Key Insights

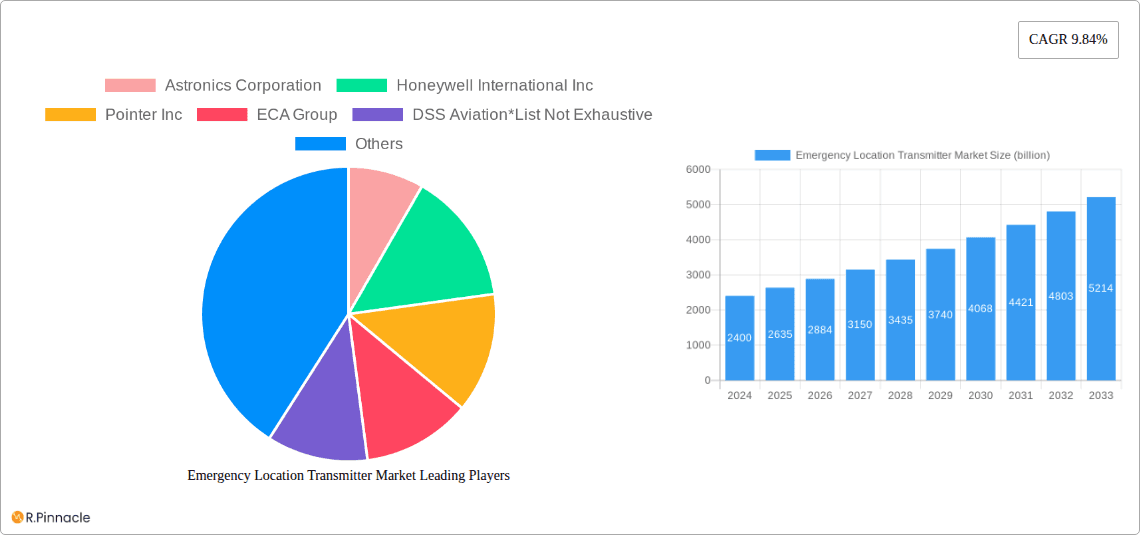

The global Emergency Location Transmitter (ELT) market is poised for significant expansion, projected to reach approximately USD 2.4 billion in 2024. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.84%, indicating a dynamic and expanding industry. The market's upward trajectory is fueled by several key drivers, including the increasing demand for enhanced aviation safety, stricter regulatory mandates for ELTs across commercial and defense sectors, and advancements in ELT technology, such as the integration of GPS capabilities for more precise location data and the transition to digital transmission standards (e.g., 406 MHz). Furthermore, the growing adoption of ELTs in maritime applications for distress signaling and the personal safety segment, particularly for outdoor enthusiasts and remote workers, are contributing to market expansion.

Emergency Location Transmitter Market Market Size (In Billion)

The forecast period, from 2025 to 2033, is expected to witness sustained innovation and market penetration. While the aviation sector, encompassing both commercial and defense applications, will continue to be the dominant end-user vertical, the maritime and personal applications segments are anticipated to show considerable growth. Challenges such as high initial costs for some advanced ELT systems and the need for robust infrastructure for signal reception and processing remain, but are being mitigated by technological advancements and increasing safety awareness. Key players like Astronics Corporation, Honeywell International Inc., and Pointer Inc. are actively involved in product development and strategic collaborations to capture market share. The market is geographically diverse, with North America and Europe leading in adoption due to stringent safety regulations and a mature aerospace industry, while the Asia Pacific region presents significant growth potential driven by increasing air travel and defense spending.

Emergency Location Transmitter Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Emergency Location Transmitter (ELT) market, providing critical insights for industry stakeholders. With a study period spanning 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report delivers actionable intelligence on market structure, dynamics, regional dominance, product innovations, and future opportunities. The global Emergency Location Transmitter market is projected to reach significant valuations, with projections for 2025 estimated at $X.XX billion and forecasted to reach $Y.YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z.ZZ%.

Emergency Location Transmitter Market Market Structure & Innovation Trends

The Emergency Location Transmitter market exhibits a moderately concentrated structure, with key players like Honeywell International Inc., Orolia Holding SAS, and ACR Electronics Inc. holding substantial market shares. Innovation is a significant driver, with ongoing advancements in satellite technology, miniaturization, and enhanced battery life shaping product development. Regulatory frameworks, such as those mandated by the International Civil Aviation Organization (ICAO) and the International Maritime Organization (IMO), play a crucial role in dictating ELT specifications and adoption rates, thereby influencing market dynamics. While direct product substitutes are limited, the increasing integration of ELTs into broader avionics and maritime safety systems represents an indirect competitive factor. End-user demographics are primarily driven by commercial aviation, defense sectors, and maritime operations, with a growing niche in personal safety applications. Mergers and acquisitions (M&A) activity, valued at approximately $XXX million historically, has been strategic, focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated.

- Innovation Drivers: Miniaturization, satellite connectivity (e.g., Cospas-Sarsat, Galileo), enhanced battery technology, IoT integration.

- Regulatory Frameworks: ICAO, IMO, EASA, FAA mandates for aviation; SOLAS for maritime.

- Product Substitutes: Integrated survival systems, personal locator beacons (PLBs) for certain applications.

- End-User Demographics: Commercial airlines, military forces, cargo ships, recreational boaters, hikers, aviators.

- M&A Activity: Strategic acquisitions for technology and market access.

Emergency Location Transmitter Market Market Dynamics & Trends

The Emergency Location Transmitter market is experiencing robust growth, primarily fueled by increasing air traffic and maritime activities, coupled with stringent aviation safety regulations worldwide. The Aerospace Applications (Commercial and Defense) segment dominates the market, driven by mandatory ELT installations in all aircraft. The growing demand for enhanced aviation safety, especially in remote and challenging environments, acts as a significant growth accelerator. Technological disruptions, such as the transition from analog to digital ELTs and the integration of GPS and multi-constellation satellite capabilities, are transforming the market, offering faster and more accurate distress signaling. Consumer preferences are shifting towards more reliable, user-friendly, and connected ELT solutions, with an emphasis on reduced false alarms and longer operational lifespans. Competitive dynamics are characterized by intense product development, price competition, and strategic partnerships aimed at securing market share. The market penetration of advanced ELTs is steadily increasing, with an estimated XX% in commercial aviation and YY% in maritime sectors by 2025. Emerging trends include the development of ELTs with built-in flight data recorder capabilities and enhanced remote monitoring features, further solidifying the market's upward trajectory. The market is expected to witness a CAGR of Z.ZZ% during the forecast period.

Dominant Regions & Segments in Emergency Location Transmitter Market

North America currently holds a dominant position in the Emergency Location Transmitter market, driven by the presence of a large commercial aviation fleet, significant defense spending, and stringent safety regulations implemented by bodies like the Federal Aviation Administration (FAA). The United States, in particular, accounts for a substantial share of the regional market due to its advanced aerospace industry and robust maritime sector.

Aerospace Applications (Commercial and Defense)

This segment is the primary revenue generator for the Emergency Location Transmitter market.

- Key Drivers:

- Mandatory ELT carriage in civil aviation.

- Continuous fleet expansion in commercial airlines.

- Ongoing modernization of military aircraft fleets.

- Increased focus on search and rescue (SAR) capabilities.

- Technological advancements enabling faster and more accurate distress alerts.

- Dominance Analysis: The commercial aviation sector's sheer volume of aircraft, coupled with the defense sector's demand for robust and specialized ELTs, creates a consistent and significant market for these devices. Regulatory compliance remains a critical factor, ensuring a steady demand for certified ELTs.

Maritime Applications

The maritime sector represents a significant and growing segment within the Emergency Location Transmitter market.

- Key Drivers:

- International Maritime Organization (IMO) regulations, such as the Global Maritime Distress and Safety System (GMDSS).

- Increasing global shipping volumes and cargo transportation.

- Growth in recreational boating and leisure activities.

- Demand for enhanced safety for fishing fleets and offshore support vessels.

- Technological advancements in beacon durability and signaling range.

- Dominance Analysis: Stringent safety protocols in the maritime industry, particularly for commercial vessels, mandate the use of reliable distress signaling equipment. The growing awareness of personal safety among recreational boaters also contributes to market expansion.

Personal Applications

While a smaller segment, Personal Applications for Emergency Location Transmitters are witnessing steady growth.

- Key Drivers:

- Increased participation in outdoor adventure activities like hiking, climbing, and aviation.

- Growing awareness of personal safety and the need for remote communication.

- Development of more compact and user-friendly Personal Locator Beacons (PLBs).

- Advancements in satellite network coverage enabling global accessibility.

- Dominance Analysis: This segment is driven by individual consumer demand for enhanced safety during solo or remote expeditions. The affordability and portability of modern PLBs are key factors in their increasing adoption.

Emergency Location Transmitter Market Product Innovations

Recent product innovations in the Emergency Location Transmitter market focus on enhancing reliability, accuracy, and connectivity. Developments include ELTs with integrated GPS for precise location data, multi-frequency transmission capabilities for broader satellite reception, and extended battery life for prolonged operational periods. The introduction of 406 MHz ELTs with 121.5 MHz homing signals, alongside advancements in digital signal processing, minimizes false alarms and improves detection speed. These innovations offer competitive advantages by addressing critical end-user needs for swift and accurate distress alerting, thus bolstering market adoption.

Report Scope & Segmentation Analysis

The Emergency Location Transmitter Market is segmented by End-user Vertical into Aerospace Applications (Commercial and Defense), Maritime Applications, and Personal Applications.

The Aerospace Applications (Commercial and Defense) segment is projected to hold the largest market share, driven by mandatory regulations and continuous fleet expansion. Its market size is estimated to be $A.AA billion in 2025, with a projected CAGR of B.BB% during the forecast period.

The Maritime Applications segment is expected to witness significant growth, fueled by increased global shipping and recreational boating activities. The market size for this segment is anticipated to reach $C.CC billion by 2033, with a CAGR of D.DD%.

The Personal Applications segment, though smaller, presents a niche growth opportunity, driven by increasing consumer awareness for outdoor safety. Its market size is estimated to be $E.EE billion in 2025, with a projected CAGR of F.FF%.

Key Drivers of Emergency Location Transmitter Market Growth

The Emergency Location Transmitter market is propelled by several key drivers. Foremost is the escalating global demand for enhanced aviation and maritime safety, mandated by international regulatory bodies like ICAO and IMO. Technological advancements, including the integration of GPS and Galileo satellite systems, enable faster and more precise distress signaling, reducing search and rescue times significantly. The continuous growth in commercial aviation, with increasing passenger and cargo traffic, necessitates a larger fleet of aircraft equipped with reliable ELTs. Furthermore, the expanding maritime industry, encompassing both commercial shipping and recreational boating, along with a growing emphasis on personal safety for outdoor enthusiasts, contributes to the sustained demand for ELTs and Personal Locator Beacons (PLBs).

Challenges in the Emergency Location Transmitter Market Sector

Despite the growth, the Emergency Location Transmitter market faces several challenges. High initial costs associated with advanced ELT systems can be a barrier, particularly for smaller operators or in less regulated segments. Supply chain disruptions, as observed in recent global events, can impact the availability and pricing of critical components. Moreover, the increasing sophistication of ELTs requires specialized maintenance and training, adding to operational expenses. Intense competition among manufacturers can lead to price pressures, potentially affecting profit margins. The continuous evolution of technology also necessitates ongoing investment in research and development to remain competitive, posing a challenge for smaller players.

Emerging Opportunities in Emergency Location Transmitter Market

Emerging opportunities in the Emergency Location Transmitter market are abundant. The increasing adoption of IoT (Internet of Things) in safety devices presents a pathway for 'smart' ELTs with enhanced connectivity and real-time data transmission capabilities. Expansion into emerging economies with developing aviation and maritime infrastructure offers significant untapped market potential. The rising trend in adventure tourism and remote exploration creates a growing demand for personal locator beacons (PLBs) and wearable safety devices. Furthermore, the integration of ELT technology with advanced drone surveillance systems for SAR operations presents a novel and promising avenue for market growth.

Leading Players in the Emergency Location Transmitter Market Market

- Astronics Corporation

- Honeywell International Inc.

- Pointer Inc.

- ECA Group

- DSS Aviation

- HR Smith Group of Companies

- Orolia Holding SAS

- Dukane Seacom (Heico Corporation)

- Ack Avionics Technologies Inc.

- Emergency Beacon Corp.

- ACR Electronics Inc.

Key Developments in Emergency Location Transmitter Market Industry

- 2024: Introduction of new generation ELTs with Galileo return link service (RLS) capability, providing confirmation to the user that their distress message has been received.

- 2023: Increased focus on miniaturization and lighter weight ELTs for general aviation and personal safety applications.

- 2023: Advancements in battery technology leading to significantly longer operational life for ELTs, reducing maintenance frequency.

- 2022: Growing adoption of ELTs with integrated flight data recording capabilities in commercial aircraft.

- 2021: Enhanced regulatory push for mandatory ELT upgrades to meet newer communication standards and improved accuracy.

- 2020: Strategic partnerships between ELT manufacturers and satellite service providers to ensure seamless distress signaling.

Future Outlook for Emergency Location Transmitter Market Market

The future outlook for the Emergency Location Transmitter market remains exceptionally positive, driven by an unwavering commitment to aviation and maritime safety. Continued technological advancements, particularly in satellite communication and IoT integration, will lead to more intelligent and interconnected ELT systems. The expansion of commercial aviation in emerging markets, coupled with the growing popularity of recreational activities, will sustain demand. Innovations in power efficiency and miniaturization will make ELTs more accessible and suitable for a wider range of applications, including personal safety devices. Strategic collaborations and a focus on regulatory compliance will further solidify the market's growth trajectory, ensuring its critical role in global safety and rescue operations.

Emergency Location Transmitter Market Segmentation

-

1. End-user Vertical

- 1.1. Aerospace Applications (Commercial and Defense)

- 1.2. Maritime Applications

- 1.3. Personal Applications

Emergency Location Transmitter Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Emergency Location Transmitter Market Regional Market Share

Geographic Coverage of Emergency Location Transmitter Market

Emergency Location Transmitter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Aviation/Maritime Disasters

- 3.3. Market Restrains

- 3.3.1. ; Government Regulations and Policies on the Standards to be Maintained on the Devices

- 3.4. Market Trends

- 3.4.1. Aerospace Vertical to Have a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Emergency Location Transmitter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Aerospace Applications (Commercial and Defense)

- 5.1.2. Maritime Applications

- 5.1.3. Personal Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. North America Emergency Location Transmitter Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.1.1. Aerospace Applications (Commercial and Defense)

- 6.1.2. Maritime Applications

- 6.1.3. Personal Applications

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7. Europe Emergency Location Transmitter Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.1.1. Aerospace Applications (Commercial and Defense)

- 7.1.2. Maritime Applications

- 7.1.3. Personal Applications

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8. Asia Pacific Emergency Location Transmitter Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.1.1. Aerospace Applications (Commercial and Defense)

- 8.1.2. Maritime Applications

- 8.1.3. Personal Applications

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9. Latin America Emergency Location Transmitter Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.1.1. Aerospace Applications (Commercial and Defense)

- 9.1.2. Maritime Applications

- 9.1.3. Personal Applications

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10. Middle East and Africa Emergency Location Transmitter Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.1.1. Aerospace Applications (Commercial and Defense)

- 10.1.2. Maritime Applications

- 10.1.3. Personal Applications

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Astronics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pointer Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ECA Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DSS Aviation*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HR Smith Group of Companies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Orolia Holding SAS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dukane Seacom (Heico Corporation)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ack Avionics Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emergency Beacon Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ACR Electronics Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Astronics Corporation

List of Figures

- Figure 1: Global Emergency Location Transmitter Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Emergency Location Transmitter Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 3: North America Emergency Location Transmitter Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 4: North America Emergency Location Transmitter Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Emergency Location Transmitter Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Emergency Location Transmitter Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 7: Europe Emergency Location Transmitter Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: Europe Emergency Location Transmitter Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Emergency Location Transmitter Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Emergency Location Transmitter Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 11: Asia Pacific Emergency Location Transmitter Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Asia Pacific Emergency Location Transmitter Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Emergency Location Transmitter Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Emergency Location Transmitter Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 15: Latin America Emergency Location Transmitter Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Latin America Emergency Location Transmitter Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Emergency Location Transmitter Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Emergency Location Transmitter Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 19: Middle East and Africa Emergency Location Transmitter Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 20: Middle East and Africa Emergency Location Transmitter Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Emergency Location Transmitter Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Emergency Location Transmitter Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 2: Global Emergency Location Transmitter Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Emergency Location Transmitter Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Emergency Location Transmitter Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Emergency Location Transmitter Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Emergency Location Transmitter Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Emergency Location Transmitter Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Emergency Location Transmitter Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Emergency Location Transmitter Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Emergency Location Transmitter Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Emergency Location Transmitter Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Emergency Location Transmitter Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Emergency Location Transmitter Market?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the Emergency Location Transmitter Market?

Key companies in the market include Astronics Corporation, Honeywell International Inc, Pointer Inc, ECA Group, DSS Aviation*List Not Exhaustive, HR Smith Group of Companies, Orolia Holding SAS, Dukane Seacom (Heico Corporation), Ack Avionics Technologies Inc, Emergency Beacon Corp, ACR Electronics Inc.

3. What are the main segments of the Emergency Location Transmitter Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.4 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Aviation/Maritime Disasters.

6. What are the notable trends driving market growth?

Aerospace Vertical to Have a Major Market Share.

7. Are there any restraints impacting market growth?

; Government Regulations and Policies on the Standards to be Maintained on the Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Emergency Location Transmitter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Emergency Location Transmitter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Emergency Location Transmitter Market?

To stay informed about further developments, trends, and reports in the Emergency Location Transmitter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence