Key Insights

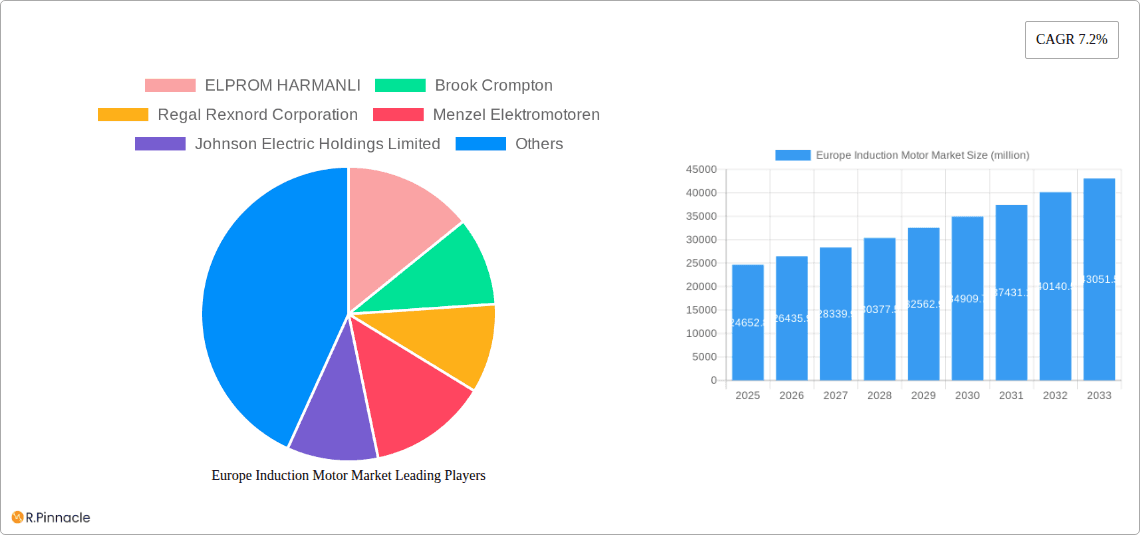

The European Induction Motor Market is poised for significant expansion, projected to reach USD 24,652.8 million in 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This upward trajectory is fueled by the increasing demand for energy-efficient motors across various industrial sectors, driven by stringent environmental regulations and a growing emphasis on sustainability. Key growth drivers include the ongoing industrial automation initiatives, the replacement of older, less efficient motor technologies, and the expansion of critical infrastructure projects, particularly in power generation and water & wastewater management. The "Industry 4.0" revolution further propels the market as smart factories integrate advanced induction motors for enhanced operational efficiency and predictive maintenance capabilities.

Europe Induction Motor Market Market Size (In Billion)

The market's growth is further bolstered by the burgeoning demand for both single-phase and three-phase induction motors, with three-phase motors likely to dominate due to their higher efficiency and power output, essential for heavy-duty industrial applications. Key end-user industries such as Oil & Gas, Chemical & Petrochemical, and Power Generation are anticipated to be major contributors, leveraging induction motors for their core operations. The Metal & Mining and Food & Beverage sectors also represent significant growth avenues. While the market presents substantial opportunities, potential restraints such as the high initial cost of advanced, energy-efficient motors and the availability of alternative motor technologies may pose challenges. However, the long-term benefits of reduced energy consumption and operational costs are expected to outweigh these concerns, ensuring sustained market expansion.

Europe Induction Motor Market Company Market Share

Gain unparalleled insights into the Europe Induction Motor Market with this comprehensive report, meticulously crafted to equip industry professionals with actionable intelligence. Covering the period from 2019 to 2033, with a base year of 2025, this study delves deep into market dynamics, regional dominance, product innovations, and key growth drivers. Uncover critical trends shaping the industrial motor landscape, including the increasing demand for energy-efficient motors and the impact of evolving regulatory frameworks. Essential for OEMs, component manufacturers, distributors, and end-users across sectors like Oil & Gas, Chemical & Petrochemical, and Power Generation, this report provides a definitive roadmap for strategic decision-making in the burgeoning electric motor market.

Europe Induction Motor Market Market Structure & Innovation Trends

The Europe Induction Motor Market exhibits a moderate to high level of concentration, with a few dominant players holding significant market share. Innovation is primarily driven by the relentless pursuit of enhanced energy efficiency, increased power density, and improved reliability. Regulatory frameworks, particularly those focused on energy conservation and emissions reduction, are powerful catalysts for product development and adoption. While direct product substitutes are limited in core applications, advancements in alternative motor technologies and power electronics present potential competitive pressures. End-user demographics are increasingly influenced by sustainability initiatives and the total cost of ownership, favoring solutions that offer long-term operational savings. Mergers and acquisitions (M&A) activities have been strategic, aimed at consolidating market positions, expanding product portfolios, and acquiring technological expertise. The market share of key players is estimated to be closely monitored, with M&A deal values often reflecting strategic market access and technological integration.

Europe Induction Motor Market Market Dynamics & Trends

The Europe Induction Motor Market is experiencing robust growth, fueled by several key dynamics and trends. A primary growth driver is the escalating emphasis on energy efficiency across all industrial sectors. Stringent government regulations and corporate sustainability goals are compelling industries to adopt motors with higher efficiency ratings, such as IE4 and IE5, thereby reducing operational costs and carbon footprints. This trend is particularly evident in sectors like Water & Wastewater, Metal & Mining, and Discrete Industries, where motor-driven equipment accounts for a substantial portion of energy consumption. Technological disruptions are also playing a pivotal role. The integration of advanced materials, sophisticated control systems, and smart features like predictive maintenance capabilities is enhancing motor performance and longevity. For instance, the development of permanent magnet synchronous motors and advancements in variable frequency drives (VFDs) are offering superior control and energy savings, pushing the boundaries of traditional induction motor capabilities.

Consumer preferences are shifting towards solutions that offer not only high performance but also ease of integration, reduced maintenance, and extended service life. The total cost of ownership (TCO) is becoming a critical purchasing criterion, with end-users actively seeking motors that deliver long-term economic benefits. This preference is driving demand for durable, reliable, and easily maintainable induction motors. Competitive dynamics are intensifying, with manufacturers investing heavily in R&D to differentiate their offerings through superior efficiency, advanced features, and innovative designs. The market penetration of high-efficiency motors is projected to increase significantly over the forecast period, driven by both regulatory mandates and market demand. The compound annual growth rate (CAGR) for the Europe Induction Motor Market is expected to remain healthy, reflecting the ongoing industrialization, infrastructure development, and the continuous drive for operational excellence across the continent. The increasing adoption of automation in manufacturing processes further boosts the demand for reliable and efficient induction motors to power various machinery and equipment.

Dominant Regions & Segments in Europe Induction Motor Market

The Germany region stands out as a dominant force within the Europe Induction Motor Market, driven by its robust industrial base, strong manufacturing sector, and significant investments in energy-efficient technologies. Germany's economic policies, particularly its commitment to the Energiewende (energy transition), foster a supportive environment for the adoption of advanced and sustainable industrial equipment, including high-efficiency induction motors. The country's stringent environmental regulations and incentives for energy-saving solutions further bolster the demand for these products.

Within the Type segmentation, the Three-phase Induction Motor segment holds a commanding market share. This dominance is attributed to their superior power output, efficiency, and versatility, making them indispensable for heavy-duty industrial applications across various end-user industries. Their ability to handle high torque and continuous operation makes them the preferred choice for critical processes in sectors like Power Generation, Chemical & Petrochemical, and Metal & Mining.

In terms of End-user Industry, the Power Generation sector is a significant contributor to the market's growth. The continuous demand for electricity, coupled with the ongoing modernization of power plants and the expansion of renewable energy infrastructure, necessitates a steady supply of reliable and efficient induction motors for pumps, fans, and other auxiliary equipment. The Water & Wastewater industry also presents substantial demand due to the critical need for pumping and aeration systems, where energy efficiency directly translates to operational cost savings. Furthermore, the Chemical & Petrochemical sector relies heavily on induction motors for various processing applications, including pumps, compressors, and mixers, where reliability and efficiency are paramount. The Discrete Industries, encompassing manufacturing and assembly operations, also contribute significantly, driven by automation and the need to power a wide array of machinery.

Europe Induction Motor Market Product Innovations

Product innovations in the Europe Induction Motor Market are increasingly focused on enhancing energy efficiency, extending operational lifespan, and integrating smart capabilities. Manufacturers are developing motors with advanced materials and designs to achieve higher IE efficiency classes, such as IE4 and IE5, leading to substantial energy savings for end-users. The integration of IoT and AI for predictive maintenance is a significant trend, allowing for real-time monitoring of motor health and enabling proactive servicing to prevent downtime. These innovations not only improve performance and reduce operational costs but also offer a competitive edge by providing enhanced reliability and sustainability.

Report Scope & Key Developments in Europe Induction Motor Market Industry

The Europe Induction Motor Market is segmented by Type into Single-phase Induction Motor and Three-phase Induction Motor. The Single-phase Induction Motor segment, while smaller, caters to specific applications requiring lower power outputs. The Three-phase Induction Motor segment is significantly larger and more dynamic, serving a broad range of industrial needs.

The market is further segmented by End-user Industry, including Oil & Gas, Chemical & Petrochemical, Power Generation, Water & Wastewater, Metal & Mining, Food & Beverage, Discrete Industries, and Other End-user Industries. Each segment exhibits unique demand drivers and growth trajectories, influenced by industry-specific operational requirements and regulatory landscapes. For instance, the Oil & Gas sector's demand is linked to exploration and production activities, while the Food & Beverage industry requires motors compliant with stringent hygiene standards.

Key Developments:

- June 2022: ABB announced that its electric motors can achieve a prolonged operational life of up to 50,000 hours. The company is championing energy efficiency principles across all motor-driven applications, including heavy-duty construction machinery, and is committed to meeting future goals through zero-emission technology. ABB's first zero-emissions building project involves fitting an electric motor and drive, an energy management system, a battery and charging solution, and a power connection. ABB is supplying the electric powertrain components and providing essential technical advice.

- April 2022: In response to rising energy costs, Nidec Motor Corporation introduced its innovative SynRA product, designed to meet the critical need for highly energy-efficient pumping equipment. This new motor offers one of the highest efficiencies available for commercial pumping and HVAC equipment, achieving IE 4 and IE 5 ratings. The SynRA's unique design allows for the replacement of individual components rather than the entire system, leading to lower maintenance costs and enhanced operational benefits.

Key Drivers of Europe Induction Motor Market Growth

The Europe Induction Motor Market is propelled by several significant growth drivers. The intensifying focus on energy efficiency and sustainability, driven by stringent environmental regulations and corporate social responsibility initiatives, is a primary catalyst. The increasing demand for automation and smart manufacturing across various industries, necessitating reliable and high-performance motor solutions, further fuels market expansion. Moreover, ongoing infrastructure development and modernization projects in sectors like power generation and water treatment require substantial numbers of induction motors. The transition towards electric vehicles and the electrification of industrial processes also contribute to sustained demand.

Challenges in the Europe Induction Motor Market Sector

Despite the positive growth trajectory, the Europe Induction Motor Market faces several challenges. Intense price competition among manufacturers, particularly for standard motor models, can strain profit margins. Fluctuations in raw material costs, such as copper and steel, can impact production expenses and pricing strategies. The increasing adoption of advanced motor technologies, like permanent magnet synchronous motors, presents a competitive challenge to traditional induction motors in certain high-performance applications. Furthermore, the complex regulatory landscape across different European countries can create compliance hurdles for manufacturers and distributors. Supply chain disruptions, as experienced globally in recent years, can also impact the availability of components and lead to production delays.

Emerging Opportunities in Europe Induction Motor Market

Emerging opportunities in the Europe Induction Motor Market are abundant, driven by technological advancements and evolving market demands. The growing demand for highly efficient motors (IE4 and IE5 standards) presents a significant opportunity for manufacturers to innovate and capture market share. The expansion of the industrial Internet of Things (IIoT) ecosystem creates opportunities for smart motors equipped with advanced sensors and connectivity for predictive maintenance and remote monitoring. The increasing adoption of electric propulsion systems in marine and industrial applications also opens new avenues for growth. Furthermore, the focus on decarbonization and the circular economy is driving demand for motor solutions that are not only energy-efficient but also designed for longevity and recyclability.

Leading Players in the Europe Induction Motor Market Market

- ELPROM HARMANLI

- Brook Crompton

- Regal Rexnord Corporation

- Menzel Elektromotoren

- Johnson Electric Holdings Limited

- AC-MOTOREN GmbH

- CG Power & Industrial Solutions Ltd

- WEG

- Nidec Motor Corporation

- ABB

Future Outlook for Europe Induction Motor Market Market

The future outlook for the Europe Induction Motor Market remains exceptionally bright, underpinned by sustained demand for industrialization, technological innovation, and a strong commitment to sustainability. The increasing adoption of advanced energy-efficient motors, driven by evolving regulatory mandates and a growing awareness of operational cost savings, will continue to be a primary growth accelerator. The integration of smart technologies, such as IoT-enabled monitoring and predictive maintenance, will further enhance the value proposition of induction motors, offering greater reliability and operational efficiency. The ongoing expansion of automation across various industries, coupled with the electrification of new sectors, will create sustained demand for these essential industrial components. Strategic partnerships and mergers aimed at expanding product portfolios and market reach are anticipated, further shaping the competitive landscape and driving technological advancements.

Europe Induction Motor Market Segmentation

-

1. Type

- 1.1. Single-phase Induction Motor

- 1.2. Three-phase Induction Motor

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Chemical & Petrochemical

- 2.3. Power Generation

- 2.4. Water & Wastewater

- 2.5. Metal & Mining

- 2.6. Food & Beverage

- 2.7. Discrete Industries

- 2.8. Other End-user Industries

Europe Induction Motor Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Induction Motor Market Regional Market Share

Geographic Coverage of Europe Induction Motor Market

Europe Induction Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Elevated Requirement of Power Savings in Residential and Industrial Sectors; Increasing Application in Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Amongst Non-data Center Applications

- 3.4. Market Trends

- 3.4.1. Energy-Efficient Motors Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Induction Motor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-phase Induction Motor

- 5.1.2. Three-phase Induction Motor

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemical & Petrochemical

- 5.2.3. Power Generation

- 5.2.4. Water & Wastewater

- 5.2.5. Metal & Mining

- 5.2.6. Food & Beverage

- 5.2.7. Discrete Industries

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ELPROM HARMANLI

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brook Crompton

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Regal Rexnord Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Menzel Elektromotoren

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Electric Holdings Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AC-MOTOREN GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CG Power & Industrial Solutions Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WEG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nidec Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ABB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ELPROM HARMANLI

List of Figures

- Figure 1: Europe Induction Motor Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Induction Motor Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Induction Motor Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Induction Motor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Induction Motor Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Induction Motor Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Induction Motor Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Induction Motor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Induction Motor Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Induction Motor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Europe Induction Motor Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Induction Motor Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Induction Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Induction Motor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: France Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Induction Motor Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Europe Induction Motor Market?

Key companies in the market include ELPROM HARMANLI, Brook Crompton, Regal Rexnord Corporation, Menzel Elektromotoren, Johnson Electric Holdings Limited, AC-MOTOREN GmbH, CG Power & Industrial Solutions Ltd, WEG, Nidec Motor Corporation, ABB.

3. What are the main segments of the Europe Induction Motor Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24652.8 million as of 2022.

5. What are some drivers contributing to market growth?

Elevated Requirement of Power Savings in Residential and Industrial Sectors; Increasing Application in Electric Vehicles.

6. What are the notable trends driving market growth?

Energy-Efficient Motors Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness Amongst Non-data Center Applications.

8. Can you provide examples of recent developments in the market?

June 2022 - The electric motors from ABB can have a prolonged life of up to 50,000 hours. Energy efficiency principles can be applied to any motor-driven application, including heavy-duty construction machinery. The company is meeting future goals through zero-emission technology. The company's first zero-emissions building project includes fitting an electric motor and drive, an energy management system, a battery and charging solution, and a power connection. ABB supplies the electric powertrain components and provides technical advice.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Induction Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Induction Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Induction Motor Market?

To stay informed about further developments, trends, and reports in the Europe Induction Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence