Key Insights

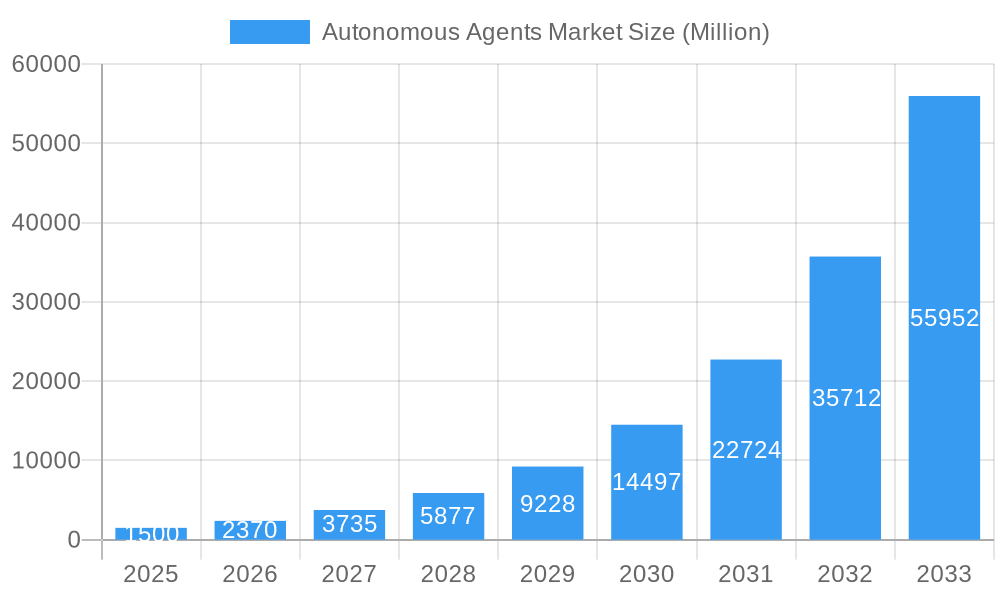

The global Autonomous Agents market is poised for substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of 46.3%. The market is anticipated to reach a valuation of 7.84 billion by 2025, driven by escalating demand for automation and advanced AI capabilities. Key growth drivers include the increasing adoption of cloud-based solutions for enhanced scalability and accessibility, and significant advancements in Artificial Intelligence (AI) and Machine Learning (ML) that empower autonomous agents to manage intricate tasks. This surge in efficiency and productivity is transforming sectors such as BFSI, IT & Telecom, and Healthcare. While initial implementation costs can be considerable, the compelling long-term return on investment (ROI) is making autonomous agent technology an attractive strategic imperative for both large enterprises and Small and Medium-sized Enterprises (SMEs). The market is segmented by deployment type (cloud, on-premises), organization size (SMEs, large enterprises), and industry vertical, with North America and Asia Pacific leading regional adoption.

Autonomous Agents Market Market Size (In Billion)

The competitive arena features prominent technology corporations such as IBM, Google, Microsoft, and Salesforce, alongside specialized providers like SAS Institute and Infosys, and emerging innovative firms. This dynamic competition fuels continuous innovation and the development of sophisticated autonomous agent solutions. Nevertheless, challenges persist, including crucial considerations around data privacy, security, and the ethical implications of AI-driven decision-making. Addressing these concerns through robust frameworks and investing in skilled professionals for development, implementation, and maintenance are vital for sustained market growth and responsible adoption.

Autonomous Agents Market Company Market Share

Autonomous Agents Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Autonomous Agents Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report segments the market by deployment type (cloud, on-premises), organization size (SMEs, large enterprises), and industry vertical (BFSI, IT & Telecom, Healthcare, Manufacturing, Transportation & Mobility, Other). Key players analyzed include SAS Institute Inc, Infosys Limited, Fair Isaac Corporation, Aptiv PLC, IBM Corporation, Google LLC, Nuance Communications, Salesforce com Inc, Microsoft Corporation, Affectiva Inc, Amazon Web Services Inc, Fetch.ai, Oracle Corporation, Intel Corporation, and SAP SE. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Autonomous Agents Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Autonomous Agents Market, examining market concentration, innovation drivers, regulatory frameworks, and market dynamics. The report details mergers and acquisitions (M&A) activities, providing insights into market share distribution among key players. For instance, the top three players – [Insert Names of Top 3 Companies and their approximate Market Share if available, otherwise use 'xx'] – collectively hold an estimated xx% market share. The report further identifies key innovation drivers such as advancements in AI, machine learning, and natural language processing. Regulatory frameworks impacting market growth are also discussed, along with an analysis of substitute products and their potential market impact. M&A activity analysis includes the value of significant deals concluded within the study period (2019-2024), highlighting strategic shifts and market consolidation. The evolving end-user demographics, with a focus on their adoption rates and preferences for different autonomous agent solutions, are also explored.

Autonomous Agents Market Market Dynamics & Trends

This section delves into the key market dynamics influencing the growth trajectory of the Autonomous Agents Market. It comprehensively explores market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. Key factors driving market expansion include the increasing demand for automation across industries, advancements in AI and machine learning, and the growing adoption of cloud-based solutions. Technological disruptions are analyzed, considering the impact of emerging technologies such as edge computing and blockchain on autonomous agent development and deployment. Consumer preferences are evaluated, focusing on the factors influencing the selection of autonomous agent solutions. Competitive dynamics are assessed, including strategies employed by major players to gain market share and maintain a competitive edge. The report provides a detailed analysis of market penetration rates across different segments, along with a projection of future growth based on the observed trends and expected market developments.

Dominant Regions & Segments in Autonomous Agents Market

This section identifies the leading regions and segments within the Autonomous Agents Market. Based on the analysis, [Insert Name of Leading Region/Country] emerges as the dominant market, driven by [Explain reasons: e.g., robust technological infrastructure, favorable government policies, high adoption rates].

Key Drivers by Segment:

By Deployment Type:

- Cloud: High scalability, cost-effectiveness, and accessibility drive significant growth.

- On-Premises: Enhanced security and control appeal to certain industry segments.

By Organization Size:

- Large Enterprises: Higher investment capacity fuels adoption and faster growth.

- SMEs: Focus is shifting towards cost-effective cloud-based solutions.

By Industry Vertical:

- BFSI: High demand for fraud detection, risk management, and customer service automation.

- IT & Telecom: Use of autonomous agents for network optimization and customer support.

- Healthcare: Growing adoption for tasks such as patient monitoring and administrative support.

- Manufacturing: Autonomous agents optimize processes and improve efficiency.

- Transportation & Mobility: Significant potential for autonomous vehicles and logistics optimization.

- Other Industry Verticals: Growing adoption across diverse sectors like retail and education.

Autonomous Agents Market Product Innovations

Recent product developments reflect a focus on enhanced capabilities, including improved natural language processing, more sophisticated machine learning algorithms, and seamless integration with existing systems. These innovations enhance user experience and address specific industry needs. The market is witnessing the emergence of specialized autonomous agents tailored to niche applications, offering competitive advantages through superior performance and customization. This trend underscores the dynamic nature of the market and the continuous evolution of autonomous agent technology.

Report Scope & Segmentation Analysis

The report encompasses a comprehensive segmentation analysis of the Autonomous Agents Market, categorized by deployment type (cloud, on-premises), organization size (SMEs, large enterprises), and industry vertical (BFSI, IT & Telecom, Healthcare, Manufacturing, Transportation & Mobility, Other). Each segment's growth trajectory, market size, and competitive dynamics are analyzed. Detailed growth projections are presented for each segment throughout the forecast period (2025-2033), offering valuable insights for informed decision-making. The competitive landscape within each segment is analyzed, highlighting key players, their market share, and competitive strategies.

Key Drivers of Autonomous Agents Market Growth

The Autonomous Agents Market is propelled by several factors. Technological advancements, particularly in AI and machine learning, are key drivers. The increasing demand for automation across diverse industries is another significant factor, alongside the growing adoption of cloud-based solutions. Favorable regulatory environments in certain regions further contribute to market growth. For example, [Provide example of a specific government initiative supporting AI/autonomous agents].

Challenges in the Autonomous Agents Market Sector

Despite substantial growth potential, the Autonomous Agents Market faces several challenges. Regulatory hurdles, particularly concerning data privacy and security, pose a significant obstacle. Supply chain disruptions can impact the availability of essential components for autonomous agent development and deployment. Intense competition among established players and new entrants creates pressure on pricing and profit margins. These factors can collectively impact market growth if not effectively addressed.

Emerging Opportunities in Autonomous Agents Market

The Autonomous Agents Market presents significant emerging opportunities. Expansion into new industry verticals, such as [Insert example of emerging industry], offers substantial growth potential. The development of more sophisticated and specialized autonomous agents addresses specific industry needs. Growing consumer demand for personalized experiences fuels the need for adaptive and intelligent autonomous agents. These factors together suggest that the market's future is bright and filled with exciting developments.

Leading Players in the Autonomous Agents Market Market

Key Developments in Autonomous Agents Market Industry

- January 2023: [Company Name] launched a new autonomous agent platform with enhanced capabilities.

- June 2022: [Company A] and [Company B] announced a strategic partnership to develop joint autonomous agent solutions.

- October 2021: [Regulation Name] was implemented, impacting the development and deployment of autonomous agents.

- [Add more bullet points with specific developments and dates]

Future Outlook for Autonomous Agents Market Market

The future of the Autonomous Agents Market is promising, driven by continuous technological advancements and expanding applications across various sectors. The market is poised for significant growth, fueled by increasing demand for automation, the adoption of cloud-based solutions, and the development of specialized autonomous agents. Strategic partnerships, collaborations, and acquisitions will continue to shape the competitive landscape, leading to further innovation and market consolidation. The market is expected to witness a surge in demand for advanced functionalities, such as improved decision-making capabilities, enhanced user interfaces, and greater integration with other technologies.

Autonomous Agents Market Segmentation

-

1. Deployment Type

- 1.1. Cloud

- 1.2. On-Premises

-

2. Organization Size

- 2.1. Small & Medium-Sized Enterprises (SMEs)

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT &Telecom

- 3.3. Healthcare

- 3.4. Manufacturing

- 3.5. Transportation & Mobility

- 3.6. Other Industry Verticals

Autonomous Agents Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Autonomous Agents Market Regional Market Share

Geographic Coverage of Autonomous Agents Market

Autonomous Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 46.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Number of AI Applications; Growing Presence of Parallel Computational Resources

- 3.3. Market Restrains

- 3.3.1. Maintaining the Privacy and Integrity of Patient Data

- 3.4. Market Trends

- 3.4.1. Transportation and Mobility Segments to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Agents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. Cloud

- 5.1.2. On-Premises

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small & Medium-Sized Enterprises (SMEs)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT &Telecom

- 5.3.3. Healthcare

- 5.3.4. Manufacturing

- 5.3.5. Transportation & Mobility

- 5.3.6. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Autonomous Agents Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. Cloud

- 6.1.2. On-Premises

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small & Medium-Sized Enterprises (SMEs)

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. BFSI

- 6.3.2. IT &Telecom

- 6.3.3. Healthcare

- 6.3.4. Manufacturing

- 6.3.5. Transportation & Mobility

- 6.3.6. Other Industry Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Autonomous Agents Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. Cloud

- 7.1.2. On-Premises

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small & Medium-Sized Enterprises (SMEs)

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. BFSI

- 7.3.2. IT &Telecom

- 7.3.3. Healthcare

- 7.3.4. Manufacturing

- 7.3.5. Transportation & Mobility

- 7.3.6. Other Industry Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Pacific Autonomous Agents Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. Cloud

- 8.1.2. On-Premises

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small & Medium-Sized Enterprises (SMEs)

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. BFSI

- 8.3.2. IT &Telecom

- 8.3.3. Healthcare

- 8.3.4. Manufacturing

- 8.3.5. Transportation & Mobility

- 8.3.6. Other Industry Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America Autonomous Agents Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. Cloud

- 9.1.2. On-Premises

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small & Medium-Sized Enterprises (SMEs)

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. BFSI

- 9.3.2. IT &Telecom

- 9.3.3. Healthcare

- 9.3.4. Manufacturing

- 9.3.5. Transportation & Mobility

- 9.3.6. Other Industry Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East Autonomous Agents Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. Cloud

- 10.1.2. On-Premises

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Small & Medium-Sized Enterprises (SMEs)

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. BFSI

- 10.3.2. IT &Telecom

- 10.3.3. Healthcare

- 10.3.4. Manufacturing

- 10.3.5. Transportation & Mobility

- 10.3.6. Other Industry Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infosys Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fair Isaac Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aptiv PLC*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Google LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nuance Communications

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Salesforce com Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Microsoft Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Affectiva Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amazon Web Services Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fetch ai

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Oracle Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Intel Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SAP SE

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Autonomous Agents Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Agents Market Revenue (billion), by Deployment Type 2025 & 2033

- Figure 3: North America Autonomous Agents Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 4: North America Autonomous Agents Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 5: North America Autonomous Agents Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Autonomous Agents Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 7: North America Autonomous Agents Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 8: North America Autonomous Agents Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Autonomous Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Autonomous Agents Market Revenue (billion), by Deployment Type 2025 & 2033

- Figure 11: Europe Autonomous Agents Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 12: Europe Autonomous Agents Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 13: Europe Autonomous Agents Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Autonomous Agents Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 15: Europe Autonomous Agents Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 16: Europe Autonomous Agents Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Autonomous Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Autonomous Agents Market Revenue (billion), by Deployment Type 2025 & 2033

- Figure 19: Asia Pacific Autonomous Agents Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 20: Asia Pacific Autonomous Agents Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific Autonomous Agents Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific Autonomous Agents Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 23: Asia Pacific Autonomous Agents Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 24: Asia Pacific Autonomous Agents Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Autonomous Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Autonomous Agents Market Revenue (billion), by Deployment Type 2025 & 2033

- Figure 27: Latin America Autonomous Agents Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 28: Latin America Autonomous Agents Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 29: Latin America Autonomous Agents Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Latin America Autonomous Agents Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 31: Latin America Autonomous Agents Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 32: Latin America Autonomous Agents Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Autonomous Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Autonomous Agents Market Revenue (billion), by Deployment Type 2025 & 2033

- Figure 35: Middle East Autonomous Agents Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 36: Middle East Autonomous Agents Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 37: Middle East Autonomous Agents Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Middle East Autonomous Agents Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 39: Middle East Autonomous Agents Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 40: Middle East Autonomous Agents Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Autonomous Agents Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Agents Market Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Autonomous Agents Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Global Autonomous Agents Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Global Autonomous Agents Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Autonomous Agents Market Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 6: Global Autonomous Agents Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Global Autonomous Agents Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Global Autonomous Agents Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Autonomous Agents Market Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 10: Global Autonomous Agents Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 11: Global Autonomous Agents Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 12: Global Autonomous Agents Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Autonomous Agents Market Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 14: Global Autonomous Agents Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 15: Global Autonomous Agents Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 16: Global Autonomous Agents Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Autonomous Agents Market Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 18: Global Autonomous Agents Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 19: Global Autonomous Agents Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 20: Global Autonomous Agents Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Autonomous Agents Market Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 22: Global Autonomous Agents Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 23: Global Autonomous Agents Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 24: Global Autonomous Agents Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Agents Market?

The projected CAGR is approximately 46.3%.

2. Which companies are prominent players in the Autonomous Agents Market?

Key companies in the market include SAS Institute Inc, Infosys Limited, Fair Isaac Corporation, Aptiv PLC*List Not Exhaustive, IBM Corporation, Google LLC, Nuance Communications, Salesforce com Inc, Microsoft Corporation, Affectiva Inc, Amazon Web Services Inc, Fetch ai, Oracle Corporation, Intel Corporation, SAP SE.

3. What are the main segments of the Autonomous Agents Market?

The market segments include Deployment Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.84 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Number of AI Applications; Growing Presence of Parallel Computational Resources.

6. What are the notable trends driving market growth?

Transportation and Mobility Segments to Dominate the Market.

7. Are there any restraints impacting market growth?

Maintaining the Privacy and Integrity of Patient Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Agents Market?

To stay informed about further developments, trends, and reports in the Autonomous Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence