Key Insights

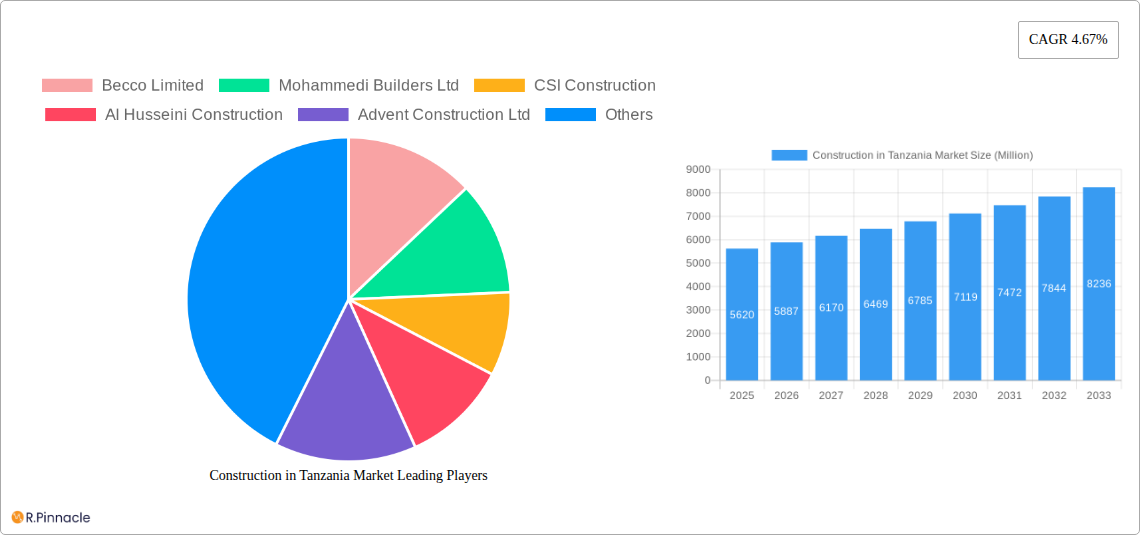

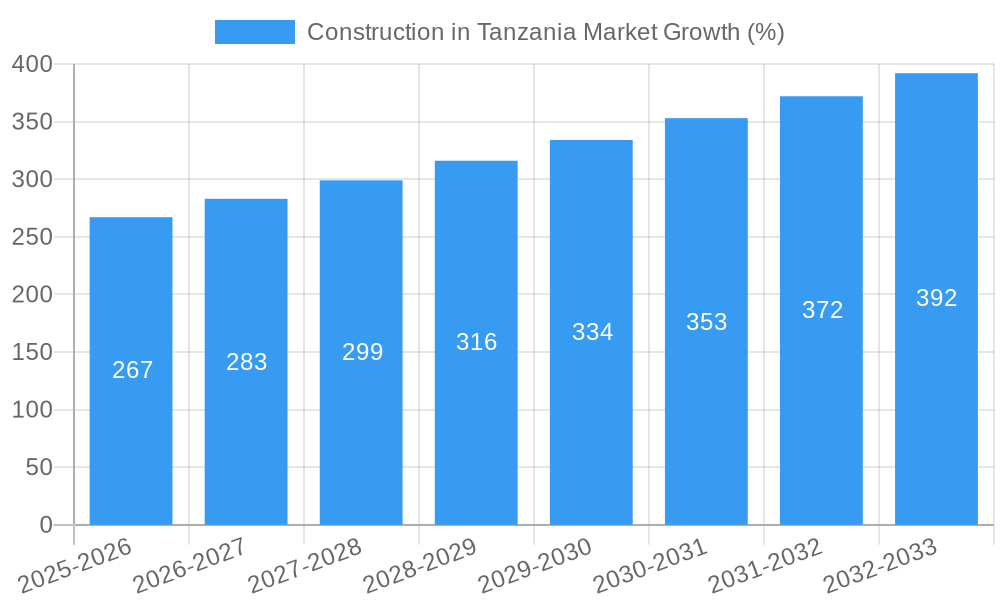

The Tanzanian construction market, valued at $5.62 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.67% from 2025 to 2033. This growth is fueled by significant investments in infrastructure development, particularly in transportation networks (roads, railways, and ports) and energy and utility projects. A burgeoning residential sector, driven by a growing population and urbanization, further contributes to market expansion. The commercial sector, encompassing office spaces, retail establishments, and hospitality facilities, also shows promising growth trajectory, supported by increasing foreign direct investment and economic diversification. While challenges such as fluctuating material prices, skills gaps within the construction workforce, and regulatory complexities exist, the overall market outlook remains positive. The government's ongoing commitment to infrastructure projects and supportive economic policies are expected to mitigate these restraints and maintain a steady growth momentum. Key players such as Becco Limited, Mohammedi Builders Ltd, and others are well-positioned to capitalize on this expansion, though competition is likely to intensify as the market matures. The segmentation by sector (residential, commercial, industrial, infrastructure, energy and utilities) allows for targeted investment and business development strategies.

The market's future success depends on effective management of these challenges. Addressing skilled labor shortages through training programs and attracting foreign expertise can enhance productivity and project delivery timelines. Streamlining regulatory processes and fostering transparency will attract further investment and encourage private sector participation. Continued government focus on sustainable and resilient infrastructure development, addressing environmental concerns, and promoting environmentally friendly building practices will attract responsible investors and contribute to long-term market health. The geographical concentration in Tanzania presents opportunities for localized expertise and strategic partnerships, ensuring the market's growth remains inclusive and benefits local communities.

Construction in Tanzania Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Tanzanian construction market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. It delves into key segments, leading players, and major developments, offering actionable intelligence to navigate this dynamic market. The report uses USD Million for all financial values.

Construction in Tanzania Market Market Structure & Innovation Trends

This section analyzes the Tanzanian construction market's structure, highlighting market concentration, innovation drivers, and regulatory aspects. We examine the competitive landscape, including mergers and acquisitions (M&A) activity, and assess the influence of product substitutes and end-user demographics.

Market Concentration: The Tanzanian construction market exhibits a moderately fragmented structure, with several key players competing alongside numerous smaller firms. The top five players collectively hold an estimated xx% market share in 2025, while the remaining share is distributed across a large number of smaller companies. Accurate market share data for each company is difficult to obtain due to limited public disclosures, therefore accurate market share data is difficult to obtain.

Innovation Drivers: Technological advancements, particularly in construction materials and techniques (e.g., prefabrication, 3D printing), are driving innovation within the industry. Government initiatives promoting sustainable and environmentally friendly construction practices are also accelerating innovation.

Regulatory Framework: The regulatory framework influences the construction industry in Tanzania through building codes, environmental regulations, and licensing requirements. Streamlining regulatory processes and ensuring transparency are vital for market growth and attracting foreign investment.

M&A Activity: The construction sector has witnessed a moderate level of M&A activity in recent years, with deal values estimated to total around xx Million USD in the period 2019-2024. Further consolidation is expected as larger companies seek to expand their market share and geographic reach.

Product Substitutes: The availability of alternative building materials and technologies, such as sustainable materials (e.g., bamboo, recycled materials) is affecting the traditional building materials industry. The increasing competition from these substitutes is placing pressure on pricing and driving innovation.

End-User Demographics: The growing urban population and rising disposable incomes are driving demand for residential and commercial construction. This increasing demand further fuels market expansion.

Construction in Tanzania Market Market Dynamics & Trends

This section explores the key dynamics shaping the Tanzanian construction market. We examine market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing quantitative data to support our analysis. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of new technologies varies significantly across different market segments.

This growth is fueled by several factors including substantial government investment in infrastructure projects, a burgeoning population, and increasing urbanization. The construction industry is also increasingly adopting digital tools and technologies such as Building Information Modeling (BIM) and project management software to improve efficiency and productivity. However, challenges such as infrastructure gaps, skilled labor shortages, and access to finance continue to pose obstacles to market expansion.

Dominant Regions & Segments in Construction in Tanzania Market

This section identifies the leading regions and segments within the Tanzanian construction market. While specific regional breakdowns are not readily available to provide a precise dominance analysis, industry trends suggest that major urban centers experience higher growth rates compared to rural areas.

Key Drivers: Economic policies promoting infrastructure development, government investments in transportation networks (roads, railways, ports), and the expansion of energy and utility networks are pivotal drivers.

Dominance Analysis: The residential construction sector holds a substantial share of the market, driven by rapid urbanization and population growth. The infrastructure segment, particularly transportation infrastructure, is also experiencing significant growth due to ongoing government projects. The commercial sector also shows significant growth potential.

Regional Variations: Dar es Salaam, being the largest city and commercial hub, accounts for a significant portion of the construction activity. Other major urban centers like Mwanza, Arusha, and Zanzibar also exhibit strong growth.

Construction in Tanzania Market Product Innovations

The Tanzanian construction market is witnessing the adoption of innovative building materials and construction technologies. Prefabrication methods, sustainable construction materials (including locally sourced materials), and the integration of smart technologies within buildings are enhancing efficiency and sustainability. These innovations are improving building quality, reducing construction timelines, and aligning with environmentally conscious goals. Furthermore, the integration of Building Information Modelling (BIM) software is improving construction project management.

Report Scope & Segmentation Analysis

This report segments the Tanzanian construction market by sector: Residential, Commercial, Industrial, Infrastructure (Transportation), and Energy and Utilities.

Residential: This segment is characterized by high demand driven by population growth and urbanization, with a projected market size of xx Million USD in 2025, growing to xx Million USD by 2033. The segment is marked by varying levels of competition across price points.

Commercial: This segment comprises office buildings, shopping malls, and other commercial structures. The market size is projected at xx Million USD in 2025 and xx Million USD by 2033, largely driven by economic growth and foreign investment. Competition is moderate to high.

Industrial: This segment encompasses factories, warehouses, and other industrial structures. It's estimated at xx Million USD in 2025 and xx Million USD by 2033, influenced by the growth of manufacturing and industrial activities. The competitive intensity is moderate.

Infrastructure (Transportation): This rapidly expanding segment includes roads, railways, airports, and ports. The market size is estimated at xx Million USD in 2025 and xx Million USD by 2033, driven by government investments. Competition in this segment is intense.

Energy and Utilities: This segment, covering power plants, water treatment facilities, and related infrastructure, is estimated at xx Million USD in 2025 and xx Million USD by 2033. Growth is influenced by government initiatives promoting energy access and improved infrastructure. Competition levels are moderate.

Key Drivers of Construction in Tanzania Market Growth

Several factors are driving the growth of the Tanzanian construction market. Significant government investment in infrastructure projects aims to boost economic development, coupled with the rapid urbanization and increasing population. The ongoing development of the energy and utility sectors also fuels construction activity. Furthermore, foreign direct investment in various sectors contributes substantially to construction growth.

Challenges in the Construction in Tanzania Market Sector

The Tanzanian construction market faces several challenges including access to finance, skills shortages, and fluctuating material costs. Regulatory hurdles can create delays, impacting project timelines. Supply chain inefficiencies and the inconsistent availability of building materials also pose obstacles. Moreover, competition and market fragmentation can lead to price wars and reduced profitability.

Emerging Opportunities in Construction in Tanzania Market

The Tanzanian construction market presents numerous opportunities for growth. The expanding middle class is driving demand for better housing. The government’s focus on infrastructure development creates immense potential. The adoption of sustainable building practices presents opportunities for eco-friendly construction. Furthermore, utilizing innovative construction technologies can improve efficiency and sustainability, while public-private partnerships are crucial for large-scale project development.

Leading Players in the Construction in Tanzania Market Market

- Becco Limited

- Mohammedi Builders Ltd

- CSI Construction

- Al Husseini Construction

- Advent Construction Ltd

- Salem Construction Limited

- Masasi Construction Co Ltd

- Imperial Construction Company

- Nordic Construction Company Limited

- Milembe Construction Co Ltd

- Estim Construction

Key Developments in Construction in Tanzania Market Industry

August 2022: Adani Group (APSEZ) and AD Ports signed an agreement to pursue Tanzanian strategic investment possibilities, focusing on end-to-end logistics infrastructure. This significantly boosts the infrastructure sector's growth potential.

March 2023: Tanzania finalized negotiations for a USD 30 Billion LNG project, signifying massive investment and construction activity in the energy sector. This development is a major catalyst for growth in the energy and related infrastructure segments.

Future Outlook for Construction in Tanzania Market Market

The Tanzanian construction market's future is promising, driven by continued government investment in infrastructure, rapid urbanization, and a growing population. The country's economic growth and foreign direct investment further stimulate the market. The adoption of innovative technologies and sustainable construction practices will shape the industry's future. Strategic partnerships and collaborations will play a key role in harnessing the market's vast potential.

Construction in Tanzania Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

Construction in Tanzania Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction in Tanzania Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw material prices

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Infrastructure Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction in Tanzania Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction in Tanzania Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure (Transportation)

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction in Tanzania Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure (Transportation)

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction in Tanzania Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure (Transportation)

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction in Tanzania Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure (Transportation)

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction in Tanzania Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure (Transportation)

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Becco Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mohammedi Builders Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CSI Construction

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Husseini Construction

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advent Construction Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Salem Construction Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Masasi Construction Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Imperial Construction Company**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nordic Construction Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Milembe Construction Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Estim Construction

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Becco Limited

List of Figures

- Figure 1: Global Construction in Tanzania Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Tanzania Construction in Tanzania Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Tanzania Construction in Tanzania Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction in Tanzania Market Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction in Tanzania Market Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction in Tanzania Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Construction in Tanzania Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Construction in Tanzania Market Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Construction in Tanzania Market Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Construction in Tanzania Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Construction in Tanzania Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Construction in Tanzania Market Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Construction in Tanzania Market Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Construction in Tanzania Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Construction in Tanzania Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Construction in Tanzania Market Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Construction in Tanzania Market Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Construction in Tanzania Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Construction in Tanzania Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Construction in Tanzania Market Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Construction in Tanzania Market Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Construction in Tanzania Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Construction in Tanzania Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction in Tanzania Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction in Tanzania Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction in Tanzania Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Construction in Tanzania Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Construction in Tanzania Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Construction in Tanzania Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Construction in Tanzania Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Construction in Tanzania Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Construction in Tanzania Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Construction in Tanzania Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Construction in Tanzania Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Construction in Tanzania Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Construction in Tanzania Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Construction in Tanzania Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Construction in Tanzania Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction in Tanzania Market?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the Construction in Tanzania Market?

Key companies in the market include Becco Limited, Mohammedi Builders Ltd, CSI Construction, Al Husseini Construction, Advent Construction Ltd, Salem Construction Limited, Masasi Construction Co Ltd, Imperial Construction Company**List Not Exhaustive, Nordic Construction Company Limited, Milembe Construction Co Ltd, Estim Construction.

3. What are the main segments of the Construction in Tanzania Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture.

6. What are the notable trends driving market growth?

Increasing Investment in Infrastructure Projects.

7. Are there any restraints impacting market growth?

Volatility in Raw material prices.

8. Can you provide examples of recent developments in the market?

August 2022: Adani Group (APSEZ), an Indian port giant, and AD Ports (Abu Dhabi Ports) have signed an agreement to work together to pursue Tanzanian strategic investment possibilities. The joint venture partners intended to provide end-to-end logistics infrastructure and services, including rail, ports, maritime services, digital services, and industrial zones in Tanzania.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction in Tanzania Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction in Tanzania Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction in Tanzania Market?

To stay informed about further developments, trends, and reports in the Construction in Tanzania Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence