Key Insights

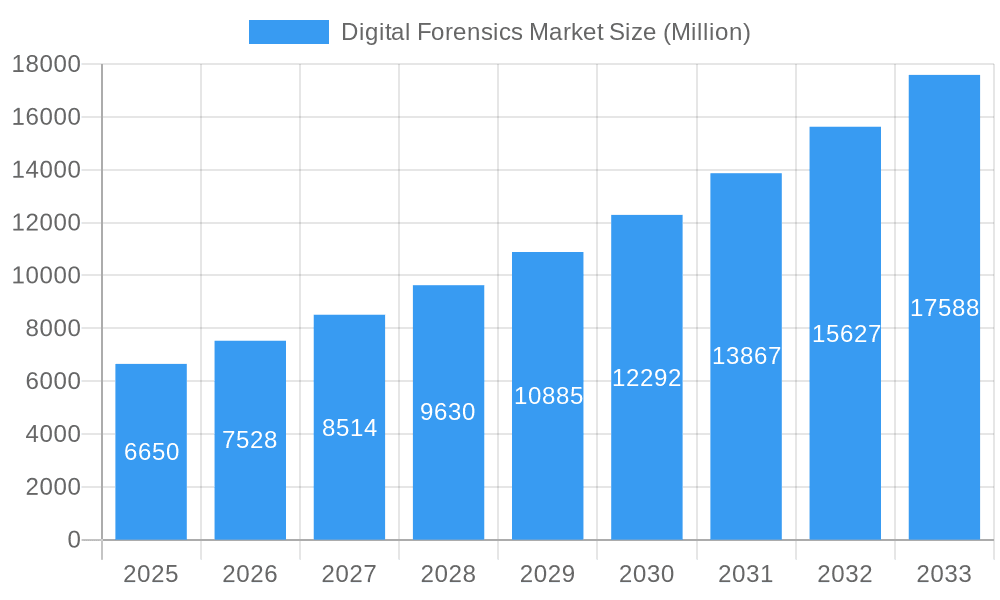

The global Digital Forensics Market is poised for substantial expansion, projected to reach an impressive market size of USD 6.65 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 12.92%, indicating a dynamic and rapidly evolving sector. The increasing sophistication and pervasiveness of cyber threats across all industries necessitate advanced digital forensics solutions for investigation, evidence collection, and legal proceedings. Government and law enforcement agencies remain the primary consumers, driven by the escalating need to combat cybercrime, terrorism, and other digital offenses. The IT and Telecom sector, along with the BFSI (Banking, Financial Services, and Insurance) industry, are also significant contributors, facing persistent threats like data breaches, fraud, and intellectual property theft.

Digital Forensics Market Market Size (In Billion)

The market's expansion is fueled by several key drivers, including the escalating volume of digital data, the growing complexity of cyberattacks, and stringent regulatory compliance demands. Technological advancements, such as the integration of AI and machine learning in forensic tools, are enhancing analytical capabilities and speeding up investigation processes. Furthermore, the rise of cloud computing and the Internet of Things (IoT) presents new avenues for digital forensic analysis. However, the market also faces restraints, including a shortage of skilled digital forensics professionals, high implementation costs of advanced tools, and evolving legal frameworks that sometimes lag behind technological advancements. The market segmentation reveals a strong emphasis on software and services, reflecting the growing demand for sophisticated analytical platforms and expert support, alongside the foundational hardware components.

Digital Forensics Market Company Market Share

Unlock Critical Insights: Comprehensive Digital Forensics Market Report (2019-2033)

Gain a definitive understanding of the rapidly evolving Digital Forensics Market with this in-depth, SEO-optimized report. Covering the historical period of 2019-2024, base year 2025, and a robust forecast period of 2025-2033, this report provides actionable intelligence for industry professionals. Leverage high-ranking keywords for superior search visibility and make informed strategic decisions. This report is ready for immediate use with no modifications required.

Digital Forensics Market Market Structure & Innovation Trends

The Digital Forensics Market is characterized by a dynamic structure, with ongoing innovation driving its growth. Market concentration is moderate, with several key players vying for dominance, but the landscape is also dotted with specialized service providers. Innovation is heavily fueled by advancements in artificial intelligence (AI), machine learning (ML), and cloud computing, enabling more sophisticated data analysis and faster evidence acquisition. Regulatory frameworks, while sometimes posing compliance challenges, also create demand for specialized forensic solutions. Product substitutes are emerging, particularly in the realm of AI-driven threat intelligence platforms that offer some overlapping functionalities. End-user demographics are expanding beyond traditional law enforcement to include a growing number of BFSI and IT sectors grappling with sophisticated cyber threats. Mergers and acquisitions (M&A) are a significant feature, with larger entities acquiring innovative startups to bolster their portfolios. For instance, recent M&A activities indicate a trend towards consolidating expertise in areas like cloud forensics and advanced data recovery, with reported deal values in the tens of millions. Key players are continuously investing in R&D to stay ahead of evolving cyberattack methodologies and data complexities.

- Innovation Drivers: AI/ML integration, cloud forensics, IoT device analysis, blockchain forensics.

- Regulatory Influence: Growing compliance requirements in data privacy and evidence handling, driving demand for compliant solutions.

- Market Concentration: Moderate, with a mix of large enterprises and niche players.

- M&A Activity: Strategic acquisitions aimed at enhancing technological capabilities and market reach.

Digital Forensics Market Market Dynamics & Trends

The Digital Forensics Market is experiencing robust growth, propelled by an escalating volume of cybercrime and data breaches across all sectors. The Compound Annual Growth Rate (CAGR) is projected to be strong, estimated at xx%, driven by the increasing digitalization of our world and the subsequent explosion of digital data that requires meticulous examination. Technological disruptions are at the forefront, with advancements in AI and automation revolutionizing how digital evidence is collected, analyzed, and presented. Consumers, including enterprise clients and government agencies, are increasingly demanding faster, more accurate, and cost-effective forensic solutions to combat sophisticated cyber threats, including ransomware, data exfiltration, and nation-state attacks. Competitive dynamics are intensifying, with established players like FireEye Inc. and IBM Corporation investing heavily in R&D and strategic partnerships to maintain their market share. Emerging players are focusing on specialized niches, such as mobile forensics or cloud forensics, to carve out their own space. The growing adoption of cloud-based services and the Internet of Things (IoT) devices creates new frontiers for digital forensics, demanding innovative tools and techniques for data acquisition and analysis from a vast array of interconnected devices. The sheer volume and complexity of data generated by these sources necessitate advanced analytical capabilities, pushing the boundaries of traditional forensic methodologies. Furthermore, the increasing awareness of data privacy regulations and the potential for severe financial and reputational damage from breaches are compelling organizations to invest proactively in digital forensics services and solutions. This proactive approach, rather than a reactive one, is becoming a significant trend, leading to higher market penetration for advanced forensic tools and services. The need for skilled forensic analysts who can navigate these complex technological landscapes and legal frameworks is also a growing concern, driving demand for training and certification programs.

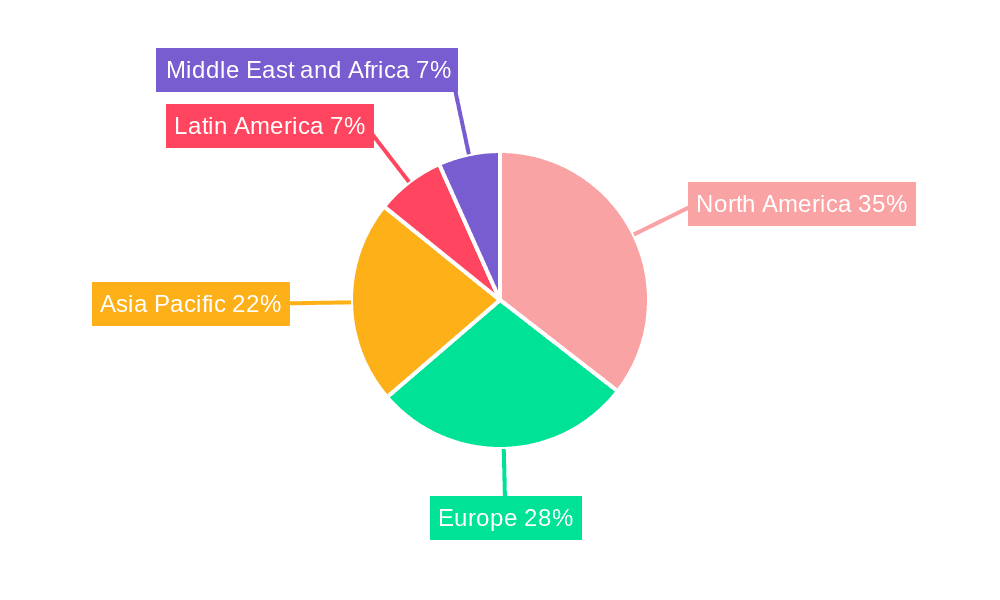

Dominant Regions & Segments in Digital Forensics Market

The Digital Forensics Market is experiencing significant dominance in the North America region, largely driven by the United States' robust technological infrastructure, substantial investment in cybersecurity, and a proactive stance by government and law enforcement agencies in combating cybercrime.

- Leading Region: North America, with the United States at its forefront.

- Key Drivers: High incidence of cyberattacks, strong government funding for cybersecurity and forensic capabilities, established market for advanced technology solutions, stringent data protection regulations.

- Economic Policies: Favorable investment climate for technology and cybersecurity firms.

- Infrastructure: Advanced technological infrastructure supporting the development and deployment of digital forensics tools.

The Government and Law Enforcement Agencies end-user vertical stands out as a primary driver of market growth. This segment's critical need for digital forensics spans criminal investigations, national security, and counter-terrorism efforts, leading to consistent demand for sophisticated solutions.

- Dominant End-user Vertical: Government and Law Enforcement Agencies.

- Key Drivers: Escalating threats to national security, need for evidence in criminal prosecutions, increasing adoption of digital investigation tools, substantial government budgets allocated to defense and law enforcement.

- Specific Applications: Digital evidence collection from various devices, network intrusion analysis, cybercrime investigation, digital reconstruction of events.

Within the Component segmentation, Software is a dominant segment. This is attributable to the increasing complexity of digital data and the need for advanced analytical tools. Software solutions offer scalability, flexibility, and the ability to process vast amounts of data, making them indispensable for modern forensic investigations.

- Dominant Component: Software.

- Key Drivers: Sophistication of cyber threats requiring advanced analytical algorithms, demand for automation in evidence processing, development of specialized forensic software for various data types (e.g., mobile, cloud, IoT), cloud-based forensic software solutions offering accessibility and scalability.

In terms of Type, Mobile Forensics is a rapidly growing and crucial segment. The ubiquity of smartphones and other mobile devices as sources of critical digital evidence makes this area indispensable for investigations across law enforcement, corporate security, and civil litigation.

- Dominant Type: Mobile Forensics.

- Key Drivers: Proliferation of mobile devices and their extensive use in daily life, generation of vast amounts of sensitive data on mobile devices, need to extract data from locked or damaged devices, evolution of mobile operating systems and applications creating new forensic challenges.

Digital Forensics Market Product Innovations

Product innovations in the digital forensics market are sharply focused on enhancing speed, accuracy, and automation. Key developments include AI-powered analytics for faster identification of malicious activity, advanced mobile forensic tools capable of extracting data from the latest operating systems and encrypted devices, and cloud-based forensic platforms that streamline evidence collection and analysis from distributed environments. These innovations provide a significant competitive advantage by enabling forensic analysts to conduct investigations more efficiently and comprehensively, reducing investigation times and improving the quality of evidence presented.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Digital Forensics Market across several key segments. The Component segmentation includes Hardware, Software, and Service, each playing a vital role in the forensic ecosystem. The Type segmentation covers Mobile Forensics, Computer Forensics, Network Forensics, and Other Types, reflecting the diverse nature of digital evidence. Furthermore, the End-user Vertical segmentation explores Government and Law Enforcement Agencies, BFSI, IT and Telecom, and Other End-user Verticals, highlighting where demand is most concentrated and growing. Growth projections and competitive dynamics are detailed for each segment.

Key Drivers of Digital Forensics Market Growth

The Digital Forensics Market is propelled by several critical growth drivers. The relentless increase in cybercrime and data breaches across all sectors necessitates advanced forensic capabilities for investigation and recovery. Technological advancements, particularly in AI and machine learning, are enabling more sophisticated and efficient data analysis. Evolving regulatory landscapes, such as GDPR and CCPA, mandate robust data protection and incident response mechanisms, driving demand for forensic solutions. The proliferation of IoT devices and cloud computing environments creates new attack vectors and data sources that require specialized forensic expertise.

- Increasing Cyber Threats: Sophisticated and frequent cyberattacks.

- Technological Advancements: AI, ML, and automation in forensic tools.

- Regulatory Compliance: Data privacy laws and incident reporting requirements.

- Expanding Digital Footprint: IoT and cloud adoption creating new evidence sources.

Challenges in the Digital Forensics Market Sector

Despite robust growth, the Digital Forensics Market faces several challenges. The rapidly evolving nature of technology means that forensic tools and techniques can quickly become outdated, requiring continuous R&D investment. The scarcity of skilled digital forensic analysts, coupled with the complexity of legal and ethical considerations surrounding digital evidence, poses a significant barrier. High implementation costs for advanced forensic solutions can deter smaller organizations. Furthermore, cross-border data transfer regulations and privacy laws can complicate international investigations.

- Talent Shortage: Difficulty in finding and retaining skilled forensic professionals.

- Technological Obsolescence: Rapid advancements requiring constant tool updates.

- High Implementation Costs: Expense of advanced hardware and software.

- Regulatory Complexity: Navigating diverse international data privacy laws.

Emerging Opportunities in Digital Forensics Market

Emerging opportunities in the Digital Forensics Market are abundant, driven by new technological frontiers and evolving threat landscapes. The growth of the Internet of Things (IoT) presents a vast, largely untapped area for forensic investigation, requiring specialized tools to handle the diverse and often proprietary data formats of connected devices. Cloud forensics is another significant growth area as more organizations migrate their data and operations to the cloud, necessitating expertise in extracting and analyzing evidence from cloud storage and services. The increasing use of AI and ML in cyberattacks also drives demand for AI-powered forensic tools that can detect sophisticated threats and analyze large datasets more effectively. Furthermore, the growing focus on insider threats and corporate espionage is creating opportunities for advanced forensic solutions in corporate security and risk management.

- IoT Forensics: Investigating data from an expanding ecosystem of connected devices.

- Cloud Forensics: Analyzing evidence from cloud platforms and services.

- AI-Driven Forensics: Utilizing AI for faster and more accurate threat detection.

- Insider Threat Analysis: Developing solutions for internal corporate investigations.

Leading Players in the Digital Forensics Market Market

- FireEye Inc

- IBM Corporation

- MSAB Inc

- Cisco Systems Inc

- Oxygen Forensics Inc

- AccessData Group LLC

- LogRhythm Inc

- Guidance Software Inc (Opentext)

- Paraben Corporation

- Binary Intelligence LLC

- KLDiscovery Inc

Key Developments in Digital Forensics Market Industry

- September 2023: SentinelOne launched Singularity RemoteOps Forensics, a new solution designed for incident response and evidence acquisition, integrating forensic evidence with immediate telemetry for comprehensive security incident insights.

- September 2023: Reveal, a leader in AI-powered eDiscovery, partnered with CBIT Digital Forensics Services (CDFS) to offer enhanced eDiscovery solutions to legal and corporate clients globally, leveraging Reveal’s AI platform to streamline eDiscovery and provide advanced expertise.

Future Outlook for Digital Forensics Market Market

The future outlook for the Digital Forensics Market is exceptionally bright, driven by an ever-increasing reliance on digital infrastructure and the corresponding rise in cyber threats. Growth accelerators include the continued expansion of cloud computing and IoT, creating new frontiers for forensic investigation. The ongoing development and adoption of AI and machine learning will further refine analytical capabilities, enabling faster and more accurate incident response. The increasing sophistication of cybercriminals will necessitate continuous innovation in forensic tools and methodologies, ensuring a sustained demand for specialized services. Furthermore, the growing emphasis on data privacy and compliance across industries will drive investment in solutions that can effectively manage and secure digital information, solidifying the market's robust growth trajectory for years to come.

Digital Forensics Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Service

-

2. Type

- 2.1. Mobile Forensics

- 2.2. Computer Forensics

- 2.3. Network Forensics

- 2.4. Other Types

-

3. End-user Vertical

- 3.1. Government and Law Enforcement Agencies

- 3.2. BFSI

- 3.3. IT and Telecom

- 3.4. Other End-user Verticals

Digital Forensics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Digital Forensics Market Regional Market Share

Geographic Coverage of Digital Forensics Market

Digital Forensics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of IoT Devices Driving Demand for Digital Forensics Solutions and Services; Network Forensics is Expected to Hold a Significant Market Share

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Mobile Forensics Type Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mobile Forensics

- 5.2.2. Computer Forensics

- 5.2.3. Network Forensics

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Government and Law Enforcement Agencies

- 5.3.2. BFSI

- 5.3.3. IT and Telecom

- 5.3.4. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Service

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Mobile Forensics

- 6.2.2. Computer Forensics

- 6.2.3. Network Forensics

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Government and Law Enforcement Agencies

- 6.3.2. BFSI

- 6.3.3. IT and Telecom

- 6.3.4. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Service

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Mobile Forensics

- 7.2.2. Computer Forensics

- 7.2.3. Network Forensics

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Government and Law Enforcement Agencies

- 7.3.2. BFSI

- 7.3.3. IT and Telecom

- 7.3.4. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Service

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Mobile Forensics

- 8.2.2. Computer Forensics

- 8.2.3. Network Forensics

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Government and Law Enforcement Agencies

- 8.3.2. BFSI

- 8.3.3. IT and Telecom

- 8.3.4. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Service

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Mobile Forensics

- 9.2.2. Computer Forensics

- 9.2.3. Network Forensics

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Government and Law Enforcement Agencies

- 9.3.2. BFSI

- 9.3.3. IT and Telecom

- 9.3.4. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Service

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Mobile Forensics

- 10.2.2. Computer Forensics

- 10.2.3. Network Forensics

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Government and Law Enforcement Agencies

- 10.3.2. BFSI

- 10.3.3. IT and Telecom

- 10.3.4. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 FireEye Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSAB Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oxygen Forensics Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AccessData Group LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LogRhythm Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Guidance Software Inc (Opentext)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Paraben Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Binary Intelligence LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KLDiscovery Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 FireEye Inc

List of Figures

- Figure 1: Global Digital Forensics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Digital Forensics Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Digital Forensics Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Digital Forensics Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Digital Forensics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Digital Forensics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Digital Forensics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Digital Forensics Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Digital Forensics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Digital Forensics Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Digital Forensics Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Digital Forensics Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Digital Forensics Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Digital Forensics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Digital Forensics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Digital Forensics Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Digital Forensics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Digital Forensics Market Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia Pacific Digital Forensics Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Digital Forensics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Digital Forensics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Digital Forensics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Digital Forensics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Digital Forensics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Digital Forensics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Digital Forensics Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Latin America Digital Forensics Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Digital Forensics Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Digital Forensics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Digital Forensics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Digital Forensics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Digital Forensics Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Digital Forensics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Digital Forensics Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa Digital Forensics Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Digital Forensics Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Digital Forensics Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Digital Forensics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Digital Forensics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Digital Forensics Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Digital Forensics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Forensics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Digital Forensics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Digital Forensics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Digital Forensics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Digital Forensics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Digital Forensics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Digital Forensics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Digital Forensics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Digital Forensics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Digital Forensics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Digital Forensics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Digital Forensics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Digital Forensics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Digital Forensics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Digital Forensics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Digital Forensics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Digital Forensics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Digital Forensics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Digital Forensics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Digital Forensics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Digital Forensics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Digital Forensics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Digital Forensics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Digital Forensics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Forensics Market?

The projected CAGR is approximately 12.92%.

2. Which companies are prominent players in the Digital Forensics Market?

Key companies in the market include FireEye Inc, IBM Corporation, MSAB Inc *List Not Exhaustive, Cisco Systems Inc, Oxygen Forensics Inc, AccessData Group LLC, LogRhythm Inc, Guidance Software Inc (Opentext), Paraben Corporation, Binary Intelligence LLC, KLDiscovery Inc.

3. What are the main segments of the Digital Forensics Market?

The market segments include Component, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of IoT Devices Driving Demand for Digital Forensics Solutions and Services; Network Forensics is Expected to Hold a Significant Market Share.

6. What are the notable trends driving market growth?

Mobile Forensics Type Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

In September 2023, SentinelOne Launched a new solution named Singularity RemoteOps Forensics. It is designed for incident response as well as evidence acquisition. New-fangled solution associations forensics evidence with immediate telemetry to offer combined insights into security incidents; analysts must conduct the investigation and response activities competently and swiftly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Forensics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Forensics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Forensics Market?

To stay informed about further developments, trends, and reports in the Digital Forensics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence