Key Insights

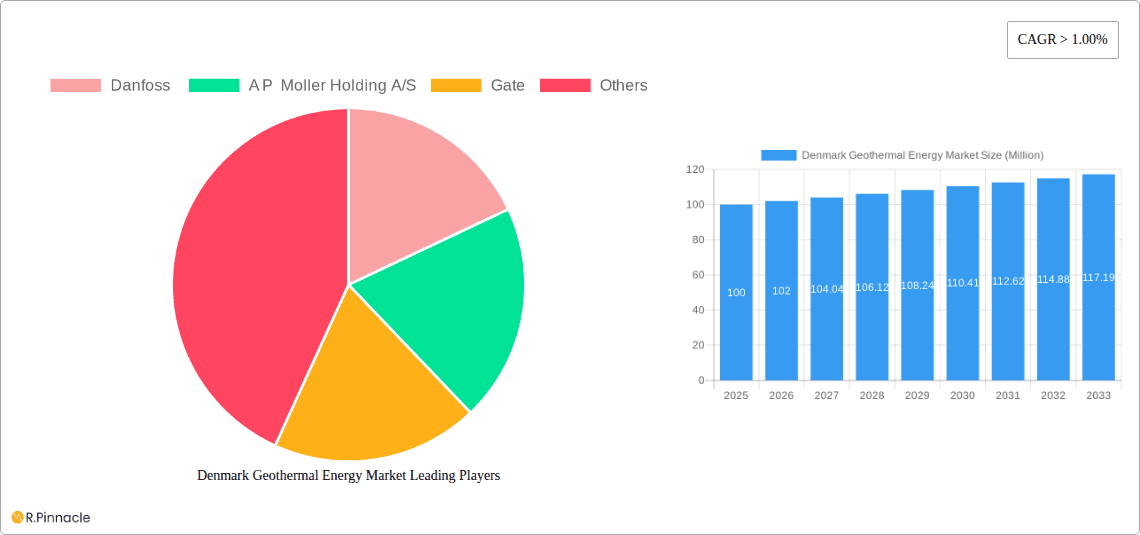

The Danish geothermal energy market is poised for significant expansion, driven by robust government backing for renewable energy and a strong commitment to carbon emission reduction. With a projected Compound Annual Growth Rate (CAGR) of 6.2%, the market is anticipated to grow from its current size to reach 7172 million by 2025. Key growth catalysts include the escalating demand for sustainable energy to support the burgeoning electric vehicle (EV) sector and the critical need for dependable energy storage solutions for intermittent renewables like wind and solar power. Lithium-ion batteries are expected to lead market segmentation due to their superior energy density and ongoing technological advancements. However, initial high investment costs and potential regulatory challenges present ongoing market constraints. Leading market participants are likely to be multinational corporations with established expertise in energy storage and renewable technologies, capitalizing on Denmark's supportive policy environment.

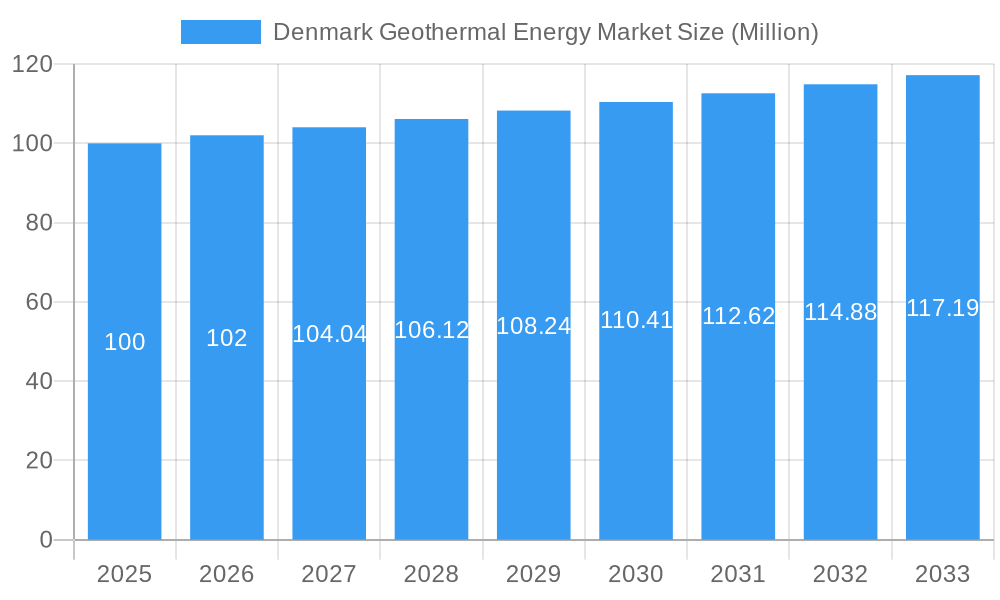

Denmark Geothermal Energy Market Market Size (In Billion)

Significant market growth is forecast within the 2025-2033 period. The presence of established companies such as Danfoss and A.P. Moller Holding A/S indicates a dynamic and collaborative landscape that encourages innovation. The strong emphasis on electric vehicles and energy storage solutions within the end-user segment highlights the market's alignment with Denmark's comprehensive sustainability objectives. The market size is projected to expand considerably, positioning Denmark as a prospective frontrunner in sustainable geothermal energy solutions across the Nordic region and globally.

Denmark Geothermal Energy Market Company Market Share

Denmark Geothermal Energy Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Denmark Geothermal Energy Market, covering the period 2019-2033. It offers in-depth insights into market dynamics, key players, growth drivers, challenges, and future opportunities, making it an invaluable resource for industry professionals, investors, and policymakers. The report leverages rigorous data analysis and market research to provide actionable intelligence. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024.

Denmark Geothermal Energy Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Danish geothermal energy market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a moderate level of concentration, with key players including Danfoss, A.P. Moller Holding A/S, and Gate holding significant market shares. Precise market share data is unavailable at this time and will be provided in the full report, along with an assessment of recent M&A activity and deal values (estimated at xx Million).

- Market Concentration: Moderate, with a few dominant players. Details on market share percentages will be included in the full report.

- Innovation Drivers: Government incentives for renewable energy, technological advancements in geothermal drilling and energy extraction, and growing awareness of climate change are driving innovation.

- Regulatory Framework: The Danish government's supportive policies towards renewable energy sources, including geothermal, play a crucial role in shaping market dynamics. Specific details about regulatory frameworks and their impact will be in the full report.

- Product Substitutes: Competition comes primarily from other renewable energy sources such as wind and solar power. The report will delve into a comparative analysis of these substitute sources.

- End-User Demographics: The primary end-users include district heating systems, industrial facilities, and potentially, in the future, direct-use applications in homes and businesses. The full report will include a detailed breakdown of end-user segments.

- M&A Activities: While precise figures are currently unavailable, the report will analyze recent mergers and acquisitions and their impact on market consolidation and competitive dynamics.

Denmark Geothermal Energy Market Dynamics & Trends

This section explores the key factors influencing the growth and development of the Danish geothermal energy market. The market is projected to experience substantial growth over the forecast period, driven by factors such as increasing energy demand, government support for renewable energy, and falling costs of geothermal technology. The report will provide a detailed analysis of these factors, including specific CAGR and market penetration metrics.

The market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by supportive government policies and technological improvements in geothermal energy production. Market penetration is currently estimated at xx% and is expected to increase substantially due to several influencing factors like increasing energy demand, climate change concerns and the decreasing cost of technology.

Dominant Regions & Segments in Denmark Geothermal Energy Market

The report will identify the leading regions and segments within the Danish geothermal energy market. While precise regional dominance is not available at this time and needs further analysis, the report will include this information.

Leading Regions: Analysis will highlight specific regions within Denmark exhibiting the highest growth potential based on factors like geothermal resource availability, existing infrastructure and government policies.

Dominant Segments: The report will identify the dominant segments across various parameters:

Battery Type and Electrolyte Type: The report will analyze the market share of different battery types, including Lead Acid, Lithium-ion, Flow Battery (Zinc Bromide), and other types. Detailed market size and growth projection will be provided for each segment.

End User: The report will analyze the market size and growth of each end-user segment including Electric Vehicle, Energy Storage, Consumer Electronics, and Other End Users. Factors such as government regulations, technological advancements, and cost considerations will be factored into this segment analysis.

Denmark Geothermal Energy Market Product Innovations

The Danish geothermal energy market is witnessing significant product innovations, particularly in drilling technologies, heat extraction methods, and energy storage solutions. These innovations are enhancing efficiency, reducing costs, and expanding the applications of geothermal energy. The full report will detail these advancements and provide a comprehensive overview of their competitive advantages and market fit.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Denmark Geothermal Energy Market across Battery Type and Electrolyte Type (Lead Acid, Gel Electrolyte, Lithium-ion, Liquid Electrolyte, Zinc Bromide, and Other Battery Types and Electrolyte Types), and End User (Electric Vehicle, Energy Storage, Consumer Electronics, and Other End Users). Each segment will be analyzed individually, with detailed assessments of market size, growth projections, and competitive dynamics.

Key Drivers of Denmark Geothermal Energy Market Growth

The growth of the Denmark Geothermal Energy Market is driven by a combination of factors, including supportive government policies promoting renewable energy, rising energy demand, advancements in geothermal technologies leading to cost reductions and increased efficiency, and a growing awareness of the need for sustainable energy solutions. The report will delve into each of these drivers with specific examples.

Challenges in the Denmark Geothermal Energy Market Sector

Despite its growth potential, the Denmark Geothermal Energy Market faces challenges such as high upfront investment costs associated with geothermal plant development, potential environmental impacts related to geothermal exploration and exploitation, and the need for advanced technical expertise for both installation and maintenance of geothermal systems. The report will explore these challenges along with their quantitative impacts.

Emerging Opportunities in Denmark Geothermal Energy Market

The Denmark Geothermal Energy Market presents several exciting opportunities, including the integration of geothermal energy into district heating systems to decarbonize urban heat supply, the potential use of geothermal energy for industrial processes and applications, and advancements in geothermal energy storage, allowing for efficient energy management. The report will highlight these opportunities and their potential impact.

Leading Players in the Denmark Geothermal Energy Market Market

- Danfoss

- A.P. Moller Holding A/S

- Gate

Key Developments in Denmark Geothermal Energy Market Industry

- December 2022: Innargi and Fors agree to investigate geothermal heating in Holbaek, aiming for delivery by the end of 2026. This signifies growing interest in utilizing geothermal energy for district heating.

- January 2022: ATP plans to invest in what could become the EU's largest geothermal plant in Aarhus, developed by a subsidiary of AP Moller. This highlights substantial investment potential and market confidence.

Future Outlook for Denmark Geothermal Energy Market Market

The future of the Denmark Geothermal Energy Market looks promising. Continued government support, technological advancements, and growing environmental awareness will drive market expansion, creating significant opportunities for investors and industry players alike. The report will provide detailed projections of market growth and identify key strategic opportunities.

Denmark Geothermal Energy Market Segmentation

-

1. Type

- 1.1. Deep Geothermal Systems

- 1.2. Shallow Geothermal Systems

-

2. Application

- 2.1. Electricity Generation

- 2.2. Direct Heating

- 2.3. Heat Pumps

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Denmark Geothermal Energy Market Segmentation By Geography

- 1. Denmark

Denmark Geothermal Energy Market Regional Market Share

Geographic Coverage of Denmark Geothermal Energy Market

Denmark Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Geothermal energy is increasingly integrated into Denmark's district heating systems

- 3.2.2 providing a sustainable and efficient heating solution. The development of 5th generation district heating and cooling grids based on borehole heat exchangers and aquifers is a notable trend

- 3.2.3 enhancing the attractiveness of shallow geothermal resources.

- 3.3. Market Restrains

- 3.3.1 The upfront capital required for geothermal energy projects

- 3.3.2 including exploration

- 3.3.3 drilling

- 3.3.4 and plant construction

- 3.3.5 can be substantial. This financial barrier may deter potential investors and slow the adoption of geothermal energy

- 3.4. Market Trends

- 3.4.1 Denmark is leveraging its existing district heating infrastructure to incorporate geothermal energy. This integration allows for efficient heat distribution and reduces reliance on fossil fuels

- 3.4.2 aligning with the country's sustainability objectives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Geothermal Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Deep Geothermal Systems

- 5.1.2. Shallow Geothermal Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electricity Generation

- 5.2.2. Direct Heating

- 5.2.3. Heat Pumps

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Danfoss

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 A P Moller Holding A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gate

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.1 Danfoss

List of Figures

- Figure 1: Denmark Geothermal Energy Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Denmark Geothermal Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark Geothermal Energy Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Denmark Geothermal Energy Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Denmark Geothermal Energy Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Denmark Geothermal Energy Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Denmark Geothermal Energy Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Denmark Geothermal Energy Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Denmark Geothermal Energy Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Denmark Geothermal Energy Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Geothermal Energy Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Denmark Geothermal Energy Market?

Key companies in the market include Danfoss , A P Moller Holding A/S, Gate.

3. What are the main segments of the Denmark Geothermal Energy Market?

The market segments include Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7172 million as of 2022.

5. What are some drivers contributing to market growth?

Geothermal energy is increasingly integrated into Denmark's district heating systems. providing a sustainable and efficient heating solution. The development of 5th generation district heating and cooling grids based on borehole heat exchangers and aquifers is a notable trend. enhancing the attractiveness of shallow geothermal resources..

6. What are the notable trends driving market growth?

Denmark is leveraging its existing district heating infrastructure to incorporate geothermal energy. This integration allows for efficient heat distribution and reduces reliance on fossil fuels. aligning with the country's sustainability objectives.

7. Are there any restraints impacting market growth?

The upfront capital required for geothermal energy projects. including exploration. drilling. and plant construction. can be substantial. This financial barrier may deter potential investors and slow the adoption of geothermal energy.

8. Can you provide examples of recent developments in the market?

December 2022: The Danish geothermal developer Innargi has entered into an agreement with Fors to investigate the possibility of geothermal heating in the Danish city of Holbaek. Innargi has indicated that the geothermal heat will be delivered in conjunction with the expansion of the district heating network in Holbaek by the end of 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Denmark Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence