Key Insights

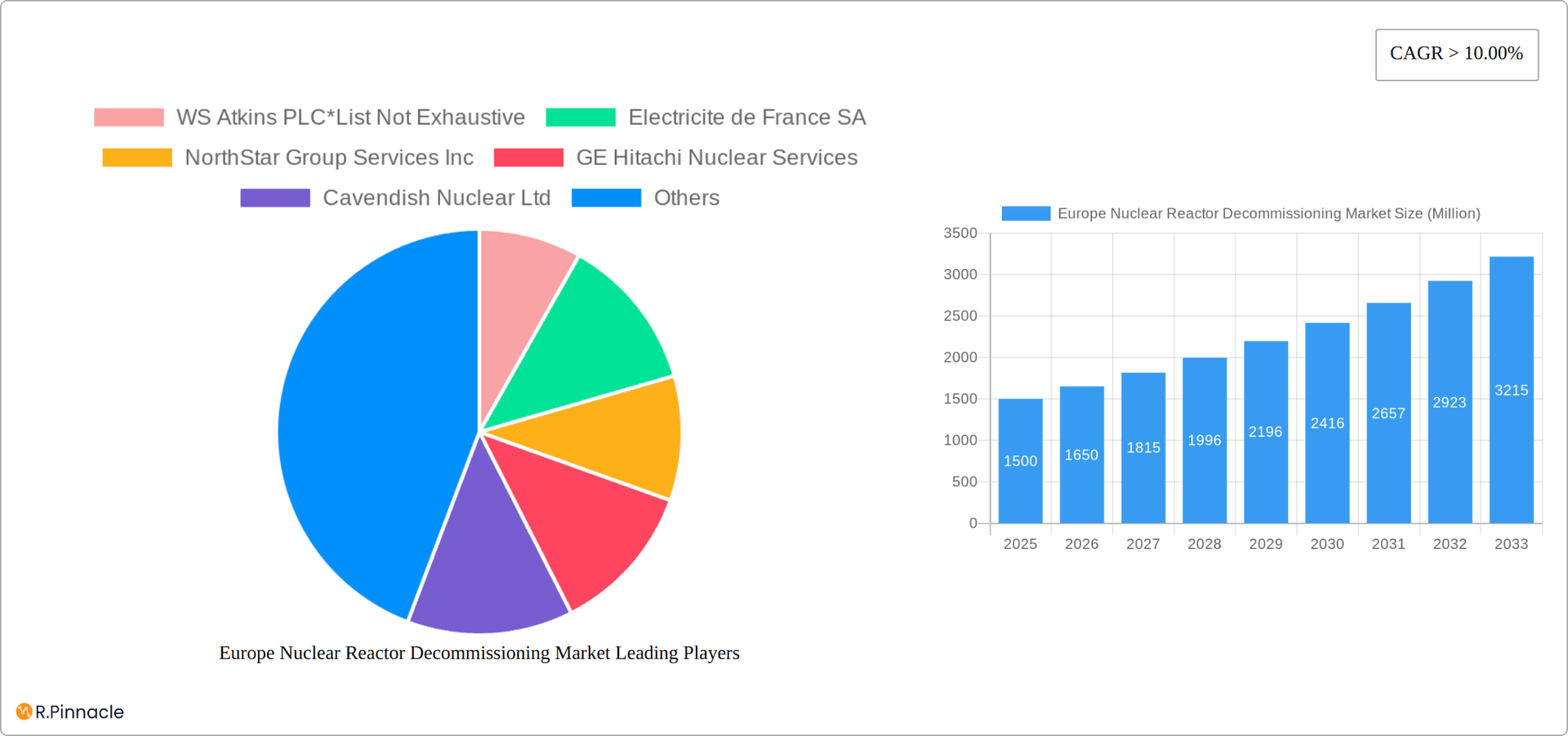

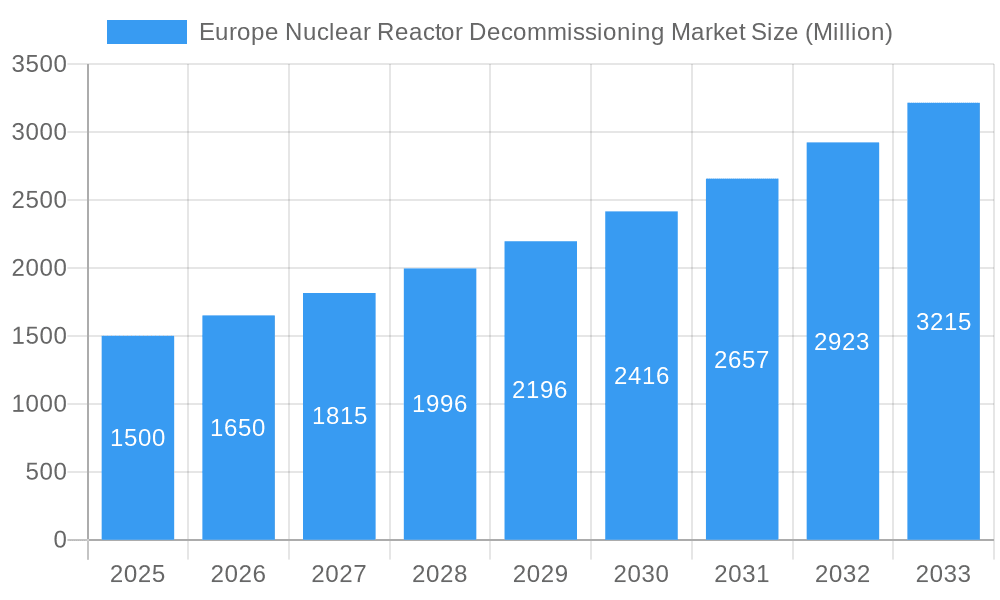

The European nuclear reactor decommissioning market is poised for significant expansion, fueled by an aging nuclear power infrastructure and escalating regulatory mandates for safe and efficient dismantling. With an estimated market size of 9.84 billion in the base year 2025, and a projected Compound Annual Growth Rate (CAGR) of 18.5%, the market is set for substantial growth. This expansion is driven by an increasing number of reactors reaching their end-of-life, the complex nature of decommissioning large-scale facilities demanding specialized expertise and advanced technologies, and stringent environmental regulations focused on minimizing radioactive waste and ensuring public safety. The market is segmented by application (commercial, prototype, research), capacity (below 100 MW, 100-1000 MW, above 1000 MW), and reactor type (Pressurized Water Reactor, Boiling Water Reactor, Gas-cooled Reactor, others), with each segment presenting distinct decommissioning challenges and opportunities. Leading entities such as WS Atkins PLC, EDF, and GE Hitachi Nuclear Energy are instrumental in driving technological innovation and market competition. Key contributors to market growth include Germany, France, and the UK, reflecting their extensive nuclear power histories.

Europe Nuclear Reactor Decommissioning Market Market Size (In Billion)

Continued market growth is anticipated due to several pivotal trends. Advancements in decommissioning technologies, including robotic systems and automation, are optimizing operations and reducing costs. Furthermore, a heightened focus on sustainable and environmentally conscious decommissioning practices is shaping market dynamics. However, potential restraints exist, such as the substantial capital investment required for large-scale reactor decommissioning, protracted project timelines often extending over decades, and the persistent complexities of safely managing and disposing of radioactive waste. Geographic market distribution is influenced by the concentration of aging reactors in specific European nations, leading to regional market focal points. Long-term forecasts indicate sustained market growth, driven by ongoing decommissioning imperatives and a strong commitment to nuclear safety across the European Union.

Europe Nuclear Reactor Decommissioning Market Company Market Share

Europe Nuclear Reactor Decommissioning Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Nuclear Reactor Decommissioning Market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete picture of past performance, present state, and future projections. The market is segmented by application, capacity, and reactor type, providing granular data for strategic decision-making. The report highlights key players such as WS Atkins PLC, Electricite de France SA, and NorthStar Group Services Inc., among others.

Europe Nuclear Reactor Decommissioning Market Structure & Innovation Trends

The European nuclear reactor decommissioning market exhibits a moderately consolidated structure, with a few large players holding significant market share. Precise market share figures for each company are not available but estimates indicate that the top 5 companies hold approximately xx% of the market. Market concentration is influenced by factors such as stringent regulatory requirements, specialized technical expertise, and high capital investments needed for decommissioning projects. Innovation is primarily driven by the need for safer, more efficient, and cost-effective decommissioning technologies. This includes advancements in robotics, remote handling systems, and waste management solutions. The regulatory landscape, particularly concerning nuclear waste disposal and environmental protection, plays a crucial role in shaping market dynamics. Product substitutes are limited, as decommissioning requires specialized expertise and equipment. The end-user demographic primarily consists of government agencies, nuclear power plant operators, and specialized decommissioning companies. Mergers and acquisitions (M&A) activity has been relatively moderate, with deal values averaging around xx Million per transaction in recent years. Examples include the significant acquisitions by larger players in the space for bolstering their technical capabilities and project portfolios.

Europe Nuclear Reactor Decommissioning Market Dynamics & Trends

The European nuclear reactor decommissioning market is experiencing robust growth, driven by the increasing number of aging nuclear power plants reaching the end of their operational lifespan. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by stringent regulatory mandates for safe and timely decommissioning, coupled with growing environmental concerns related to nuclear waste. Technological advancements, particularly in robotics and automated systems, are enhancing efficiency and reducing the risks associated with decommissioning. Consumer preferences, specifically among regulatory bodies and public opinion, favor environmentally responsible and safe decommissioning practices, boosting demand for innovative solutions. Competitive dynamics are characterized by a mix of established players and emerging companies, leading to a focus on technological innovation and cost optimization. Market penetration is gradually increasing, especially in countries with a large number of aging reactors.

Dominant Regions & Segments in Europe Nuclear Reactor Decommissioning Market

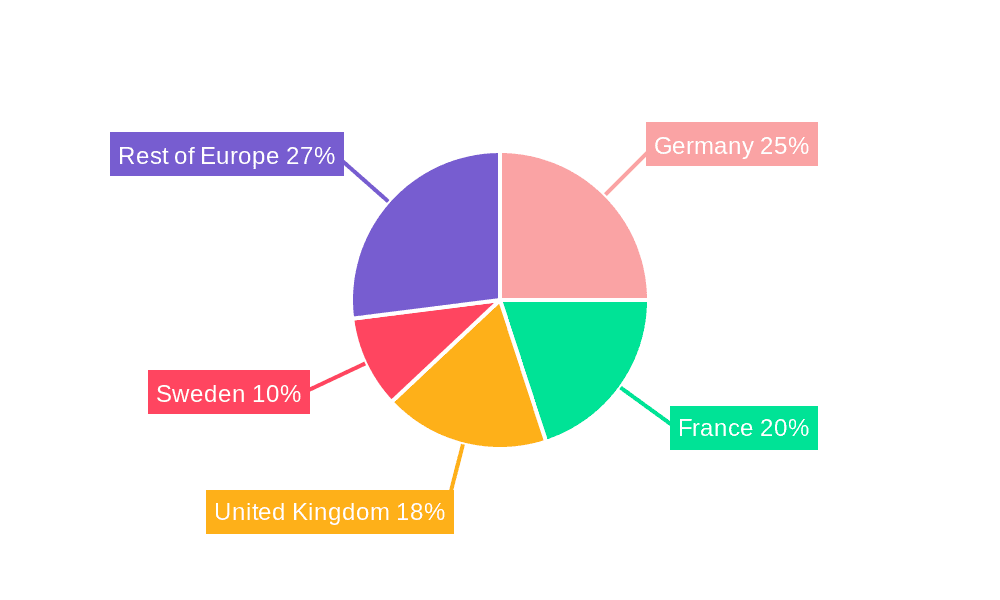

- Leading Region: France maintains a commanding position in the European nuclear reactor decommissioning market, driven by a high density of aging nuclear power plants and a robust, established decommissioning infrastructure. This concentration of aging reactors creates a significant demand for specialized services and expertise.

- Leading Country: France's extensive nuclear fleet directly translates to its dominant market share, reflecting the sheer scale of decommissioning projects underway.

- Leading Segment (by Application): The Commercial Power Reactor segment decisively dominates the market, reflecting the substantial number of commercial reactors approaching the end of their operational lifespan and requiring decommissioning.

- Leading Segment (by Capacity): Reactors with capacities between 100-1000 MW represent the largest market share, a consequence of the prevalence of this reactor size across Europe's nuclear landscape.

- Leading Segment (by Reactor Type): Pressurized Water Reactors (PWRs) constitute the most significant segment, owing to their widespread deployment across numerous European nations.

Key Drivers for Dominant Regions and Segments:

- France: France's leadership stems from a confluence of factors: a proactive and robust regulatory framework, a highly skilled and experienced workforce, and significant, sustained investment in advanced decommissioning infrastructure and technologies.

- Commercial Power Reactors: The large-scale nature of commercial reactor decommissioning projects, coupled with substantial decommissioning costs and stringent regulatory compliance requirements, fuels market growth in this segment.

- 100-1000 MW capacity: The sheer number of reactors falling within this capacity range ensures a consistent and substantial demand for decommissioning services.

- Pressurized Water Reactors: The extensive deployment of PWRs across European countries creates a significant and geographically dispersed market for specialized decommissioning expertise and services.

While France holds a leading position, significant market opportunities also exist in other European countries, including the United Kingdom, Germany, and Spain, each possessing a considerable number of aging reactors requiring decommissioning.

Europe Nuclear Reactor Decommissioning Market Product Innovations

Recent innovations focus on improving the safety, efficiency, and cost-effectiveness of decommissioning processes. This includes advancements in robotics for handling radioactive materials, development of advanced waste management solutions, and improved techniques for dismantling reactor components. These innovations are improving the safety of the workforce, reducing the time required for decommissioning and minimizing the environmental impact. The market is witnessing a shift towards more automated and remotely operated systems to enhance safety and efficiency.

Report Scope & Segmentation Analysis

This report segments the European nuclear reactor decommissioning market in the following ways:

By Application: Commercial Power Reactor, Prototype Power Reactor, Research Reactor. The Commercial Power Reactor segment shows the highest growth projection due to the large number of aging plants.

By Capacity: Below 100 MW, Between 100 - 1000 MW, Above 1000 MW. The 100-1000 MW segment represents the largest market size.

By Reactor Type: Pressurized Water Reactor, Boiling Water Reactor, Gas Cooled Reactor, Other Reactor Types. Pressurized Water Reactors dominate due to their widespread use.

Each segment displays distinct growth trajectories and competitive dynamics, influenced by factors such as reactor type, size, and location. Growth projections vary for each segment based on the factors influencing each segment.

Key Drivers of Europe Nuclear Reactor Decommissioning Market Growth

The market's robust growth trajectory is fueled by several key factors:

- Aging Nuclear Infrastructure: A substantial portion of Europe's nuclear reactors are approaching or have reached the end of their operational lifecycles, creating a significant and rapidly expanding demand for decommissioning services.

- Stringent Regulations & Environmental Concerns: The increasingly stringent environmental regulations and heightened safety concerns surrounding nuclear waste management are driving demand for specialized and highly compliant decommissioning services. This necessitates the use of advanced technologies and highly skilled personnel.

- Technological Advancements: Continuous advancements in robotics, remote handling systems, and nuclear waste management techniques are enhancing the efficiency, safety, and cost-effectiveness of decommissioning processes, further stimulating market growth.

- Government Policies and Incentives: Government policies and initiatives aimed at promoting safe and efficient nuclear decommissioning are playing a vital role in supporting market expansion.

Challenges in the Europe Nuclear Reactor Decommissioning Market Sector

The market faces various challenges:

- High Decommissioning Costs: The process is inherently capital-intensive, posing a significant financial burden on operators.

- Complex Regulatory Environment: Navigating complex regulations and obtaining necessary permits can cause significant delays.

- Technical Complexity: Decommissioning nuclear reactors requires highly specialized expertise and equipment.

These factors can slow down the overall decommissioning process and limit the growth of the market.

Emerging Opportunities in Europe Nuclear Reactor Decommissioning Market

Opportunities exist in:

- Advanced Robotics and Automation: The adoption of advanced technologies offers significant potential for improving safety and efficiency.

- Sustainable Waste Management: Innovative solutions for nuclear waste disposal and recycling will be increasingly sought after.

- International Collaboration: Sharing best practices and technological advancements across European countries can improve the efficiency of decommissioning efforts.

Leading Players in the Europe Nuclear Reactor Decommissioning Market Market

- WS Atkins PLC

- Electricite de France SA

- NorthStar Group Services Inc

- GE Hitachi Nuclear Services

- Cavendish Nuclear Ltd

- James Fisher & Sons PLC

- Fluor Corporation

- Babcock International Group PLC

- Studsvik AB

Key Developments in Europe Nuclear Reactor Decommissioning Market Industry

- June 2022: Enresa successfully completed the demolition of the turbine building at the Jose Cabrera nuclear power plant in Spain, repurposing it as an auxiliary decommissioning building – a significant milestone in the project's progress.

- December 2021: Westinghouse Electric Company secured a contract with RWE Nuclear GmbH for the dismantling of two reactors at the Gundremmingen nuclear facility in Germany, highlighting ongoing large-scale decommissioning projects.

- [Add other recent significant developments and/or mention ongoing large projects with key players involved]

These are just a few examples of the ongoing decommissioning activities and the substantial involvement of major players in shaping the future of the European nuclear reactor decommissioning market. The market is characterized by continuous evolution, driven by technological innovation and the increasing number of reactors reaching the end of their operational lives.

Future Outlook for Europe Nuclear Reactor Decommissioning Market Market

The future outlook is positive, driven by continued growth in the number of reactors requiring decommissioning and ongoing technological advancements. The market is expected to witness significant growth in the coming years, driven by regulatory mandates, technological innovation, and the need for safe and efficient decommissioning practices. Strategic opportunities exist for companies that can develop and deploy innovative and cost-effective solutions. The focus will remain on enhancing safety, minimizing environmental impact, and optimizing decommissioning costs.

Europe Nuclear Reactor Decommissioning Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Boiling Water Reactor

- 1.3. Gas Cooled Reactor

- 1.4. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. Between 100 - 1000 MW

- 3.3. Above 1000 MW

Europe Nuclear Reactor Decommissioning Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. United Kingdom

- 4. Ukraine

- 5. Rest of Europe

Europe Nuclear Reactor Decommissioning Market Regional Market Share

Geographic Coverage of Europe Nuclear Reactor Decommissioning Market

Europe Nuclear Reactor Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Research Reactors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Boiling Water Reactor

- 5.1.3. Gas Cooled Reactor

- 5.1.4. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. Between 100 - 1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.4.2. Germany

- 5.4.3. United Kingdom

- 5.4.4. Ukraine

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. France Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6.1.1. Pressurized Water Reactor

- 6.1.2. Boiling Water Reactor

- 6.1.3. Gas Cooled Reactor

- 6.1.4. Other Reactor Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial Power Reactor

- 6.2.2. Prototype Power Reactor

- 6.2.3. Research Reactor

- 6.3. Market Analysis, Insights and Forecast - by Capacity

- 6.3.1. Below 100 MW

- 6.3.2. Between 100 - 1000 MW

- 6.3.3. Above 1000 MW

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7. Germany Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7.1.1. Pressurized Water Reactor

- 7.1.2. Boiling Water Reactor

- 7.1.3. Gas Cooled Reactor

- 7.1.4. Other Reactor Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial Power Reactor

- 7.2.2. Prototype Power Reactor

- 7.2.3. Research Reactor

- 7.3. Market Analysis, Insights and Forecast - by Capacity

- 7.3.1. Below 100 MW

- 7.3.2. Between 100 - 1000 MW

- 7.3.3. Above 1000 MW

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8. United Kingdom Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8.1.1. Pressurized Water Reactor

- 8.1.2. Boiling Water Reactor

- 8.1.3. Gas Cooled Reactor

- 8.1.4. Other Reactor Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial Power Reactor

- 8.2.2. Prototype Power Reactor

- 8.2.3. Research Reactor

- 8.3. Market Analysis, Insights and Forecast - by Capacity

- 8.3.1. Below 100 MW

- 8.3.2. Between 100 - 1000 MW

- 8.3.3. Above 1000 MW

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9. Ukraine Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9.1.1. Pressurized Water Reactor

- 9.1.2. Boiling Water Reactor

- 9.1.3. Gas Cooled Reactor

- 9.1.4. Other Reactor Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial Power Reactor

- 9.2.2. Prototype Power Reactor

- 9.2.3. Research Reactor

- 9.3. Market Analysis, Insights and Forecast - by Capacity

- 9.3.1. Below 100 MW

- 9.3.2. Between 100 - 1000 MW

- 9.3.3. Above 1000 MW

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10. Rest of Europe Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10.1.1. Pressurized Water Reactor

- 10.1.2. Boiling Water Reactor

- 10.1.3. Gas Cooled Reactor

- 10.1.4. Other Reactor Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial Power Reactor

- 10.2.2. Prototype Power Reactor

- 10.2.3. Research Reactor

- 10.3. Market Analysis, Insights and Forecast - by Capacity

- 10.3.1. Below 100 MW

- 10.3.2. Between 100 - 1000 MW

- 10.3.3. Above 1000 MW

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WS Atkins PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Electricite de France SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NorthStar Group Services Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Hitachi Nuclear Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cavendish Nuclear Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 James Fisher & Sons PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fluor Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Babcock International Group PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Studsvik AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 WS Atkins PLC*List Not Exhaustive

List of Figures

- Figure 1: Europe Nuclear Reactor Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Nuclear Reactor Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 10: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 12: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 14: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 16: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 18: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 20: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 22: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 24: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nuclear Reactor Decommissioning Market?

The projected CAGR is approximately 18.5%.

2. Which companies are prominent players in the Europe Nuclear Reactor Decommissioning Market?

Key companies in the market include WS Atkins PLC*List Not Exhaustive, Electricite de France SA, NorthStar Group Services Inc, GE Hitachi Nuclear Services, Cavendish Nuclear Ltd, James Fisher & Sons PLC, Fluor Corporation, Babcock International Group PLC, Studsvik AB.

3. What are the main segments of the Europe Nuclear Reactor Decommissioning Market?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.84 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Research Reactors to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

June 2022- The Spanish decommissioning and waste management firm Enresa announced the completion of the demolition works on the last remaining large building, the turbine building, at the Jose Cabrera (Zorita) nuclear power plant in Spain. The 30 meters high structure made of reinforced concrete was converted to the Auxiliary Decommissioning Building, where radioactive waste from dismantling the plant's active parts was conditioned.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nuclear Reactor Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nuclear Reactor Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nuclear Reactor Decommissioning Market?

To stay informed about further developments, trends, and reports in the Europe Nuclear Reactor Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence