Key Insights

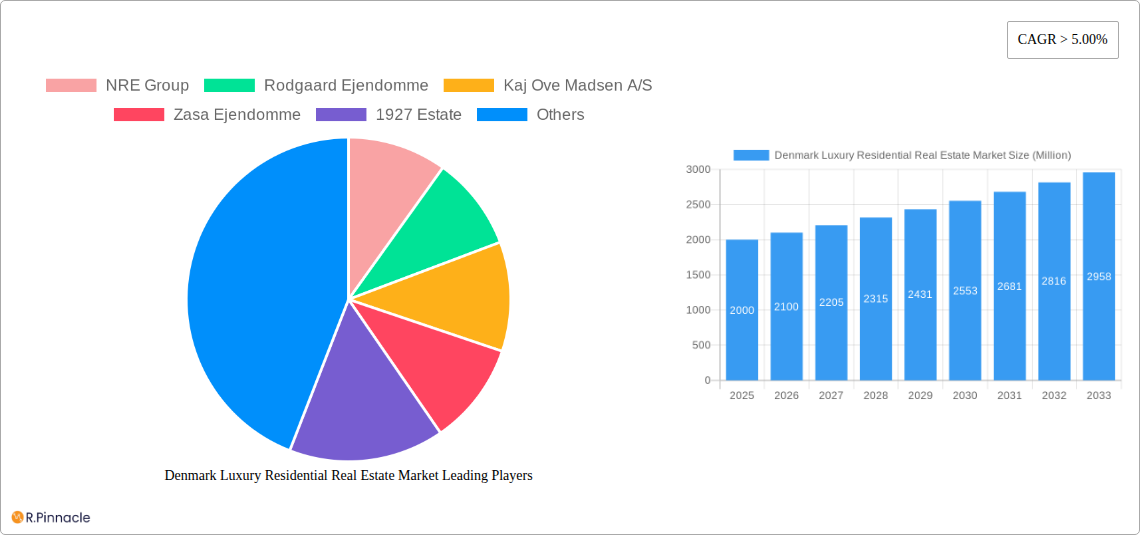

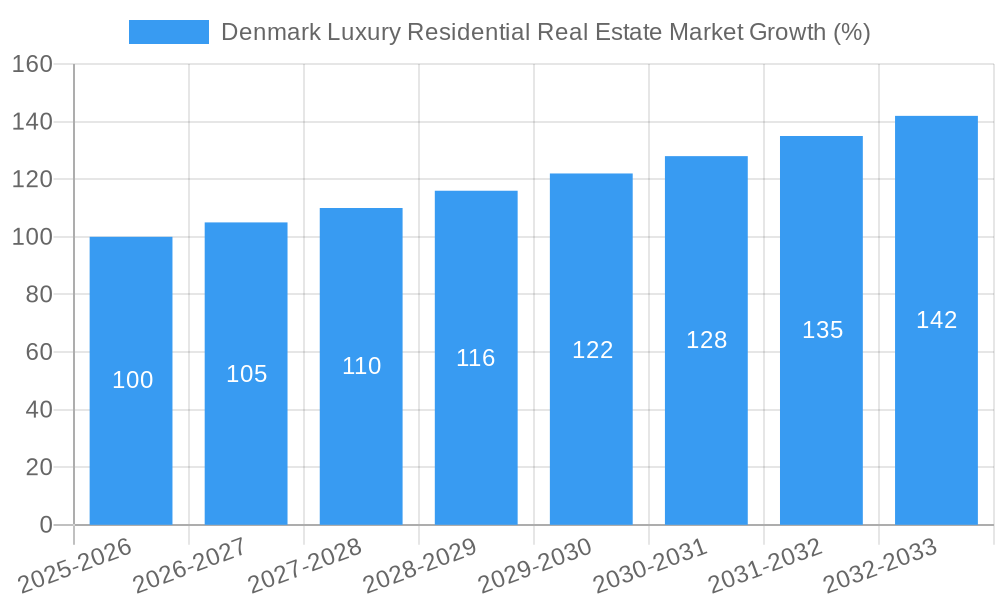

The Denmark luxury residential real estate market, currently valued at an estimated €2 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, a rising high-net-worth individual (HNWI) population in Denmark, coupled with increasing disposable incomes, fuels demand for premium properties. Secondly, Denmark's strong economy and stable political environment create a secure investment climate, attracting both domestic and international buyers. Finally, a limited supply of luxury properties, particularly in prime locations like Copenhagen and coastal areas, contributes to upward price pressure. The market is segmented primarily into villas/landed houses and condominiums/apartments, with villas commanding higher prices due to their exclusivity and larger land plots. Key players such as NRE Group, Rodgaard Ejendomme, and Kaj Ove Madsen A/S dominate the market, showcasing sophisticated developments and leveraging their established brand recognition. However, challenges remain, including potential interest rate hikes which could impact affordability and potentially dampen demand. Furthermore, stringent building regulations and environmental concerns might influence future development and construction timelines.

The forecast for the Danish luxury residential market remains positive, with continued growth expected throughout the forecast period. However, the market's trajectory will be influenced by macroeconomic factors, including global economic stability and fluctuations in the Danish Krone. The continued appeal of Denmark as a desirable location for luxury living, combined with ongoing investment in infrastructure and urban development in key cities, suggests a resilient and expanding market. Nevertheless, developers and investors should carefully consider potential headwinds, such as regulatory changes and the availability of skilled labor in the construction sector. Strategic land acquisition and a focus on sustainable and environmentally friendly construction practices will be crucial for success in this competitive yet promising market.

Denmark Luxury Residential Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Denmark luxury residential real estate market, covering the period 2019-2033, with a focus on 2025. It offers actionable insights for industry professionals, investors, and stakeholders seeking to navigate this dynamic market. The report utilizes robust data and analysis to uncover key trends, challenges, and opportunities within the luxury residential sector. Discover detailed market segmentation by type (Villas/Landed Houses and Condominiums/Apartments), regional dominance analysis, and profiles of leading players such as NRE Group, Rodgaard Ejendomme, and others. This report is essential for strategic decision-making and informed investment strategies in the Danish luxury real estate market.

Denmark Luxury Residential Real Estate Market Structure & Innovation Trends

The Danish luxury residential real estate market exhibits a moderately concentrated structure, with several key players commanding significant market share. While precise market share figures for individual companies are proprietary and unavailable publicly, NRE Group, Rodgaard Ejendomme, and Kaj Ove Madsen A/S are recognized as prominent players. The market is driven by innovations in sustainable building materials, smart home technology integration, and architectural designs that cater to high-end preferences. Regulatory frameworks, particularly those concerning building codes and environmental regulations, significantly influence the market. Product substitutes, such as high-end rentals or luxury developments outside of Copenhagen, represent a level of competition. The end-user demographics are predominantly high-net-worth individuals, both domestic and international, seeking exclusive properties. M&A activity has seen significant deal values in recent years, with the purchase of large portfolios of residential units as evidenced by Orange Capital Partners' acquisition in June 2022.

- Market Concentration: Moderately concentrated, with a few major players holding substantial shares (precise figures unavailable).

- Innovation Drivers: Sustainable building materials, smart home technologies, unique architectural designs.

- Regulatory Frameworks: Building codes, environmental regulations, and zoning laws.

- Product Substitutes: High-end rental properties, luxury developments in neighboring countries.

- End-User Demographics: High-net-worth individuals (domestic and international).

- M&A Activity: Significant deals, with values estimated in the hundreds of Millions (e.g., Orange Capital Partners' acquisition of a 110,000 sqm portfolio for an undisclosed sum in 2022).

Denmark Luxury Residential Real Estate Market Dynamics & Trends

The Danish luxury residential real estate market displays strong growth drivers, despite experiencing fluctuations in response to global economic conditions and interest rate changes. The CAGR (Compound Annual Growth Rate) for the period 2019-2024 is estimated to be xx%, with a projected CAGR of xx% for the forecast period (2025-2033). Market penetration of smart home technologies and sustainable building practices is steadily increasing, driven by consumer preference for eco-friendly and technologically advanced living spaces. The competitive dynamics are shaped by both established players and new entrants targeting specific niche markets within the luxury segment. Technological disruptions, such as virtual property tours and online platforms specializing in luxury real estate, are transforming the way properties are marketed and sold. The luxury sector shows remarkable resilience even during economic downturns, due to the inelastic nature of demand from its target clientele.

Dominant Regions & Segments in Denmark Luxury Residential Real Estate Market

Copenhagen maintains its position as the dominant region for luxury residential real estate in Denmark. Its strong economy, established infrastructure, and cultural attractions draw significant demand. Aarhus also presents a notable market, benefiting from its growing economy and expanding urban landscape.

By Type:

Villas/Landed Houses: This segment enjoys high demand, driven by exclusivity and the preference for larger properties and privacy. The market size for villas and landed houses in 2025 is estimated at xx Million.

Condominiums/Apartments: This segment attracts buyers seeking more convenient and centrally located luxury options. The market size for condominiums/apartments in 2025 is estimated at xx Million.

Key Drivers for Copenhagen's Dominance:

- Strong economic performance.

- Well-developed infrastructure (transportation, utilities).

- High concentration of high-net-worth individuals.

- Extensive cultural and recreational amenities.

Denmark Luxury Residential Real Estate Market Product Innovations

The market showcases ongoing innovations in design, technology, and sustainability. Smart home integration, energy-efficient building materials, and architectural features focusing on natural light and open spaces are prominent trends. These innovations not only enhance the luxury appeal but also improve the environmental footprint of these properties, aligning with growing consumer preferences. This competitive edge attracts discerning buyers and enhances overall market value.

Report Scope & Segmentation Analysis

This report segments the Denmark luxury residential real estate market by property type: Villas/Landed Houses and Condominiums/Apartments.

Villas/Landed Houses: This segment is projected to experience steady growth driven by continuous demand for exclusive, spacious properties. The market size for 2025 is estimated at xx Million, with a projected growth of xx% during 2025-2033. Competitive dynamics are shaped by a blend of established developers and bespoke architectural firms.

Condominiums/Apartments: This segment demonstrates strong growth potential, particularly in prime urban locations within Copenhagen and Aarhus. The 2025 market size is estimated at xx Million, showing a projected growth of xx% during the 2025-2033 period. The competitive landscape is characterized by both large developers and boutique firms specializing in luxury apartments.

Key Drivers of Denmark Luxury Residential Real Estate Market Growth

Several key factors contribute to the growth of the Danish luxury residential real estate market. Firstly, a robust economy and a stable political climate provide a secure investment environment. Secondly, the growing number of high-net-worth individuals, both domestic and international, fuels the demand for luxury properties. Finally, continuous innovation in design, technology, and sustainability enhances the appeal and value of luxury homes. The increasing preference for sustainable and energy-efficient living further contributes to growth.

Challenges in the Denmark Luxury Residential Real Estate Market Sector

The market faces challenges such as stringent building regulations which can increase development costs and timelines. Supply chain disruptions, particularly in the sourcing of premium building materials, can lead to delays and increased prices. Finally, intense competition among developers necessitates offering unique features and high-quality construction to attract discerning buyers. These factors can influence profitability and market share.

Emerging Opportunities in Denmark Luxury Residential Real Estate Market

Emerging opportunities exist in incorporating sustainable and energy-efficient technologies into luxury developments to cater to growing environmentally conscious buyers. Furthermore, the integration of smart home automation systems offers a competitive advantage and a chance to tap into the growing demand for convenience and technologically advanced living. Expanding into secondary markets outside Copenhagen while maintaining luxury standards represents another significant opportunity for market expansion.

Leading Players in the Denmark Luxury Residential Real Estate Market Market

- NRE Group

- Rodgaard Ejendomme

- Kaj Ove Madsen A/S

- Zasa Ejendomme

- 1927 Estate

- Krobi

- Juvel Ejendomme

- Bruce Turner

- Fink Ejendomme

- Unika Ejendomme ApS

Key Developments in Denmark Luxury Residential Real Estate Market Industry

November 2022: AkademikerPension's expansion of its real estate allocation, with a planned shift towards 50% residential properties by 2026, signifies a major investment in the residential sector, particularly in Copenhagen and Aarhus, boosting the market.

June 2022: Orange Capital Partners' acquisition of a significant residential portfolio (1,220 apartments) from NREP highlights the considerable investor interest and capital inflow into the Danish luxury residential market. This points toward consolidation and further investment activity.

Future Outlook for Denmark Luxury Residential Real Estate Market Market

The future outlook for the Danish luxury residential real estate market remains positive, driven by continued economic growth, increased high-net-worth individuals, and persistent demand for exclusive properties. Strategic opportunities lie in the adoption of cutting-edge technologies, prioritizing sustainability, and identifying niche markets for specialized luxury developments. The sector is poised for continued growth with increasing focus on innovation and tailored customer experiences.

Denmark Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

-

2. Geography

- 2.1. Copenhagen

- 2.2. Aarhus

- 2.3. Odense

- 2.4. Aalborg

- 2.5. Rest of Denmark

Denmark Luxury Residential Real Estate Market Segmentation By Geography

- 1. Copenhagen

- 2. Aarhus

- 3. Odense

- 4. Aalborg

- 5. Rest of Denmark

Denmark Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance

- 3.3. Market Restrains

- 3.3.1. 4.; Rising cost of construction materials.

- 3.4. Market Trends

- 3.4.1. Increasing demand for luxury residences driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Copenhagen

- 5.2.2. Aarhus

- 5.2.3. Odense

- 5.2.4. Aalborg

- 5.2.5. Rest of Denmark

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Copenhagen

- 5.3.2. Aarhus

- 5.3.3. Odense

- 5.3.4. Aalborg

- 5.3.5. Rest of Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Copenhagen Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas/Landed Houses

- 6.1.2. Condominiums/Apartments

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Copenhagen

- 6.2.2. Aarhus

- 6.2.3. Odense

- 6.2.4. Aalborg

- 6.2.5. Rest of Denmark

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Aarhus Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas/Landed Houses

- 7.1.2. Condominiums/Apartments

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Copenhagen

- 7.2.2. Aarhus

- 7.2.3. Odense

- 7.2.4. Aalborg

- 7.2.5. Rest of Denmark

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Odense Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas/Landed Houses

- 8.1.2. Condominiums/Apartments

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Copenhagen

- 8.2.2. Aarhus

- 8.2.3. Odense

- 8.2.4. Aalborg

- 8.2.5. Rest of Denmark

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Aalborg Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas/Landed Houses

- 9.1.2. Condominiums/Apartments

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Copenhagen

- 9.2.2. Aarhus

- 9.2.3. Odense

- 9.2.4. Aalborg

- 9.2.5. Rest of Denmark

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Denmark Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas/Landed Houses

- 10.1.2. Condominiums/Apartments

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Copenhagen

- 10.2.2. Aarhus

- 10.2.3. Odense

- 10.2.4. Aalborg

- 10.2.5. Rest of Denmark

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NRE Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rodgaard Ejendomme

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kaj Ove Madsen A/S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zasa Ejendomme

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 1927 Estate

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Krobi**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Juvel Ejendomme

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bruce Turner

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fink Ejendomme

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unika Ejendomme ApS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NRE Group

List of Figures

- Figure 1: Denmark Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Luxury Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Luxury Residential Real Estate Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Denmark Luxury Residential Real Estate Market?

Key companies in the market include NRE Group, Rodgaard Ejendomme, Kaj Ove Madsen A/S, Zasa Ejendomme, 1927 Estate, Krobi**List Not Exhaustive, Juvel Ejendomme, Bruce Turner, Fink Ejendomme, Unika Ejendomme ApS.

3. What are the main segments of the Denmark Luxury Residential Real Estate Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance.

6. What are the notable trends driving market growth?

Increasing demand for luxury residences driving the market.

7. Are there any restraints impacting market growth?

4.; Rising cost of construction materials..

8. Can you provide examples of recent developments in the market?

November 2022: The AkademikerPension expands real estate allocation. Whereas the portfolio currently consists primarily of offices in Copenhagen, the distribution in 2026 should be 50% residential, 30% offices, and various construction projects. Most investments will be made in Copenhagen and Aarhus, but approximately 25% of the real estate investments will be made in smaller Danish cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Denmark Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence