Key Insights

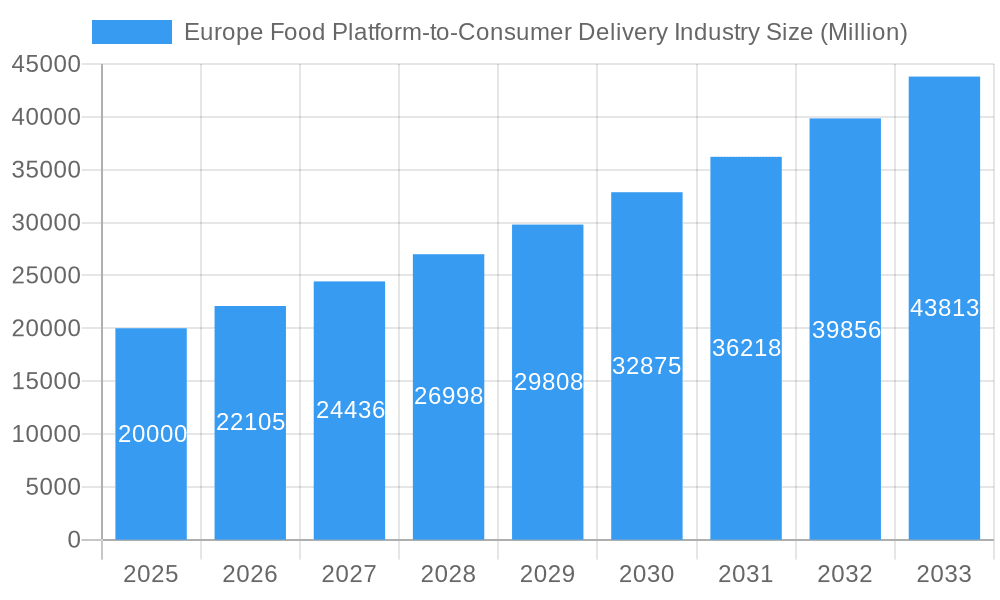

The European Food Platform-to-Consumer Delivery market is projected to reach 73798.4 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.7% from a base year of 2024. This growth is propelled by escalating smartphone adoption, evolving consumer lifestyles prioritizing convenience, and the broadening array of culinary options available online. Key drivers include the surge in quick-commerce, advanced technological integration (AI, machine learning) for optimized operations, and the increasing popularity of subscription services and loyalty programs. Leading companies are actively investing in technology, expanding service areas, and forming strategic restaurant partnerships to strengthen their market standing. While challenges like fluctuating operational costs and intense competition persist, sustained consumer demand and continuous innovation ensure a positive market trajectory.

Europe Food Platform-to-Consumer Delivery Industry Market Size (In Billion)

Potential restraints include regulatory complexities surrounding food safety, labor legislation for gig workers, and environmental concerns stemming from delivery-related carbon footprints. Market segmentation across European nations reveals diverse growth patterns, with Germany, the UK, and France leading in adoption and competition. Southern European countries show promising growth potential, albeit with potentially slower adoption rates influenced by factors such as smartphone penetration and cultural nuances. Sustained market success will depend on addressing these challenges through sustainable practices, ethical labor models, and technological advancements that boost efficiency and minimize environmental impact. The competitive environment, featuring both established global players and agile local entrants, fosters ongoing innovation and benefits consumers.

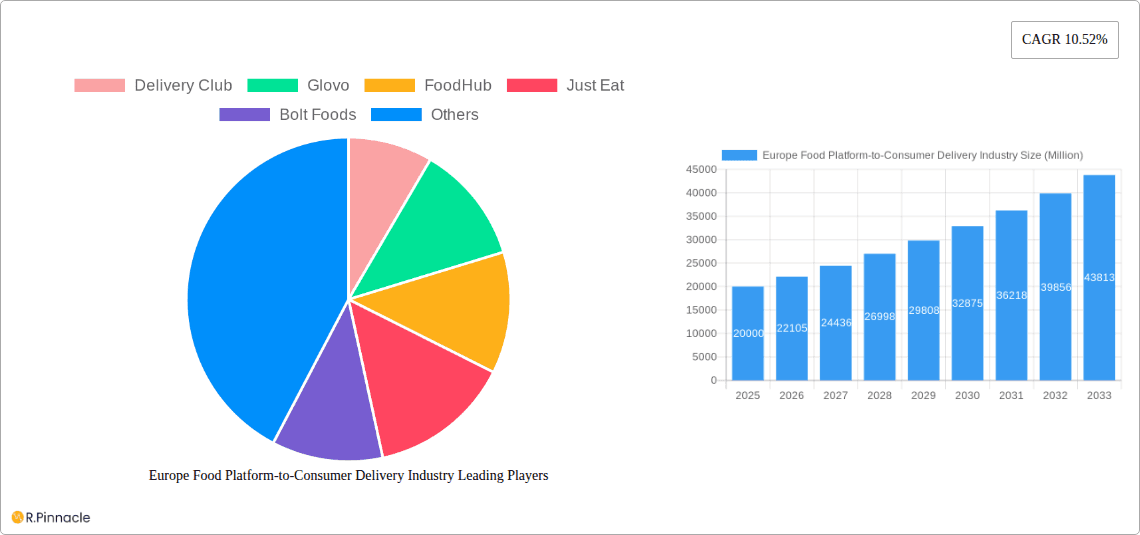

Europe Food Platform-to-Consumer Delivery Industry Company Market Share

Europe Food Platform-to-Consumer Delivery Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Europe Food Platform-to-Consumer Delivery Industry, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategists seeking to navigate this dynamic and rapidly evolving market. With a focus on key players like Delivery Club, Glovo, FoodHub, Just Eat, Bolt Foods, Delivery Hero, Deliveroo, Uber Eats, GrubHub, Doordash Inc., and FoodPanda, the report delivers actionable intelligence on market size, growth projections, and competitive landscapes across key European countries. The base year for this report is 2025, with estimates and forecasts extending to 2033.

Europe Food Platform-to-Consumer Delivery Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European food delivery market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report delves into the end-user demographics driving growth and the impact of substitute products.

- Market Concentration: The market is characterized by a mix of large multinational players and regional specialists. The top five players (estimated) hold approximately XX% of the market share in 2025.

- Innovation Drivers: Technological advancements, such as AI-powered recommendation engines and drone delivery trials, are key innovation drivers. Furthermore, evolving consumer preferences for convenience and diverse cuisines fuel innovation in menu offerings and delivery options.

- Regulatory Frameworks: Varying regulations across European countries influence operational costs and market entry strategies. Data privacy and food safety regulations are significant considerations for all players.

- M&A Activities: The report documents significant M&A activity in the historical period (2019-2024), with a total deal value estimated at €XX Billion. Key acquisitions are analyzed in detail.

- Product Substitutes: The rise of quick-commerce grocery delivery services represents a growing competitive threat to traditional food delivery platforms.

Europe Food Platform-to-Consumer Delivery Industry Market Dynamics & Trends

This section explores the key market dynamics driving growth in the European food delivery sector. It examines market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report includes detailed analysis of market penetration and compound annual growth rate (CAGR).

The European food delivery market is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and a surge in demand for convenience. Technological advancements, particularly in mobile app technology and logistics optimization, are further accelerating market expansion. Consumer preferences are shifting towards healthier options, personalized experiences, and sustainable practices. The highly competitive landscape fosters innovation and efficiency improvements. The CAGR for the forecast period (2025-2033) is projected at XX%, with market penetration expected to reach XX% by 2033.

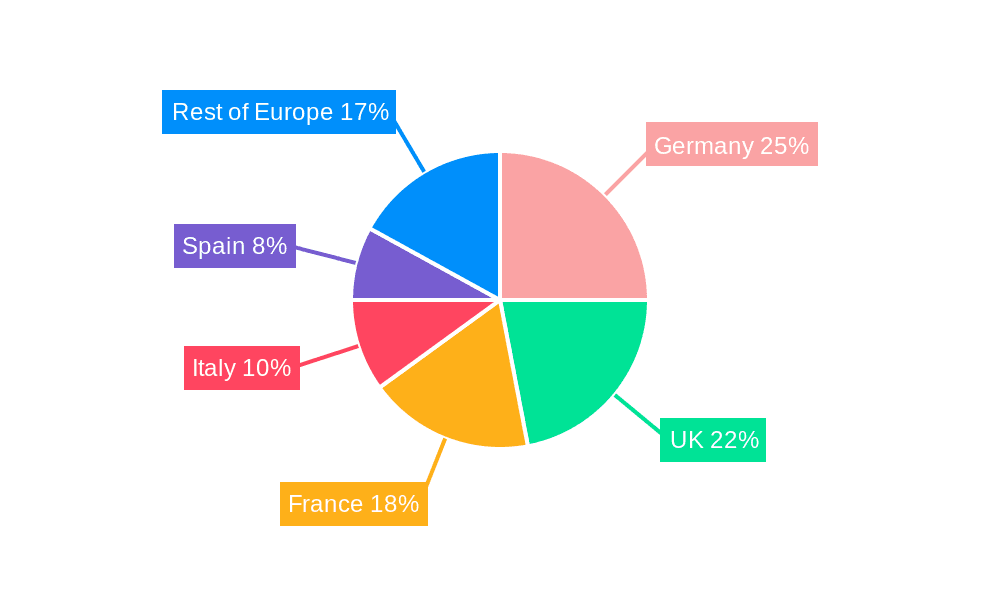

Dominant Regions & Segments in Europe Food Platform-to-Consumer Delivery Industry

This section identifies the leading regions and segments within the European food delivery market. Detailed analysis focuses on the United Kingdom, Germany, France, Italy, Spain, and the Rest of Europe.

Key Findings:

- United Kingdom: The UK remains a dominant market, driven by high smartphone penetration, strong consumer spending, and a well-established delivery infrastructure.

- Germany: Germany presents significant growth potential, fueled by increasing urban populations and rising adoption of online food ordering.

- France: France exhibits steady growth, with increasing demand for diverse cuisines and convenient delivery options.

- Italy: Italy shows moderate growth, influenced by the traditional preference for dining in and varying levels of digital penetration across regions.

- Spain: Spain's market is characterized by a high rate of adoption among younger demographics and increased competition.

- Rest of Europe: This segment displays diverse growth trajectories across various nations, reflecting their individual economic and technological landscapes.

Key Drivers:

- Economic Policies: Government incentives and regulations influence the industry's growth trajectory and investor confidence.

- Infrastructure: Efficient transportation networks and reliable logistics are essential for successful operations.

- Consumer Behavior: Changing lifestyles, urbanisation, and preference for convenience greatly influence demand.

Europe Food Platform-to-Consumer Delivery Industry Product Innovations

Continuous product innovation is crucial in this competitive market. Recent trends include the introduction of subscription services, expansion of delivery options (e.g., grocery delivery, dark kitchens), and integration of AI-powered features to enhance user experience. These innovations are aimed at enhancing convenience, improving efficiency, and creating unique value propositions to gain a competitive edge.

Report Scope & Segmentation Analysis

This report segments the market by country: United Kingdom, Germany, France, Italy, Spain, and Rest of Europe. Each segment is analyzed based on market size, growth projections, and competitive dynamics. Growth projections for each segment vary depending on local market conditions and regulatory frameworks. The UK and German markets are projected to experience the highest growth during the forecast period. Competitive intensity varies significantly by region, with some markets exhibiting a more consolidated structure compared to others.

Key Drivers of Europe Food Platform-to-Consumer Delivery Industry Growth

Several key factors are driving growth in the European food platform-to-consumer delivery industry. These include the increasing prevalence of smartphones and mobile internet access, changing consumer lifestyles favoring convenience, rising disposable incomes, and the emergence of innovative business models such as ghost kitchens and quick-commerce services. Furthermore, government initiatives promoting digitalization and e-commerce contribute to this expansion.

Challenges in the Europe Food Platform-to-Consumer Delivery Industry Sector

The sector faces several challenges, including high operating costs, intense competition, stringent regulations, and concerns around food safety and data privacy. Fluctuating fuel prices and labor shortages also present operational hurdles. These factors exert pressure on profit margins and require companies to constantly adapt their strategies. The impact of these challenges is reflected in varying profit margins across different markets and company sizes.

Emerging Opportunities in Europe Food Platform-to-Consumer Delivery Industry

Several emerging opportunities exist. These include the expansion into underserved regions, the development of specialized delivery services (e.g., grocery, alcohol), the integration of new technologies (e.g., drones, autonomous vehicles), and the personalization of the customer experience through AI-powered recommendations. The sustainability of the industry is also emerging as a key opportunity, with consumers increasingly demanding eco-friendly delivery solutions.

Leading Players in the Europe Food Platform-to-Consumer Delivery Industry Market

- Delivery Hero

- Deliveroo

- Uber Eats

- Just Eat Takeaway

- Glovo

- Bolt Foods

- FoodHub

- GrubHub

- Doordash Inc.

- FoodPanda

- Delivery Club

Key Developments in Europe Food Platform-to-Consumer Delivery Industry

- June 2022: Just Eat increased its restaurant commission charges by 1% due to rising inflation and operational costs. This impacted restaurant profitability and potentially consumer prices.

- March 2022: Deliveroo launched an engineering center in Hyderabad, India, marking its expansion into the Indian market.

Future Outlook for Europe Food Platform-to-Consumer Delivery Industry Market

The future outlook for the European food delivery market remains positive, driven by sustained consumer demand for convenience, technological advancements, and the continued growth of e-commerce. However, companies must navigate regulatory challenges and intense competition to capitalize on this growth potential. Strategic partnerships, technological innovation, and efficient operations will be crucial for success in this evolving market.

Europe Food Platform-to-Consumer Delivery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Food Platform-to-Consumer Delivery Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Food Platform-to-Consumer Delivery Industry Regional Market Share

Geographic Coverage of Europe Food Platform-to-Consumer Delivery Industry

Europe Food Platform-to-Consumer Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. New delivery platforms (Aggregator platforms) are driving the growth towards the market; Increasing the number of takeaway services

- 3.3. Market Restrains

- 3.3.1. Increased Competition in the Market

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Online Food Delivery Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delivery Club

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Glovo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FoodHub

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Just Eat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bolt Foods

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delivery Hero

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Deliveroo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Uber Eat

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GrubHub

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Doordash Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 FoodPanda

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Delivery Club

List of Figures

- Figure 1: Europe Food Platform-to-Consumer Delivery Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Food Platform-to-Consumer Delivery Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Region 2020 & 2033

- Table 7: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Platform-to-Consumer Delivery Industry?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Europe Food Platform-to-Consumer Delivery Industry?

Key companies in the market include Delivery Club, Glovo, FoodHub, Just Eat, Bolt Foods, Delivery Hero, Deliveroo, Uber Eat, GrubHub, Doordash Inc, FoodPanda.

3. What are the main segments of the Europe Food Platform-to-Consumer Delivery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 73798.4 million as of 2022.

5. What are some drivers contributing to market growth?

New delivery platforms (Aggregator platforms) are driving the growth towards the market; Increasing the number of takeaway services.

6. What are the notable trends driving market growth?

Increasing Demand of Online Food Delivery Platforms.

7. Are there any restraints impacting market growth?

Increased Competition in the Market.

8. Can you provide examples of recent developments in the market?

June 2022 - Just Eat, one of the prominent players in the online meals delivery market in Europe, increased its restaurant commission charges by 1%. With rising inflation and higher operational costs, the company has increased its commission charges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Platform-to-Consumer Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Platform-to-Consumer Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Platform-to-Consumer Delivery Industry?

To stay informed about further developments, trends, and reports in the Europe Food Platform-to-Consumer Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence