Key Insights

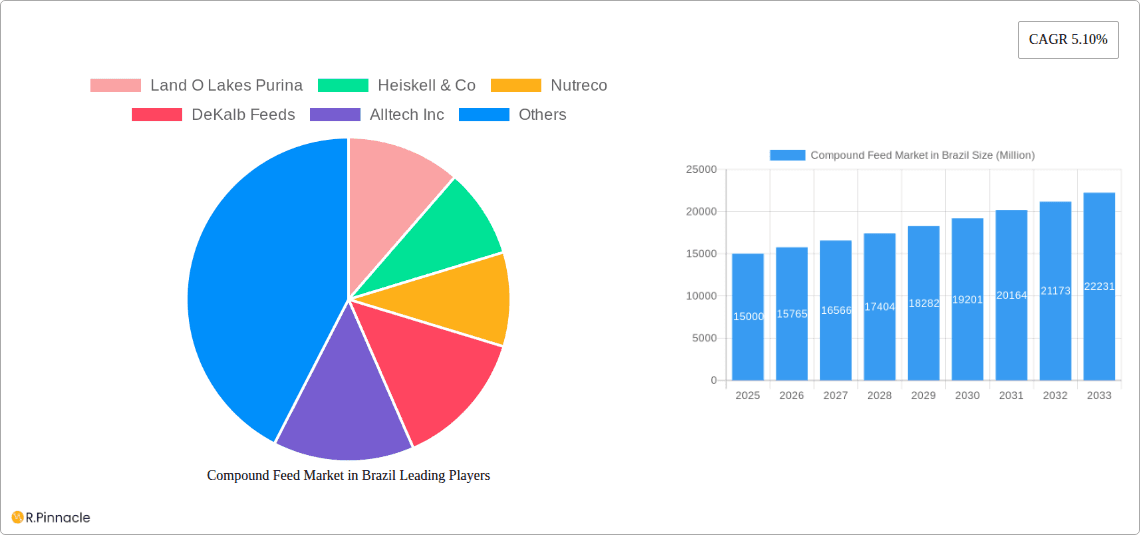

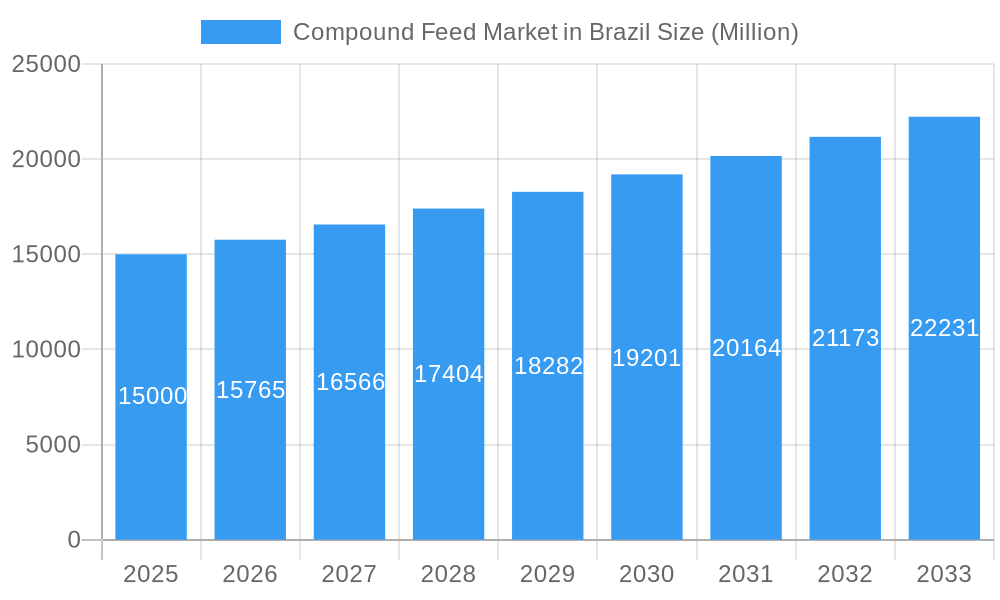

The Brazilian compound feed market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for animal protein, particularly poultry and swine, within Brazil's growing population is a significant factor. Furthermore, advancements in feed formulation and technology, leading to improved animal productivity and feed efficiency, are boosting market growth. The rising adoption of sustainable and specialized feed solutions, catering to specific animal needs and promoting animal health, is another positive influence. However, challenges remain. Fluctuations in raw material prices, particularly cereals and by-products, pose a significant threat to profitability and price stability. Government regulations impacting the feed industry and the potential for disease outbreaks also exert constraints on market expansion. Market segmentation reveals a strong focus on ruminants, poultry, and swine, with cereals and cakes & meals being the dominant ingredients. Key players like Land O Lakes Purina, Heiskell & Co, Nutreco, and Cargill Inc. are competing fiercely, driving innovation and market consolidation.

Compound Feed Market in Brazil Market Size (In Billion)

The Brazilian compound feed market's segmental breakdown reflects the country's agricultural landscape. Ruminants (cattle, goats, sheep) constitute a substantial share of the market, driven by Brazil's large beef and dairy industry. Poultry and swine sectors, characterized by intensive farming practices, also significantly contribute to demand. The aquaculture segment shows potential for future growth as consumer demand for seafood products increases. Ingredient-wise, cereals like corn and soybeans form the foundation of most compound feeds, while by-products and specialized supplements are increasingly integrated to enhance nutritional value and animal health. The forecast period (2025-2033) suggests continued expansion, albeit potentially at a moderated pace due to ongoing economic and environmental factors. Companies are likely to focus on strategic partnerships, technological advancements, and efficient supply chain management to maintain their competitiveness and capitalize on emerging market opportunities. The historical period (2019-2024) serves as a valuable benchmark for understanding past market performance and identifying trends relevant for future projections. Note that while specific numerical values for market size in previous years are unavailable, the provided CAGR and market trends allow for a robust qualitative assessment.

Compound Feed Market in Brazil Company Market Share

Compound Feed Market in Brazil: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Compound Feed Market in Brazil, covering market size, segmentation, growth drivers, challenges, and future outlook from 2019 to 2033. The study period is 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033 and the historical period is 2019-2024. This report is an essential resource for industry professionals, investors, and anyone seeking to understand the dynamics of this crucial market.

Compound Feed Market in Brazil Market Structure & Innovation Trends

This section analyzes the competitive landscape of Brazil's compound feed market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational corporations and smaller regional players. Key players include Land O Lakes Purina, Heiskell & Co, Nutreco, DeKalb Feeds, Alltech Inc, Archer Daniels Midland (ADM), Cargill Inc (Cargill), and Kent Feeds.

Market share data reveals a moderately concentrated market, with the top 5 players accounting for approximately xx% of the total market value in 2024. Innovation is driven by the need for improved feed efficiency, reduced environmental impact, and enhanced animal health and welfare. Regulatory frameworks, while generally supportive of industry growth, are subject to periodic revisions influencing product formulations and operational practices.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- M&A Activity: Significant transactions, such as Cargill's acquisition of Integral Animal Nutrition in October 2022, reshape the market landscape. The deal value is estimated at xx Million. Such acquisitions highlight the strategic importance of the Brazilian market and the pursuit of market consolidation.

- Innovation Drivers: Demand for sustainable and efficient feed solutions, advancements in precision livestock farming, and growing focus on traceability and transparency are key innovation drivers.

- Product Substitutes: Limited direct substitutes exist, however, competition arises from alternative farming practices and the availability of locally sourced ingredients.

Compound Feed Market in Brazil Market Dynamics & Trends

The Brazilian compound feed market exhibits robust growth driven by several factors. Increasing livestock production, coupled with rising demand for animal protein, fuels the market's expansion. Technological advancements in feed formulation and processing enhance feed efficiency and nutritional value. Consumer preferences for sustainably produced animal products are influencing the adoption of environmentally friendly feed solutions. However, economic fluctuations and variations in raw material prices pose challenges to consistent growth. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

The competitive landscape is dynamic, characterized by intense competition among established players and the emergence of new entrants. Strategic partnerships and collaborations are crucial for navigating the challenges and opportunities presented by this market. Technological disruptions, particularly in areas like precision feeding and data analytics, are reshaping business models and operational strategies.

Dominant Regions & Segments in Compound Feed Market in Brazil

The Brazilian compound feed market displays regional variations in growth and consumption patterns. While data at the regional level may not be readily available, analysis suggests the South and Southeast regions are likely the leading consumers of compound feed due to higher livestock densities and established agricultural infrastructure. Among animal types, Poultry is a dominant segment followed by Swine and Ruminants. Within ingredients, Cereals and Cakes & Meals are major components, accounting for the significant share of the market.

- Poultry Segment Key Drivers: High demand for poultry products, relatively efficient production systems, and government support for the poultry sector.

- Swine Segment Key Drivers: Increasing domestic consumption of pork, government initiatives to modernize swine farming, and improved feed efficiency technologies.

- Ruminants Segment Key Drivers: Growing demand for beef and dairy products, expansion of feedlot operations, and the increasing availability of improved feed technologies.

- Cereals and Cakes & Meals Segment Key Drivers: Abundant availability of locally produced cereals (corn, soy), relatively low cost, and established supply chains.

- By-products and Supplements Segment Key Drivers: Rising focus on optimizing feed costs, increased adoption of functional feed additives to improve animal health and productivity.

These segments' dominance reflects the prevailing consumer preferences, technological advancements, and the specific economic conditions within Brazil. Further analysis of regional dominance requires more detailed data.

Compound Feed Market in Brazil Product Innovations

Recent innovations in compound feed include the development of customized feed formulations tailored to specific animal breeds and life stages, the incorporation of functional ingredients (probiotics, prebiotics, and enzymes) to enhance animal health and performance, and the use of sustainable ingredients and environmentally friendly processing techniques. These innovations improve feed efficiency and address consumer demand for high-quality, sustainably produced animal products. The market is witnessing the emergence of smart feeding systems, utilizing digital technologies to optimize feed delivery and monitor animal health parameters.

Report Scope & Segmentation Analysis

This report segments the Brazilian compound feed market across various parameters, including animal type (Ruminants, Poultry, Swine, Aquaculture, Other Animal Types) and ingredients (Cereals, Cakes & Meals, By-products, Supplements). Each segment's growth projections, market size (Million), and competitive dynamics are analyzed in detail. For instance, the Poultry segment is projected to experience significant growth owing to the increasing consumption of poultry products in Brazil, leading to increased demand for poultry feed. Similarly, the Cereals segment will continue its dominance due to readily available resources and lower cost.

Key Drivers of Compound Feed Market in Brazil Growth

The growth of the Brazilian compound feed market is primarily driven by the increasing demand for animal protein, advancements in animal farming technologies (leading to higher feed efficiency), government initiatives to support livestock production, and rising disposable incomes fueling higher consumption. The expansion of the aquaculture industry also contributes significantly. Favorable regulatory frameworks further promote market growth.

Challenges in the Compound Feed Market in Brazil Sector

The Brazilian compound feed market faces challenges such as fluctuations in raw material prices (particularly grains and soybeans), logistical bottlenecks hindering efficient supply chains, and intense competition among existing players. Regulatory changes regarding feed composition and environmental concerns also introduce uncertainties. These factors can influence production costs and profitability, thus impacting the overall market growth.

Emerging Opportunities in Compound Feed Market in Brazil

Emerging opportunities include the growing demand for specialized and functional feed, increased adoption of precision feeding technologies, and the rising interest in sustainable and traceable feed solutions. Expanding into new markets (e.g., smaller regional producers) and focusing on value-added services further present promising opportunities for growth. The use of data analytics to optimize feed formulation and animal health management offers significant potential.

Key Developments in Compound Feed Market in Brazil Industry

- October 2022: Cargill's acquisition of Integral Animal Nutrition expands its presence in the Brazilian cattle feed market, enhancing its product portfolio and geographic reach.

- January 2022: Archer Daniels Midland's (ADM) new Aquaculture Innovation Lab strengthens its research and development capabilities in Brazil and the broader Latin American region, driving innovation in aquaculture feed.

Future Outlook for Compound Feed Market in Brazil Market

The future outlook for the Brazilian compound feed market remains positive, driven by steady growth in livestock production, rising consumer demand for animal products, technological advancements in feed formulation and processing, and increasing adoption of sustainable farming practices. Strategic investments in research and development, coupled with effective supply chain management, are crucial for capitalizing on the market's growth potential. Companies focusing on customized feed solutions, efficient production systems, and sustainable practices are well-positioned to succeed in this dynamic market.

Compound Feed Market in Brazil Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

- 2.4. Supplements

Compound Feed Market in Brazil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Compound Feed Market in Brazil Regional Market Share

Geographic Coverage of Compound Feed Market in Brazil

Compound Feed Market in Brazil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Demand for Quality Compound Feed to boost Balanced Diet in Animals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. South America Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Europe Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East & Africa Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Asia Pacific Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes & Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Land O Lakes Purina

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Heiskell & Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nutreco

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DeKalb Feeds

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alltech Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Archer Daniels Midland

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cargill Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kent Feeds

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Land O Lakes Purina

List of Figures

- Figure 1: Global Compound Feed Market in Brazil Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 3: North America Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 5: North America Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: North America Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 9: South America Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: South America Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 11: South America Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: South America Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 15: Europe Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 17: Europe Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Europe Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 21: Middle East & Africa Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: Middle East & Africa Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 23: Middle East & Africa Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: Middle East & Africa Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 27: Asia Pacific Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Asia Pacific Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 29: Asia Pacific Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Asia Pacific Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 2: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 3: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 5: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 6: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 12: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 17: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 18: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 29: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 30: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 38: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 39: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compound Feed Market in Brazil?

The projected CAGR is approximately 3.78%.

2. Which companies are prominent players in the Compound Feed Market in Brazil?

Key companies in the market include Land O Lakes Purina, Heiskell & Co, Nutreco, DeKalb Feeds, Alltech Inc, Archer Daniels Midland, Cargill Inc, Kent Feeds.

3. What are the main segments of the Compound Feed Market in Brazil?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Demand for Quality Compound Feed to boost Balanced Diet in Animals.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

October 2022: Cargill has acquired Integral Animal Nutrition, a cattle feed producer in Brazil with this the company will purchase 100 percent of Integral's assets, including a production plant located in Brazil, a portfolio of products ranging from Free Choice minerals to premixes, will help the company further develop its Free Choice Mineral and premix capabilities to better serve its customers across the country's mid-west region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compound Feed Market in Brazil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compound Feed Market in Brazil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compound Feed Market in Brazil?

To stay informed about further developments, trends, and reports in the Compound Feed Market in Brazil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence