Key Insights

The global Education Security Market is poised for significant expansion, projected to reach $0.81 Billion by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 11.96%. This robust growth is primarily fueled by an increasing awareness of the need for comprehensive safety and security measures in educational institutions, ranging from K-12 schools to higher education campuses. Key drivers include the escalating threat landscape, encompassing physical security concerns, cyber threats targeting student data, and the need for proactive measures against potential disruptions. Educational institutions are increasingly investing in advanced security systems, including intelligent surveillance, access control, and emergency communication platforms, to safeguard students, staff, and valuable assets. Furthermore, evolving regulatory frameworks and a growing emphasis on creating a secure learning environment are compelling institutions to adopt sophisticated security solutions. The market's expansion is further supported by technological advancements, such as AI-powered analytics for threat detection and sophisticated integrated security management systems that offer a holistic approach to campus safety.

Education Security Market Market Size (In Million)

The Education Security Market encompasses a wide array of services and facilities, with Guarding, Pre-Employment Screening, Security Consulting, Systems Integration & Management, and Alarm Monitoring Services forming the core service segments. These services are crucial for creating a layered security approach within Primary & Secondary Facilities, Higher Education Facilities, and Other Educational Facilities. The demand for integrated solutions is on the rise, pushing for greater synergy between physical security and IT infrastructure. Companies like Silverseal Corporation, Honeywell International Inc., and Bosch Sicherheitssysteme GmbH are at the forefront, offering a broad spectrum of innovative security technologies and services. While the market demonstrates strong growth, potential restraints could include budget limitations for some institutions and the complexity of integrating new security technologies with legacy systems. However, the clear imperative to enhance campus safety is expected to outweigh these challenges, driving sustained investment and innovation across the education sector.

Education Security Market Company Market Share

Unlock critical insights into the burgeoning education security market with our in-depth report. This comprehensive analysis provides actionable intelligence for stakeholders seeking to navigate evolving threats, leverage technological advancements, and capitalize on growth opportunities within educational institutions worldwide. With a detailed study period spanning 2019-2033 and a base year of 2025, this report delivers robust market data, expert analysis, and strategic recommendations.

Education Security Market Market Structure & Innovation Trends

The education security market exhibits a moderately consolidated structure, with key players like Honeywell International Inc., Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH), and Hangzhou Hikvision Digital Technology Co Ltd holding significant market share. Innovation is a primary driver, fueled by the increasing adoption of AI-powered surveillance, advanced access control systems, and integrated security platforms. Regulatory frameworks, particularly those focused on student safety and data privacy (e.g., FERPA in the US), are shaping product development and market entry strategies. Product substitutes, such as basic alarm systems and traditional guarding services, are facing pressure from sophisticated, technologically driven solutions. End-user demographics are diverse, encompassing K-12 schools, higher education institutions, and specialized educational facilities, each with unique security needs. Mergers and acquisitions (M&A) activity is on the rise, with estimated deal values in the hundreds of millions of dollars, indicating a strategic consolidation phase. Key M&A activities include Securitas Technology (Securitas AB) bolstering its presence through strategic acquisitions to expand its service offerings.

Education Security Market Market Dynamics & Trends

The education security market is experiencing robust growth, driven by a confluence of escalating safety concerns, technological advancements, and evolving institutional policies. The projected Compound Annual Growth Rate (CAGR) is approximately 7.5% from 2025 to 2033, reflecting increasing investment in comprehensive security solutions for educational environments. Market penetration is deepening as institutions recognize the imperative to safeguard students, staff, and assets against a spectrum of threats, ranging from physical security breaches to cyber vulnerabilities. Technological disruptions, including the widespread deployment of AI-driven video analytics for threat detection, behavioral anomaly recognition, and smart access control systems, are revolutionizing how educational institutions approach security. The demand for integrated security platforms that seamlessly combine video surveillance, access control, intrusion detection, and emergency communication systems is a significant trend. Consumer preferences are shifting towards proactive, intelligent security measures that minimize disruptions while maximizing protection. This includes a growing interest in solutions that offer remote monitoring capabilities, real-time alerts, and robust data analytics for informed decision-making. Competitive dynamics are intensifying, with established security giants competing alongside agile, technology-focused startups. Companies are differentiating themselves through innovation in areas such as facial recognition, advanced threat detection algorithms, and user-friendly management interfaces. The integration of cybersecurity measures alongside physical security solutions is becoming increasingly crucial, as cyber-attacks targeting educational institutions can have severe consequences. Furthermore, the ongoing debate surrounding the appropriate use of security technologies in educational settings, balancing safety with privacy concerns, continues to shape market evolution.

Dominant Regions & Segments in Education Security Market

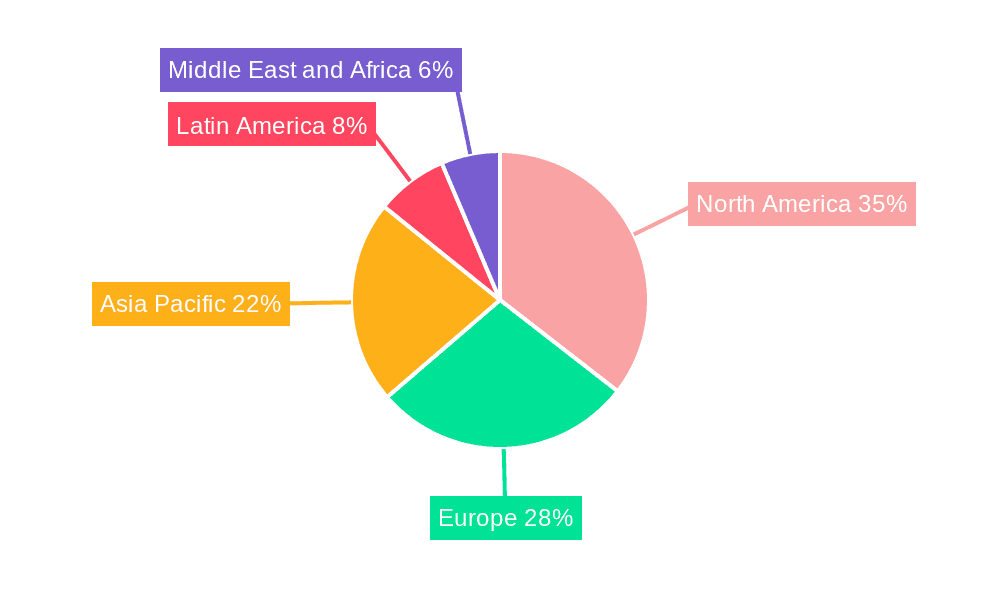

Leading Region: North America is currently the dominant region in the global education security market, driven by stringent safety regulations, significant funding for school security initiatives, and a high adoption rate of advanced security technologies. The United States, in particular, leads with substantial investments in K-12 and higher education security infrastructure.

- Key Drivers in North America:

- Federal and state-level funding for school safety grants.

- High prevalence of active shooter incidents and other security threats.

- Advanced technological infrastructure and a strong R&D ecosystem.

- Increasing awareness and prioritization of student and staff well-being.

Dominant Segments:

Services: Systems Integration & Management stands out as a leading segment within the services domain. The complexity of modern educational security requires integrated solutions that manage multiple subsystems, including video surveillance, access control, and alarm monitoring. Educational institutions are increasingly outsourcing the integration and ongoing management of these systems to specialized providers to ensure seamless operation and optimal effectiveness.

- Key Drivers: Need for unified security platforms, shortage of in-house expertise, desire for comprehensive risk mitigation, and the growing adoption of smart campus technologies.

- Market Size Projection: Expected to reach over USD 8 Billion by 2033.

Facilities: Primary & Secondary Facilities represent the largest and fastest-growing segment within the facilities category. The sheer number of K-12 institutions globally, coupled with heightened security concerns at this level, drives substantial investment.

- Key Drivers: Vulnerability of younger students, pressure from parents and communities, regulatory mandates for school safety, and increasing adoption of surveillance and access control systems in elementary and high schools.

- Market Size Projection: Expected to surpass USD 10 Billion by 2033.

Other Significant Segments:

- Higher Education Facilities: This segment is characterized by sophisticated security needs, including the protection of research facilities, student housing, and large campuses. Investment here is driven by a need for advanced access control, campus-wide surveillance, and integrated emergency response systems.

- Guarding: While technology is advancing, physical guarding services remain a crucial component of educational security, providing a visible deterrent and immediate response capability.

- Alarm Monitoring Services: Essential for timely threat detection and response, alarm monitoring services continue to be a fundamental part of educational security infrastructure.

Education Security Market Product Innovations

Recent product innovations in the education security market focus on enhancing proactive threat detection, improving situational awareness, and streamlining security operations. This includes the development of AI-powered video analytics capable of identifying suspicious behavior, unattended bags, and unauthorized access in real-time. Advanced access control systems are leveraging biometrics and mobile credentials for secure and convenient entry, while integrated communication platforms are enabling faster and more effective emergency response. The trend towards cloud-based security solutions offers scalability, remote management, and data accessibility. These innovations provide educational institutions with enhanced security, improved operational efficiency, and greater peace of mind.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the Education Security Market, segmented across key areas. The Services segment includes Guarding, Pre-Employment Screening, Security Consulting, Systems Integration & Management, Alarm Monitoring Services, and Other Private Security Services. Each of these services is experiencing growth driven by specific institutional needs, with Systems Integration & Management projected to hold the largest market share due to the increasing complexity of security solutions. The Facilities segment covers Primary & Secondary Facilities, Higher Education Facilities, and Other Educational Facilities. Primary & Secondary Facilities are the largest segment due to their extensive number and heightened security concerns. Growth projections for each segment indicate steady expansion, with competitive dynamics revolving around technological sophistication and cost-effectiveness.

Key Drivers of Education Security Market Growth

The education security market is propelled by a potent combination of factors. Technological advancements are paramount, with AI, IoT, and advanced analytics enabling more sophisticated threat detection and response. Increasing safety concerns, including active shooter events and general campus violence, are compelling institutions to invest heavily in protective measures. Regulatory mandates and funding initiatives from governments worldwide provide crucial impetus, often requiring specific security upgrades and offering financial support for implementation. Furthermore, the growing awareness among parents and educators about the importance of a secure learning environment creates demand for comprehensive security solutions.

Challenges in the Education Security Market Sector

Despite strong growth, the education security market faces several hurdles. Budgetary constraints within educational institutions remain a significant challenge, limiting the adoption of expensive advanced solutions. The complexity of integrating disparate security systems can lead to interoperability issues and increased operational costs. Concerns over privacy and data security associated with surveillance technologies require careful consideration and compliance with regulations. The rapid pace of technological change necessitates continuous investment in upgrades and training, which can be demanding for already stretched budgets. Finally, finding and retaining qualified security personnel for both technological and physical security roles presents an ongoing challenge.

Emerging Opportunities in Education Security Market

The education security market is ripe with emerging opportunities. The expansion of threat intelligence platforms and predictive analytics offers a proactive approach to security management. The growing demand for integrated cybersecurity and physical security solutions presents a significant growth avenue. The development of smarter campus technologies, including intelligent building management systems that incorporate security features, is another promising area. Furthermore, global expansion into developing economies with increasing investments in education infrastructure and security awareness presents untapped market potential. The rising adoption of behavioral analytics in surveillance systems to identify potential threats before they escalate is also a key opportunity.

Leading Players in the Education Security Market Market

- Silverseal Corporation

- Honeywell International Inc

- SEICO Inc

- Pelco Inc (Motorola Solutions Inc )

- Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- Cisco Systems Inc

- Genetec Inc

- Verkada Inc

- Securitas Technology (Securitas AB)

- Hangzhou Hikvision Digital Technology Co Ltd

- Kisi Incorporated

- AV Costar

- Axis Communications AB

- Siemens A

Key Developments in Education Security Market Industry

- May 2024: Senator Wayne Fontana, D-District 42, announced USD 8,25,522 in School and Safety grants to enhance student and staff safety, security, and mental health support. This initiative is expected to drive demand for advanced security technologies and services in educational institutions.

- March 2024: Schools in Ontario could soon be equipped with more security cameras and more vape detectors. Premier Kathleen Wynne announced that USD 30 million would be spent on school safety in the province’s budget. Installing vape detectors and smoke detectors that detect vapor in places like washrooms will help keep students healthy and safe. This development highlights the growing focus on comprehensive safety measures beyond traditional security.

Future Outlook for Education Security Market Market

The future outlook for the education security market is exceptionally positive, driven by an unwavering commitment to safeguarding educational environments. The integration of advanced technologies like AI, machine learning, and IoT will continue to shape solutions, moving towards more predictive and automated security systems. The increasing emphasis on holistic safety, encompassing physical security, cybersecurity, and mental health support, will foster demand for integrated platforms. Governments worldwide are expected to continue their investment in school safety, creating sustained market growth. The trend towards smarter, more connected campuses will further accelerate the adoption of sophisticated security infrastructure, making the education security market a dynamic and expanding sector for years to come.

Education Security Market Segmentation

-

1. Services

- 1.1. Guarding

- 1.2. Pre-Employment Screening

- 1.3. Security Consulting

- 1.4. Systems Integration & Management

- 1.5. Alarm Monitoring Services

- 1.6. Other Private Security Services

-

2. Facilities

- 2.1. Primary & Secondary Facilities

- 2.2. Higher Education Facilities

- 2.3. Other Educational Facilities

Education Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Education Security Market Regional Market Share

Geographic Coverage of Education Security Market

Education Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Real-time Surveillance; Growing Demand for Cost-effective security solutions and significant Infrastructure Developments

- 3.3. Market Restrains

- 3.3.1. The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Higher Education Facilities are Expected to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Education Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Guarding

- 5.1.2. Pre-Employment Screening

- 5.1.3. Security Consulting

- 5.1.4. Systems Integration & Management

- 5.1.5. Alarm Monitoring Services

- 5.1.6. Other Private Security Services

- 5.2. Market Analysis, Insights and Forecast - by Facilities

- 5.2.1. Primary & Secondary Facilities

- 5.2.2. Higher Education Facilities

- 5.2.3. Other Educational Facilities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Education Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Guarding

- 6.1.2. Pre-Employment Screening

- 6.1.3. Security Consulting

- 6.1.4. Systems Integration & Management

- 6.1.5. Alarm Monitoring Services

- 6.1.6. Other Private Security Services

- 6.2. Market Analysis, Insights and Forecast - by Facilities

- 6.2.1. Primary & Secondary Facilities

- 6.2.2. Higher Education Facilities

- 6.2.3. Other Educational Facilities

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Education Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Guarding

- 7.1.2. Pre-Employment Screening

- 7.1.3. Security Consulting

- 7.1.4. Systems Integration & Management

- 7.1.5. Alarm Monitoring Services

- 7.1.6. Other Private Security Services

- 7.2. Market Analysis, Insights and Forecast - by Facilities

- 7.2.1. Primary & Secondary Facilities

- 7.2.2. Higher Education Facilities

- 7.2.3. Other Educational Facilities

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Education Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Guarding

- 8.1.2. Pre-Employment Screening

- 8.1.3. Security Consulting

- 8.1.4. Systems Integration & Management

- 8.1.5. Alarm Monitoring Services

- 8.1.6. Other Private Security Services

- 8.2. Market Analysis, Insights and Forecast - by Facilities

- 8.2.1. Primary & Secondary Facilities

- 8.2.2. Higher Education Facilities

- 8.2.3. Other Educational Facilities

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Education Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Guarding

- 9.1.2. Pre-Employment Screening

- 9.1.3. Security Consulting

- 9.1.4. Systems Integration & Management

- 9.1.5. Alarm Monitoring Services

- 9.1.6. Other Private Security Services

- 9.2. Market Analysis, Insights and Forecast - by Facilities

- 9.2.1. Primary & Secondary Facilities

- 9.2.2. Higher Education Facilities

- 9.2.3. Other Educational Facilities

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East and Africa Education Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Guarding

- 10.1.2. Pre-Employment Screening

- 10.1.3. Security Consulting

- 10.1.4. Systems Integration & Management

- 10.1.5. Alarm Monitoring Services

- 10.1.6. Other Private Security Services

- 10.2. Market Analysis, Insights and Forecast - by Facilities

- 10.2.1. Primary & Secondary Facilities

- 10.2.2. Higher Education Facilities

- 10.2.3. Other Educational Facilities

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Silverseal Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SEICO Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pelco Inc (Motorola Solutions Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Genetec Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Verkada Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Securitas Technology (Securitas AB)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hangzhou Hikvision Digital Technology Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kisi Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AV Costar

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Axis Communications AB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Siemens A

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Silverseal Corporation

List of Figures

- Figure 1: Global Education Security Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 3: North America Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 5: North America Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 6: North America Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 9: Europe Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 10: Europe Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 11: Europe Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 12: Europe Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 15: Asia Pacific Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 16: Asia Pacific Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 17: Asia Pacific Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 18: Asia Pacific Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 21: Latin America Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Latin America Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 23: Latin America Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 24: Latin America Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 27: Middle East and Africa Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Middle East and Africa Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 29: Middle East and Africa Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 30: Middle East and Africa Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Education Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 3: Global Education Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 6: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 8: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 9: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 11: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 12: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 14: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 15: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 17: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 18: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Education Security Market?

The projected CAGR is approximately 11.96%.

2. Which companies are prominent players in the Education Security Market?

Key companies in the market include Silverseal Corporation, Honeywell International Inc, SEICO Inc, Pelco Inc (Motorola Solutions Inc ), Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH), Cisco Systems Inc, Genetec Inc, Verkada Inc, Securitas Technology (Securitas AB), Hangzhou Hikvision Digital Technology Co Ltd, Kisi Incorporated, AV Costar, Axis Communications AB, Siemens A.

3. What are the main segments of the Education Security Market?

The market segments include Services, Facilities.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Real-time Surveillance; Growing Demand for Cost-effective security solutions and significant Infrastructure Developments.

6. What are the notable trends driving market growth?

Higher Education Facilities are Expected to Witness Major Growth.

7. Are there any restraints impacting market growth?

The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market.

8. Can you provide examples of recent developments in the market?

May 2024: Senator Wayne Fontana, D-District 42, announced USD 8,25,522 in School and Safety grants to enhance student and staff safety, security, and mental health support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Education Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Education Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Education Security Market?

To stay informed about further developments, trends, and reports in the Education Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence