Key Insights

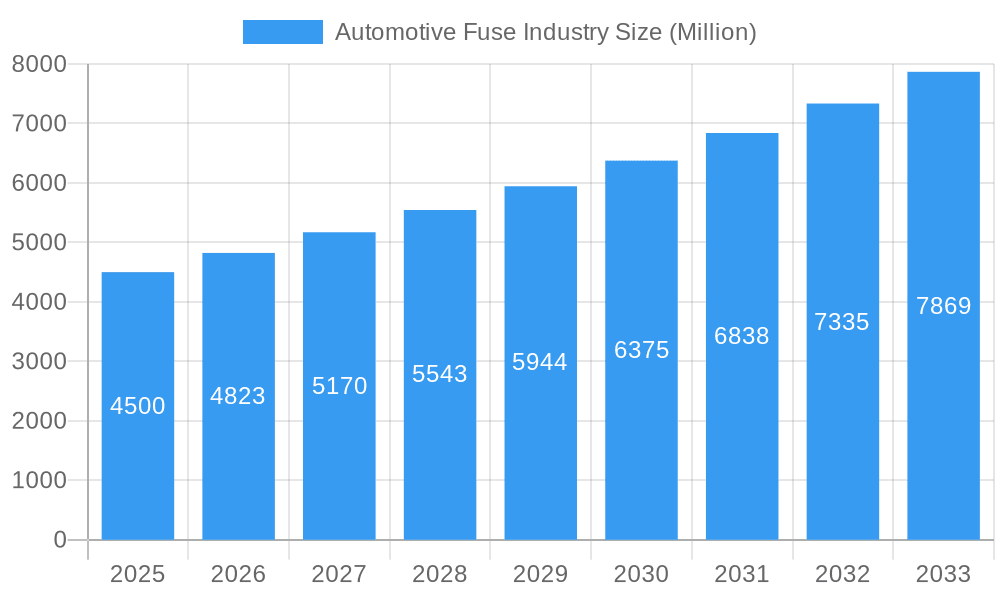

The global automotive fuse market is poised for robust growth, projected to reach a substantial size of approximately USD 4,500 million in 2025, driven by a compound annual growth rate (CAGR) of 7.10% through 2033. This expansion is primarily fueled by the escalating production of traditional internal combustion engine (ICE) vehicles, which continue to dominate global automotive sales, and the rapid adoption of electric and hybrid vehicles (EV/HEVs). EVs and HEVs, with their complex electrical architectures and higher voltage systems, necessitate an increased number and variety of specialized fuses, creating significant demand. Furthermore, advancements in vehicle safety features and the increasing integration of sophisticated electronic components across all vehicle types, from passenger cars to commercial vehicles, are key market accelerators. The growing stringency of automotive safety regulations worldwide also mandates the inclusion of advanced protective devices, including high-quality fuses, further bolstering market expansion.

Automotive Fuse Industry Market Size (In Billion)

The market is segmented by fuse type, with blade fuses and chip fuses holding significant shares due to their widespread application in conventional and modern automotive electrical systems, respectively. High-voltage fuses are experiencing particularly strong growth, directly correlating with the increasing prevalence of EVs. While the market benefits from these strong drivers, certain restraints such as price sensitivity in the aftermarket segment and the potential for over-reliance on advanced electronic protection relays in some niche applications could temper growth. Key players like Eaton Corporation, Mersen Electrical Power, and Littelfuse Inc. are at the forefront of innovation, investing in advanced fuse technologies to meet the evolving demands of the automotive industry, particularly in regions like Asia and North America, which are leading in both production and adoption of new vehicle technologies.

Automotive Fuse Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the global automotive fuse industry, exploring market dynamics, technological innovations, regional dominance, and future outlook. Leveraging high-ranking keywords like "automotive fuses," "EV fuses," "circuit protection," and "vehicle electronics," this report is designed for industry professionals seeking actionable insights and strategic guidance. Our study covers the historical period from 2019 to 2024, with a base year of 2025 and a detailed forecast extending to 2033, providing a 10-year outlook.

Automotive Fuse Industry Market Structure & Innovation Trends

The automotive fuse industry exhibits a moderate market concentration, with key players dominating significant market share. Innovation is primarily driven by the increasing complexity of vehicle electronics, the burgeoning electric and hybrid vehicle (EV/HEV) sector, and stringent safety regulations. The market is shaped by evolving regulatory frameworks demanding higher performance and reliability from automotive components. Potential product substitutes, such as resettable circuit breakers, are gradually gaining traction but face limitations in cost and space constraints for widespread adoption. End-user demographics are shifting rapidly, with a growing demand for advanced safety features and energy-efficient solutions in both traditional internal combustion engine (ICE) vehicles and next-generation electric powertrains. Merger and acquisition (M&A) activities are strategic, focusing on acquiring specialized technologies or expanding market reach. For instance, the market has seen M&A deal values in the tens of millions of dollars, aimed at consolidating market positions and fostering innovation. Key market share leaders in 2025 are estimated to hold approximately 60% of the global market.

Automotive Fuse Industry Market Dynamics & Trends

The automotive fuse industry is experiencing robust growth, propelled by several critical market dynamics and trends. The accelerating adoption of electric and hybrid vehicles is a paramount growth driver, necessitating specialized high-voltage fuses and advanced circuit protection solutions to manage increased power demands and ensure safety. This transition is further amplified by government mandates and incentives promoting sustainable mobility, directly impacting the market penetration of EV-specific fuses. Technological disruptions are evident in the development of smaller, more efficient, and highly resilient fuse technologies, including advanced chip fuses and polymer PTC resettable fuses, designed to withstand the demanding environments of modern vehicles. Consumer preferences are increasingly leaning towards vehicles equipped with sophisticated safety systems and advanced driver-assistance systems (ADAS), all of which rely on reliable circuit protection. The competitive landscape is characterized by intense rivalry among established players and emerging innovators, focusing on product differentiation through enhanced performance, miniaturization, and cost-effectiveness. The Compound Annual Growth Rate (CAGR) for the automotive fuse market is projected to be around 6.5% over the forecast period. Market penetration for specialized EV fuses is expected to reach over 70% by 2030.

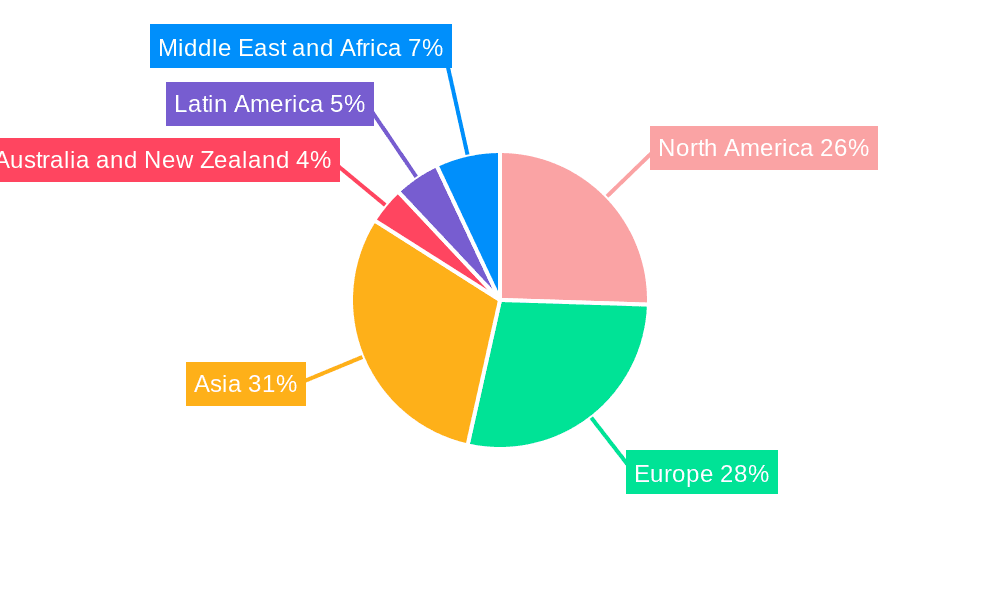

Dominant Regions & Segments in Automotive Fuse Industry

The North American region is poised to be a dominant force in the automotive fuse industry, driven by substantial investments in advanced automotive manufacturing and a strong consumer appetite for cutting-edge vehicle technologies. The United States, in particular, leads with its expansive automotive market and significant research and development initiatives in electric vehicle technology.

- Key Drivers in North America:

- Favorable government policies promoting EV adoption and manufacturing.

- Robust infrastructure development for charging stations and electric mobility.

- High consumer spending power and demand for premium automotive features.

- Presence of major automotive OEMs and component manufacturers.

Within the Type of Vehicle segmentation, Electric/Hybrid Vehicles are emerging as the most dominant segment. The rapid global shift towards electrification is fueling an unprecedented demand for specialized high-voltage fuses and advanced circuit protection systems crucial for battery management, power distribution, and overall vehicle safety. The increasing number of electric vehicles being manufactured globally, coupled with the growing battery capacities, directly translates into a higher requirement for robust and reliable fuse solutions.

In terms of Type, High-Voltage Fuses are experiencing the most significant growth and are becoming increasingly dominant due to their indispensable role in EV and HEV powertrains. These fuses are engineered to safely manage the high electrical currents and voltages characteristic of electric vehicle systems, ensuring protection against overcurrents and short circuits in battery packs, inverters, and charging systems. Their critical safety function in preventing thermal runaway and electrical hazards makes them paramount for the success of the e-mobility sector.

Automotive Fuse Industry Product Innovations

Product innovations in the automotive fuse industry are sharply focused on meeting the evolving demands of electric vehicles and advanced automotive electronics. The development of highly specialized high-voltage fuses, such as Littelfuse’s EV1K Series with a 1000Vdc rating, addresses the critical need for reliable overcurrent protection in the e-mobility market. Concurrently, advancements in polymer PTC resettable fuses, like THINKING’s KRG-C series, offer enhanced safety and operational continuity for electronic modules, DC motors, and harness protection, particularly in applications requiring AEC-Q 200 qualification. These innovations offer significant competitive advantages by improving vehicle safety, reliability, and enabling the integration of more complex electronic systems.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the automotive fuse industry. The Type segmentation includes Blade, Glass, Slow Blow, High-Voltage Fuses, Chip Fuse, and Other Types. The Type of Vehicle segmentation encompasses Passenger Cars (Traditional -ICE), Commercial Vehicles (Traditional -ICE), and Electric/Hybrid Vehicles. The Electric/Hybrid Vehicles segment is projected to witness the highest growth rate, with an estimated market size exceeding $2.5 Billion by 2030, driven by global electrification trends and increasing battery voltages. High-Voltage Fuses are a key sub-segment within the 'Type' category, expected to grow at a CAGR of over 8% due to their critical role in EV safety.

Key Drivers of Automotive Fuse Industry Growth

The automotive fuse industry is propelled by several key drivers. The accelerating transition to Electric and Hybrid Vehicles is paramount, demanding sophisticated circuit protection for high-voltage systems. Growing emphasis on Vehicle Safety and Advanced Driver-Assistance Systems (ADAS) necessitates reliable fuse solutions to protect complex electronic modules. Stringent Regulatory Standards for vehicle safety and emissions are pushing manufacturers to adopt higher-quality, more resilient components. Furthermore, increasing Vehicle Electrification across all segments, from passenger cars to commercial vehicles, is expanding the market for specialized fuses.

Challenges in the Automotive Fuse Industry Sector

Despite strong growth, the automotive fuse industry faces several challenges. Supply Chain Disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production and lead times. Increasingly complex Regulatory Hurdles for component certification, especially for high-voltage applications, demand significant investment in testing and compliance. Intense Competitive Pressures lead to price erosion, requiring manufacturers to innovate continuously to maintain margins. The Development of Alternative Protection Technologies, such as advanced solid-state circuit breakers, poses a potential long-term threat to traditional fuse markets, although significant adoption hurdles remain.

Emerging Opportunities in Automotive Fuse Industry

Emerging opportunities in the automotive fuse industry are abundant. The rapid expansion of the Electric Vehicle (EV) Market globally presents a significant growth avenue for specialized high-voltage fuses and advanced circuit protection solutions. The increasing integration of Smart Technologies and Connectivity in vehicles creates demand for miniaturized, high-performance fuses for complex electronic control units (ECUs). The development of Autonomous Driving Systems will further increase the number of electronic components requiring robust and reliable overcurrent protection. Exploring new applications in Commercial Electric Vehicles and Micro-mobility Solutions also offers untapped market potential.

Leading Players in the Automotive Fuse Industry Market

- Eaton Corporation

- Mersen Electrical Power

- Bel Fuse Inc.

- E-T-A Elektrotechnische Apparate GmbH

- AEM Components (USA) Inc.

- Pacific Engineering Corporation

- OptiFuse

- Littelfuse Inc.

Key Developments in Automotive Fuse Industry Industry

- July 2022: THINKING launched the KRG-C series, a leaded type polymer PTC resettable fuse (PPTC) for automotive applications. Its Vmax ratings are 6V, 16V, 30V, and 60V, and its Ihold ranges from 0.1A to 15A. The KRG-C series is an AEC-Q 200-qualified product, offering over-current protection to ensure the regular operation of automotive applications, and is recommended for electronic modules, DC motors, and harness protection.

- March 2022: Littelfuse, Inc. announced the new EV1K Series Fuses, the first Automotive grade fuse with a rating of 1000Vdc. They are developed and tested to meet the overcurrent circuit protection needs of the e-Mobility market, especially Electric Vehicle (EVs) applications.

Future Outlook for Automotive Fuse Industry Market

The future outlook for the automotive fuse industry is exceptionally positive, driven by the sustained global momentum towards vehicle electrification and the increasing sophistication of automotive electronics. The continued growth of the electric and hybrid vehicle market will remain the primary growth accelerator, creating sustained demand for high-voltage fuses and advanced circuit protection. Innovations in areas like intelligent fuse systems and enhanced miniaturization will cater to the evolving needs of autonomous driving and connected car technologies. Strategic partnerships and market expansion into emerging economies will further fuel growth, solidifying the industry's crucial role in ensuring vehicle safety, reliability, and efficiency in the coming decade.

Automotive Fuse Industry Segmentation

-

1. Type

- 1.1. Blade

- 1.2. Glass

- 1.3. Slow Blow

- 1.4. High-Voltage Fuses

- 1.5. Chip Fuse

- 1.6. Other Types

-

2. Type of Vehicle

- 2.1. Passenger Cars (Traditional -ICE)

- 2.2. Commercial Vehicles (Traditional -ICE)

- 2.3. Electric/Hybrid Vehicles

Automotive Fuse Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Spain

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Automotive Fuse Industry Regional Market Share

Geographic Coverage of Automotive Fuse Industry

Automotive Fuse Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of New Automotive Era -Electrification and Autonomy; Increasing Incorporation of Electrical and Electronic Units in Automobiles

- 3.3. Market Restrains

- 3.3.1. Limited Development in the Field of Low-Voltage Fuses and Unorganized Aftermarket in the Fuse Market

- 3.4. Market Trends

- 3.4.1. Electric/Hybrid Vehicles is Anticipated to Grow at Major Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Fuse Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Blade

- 5.1.2. Glass

- 5.1.3. Slow Blow

- 5.1.4. High-Voltage Fuses

- 5.1.5. Chip Fuse

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Type of Vehicle

- 5.2.1. Passenger Cars (Traditional -ICE)

- 5.2.2. Commercial Vehicles (Traditional -ICE)

- 5.2.3. Electric/Hybrid Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Fuse Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Blade

- 6.1.2. Glass

- 6.1.3. Slow Blow

- 6.1.4. High-Voltage Fuses

- 6.1.5. Chip Fuse

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Type of Vehicle

- 6.2.1. Passenger Cars (Traditional -ICE)

- 6.2.2. Commercial Vehicles (Traditional -ICE)

- 6.2.3. Electric/Hybrid Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Fuse Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Blade

- 7.1.2. Glass

- 7.1.3. Slow Blow

- 7.1.4. High-Voltage Fuses

- 7.1.5. Chip Fuse

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Type of Vehicle

- 7.2.1. Passenger Cars (Traditional -ICE)

- 7.2.2. Commercial Vehicles (Traditional -ICE)

- 7.2.3. Electric/Hybrid Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Automotive Fuse Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Blade

- 8.1.2. Glass

- 8.1.3. Slow Blow

- 8.1.4. High-Voltage Fuses

- 8.1.5. Chip Fuse

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Type of Vehicle

- 8.2.1. Passenger Cars (Traditional -ICE)

- 8.2.2. Commercial Vehicles (Traditional -ICE)

- 8.2.3. Electric/Hybrid Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Automotive Fuse Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Blade

- 9.1.2. Glass

- 9.1.3. Slow Blow

- 9.1.4. High-Voltage Fuses

- 9.1.5. Chip Fuse

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Type of Vehicle

- 9.2.1. Passenger Cars (Traditional -ICE)

- 9.2.2. Commercial Vehicles (Traditional -ICE)

- 9.2.3. Electric/Hybrid Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Automotive Fuse Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Blade

- 10.1.2. Glass

- 10.1.3. Slow Blow

- 10.1.4. High-Voltage Fuses

- 10.1.5. Chip Fuse

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Type of Vehicle

- 10.2.1. Passenger Cars (Traditional -ICE)

- 10.2.2. Commercial Vehicles (Traditional -ICE)

- 10.2.3. Electric/Hybrid Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Automotive Fuse Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Blade

- 11.1.2. Glass

- 11.1.3. Slow Blow

- 11.1.4. High-Voltage Fuses

- 11.1.5. Chip Fuse

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Type of Vehicle

- 11.2.1. Passenger Cars (Traditional -ICE)

- 11.2.2. Commercial Vehicles (Traditional -ICE)

- 11.2.3. Electric/Hybrid Vehicles

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Eaton Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Mersen Electrical Power

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bel Fuse Inc *List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 E-T-A ElektrotechnischeApparateGmbH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AEM Components (USA) Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pacific Engineering Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 OptiFuse

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Little Fuse Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Eaton Corporation

List of Figures

- Figure 1: Global Automotive Fuse Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Fuse Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Automotive Fuse Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Fuse Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 5: North America Automotive Fuse Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 6: North America Automotive Fuse Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Fuse Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Fuse Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Automotive Fuse Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Automotive Fuse Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 11: Europe Automotive Fuse Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 12: Europe Automotive Fuse Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Fuse Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Automotive Fuse Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Automotive Fuse Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Automotive Fuse Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 17: Asia Automotive Fuse Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 18: Asia Automotive Fuse Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Automotive Fuse Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Automotive Fuse Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Automotive Fuse Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Automotive Fuse Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 23: Australia and New Zealand Automotive Fuse Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 24: Australia and New Zealand Automotive Fuse Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Automotive Fuse Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Automotive Fuse Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Automotive Fuse Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Automotive Fuse Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 29: Latin America Automotive Fuse Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 30: Latin America Automotive Fuse Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Automotive Fuse Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Automotive Fuse Industry Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Automotive Fuse Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Automotive Fuse Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 35: Middle East and Africa Automotive Fuse Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 36: Middle East and Africa Automotive Fuse Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Automotive Fuse Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Fuse Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Fuse Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 3: Global Automotive Fuse Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Fuse Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Automotive Fuse Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 6: Global Automotive Fuse Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Automotive Fuse Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Automotive Fuse Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 11: Global Automotive Fuse Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: France Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Automotive Fuse Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Automotive Fuse Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 17: Global Automotive Fuse Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Automotive Fuse Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Fuse Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Automotive Fuse Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 23: Global Automotive Fuse Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Automotive Fuse Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Automotive Fuse Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 26: Global Automotive Fuse Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Automotive Fuse Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Automotive Fuse Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 29: Global Automotive Fuse Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Fuse Industry?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Automotive Fuse Industry?

Key companies in the market include Eaton Corporation, Mersen Electrical Power, Bel Fuse Inc *List Not Exhaustive, E-T-A ElektrotechnischeApparateGmbH, AEM Components (USA) Inc, Pacific Engineering Corporation, OptiFuse, Little Fuse Inc.

3. What are the main segments of the Automotive Fuse Industry?

The market segments include Type, Type of Vehicle.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of New Automotive Era -Electrification and Autonomy; Increasing Incorporation of Electrical and Electronic Units in Automobiles.

6. What are the notable trends driving market growth?

Electric/Hybrid Vehicles is Anticipated to Grow at Major Rate.

7. Are there any restraints impacting market growth?

Limited Development in the Field of Low-Voltage Fuses and Unorganized Aftermarket in the Fuse Market.

8. Can you provide examples of recent developments in the market?

July 2022: THINKING launched the KRG-C series, a leaded type polymer PTC resettable fuse (PPTC) for automotive applications. Its Vmax ratings are 6V, 16V, 30V, and 60V, and its Ihold ranges from 0.1A to 15A. The KRG-C series is an AEC-Q 200-qualified product, and it offers over-current protection to ensure the regular operation of automotive applications. The component is also recommended for electronic modules, DC motors, and harness protection applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Fuse Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Fuse Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Fuse Industry?

To stay informed about further developments, trends, and reports in the Automotive Fuse Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence