Key Insights

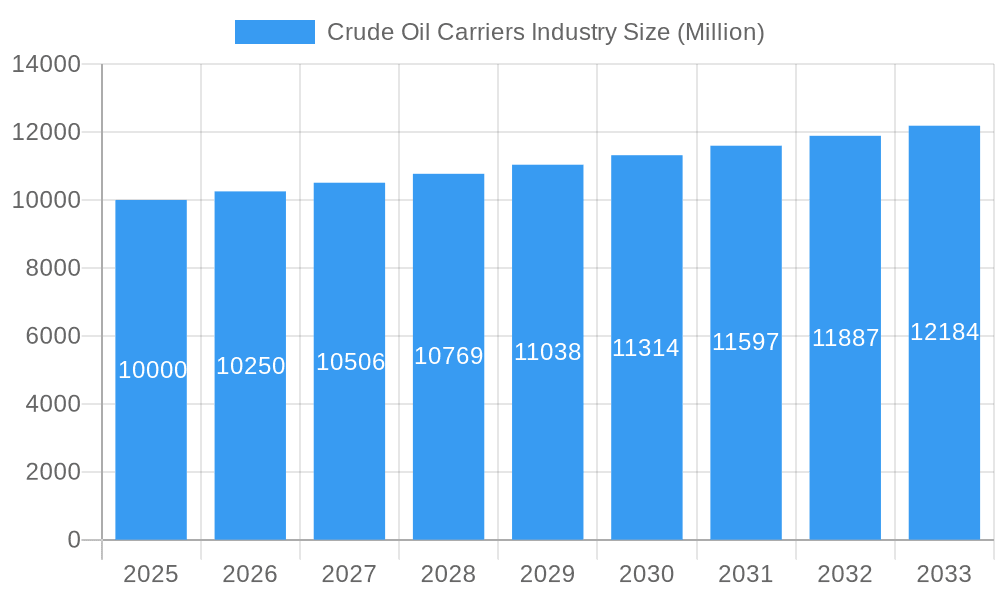

The global crude oil carrier market, estimated at $225142.8 million in the base year 2025, is poised for significant expansion. Projections indicate a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033. This growth trajectory is underpinned by escalating global crude oil demand, particularly from emerging Asian and Middle Eastern economies. Despite the ongoing energy transition, crude oil remains vital, ensuring sustained demand for maritime transport. Technological advancements, such as fuel-efficient vessels and enhanced navigation systems, are optimizing operations and reducing costs. Key challenges include volatile oil prices and geopolitical instability, which can impact profitability and supply chain reliability. The market is segmented by vessel size including Medium Range, Panamax, Aframax, Suezmax, VLCC, and ULCC, with VLCCs and ULCCs leading long-haul, high-volume crude oil transportation.

Crude Oil Carriers Industry Market Size (In Billion)

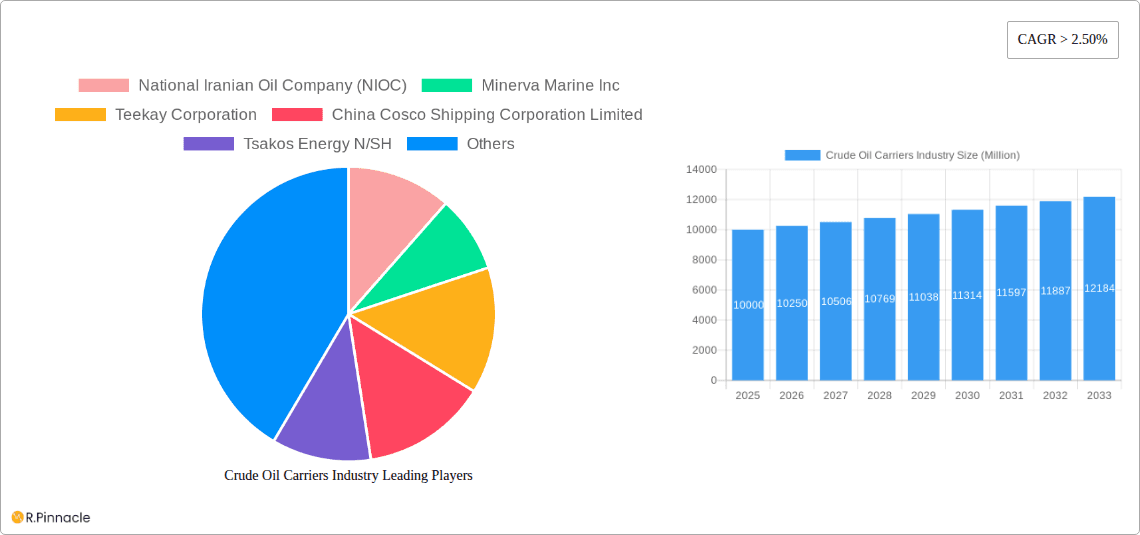

The competitive landscape features established entities such as National Iranian Oil Company (NIOC), Teekay Corporation, and China Cosco Shipping Corporation Limited, alongside specialized regional operators. Geographically, North America, Europe, and Asia Pacific are key markets, with Asia Pacific expected to exhibit the strongest growth due to increasing energy consumption. The forecast period (2025-2033) anticipates continued market growth, influenced by geopolitical developments, oil price fluctuations, and the adoption of maritime technologies. Continuous monitoring of these factors is essential for accurate market forecasting.

Crude Oil Carriers Industry Company Market Share

Crude Oil Carriers Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Crude Oil Carriers industry, offering crucial insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We analyze market dynamics, key players, and emerging trends to provide a clear picture of this vital sector. Market values are expressed in Millions.

Crude Oil Carriers Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Crude Oil Carriers industry, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The industry exhibits a moderately concentrated structure, with key players such as Teekay Corporation, China Cosco Shipping Corporation Limited, Euronav NV, and others holding significant market share. Precise market share figures vary depending on the vessel segment, but major players collectively control a substantial portion (estimated at xx%) of the overall market. Innovation is driven primarily by the need for enhanced efficiency, reduced emissions, and improved safety standards. Regulatory frameworks, including those related to environmental protection (IMO 2020, etc.), significantly influence technological advancements and operational strategies. Product substitutes, primarily pipelines and other modes of transportation, exert competitive pressure. M&A activity in the sector has been moderate in recent years, with total deal values estimated at $xx Million between 2019 and 2024. Future M&A activity is projected to increase as companies seek to consolidate market share and access new technologies.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Drivers: Efficiency, emissions reduction, safety enhancements.

- Regulatory Framework: Significant influence from IMO regulations and environmental concerns.

- M&A Activity: Total deal value of approximately $xx Million between 2019-2024.

Crude Oil Carriers Industry Market Dynamics & Trends

The Crude Oil Carriers market is expected to experience significant growth during the forecast period (2025-2033), driven by increasing global crude oil demand and the continued reliance on maritime transportation. The compound annual growth rate (CAGR) is projected to be xx% during this period. Technological disruptions, such as the adoption of digitalization and automation, are streamlining operations and improving efficiency. Consumer preferences (i.e., oil importers and exporters) are heavily influenced by pricing, reliability, and environmental considerations. Competitive dynamics are characterized by ongoing investments in new vessels and strategic alliances. Market penetration of technologically advanced vessels (e.g., those with enhanced fuel efficiency) is steadily increasing, reaching an estimated xx% in 2025. Fluctuations in oil prices and geopolitical events represent major uncertainties that can impact market growth.

Dominant Regions & Segments in Crude Oil Carriers Industry

The Middle East remains a dominant region in the crude oil carriers industry, owing to its substantial crude oil production and exports. Within vessel segments, Very Large Crude Carriers (VLCCs) and Suezmax vessels dominate the market in terms of volume.

Key Drivers for Middle Eastern Dominance:

- Significant Crude Oil Production: High production volumes necessitate extensive maritime transport.

- Strategic Location: Facilitates efficient shipping routes to major global markets.

- Governmental Support: Investments in port infrastructure and related industries.

Segment Analysis:

- VLCCs: Largest vessel type, dominating long-haul crude oil transportation.

- Suezmax: Significant market share due to their suitability for various trade routes.

- Aframax: Moderate market share, primarily serving regional and shorter-haul transportation.

- Panamx: Moderate market share, with specific trade route applications.

- Medium Range: Smaller vessels, catering to niche markets and shorter distances.

- ULCCs: Smaller market share compared to VLCCs and Suezmax, but increasing in specific niche areas.

Further detailed analysis provides a granular view of regional market shares and segment growth projections for each category within the forecast period.

Crude Oil Carriers Industry Product Innovations

Recent innovations in the Crude Oil Carriers industry focus on improving fuel efficiency, reducing environmental impact, and enhancing operational safety. These include the adoption of scrubber technologies to meet stricter emission regulations, the use of advanced hull designs to optimize fuel consumption, and the implementation of digital technologies for improved vessel monitoring and management. These innovations provide competitive advantages by lowering operating costs, reducing environmental footprint, and improving overall efficiency.

Report Scope & Segmentation Analysis

This report segments the Crude Oil Carriers market by vessel size: Medium Range, Panamax, Aframax, Suezmax, Very Large Crude Carriers (VLCCs), and Ultra Large Crude Carriers (ULCCs). Each segment is analyzed based on its market size, growth rate, competitive landscape, and key drivers. The forecast period projects significant growth across all segments, driven by varying factors like demand from specific regions and trading routes. For example, VLCCs are expected to maintain a strong market position due to the long-haul nature of global crude oil trade, while Aframax and Panamax vessels will likely see growth within regional markets.

Key Drivers of Crude Oil Carriers Industry Growth

The growth of the crude oil carriers industry is fueled by several factors: increasing global demand for crude oil, particularly in developing economies; the continued reliance on maritime transport for efficient crude oil delivery; ongoing investments in new vessel construction; and the evolution of shipping routes and logistics networks. Technological advancements, such as improved vessel designs and automation technologies, also contribute to enhanced efficiency and reduced operating costs.

Challenges in the Crude Oil Carriers Industry Sector

The industry faces several challenges, including volatile oil prices that affect demand and investment decisions; fluctuations in freight rates impacting profitability; stringent environmental regulations increasing operational costs; geopolitical instability and trade disputes disrupting shipping routes; and intense competition among carriers, leading to price wars and pressure on margins. These factors collectively impact the industry's long-term growth trajectory.

Emerging Opportunities in Crude Oil Carriers Industry

Emerging opportunities include the growth of liquefied natural gas (LNG) carriers as a cleaner alternative fuel source; the development of autonomous and remotely operated vessels to improve safety and efficiency; and increased demand from emerging markets experiencing rapid economic growth and consequent energy demands. Further, the adoption of digital technologies presents substantial opportunities for enhancing operational efficiencies and reducing costs throughout the value chain.

Leading Players in the Crude Oil Carriers Industry Market

- National Iranian Oil Company (NIOC)

- Minerva Marine Inc

- Teekay Corporation

- China Cosco Shipping Corporation Limited

- Tsakos Energy N/SH

- China Merchants Group Ltd

- Euronav NV

- Petroliam Nasional Berhad (PETRONAS)

- The National Shipping Co Saudi Arabia

- Angelicoussis Shipping Group Ltd

Key Developments in Crude Oil Carriers Industry

- [Month, Year]: [Development description and impact on market dynamics].

- [Month, Year]: [Development description and impact on market dynamics].

- [Month, Year]: [Development description and impact on market dynamics]. (Example: October 2023: Launch of new VLCC with enhanced fuel efficiency by Teekay Corporation, increasing its competitive advantage.)

Future Outlook for Crude Oil Carriers Industry Market

The future outlook for the Crude Oil Carriers industry is positive, driven by the continued growth in global oil demand and the crucial role of maritime transport in the global energy supply chain. However, navigating the challenges of environmental regulations, geopolitical uncertainties, and volatile oil prices will be critical for sustained growth. Strategic investments in fuel-efficient technologies, digitalization, and fleet modernization will be essential for players to maintain a competitive edge in the years to come.

Crude Oil Carriers Industry Segmentation

-

1. Size

- 1.1. Medium Range

- 1.2. Panaxax

- 1.3. Aframax

- 1.4. Suezmax

- 1.5. Very Lar

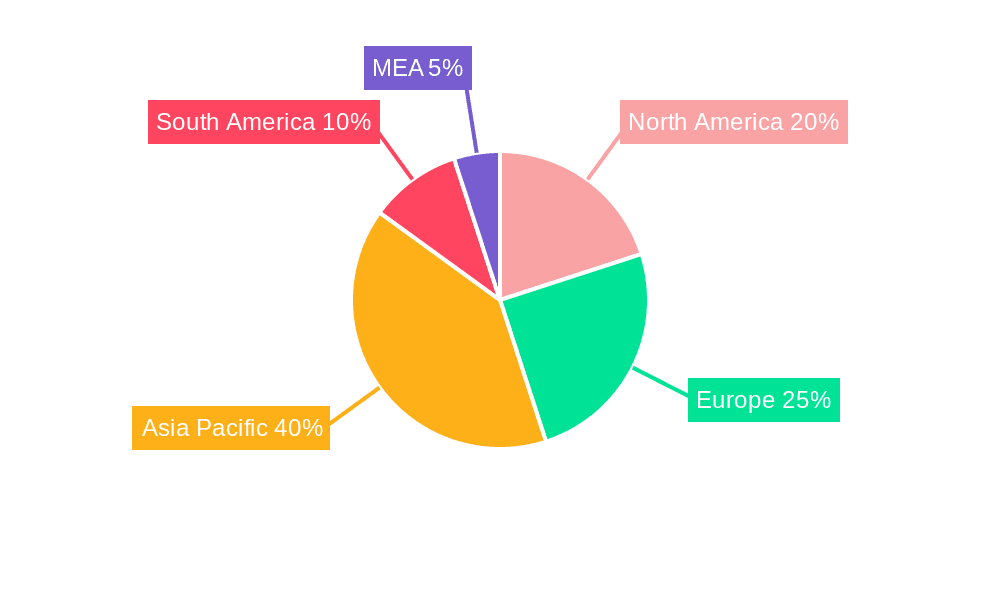

Crude Oil Carriers Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Crude Oil Carriers Industry Regional Market Share

Geographic Coverage of Crude Oil Carriers Industry

Crude Oil Carriers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electricity Demand; Rising Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Very Large Crude Carrier to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Medium Range

- 5.1.2. Panaxax

- 5.1.3. Aframax

- 5.1.4. Suezmax

- 5.1.5. Very Lar

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Medium Range

- 6.1.2. Panaxax

- 6.1.3. Aframax

- 6.1.4. Suezmax

- 6.1.5. Very Lar

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Europe Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Medium Range

- 7.1.2. Panaxax

- 7.1.3. Aframax

- 7.1.4. Suezmax

- 7.1.5. Very Lar

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Asia Pacific Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Medium Range

- 8.1.2. Panaxax

- 8.1.3. Aframax

- 8.1.4. Suezmax

- 8.1.5. Very Lar

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. South America Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Medium Range

- 9.1.2. Panaxax

- 9.1.3. Aframax

- 9.1.4. Suezmax

- 9.1.5. Very Lar

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Middle East Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Medium Range

- 10.1.2. Panaxax

- 10.1.3. Aframax

- 10.1.4. Suezmax

- 10.1.5. Very Lar

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 National Iranian Oil Company (NIOC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Minerva Marine Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teekay Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Cosco Shipping Corporation Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tsakos Energy N/SH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Merchants Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Euronav NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Petroliam Nasional Berhad (PETRONAS)*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The National Shipping Co Saudi Arabia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Angelicoussis Shipping Group Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 National Iranian Oil Company (NIOC)

List of Figures

- Figure 1: Global Crude Oil Carriers Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Crude Oil Carriers Industry Volume Breakdown (metric tonnes, %) by Region 2025 & 2033

- Figure 3: North America Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 4: North America Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 5: North America Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 6: North America Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 7: North America Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 8: North America Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 9: North America Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 12: Europe Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 13: Europe Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 14: Europe Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 15: Europe Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 16: Europe Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 17: Europe Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 20: Asia Pacific Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 21: Asia Pacific Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 22: Asia Pacific Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 23: Asia Pacific Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Asia Pacific Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 25: Asia Pacific Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 28: South America Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 29: South America Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 30: South America Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 31: South America Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 32: South America Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 33: South America Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 36: Middle East Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 37: Middle East Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 38: Middle East Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 39: Middle East Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 40: Middle East Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 41: Middle East Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 2: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 3: Global Crude Oil Carriers Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 5: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 6: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 7: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 9: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 10: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 11: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 13: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 14: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 15: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 17: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 18: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 19: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 20: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 21: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 22: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 23: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crude Oil Carriers Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Crude Oil Carriers Industry?

Key companies in the market include National Iranian Oil Company (NIOC), Minerva Marine Inc, Teekay Corporation, China Cosco Shipping Corporation Limited, Tsakos Energy N/SH, China Merchants Group Ltd, Euronav NV, Petroliam Nasional Berhad (PETRONAS)*List Not Exhaustive, The National Shipping Co Saudi Arabia, Angelicoussis Shipping Group Ltd.

3. What are the main segments of the Crude Oil Carriers Industry?

The market segments include Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 225142.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electricity Demand; Rising Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Very Large Crude Carrier to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crude Oil Carriers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crude Oil Carriers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crude Oil Carriers Industry?

To stay informed about further developments, trends, and reports in the Crude Oil Carriers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence