Key Insights

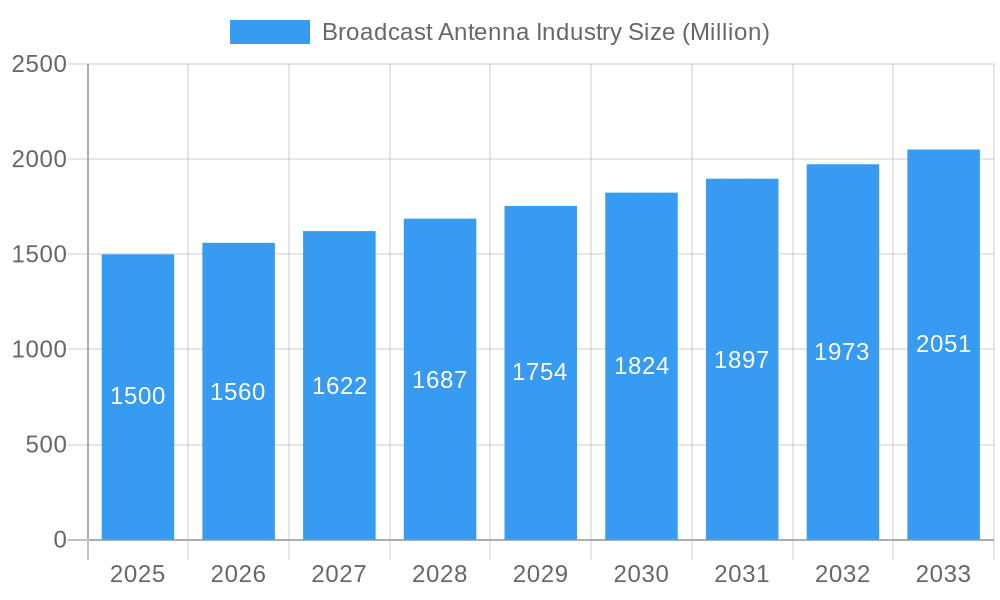

The Broadcast Antenna industry, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for high-quality broadcasting services, particularly in emerging economies experiencing rapid urbanization and technological advancements, is a significant factor. Furthermore, the ongoing migration from analog to digital broadcasting necessitates significant investment in updated antenna infrastructure, bolstering market expansion. Technological advancements, such as the development of 5G and improved antenna designs offering greater efficiency and coverage, are also contributing to industry growth. However, the market faces some restraints, including the high initial investment costs associated with antenna installations and maintenance, and the potential for regulatory hurdles in various regions. The market is segmented by antenna type (Television and FM), with the television antenna segment likely dominating due to the continued prevalence of television broadcasting, despite the rise of streaming services. Key players like Dielectric Inc, Kathrein Broadcast GmbH, and Jampro Antennas Inc, are driving innovation and competition, shaping the market landscape. Geographic distribution is expected to see strong growth in the Asia Pacific region, driven by increasing media consumption and infrastructure development.

Broadcast Antenna Industry Market Size (In Billion)

The forecast period (2025-2033) suggests a promising outlook for the Broadcast Antenna industry, although the specific regional market shares will require further analysis to determine accurate proportions. The historical period (2019-2024) likely reflects slower growth or market consolidation, leading to the current, more optimistic forecast. Competitive dynamics will continue to be a key aspect, with companies focusing on technological differentiation and cost-effective solutions to maintain a strong market position. The ongoing expansion of digital broadcasting and the demand for improved signal quality will remain the main drivers for industry growth in the coming years. Furthermore, the integration of smart technologies and the increasing adoption of IoT (Internet of Things) in broadcasting are poised to create new opportunities for innovation and growth within the Broadcast Antenna market.

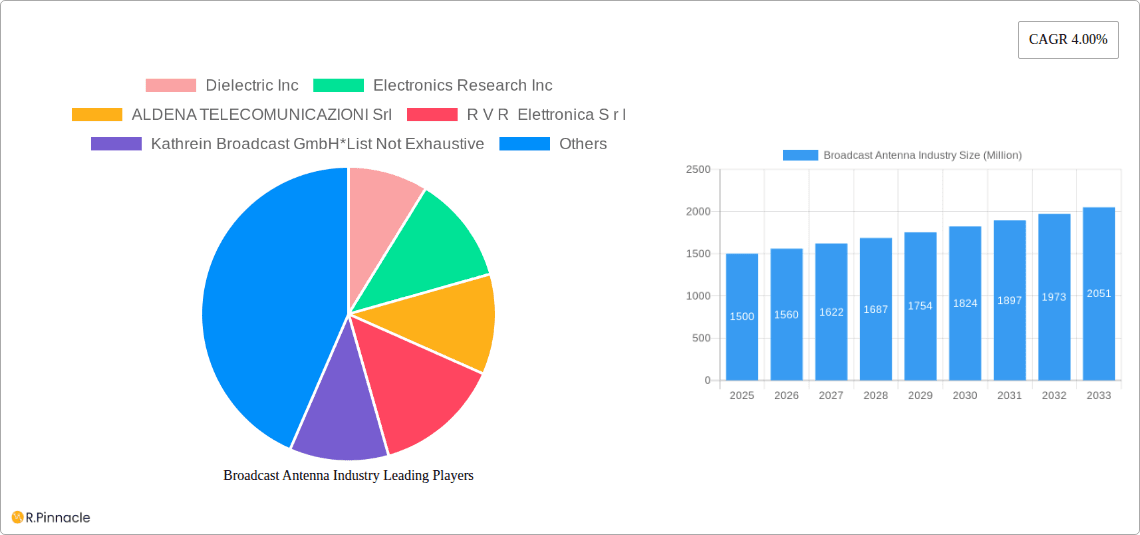

Broadcast Antenna Industry Company Market Share

Broadcast Antenna Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Broadcast Antenna Industry, offering valuable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends through 2033, leveraging historical data from 2019-2024. The report covers key market segments (Television and FM), analyzes leading players, and identifies emerging opportunities within this dynamic sector. The total market size is projected to reach xx Million by 2033.

Broadcast Antenna Industry Market Structure & Innovation Trends

The Broadcast Antenna Industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Dielectric Inc, Electronics Research Inc, and Kathrein Broadcast GmbH are among the prominent companies, but the market also includes numerous smaller, specialized firms. Market share data reveals that the top five players collectively hold approximately xx% of the global market, with the remaining share distributed among several hundred smaller competitors.

Innovation Drivers:

- Technological advancements in antenna design, materials, and signal processing.

- Growing demand for higher bandwidth and improved signal quality.

- The increasing adoption of digital broadcasting technologies like NEXTGEN TV.

- Government regulations and initiatives promoting broadcasting infrastructure upgrades.

Regulatory Frameworks: Stringent regulations governing radio frequency emissions and spectrum allocation significantly influence market dynamics. Variations in regulations across different regions create diverse opportunities and challenges.

Product Substitutes: While limited direct substitutes exist, competitive pressure arises from alternative transmission technologies like cable and satellite broadcasting, impacting market growth.

End-User Demographics: The primary end-users are broadcasting companies (television and radio stations), telecommunication providers, and government agencies responsible for public broadcasting services.

M&A Activities: The industry has witnessed a moderate level of M&A activity in recent years, primarily driven by consolidation efforts among smaller companies seeking to improve their market position. The total value of M&A deals in the period 2019-2024 is estimated to be xx Million. These mergers frequently aim to expand product portfolios, geographic reach, and technological capabilities.

Broadcast Antenna Industry Market Dynamics & Trends

The Broadcast Antenna Industry is experiencing steady growth, driven by several key factors. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increased digital television penetration, expanding broadcasting infrastructure in emerging economies, and the ongoing migration from analog to digital broadcasting. Technological advancements, such as the introduction of NEXTGEN TV, enhance broadcasting quality and capabilities, further stimulating market growth. Market penetration of digital broadcast technologies continues to rise, with a significant increase predicted in developing regions.

Consumer preferences for high-definition video and improved audio quality are pushing demand for advanced antenna systems. However, competitive pressures from alternative content delivery methods, such as streaming services, pose a challenge. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants offering innovative solutions. This creates a dynamic environment where continuous innovation and adaptation are crucial for sustained growth.

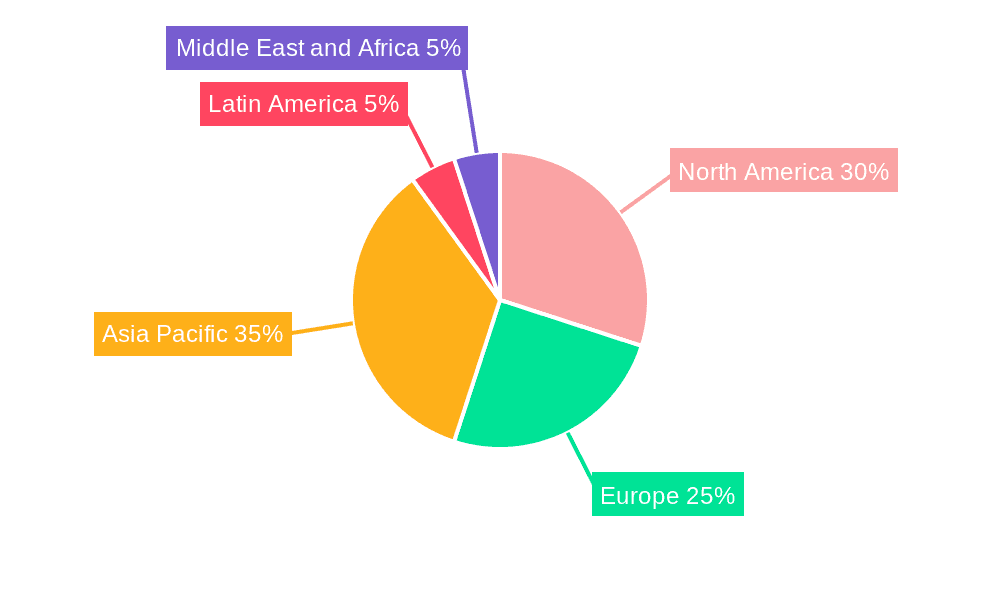

Dominant Regions & Segments in Broadcast Antenna Industry

The North American region currently holds a significant share of the Broadcast Antenna Industry, driven by high demand for advanced broadcasting infrastructure and considerable investments in upgrading television and radio networks. Within North America, the United States holds the largest market share, owing to a robust broadcasting sector. Europe also represents a substantial market, although slightly smaller than North America.

Key Drivers for North American Dominance:

- Strong broadcasting sector with a large number of television and radio stations.

- Significant investments in upgrading broadcast infrastructure.

- Adoption of advanced broadcast technologies like NEXTGEN TV.

- Favorable regulatory policies supporting broadcasting expansion.

Television Segment Dominance: The television segment accounts for the largest share of the overall market due to extensive television broadcasting and continuous technological upgrades (e.g., NEXTGEN TV adoption). The market for FM broadcast antennas is smaller but also demonstrates steady growth driven by ongoing broadcasting infrastructure upgrades.

Broadcast Antenna Industry Product Innovations

Recent innovations include the development of higher-gain antennas that deliver improved signal reception and coverage. Advancements in antenna materials and design have enabled the production of lighter, more durable, and cost-effective antennas. The integration of smart features, like remote monitoring and control capabilities, enhances operational efficiency and maintenance. These innovations align with the industry's shift toward more efficient and cost-effective broadcast solutions. The development of specialized antennas to cater to specific applications, such as high-power broadcasting and mobile broadcasting, is also gaining traction.

Report Scope & Segmentation Analysis

This report segments the Broadcast Antenna Industry by type: Television and FM.

Television Broadcast Antennas: This segment is characterized by substantial growth, driven by the transition to digital broadcasting and the rising demand for higher-quality video and audio transmission. Market size for television broadcast antennas was valued at xx Million in 2024 and is projected to reach xx Million by 2033. Competition is intense due to technological advancements and the presence of numerous established players.

FM Broadcast Antennas: The FM broadcast antenna segment exhibits more moderate growth, though it benefits from sustained demand from existing radio broadcasting networks and the adoption of improved broadcasting technologies. The market size for FM broadcast antennas stood at xx Million in 2024 and is anticipated to reach xx Million by 2033. The market is less concentrated compared to television broadcast antennas.

Key Drivers of Broadcast Antenna Industry Growth

Technological advancements, particularly in digital broadcasting and antenna design, are primary drivers of market growth. Expanding digital television penetration globally, coupled with the adoption of new broadcast standards, drives demand for higher-performing antennas. Government initiatives promoting digital broadcasting infrastructure upgrades in many regions, also fuel market expansion. Finally, the growing need for reliable and efficient broadcasting networks boosts the need for advanced antenna systems.

Challenges in the Broadcast Antenna Industry Sector

The industry faces challenges such as intense competition among existing players, the emergence of new entrants, and increasing regulatory hurdles. Supply chain disruptions can also negatively impact production and delivery schedules, potentially leading to increased costs. Furthermore, the shift towards alternative content delivery methods presents competitive pressure that restricts market growth to some degree. The overall impact of these challenges on the market is estimated to restrain growth by approximately xx% over the forecast period.

Emerging Opportunities in Broadcast Antenna Industry

The integration of 5G and other wireless technologies with broadcast antenna systems presents significant opportunities for growth. The increasing demand for high-quality broadcasting in emerging markets provides fertile ground for expansion. Innovation in antenna design, such as the development of more energy-efficient and compact systems, offers further growth avenues. Finally, the growing need for reliable and resilient broadcast infrastructure to support emergency alerts and critical communication systems represents a key opportunity.

Leading Players in the Broadcast Antenna Industry Market

- Dielectric Inc

- Electronics Research Inc

- ALDENA TELECOMUNICAZIONI Srl

- R V R Elettronica S r l

- Kathrein Broadcast GmbH

- OMB Sistemas Electrónicos S A

- ELETEC Broadcast Transmitters Sarl

- Jampro Antennas Inc

- TE Connectivity Ltd

- TCI International Inc

- Twin Engineers Private Limited

- Propagation Systems Inc (PSI Antenna)

- ABE Elettronica s r l

Key Developments in Broadcast Antenna Industry

January 2022: Four television stations in San Antonio, US, adopted NEXTGEN TV, showcasing the technology's potential for market disruption and improved viewer experience. This marks an important milestone in the adoption of this technology.

June 2021: Hiltron Communications' satellite uplink and downlink system implementation for a German news broadcaster highlights the growing demand for sophisticated antenna systems and control infrastructure in global broadcasting networks. This illustrates the increasing complexity and integration requirements in the broadcast industry.

Future Outlook for Broadcast Antenna Industry Market

The Broadcast Antenna Industry is poised for continued growth, driven by ongoing technological advancements, expanding broadcasting infrastructure globally, and increasing consumer demand for high-quality broadcast services. Strategic opportunities lie in developing innovative antenna technologies, expanding into emerging markets, and providing customized solutions for specific applications. The long-term outlook is positive, with substantial growth potential for companies that can adapt to the evolving technological landscape and meet the increasing needs of the broadcasting industry.

Broadcast Antenna Industry Segmentation

-

1. Type

- 1.1. Television

- 1.2. FM

Broadcast Antenna Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Broadcast Antenna Industry Regional Market Share

Geographic Coverage of Broadcast Antenna Industry

Broadcast Antenna Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Usage in Construction Industry; Increasing Adoption of Automation

- 3.3. Market Restrains

- 3.3.1. Evolution of Optic Fiber is Expected to Challenge the Antenna Adoption

- 3.4. Market Trends

- 3.4.1. Television Type to Hold Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Broadcast Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Television

- 5.1.2. FM

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Broadcast Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Television

- 6.1.2. FM

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Broadcast Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Television

- 7.1.2. FM

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Broadcast Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Television

- 8.1.2. FM

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Broadcast Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Television

- 9.1.2. FM

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Broadcast Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Television

- 10.1.2. FM

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dielectric Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Electronics Research Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ALDENA TELECOMUNICAZIONI Srl

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 R V R Elettronica S r l

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kathrein Broadcast GmbH*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OMB Sistemas Electrónicos S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ELETEC Broadcast Transmitters Sarl

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jampro Antennas Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TE Connectivity Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TCI International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Twin Engineers Private Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Propagation Systems Inc (PSI Antenna)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ABE Elettronica s r l

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Dielectric Inc

List of Figures

- Figure 1: Global Broadcast Antenna Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Broadcast Antenna Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Broadcast Antenna Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Broadcast Antenna Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Broadcast Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Broadcast Antenna Industry Revenue (undefined), by Type 2025 & 2033

- Figure 7: Europe Broadcast Antenna Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Broadcast Antenna Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Broadcast Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Broadcast Antenna Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Broadcast Antenna Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Broadcast Antenna Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Broadcast Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Broadcast Antenna Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Latin America Broadcast Antenna Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Broadcast Antenna Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America Broadcast Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Broadcast Antenna Industry Revenue (undefined), by Type 2025 & 2033

- Figure 19: Middle East and Africa Broadcast Antenna Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Broadcast Antenna Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Broadcast Antenna Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Broadcast Antenna Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Broadcast Antenna Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Broadcast Antenna Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Broadcast Antenna Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Broadcast Antenna Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Broadcast Antenna Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Broadcast Antenna Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Broadcast Antenna Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Broadcast Antenna Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Broadcast Antenna Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Broadcast Antenna Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Broadcast Antenna Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Broadcast Antenna Industry?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Broadcast Antenna Industry?

Key companies in the market include Dielectric Inc, Electronics Research Inc, ALDENA TELECOMUNICAZIONI Srl, R V R Elettronica S r l, Kathrein Broadcast GmbH*List Not Exhaustive, OMB Sistemas Electrónicos S A, ELETEC Broadcast Transmitters Sarl, Jampro Antennas Inc, TE Connectivity Ltd, TCI International Inc, Twin Engineers Private Limited, Propagation Systems Inc (PSI Antenna), ABE Elettronica s r l.

3. What are the main segments of the Broadcast Antenna Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increased Usage in Construction Industry; Increasing Adoption of Automation.

6. What are the notable trends driving market growth?

Television Type to Hold Highest Market Share.

7. Are there any restraints impacting market growth?

Evolution of Optic Fiber is Expected to Challenge the Antenna Adoption.

8. Can you provide examples of recent developments in the market?

January 2022: Four television stations serving the San Antonio market in the US began broadcasting with NEXTGEN TV, a new digital broadcast technology. Based on the same fundamental technology as the Internet and digital apps, NEXTGEN TV can support a wide range of features that are currently in development. In addition to providing an improved way for broadcasters to reach viewers with advanced emergency alerts, NEXTGEN TV features videos with good color, sharper images, and a deeper contrast to create a more life-like experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Broadcast Antenna Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Broadcast Antenna Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Broadcast Antenna Industry?

To stay informed about further developments, trends, and reports in the Broadcast Antenna Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence