Key Insights

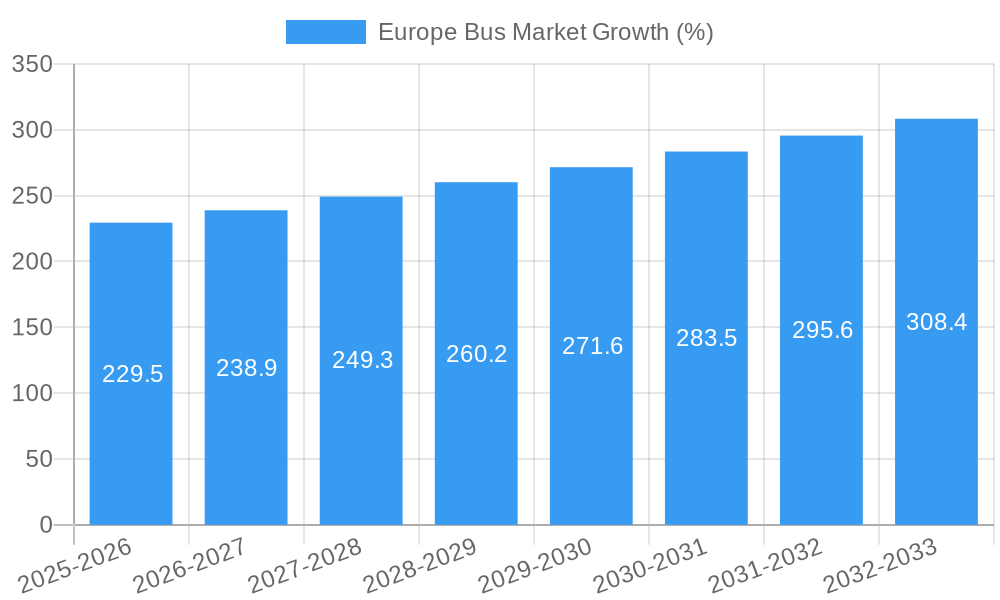

The European bus market, valued at €5.1 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising passenger numbers, and government initiatives promoting sustainable transportation. A Compound Annual Growth Rate (CAGR) of 4.5% is anticipated from 2025 to 2033, leading to a significant market expansion. Key growth drivers include the rising adoption of electric and hybrid buses fueled by stringent emission regulations and a growing focus on reducing carbon footprints. Furthermore, technological advancements in bus manufacturing, such as improved safety features and enhanced passenger comfort, are contributing to market expansion. The market is segmented by application (transit, intercity, school, and others), fuel type (diesel, battery electric, plug-in hybrid, fuel cell electric, and others), seating capacity (up to 30, 31-50, and more than 50 seats), length (up to 9 meters, 9-12 meters, and more than 12 meters), and deck type (single and double). Germany, France, and the United Kingdom represent the largest national markets within Europe, reflecting their higher population densities and extensive public transportation networks. The increasing demand for comfortable and efficient intercity travel, particularly among tourists and business travelers, is also positively impacting the market. However, challenges such as high initial investment costs for electric buses and the need for robust charging infrastructure could partially restrain market growth in the short term.

The competitive landscape is characterized by the presence of both established players like MAN Truck & Bus, Mercedes-Benz Group AG, Volvo Group, and Solaris Bus & Coaches, and emerging companies focusing on electric bus technology. These companies are actively engaged in product innovation, strategic partnerships, and expansion into new markets to gain a competitive edge. The market's future growth trajectory will significantly depend on the successful implementation of supportive government policies, continued technological advancements, and the overall economic conditions within Europe. The shift towards sustainable transportation solutions is undeniable, suggesting a promising outlook for the electric and hybrid bus segments in the coming years. Further research will focus on analyzing specific country-level trends and competitive dynamics to provide more granular insights into the evolving European bus market.

Europe Bus Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Bus Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth prospects. The study covers various segments, including application, fuel type, seating capacity, length, and country-specific analysis across major European nations.

Europe Bus Market Market Structure & Innovation Trends

The European bus market is undergoing a significant transformation driven by technological advancements, evolving regulatory landscapes, and shifting consumer preferences. This section delves into the competitive dynamics, innovation drivers, and key market trends shaping this dynamic sector. The analysis encompasses market concentration, influential mergers and acquisitions (M&A) activities, and the impact of regulatory frameworks on market participants. Leading players such as Solaris Bus & Coaches, Ballard Power Systems, MAN Truck & Bus, Mercedes Benz Group AG, ACTIA Group, IVECO Group, Traton Group, BYD Company Limited, Volvo Group (AB Volvo), and Wrightbus, are analyzed in terms of their market share and strategic initiatives.

- Market Concentration and Competition: A detailed assessment of market share held by the top players reveals the degree of market consolidation and identifies potential areas for disruption and new entrants. The competitive landscape is analyzed considering factors such as pricing strategies, product differentiation, and geographical reach. (Specific market share data would be inserted here).

- Innovation Drivers: Electrification, Automation, and Digitalization: This section examines the profound impact of electrification (including battery-electric and hydrogen fuel cell buses), automation (autonomous driving features), and digitalization (connected vehicle technologies and data analytics) on the future trajectory of the European bus market. The analysis includes discussions on technological advancements, infrastructure requirements, and the challenges involved in implementing these technologies at scale.

- Regulatory Landscape and Compliance: A comprehensive review of EU regulations concerning emissions (e.g., Euro VI and beyond), safety standards, accessibility requirements, and other relevant legislation is presented. The analysis assesses the impact of these regulations on market dynamics, including the associated compliance costs for manufacturers and operators. (Specific cost estimates would be included here).

- Impact of Substitute Transportation Options: The report assesses the influence of competing transportation modes, such as ride-sharing services, private vehicles, and high-speed rail, on the overall demand for bus services. Market projections and the factors influencing the adoption of alternative transportation modes are explored. (Specific ridership reduction projections with supporting data would be inserted here).

- Evolving End-User Demographics and Travel Patterns: The changing demographics of bus passengers are explored, considering factors such as age, income levels, and travel behavior. The analysis demonstrates how these trends affect bus design, route planning, and service offerings, focusing on the increasing demand for accessibility features catering to an aging population.

- Mergers, Acquisitions, and Strategic Alliances: This section provides a detailed overview of significant M&A activities in the European bus market, including deal values, strategic rationale, and the implications for market consolidation. Key trends in strategic partnerships and joint ventures are also discussed. (Specific deal values and details for the period 2019-2024 would be included here).

Europe Bus Market Market Dynamics & Trends

This section delves into the key factors influencing market growth, including technological advancements, evolving consumer preferences, and competitive strategies. The report projects a CAGR of xx% for the forecast period (2025-2033), driven by factors such as:

- Increasing urbanization and the need for efficient public transportation.

- Government initiatives promoting sustainable transportation.

- Technological advancements in electric and autonomous bus technologies.

- Growing demand for comfortable and convenient travel experiences.

The market penetration of electric buses is expected to increase from xx% in 2025 to xx% by 2033, driven by stricter emission regulations and advancements in battery technology. Competitive dynamics, such as pricing strategies, product differentiation, and technological innovation, are thoroughly examined.

Dominant Regions & Segments in Europe Bus Market

This section pinpoints the key geographical regions and market segments driving growth within the European bus market. Germany, France, and the United Kingdom consistently emerge as leading markets, reflecting a combination of factors such as robust public transportation infrastructure, government support for sustainable mobility, and high population density. Spain and other European countries also represent significant market opportunities.

Key Regional Drivers:

- Germany: The analysis highlights the significant investments in public transportation infrastructure, government incentives for adopting sustainable transport solutions, and the country's highly developed public transit network.

- France: The section examines France's commitment to modernizing urban transport systems, reducing carbon emissions, and the initiatives undertaken to promote the adoption of electric and alternative fuel buses.

- United Kingdom: The report emphasizes the rising demand for intercity bus services, government policies promoting improved regional connectivity, and investment in upgrading bus infrastructure.

- Spain: The analysis explores the influence of tourism on the bus market in Spain, the need for efficient public transportation in major cities, and the related opportunities for bus manufacturers and operators.

Dominant Market Segments:

- Application: A detailed breakdown of the application segments (transit buses, school buses, coach buses, etc.) with their respective market shares is provided, highlighting the dominant role of transit buses driven by urbanization.

- Fuel Type: This section analyzes the fuel type landscape, acknowledging the continued dominance of diesel while emphasizing the rapid growth of electric buses and the potential for alternative fuel types (hydrogen, biogas, etc.).

- Seating Capacity & Bus Length: The report presents a detailed segment analysis based on seating capacity and bus length, indicating the prevalent bus sizes based on market demand and operational requirements.

- Deck Type: The prevalence of single-deck versus double-deck buses in different market segments is examined, considering factors such as passenger capacity, operational efficiency, and infrastructure limitations.

Europe Bus Market Product Innovations

Recent product innovations have focused on enhancing fuel efficiency, safety, and passenger comfort. This includes the introduction of electric and hybrid buses, advanced driver-assistance systems (ADAS), and improved passenger information systems. These innovations aim to meet evolving consumer expectations and address environmental concerns. The market is seeing a significant uptake of electric buses, particularly in urban areas.

Report Scope & Segmentation Analysis

This report segments the Europe bus market by application (transit, intercity, school, other), fuel type (diesel, battery electric, plug-in hybrid, fuel cell electric, other), seating capacity (up to 30, 31-50, more than 50), length (up to 9m, 9-12m, more than 12m), country (Germany, France, UK, Spain, Rest of Europe), and deck type (single, double). Each segment's market size, growth projections, and competitive dynamics are analyzed. The market is expected to experience significant growth in the electric bus segment, driven by stringent emission norms.

Key Drivers of Europe Bus Market Growth

The European bus market is experiencing growth fueled by several factors, including increasing urbanization, government initiatives promoting sustainable transport, growing tourism, and technological advancements in electric and autonomous buses. Stricter emission regulations are driving the adoption of cleaner fuel technologies. Investments in public transportation infrastructure further boost market expansion.

Challenges in the Europe Bus Market Sector

Challenges facing the European bus market include high initial investment costs for electric buses, the availability of charging infrastructure, competition from other modes of transportation, and regulatory hurdles. Supply chain disruptions and fluctuations in raw material prices also impact profitability. The transition to electric fleets is hampered by limited charging infrastructure in certain regions.

Emerging Opportunities in Europe Bus Market

The European bus market presents numerous opportunities for growth and innovation. The increasing adoption of electric and autonomous buses is a key trend, alongside the expansion of bus rapid transit (BRT) systems designed to improve efficiency and reduce congestion in urban areas. The integration of smart technologies, such as intelligent transportation systems (ITS), offers further opportunities for enhancing the passenger experience and improving operational efficiency. The market also shows potential for premium bus services, personalized travel experiences, and the development of innovative technologies like hydrogen fuel-cell buses and advanced battery systems.

Leading Players in the Europe Bus Market Market

- Solaris Bus & Coaches

- Ballard Power Systems

- MAN Truck & Bus

- Mercedes Benz Group AG

- ACTIA Group

- IVECO Group

- Traton Group

- BYD Company Limited

- Volvo Group (AB Volvo)

- Wrightbus

Key Developments in Europe Bus Market Industry

- June 2023: BYD announces a significant expansion of its electric bus production facility in Europe, highlighting the company's commitment to the European market and the growing demand for electric buses.

- October 2022: Solaris Bus & Coaches launches its latest electric bus model with enhanced range and charging capabilities, showcasing advancements in battery technology and charging infrastructure.

- March 2022: Volvo Group announces a partnership to develop autonomous bus technologies. (Further specific development details, including partner names and project timelines, could be included here, based on actual data)

- Add other relevant key developments here with dates and brief descriptions. Include details such as new product launches, significant partnerships, regulatory updates, or noteworthy investments in the market.

Future Outlook for Europe Bus Market Market

The future outlook for the Europe bus market remains positive, driven by continued urbanization, supportive government policies, and technological advancements. The market is poised for significant growth in the electric bus segment, with opportunities for innovation in areas such as autonomous driving, improved battery technology, and enhanced passenger experience. Strategic partnerships and investments in infrastructure will play a crucial role in shaping the future of the European bus market.

Europe Bus Market Segmentation

-

1. Deck Type

- 1.1. Single

- 1.2. Double

-

2. Application

- 2.1. Transit Bus

- 2.2. Intercity Bus/Motorcoaches

- 2.3. School Bus

- 2.4. Other Applications

-

3. Fuel Type

- 3.1. Diesel

- 3.2. Battery Electric

- 3.3. Plug-in Hybrid

- 3.4. Fuel Cell Electric

- 3.5. Other Fuel Types

-

4. Seating Capacity

- 4.1. Up to 30 seats

- 4.2. 31-50 seats

- 4.3. more than 50 seats

-

5. Length

- 5.1. up to 9 meters

- 5.2. 9-12 meters

- 5.3. more than 12 meters

Europe Bus Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for New Energy Buses

- 3.3. Market Restrains

- 3.3.1. Reduced Subsidies on Electric Buses

- 3.4. Market Trends

- 3.4.1. Battery Electric Bus is Expected to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deck Type

- 5.1.1. Single

- 5.1.2. Double

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Transit Bus

- 5.2.2. Intercity Bus/Motorcoaches

- 5.2.3. School Bus

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Diesel

- 5.3.2. Battery Electric

- 5.3.3. Plug-in Hybrid

- 5.3.4. Fuel Cell Electric

- 5.3.5. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Seating Capacity

- 5.4.1. Up to 30 seats

- 5.4.2. 31-50 seats

- 5.4.3. more than 50 seats

- 5.5. Market Analysis, Insights and Forecast - by Length

- 5.5.1. up to 9 meters

- 5.5.2. 9-12 meters

- 5.5.3. more than 12 meters

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deck Type

- 6. Germany Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Bus Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Solaris Bus & Coaches

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ballard Power Systems

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 MAN Truck & Bus

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mercedes Benz Group AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ACTIA Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 IVECO Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Traton Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BYD Company Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Volvo Group (AB Volvo)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Wrightbu

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Solaris Bus & Coaches

List of Figures

- Figure 1: Europe Bus Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Bus Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Bus Market Revenue Million Forecast, by Deck Type 2019 & 2032

- Table 3: Europe Bus Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Bus Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Europe Bus Market Revenue Million Forecast, by Seating Capacity 2019 & 2032

- Table 6: Europe Bus Market Revenue Million Forecast, by Length 2019 & 2032

- Table 7: Europe Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Bus Market Revenue Million Forecast, by Deck Type 2019 & 2032

- Table 17: Europe Bus Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Bus Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 19: Europe Bus Market Revenue Million Forecast, by Seating Capacity 2019 & 2032

- Table 20: Europe Bus Market Revenue Million Forecast, by Length 2019 & 2032

- Table 21: Europe Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Bus Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Europe Bus Market?

Key companies in the market include Solaris Bus & Coaches, Ballard Power Systems, MAN Truck & Bus, Mercedes Benz Group AG, ACTIA Group, IVECO Group, Traton Group, BYD Company Limited, Volvo Group (AB Volvo), Wrightbu.

3. What are the main segments of the Europe Bus Market?

The market segments include Deck Type, Application, Fuel Type, Seating Capacity, Length.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for New Energy Buses.

6. What are the notable trends driving market growth?

Battery Electric Bus is Expected to Witness Highest Growth.

7. Are there any restraints impacting market growth?

Reduced Subsidies on Electric Buses.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Bus Market?

To stay informed about further developments, trends, and reports in the Europe Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence