Key Insights

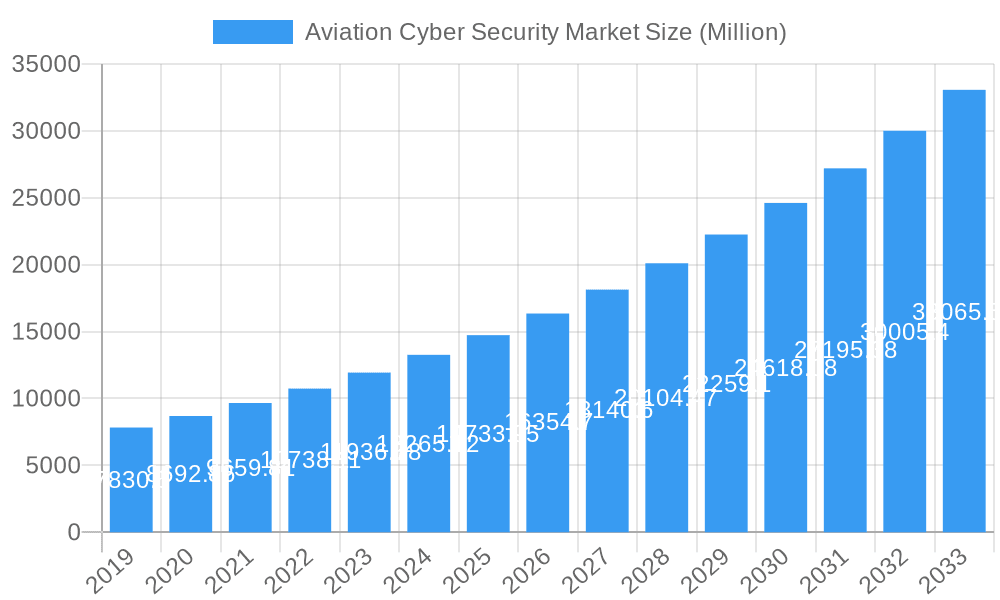

The Aviation Cybersecurity Market is projected for substantial growth, driven by the escalating sophistication and frequency of cyber threats targeting aviation infrastructure. With increasing reliance on interconnected digital platforms for operations, passenger services, and flight management, airlines, airports, and air traffic control systems face heightened risks. The expanding volume of sensitive data necessitates robust cybersecurity solutions. The market is expected to reach a size of 9.84 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 12.77% for the forecast period of 2025-2033.

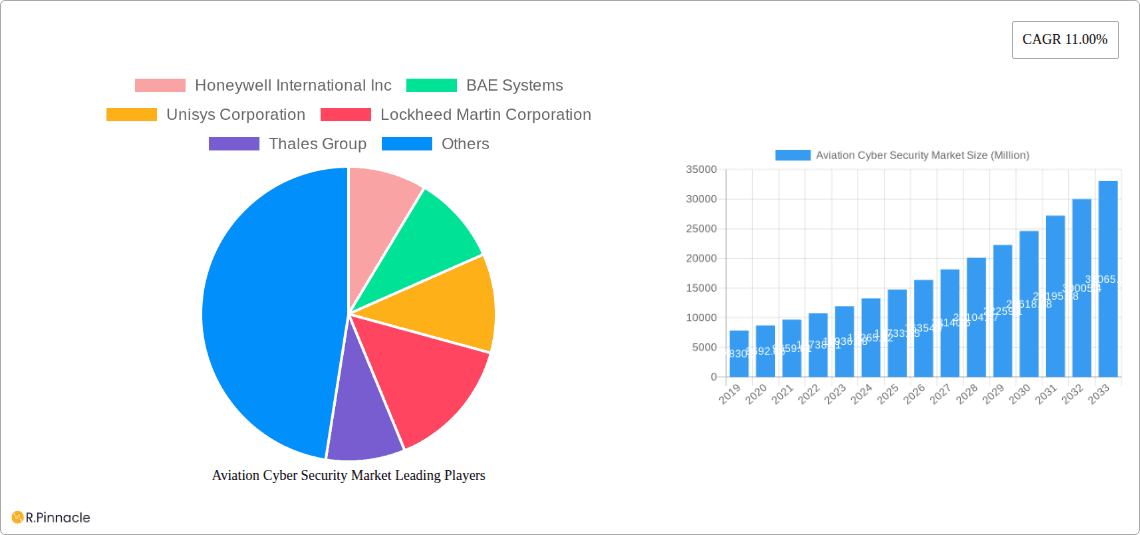

Aviation Cyber Security Market Market Size (In Billion)

Key market trends include the adoption of advanced threat intelligence, comprehensive identity and access management, and proactive data loss prevention. The demand for managed security services is rising, reflecting the industry’s need for specialized expertise. Cybersecurity integration across airline management, air cargo, airport operations, and air traffic control is becoming critical. Leading companies such as Honeywell International Inc., BAE Systems, Unisys Corporation, Lockheed Martin Corporation, Thales Group, Cisco Systems Inc., Palo Alto Networks Inc., The Raytheon Company, Northrop Grumman Corporation, and Collins Aerospace are at the forefront of innovation. North America and Europe are anticipated to lead market adoption, with Asia Pacific exhibiting significant growth potential.

Aviation Cyber Security Market Company Market Share

This comprehensive report analyzes the Aviation Cybersecurity Market, detailing market structure, dynamics, regional trends, product innovations, and future outlook. Utilizing 2025 as the base year, the report provides accurate market size estimations and forecasts for 2025–2033. Gain essential insights into the evolving landscape of aviation infrastructure protection against advanced cyber threats.

Aviation Cyber Security Market Market Structure & Innovation Trends

The Aviation Cyber Security Market is characterized by a moderately concentrated structure, with key players like Honeywell International Inc., BAE Systems, Unisys Corporation, Lockheed Martin Corporation, Thales Group, Cisco Systems Inc., Palo Alto Networks Inc., The Raytheon Company, Northrop Grumman Corporation, and Collins Aerospace holding significant market share. Innovation is a primary driver, fueled by increasing cyber-attack sophistication and the critical need to safeguard air travel operations. Regulatory frameworks, such as those established by ICAO and EASA, are continually evolving to mandate robust cybersecurity measures, influencing product development and market entry strategies. While product substitutes for dedicated aviation cybersecurity solutions are limited, the integration of broader IT security tools within aviation systems presents a dynamic competitive landscape. End-user demographics are diverse, encompassing airlines, airports, air traffic control authorities, and aircraft manufacturers, each with unique security requirements. Mergers and acquisitions (M&A) are playing a vital role in market consolidation and technology acquisition, with M&A deal values in the aviation cybersecurity sector estimated to be in the hundreds of millions of dollars annually. The market's increasing reliance on digital technologies within aircraft and ground operations necessitates continuous innovation to stay ahead of emerging threats.

Aviation Cyber Security Market Market Dynamics & Trends

The Aviation Cyber Security Market is experiencing robust growth, propelled by a confluence of escalating cyber threats, increasing digitalization across the aviation ecosystem, and stringent regulatory mandates. The global aviation industry's growing reliance on interconnected systems, from flight operations and air traffic control to passenger management and cargo logistics, creates a vast attack surface susceptible to cyber intrusions. Market penetration is steadily rising as aviation stakeholders recognize cybersecurity not merely as a compliance requirement but as a critical enabler of operational resilience and passenger safety. Technological disruptions are at the forefront, with advancements in artificial intelligence (AI), machine learning (ML), and big data analytics enabling more sophisticated threat detection and response capabilities. The adoption of cloud computing and the Internet of Things (IoT) in aviation, while offering efficiency gains, also introduce new vulnerabilities that cybersecurity providers are actively addressing. Consumer preferences are increasingly leaning towards secure and seamless travel experiences, placing greater emphasis on the cybersecurity of booking platforms, in-flight connectivity, and personal data protection. Competitive dynamics are intense, with established defense contractors, IT security giants, and specialized aviation cybersecurity firms vying for market share. This competition fosters continuous product development and innovation, driving down costs and enhancing the efficacy of security solutions. The projected Compound Annual Growth Rate (CAGR) for the Aviation Cyber Security Market is estimated to be in the range of 10% to 15% over the forecast period, underscoring its significant expansion potential. Key market drivers include the rising volume and complexity of cyber-attacks targeting critical infrastructure, the need to protect sensitive passenger and operational data, and the continuous upgrade of aviation technology, which often introduces new security challenges. The market penetration of advanced cybersecurity solutions is expected to reach over 60% by 2030.

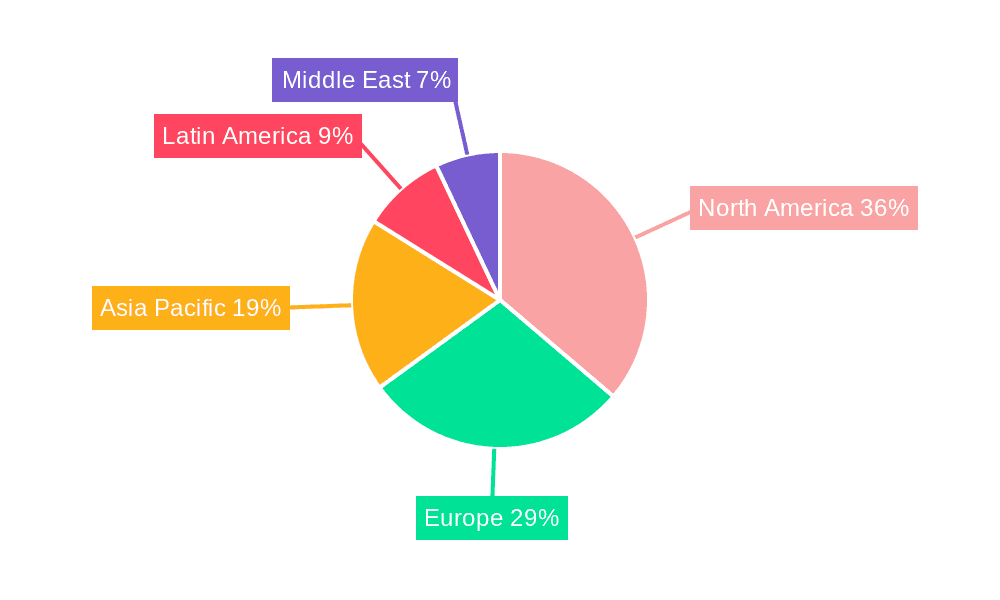

Dominant Regions & Segments in Aviation Cyber Security Market

North America currently stands as the dominant region in the global Aviation Cyber Security Market, driven by a combination of factors including a mature aviation industry, significant government investment in defense and homeland security, and a high concentration of leading aviation technology companies. The United States, in particular, plays a pivotal role due to its extensive air travel network, robust regulatory oversight, and proactive approach to cybersecurity. Key drivers for dominance in this region include strong economic policies supporting technological advancements in aviation security, substantial investments in airport infrastructure modernization, and a highly developed ecosystem of cybersecurity research and development.

In terms of Solution segmentation, Threat Intelligence and Response is emerging as a frontrunner. The increasing sophistication and frequency of cyber-attacks necessitate advanced capabilities to predict, detect, and effectively respond to threats in real-time. This segment is crucial for mitigating the impact of potential breaches and ensuring operational continuity.

Within the Application segmentation, Airport Management holds a significant share and is projected for continued growth. Airports are complex hubs managing vast amounts of data, critical infrastructure, and passenger flow. Securing these environments, from access control to baggage handling systems and passenger information systems, is paramount. The integration of smart airport technologies further amplifies the need for comprehensive cybersecurity solutions.

The dominance of these segments is further amplified by:

- Technological Advancements: Continuous innovation in AI-powered threat detection and automated response systems.

- Regulatory Compliance: Stringent mandates from aviation authorities pushing for advanced security solutions.

- Infrastructure Investments: Significant spending on upgrading and securing legacy systems and adopting new digital technologies.

- Data Security Imperatives: The increasing volume of sensitive data being processed and stored necessitates robust data loss prevention and access management.

The market size for the Threat Intelligence and Response segment is projected to reach approximately $3,500 Million by 2030, while Airport Management applications are expected to contribute over $2,000 Million to the market value during the same period.

Aviation Cyber Security Market Product Innovations

Product innovations in the Aviation Cyber Security Market are primarily focused on developing proactive, intelligent, and integrated security solutions. This includes the deployment of AI and ML-driven threat detection platforms that can identify anomalies and predict potential attacks before they occur. Advanced Identity and Access Management (IAM) systems are being developed to ensure only authorized personnel and systems can access critical aviation data and infrastructure. Furthermore, enhanced Data Loss Prevention (DLP) solutions are emerging to safeguard sensitive passenger and operational information from unauthorized exfiltration. These innovations provide a competitive advantage by offering comprehensive protection against a widening array of cyber threats, thereby ensuring the integrity, safety, and reliability of aviation operations.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Aviation Cyber Security Market across various critical segments.

Solution Segments:

- Threat Intelligence and Response: Focuses on proactive identification and reactive mitigation of cyber threats. Growth is driven by increasing attack sophistication, with market projections suggesting a value of $3,500 Million by 2030.

- Identity and Access Management (IAM): Ensures authorized access to systems and data. Driven by the need for granular control, this segment is expected to grow to $2,800 Million by 2030.

- Data Loss Prevention (DLP): Safeguards sensitive data from unauthorized disclosure. As data breaches become more costly, DLP solutions are seeing increased adoption, projected at $1,900 Million by 2030.

- Security and Vulnerability Management: Identifies and remedies weaknesses in systems. Essential for proactive security, this segment is forecast to reach $2,500 Million by 2030.

- Managed Security: Outsourced security services for continuous monitoring and management. The growing complexity of threats is fueling its expansion, estimated at $2,200 Million by 2030.

Application Segments:

- Airline Management: Secures flight operations, passenger booking, and loyalty programs. This segment is projected to reach $2,800 Million by 2030.

- Air Cargo Management: Protects logistics, tracking, and customs clearance systems. With the growth of e-commerce, this segment is expected to be valued at $1,200 Million by 2030.

- Airport Management: Secures airside and landside operations, passenger flow, and critical infrastructure. This is a substantial segment, projected at $2,000 Million by 2030.

- Air Traffic Control Management: Ensures the integrity and availability of air traffic control systems. Critical for safety, this segment is forecast to reach $2,300 Million by 2030.

Key Drivers of Aviation Cyber Security Market Growth

The Aviation Cyber Security Market is propelled by several key factors. Firstly, the escalating volume and sophistication of cyber threats targeting critical aviation infrastructure, including passenger data, flight control systems, and air traffic management, necessitate robust security measures. Secondly, the increasing digitalization and interconnectedness of the aviation ecosystem, with the adoption of cloud computing, IoT devices, and AI, expand the attack surface and create new vulnerabilities. Thirdly, stringent regulatory frameworks and compliance mandates from international aviation bodies like ICAO and regional authorities like EASA are compelling organizations to invest heavily in cybersecurity. Finally, the growing passenger demand for secure and seamless travel experiences, coupled with the airline industry's focus on operational resilience and safety, further fuels the demand for advanced cybersecurity solutions.

Challenges in the Aviation Cyber Security Market Sector

Despite robust growth, the Aviation Cyber Security Market faces significant challenges. One major hurdle is the presence of legacy systems that are difficult to update and secure, often requiring substantial investment and complex integration efforts. The shortage of skilled cybersecurity professionals within the aviation sector is another pressing issue, limiting the capacity of organizations to implement and manage advanced security solutions effectively. Furthermore, the complex and global nature of aviation operations makes it challenging to establish and enforce uniform cybersecurity standards across different jurisdictions and stakeholders. Supply chain vulnerabilities, where third-party vendors or software components may introduce security risks, also pose a considerable threat. Competitive pressures, while driving innovation, can also lead to price wars and a focus on short-term solutions rather than long-term strategic security. The estimated financial impact of these challenges on delayed implementations and potential breaches can amount to billions of dollars annually.

Emerging Opportunities in Aviation Cyber Security Market

The Aviation Cyber Security Market is ripe with emerging opportunities driven by technological advancements and evolving industry needs. The increasing adoption of AI and machine learning in aviation presents a significant opportunity for AI-driven threat detection and predictive security solutions. The growth of smart airports and the concept of "connected aircraft" create new markets for integrated cybersecurity platforms that can manage a vast network of IoT devices and sensors. Furthermore, the demand for specialized cybersecurity training and consultancy services tailored to the unique requirements of the aviation industry is expanding. The development of quantum-resistant encryption technologies also represents a future opportunity as the industry prepares for the potential threat of quantum computing. The increasing focus on securing air cargo logistics due to the rise in e-commerce also opens up new avenues for cybersecurity providers.

Leading Players in the Aviation Cyber Security Market Market

- Honeywell International Inc.

- BAE Systems

- Unisys Corporation

- Lockheed Martin Corporation

- Thales Group

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- The Raytheon Company

- Northrop Grumman Corporation

- Collins Aerospace

Key Developments in Aviation Cyber Security Market Industry

- 2024: Launch of AI-powered real-time threat monitoring systems for air traffic control networks.

- 2023: Major airline partners with cybersecurity firm for advanced data loss prevention solutions, valued at $80 Million.

- 2023: Acquisition of a specialized aviation cybersecurity analytics firm by a leading aerospace conglomerate for an undisclosed sum, aiming to enhance threat intelligence capabilities.

- 2022: Rollout of enhanced identity and access management protocols across a global airline alliance.

- 2022: Introduction of cloud-based security platforms designed for airline operations management.

- 2021: Development of new industry standards for securing connected aircraft systems.

- 2020: Implementation of advanced vulnerability management tools across major international airports.

Future Outlook for Aviation Cyber Security Market Market

The future outlook for the Aviation Cyber Security Market is exceptionally strong, driven by an unwavering commitment to safety and the escalating threat landscape. As aviation continues its digital transformation, investments in cybersecurity will undoubtedly grow, focusing on advanced threat intelligence, AI-driven defense mechanisms, and robust data protection. The integration of 5G technology and further expansion of IoT in aircraft and airport operations will create new opportunities for specialized security solutions. Collaborations between technology providers, aviation stakeholders, and regulatory bodies will be crucial in shaping future security protocols and standards. The market is poised for sustained growth, with an increasing emphasis on proactive, intelligent, and resilient cybersecurity frameworks to ensure the continued integrity and safety of global air travel, projecting a market expansion into the tens of billions of dollars by the end of the forecast period.

Aviation Cyber Security Market Segmentation

-

1. Solution

- 1.1. Threat Intelligence and Response

- 1.2. Identity and Access Management

- 1.3. Data Loss Prevention

- 1.4. Security and Vulnerability Management

- 1.5. Managed Security

-

2. Application

- 2.1. Airline Management

- 2.2. Air Cargo Management

- 2.3. Airport Management

- 2.4. Air Traffic Control Management

Aviation Cyber Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Aviation Cyber Security Market Regional Market Share

Geographic Coverage of Aviation Cyber Security Market

Aviation Cyber Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Rate of Cyber-attacks in the Aviation Sector; Technological Advancements and IT Systems Required to Support Passenger Traffic

- 3.3. Market Restrains

- 3.3.1. ; Lack of Cyber Security Professionals

- 3.4. Market Trends

- 3.4.1. Airport Management Holds a Significant Market Share being the Passengers Contact Point

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Cyber Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Threat Intelligence and Response

- 5.1.2. Identity and Access Management

- 5.1.3. Data Loss Prevention

- 5.1.4. Security and Vulnerability Management

- 5.1.5. Managed Security

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Airline Management

- 5.2.2. Air Cargo Management

- 5.2.3. Airport Management

- 5.2.4. Air Traffic Control Management

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Aviation Cyber Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Threat Intelligence and Response

- 6.1.2. Identity and Access Management

- 6.1.3. Data Loss Prevention

- 6.1.4. Security and Vulnerability Management

- 6.1.5. Managed Security

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Airline Management

- 6.2.2. Air Cargo Management

- 6.2.3. Airport Management

- 6.2.4. Air Traffic Control Management

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Aviation Cyber Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Threat Intelligence and Response

- 7.1.2. Identity and Access Management

- 7.1.3. Data Loss Prevention

- 7.1.4. Security and Vulnerability Management

- 7.1.5. Managed Security

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Airline Management

- 7.2.2. Air Cargo Management

- 7.2.3. Airport Management

- 7.2.4. Air Traffic Control Management

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Aviation Cyber Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Threat Intelligence and Response

- 8.1.2. Identity and Access Management

- 8.1.3. Data Loss Prevention

- 8.1.4. Security and Vulnerability Management

- 8.1.5. Managed Security

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Airline Management

- 8.2.2. Air Cargo Management

- 8.2.3. Airport Management

- 8.2.4. Air Traffic Control Management

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Aviation Cyber Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Threat Intelligence and Response

- 9.1.2. Identity and Access Management

- 9.1.3. Data Loss Prevention

- 9.1.4. Security and Vulnerability Management

- 9.1.5. Managed Security

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Airline Management

- 9.2.2. Air Cargo Management

- 9.2.3. Airport Management

- 9.2.4. Air Traffic Control Management

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East Aviation Cyber Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Threat Intelligence and Response

- 10.1.2. Identity and Access Management

- 10.1.3. Data Loss Prevention

- 10.1.4. Security and Vulnerability Management

- 10.1.5. Managed Security

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Airline Management

- 10.2.2. Air Cargo Management

- 10.2.3. Airport Management

- 10.2.4. Air Traffic Control Management

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BAE Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unisys Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Palo Alto Networks Inc *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Raytheon Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Collins Aerospace

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Aviation Cyber Security Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aviation Cyber Security Market Revenue (billion), by Solution 2025 & 2033

- Figure 3: North America Aviation Cyber Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Aviation Cyber Security Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Aviation Cyber Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Aviation Cyber Security Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Aviation Cyber Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aviation Cyber Security Market Revenue (billion), by Solution 2025 & 2033

- Figure 9: Europe Aviation Cyber Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 10: Europe Aviation Cyber Security Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Aviation Cyber Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Aviation Cyber Security Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Aviation Cyber Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aviation Cyber Security Market Revenue (billion), by Solution 2025 & 2033

- Figure 15: Asia Pacific Aviation Cyber Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 16: Asia Pacific Aviation Cyber Security Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Aviation Cyber Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Aviation Cyber Security Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Aviation Cyber Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aviation Cyber Security Market Revenue (billion), by Solution 2025 & 2033

- Figure 21: Latin America Aviation Cyber Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 22: Latin America Aviation Cyber Security Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Aviation Cyber Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Aviation Cyber Security Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Aviation Cyber Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Aviation Cyber Security Market Revenue (billion), by Solution 2025 & 2033

- Figure 27: Middle East Aviation Cyber Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Middle East Aviation Cyber Security Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Aviation Cyber Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Aviation Cyber Security Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Aviation Cyber Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Cyber Security Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 2: Global Aviation Cyber Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Aviation Cyber Security Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Aviation Cyber Security Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 5: Global Aviation Cyber Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Aviation Cyber Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Aviation Cyber Security Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 8: Global Aviation Cyber Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Aviation Cyber Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Aviation Cyber Security Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 11: Global Aviation Cyber Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Aviation Cyber Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Aviation Cyber Security Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 14: Global Aviation Cyber Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Aviation Cyber Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Aviation Cyber Security Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 17: Global Aviation Cyber Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Aviation Cyber Security Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Cyber Security Market?

The projected CAGR is approximately 12.77%.

2. Which companies are prominent players in the Aviation Cyber Security Market?

Key companies in the market include Honeywell International Inc, BAE Systems, Unisys Corporation, Lockheed Martin Corporation, Thales Group, Cisco Systems Inc, Palo Alto Networks Inc *List Not Exhaustive, The Raytheon Company, Northrop Grumman Corporation, Collins Aerospace.

3. What are the main segments of the Aviation Cyber Security Market?

The market segments include Solution, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.84 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Rate of Cyber-attacks in the Aviation Sector; Technological Advancements and IT Systems Required to Support Passenger Traffic.

6. What are the notable trends driving market growth?

Airport Management Holds a Significant Market Share being the Passengers Contact Point.

7. Are there any restraints impacting market growth?

; Lack of Cyber Security Professionals.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Cyber Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Cyber Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Cyber Security Market?

To stay informed about further developments, trends, and reports in the Aviation Cyber Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence