Key Insights

The global Electromagnetic Flowmeter market is projected to reach $14.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.91%. This expansion is driven by the escalating demand for precise liquid flow measurement across diverse industries, including water and wastewater management, chemicals and petrochemicals, power generation, and metals and mining. Growing industrialization in emerging economies also presents significant opportunities, fostering the adoption of advanced flowmeter technologies for improved process control and resource sustainability.

Electromagnetic Flowmeter Industry Market Size (In Billion)

Technological advancements are enhancing electromagnetic flowmeter capabilities, with a focus on IoT integration for remote monitoring, specialized low-flow meters, and cost-effective insertion-type meters. While high initial investment and alternative technologies pose some challenges, the inherent benefits of electromagnetic flowmeters—non-intrusive operation, suitability for harsh fluids, and low maintenance—ensure their continued market relevance. Leading players are investing in R&D to drive innovation and expand market share.

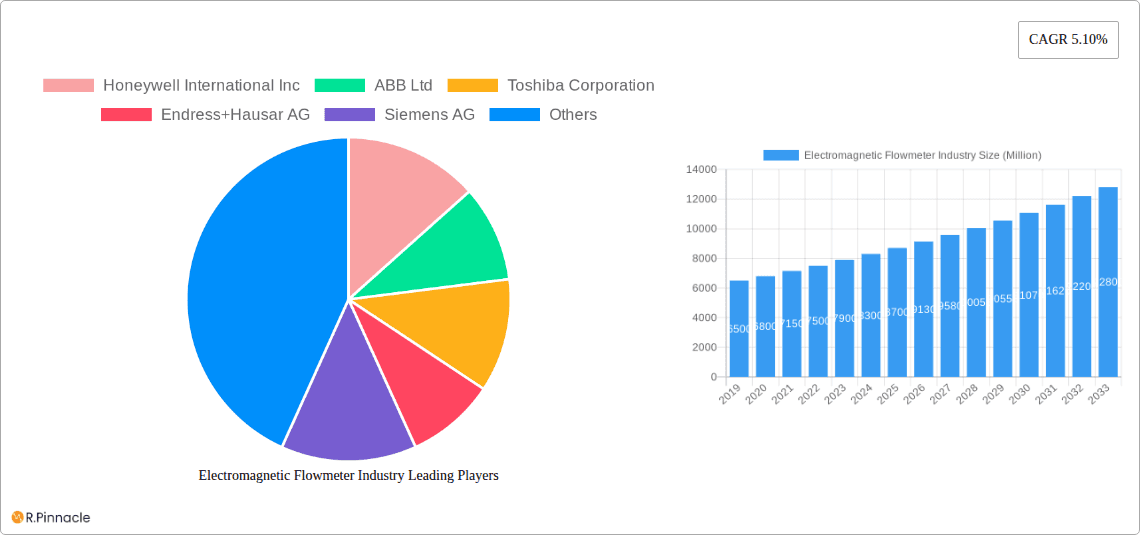

Electromagnetic Flowmeter Industry Company Market Share

Electromagnetic Flowmeter Industry Market Report: In-depth Analysis & Future Projections (2019-2033)

Gain critical insights into the global Electromagnetic Flowmeter industry with this comprehensive report. Spanning the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this analysis delves into market structure, dynamics, segmentation, and future outlook. Leveraging high-ranking keywords such as "magnetic flowmeters," "flow measurement solutions," "industrial automation," and "process control," this report is essential for industry professionals seeking to understand market concentration, innovation trends, key drivers, and emerging opportunities within this vital sector. Discover actionable intelligence on leading players, product innovations, and dominant regions to inform strategic decision-making and secure a competitive edge.

Electromagnetic Flowmeter Industry Market Structure & Innovation Trends

The Electromagnetic Flowmeter market exhibits a moderate to high level of market concentration, with key players like Honeywell International Inc, ABB Ltd, Toshiba Corporation, Endress+Hauser AG, Siemens AG, KROHNE Messtechnik GmbH, OMEGA Engineering Inc (Spectris PLC), Azbil Corporation, Emerson Electric Corporation, and Yokogawa Electric Corporation holding significant market share. These companies drive innovation through continuous research and development, focusing on enhanced accuracy, digital connectivity, and suitability for diverse industrial applications. Regulatory frameworks, particularly those concerning environmental monitoring and safety standards in sectors like Water and Wastewater and Chemicals and Petrochemicals, play a crucial role in shaping product development and market entry. While direct product substitutes are limited due to the unique operating principles of electromagnetic flowmeters, advancements in other flow measurement technologies can exert indirect competitive pressure. End-user demographics are increasingly sophisticated, demanding intelligent solutions for data acquisition and process optimization. Mergers and acquisitions (M&A) activities, though not extensively publicized with specific deal values, are ongoing as larger entities seek to consolidate their market position and acquire specialized technological expertise. The market share of leading companies often exceeds 10% individually, with the top five players collectively commanding over 50% of the global market.

Electromagnetic Flowmeter Industry Market Dynamics & Trends

The Electromagnetic Flowmeter industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is fueled by several key market growth drivers, paramount among them being the escalating global demand for efficient water management and the increasing adoption of advanced industrial automation. Industries such as Water and Wastewater treatment and Oil and Gas are heavily investing in reliable flow measurement to optimize processes, reduce waste, and ensure environmental compliance. Technological disruptions are significantly influencing market penetration, with the integration of IoT capabilities, advanced sensor technologies, and AI-driven data analytics enabling "smart" flowmeters that offer predictive maintenance and remote monitoring. This is a departure from traditional, passive measurement devices, ushering in an era of active, data-rich instrumentation. Consumer preferences are shifting towards solutions that provide not only accurate measurements but also seamless integration with existing plant control systems and cloud-based platforms, facilitating better decision-making and operational efficiency. The competitive dynamics are characterized by intense innovation, with companies vying to offer differentiated features, superior accuracy, and cost-effective solutions across various segments, including In-line, Low Flow, and Insertion Magnetic Flowmeters. The market penetration of electromagnetic flowmeters is expected to continue its upward trajectory as industries recognize their indispensable role in optimizing resource utilization and enhancing productivity.

Dominant Regions & Segments in Electromagnetic Flowmeter Industry

The Asia Pacific region is poised to be the dominant force in the global Electromagnetic Flowmeter market, with China and India leading the charge in terms of growth and adoption. This dominance is underpinned by several key drivers:

- Rapid Industrialization and Urbanization: Extensive infrastructure development, particularly in water and wastewater treatment facilities, coupled with the expansion of manufacturing sectors like Chemicals and Petrochemicals and Food and Beverages, creates a perpetual demand for reliable flow measurement solutions.

- Government Initiatives and Investments: Favorable government policies promoting industrial growth, environmental protection, and smart city initiatives directly translate into increased investment in advanced instrumentation.

- Growing Manufacturing Base: The region's established and expanding manufacturing capabilities for industrial equipment contribute to both the production and consumption of electromagnetic flowmeters.

In terms of product segmentation, the In-line Magnetic Flowmeters segment is expected to maintain its leading position. This is due to their widespread application in core industrial processes requiring high accuracy and reliability, such as in the Water and Wastewater and Chemicals and Petrochemicals sectors. Their robust construction and proven performance make them a go-to choice for a broad spectrum of fluid types.

The Application segment of Water and Wastewater is also a significant driver of market dominance. The increasing global focus on water scarcity, stringent environmental regulations for discharge, and the need for efficient management of water resources necessitate precise flow monitoring. Consequently, the demand for electromagnetic flowmeters in this sector remains consistently high.

While other segments like Low Flow Magnetic Flowmeters and Insertion Magnetic Flowmeters are crucial for specialized applications, and sectors like Power Generation, Metals and Mining, Oil and Gas, and Food and Beverages represent substantial market segments with unique demands, the sheer scale of industrial activity and infrastructure development in Asia Pacific, coupled with the fundamental need for accurate flow measurement in water management, solidifies the regional and segment dominance. The estimated market size for the Water and Wastewater application segment alone is projected to reach over $2 Billion by 2028.

Electromagnetic Flowmeter Industry Product Innovations

Product innovations in the Electromagnetic Flowmeter industry are sharply focused on enhancing digital connectivity, improving accuracy, and expanding application versatility. Leading manufacturers are integrating advanced sensor technologies for real-time data analytics, predictive maintenance capabilities, and seamless integration with Industrial IoT (IIoT) platforms. This leads to competitive advantages through reduced downtime, optimized process efficiency, and remote monitoring capabilities. The trend towards miniaturization and energy efficiency in low-flow applications and the development of robust, corrosion-resistant materials for harsh chemical environments are also key technological trends. Market fit is being redefined by solutions that offer greater user-friendliness and lower total cost of ownership.

Electromagnetic Flowmeter Industry Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Electromagnetic Flowmeter market, encompassing product and application-based segmentations. Product Segmentation:

- In-line Magnetic Flowmeters: These constitute the largest segment, favored for their high accuracy and robust performance in a wide range of industrial applications. Growth projections for this segment are steady, driven by ongoing industrialization and process optimization needs, with an estimated market size exceeding $3 Billion by 2028.

- Low Flow Magnetic Flowmeters: Essential for applications requiring precise measurement of minimal fluid volumes, particularly in laboratory settings and niche industrial processes. This segment, while smaller, is expected to witness significant growth due to advancements in micro-flow technology.

- Insertion Magnetic Flowmeters: Valued for their ease of installation and cost-effectiveness in large-diameter pipelines, these are crucial for applications where in-line installation is impractical.

Application Segmentation:

- Water and Wastewater: This is the most significant application segment, driven by global water management needs and environmental regulations.

- Chemicals and Petrochemicals: Demands high accuracy and chemical resistance for process control and safety.

- Power Generation: Critical for monitoring steam, water, and fuel flows.

- Metals and Mining: Utilized for process water and slurry measurement.

- Oil and Gas: Essential for custody transfer and process monitoring in upstream and downstream operations.

- Food and Beverages: Requires hygienic designs and high accuracy for quality control.

- Other Applications: Encompasses diverse industries such as pulp and paper, pharmaceuticals, and general manufacturing.

Key Drivers of Electromagnetic Flowmeter Industry Growth

The Electromagnetic Flowmeter industry is propelled by several significant growth drivers.

- Increasing Demand for Smart Water Management: Global concerns about water scarcity and the need for efficient distribution and treatment are driving the adoption of advanced flow metering technologies in the Water and Wastewater sector.

- Industrial Automation and Digitalization: The pervasive trend towards Industry 4.0 and the integration of IIoT are necessitating intelligent flow measurement solutions that provide real-time data for process optimization and predictive maintenance. For instance, the ABB AquaMaster4 Mobile Comms flowmeter exemplifies this trend with its advanced connectivity.

- Stringent Environmental Regulations: Stricter compliance requirements across various industries, particularly in the chemical and petrochemical sectors, mandate accurate monitoring of fluid flows to prevent pollution and ensure safe operations.

- Growth in Key End-User Industries: Expansion in sectors like Food and Beverages, Oil and Gas, and Power Generation, especially in emerging economies, directly correlates with increased demand for flowmeters.

Challenges in the Electromagnetic Flowmeter Industry Sector

Despite its robust growth, the Electromagnetic Flowmeter industry faces several challenges.

- High Initial Investment Costs: The sophisticated technology and precision engineering involved in manufacturing electromagnetic flowmeters can lead to higher upfront costs compared to simpler flow measurement devices, which can be a barrier for smaller enterprises or in price-sensitive markets.

- Technological Complexity and Calibration: Proper installation, calibration, and maintenance of electromagnetic flowmeters require specialized knowledge and skilled personnel, which may not be readily available in all regions.

- Competition from Alternative Technologies: While electromagnetic flowmeters offer unique advantages, other flow measurement technologies, such as ultrasonic and vortex flowmeters, can offer competitive solutions in specific applications, posing a continuous challenge for market share.

- Supply Chain Disruptions: Geopolitical factors and global economic volatility can impact the availability of raw materials and components, potentially leading to production delays and increased costs. The global semiconductor shortage, for example, has had a ripple effect across the instrumentation industry.

Emerging Opportunities in Electromagnetic Flowmeter Industry

The Electromagnetic Flowmeter industry is ripe with emerging opportunities.

- Expansion in Developing Economies: Significant untapped potential exists in developing regions with rapidly industrializing economies that are increasingly investing in infrastructure and process automation, particularly in Asia Pacific and Africa.

- Advancements in IoT and AI Integration: The continued integration of IoT and artificial intelligence will unlock new possibilities for predictive analytics, remote diagnostics, and optimized process control, creating demand for smarter, more connected flowmeters.

- Growth in Niche Applications: The increasing demand for precise measurement in specialized fields like biopharmaceuticals, advanced manufacturing, and renewable energy presents opportunities for customized and high-performance flowmeter solutions.

- Focus on Energy Efficiency and Sustainability: As industries prioritize sustainability, flowmeters that contribute to reduced energy consumption and resource optimization will see increased adoption.

Leading Players in the Electromagnetic Flowmeter Industry Market

- Honeywell International Inc

- ABB Ltd

- Toshiba Corporation

- Endress+Hauser AG

- Siemens AG

- KROHNE Messtechnik GmbH

- OMEGA Engineering Inc (Spectris PLC)

- Azbil Corporation

- Emerson Electric Corporation

- Yokogawa Electric Corporation

Key Developments in Electromagnetic Flowmeter Industry Industry

- June 2022: Endress+Hauser dedicated a new facility in Cernay, France, primarily for the manufacture of electromagnetic flowmeters. This expansion, adding 10,000 sq m, will focus on the Progmag H and Dosimag H models, significantly boosting production capacity for the food and life sciences industries.

- December 2021: ABB launched the AquaMaster4 Mobile Comms flowmeter, the world's first electromagnetic flowmeter with bidirectional connectivity for intelligent water loss management. This wireless solution enhances continuous flow measurement, data logging, and communication, enabling 60% lower power consumption and faster leak identification.

Future Outlook for Electromagnetic Flowmeter Industry Market

The future outlook for the Electromagnetic Flowmeter industry remains exceptionally strong. Growth will be further propelled by the ongoing digital transformation of industrial processes, with an increasing emphasis on data-driven decision-making and intelligent automation. The global push for sustainable practices and efficient resource management, especially in water-scarce regions, will continue to be a primary growth accelerator. Strategic opportunities lie in developing more compact, energy-efficient, and feature-rich flowmeters that cater to the evolving needs of industries such as the circular economy, advanced manufacturing, and the burgeoning renewable energy sector. The market is expected to see continued innovation in areas like wireless connectivity, advanced diagnostics, and material science to meet the demands for higher accuracy, reliability, and longevity in diverse and challenging operating environments. The market size is projected to reach over $7 Billion by 2033.

Electromagnetic Flowmeter Industry Segmentation

-

1. Product

- 1.1. In-line Magnetic Flowmeters

- 1.2. Low Flow Magnetic Flowmeters

- 1.3. Insertion Magnetic Flowmeters

-

2. Application

- 2.1. Water and Wastewater

- 2.2. Chemicals and Petrochemicals

- 2.3. Power Generation

- 2.4. Metals and Mining

- 2.5. Oil and Gas

- 2.6. Food and Beverages

- 2.7. Other Ap

Electromagnetic Flowmeter Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Electromagnetic Flowmeter Industry Regional Market Share

Geographic Coverage of Electromagnetic Flowmeter Industry

Electromagnetic Flowmeter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Water Shortage and the Growing Population; Technological Innovations in Irrigation

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Requirements; Hight Cost

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Industry to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. In-line Magnetic Flowmeters

- 5.1.2. Low Flow Magnetic Flowmeters

- 5.1.3. Insertion Magnetic Flowmeters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water and Wastewater

- 5.2.2. Chemicals and Petrochemicals

- 5.2.3. Power Generation

- 5.2.4. Metals and Mining

- 5.2.5. Oil and Gas

- 5.2.6. Food and Beverages

- 5.2.7. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. In-line Magnetic Flowmeters

- 6.1.2. Low Flow Magnetic Flowmeters

- 6.1.3. Insertion Magnetic Flowmeters

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water and Wastewater

- 6.2.2. Chemicals and Petrochemicals

- 6.2.3. Power Generation

- 6.2.4. Metals and Mining

- 6.2.5. Oil and Gas

- 6.2.6. Food and Beverages

- 6.2.7. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. In-line Magnetic Flowmeters

- 7.1.2. Low Flow Magnetic Flowmeters

- 7.1.3. Insertion Magnetic Flowmeters

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water and Wastewater

- 7.2.2. Chemicals and Petrochemicals

- 7.2.3. Power Generation

- 7.2.4. Metals and Mining

- 7.2.5. Oil and Gas

- 7.2.6. Food and Beverages

- 7.2.7. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. In-line Magnetic Flowmeters

- 8.1.2. Low Flow Magnetic Flowmeters

- 8.1.3. Insertion Magnetic Flowmeters

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water and Wastewater

- 8.2.2. Chemicals and Petrochemicals

- 8.2.3. Power Generation

- 8.2.4. Metals and Mining

- 8.2.5. Oil and Gas

- 8.2.6. Food and Beverages

- 8.2.7. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. In-line Magnetic Flowmeters

- 9.1.2. Low Flow Magnetic Flowmeters

- 9.1.3. Insertion Magnetic Flowmeters

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water and Wastewater

- 9.2.2. Chemicals and Petrochemicals

- 9.2.3. Power Generation

- 9.2.4. Metals and Mining

- 9.2.5. Oil and Gas

- 9.2.6. Food and Beverages

- 9.2.7. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. In-line Magnetic Flowmeters

- 10.1.2. Low Flow Magnetic Flowmeters

- 10.1.3. Insertion Magnetic Flowmeters

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water and Wastewater

- 10.2.2. Chemicals and Petrochemicals

- 10.2.3. Power Generation

- 10.2.4. Metals and Mining

- 10.2.5. Oil and Gas

- 10.2.6. Food and Beverages

- 10.2.7. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Endress+Hausar AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KROHNE Messtechnik GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OMEGA Engineering Inc (Spectris PLC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Azbil Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emerson Electric Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yokogawa Electric Corporation*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Electromagnetic Flowmeter Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 21: Latin America Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Latin America Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 27: Middle East Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electromagnetic Flowmeter Industry?

The projected CAGR is approximately 7.91%.

2. Which companies are prominent players in the Electromagnetic Flowmeter Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Toshiba Corporation, Endress+Hausar AG, Siemens AG, KROHNE Messtechnik GmbH, OMEGA Engineering Inc (Spectris PLC), Azbil Corporation, Emerson Electric Corporation, Yokogawa Electric Corporation*List Not Exhaustive.

3. What are the main segments of the Electromagnetic Flowmeter Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Water Shortage and the Growing Population; Technological Innovations in Irrigation.

6. What are the notable trends driving market growth?

Water and Wastewater Industry to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Requirements; Hight Cost.

8. Can you provide examples of recent developments in the market?

June 2022 - EEndress+Hauser dedicated a new facility in France. Endress+Hauser manufactures flowmeters in Cernay for delivery to customers around the world. The additional 10,000 sq m of space will be used primarily to manufacture electromagnetic flowmeters. The new building was designed chiefly to manufacture the Progmag H and Dosimag H electromagnetic flowmeters, mainly used in the food and life sciences industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electromagnetic Flowmeter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electromagnetic Flowmeter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electromagnetic Flowmeter Industry?

To stay informed about further developments, trends, and reports in the Electromagnetic Flowmeter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence