Key Insights

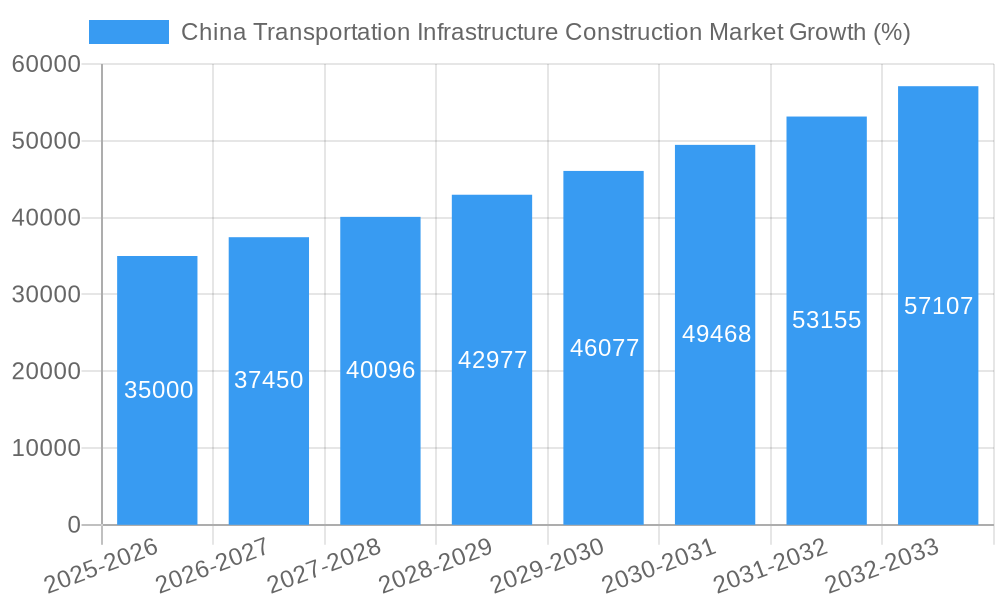

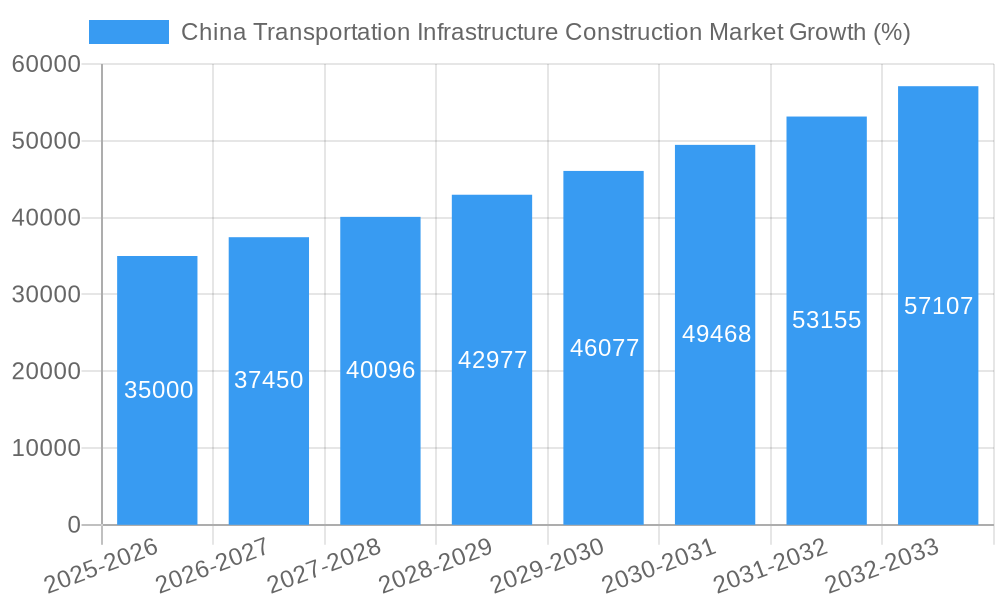

The China transportation infrastructure construction market is experiencing robust growth, driven by substantial government investment in expanding and modernizing its extensive network. The 7% CAGR (Compound Annual Growth Rate) from 2019-2033 indicates a consistently expanding market, projected to reach significant value by 2033. Key drivers include the government's ambitious Belt and Road Initiative, rapid urbanization leading to increased commuter traffic and freight movement, and the need to improve connectivity across diverse regions. Furthermore, technological advancements in construction methods and materials contribute to efficiency gains and cost reductions, further fueling market growth. While data specifics are not available in the prompt, the consistent investment and strategic importance of this sector in China strongly suggest a considerable market size exceeding several hundred billion USD by 2033, given the current market size and projected growth. The market is segmented by transportation mode, with roadways, railways, airports, ports, and inland waterways each playing a significant role. Major players like China State Construction Engineering, China Communications Construction Company, and others dominate the landscape, leveraging their expertise and scale to secure large-scale projects. While potential restraints could include fluctuating material costs and global economic conditions, the ongoing commitment to infrastructural development in China suggests continued growth and significant opportunities for market participants.

The competitive landscape is characterized by several large state-owned enterprises that often work on large-scale projects. These companies possess considerable financial resources and experience, which gives them a competitive advantage. The market is also influenced by government policies and regulations regarding environmental protection and sustainable development. The increasing demand for environmentally friendly transportation infrastructure is likely to drive adoption of new technologies and materials within the market. Future growth may also be influenced by factors such as technological advancements (e.g., automation, digitalization), evolving transportation needs (e.g., high-speed rail expansion), and the government's ongoing commitment to sustainable infrastructure development. Continued focus on inter-modal connectivity and integration across different transportation modes will further stimulate market expansion.

China Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Transportation Infrastructure Construction Market, offering crucial insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis to illuminate current market dynamics and future growth trajectories. The market size in 2025 is estimated at xx Million, projecting significant expansion throughout the forecast period.

China Transportation Infrastructure Construction Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Chinese transportation infrastructure construction market, examining market concentration, innovation drivers, regulatory frameworks, and mergers & acquisitions (M&A) activity. The market is characterized by a relatively concentrated structure, with key players like China State Construction Engineering, China Communications Construction Company, and China Railway Group holding significant market share. However, smaller regional players also contribute significantly.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable throughout the forecast period.

- Innovation Drivers: Government initiatives promoting technological advancements, such as the adoption of BIM (Building Information Modeling) and advanced construction materials, are key drivers of innovation. Furthermore, the demand for environmentally sustainable infrastructure solutions fuels innovation in green construction technologies.

- Regulatory Frameworks: Strict government regulations regarding safety, environmental protection, and project approvals significantly impact market dynamics. These regulations shape investment decisions and technological choices within the industry.

- Product Substitutes: While direct substitutes are limited, the increasing use of prefabricated components and modular construction presents alternative approaches.

- M&A Activity: The market has witnessed notable M&A activity in recent years, with deal values exceeding xx Million in 2024. These activities are primarily driven by the need for expansion, technological access and enhanced market positioning. End-user demographics across various regions also influence M&A strategies, with a focus on regional infrastructure projects.

China Transportation Infrastructure Construction Market Market Dynamics & Trends

The Chinese transportation infrastructure construction market is experiencing robust growth driven by several factors. Government investment in infrastructure development, coupled with rapid urbanization and industrialization, is fueling demand. Technological advancements are further accelerating this growth, increasing efficiency and reducing project timelines. However, challenges such as raw material price fluctuations and labor shortages continue to impact market dynamics. The Compound Annual Growth Rate (CAGR) during the forecast period is projected to be xx%, with market penetration increasing steadily across different transportation modes.

Dominant Regions & Segments in China Transportation Infrastructure Construction Market

The market's growth is geographically diverse, although specific regions lead in certain segments.

- Roadways: The roadways segment dominates the market, driven by the extensive national highway network expansion and the ongoing construction of expressways and urban road networks. Key drivers include government policies promoting rural connectivity and increasing private vehicle ownership.

- Railways: The high-speed rail network expansion significantly contributes to the railway segment's growth. Government investment in infrastructure upgrades and the increasing demand for efficient passenger and freight transport are key factors.

- Airports: Rapid expansion of air travel fuels the growth in airport construction. Investment in new airports and the modernization of existing facilities contribute to this segment's dynamism.

- Ports and Inland Waterways: The significant growth in international trade and domestic cargo transportation propels the expansion of ports and inland waterway infrastructure. Strategic investments in upgrading port facilities and expanding waterway networks play a critical role.

The dominance of the Roadways segment stems from consistent government funding, extensive project pipelines, and relatively faster execution compared to other modes. While other segments exhibit strong growth potential, roadways remain the most prominent area for investment and activity.

China Transportation Infrastructure Construction Market Product Innovations

Recent years have witnessed significant innovation in construction materials, technologies, and project management methodologies. The adoption of prefabricated components, BIM, and advanced construction equipment has enhanced efficiency and sustainability. Furthermore, the focus on green building practices and the integration of renewable energy sources are shaping product development strategies. These innovations contribute to improved project outcomes, enhanced safety, and cost optimization, while simultaneously addressing environmental concerns.

Report Scope & Segmentation Analysis

This report segments the China Transportation Infrastructure Construction Market by mode:

- Roadways: This segment includes highways, expressways, and urban roads. Growth is projected at xx% CAGR driven by government investments and increasing urbanization. Competitive dynamics are intense, with numerous companies vying for contracts.

- Railways: High-speed rail and conventional rail lines are encompassed. Significant government investment drives growth. Competitive landscape is relatively concentrated with fewer major players.

- Airports: This includes new airport construction and upgrades. Growth is tied to air travel expansion. Competitive landscape varies based on project scale.

- Ports and Inland Waterways: This includes seaports, river ports and inland waterway infrastructure. Growth is linked to trade and domestic cargo. The market is dominated by large state-owned enterprises.

Key Drivers of China Transportation Infrastructure Construction Market Growth

Several factors drive the market's growth. Firstly, substantial government investment in infrastructure projects, particularly within the "Belt and Road" initiative, fuels expansion across all segments. Secondly, rapid urbanization and industrialization create immense demand for efficient transportation networks. Thirdly, technological advancements, like BIM and prefabrication, boost efficiency and reduce costs. These interconnected factors contribute to the market's sustained expansion.

Challenges in the China Transportation Infrastructure Construction Market Sector

Despite significant growth, challenges persist. Stringent environmental regulations can increase project costs and timelines. Fluctuations in raw material prices, particularly steel and cement, impact profitability. Furthermore, intense competition among construction firms can create pricing pressures. These factors pose risks to the market's sustained growth.

Emerging Opportunities in China Transportation Infrastructure Construction Market

Several opportunities exist for market expansion. The burgeoning demand for smart transportation systems opens avenues for technological innovation and integration. The government's focus on sustainable infrastructure presents opportunities for environmentally friendly construction materials and practices. Finally, expanding into underserved rural areas presents significant growth potential.

Leading Players in the China Transportation Infrastructure Construction Market Market

- China State Construction Engineering

- China Communications Construction Company

- China Railway Group

- China Railway Construction

- Yunnan Construction and Investment Holding Group

- Shanghai Construction Group (SCG)

- China Wu Yi co Ltd

- Power Construction Corporation of China

- Beijing Construction Engineering Group

- Sichuan Road and Bridge Group

Key Developments in China Transportation Infrastructure Construction Market Industry

- 2023 Q3: Launch of a new prefabricated bridge construction technique by China Railway Construction, significantly reducing construction time.

- 2022 Q4: Merger of two regional construction companies, creating a larger entity with enhanced market presence.

- 2021 Q2: Government announcement of a major investment plan for high-speed rail expansion.

Future Outlook for China Transportation Infrastructure Construction Market Market

The China Transportation Infrastructure Construction Market is poised for continued robust growth, driven by sustained government investment, technological innovation, and the ongoing urbanization process. Strategic partnerships and diversification into emerging segments, such as smart transportation and sustainable infrastructure, will be crucial for success in this dynamic and competitive market. The consistent growth trajectory is anticipated to continue for the foreseeable future, with the market exhibiting potential for significant expansion over the coming years.

China Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airports

- 1.4. Ports and Inland Waterways

China Transportation Infrastructure Construction Market Segmentation By Geography

- 1. China

China Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Government Initiatives Driving Transport Infrastructure Construction Market in China

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China State Construction Engineering

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Communications Construction Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Railway Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Railway Construction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yunnan Construction and Investment Holding Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shanghai Construction Group (SCG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Wu Yi co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Power Construction Corporation of China

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Construction Engineering Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sichuan Road and Bridge Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China State Construction Engineering

List of Figures

- Figure 1: China Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Transportation Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 3: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 6: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Transportation Infrastructure Construction Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the China Transportation Infrastructure Construction Market?

Key companies in the market include China State Construction Engineering, China Communications Construction Company, China Railway Group, China Railway Construction, Yunnan Construction and Investment Holding Group, Shanghai Construction Group (SCG), China Wu Yi co Ltd, Power Construction Corporation of China, Beijing Construction Engineering Group**List Not Exhaustive, Sichuan Road and Bridge Group.

3. What are the main segments of the China Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Government Initiatives Driving Transport Infrastructure Construction Market in China.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the China Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence