Key Insights

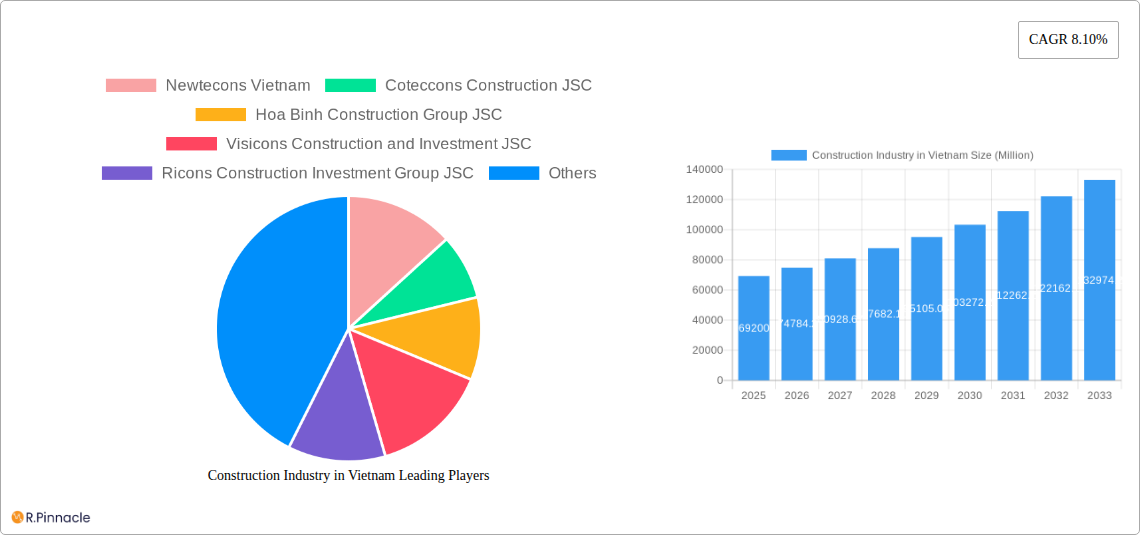

The Vietnamese construction industry, valued at $69.20 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.10% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant government investments in infrastructure development, particularly in transportation networks and energy projects, are creating substantial demand. Secondly, rapid urbanization and a growing middle class are boosting residential and commercial construction activities. The increasing adoption of sustainable building practices and technological advancements further contributes to this positive growth trajectory. However, challenges remain. Fluctuations in raw material prices, skilled labor shortages, and regulatory complexities could potentially hinder the industry's growth momentum. The market is segmented into Residential, Commercial, Industrial, Infrastructure (Transportation), and Energy & Utilities Construction, with infrastructure and residential segments likely dominating the market share due to government initiatives and population growth. Major players like Coteccons Construction JSC, Hoa Binh Construction Group JSC, and others are actively shaping the market landscape through strategic partnerships, technological integration, and expansion into new projects.

The forecast period from 2025 to 2033 suggests a continued upward trend for the Vietnamese construction sector. While the exact market size for each segment is not specified, the overall growth rate points towards a significant increase in market value by 2033. Analyzing the major players suggests a competitive landscape with opportunities for both domestic and international companies. The industry's success will heavily depend on managing the challenges mentioned earlier and adapting to evolving technological advancements and sustainability requirements. Successful players will be those that can efficiently manage resources, attract and retain skilled labor, and navigate the regulatory environment effectively. Furthermore, leveraging technological advancements in construction management and building materials will be crucial for maintaining competitiveness and achieving sustainable growth within the predicted market expansion.

Construction Industry in Vietnam: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of Vietnam's construction industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market trends, key players, and future growth potential. The study period encompasses historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). Expect detailed breakdowns across key segments and regions, offering actionable intelligence for strategic decision-making.

Construction Industry in Vietnam Market Structure & Innovation Trends

Vietnam's construction industry is characterized by a dynamic interplay of established players and emerging companies. Market concentration is moderate, with a few large firms such as Coteccons Construction JSC and Hoa Binh Construction Group JSC holding significant market share, estimated at approximately xx% and xx% respectively in 2025. However, a substantial number of smaller and medium-sized enterprises (SMEs) contribute significantly to overall activity.

- Market Share: The top 5 firms hold approximately xx% of the market share, while the remaining xx% is distributed amongst numerous SMEs.

- Innovation Drivers: Government infrastructure projects, rapid urbanization, and increasing foreign investment are key drivers of innovation. Adoption of Building Information Modeling (BIM) and prefabrication techniques is gradually increasing.

- Regulatory Framework: The government's focus on sustainable development and infrastructure development influences project awarding and construction methodologies. However, bureaucratic processes can sometimes pose challenges.

- M&A Activity: The value of M&A deals in the Vietnamese construction sector totaled approximately $xx Million in 2024, with a projected increase to $xx Million in 2025. Key deals involved strategic acquisitions and consolidations among mid-sized firms.

The market is witnessing the increased adoption of sustainable building materials and technologies, driven by environmental concerns and government initiatives. Product substitutes, such as modular construction and prefabricated components, are gradually gaining traction. End-user demographics show a strong demand for residential and commercial properties across diverse economic strata.

Construction Industry in Vietnam Market Dynamics & Trends

Vietnam's construction industry exhibits robust growth, driven primarily by rapid urbanization, increasing foreign direct investment (FDI), and significant government spending on infrastructure development. The industry's Compound Annual Growth Rate (CAGR) is projected to be xx% between 2025 and 2033. Market penetration of advanced construction technologies like BIM remains relatively low but is expected to increase steadily. Consumer preferences are shifting towards sustainable, technologically advanced buildings with improved energy efficiency.

The competitive landscape is intense, with both domestic and international players vying for market share. Price competition, coupled with the need to maintain quality and adhere to strict timelines, is a crucial factor influencing the industry’s dynamics. Challenges include labor shortages, fluctuating material costs, and regulatory complexities. However, these challenges are balanced by sustained demand from both public and private sectors, ensuring strong overall growth.

Dominant Regions & Segments in Construction Industry in Vietnam

While construction activity is widespread throughout Vietnam, Ho Chi Minh City and Hanoi remain the dominant regions, accounting for approximately xx% of the total market value in 2025. This dominance stems from concentrated economic activity, high population density, and significant infrastructure projects undertaken in these areas.

- Key Drivers for Ho Chi Minh City and Hanoi:

- High population density and urbanization.

- Concentrated economic activity and significant foreign investment.

- Government focus on infrastructure development.

- Large-scale residential and commercial construction projects.

By sector, Residential Construction maintains the largest segment share in 2025, accounting for approximately xx Million USD. This is followed by Commercial Construction and Infrastructure (Transportation) Construction, each representing significant shares of the market. The growth of Industrial Construction and Energy and Utilities Construction is also noteworthy, reflecting the ongoing industrialization and economic diversification within the country.

Construction Industry in Vietnam Product Innovations

The Vietnamese construction sector is gradually incorporating advanced technologies. BIM adoption is increasing, leading to enhanced design efficiency and cost optimization. Prefabricated components and modular construction are gaining traction, particularly in residential and commercial projects, offering faster construction times and reduced on-site labor. Sustainable building materials, including recycled content and energy-efficient solutions, are becoming increasingly popular to meet environmental regulations and consumer preferences.

Report Scope & Segmentation Analysis

This report segments the Vietnamese construction market by sector:

- Residential Construction: This segment projects a significant growth trajectory driven by urbanization and rising disposable incomes. Market size is projected at approximately xx Million USD in 2025. Competition is fierce amongst various developers.

- Commercial Construction: This sector is fueled by increased FDI and a growing economy. The market size is expected to reach xx Million USD by 2025. Competition is intense amongst both domestic and international firms.

- Industrial Construction: Growth in this segment is driven by industrial expansion and foreign investment in manufacturing. The market value is estimated at xx Million USD in 2025.

- Infrastructure (Transportation) Construction: Government investment in roads, railways, and other transportation networks is a primary growth driver for this segment. The 2025 market value is projected at approximately xx Million USD.

- Energy and Utilities Construction: Growth in this area is related to power generation projects and upgrading existing infrastructure. The sector is estimated to be valued at xx Million USD in 2025.

Key Drivers of Construction Industry in Vietnam Growth

Several factors fuel the growth of Vietnam's construction industry:

- Government Infrastructure Spending: Significant investment in transportation, energy, and urban development creates substantial demand for construction services.

- Rapid Urbanization: The ongoing migration from rural to urban areas increases the demand for housing and commercial spaces.

- Foreign Direct Investment (FDI): Attracting significant FDI inflows boosts investment in construction projects.

- Rising Disposable Incomes: An expanding middle class increases demand for improved housing and infrastructure.

Challenges in the Construction Industry in Vietnam Sector

The Vietnamese construction industry faces several challenges:

- Labor Shortages: Skilled labor is scarce, impacting project timelines and costs.

- Fluctuating Material Costs: Material price volatility can disrupt project budgets and timelines.

- Regulatory Hurdles: Complex bureaucratic processes can delay project approvals and implementation.

- Competition: A competitive environment puts pressure on profit margins.

Emerging Opportunities in Construction Industry in Vietnam

Several opportunities exist for growth:

- Green Building Technologies: Growing environmental awareness creates demand for sustainable construction practices and materials.

- Technological Advancements: Adoption of BIM and prefabrication offers improved efficiency and cost savings.

- Infrastructure Development: Ongoing investment in infrastructure provides substantial growth potential.

- Expanding Middle Class: The growing middle class drives demand for higher quality housing and commercial spaces.

Leading Players in the Construction Industry in Vietnam Market

- Newtecons Vietnam

- Coteccons Construction JSC

- Hoa Binh Construction Group JSC

- Visicons Construction and Investment JSC

- Ricons Construction Investment Group JSC

- Hung Thinh Incons JSC

- Danieli & C Officine Meccaniche SpA

- An Phong

- Vincons Vietnam Construction JSC

- Takco

- Delta Corp

- Choyoda Corp

- COFICO

- Fecon Corp JSC

- Hyundai Engineering & Construction Co Ltd

- Song Da Corp JSC

- ECOBA Vietnam JSC

- Central Cons

- GS Engineering and Construction

- CTCI Corp

Key Developments in Construction Industry in Vietnam Industry

- November 2023: COFICO, along with partners TVC and Searefico, participated in the handover ceremony for a new Betalactam factory in Hau Giang province. This project highlights the growing demand for high-quality industrial construction, particularly in the pharmaceutical sector.

- October 2023: Song Da Corp JSC's investment in the 500kV power line project underscores the government's focus on infrastructure development and the significant opportunities this presents for construction firms.

Future Outlook for Construction Industry in Vietnam Market

Vietnam's construction industry is poised for sustained growth driven by ongoing urbanization, government investment in infrastructure, and increasing FDI. The adoption of advanced technologies and sustainable building practices will further enhance the industry's competitiveness and appeal to both domestic and international players. This creates significant opportunities for expansion and innovation within the sector.

Construction Industry in Vietnam Segmentation

-

1. Sector

- 1.1. Residential Construction

- 1.2. Commercial Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

Construction Industry in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and population growth; Government policies and Foreign Investnents

- 3.3. Market Restrains

- 3.3.1. Skilled Labor Shortage; Material Price Fluctuations

- 3.4. Market Trends

- 3.4.1. Government plans to develop Infrastructure driving the Construction Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential Construction

- 5.1.2. Commercial Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential Construction

- 6.1.2. Commercial Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential Construction

- 7.1.2. Commercial Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential Construction

- 8.1.2. Commercial Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential Construction

- 9.1.2. Commercial Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential Construction

- 10.1.2. Commercial Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Newtecons Vietnam

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Coteccons Construction JSC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hoa Binh Construction Group JSC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Visicons Construction and Investment JSC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ricons Construction Investment Group JSC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hung Thinh Incons JSC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danieli & C Officine Meccaniche SpA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 An Phong

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vincons Vietnam Construction JSC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Takco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Delta Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Choyoda Corp

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 COFICO

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Fecon Corp JSC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hyundai Engineering & Construction Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Song Da Corp JSC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ECOBA Vietnam JSC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Central Cons**List Not Exhaustive

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 GS Engineering and Construction

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 CTCI Corp

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Newtecons Vietnam

List of Figures

- Figure 1: Global Construction Industry in Vietnam Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Vietnam Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 3: Vietnam Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Industry in Vietnam Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Industry in Vietnam Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Vietnam?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Construction Industry in Vietnam?

Key companies in the market include Newtecons Vietnam, Coteccons Construction JSC, Hoa Binh Construction Group JSC, Visicons Construction and Investment JSC, Ricons Construction Investment Group JSC, Hung Thinh Incons JSC, Danieli & C Officine Meccaniche SpA, An Phong, Vincons Vietnam Construction JSC, Takco, Delta Corp, Choyoda Corp, COFICO, Fecon Corp JSC, Hyundai Engineering & Construction Co Ltd, Song Da Corp JSC, ECOBA Vietnam JSC, Central Cons**List Not Exhaustive, GS Engineering and Construction, CTCI Corp.

3. What are the main segments of the Construction Industry in Vietnam?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and population growth; Government policies and Foreign Investnents.

6. What are the notable trends driving market growth?

Government plans to develop Infrastructure driving the Construction Market.

7. Are there any restraints impacting market growth?

Skilled Labor Shortage; Material Price Fluctuations.

8. Can you provide examples of recent developments in the market?

November 2023: COFICO and joint venture partners TVC and Searefico opportunistically attended the Taking Over Singing Ceremony of The New Betalactam Factory that Meets Global GMP Standards for the Investor – DHG Pharmaceutical Joint Stock Company. The project is located at Tan Phu Thanh Industrial Park – Phase 1, Chau Thanh A district, Hau Giang province, with a total project area of about 6 hectares. It is expected that after completion and operation in 2024, the Betalactam factory will meet global GMP standards, requiring high technical specifications in the stages of design, construction, and finishing. This project holds particular significance for the plan to develop high-quality product lines and deliver numerous qualified product lines to replace imported drugs for consumers of DHG Pharma.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Vietnam?

To stay informed about further developments, trends, and reports in the Construction Industry in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence