Key Insights

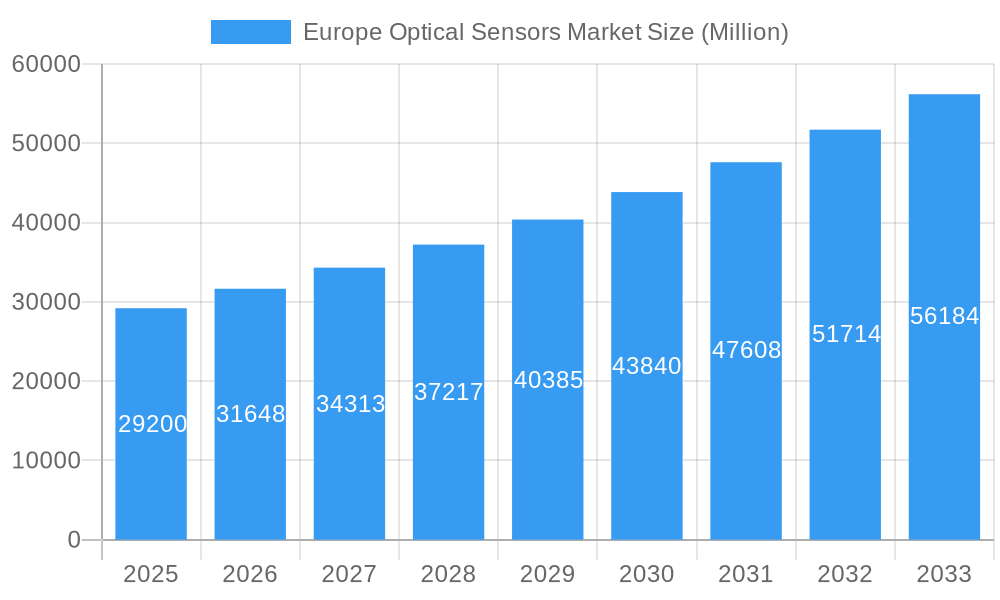

The Europe Optical Sensors Market is poised for significant expansion, projected to reach an estimated USD 29.2 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 8.3% through 2033. This dynamic growth is fueled by an increasing demand for automation and precision across various industries. Key drivers include the burgeoning adoption of industrial automation and the Internet of Things (IoT), which necessitate sophisticated sensing capabilities for real-time data acquisition and control. The healthcare sector's reliance on advanced optical sensors for diagnostic equipment, patient monitoring, and minimally invasive procedures, along with the automotive industry's drive towards enhanced safety features, autonomous driving, and in-cabin experience technologies, are further bolstering market expansion. Consumer electronics, with their integration of optical sensors for intuitive user interfaces, biometric authentication, and advanced imaging, also contribute substantially to this growth trajectory.

Europe Optical Sensors Market Market Size (In Billion)

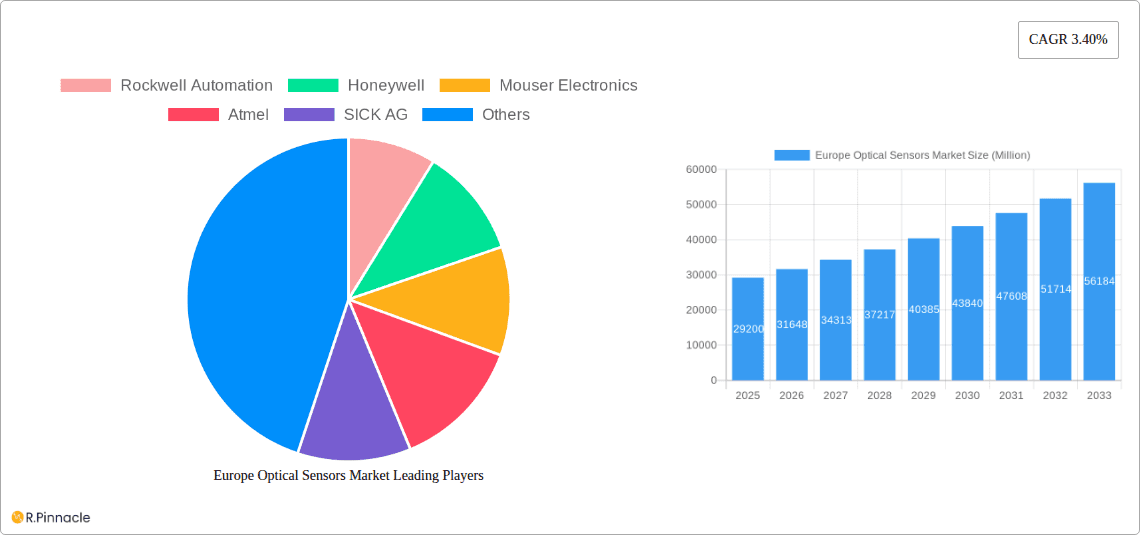

The market is characterized by a diverse range of optical sensor types, including the widely adopted Fiber Optic Sensors and Image Sensors, alongside Photoelectric Sensors, Ambient Light and Proximity Sensors, and others. This segmentation caters to a broad spectrum of applications, from stringent industrial environments and critical medical devices to the personalized demands of biometric identification and the rapidly evolving automotive and consumer electronics sectors. While the market is largely driven by technological advancements and increasing application penetration, potential restraints such as high initial investment costs for certain advanced sensor technologies and the need for skilled personnel for implementation and maintenance could present challenges. However, ongoing research and development, coupled with a strong focus on miniaturization, cost-effectiveness, and enhanced performance by leading companies like Rockwell Automation, Honeywell, and STMicroelectronics, are expected to mitigate these restraints and ensure sustained market growth across Europe.

Europe Optical Sensors Market Company Market Share

This comprehensive report delivers a granular analysis of the Europe Optical Sensors Market, providing critical insights for stakeholders navigating this dynamic landscape. With the market projected to reach xx billion by 2033, driven by a CAGR of xx% during the forecast period (2025-2033), understanding its intricacies is paramount. This study meticulously examines market structure, dynamics, regional dominance, product innovations, and future outlook, offering actionable intelligence for strategic decision-making.

Europe Optical Sensors Market Market Structure & Innovation Trends

The Europe Optical Sensors Market exhibits a moderately consolidated structure, with a blend of large multinational corporations and specialized regional players contributing to its competitive fabric. Key innovation drivers include the relentless pursuit of miniaturization, enhanced sensitivity, and the integration of advanced processing capabilities. Regulatory frameworks, such as those governing industrial automation safety and automotive emissions, play a significant role in shaping product development and market access. While extrinsic optical sensors currently dominate, intrinsic optical sensors are gaining traction due to their inherent robustness and suitability for harsh environments. The market is characterized by a growing demand for fiber optic sensors, image sensors, and photoelectric sensors across various applications. Product substitutes, while present in simpler sensing tasks, are increasingly being outpaced by the superior performance and versatility of optical sensors. End-user demographics are diverse, spanning from demanding industrial automation sectors to sophisticated medical devices and the rapidly evolving automotive industry. Mergers and acquisitions (M&A) activity is a notable trend, with strategic consolidations aimed at expanding product portfolios and market reach. For instance, the acquisition of First Sensor AG by TE Connectivity Ltd. in March 2020, valued at an undisclosed sum, signifies the ongoing consolidation in the market. This strategic move aimed to leverage TE's broader connectivity solutions with First Sensor's innovative optical sensing capabilities, particularly in industrial and automotive applications, reflecting a growing market share consolidation strategy.

Europe Optical Sensors Market Market Dynamics & Trends

The Europe Optical Sensors Market is poised for robust expansion, fueled by a confluence of technological advancements, evolving consumer preferences, and increasing industrial automation. The primary growth driver is the escalating demand for sophisticated sensing solutions across diverse sectors. In industrial applications, the push for Industry 4.0, smart manufacturing, and enhanced process control necessitates highly accurate and reliable optical sensors for tasks ranging from object detection and measurement to quality inspection and safety monitoring. The adoption of fiber optic sensors is particularly significant in these environments due to their immunity to electromagnetic interference and their ability to transmit data over long distances with minimal signal loss, supporting the trend of remote monitoring and data analytics.

The automotive sector is another critical engine of growth, driven by the rapid evolution of Advanced Driver-Assistance Systems (ADAS), autonomous driving technologies, and in-cabin sensing. Optical sensors are integral to LiDAR, radar, and camera systems that enable features like adaptive cruise control, lane departure warnings, and pedestrian detection. The increasing stringency of automotive safety regulations further accelerates the adoption of these advanced sensing technologies. Image sensors and proximity sensors are becoming indispensable components in this domain.

In the medical industry, optical sensors are revolutionizing diagnostics, patient monitoring, and surgical procedures. Their non-invasive nature and high precision make them ideal for applications such as pulse oximetry, blood glucose monitoring, and advanced imaging systems. The growing healthcare expenditure and the increasing prevalence of chronic diseases are contributing to the sustained demand for these medical-grade optical sensors.

The consumer electronics market also presents a significant avenue for growth, with optical sensors finding applications in smartphones, smart home devices, wearables, and augmented reality (AR) and virtual reality (VR) headsets. The demand for enhanced user experiences, intuitive interfaces, and personalized functionalities is driving the integration of ambient light sensors, proximity sensors, and advanced image sensors in these devices.

Technological disruptions, such as the development of novel sensing materials, improved signal processing algorithms, and the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities, are further propelling the market forward. These innovations are leading to the creation of smaller, more energy-efficient, and more intelligent optical sensors that can perform complex tasks with greater accuracy and speed.

Competitive dynamics are intense, with established players continually investing in research and development to maintain their market leadership. Strategic partnerships, collaborations, and acquisitions are common strategies employed to expand product portfolios and gain a competitive edge. The market penetration of optical sensors is expected to deepen as their cost-effectiveness improves and their capabilities continue to expand, making them an essential component across a wide spectrum of applications. The overall market penetration is estimated to grow from xx% in the base year to xx% by the end of the forecast period. The CAGR of xx% reflects this sustained and robust growth trajectory.

Dominant Regions & Segments in Europe Optical Sensors Market

The Europe Optical Sensors Market is characterized by a strong and pervasive demand across its key application segments. Among the regions, Germany stands out as the dominant country, driven by its robust industrial manufacturing base, its leadership in automotive innovation, and significant investments in R&D for advanced technologies. The country's strong emphasis on Industry 4.0 initiatives and its thriving automotive sector, a major consumer of sophisticated optical sensing technologies, solidify its leading position.

The Industrial application segment represents the largest market share, accounting for approximately xx% of the total market revenue in the base year. This dominance is attributed to the widespread adoption of optical sensors in factory automation, process control, robotics, and logistics. The drive towards smart factories, predictive maintenance, and enhanced operational efficiency necessitates highly reliable and precise sensing solutions. Photoelectric sensors and fiber optic sensors are particularly crucial in this segment, enabling tasks such as object detection, distance measurement, and material identification. The economic policies supporting manufacturing growth and infrastructure development in countries like Germany and France further bolster this segment.

Within the Sensor Type segmentation, Fiber Optic Sensors are projected to witness the highest growth rate, driven by their inherent advantages in harsh environments, immunity to electromagnetic interference, and suitability for long-distance data transmission, which are critical for industrial and medical applications. Image Sensors are also experiencing rapid expansion, fueled by the increasing demand for advanced vision systems in automotive ADAS, industrial inspection, and consumer electronics.

The Type segmentation sees Extrinsic Optical Sensors currently holding the larger market share, owing to their mature technology and broad applicability across various industries. However, Intrinsic Optical Sensors are gaining significant traction due to their enhanced durability and ability to operate in extreme conditions, opening up new application frontiers in specialized industrial and scientific research.

The Automotive application segment is another major contributor, driven by the relentless evolution of vehicle safety features, infotainment systems, and the burgeoning field of autonomous driving. The increasing sophistication of ADAS, including LiDAR, radar, and advanced camera systems, relies heavily on the precise and reliable performance of optical sensors. Government mandates for enhanced vehicle safety and the growing consumer demand for advanced automotive technologies are key drivers.

Furthermore, the Medical segment is experiencing substantial growth, fueled by advancements in medical imaging, diagnostics, and minimally invasive surgical techniques. Optical sensors are integral to devices like pulse oximeters, blood glucose monitors, and endoscopes, supporting the increasing demand for personalized and remote healthcare solutions.

The Consumer Electronics segment, while smaller in comparison to industrial and automotive, is also a significant growth area, driven by the proliferation of smart devices, wearables, and augmented/virtual reality (AR/VR) technologies. Ambient light sensors and proximity sensors are ubiquitous in smartphones and other consumer gadgets, enhancing user experience and power efficiency.

In summary, the dominance of Germany and the industrial application segment, coupled with the surging demand for fiber optic and image sensors, underpinned by supportive economic policies and infrastructure, are the defining characteristics of the Europe Optical Sensors Market.

Europe Optical Sensors Market Product Innovations

The Europe Optical Sensors Market is witnessing a surge in product innovations focused on enhancing performance, miniaturization, and intelligence. Key developments include the introduction of CMOS laser sensors with superior detection capabilities, such as OMRON Corporation's E3AS-HL, which significantly reduces installation and adjustment time in industrial settings. This innovation addresses the critical need for user-friendly and highly reliable sensing solutions, boosting efficiency and reducing reliance on expert human intervention. Another significant advancement is TE Connectivity's integration of First Sensor AG's portfolio, enriching their offerings with innovative optical sensing solutions tailored for demanding industrial, heavy truck, and automotive applications. These advancements are characterized by improved sensitivity, faster response times, and greater robustness, catering to the evolving needs of sectors like automotive ADAS, industrial automation, and medical devices, thereby offering distinct competitive advantages.

Report Scope & Segmentation Analysis

This report meticulously segments the Europe Optical Sensors Market across key parameters to provide a granular understanding of market dynamics and growth trajectories. The Type segmentation includes Extrinsic Optical Sensors, which are currently dominant due to their versatility, and Intrinsic Optical Sensors, poised for significant growth in niche and demanding applications. The Sensor Type segmentation encompasses Fiber Optic Sensors, experiencing robust demand for industrial and harsh environment applications; Image Sensors, critical for automotive and consumer electronics; Photoelectric Sensors, fundamental to industrial automation; Ambient Light and Proximity Sensors, essential for consumer electronics and smart devices; and Other Sensor Types, addressing specialized market needs.

The Application segmentation analyzes the market across Industrial, Medical, Biometric, Automotive, Consumer Electronics, and Other Applications. The industrial segment is expected to maintain its leading position throughout the forecast period, driven by Industry 4.0 adoption. The automotive segment is projected to exhibit strong growth due to ADAS and autonomous driving advancements. Medical applications are also anticipated to expand significantly with the increasing demand for advanced healthcare technologies. Competitive dynamics within each segment are influenced by technological innovation, regulatory compliance, and end-user specific requirements, with projected market sizes varying based on adoption rates and technological advancements.

Key Drivers of Europe Optical Sensors Market Growth

The Europe Optical Sensors Market is propelled by several key drivers. Technologically, the relentless advancement in sensor technology, including miniaturization, increased sensitivity, and integration of AI/ML capabilities, is a primary catalyst. The growing demand for smart manufacturing and Industry 4.0 initiatives worldwide necessitates sophisticated optical sensors for enhanced automation and process control. Economically, increasing investments in automotive safety features like ADAS and the burgeoning development of autonomous driving technologies are creating substantial demand. Furthermore, the healthcare sector's expansion, driven by an aging population and the need for advanced diagnostic and monitoring tools, is a significant growth accelerant. Regulatory pressures, particularly in the automotive industry for enhanced safety and in industrial sectors for improved operational efficiency and compliance, also contribute significantly to market expansion.

Challenges in the Europe Optical Sensors Market Sector

Despite robust growth prospects, the Europe Optical Sensors Market faces several challenges. Intense competition among established players and emerging startups exerts significant price pressure, potentially impacting profit margins. The complex and evolving regulatory landscape across different European nations can create hurdles for market entry and product certification, particularly for specialized applications like medical devices. Supply chain disruptions, as witnessed in recent global events, can lead to increased lead times and component shortages, impacting production schedules and delivery timelines. Moreover, the high initial investment required for research and development of cutting-edge optical sensor technologies can be a barrier for smaller companies, further consolidating the market among larger entities. The constant need for technological upgrades and adaptation to new standards also presents a challenge, requiring continuous R&D investment.

Emerging Opportunities in Europe Optical Sensors Market

The Europe Optical Sensors Market is brimming with emerging opportunities. The continued expansion of IoT (Internet of Things) applications across industries is creating a demand for interconnected and intelligent sensors, with optical sensors playing a crucial role in data acquisition. The growing trend towards personalized healthcare and remote patient monitoring presents significant opportunities for advanced medical optical sensors. The increasing adoption of augmented reality (AR) and virtual reality (VR) technologies in gaming, training, and industrial applications is driving demand for sophisticated image and proximity sensors. Furthermore, the development of sustainable and energy-efficient optical sensors aligns with Europe's focus on green technologies and offers a competitive advantage. The exploration of new materials and fabrication techniques promises further advancements, leading to novel applications in areas like environmental monitoring and advanced security systems.

Leading Players in the Europe Optical Sensors Market Market

- Rockwell Automation

- Honeywell

- Mouser Electronics

- Atmel

- SICK AG

- STMicroelectronics

- Turck

- Bosch

- Eaton

- Omnvisio

- Hitachi

Key Developments in Europe Optical Sensors Market Industry

- October 2020: OMRON Corporation announced the global release of the new E3AS-HL CMOS laser sensor, featuring industry-first sensing technology that significantly improves detection capability. This innovation aims to enhance reliability in detecting difficult targets, reducing installation design and adjustment time in equipment commissioning.

- March 2020: TE Connectivity Ltd completed the public acquisition of First Sensor AG, acquiring a 71.87% stake. This strategic move integrated First Sensor's portfolio, including innovative market-leading optical sensors, into TE's broader product base, expanding market opportunities in industrial, heavy truck, and automotive optical sensing applications.

Future Outlook for Europe Optical Sensors Market Market

The future outlook for the Europe Optical Sensors Market is exceptionally promising, driven by an accelerating pace of technological innovation and an ever-expanding array of applications. The continued integration of AI and machine learning into sensor systems will lead to smarter, more autonomous sensing solutions, further enhancing industrial automation and driving advancements in autonomous vehicles. The miniaturization trend will enable the incorporation of optical sensors into an even wider range of portable and wearable devices, fueling growth in the consumer electronics and medical sectors. Furthermore, increasing global emphasis on sustainability and energy efficiency will spur the development of low-power, eco-friendly optical sensors. Strategic collaborations and potential further consolidation among key players are expected to shape the competitive landscape, driving efficiency and innovation. The market is poised for sustained growth as optical sensors become increasingly indispensable across nearly every facet of modern industry and daily life, creating significant opportunities for market expansion and technological leadership.

Europe Optical Sensors Market Segmentation

-

1. Type

- 1.1. Extrinsic Optical Sensor

- 1.2. Intrinsic Optical Sensor

-

2. Sensor Type

- 2.1. Fiber Optic Sensor

- 2.2. Image Sensor

- 2.3. Photoelectric Sensor

- 2.4. Ambient Light and Proximity Sensor

- 2.5. Other Sensor Types

-

3. Application

- 3.1. Industrial

- 3.2. Medical

- 3.3. Biometric

- 3.4. Automotive

- 3.5. Consumer Electronics

- 3.6. Other Applications

Europe Optical Sensors Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

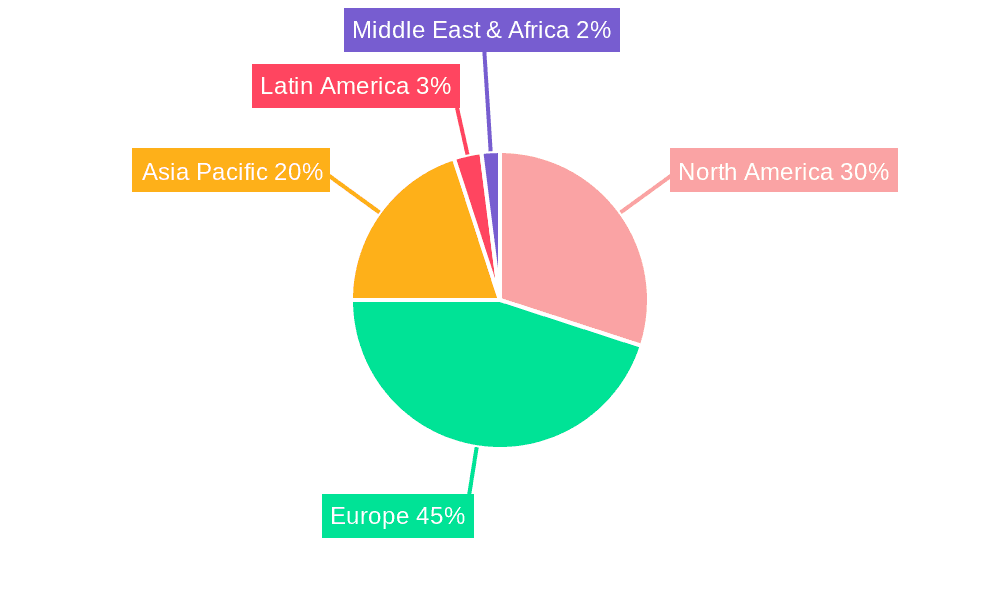

Europe Optical Sensors Market Regional Market Share

Geographic Coverage of Europe Optical Sensors Market

Europe Optical Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Market Penetration of Smartphones; Increasing Demand for Power-saving Devices Across Industries; Increasing Market Penetration of Automation Techniques Across Various Industries

- 3.3. Market Restrains

- 3.3.1. Imbalance Between the Image Quality and Price

- 3.4. Market Trends

- 3.4.1. Adoption of opical sensors in automobiles is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Optical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Extrinsic Optical Sensor

- 5.1.2. Intrinsic Optical Sensor

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Fiber Optic Sensor

- 5.2.2. Image Sensor

- 5.2.3. Photoelectric Sensor

- 5.2.4. Ambient Light and Proximity Sensor

- 5.2.5. Other Sensor Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial

- 5.3.2. Medical

- 5.3.3. Biometric

- 5.3.4. Automotive

- 5.3.5. Consumer Electronics

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rockwell Automation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mouser Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atmel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SICK AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STMicroelectronics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Turck

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eaton

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Omnvisio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hitachi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Rockwell Automation

List of Figures

- Figure 1: Europe Optical Sensors Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Optical Sensors Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Optical Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Optical Sensors Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 3: Europe Optical Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Europe Optical Sensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe Optical Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Europe Optical Sensors Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 7: Europe Optical Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Europe Optical Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Optical Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Optical Sensors Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Optical Sensors Market?

Key companies in the market include Rockwell Automation, Honeywell, Mouser Electronics, Atmel, SICK AG, STMicroelectronics, Turck, Bosch, Eaton, Omnvisio, Hitachi.

3. What are the main segments of the Europe Optical Sensors Market?

The market segments include Type, Sensor Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Market Penetration of Smartphones; Increasing Demand for Power-saving Devices Across Industries; Increasing Market Penetration of Automation Techniques Across Various Industries.

6. What are the notable trends driving market growth?

Adoption of opical sensors in automobiles is expected to drive the market.

7. Are there any restraints impacting market growth?

Imbalance Between the Image Quality and Price.

8. Can you provide examples of recent developments in the market?

October 2020 - OMRON Corporation announced the global release of the new E3AS-HL CMOS laser sensor*2 equipped with the industry's first sensing technology that significantly improves detection capability. Reliable detection of hard-to-find targets eliminates the need for time-consuming installation design and adjustments in equipment commissioning without relying on human experience or skill.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Optical Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Optical Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Optical Sensors Market?

To stay informed about further developments, trends, and reports in the Europe Optical Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence