Key Insights

The Enzyme Inhibitors Drugs market is poised for significant expansion, driven by the escalating prevalence of chronic conditions such as cancer, HIV, and cardiovascular diseases necessitating enzyme inhibitor therapies. The market is projected to reach $14.98 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.07%. Key growth catalysts include advancements in targeted drug discovery, an aging global population, and rising healthcare expenditures worldwide. Market segmentation highlights the substantial contributions of Proton Pump Inhibitors (PPIs) for GERD and peptic ulcers, alongside Protease Inhibitors for HIV, Reverse Transcriptase Inhibitors, and Kinase Inhibitors for cancer treatment. North America and Europe currently lead market performance due to robust healthcare infrastructures and high adoption of advanced therapies. However, the Asia Pacific region is demonstrating rapid growth, fueled by increased awareness of chronic diseases, enhanced healthcare access, and a growing middle class. Intense competition exists among major pharmaceutical firms like Boehringer Ingelheim, Bayer, and Novartis, who are investing in R&D and strategic partnerships. Challenges include high development costs, potential drug resistance, and regulatory hurdles.

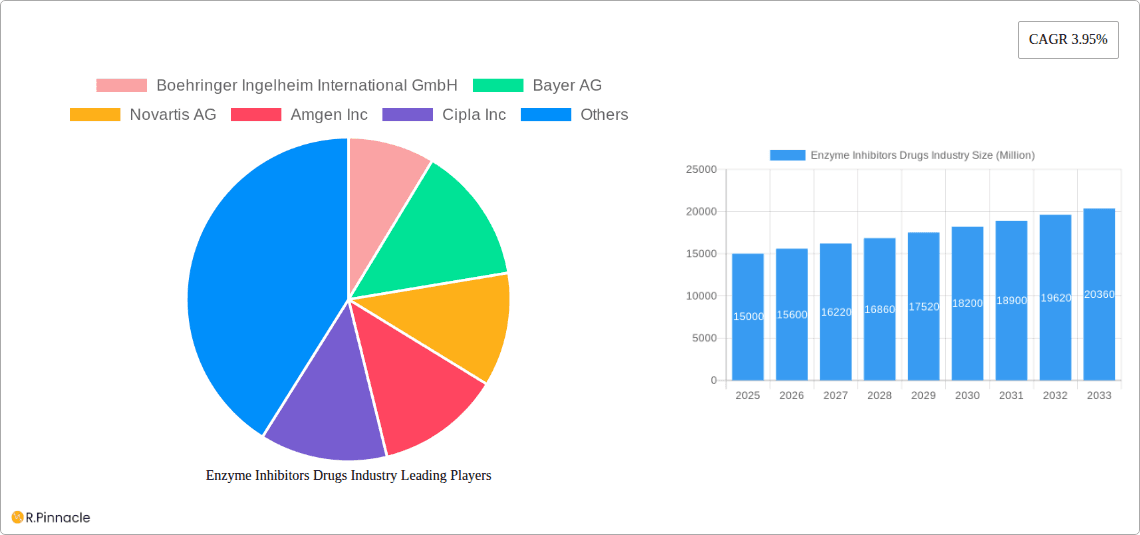

Enzyme Inhibitors Drugs Industry Market Size (In Billion)

Future market growth will be propelled by ongoing innovation in drug development, emphasizing improved efficacy, reduced side effects, and personalized medicine. Precision medicine and targeted therapies will significantly contribute, while biosimilar drug development may introduce pricing pressures. Growth is expected to be more rapid in emerging economies due to improving healthcare access and affordability. The competitive landscape will remain dynamic, with companies pursuing mergers, acquisitions, licensing agreements, and global expansion. Navigating regulatory complexities and ensuring patient safety will be critical for sustained market trust and growth.

Enzyme Inhibitors Drugs Industry Company Market Share

Enzyme Inhibitors Drugs Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Enzyme Inhibitors Drugs industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils market dynamics, competitive landscapes, and future growth opportunities. The global market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Enzyme Inhibitors Drugs Industry Market Structure & Innovation Trends

The Enzyme Inhibitors Drugs market exhibits a moderately concentrated structure, with key players like Boehringer Ingelheim International GmbH, Bayer AG, Novartis AG, and Amgen Inc. holding significant market share. Market share analysis reveals that the top five companies collectively account for approximately xx% of the global market in 2025. Innovation is driven by the continuous need for more effective, safer, and targeted enzyme inhibitors to treat various diseases. The regulatory landscape significantly impacts market growth, with stringent approval processes and safety regulations influencing product launches and market entry.

Product substitution is a key competitive factor, with companies constantly innovating to improve efficacy and reduce side effects. The end-user demographics are diverse, encompassing various healthcare settings (hospitals, clinics, etc.) and patient populations. Mergers and acquisitions (M&A) play a crucial role in market consolidation and technological advancement. Notable M&A activities include AstraZeneca's acquisition of CinCor Pharma in January 2023, valued at xx Million, significantly bolstering AstraZeneca's cardiorenal pipeline.

- Market Concentration: Moderately concentrated, top 5 players hold xx% market share (2025).

- Innovation Drivers: Need for improved efficacy, safety, and targeted therapies.

- Regulatory Framework: Stringent approval processes and safety regulations.

- M&A Activity: Significant role in market consolidation and technological advancement. Example: AstraZeneca's acquisition of CinCor Pharma (January 2023).

Enzyme Inhibitors Drugs Industry Market Dynamics & Trends

The Enzyme Inhibitors Drugs market is experiencing robust growth, fueled by increasing prevalence of chronic diseases, rising healthcare expenditure, and technological advancements in drug discovery and development. The market is witnessing a shift towards targeted therapies with improved efficacy and reduced side effects. Technological disruptions, particularly in areas like personalized medicine and biosimilars, are reshaping the competitive landscape. Consumer preferences are increasingly focused on convenient formulations and improved patient outcomes. Competitive dynamics are intense, characterized by ongoing innovation, strategic alliances, and product differentiation strategies.

The market's Compound Annual Growth Rate (CAGR) is projected at xx% from 2025 to 2033, driven primarily by the growing demand for effective treatments for various diseases. Market penetration is expected to increase significantly across various regions, particularly in developing economies with rising healthcare infrastructure. The industry faces challenges from generic competition, stringent regulatory requirements, and price pressure from healthcare payers.

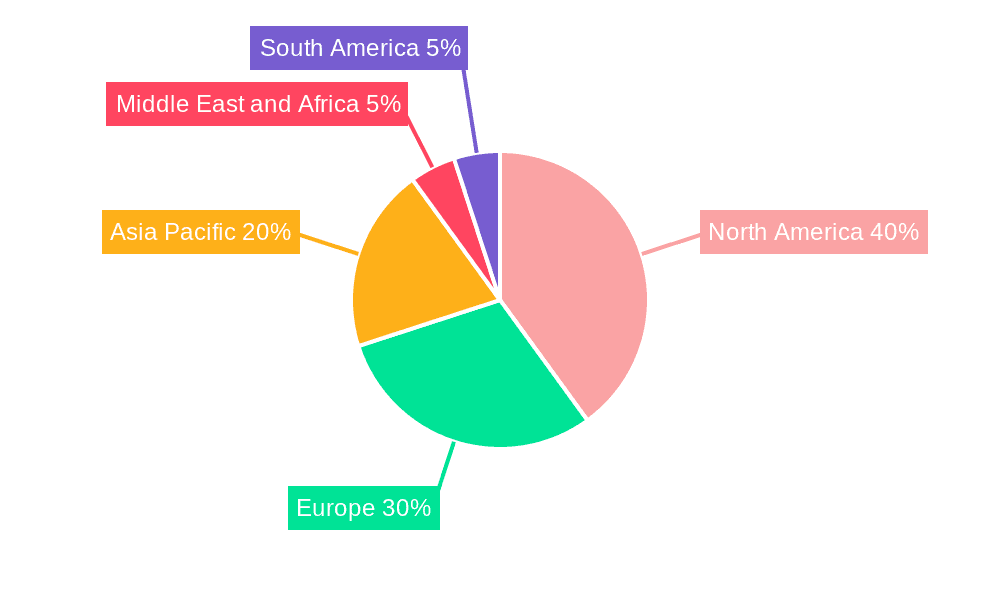

Dominant Regions & Segments in Enzyme Inhibitors Drugs Industry

The North American region currently dominates the Enzyme Inhibitors Drugs market, driven by high healthcare expenditure, advanced healthcare infrastructure, and a large patient population. However, emerging markets in Asia-Pacific are experiencing rapid growth, presenting significant future opportunities.

- By Type:

- Proton Pump Inhibitors (PPIs): High market share due to widespread use in treating acid reflux and ulcers.

- Protease Inhibitors: Significant growth in HIV/AIDS treatment.

- Reverse Transcriptase Inhibitors: Large market share in HIV/AIDS treatment.

- Kinase Inhibitors: Rapid growth driven by increasing use in cancer treatment.

- Other Types: Includes various specialized enzyme inhibitors with niche applications.

- By Application:

- Medical: The dominant segment, encompassing various therapeutic areas.

- Agriculture: Growing segment driven by the demand for pest control and crop protection.

- Other Applications: Includes industrial and research applications.

Key Drivers (Examples):

- North America: High healthcare expenditure, advanced healthcare infrastructure.

- Asia-Pacific: Rapid economic growth, increasing healthcare awareness.

- Europe: Established healthcare systems, focus on research and development.

Enzyme Inhibitors Drugs Industry Product Innovations

Recent product innovations focus on developing more targeted and effective enzyme inhibitors with reduced side effects. Advances in drug delivery systems and personalized medicine approaches are driving the development of novel formulations and treatment strategies. The market is witnessing a rise in biosimilar enzyme inhibitors, offering cost-effective alternatives to brand-name drugs. Companies are actively investing in research and development to improve the therapeutic index and expand the range of treatable diseases.

Report Scope & Segmentation Analysis

This report segments the Enzyme Inhibitors Drugs market by type (Proton Pump Inhibitors [PPIs], Protease Inhibitors, Reverse Transcriptase Inhibitors, Kinase Inhibitors, Other Types) and application (Medical, Agriculture, Other Applications). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. The report provides a comprehensive overview of the market, including historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033).

Key Drivers of Enzyme Inhibitors Drugs Industry Growth

The growth of the Enzyme Inhibitors Drugs industry is primarily driven by the rising prevalence of chronic diseases such as cardiovascular diseases, cancer, and HIV/AIDS. Technological advancements in drug discovery and development, increasing healthcare expenditure, and the growing adoption of targeted therapies also contribute significantly to market growth. Favorable regulatory environments in certain regions further stimulate market expansion. The increasing awareness of the benefits of enzyme inhibitors among healthcare professionals and patients also plays a crucial role.

Challenges in the Enzyme Inhibitors Drugs Industry Sector

The Enzyme Inhibitors Drugs industry faces challenges such as stringent regulatory approvals, increasing generic competition, high research and development costs, and patent expirations. Supply chain disruptions and price pressures from healthcare payers further constrain market growth. The need for continuous innovation to stay ahead of competitors and adapt to evolving market dynamics represents a significant challenge. The complexity of drug development and the high failure rate of clinical trials also contribute to the challenges faced by companies in the industry.

Emerging Opportunities in Enzyme Inhibitors Drugs Industry

Emerging opportunities lie in the development of novel enzyme inhibitors with improved efficacy and reduced side effects, especially in areas such as oncology and immunology. Growing demand for personalized medicine and advancements in biosimilar development present significant opportunities for market growth. Expanding into new geographic markets, particularly in developing economies, and focusing on unmet medical needs also offer substantial potential. The rise of precision medicine and combination therapies presents additional avenues for growth.

Leading Players in the Enzyme Inhibitors Drugs Industry Market

Key Developments in Enzyme Inhibitors Drugs Industry Industry

- January 2023: AstraZeneca announced the acquisition of CinCor Pharma, Inc., enhancing its cardiorenal pipeline.

- April 2022: Daewon Pharmaceutical launched Escorten, one of Korea's first proton-pump inhibitor drugs.

Future Outlook for Enzyme Inhibitors Drugs Industry Market

The Enzyme Inhibitors Drugs market is poised for continued growth, driven by technological advancements, expanding disease prevalence, and increasing healthcare spending. Strategic partnerships, acquisitions, and investments in research and development will further shape the market landscape. Focus on developing targeted therapies, biosimilars, and personalized medicine approaches will drive future market potential and offer significant strategic opportunities for industry players.

Enzyme Inhibitors Drugs Industry Segmentation

-

1. Type

- 1.1. Proton Pump Inhibitors [PPIs]

- 1.2. Protease Inhibitors

- 1.3. Reverse Transcriptase Inhibitors

- 1.4. Kinase Inhibitors

- 1.5. Other Types

-

2. Application

- 2.1. Medical

- 2.2. Agriculture

- 2.3. Other Applications

Enzyme Inhibitors Drugs Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Enzyme Inhibitors Drugs Industry Regional Market Share

Geographic Coverage of Enzyme Inhibitors Drugs Industry

Enzyme Inhibitors Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Effective and Accurate Drugs; Exponential Rise in the Incidence of Diseases like Cancer; Rising Global Agricultural Activities and Pharmaceutical Establishments

- 3.3. Market Restrains

- 3.3.1. Patent Expirations of Enzyme Inhibitor Drugs; Low-cost Generic Drugs

- 3.4. Market Trends

- 3.4.1. Kinase Inhibitors Segment Is Expected to Hold a Significant Share in the Enzyme Inhibitors Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enzyme Inhibitors Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proton Pump Inhibitors [PPIs]

- 5.1.2. Protease Inhibitors

- 5.1.3. Reverse Transcriptase Inhibitors

- 5.1.4. Kinase Inhibitors

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical

- 5.2.2. Agriculture

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Enzyme Inhibitors Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Proton Pump Inhibitors [PPIs]

- 6.1.2. Protease Inhibitors

- 6.1.3. Reverse Transcriptase Inhibitors

- 6.1.4. Kinase Inhibitors

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical

- 6.2.2. Agriculture

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Enzyme Inhibitors Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Proton Pump Inhibitors [PPIs]

- 7.1.2. Protease Inhibitors

- 7.1.3. Reverse Transcriptase Inhibitors

- 7.1.4. Kinase Inhibitors

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical

- 7.2.2. Agriculture

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Enzyme Inhibitors Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Proton Pump Inhibitors [PPIs]

- 8.1.2. Protease Inhibitors

- 8.1.3. Reverse Transcriptase Inhibitors

- 8.1.4. Kinase Inhibitors

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical

- 8.2.2. Agriculture

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Enzyme Inhibitors Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Proton Pump Inhibitors [PPIs]

- 9.1.2. Protease Inhibitors

- 9.1.3. Reverse Transcriptase Inhibitors

- 9.1.4. Kinase Inhibitors

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Medical

- 9.2.2. Agriculture

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Enzyme Inhibitors Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Proton Pump Inhibitors [PPIs]

- 10.1.2. Protease Inhibitors

- 10.1.3. Reverse Transcriptase Inhibitors

- 10.1.4. Kinase Inhibitors

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Medical

- 10.2.2. Agriculture

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim International GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amgen Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cipla Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ACROBiosystems Grou

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AstraZeneca PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Takeda Pharmaceutical Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abbott Laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bristol-Myers Squibb

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GlaxoSmithKline Pharmaceuticals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Merck & Co

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 F Hoffmann-La Roche

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pfizer Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim International GmbH

List of Figures

- Figure 1: Global Enzyme Inhibitors Drugs Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Enzyme Inhibitors Drugs Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Enzyme Inhibitors Drugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Enzyme Inhibitors Drugs Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Enzyme Inhibitors Drugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Enzyme Inhibitors Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Enzyme Inhibitors Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Enzyme Inhibitors Drugs Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Enzyme Inhibitors Drugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Enzyme Inhibitors Drugs Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Enzyme Inhibitors Drugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Enzyme Inhibitors Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Enzyme Inhibitors Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Enzyme Inhibitors Drugs Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Enzyme Inhibitors Drugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Enzyme Inhibitors Drugs Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Enzyme Inhibitors Drugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Enzyme Inhibitors Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Enzyme Inhibitors Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Enzyme Inhibitors Drugs Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East and Africa Enzyme Inhibitors Drugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Enzyme Inhibitors Drugs Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Middle East and Africa Enzyme Inhibitors Drugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Enzyme Inhibitors Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Enzyme Inhibitors Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Enzyme Inhibitors Drugs Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: South America Enzyme Inhibitors Drugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Enzyme Inhibitors Drugs Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: South America Enzyme Inhibitors Drugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Enzyme Inhibitors Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Enzyme Inhibitors Drugs Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: India Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: China Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Enzyme Inhibitors Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Enzyme Inhibitors Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enzyme Inhibitors Drugs Industry?

The projected CAGR is approximately 9.07%.

2. Which companies are prominent players in the Enzyme Inhibitors Drugs Industry?

Key companies in the market include Boehringer Ingelheim International GmbH, Bayer AG, Novartis AG, Amgen Inc, Cipla Inc, ACROBiosystems Grou, AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Abbott Laboratories, Bristol-Myers Squibb, GlaxoSmithKline Pharmaceuticals, 6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE, Merck & Co, F Hoffmann-La Roche, Pfizer Inc.

3. What are the main segments of the Enzyme Inhibitors Drugs Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Effective and Accurate Drugs; Exponential Rise in the Incidence of Diseases like Cancer; Rising Global Agricultural Activities and Pharmaceutical Establishments.

6. What are the notable trends driving market growth?

Kinase Inhibitors Segment Is Expected to Hold a Significant Share in the Enzyme Inhibitors Market.

7. Are there any restraints impacting market growth?

Patent Expirations of Enzyme Inhibitor Drugs; Low-cost Generic Drugs.

8. Can you provide examples of recent developments in the market?

In January 2023, AstraZeneca announced its acquisition of CinCor Pharma, Inc. The acquisition aims to enhance AstraZeneca's cardiorenal pipeline by including CinCor's candidate drug, baxdrostat (CIN-107), an aldosterone synthase inhibitor (ASI) for reducing blood pressure in cases of treatment-resistant hypertension.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enzyme Inhibitors Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enzyme Inhibitors Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enzyme Inhibitors Drugs Industry?

To stay informed about further developments, trends, and reports in the Enzyme Inhibitors Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence