Key Insights

The Brazilian Combined Heat and Power (CHP) market is a dynamic sector poised for significant growth. Driven by increasing industrialization, urbanization, and a strong emphasis on energy efficiency, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.3%. While the residential sector is currently a smaller contributor, its potential for growth is substantial due to rising awareness of CHP's cost-effectiveness and environmental advantages. The commercial and industrial sectors are primary growth engines, propelled by the demand for reliable and economical energy solutions. Natural gas remains the predominant fuel source, though diversification into biomass and other renewable energy sources presents a promising avenue, aligning with Brazil's sustainability objectives. Key challenges include navigating regulatory frameworks, managing substantial initial investment, and mitigating fluctuating fuel prices to ensure sustained market expansion.

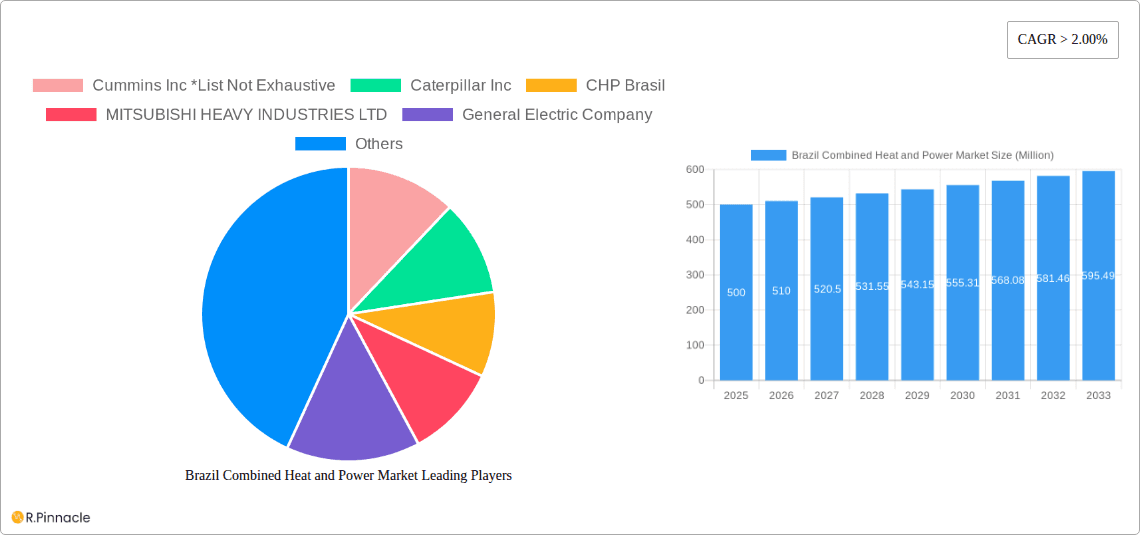

Brazil Combined Heat and Power Market Market Size (In Billion)

The forecast period (2025-2033) is anticipated to witness accelerated growth, supported by government initiatives promoting energy efficiency and renewable energy integration. Market segmentation offers opportunities for tailored strategies, such as developing customized solutions for industrial applications with high energy demands. Collaborations with local enterprises and governmental bodies are crucial for facilitating project development and market entry. The market size in 2025, estimated at 32.02 billion, provides a strong foundation for future expansion, making the Brazilian CHP market an attractive investment prospect. Continuous growth is expected over the next decade, reinforcing its appeal to both domestic and international investors.

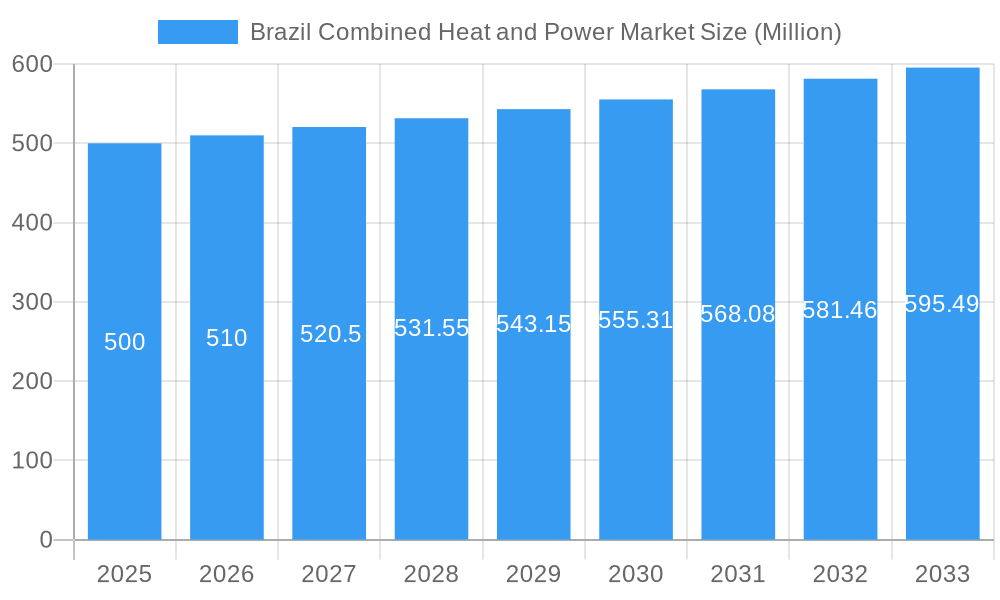

Brazil Combined Heat and Power Market Company Market Share

Brazil Combined Heat and Power (CHP) Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Brazil Combined Heat and Power (CHP) market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a detailed understanding of market dynamics, technological advancements, and future growth potential.

Brazil Combined Heat and Power Market Market Structure & Innovation Trends

The Brazilian CHP market exhibits a moderately concentrated structure, with key players like Cummins Inc, Caterpillar Inc, CHP Brasil, MITSUBISHI HEAVY INDUSTRIES LTD, and General Electric Company holding significant market share. However, the market is witnessing increasing participation from smaller, specialized players, particularly in niche segments like biomass-based CHP. Market share data for 2025 estimates Cummins Inc. at approximately 18%, Caterpillar Inc at 15%, and MHI at 12%, with the remaining share distributed among other players. Innovation is driven by government incentives promoting renewable energy sources, stringent emission regulations, and the rising demand for efficient energy solutions across various sectors. The regulatory framework is evolving to support CHP deployment, but inconsistencies and bureaucratic hurdles remain. The major M&A activity in the past five years involved approximately $xx Million in deals, primarily focused on enhancing technological capabilities and expanding market reach. Product substitutes, such as independent power producers (IPPs) and grid electricity, pose a competitive challenge, although CHP's inherent efficiency and cost-effectiveness provide a significant advantage. End-user demographics are shifting towards larger industrial and utility applications, driven by the need for reliable and cost-effective power generation.

Brazil Combined Heat and Power Market Market Dynamics & Trends

The Brazilian CHP market is projected to experience significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. This growth is fueled by several factors, including increasing industrialization, urbanization, and the growing demand for reliable energy supplies. Technological disruptions, such as advancements in energy storage and smart grid technologies, are enhancing CHP efficiency and integration into the overall energy system. Consumer preferences are shifting towards sustainable and environmentally friendly energy solutions, creating a favorable environment for CHP adoption, particularly those fueled by biomass and natural gas. However, competitive dynamics remain intense, with established players facing challenges from new entrants offering innovative technologies and competitive pricing. Market penetration of CHP systems is currently estimated at xx% in 2025 and is expected to increase to xx% by 2033. Significant infrastructure development projects and government initiatives supporting renewable energy technologies are also contributing to the overall market expansion.

Dominant Regions & Segments in Brazil Combined Heat and Power Market

Leading Region: Southeast Brazil, driven by its high concentration of industrial activity and population density. Key drivers include robust economic activity, well-developed infrastructure, and supportive government policies focused on industrial development and energy efficiency.

Dominant Application Segment: The industrial sector dominates the Brazilian CHP market due to high energy consumption and the potential for significant cost savings through on-site power generation and heat recovery.

Leading Fuel Type: Natural gas currently holds the largest market share among fuel types due to its relatively low cost, readily available supply, and comparatively lower emissions compared to coal.

Other Significant Segments: The commercial and utility sectors show substantial growth potential, driven by rising energy costs and increasing demand for reliable power. The residential sector remains relatively small but is experiencing growth, driven by increasing affluence and government programs incentivizing energy efficiency. Biomass holds potential for growth given its sustainability and the abundance of renewable resources in Brazil. Coal continues to be used but is expected to diminish with rising environmental concerns and cost competition.

Dominance Analysis: The Southeast region's dominance stems from its established industrial base, favorable regulatory environment, and access to infrastructure. The industrial application segment's leadership is attributable to high energy demand and cost savings from CHP. Natural gas benefits from readily available supply and price competitiveness.

Brazil Combined Heat and Power Market Product Innovations

Recent product innovations focus on improving efficiency, reducing emissions, and enhancing integration with smart grids. Advancements in turbine technology, heat recovery systems, and control systems are enabling CHP systems to operate with higher efficiency and reliability. Modular CHP units are gaining popularity due to their flexibility and ease of installation, particularly for smaller commercial and industrial applications. The market is also witnessing increasing adoption of CHP systems that incorporate renewable energy sources, such as biomass and solar thermal, enhancing sustainability. These innovations cater to the rising demand for cleaner and more efficient energy solutions while aligning with the broader shift towards sustainable development.

Report Scope & Segmentation Analysis

This report segments the Brazil CHP market by application (Residential, Commercial, Industrial, Utility) and fuel type (Natural Gas, Biomass, Coal, Other Fuel Types). Each segment's analysis includes market size, growth projections, and competitive dynamics for the forecast period. The Industrial segment is projected for the highest growth, driven by its energy-intensive nature. Natural gas remains the dominant fuel type, but the biomass segment is expected to show significant growth due to government support for renewable energy sources.

Key Drivers of Brazil Combined Heat and Power Market Growth

Key drivers for the Brazil CHP market include:

- Government incentives for renewable energy and energy efficiency: Policies promoting clean energy have spurred investments in CHP technologies.

- Rising energy costs: CHP offers cost-effective solutions, making it attractive to businesses and industries.

- Industrial growth and urbanization: Increased energy demand fuels the need for efficient and reliable power generation.

- Stringent environmental regulations: CHP's ability to reduce emissions is driving its adoption.

Challenges in the Brazil Combined Heat and Power Market Sector

Challenges include:

- High initial investment costs: The upfront capital investment can be a barrier for some potential adopters.

- Regulatory complexities and bureaucratic hurdles: Navigating approvals and permits can be time-consuming and costly.

- Competition from other power generation technologies: CHP faces competition from solar, wind, and conventional power plants.

- Intermittency issues with renewable fuels: The reliability of biomass-based CHP can be affected by seasonal variations in biomass availability.

Emerging Opportunities in Brazil Combined Heat and Power Market

Emerging opportunities lie in:

- Integration of CHP with renewable energy sources: Hybrid systems using biomass, solar, or wind power offer enhanced sustainability.

- Expansion into the commercial and residential sectors: Growing demand in these sectors creates significant market potential.

- Development of smart grid integration technologies: Optimizing CHP operation within smart grids enhances efficiency.

- Advancements in energy storage solutions: Integrating energy storage improves CHP reliability and grid stability.

Leading Players in the Brazil Combined Heat and Power Market Market

- Cummins Inc

- Caterpillar Inc

- CHP Brasil

- MITSUBISHI HEAVY INDUSTRIES LTD

- General Electric Company

Key Developments in Brazil Combined Heat and Power Market Industry

- (Date): Cummins Inc. launches a new line of high-efficiency CHP systems optimized for Brazilian conditions.

- (Date): Caterpillar Inc. invests in a new manufacturing facility for CHP components in Brazil.

- (Date): A major utility company signs a contract for a large-scale CHP project utilizing biomass.

- (Date): The Brazilian government announces new incentives for CHP deployment in industrial sectors.

Future Outlook for Brazil Combined Heat and Power Market Market

The future outlook for the Brazilian CHP market is positive, driven by sustained economic growth, increasing energy demand, and supportive government policies. Continued technological advancements, such as improved efficiency and integration with renewable sources, will further fuel market growth. The strategic focus should be on expanding into new market segments, developing innovative solutions, and enhancing partnerships to overcome existing challenges. This will allow the Brazilian CHP market to realize its substantial growth potential in the coming years.

Brazil Combined Heat and Power Market Segmentation

-

1. Applicaton

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Biomass

- 2.3. Coal

- 2.4. Other Fuel Types

Brazil Combined Heat and Power Market Segmentation By Geography

- 1. Brazil

Brazil Combined Heat and Power Market Regional Market Share

Geographic Coverage of Brazil Combined Heat and Power Market

Brazil Combined Heat and Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies4.; Strong Wind Energy Potential in Romania

- 3.3. Market Restrains

- 3.3.1. 4.; Development of Alternate renewable energy sources

- 3.4. Market Trends

- 3.4.1. Biomass Based CHP is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Combined Heat and Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Applicaton

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Biomass

- 5.2.3. Coal

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Applicaton

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cummins Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caterpillar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CHP Brasil

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MITSUBISHI HEAVY INDUSTRIES LTD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Cummins Inc *List Not Exhaustive

List of Figures

- Figure 1: Brazil Combined Heat and Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Combined Heat and Power Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Combined Heat and Power Market Revenue billion Forecast, by Applicaton 2020 & 2033

- Table 2: Brazil Combined Heat and Power Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Brazil Combined Heat and Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Combined Heat and Power Market Revenue billion Forecast, by Applicaton 2020 & 2033

- Table 5: Brazil Combined Heat and Power Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 6: Brazil Combined Heat and Power Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Combined Heat and Power Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Brazil Combined Heat and Power Market?

Key companies in the market include Cummins Inc *List Not Exhaustive, Caterpillar Inc, CHP Brasil, MITSUBISHI HEAVY INDUSTRIES LTD, General Electric Company.

3. What are the main segments of the Brazil Combined Heat and Power Market?

The market segments include Applicaton, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.02 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies4.; Strong Wind Energy Potential in Romania.

6. What are the notable trends driving market growth?

Biomass Based CHP is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Development of Alternate renewable energy sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Combined Heat and Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Combined Heat and Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Combined Heat and Power Market?

To stay informed about further developments, trends, and reports in the Brazil Combined Heat and Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence