadily increasing, with a projected Compound Annual Growth Rate (CAGR) in the billions of dollars over the forecast period, reflecting the critical role these solutions play in ensuring automotive quality, safety, and compliance.

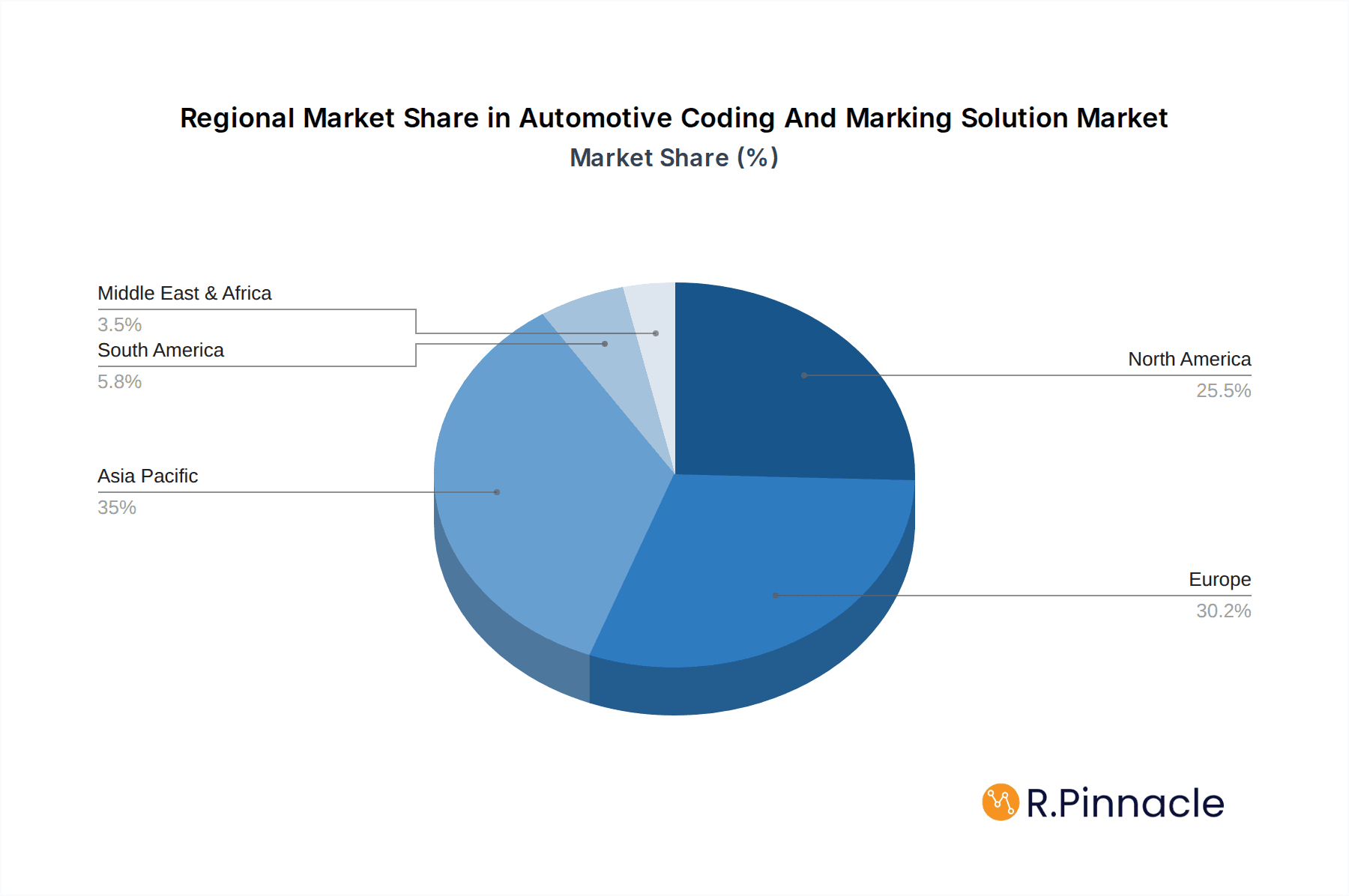

Dominant Regions & Segments in Automotive Coding And Marking Solution

The Asia Pacific region stands out as a dominant force in the global Automotive Coding and Marking Solution market. This dominance is underpinned by the region's status as a manufacturing powerhouse for both passenger vehicles and commercial vehicles. Countries like China, Japan, South Korea, and India are home to a vast number of automotive manufacturers and their extensive supply chains, creating a substantial and continuous demand for coding and marking solutions.

Key Drivers for Asia Pacific Dominance:

- Economic Policies and Infrastructure: Favorable government policies supporting manufacturing, significant investments in automotive production facilities, and well-developed logistics infrastructure facilitate the widespread adoption of advanced coding and marking technologies. The sheer volume of vehicles produced annually in this region translates to billions of components requiring compliant marking.

- Cost-Effectiveness and Scale: The ability to produce vehicles and components at a large scale and competitive cost incentivizes the implementation of efficient and cost-effective coding and marking solutions, driving demand for both equipment and consumables.

- Growing Aftermarket and Repair Services: The burgeoning aftermarket sector in Asia Pacific, coupled with increasing vehicle ownership, further fuels the need for reliable part identification for maintenance and repair.

Within the Application segment, Passenger Vehicles represent the largest share of the market. This is due to the sheer volume of passenger cars produced globally, each comprising thousands of individual parts that require distinct and traceable coding. The increasing technological sophistication of passenger vehicles, with advanced electronics and safety features, further necessitates precise component identification.

In terms of Type, Coding and Marking Equipment commands a significant market share. This includes a wide array of technologies such as laser markers, inkjet printers (CIJ, DOD, TIJ), dot peen markers, and label printers. The demand for durable, high-resolution, and high-speed marking equipment is paramount for meeting the production demands of the automotive industry. However, Coding and Marking Consumables – including inks, solvents, ribbons, and labels – also represent a substantial and recurring revenue stream, as these are integral to the operation of the marking equipment. The continuous need for replacement and specialized formulations for different materials and environmental conditions ensures consistent market demand for consumables, contributing billions to the overall market value.

Automotive Coding And Marking Solution Product Innovations

Product innovations in automotive coding and marking are focused on enhanced durability, speed, and data integration. Laser marking solutions are evolving with higher power lasers for faster engraving on tougher materials like hardened steel, while also offering finer precision for intricate part markings. Inkjet technologies are seeing advancements in quick-drying, solvent-resistant inks that adhere to diverse substrates, including challenging plastics and coated metals. The integration of AI and machine learning into vision systems is enabling real-time quality checks of codes, ensuring readability and compliance. These advancements provide manufacturers with competitive advantages by reducing errors, improving traceability, and meeting stringent regulatory requirements efficiently.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Automotive Coding and Marking Solution market, segmented by key applications and product types.

Application: Passenger Vehicle This segment encompasses all coding and marking solutions applied to components used in passenger cars, including engines, transmissions, chassis parts, interior components, and electronic modules. With billions of units produced annually, this segment is expected to exhibit strong growth driven by increasing vehicle complexity and regulatory demands for traceability.

Application: Commercial Vehicle This segment covers components for trucks, buses, and other heavy-duty vehicles. While the volume is lower than passenger vehicles, the stringent durability and identification requirements for heavy-duty parts, coupled with the growth in logistics and transportation, contribute significantly to market value in the billions.

Type: Coding and Marking Equipment This includes various marking technologies such as laser coders, inkjet printers (continuous inkjet, drop-on-demand), dot peen markers, and label applicators. The market for equipment is driven by the need for advanced, high-speed, and robust solutions to meet automotive production lines' demands, with substantial investments in billions of dollars.

Type: Coding and Marking Consumables This segment comprises inks, solvents, ribbons, and labels essential for the operation of coding and marking equipment. The recurring nature of consumable purchases, driven by the high throughput of automotive manufacturing, represents a consistent and significant revenue stream in the billions.

Key Drivers of Automotive Coding And Marking Solution Growth

The Automotive Coding and Marking Solution market is propelled by a confluence of powerful drivers. Increasing regulatory mandates globally for part traceability, anti-counterfeiting, and recall management are paramount, pushing manufacturers to adopt robust identification systems. The growing complexity of vehicle electronics and the rise of autonomous driving technologies necessitate precise identification of individual components for enhanced diagnostics and safety, adding billions to the market's potential. Industry 4.0 initiatives and smart manufacturing adoption are driving the integration of coding and marking systems with IT infrastructure for real-time data tracking and supply chain optimization. Furthermore, the expansion of global automotive production, particularly in emerging economies, directly translates to a higher demand for marking solutions, underpinning billions in market expansion.

Challenges in the Automotive Coding And Marking Solution Sector

Despite robust growth, the Automotive Coding and Marking Solution sector faces significant challenges. Stringent and evolving regulatory landscapes across different regions can create compliance complexities and necessitate frequent system updates, impacting operational costs in the billions. Supply chain disruptions, as experienced in recent years, can affect the availability of specialized inks, printheads, and laser components, leading to production delays and increased costs. The high initial investment cost for advanced coding and marking equipment can be a barrier for smaller Tier 2 and Tier 3 suppliers. Moreover, intense competitive pressure among established players and emerging technology providers can lead to price wars, potentially affecting profit margins, even with billions in market value.

Emerging Opportunities in Automotive Coding And Marking Solution

Emerging opportunities in the Automotive Coding and Marking Solution market are primarily driven by technological advancements and shifting industry trends. The increasing adoption of electric vehicles (EVs) presents a new frontier, requiring specialized marking solutions for batteries, charging components, and sophisticated power electronics, representing billions in future market potential. The growing demand for sustainable and eco-friendly marking solutions, such as low-VOC inks and energy-efficient laser systems, aligns with the automotive industry's sustainability goals. Furthermore, the expansion of digitalization and data analytics capabilities within coding and marking systems offers opportunities for predictive maintenance, enhanced quality control, and seamless integration into smart factory ecosystems, unlocking billions in added value.

Leading Players in the Automotive Coding And Marking Solution Market

- Brother

- Hitachi

- Dover

- Han's Laser

- Trumpf

- Telesis

- Danaher

- Macsa

- SATO

- Gravotech

- Trotec

- Rofin

- TYKMA Electrox

- REA JET

- ITW

- SUNINE

- Matthews

- Control print

- KBA-Metronic

Key Developments in Automotive Coding And Marking Solution Industry

- 2023 January: Brother launched a new range of industrial inkjet printers with advanced connectivity features, enhancing real-time data transfer for automotive production lines.

- 2023 March: Hitachi introduced a high-speed laser marking system designed for permanent and durable marking on automotive metal components, addressing the need for robust identification solutions.

- 2023 June: Dover Corporation's subsidiary, Markem-Imaje, announced a strategic partnership with an AI-powered vision system provider to enhance code verification accuracy in automotive manufacturing.

- 2023 September: Han's Laser unveiled a new generation of fiber laser markers with enhanced beam quality for intricate marking on automotive sensors and electronic parts.

- 2023 October: Trumpf showcased its latest advancements in laser marking technology for the automotive sector, focusing on increased speed and reduced energy consumption.

- 2024 February: Telesis Technologies introduced a new series of thermal transfer overprinters (TTO) specifically designed for flexible packaging and labeling of automotive interior components.

- 2024 April: Danaher's Videojet Technologies expanded its range of high-resolution inkjet printers, offering improved ink formulations for challenging automotive substrates.

Future Outlook for Automotive Coding And Marking Solution Market

The future outlook for the Automotive Coding and Marking Solution market is exceptionally positive, with continued growth projected in the billions. The acceleration of EV adoption, the increasing integration of sophisticated electronics, and the ongoing pursuit of supply chain transparency will remain key growth accelerators. The market will witness further integration of smart technologies, including AI-driven quality control and predictive analytics, enhancing operational efficiency and data integrity for automotive manufacturers. Strategic collaborations and acquisitions will continue to shape the competitive landscape, fostering innovation and expanding market reach for advanced coding and marking solutions. The industry is poised for sustained expansion, driven by the critical need for reliable and compliant part identification in an increasingly complex and connected automotive ecosystem.

Automotive Coding And Marking Solution Segmentation

-

1. Application

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Type

- 2.1. Coding and Marking Equipment

- 2.2. Coding and Marking Consumables

Automotive Coding And Marking Solution Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Coding And Marking Solution Regional Market Share

Geographic Coverage of Automotive Coding And Marking Solution

Automotive Coding And Marking Solution REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Coding And Marking Solution Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Coding and Marking Equipment

- 5.2.2. Coding and Marking Consumables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Coding And Marking Solution Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Coding and Marking Equipment

- 6.2.2. Coding and Marking Consumables

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Coding And Marking Solution Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Coding and Marking Equipment

- 7.2.2. Coding and Marking Consumables

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Coding And Marking Solution Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Coding and Marking Equipment

- 8.2.2. Coding and Marking Consumables

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Coding And Marking Solution Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Coding and Marking Equipment

- 9.2.2. Coding and Marking Consumables

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Coding And Marking Solution Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Coding and Marking Equipment

- 10.2.2. Coding and Marking Consumables

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Brother

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hitachi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dover

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Han's Laser

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trumpf

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Telesis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Macsa

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SATO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gravotech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Trotec

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rofin

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TYKMA Electrox

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 REA JET

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ITW

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SUNINE

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Matthews

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Control print

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 KBA-Metronic

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Brother

List of Figures

- Figure 1: Global Automotive Coding And Marking Solution Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Automotive Coding And Marking Solution Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Automotive Coding And Marking Solution Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Automotive Coding And Marking Solution Volume (K), by Application 2025 & 2033

- Figure 5: North America Automotive Coding And Marking Solution Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Automotive Coding And Marking Solution Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Automotive Coding And Marking Solution Revenue (undefined), by Type 2025 & 2033

- Figure 8: North America Automotive Coding And Marking Solution Volume (K), by Type 2025 & 2033

- Figure 9: North America Automotive Coding And Marking Solution Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Automotive Coding And Marking Solution Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Automotive Coding And Marking Solution Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Automotive Coding And Marking Solution Volume (K), by Country 2025 & 2033

- Figure 13: North America Automotive Coding And Marking Solution Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Automotive Coding And Marking Solution Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Automotive Coding And Marking Solution Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America Automotive Coding And Marking Solution Volume (K), by Application 2025 & 2033

- Figure 17: South America Automotive Coding And Marking Solution Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Automotive Coding And Marking Solution Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Automotive Coding And Marking Solution Revenue (undefined), by Type 2025 & 2033

- Figure 20: South America Automotive Coding And Marking Solution Volume (K), by Type 2025 & 2033

- Figure 21: South America Automotive Coding And Marking Solution Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Automotive Coding And Marking Solution Volume Share (%), by Type 2025 & 2033

- Figure 23: South America Automotive Coding And Marking Solution Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Automotive Coding And Marking Solution Volume (K), by Country 2025 & 2033

- Figure 25: South America Automotive Coding And Marking Solution Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Coding And Marking Solution Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Automotive Coding And Marking Solution Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Automotive Coding And Marking Solution Volume (K), by Application 2025 & 2033

- Figure 29: Europe Automotive Coding And Marking Solution Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Automotive Coding And Marking Solution Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Automotive Coding And Marking Solution Revenue (undefined), by Type 2025 & 2033

- Figure 32: Europe Automotive Coding And Marking Solution Volume (K), by Type 2025 & 2033

- Figure 33: Europe Automotive Coding And Marking Solution Revenue Share (%), by Type 2025 & 2033

- Figure 34: Europe Automotive Coding And Marking Solution Volume Share (%), by Type 2025 & 2033

- Figure 35: Europe Automotive Coding And Marking Solution Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Automotive Coding And Marking Solution Volume (K), by Country 2025 & 2033

- Figure 37: Europe Automotive Coding And Marking Solution Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Automotive Coding And Marking Solution Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Automotive Coding And Marking Solution Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa Automotive Coding And Marking Solution Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Automotive Coding And Marking Solution Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Automotive Coding And Marking Solution Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Automotive Coding And Marking Solution Revenue (undefined), by Type 2025 & 2033

- Figure 44: Middle East & Africa Automotive Coding And Marking Solution Volume (K), by Type 2025 & 2033

- Figure 45: Middle East & Africa Automotive Coding And Marking Solution Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East & Africa Automotive Coding And Marking Solution Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East & Africa Automotive Coding And Marking Solution Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Automotive Coding And Marking Solution Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Automotive Coding And Marking Solution Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Automotive Coding And Marking Solution Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Automotive Coding And Marking Solution Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific Automotive Coding And Marking Solution Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Automotive Coding And Marking Solution Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Automotive Coding And Marking Solution Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Automotive Coding And Marking Solution Revenue (undefined), by Type 2025 & 2033

- Figure 56: Asia Pacific Automotive Coding And Marking Solution Volume (K), by Type 2025 & 2033

- Figure 57: Asia Pacific Automotive Coding And Marking Solution Revenue Share (%), by Type 2025 & 2033

- Figure 58: Asia Pacific Automotive Coding And Marking Solution Volume Share (%), by Type 2025 & 2033

- Figure 59: Asia Pacific Automotive Coding And Marking Solution Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Automotive Coding And Marking Solution Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Automotive Coding And Marking Solution Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Automotive Coding And Marking Solution Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Automotive Coding And Marking Solution Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Automotive Coding And Marking Solution Volume K Forecast, by Type 2020 & 2033

- Table 5: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Coding And Marking Solution Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Automotive Coding And Marking Solution Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Automotive Coding And Marking Solution Volume K Forecast, by Type 2020 & 2033

- Table 11: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Automotive Coding And Marking Solution Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Coding And Marking Solution Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Automotive Coding And Marking Solution Volume K Forecast, by Type 2020 & 2033

- Table 23: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Automotive Coding And Marking Solution Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Automotive Coding And Marking Solution Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Automotive Coding And Marking Solution Volume K Forecast, by Type 2020 & 2033

- Table 35: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Automotive Coding And Marking Solution Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global Automotive Coding And Marking Solution Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Type 2020 & 2033

- Table 58: Global Automotive Coding And Marking Solution Volume K Forecast, by Type 2020 & 2033

- Table 59: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Automotive Coding And Marking Solution Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global Automotive Coding And Marking Solution Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Type 2020 & 2033

- Table 76: Global Automotive Coding And Marking Solution Volume K Forecast, by Type 2020 & 2033

- Table 77: Global Automotive Coding And Marking Solution Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Automotive Coding And Marking Solution Volume K Forecast, by Country 2020 & 2033

- Table 79: China Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Automotive Coding And Marking Solution Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Automotive Coding And Marking Solution Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Coding And Marking Solution?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Automotive Coding And Marking Solution?

Key companies in the market include Brother, Hitachi, Dover, Han's Laser, Trumpf, Telesis, Danaher, Macsa, SATO, Gravotech, Trotec, Rofin, TYKMA Electrox, REA JET, ITW, SUNINE, Matthews, Control print, KBA-Metronic.

3. What are the main segments of the Automotive Coding And Marking Solution?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Coding And Marking Solution," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Coding And Marking Solution report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Coding And Marking Solution?

To stay informed about further developments, trends, and reports in the Automotive Coding And Marking Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence