Key Insights

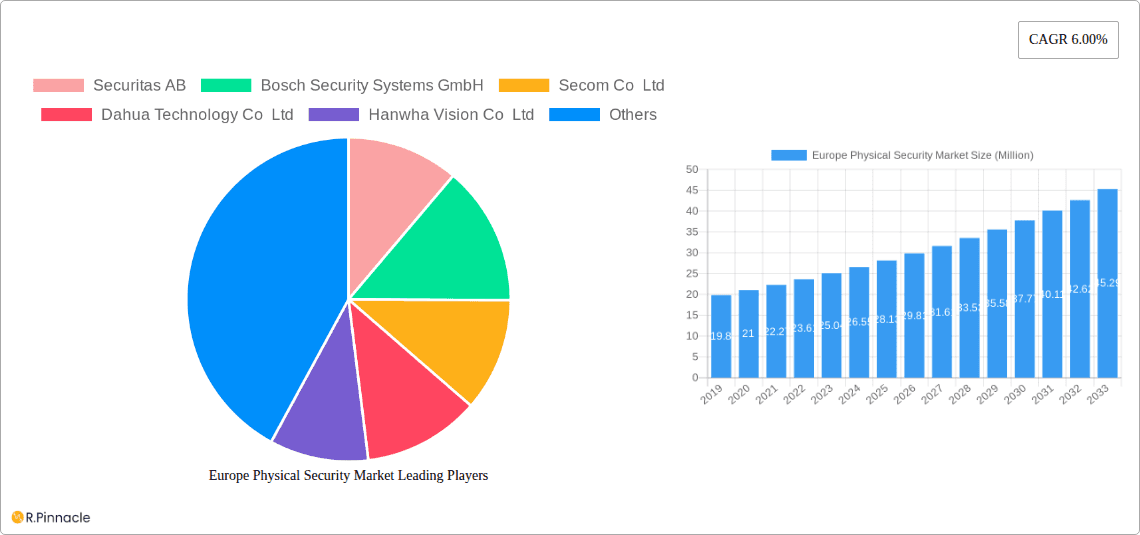

The Europe Physical Security Market is poised for significant expansion, projected to reach $28.13 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.00% through 2033. This growth is fueled by an increasing emphasis on safeguarding critical infrastructure, businesses, and individuals against evolving security threats. The market's dynamism is evident across its diverse segments, with Video Surveillance Systems, encompassing IP, Analog, and Hybrid solutions, leading the charge. Physical Access Control Systems (PACS) and Biometric Systems are also experiencing strong demand, driven by the need for sophisticated identity verification and controlled access. Intrusion Detection and Perimeter Security further bolster the market, providing comprehensive layers of defense. The increasing adoption of cloud-based solutions, particularly Access Control as a Service (ACaaS) and Video Surveillance as a Service (VSaaS), is a pivotal trend, offering scalability, cost-effectiveness, and enhanced manageability for organizations of all sizes, from SMEs to large enterprises.

Europe Physical Security Market Market Size (In Million)

Key drivers propelling this market forward include the escalating sophistication of security breaches, heightened awareness of potential risks, and stringent regulatory requirements across various end-user industries. Government Services, Banking and Financial Services, IT and Telecommunications, and Healthcare are particularly invested in advanced physical security measures. Geographically, Europe, with key markets like the United Kingdom, Germany, France, and Italy, is a central hub for these investments, benefiting from strong economic conditions and a proactive approach to security. While the market exhibits immense potential, challenges such as high initial investment costs for advanced systems and concerns regarding data privacy and cybersecurity can moderate growth. However, ongoing technological advancements in AI, IoT integration, and advanced analytics are expected to mitigate these restraints, paving the way for a more secure and resilient future for the European physical security landscape.

Europe Physical Security Market Company Market Share

This in-depth report provides an exhaustive analysis of the Europe Physical Security Market, offering critical insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study delves into market dynamics, technological advancements, competitive landscapes, and future growth trajectories.

The Europe Physical Security Market is experiencing robust growth, driven by increasing security concerns, technological innovations, and a growing adoption of integrated security solutions across various end-user industries. This report utilizes high-ranking keywords such as "Europe physical security," "video surveillance systems," "access control," "biometric security," "perimeter security," and "intrusion detection" to ensure maximum search visibility.

Europe Physical Security Market Market Structure & Innovation Trends

The Europe Physical Security Market is characterized by a moderately concentrated structure, with a mix of established global players and emerging regional innovators. Major companies like Honeywell International Inc., Johnson Controls, and Siemens AG hold significant market shares, particularly in large-scale enterprise solutions. Innovation is a key differentiator, driven by advancements in Artificial Intelligence (AI), the Internet of Things (IoT), and cloud computing, leading to the development of more sophisticated and integrated physical security solutions. Regulatory frameworks, including GDPR and various national security directives, are shaping product development and data handling practices, creating both challenges and opportunities. Product substitutes, such as cybersecurity solutions that address digital threats, are increasingly being integrated into comprehensive physical security strategies. End-user demographics are shifting towards a greater demand for scalable, cloud-based solutions, particularly from SMEs. Mergers and acquisitions (M&A) remain a significant trend, with strategic deals aimed at expanding product portfolios and geographical reach. For instance, the recent investment by Secom Co Ltd in cloud video surveillance providers underscores this trend, signifying a consolidated market value of approximately USD 192 million in this specific acquisition.

- Market Concentration: Moderate, with dominance by key global players in specific segments.

- Innovation Drivers: AI, IoT, cloud computing, advancements in sensor technology, and cybersecurity integration.

- Regulatory Frameworks: GDPR compliance, national security standards, and data privacy regulations.

- Product Substitutes: Growing integration with cybersecurity solutions, emphasizing holistic security.

- End-User Demographics: Increasing demand for integrated, smart, and cloud-enabled solutions.

- M&A Activities: Strategic acquisitions to gain technology, market access, and expand service offerings.

Europe Physical Security Market Market Dynamics & Trends

The Europe Physical Security Market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth is primarily fueled by a heightened awareness of security threats, from organized crime to terrorism, necessitating robust physical security measures across critical infrastructure, commercial establishments, and residential areas. Technological disruptions are at the forefront of market dynamics, with the pervasive integration of Artificial Intelligence (AI) and machine learning transforming traditional security systems. AI-powered video analytics, for example, are enabling intelligent threat detection, facial recognition, and anomaly identification, thereby enhancing proactive security measures. The adoption of cloud-based solutions, such as Video Surveillance as a Service (VSaaS) and Access Control as a Service (ACaaS), is rapidly increasing, offering scalability, cost-effectiveness, and remote management capabilities, particularly attractive to Small and Medium-sized Enterprises (SMEs). Consumer preferences are evolving towards more user-friendly, integrated, and data-driven security systems that offer seamless operation and real-time insights. The competitive landscape is intense, with companies continually innovating to offer advanced features and comprehensive solutions. Key players like Axis Communications AB and Hikvision are leading the charge in developing high-resolution cameras with advanced analytics, while companies like HID Global Corporation are at the forefront of biometric and secure identity solutions. The market penetration of advanced physical security technologies is steadily increasing, driven by declining hardware costs and an enhanced understanding of the ROI associated with intelligent security infrastructure. The ongoing digital transformation across industries further amplifies the demand for converged security solutions that bridge the gap between physical and cyber security.

Dominant Regions & Segments in Europe Physical Security Market

The Europe Physical Security Market exhibits distinct regional dominance and segment preferences. Western Europe, encompassing countries like Germany, the United Kingdom, France, and the Netherlands, currently represents the largest market share. This dominance is attributed to a strong economic footing, robust industrial base, high adoption rates of advanced technologies, and stringent security regulations.

Within Western Europe, Germany stands out as a leading country, driven by its significant manufacturing sector, extensive government infrastructure projects, and a proactive approach to security upgrades in both commercial and public spaces. The market's growth in this region is further propelled by increasing investments in smart city initiatives and critical infrastructure protection.

Analyzing by System Type, the Video Surveillance System segment holds the largest market share.

- IP Surveillance: This sub-segment is experiencing the most rapid growth due to its superior image quality, network capabilities, remote accessibility, and integration with AI analytics. Major companies like Dahua Technology Co Ltd and Hangzhou Hikvision Digital Technology Co Ltd are key contributors to this segment's expansion.

- Physical Access Control System (PACS): This segment also commands a significant market share, essential for managing entry and exit in secure facilities. Integration with biometric systems and cloud-based platforms is a key trend.

- Biometric System: While a niche segment, it is witnessing substantial growth driven by the demand for highly secure identity verification in sectors like banking and government services.

- Perimeter Security and Intrusion Detection: These systems are crucial for safeguarding large areas and critical assets, with advancements in sensor technology and AI-powered threat detection enhancing their effectiveness.

In terms of Service Type, Video Surveillance as a Service (VSaaS) is gaining significant traction, offering flexibility and cost-efficiency, especially for SMEs.

- Access Control as a Service (ACaaS): Similar to VSaaS, ACaaS provides subscription-based access control solutions, facilitating easier management and scalability.

Type of Deployment analysis reveals a growing preference for Cloud-based solutions, although On-Premises deployments remain significant for organizations with strict data sovereignty requirements.

The Organization Size landscape shows a strong market presence for Large Enterprises, which often require comprehensive and complex security systems. However, the SMEs segment is a rapidly growing area, increasingly adopting scalable and cost-effective cloud solutions.

The End-user Industry landscape is diverse, with significant contributions from:

- Government Services: Driven by national security concerns and critical infrastructure protection.

- Banking and Financial Services: Requiring high levels of security for sensitive data and assets.

- Transportation and Logistics: Essential for securing ports, airports, and supply chains.

- Retail: Increasing adoption of video analytics for loss prevention and customer behavior analysis.

- Healthcare: Ensuring patient safety and the security of sensitive medical data.

Europe Physical Security Market Product Innovations

The Europe Physical Security Market is witnessing a wave of groundbreaking product innovations aimed at enhancing detection, identification, and operational efficiency. A prime example is Hanwha Vision's launch of its new bi-spectrum AI camera range in June 2023. These cameras integrate visual and thermal imaging capabilities, allowing for robust perimeter monitoring even in challenging lighting or weather conditions. The thermal lens provides crucial identification details for suspicious activities, expediting detection and reducing installation costs. This signifies a trend towards multi-modal sensing and intelligent analytics embedded directly into devices. Furthermore, the development of edge AI capabilities within surveillance devices is reducing reliance on centralized processing, improving real-time response times. Advancements in sensor technology are also enabling more accurate intrusion detection and better environmental monitoring.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the Europe Physical Security Market, offering detailed insights into each category. The System Type segmentation includes Video Surveillance Systems (IP Surveillance, Analog Surveillance, Hybrid Surveillance), Physical Access Control Systems (PACS), Biometric Systems, Perimeter Security, and Intrusion Detection. The Service Type segmentation covers Access Control as a Service (ACaaS) and Video Surveillance as a Service (VSaaS). The Type of Deployment is analyzed for On-Premises and Cloud solutions, while Organization Size is segmented into SMEs and Large Enterprises. Finally, the End-user Industry segmentation encompasses Government Services, Banking and Financial Services, IT and Telecommunications, Transportation and Logistics, Retail, Healthcare, Residential, and Other End-user Industries. Each segment is analyzed for its current market size, projected growth rates, and key market dynamics, providing a comprehensive understanding of the competitive landscape and future potential.

Key Drivers of Europe Physical Security Market Growth

The Europe Physical Security Market growth is propelled by several interconnected factors. Increasing geopolitical instability and a rise in sophisticated crime incidents are driving demand for advanced security solutions. Technological advancements, particularly in AI, machine learning, and IoT, are enabling the development of smarter, more integrated, and proactive security systems. The growing adoption of cloud-based services like VSaaS and ACaaS offers cost-effectiveness and scalability, making advanced security accessible to a wider range of organizations, including SMEs. Furthermore, stringent government regulations and compliance requirements related to data protection and critical infrastructure security are compelling businesses to invest in robust physical security measures. The ongoing digitalization of industries and the expansion of smart city initiatives also contribute significantly to market expansion.

Challenges in the Europe Physical Security Market Sector

Despite its robust growth, the Europe Physical Security Market faces several challenges. The high initial cost of implementing advanced physical security systems can be a barrier for some small and medium-sized enterprises. Data privacy concerns, particularly in light of regulations like GDPR, require careful consideration in the deployment and management of surveillance and access control systems, especially those involving biometric data. Interoperability issues between different security systems and vendors can also hinder the seamless integration of comprehensive solutions. Furthermore, the constant evolution of cyber threats necessitates a vigilant approach to ensuring the security of physical security systems themselves against potential breaches. The availability of skilled professionals for installation, maintenance, and management of complex security solutions remains a challenge in certain regions.

Emerging Opportunities in Europe Physical Security Market

Emerging opportunities in the Europe Physical Security Market are primarily centered around the continued integration of AI and machine learning, leading to predictive analytics and enhanced threat intelligence. The growing demand for converged security solutions, bridging the gap between physical and cybersecurity, presents significant potential. The expansion of the smart home and smart city markets is creating new avenues for residential and urban security solutions. Furthermore, the increasing focus on securing critical infrastructure, such as energy grids and transportation networks, offers substantial growth prospects. The development of more cost-effective and modular security solutions tailored for SMEs, particularly through subscription-based models, is another key opportunity. The growing adoption of mobile credentials for access control and the use of drones for perimeter surveillance are also indicative of future market trends.

Leading Players in the Europe Physical Security Market Market

- Securitas AB

- Bosch Security Systems GmbH

- Secom Co Ltd

- Dahua Technology Co Ltd

- Hanwha Vision Co Ltd

- G4S Limited

- Vanderbilt Industries

- Siemens AG

- Teledyne FLIR LLC

- Genetec Inc

- Johnson Controls

- Hangzhou Hikvision Digital Technology Co Ltd

- Schneider Electric SE

- Honeywell International Inc

- Axis Communications AB

- NEC Corporation

- HID Global Corporation

Key Developments in Europe Physical Security Market Industry

- June 2023: Hanwha Vision launched its new bi-spectrum AI camera range, offering visual and thermal imaging capabilities. The thermal lens allows the perimeter to be monitored for suspicious activity, even in dim lighting, inclement weather, or visual obstructions. The lens also provides identification details, identifying suspicious activity, such as an intruder. This expedited detection and identification process reduces the time and cost of installing the device.

- May 2023: Secom, a security integration company, invested USD 192 million in two cloud video surveillance providers, the Eagle Eye and the Brivo. Eagle Eye offers a comprehensive cloud video surveillance solution, combining cyber security, cloud video, artificial intelligence (AI), and analytics to provide businesses with a more secure and efficient way to monitor their operations. Artificial intelligence (AI) is also utilized for more sophisticated video analytics, including smart video search and smart alarms, which can detect abnormal activity or particular occurrences in video recordings.

Future Outlook for Europe Physical Security Market Market

The future outlook for the Europe Physical Security Market is exceptionally bright, driven by an unwavering commitment to enhanced safety and security across all sectors. The ongoing digital transformation will continue to fuel the demand for integrated, intelligent, and scalable security solutions. Expect further advancements in AI-powered analytics, enabling predictive capabilities and autonomous threat response. The widespread adoption of cloud-based services will democratize access to sophisticated security technologies, particularly for SMEs. Investments in critical infrastructure protection and smart city development will create substantial growth opportunities. The convergence of physical and cybersecurity will become increasingly crucial, leading to unified security platforms. Strategic collaborations and acquisitions will continue to shape the market landscape, fostering innovation and market consolidation. The market is expected to witness sustained growth, driven by technological innovation, evolving threat landscapes, and increasing security consciousness among businesses and individuals.

Europe Physical Security Market Segmentation

-

1. System Type

-

1.1. Video Surveillance System

- 1.1.1. IP Surveillance

- 1.1.2. Analog Surveillance

- 1.1.3. Hybrid Surveillance

- 1.2. Physical Access Control System (PACS)

- 1.3. Biometric System

- 1.4. Perimeter Security

- 1.5. Intrusion Detection

-

1.1. Video Surveillance System

-

2. Service Type

- 2.1. Access Control as a Service (ACaaS)

- 2.2. Video Surveillance as a Service (VSaaS)

-

3. Type of Deployment

- 3.1. On-Premises

- 3.2. Cloud

-

4. Organization Size

- 4.1. SMEs

- 4.2. Large Enterprises

-

5. End-user Industry

- 5.1. Government Services

- 5.2. Banking and Financial Services

- 5.3. IT and Telecommunications

- 5.4. Transportation and Logistics

- 5.5. Retail

- 5.6. Healthcare

- 5.7. Residential

- 5.8. Other End-user Industries

Europe Physical Security Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

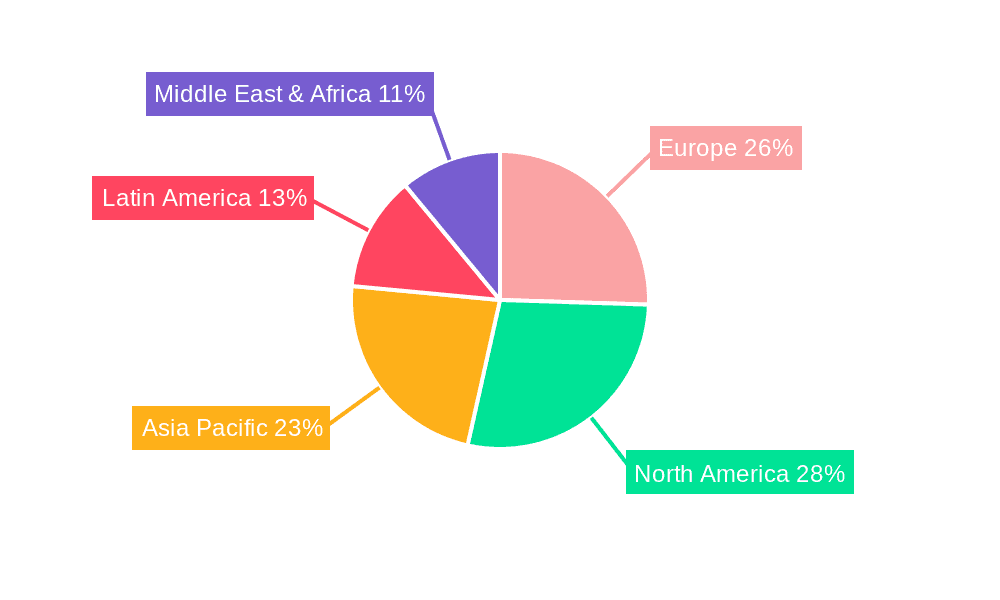

Europe Physical Security Market Regional Market Share

Geographic Coverage of Europe Physical Security Market

Europe Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Corporate Risks and Physical Security Threats; Organizations' Access Control Requirements have Grown Due to the Prevalence of Remote and Hybrid Work; The Accelerated Incorporation of Machine Learning (ML) and Artificial Intelligence (AI)

- 3.3. Market Restrains

- 3.3.1. Corporate Risks and Physical Security Threats; Organizations' Access Control Requirements have Grown Due to the Prevalence of Remote and Hybrid Work; The Accelerated Incorporation of Machine Learning (ML) and Artificial Intelligence (AI)

- 3.4. Market Trends

- 3.4.1. The Biometric System Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Physical Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System Type

- 5.1.1. Video Surveillance System

- 5.1.1.1. IP Surveillance

- 5.1.1.2. Analog Surveillance

- 5.1.1.3. Hybrid Surveillance

- 5.1.2. Physical Access Control System (PACS)

- 5.1.3. Biometric System

- 5.1.4. Perimeter Security

- 5.1.5. Intrusion Detection

- 5.1.1. Video Surveillance System

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Access Control as a Service (ACaaS)

- 5.2.2. Video Surveillance as a Service (VSaaS)

- 5.3. Market Analysis, Insights and Forecast - by Type of Deployment

- 5.3.1. On-Premises

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by Organization Size

- 5.4.1. SMEs

- 5.4.2. Large Enterprises

- 5.5. Market Analysis, Insights and Forecast - by End-user Industry

- 5.5.1. Government Services

- 5.5.2. Banking and Financial Services

- 5.5.3. IT and Telecommunications

- 5.5.4. Transportation and Logistics

- 5.5.5. Retail

- 5.5.6. Healthcare

- 5.5.7. Residential

- 5.5.8. Other End-user Industries

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by System Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Securitas AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security Systems GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Secom Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dahua Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanwha Vision Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 G4S Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vanderbilt Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Teledyne FLIR LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Genetec Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Johnson Controls

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Schneider Electric SE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Honeywell International Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Axis Communications AB

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 NEC Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 HID Global Corporatio

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Securitas AB

List of Figures

- Figure 1: Europe Physical Security Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Physical Security Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Physical Security Market Revenue Million Forecast, by System Type 2020 & 2033

- Table 2: Europe Physical Security Market Volume Billion Forecast, by System Type 2020 & 2033

- Table 3: Europe Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Europe Physical Security Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 5: Europe Physical Security Market Revenue Million Forecast, by Type of Deployment 2020 & 2033

- Table 6: Europe Physical Security Market Volume Billion Forecast, by Type of Deployment 2020 & 2033

- Table 7: Europe Physical Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 8: Europe Physical Security Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 9: Europe Physical Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Physical Security Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Physical Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Europe Physical Security Market Volume Billion Forecast, by Region 2020 & 2033

- Table 13: Europe Physical Security Market Revenue Million Forecast, by System Type 2020 & 2033

- Table 14: Europe Physical Security Market Volume Billion Forecast, by System Type 2020 & 2033

- Table 15: Europe Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Europe Physical Security Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 17: Europe Physical Security Market Revenue Million Forecast, by Type of Deployment 2020 & 2033

- Table 18: Europe Physical Security Market Volume Billion Forecast, by Type of Deployment 2020 & 2033

- Table 19: Europe Physical Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 20: Europe Physical Security Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 21: Europe Physical Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Europe Physical Security Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 23: Europe Physical Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Physical Security Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Germany Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: France Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Italy Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Spain Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Netherlands Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Netherlands Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Belgium Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Belgium Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Sweden Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Sweden Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Norway Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Norway Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Poland Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Poland Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Denmark Europe Physical Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Denmark Europe Physical Security Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Physical Security Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Europe Physical Security Market?

Key companies in the market include Securitas AB, Bosch Security Systems GmbH, Secom Co Ltd, Dahua Technology Co Ltd, Hanwha Vision Co Ltd, G4S Limited, Vanderbilt Industries, Siemens AG, Teledyne FLIR LLC, Genetec Inc, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, Schneider Electric SE, Honeywell International Inc, Axis Communications AB, NEC Corporation, HID Global Corporatio.

3. What are the main segments of the Europe Physical Security Market?

The market segments include System Type, Service Type, Type of Deployment, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Corporate Risks and Physical Security Threats; Organizations' Access Control Requirements have Grown Due to the Prevalence of Remote and Hybrid Work; The Accelerated Incorporation of Machine Learning (ML) and Artificial Intelligence (AI).

6. What are the notable trends driving market growth?

The Biometric System Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Corporate Risks and Physical Security Threats; Organizations' Access Control Requirements have Grown Due to the Prevalence of Remote and Hybrid Work; The Accelerated Incorporation of Machine Learning (ML) and Artificial Intelligence (AI).

8. Can you provide examples of recent developments in the market?

June 2023: Hanwha Vision launched its new bi-spectrum AI camera range, offering visual and thermal imaging capabilities. The thermal lens allows the perimeter to be monitored for suspicious activity, even in dim lighting, inclement weather, or visual obstructions. The lens also provides identification details, identifying suspicious activity, such as an intruder. This expedited detection and identification process reduces the time and cost of installing the device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Physical Security Market?

To stay informed about further developments, trends, and reports in the Europe Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence