Key Insights

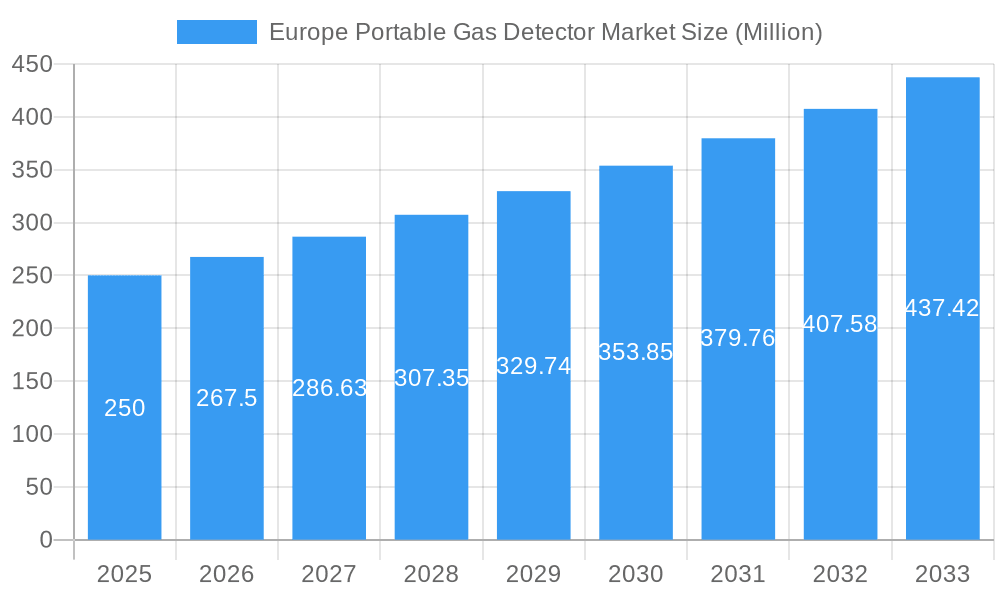

The European portable gas detector market is poised for significant expansion, propelled by increasingly stringent workplace safety regulations across key sectors including oil and gas, manufacturing, and construction. Heightened awareness of gas leak hazards and environmental compliance demands are driving demand for advanced detection solutions. Innovations such as wireless connectivity, enhanced sensor accuracy, and more compact, user-friendly designs are key growth enablers. Following a period of substantial historical growth, the market is projected to reach €2.8 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 5.13% from the base year 2025 through 2033.

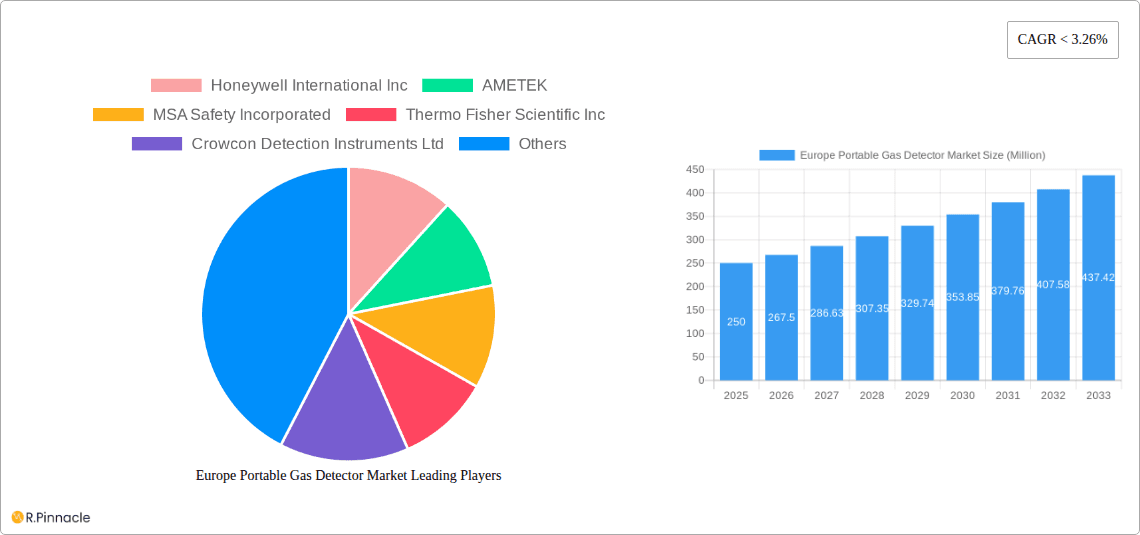

Europe Portable Gas Detector Market Market Size (In Billion)

Future market dynamics will be shaped by economic conditions, ongoing technological advancements, and evolving safety regulations. While challenges like raw material price volatility exist, the outlook remains optimistic, supported by proactive safety initiatives and robust compliance enforcement. Opportunities lie in integrating advanced data analytics and cloud solutions for predictive maintenance and enhanced safety management.

Europe Portable Gas Detector Market Company Market Share

Europe Portable Gas Detector Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Portable Gas Detector Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market structure, dynamics, key players, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Portable Gas Detector Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the European portable gas detector market. The market is moderately consolidated, with key players such as Honeywell International Inc, AMETEK, MSA Safety Incorporated, and Thermo Fisher Scientific Inc holding significant market share. However, smaller, specialized companies like Crowcon Detection Instruments Ltd and RIKEN KEIKI Co Ltd also contribute significantly.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market.

- Innovation Drivers: Stringent safety regulations, increasing demand for enhanced safety measures across various industries, and technological advancements driving miniaturization and improved sensor technology are major drivers.

- Regulatory Framework: EU directives on workplace safety and environmental protection significantly influence market growth and product development. Compliance with these regulations is a key factor for manufacturers.

- Product Substitutes: While there are limited direct substitutes for portable gas detectors, alternative safety monitoring systems might influence market adoption rates.

- End-User Demographics: The market is largely driven by industries with high-risk environments such as oil & gas, chemicals, and mining.

- M&A Activities: The past five years have witnessed xx M&A deals in this market, with a total value of approximately xx Million. These activities reflect the strategic importance of this sector and the desire for enhanced market share.

Europe Portable Gas Detector Market Dynamics & Trends

The European portable gas detector market is experiencing robust growth driven by several factors. The rising awareness of workplace safety, stringent environmental regulations, and the increasing adoption of advanced technologies are key contributors. The market is witnessing a significant shift towards multi-gas detectors due to their ability to detect multiple hazards simultaneously. Furthermore, technological disruptions, such as the integration of IoT and cloud-based data analytics, are transforming the industry, enabling real-time monitoring and improved safety protocols. Consumer preference is shifting towards portable gas detectors that offer enhanced connectivity, durability, and ease of use. The competitive landscape is characterized by intense rivalry, with companies focusing on innovation, product differentiation, and strategic partnerships to maintain market share.

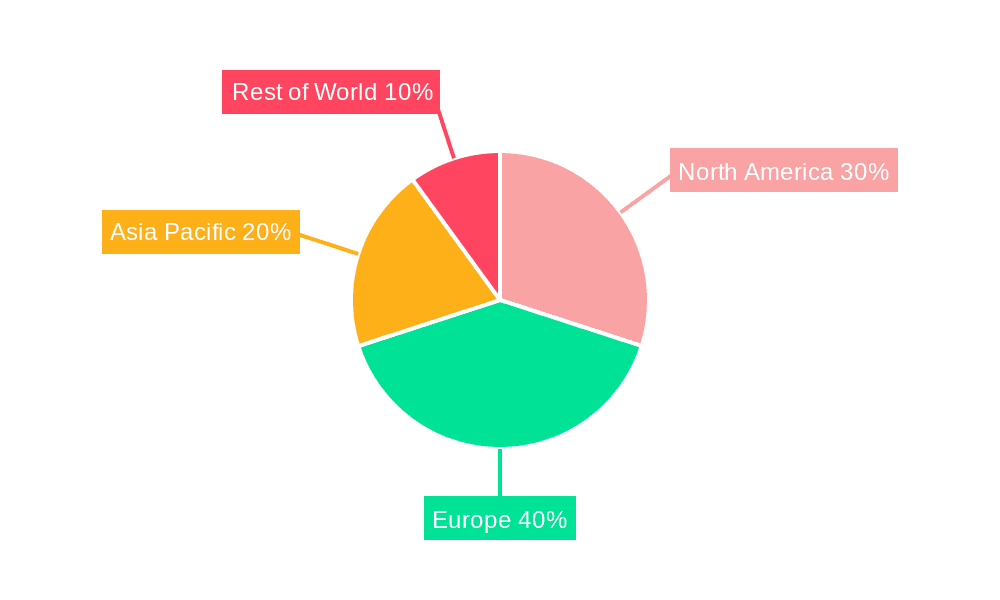

Dominant Regions & Segments in Europe Portable Gas Detector Market

The German market currently holds the largest share of the European portable gas detector market, followed by the UK and France. This dominance can be attributed to a combination of factors:

- Germany: Strong industrial base, robust regulatory framework, high adoption rates in various industries, and a well-established distribution network.

- UK: Significant oil and gas activities, increasing awareness regarding workplace safety, and a well-developed industrial sector.

- France: Growing investments in renewable energy and infrastructure projects, driving demand for gas detection equipment.

By Type:

- Multi-gas detectors: This segment holds a larger market share due to increased safety requirements and the capability to detect multiple gases simultaneously.

- Single-gas detectors: While smaller in market share, this segment continues to see steady growth driven by specific niche applications.

By End-user Industry:

- Oil & Gas: This remains the largest end-user segment, driven by the inherent risks associated with oil and gas operations.

- Chemicals & Petrochemicals: Stringent safety regulations and the hazardous nature of chemical processes contribute to high demand in this sector.

- Other End-user Industries: Growing adoption in sectors such as mining, water & wastewater, and power generation is expanding the market's reach.

Europe Portable Gas Detector Market Product Innovations

Recent product innovations focus on enhanced connectivity, improved sensor technology, and miniaturization. The introduction of connected gas detectors with real-time data monitoring capabilities is gaining significant traction, enabling proactive safety management. Improved sensor technology allows for faster response times and greater accuracy in detecting hazardous gases. The trend is towards more compact and user-friendly devices, enhancing portability and usability.

Report Scope & Segmentation Analysis

This report segments the European portable gas detector market by type (single-gas, multi-gas) and end-user industry (oil & gas, chemicals & petrochemicals, water & wastewater, power generation & transmission, metal & mining, other end-user industries). Each segment’s growth projections, market size, and competitive dynamics are analyzed in detail. The report provides a comprehensive overview of the market’s current state and future outlook, offering valuable insights into the key growth drivers, challenges, and opportunities.

Key Drivers of Europe Portable Gas Detector Market Growth

Several factors drive the growth of the European portable gas detector market. Stringent safety regulations enforced across various industries mandate the use of these detectors, boosting market demand. The increasing awareness of workplace safety and the need to minimize accidents and fatalities also contribute significantly. Technological advancements lead to the development of more advanced and reliable detectors, further driving market growth.

Challenges in the Europe Portable Gas Detector Market Sector

The European portable gas detector market faces several challenges, including the high initial cost of advanced detectors, which can be a barrier for some smaller companies. The market is also subject to fluctuations in raw material prices, which can affect production costs. Competition among various manufacturers can also lead to price wars, impacting profitability.

Emerging Opportunities in Europe Portable Gas Detector Market

The growing demand for sophisticated gas detection technologies in emerging economies within Europe presents significant opportunities. The development of wireless and connected gas detectors offers vast potential for real-time monitoring and improved safety management. The integration of artificial intelligence (AI) and machine learning (ML) into gas detection systems opens new avenues for predictive maintenance and improved safety protocols.

Leading Players in the Europe Portable Gas Detector Market Market

Key Developments in Europe Portable Gas Detector Market Industry

- September 2022: Blackline Safety Corp. launched the G6 single-gas detector, a linked employee wearable, targeting petrochemical, oil & gas, and other industrial sectors. This highlights the growing trend of connected safety devices.

- August 2022: Riken Keiki Co., Ltd. released the GX-Force portable four-gas detector with built-in pumping aspiration, enhancing the speed and reliability of hazardous gas detection.

Future Outlook for Europe Portable Gas Detector Market Market

The European portable gas detector market is poised for continued growth, driven by technological advancements, increasing safety regulations, and rising demand across diverse industries. The focus on connected devices, improved sensor technology, and data analytics will shape future market dynamics. Strategic partnerships and acquisitions will play a crucial role in shaping the competitive landscape, fostering innovation and expanding market reach.

Europe Portable Gas Detector Market Segmentation

-

1. Type

- 1.1. Single-gas

- 1.2. Multi-gas

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Chemicals & Petrochemical

- 2.3. Water & Wastewater

- 2.4. Power Generation & Transmission

- 2.5. Metal & Mining

- 2.6. Other End User Industries

Europe Portable Gas Detector Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Rest of Western Europe

- 5. Central

Europe Portable Gas Detector Market Regional Market Share

Geographic Coverage of Europe Portable Gas Detector Market

Europe Portable Gas Detector Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness on Worker Safety and Stringent Regulations

- 3.3. Market Restrains

- 3.3.1. Increasing Frequency of False Detection

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Offer Market Growth Opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-gas

- 5.1.2. Multi-gas

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemicals & Petrochemical

- 5.2.3. Water & Wastewater

- 5.2.4. Power Generation & Transmission

- 5.2.5. Metal & Mining

- 5.2.6. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Rest of Western Europe

- 5.3.5. Central

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single-gas

- 6.1.2. Multi-gas

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil & Gas

- 6.2.2. Chemicals & Petrochemical

- 6.2.3. Water & Wastewater

- 6.2.4. Power Generation & Transmission

- 6.2.5. Metal & Mining

- 6.2.6. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single-gas

- 7.1.2. Multi-gas

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil & Gas

- 7.2.2. Chemicals & Petrochemical

- 7.2.3. Water & Wastewater

- 7.2.4. Power Generation & Transmission

- 7.2.5. Metal & Mining

- 7.2.6. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single-gas

- 8.1.2. Multi-gas

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil & Gas

- 8.2.2. Chemicals & Petrochemical

- 8.2.3. Water & Wastewater

- 8.2.4. Power Generation & Transmission

- 8.2.5. Metal & Mining

- 8.2.6. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Western Europe Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single-gas

- 9.1.2. Multi-gas

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil & Gas

- 9.2.2. Chemicals & Petrochemical

- 9.2.3. Water & Wastewater

- 9.2.4. Power Generation & Transmission

- 9.2.5. Metal & Mining

- 9.2.6. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Central Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single-gas

- 10.1.2. Multi-gas

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil & Gas

- 10.2.2. Chemicals & Petrochemical

- 10.2.3. Water & Wastewater

- 10.2.4. Power Generation & Transmission

- 10.2.5. Metal & Mining

- 10.2.6. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AMETEK

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSA Safety Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Crowcon Detection Instruments Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teledyne Technologies Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GfG Gas Detection

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Industrial Scientific

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RIKEN KEIKI Co Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Drgerwerk AG & Co KGaA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Portable Gas Detector Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Portable Gas Detector Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Portable Gas Detector Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Portable Gas Detector Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe Portable Gas Detector Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Portable Gas Detector Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Portable Gas Detector Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Portable Gas Detector Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Portable Gas Detector Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Portable Gas Detector Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Europe Portable Gas Detector Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Portable Gas Detector Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Portable Gas Detector Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Europe Portable Gas Detector Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Portable Gas Detector Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Portable Gas Detector Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Europe Portable Gas Detector Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Portable Gas Detector Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Portable Gas Detector Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Europe Portable Gas Detector Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Portable Gas Detector Market?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the Europe Portable Gas Detector Market?

Key companies in the market include Honeywell International Inc, AMETEK, MSA Safety Incorporated, Thermo Fisher Scientific Inc, Crowcon Detection Instruments Ltd, Teledyne Technologies Incorporated, GfG Gas Detection, Industrial Scientific, RIKEN KEIKI Co Ltd *List Not Exhaustive, Drgerwerk AG & Co KGaA.

3. What are the main segments of the Europe Portable Gas Detector Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness on Worker Safety and Stringent Regulations.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Offer Market Growth Opportunities.

7. Are there any restraints impacting market growth?

Increasing Frequency of False Detection.

8. Can you provide examples of recent developments in the market?

September 2022 : Blackline Safety Corp. announced the release of the G6 single-gas detector, establishing a new trend in linked employee wearables. Blackline's latest product, the G6 single-gas sensor, is designed for petrochemical, oil and gas, and other industrial sectors, allowing for faster incident reaction time, excellent safety and compliance, long-term connection, and increased efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Portable Gas Detector Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Portable Gas Detector Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Portable Gas Detector Market?

To stay informed about further developments, trends, and reports in the Europe Portable Gas Detector Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence