Key Insights

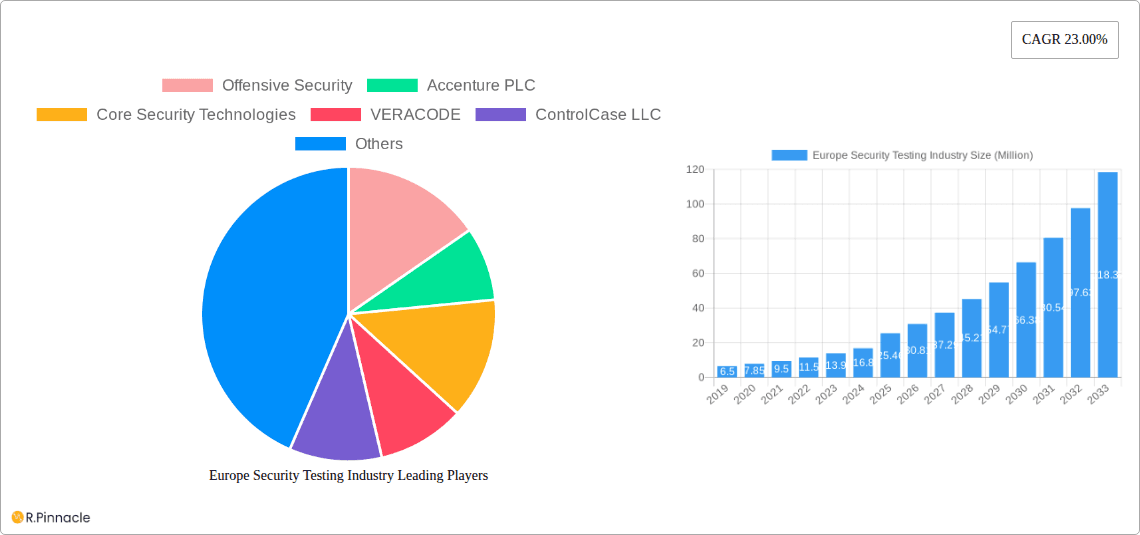

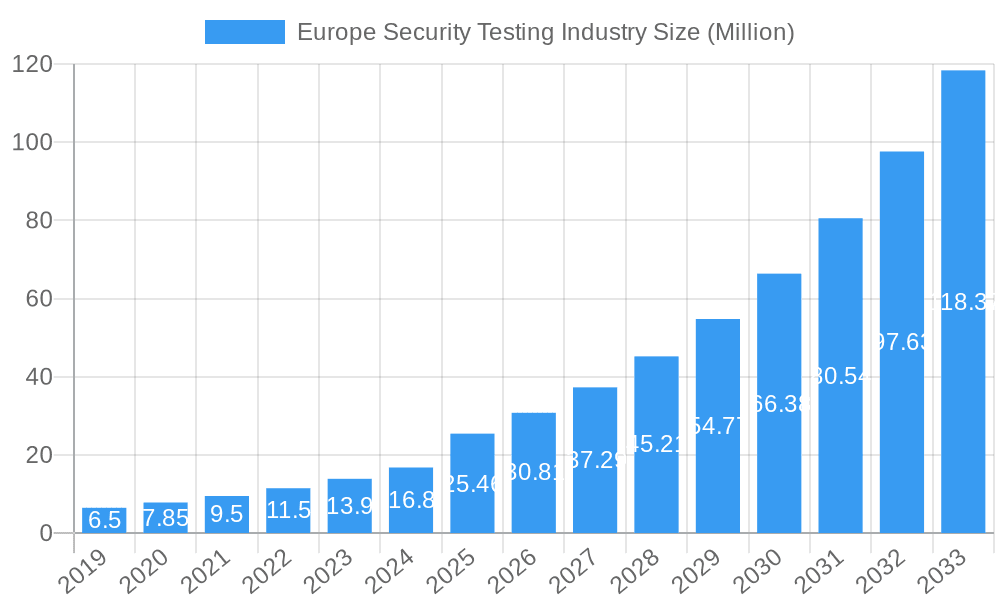

The Europe Security Testing Industry is poised for significant expansion, projected to reach an estimated USD 25.46 million in market size by 2025, and exhibiting a robust Compound Annual Growth Rate (CAGR) of 23.00% through 2033. This remarkable growth is propelled by a confluence of escalating cyber threats, increasing regulatory compliance demands, and the pervasive digital transformation across various sectors. Organizations in Europe are recognizing security testing not as a mere compliance checkbox, but as a critical component for safeguarding sensitive data, maintaining customer trust, and ensuring business continuity in an increasingly interconnected world. The adoption of sophisticated testing methodologies like SAST (Static Application Security Testing), DAST (Dynamic Application Security Testing), and IAST (Interactive Application Security Testing) is on the rise, reflecting a proactive approach to identifying and mitigating vulnerabilities early in the development lifecycle.

Europe Security Testing Industry Market Size (In Million)

The market segmentation highlights key areas of focus and innovation. Deployment models are shifting towards cloud and hybrid environments, necessitating specialized security testing for these dynamic infrastructures. Network security testing, encompassing VPN and firewall testing, remains a cornerstone, while application security testing, particularly for mobile, web, and cloud applications, is witnessing accelerated adoption due to the expanding digital footprint of businesses. The BFSI, Healthcare, and Government sectors are leading the charge in investing in comprehensive security testing solutions, driven by stringent data protection regulations such as GDPR and the high stakes associated with breaches in these sensitive industries. Emerging trends also include the integration of AI and machine learning in security testing tools to enhance efficiency and accuracy in identifying complex threats.

Europe Security Testing Industry Company Market Share

Europe Security Testing Industry Market Analysis: In-Depth Report 2019–2033

This comprehensive report provides an exhaustive analysis of the Europe Security Testing Industry market, delving into its intricate structure, dynamic growth, dominant segments, and future trajectory. Covering the historical period from 2019–2024, a base year of 2025, and an extensive forecast period of 2025–2033, this study offers actionable insights for industry professionals, investors, and stakeholders. We leverage high-ranking keywords to ensure maximum search visibility for critical terms such as "Europe security testing market," "application security testing," "network security testing," and "penetration testing tools." The report meticulously examines market segmentation across deployment types, testing methodologies, tools, and end-user industries, providing granular data and strategic recommendations.

Europe Security Testing Industry Market Structure & Innovation Trends

The Europe Security Testing Industry exhibits a moderately concentrated market structure, with key players like Accenture PLC, IBM, and Hewlett Packard Enterprise Development LP holding significant market shares, estimated at over 20% collectively for the top five entities. Innovation remains a paramount driver, fueled by the escalating sophistication of cyber threats and the increasing adoption of digital technologies across all sectors. Regulatory frameworks, such as GDPR, continue to shape the demand for robust security testing solutions, driving compliance-oriented investments. Product substitutes, while present in the form of in-house security teams, often fall short of the specialized expertise and comprehensive coverage offered by dedicated security testing services. End-user demographics are increasingly leaning towards the IT and Telecom, BFSI, and Healthcare sectors, which are early adopters of advanced security testing solutions due to the sensitive nature of their data. Mergers and acquisitions (M&A) activities are on the rise, with an estimated M&A deal value exceeding 500 Million in the last two years, indicating a trend towards consolidation and strategic expansion as companies aim to broaden their service portfolios and geographical reach.

Europe Security Testing Industry Market Dynamics & Trends

The Europe Security Testing Industry is poised for substantial growth, driven by a confluence of escalating cyber threats, the rapid digital transformation of businesses, and increasingly stringent regulatory compliance requirements. The Compound Annual Growth Rate (CAGR) for the security testing market in Europe is projected to be a robust 15%, reaching an estimated market size of over 30,000 Million by 2033. Technological disruptions are playing a pivotal role, with the advent of AI and machine learning enabling more sophisticated and automated security testing solutions, such as intelligent penetration testing and advanced vulnerability detection. Consumer preferences are shifting towards proactive and continuous security testing, moving away from periodic assessments. This includes a growing demand for integrated security testing within the Software Development Life Cycle (SDLC), emphasizing DevSecOps practices. Competitive dynamics are intensifying, with both established security giants and agile niche players vying for market share. Companies are investing heavily in research and development to offer specialized services, including cloud security testing, API security testing, and IoT security testing. The increasing adoption of hybrid and multi-cloud environments also necessitates specialized testing strategies. Furthermore, the growing awareness of supply chain risks is driving demand for code and software supply chain security testing. Market penetration is steadily increasing across all end-user industries, as organizations recognize security testing not as a cost center but as a critical business enabler, safeguarding reputation and preventing significant financial losses. The evolving threat landscape, marked by ransomware attacks and sophisticated phishing campaigns, further underscores the imperative for continuous and effective security testing.

Dominant Regions & Segments in Europe Security Testing Industry

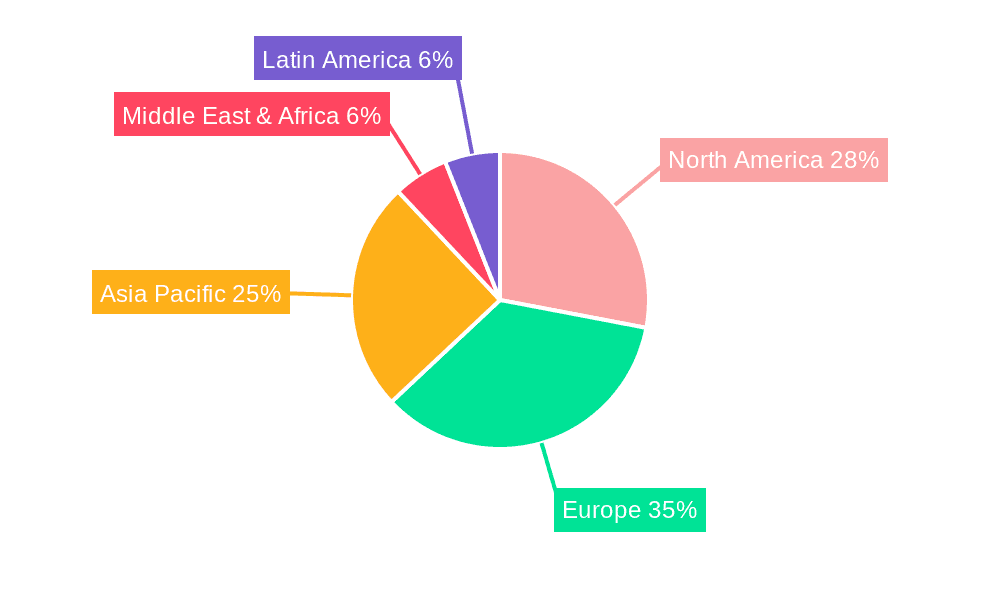

The United Kingdom consistently emerges as a dominant region within the Europe Security Testing Industry, owing to its mature digital economy, a high concentration of financial services, and a proactive regulatory environment that mandates stringent data protection measures. Germany and France follow closely, driven by their robust manufacturing sectors increasingly integrating IoT technologies and the BFSI sector's continuous need for advanced cybersecurity.

Within the Deployment segment, Cloud deployment is experiencing the fastest growth, driven by the widespread adoption of cloud services across European enterprises. Hybrid cloud solutions also hold significant traction, reflecting the transitional phase for many organizations.

In terms of Type, Application Security Testing (AST) is capturing a substantial market share and is projected to outperform Network Security Testing in the coming years. This is directly linked to the increasing reliance on software applications for critical business operations and the growing sophistication of application-level attacks.

Application Type Dominance:

- Web Application Security Testing leads the AST segment due to the ubiquitous nature of web-based services.

- Mobile Application Security Testing is rapidly gaining prominence with the proliferation of mobile-first strategies.

- Cloud Application Security Testing is crucial for securing SaaS, PaaS, and IaaS environments.

- Enterprise Application Security Testing remains vital for mission-critical business systems.

Testing Type Dominance:

- Dynamic Application Security Testing (DAST) is widely adopted for its ability to identify vulnerabilities in running applications.

- Static Application Security Testing (SAST) is gaining traction as organizations embed security earlier in the SDLC.

- Interactive Application Security Testing (IAST) offers a hybrid approach, combining elements of SAST and DAST.

- Runtime Application Self-Protection (RASP) is emerging as a proactive defense mechanism.

Testing Tool Dominance:

- Penetration Testing Tools remain a cornerstone for simulating real-world attacks.

- Web Application Testing Tools are essential for identifying web-specific vulnerabilities.

- Code Review Tools are increasingly utilized for early-stage vulnerability detection.

End-User Industry Dominance:

- BFSI (Banking, Financial Services, and Insurance): Holds the largest market share due to stringent compliance mandates and the high value of sensitive financial data.

- IT and Telecom: A major consumer of security testing services, driven by the complex and interconnected nature of their networks and services.

- Government: Increasing focus on national security and citizen data protection fuels demand.

- Healthcare: Driven by the sensitivity of patient data and evolving regulatory landscapes.

- Manufacturing: Growing adoption of Industry 4.0 and IoT technologies necessitates robust security testing.

- Retail: Protecting customer data and payment information is a key driver.

Europe Security Testing Industry Product Innovations

The Europe Security Testing Industry is witnessing a surge in product innovations focused on automation, intelligence, and integration. GrammaTech's CodeSentry platform, introduced in January 2022, exemplifies this trend with its advanced software supply chain security capabilities, enabling rapid SBOM generation and proactive risk mitigation. Similarly, NTT Security AppSec Solutions Inc.'s January 2022 launch of a dynamic application security testing solution integrated into the development lifecycle highlights the industry's move towards continuous security. These innovations are characterized by their ability to detect and address vulnerabilities earlier and more efficiently, offering competitive advantages through enhanced speed, accuracy, and comprehensive coverage, thereby aligning with the market’s growing demand for sophisticated and seamless security solutions.

Report Scope & Segmentation Analysis

This report meticulously segments the Europe Security Testing Industry across key parameters to provide a granular understanding of market dynamics and growth opportunities.

Deployment: The market is analyzed based on On Premise, Cloud, and Hybrid deployment models. Cloud deployment is projected to witness the highest CAGR due to the scalability and flexibility it offers, with an estimated market size of over 15,000 Million by 2033. Hybrid models are also expected to grow steadily.

Type: The analysis covers two primary types: Network Security Testing (including VPN Testing, Firewall Testing, and Other Service Types) and Application Security Testing (AST). AST is the dominant segment, expected to reach over 20,000 Million by 2033, driven by the increasing complexity of software applications. Within AST, Application Type segmentation includes Mobile Application Security Testing, Web Application Security Testing, Cloud Application Security Testing, and Enterprise Application Security Testing. Web and Cloud AST are expected to exhibit the fastest growth. The Testing Type segmentation within AST comprises SAST, DAST, IAST, and RASP, with DAST currently holding a significant market share.

Testing Tool: The market for Web Application Testing Tools, Code Review Tools, Penetration Testing Tools, Software Testing Tools, and Other Testing Tools is examined. Penetration testing and web application testing tools are expected to maintain strong demand.

End-User Industry: Analysis spans across Government, BFSI, Healthcare, Manufacturing, IT and Telecom, Retail, and Other End-User Industries. The BFSI and IT and Telecom sectors are projected to remain the largest consumers, with significant growth anticipated in Healthcare and Manufacturing due to evolving digital landscapes and increased regulatory scrutiny.

Key Drivers of Europe Security Testing Industry Growth

Several interconnected factors are propelling the growth of the Europe Security Testing Industry. The escalating frequency and sophistication of cyberattacks, including ransomware, phishing, and data breaches, are the primary catalysts, compelling organizations across all sectors to bolster their defenses. The rapid digital transformation and cloud adoption by European businesses necessitate robust security testing to protect evolving IT infrastructures and sensitive data. Increasingly stringent regulatory landscapes, such as the GDPR and NIS2 Directive, mandate comprehensive security measures, driving compliance-driven investments in security testing services. Furthermore, the growing awareness of the business impact of security failures, including financial losses, reputational damage, and operational disruptions, is encouraging proactive security strategies. The expansion of IoT devices and the integration of AI in business operations introduce new attack vectors, further amplifying the demand for specialized security testing solutions.

Challenges in the Europe Security Testing Industry Sector

Despite robust growth, the Europe Security Testing Industry faces several significant challenges. A persistent shortage of skilled cybersecurity professionals, particularly those with specialized security testing expertise, can hamper service delivery and innovation. The rapidly evolving threat landscape requires continuous updates to testing methodologies and tools, leading to high R&D costs for service providers. Ensuring consistent and effective security testing across complex hybrid and multi-cloud environments presents technical and operational hurdles. Furthermore, the cost of advanced security testing solutions can be a barrier for small and medium-sized enterprises (SMEs), limiting their market penetration. Competitive pressures from established players and emerging niche providers can also lead to price erosion and impact profitability. Finally, the challenge of accurately measuring the ROI of security testing services can sometimes make it difficult to secure executive buy-in and adequate budget allocation.

Emerging Opportunities in Europe Security Testing Industry

The Europe Security Testing Industry is ripe with emerging opportunities. The increasing adoption of DevSecOps practices presents a significant opportunity for integrated security testing solutions that seamlessly fit into the software development lifecycle. The burgeoning Internet of Things (IoT) ecosystem, with its vast array of connected devices, opens up a substantial market for specialized IoT security testing. The growing emphasis on supply chain security, driven by high-profile breaches, creates demand for comprehensive software supply chain security testing and SBOM analysis. The expansion of AI and machine learning in cybersecurity is enabling the development of more intelligent and automated testing tools, offering new avenues for service differentiation. Furthermore, the increasing focus on data privacy and regulatory compliance in emerging sectors like renewable energy and advanced manufacturing presents new client bases for security testing providers. The growing demand for cloud-native application security testing is also a significant growth area.

Leading Players in the Europe Security Testing Industry Market

- Offensive Security

- Accenture PLC

- Core Security Technologies

- VERACODE

- ControlCase LLC

- McAfee LLC

- Netcraft Ltd

- Maveric Systems

- Paladion Networks

- Cisco Systems Inc

- IBM

- Hewlett Packard Enterprise Development LP

Key Developments in Europe Security Testing Industry Industry

- January 2022: GrammaTech, an application security testing product and software research service provider, launched a new version of its CodeSentry software supply chain security platform. This innovation enables organizations to quickly produce a Software Bill of Materials (SBOM), proactively detect and address risks in commercial off-the-shelf and third-party software, and helps development teams deliver secure and compliant software.

- January 2022: NTT Security AppSec Solutions Inc. announced the launch of a new solution empowering enterprises to conduct dynamic application security testing at each phase of the development cycle, effectively preventing exploitable vulnerabilities from reaching production.

Future Outlook for Europe Security Testing Industry Market

The future outlook for the Europe Security Testing Industry is exceptionally bright, characterized by sustained high growth and continuous innovation. The increasing reliance on digital technologies, coupled with the ever-evolving threat landscape, will continue to fuel demand for comprehensive security testing solutions. Key growth accelerators will include the widespread adoption of DevSecOps, the burgeoning IoT security testing market, and the imperative for robust software supply chain security. Investments in AI-powered security testing tools and advanced analytics will become increasingly critical for staying ahead of sophisticated cyber threats. The expanding regulatory framework across European nations will further solidify the need for proactive and continuous security testing. Organizations that can offer integrated, automated, and intelligent security testing solutions, tailored to specific industry needs and deployment models, are well-positioned to capture significant market share and drive the industry's future trajectory. The focus will increasingly shift from reactive incident response to proactive risk mitigation, making security testing an indispensable component of business resilience.

Europe Security Testing Industry Segmentation

-

1. Deployment

- 1.1. On Premise

- 1.2. Cloud

- 1.3. Hybrid

-

2. Type

-

2.1. Network Security Testing

- 2.1.1. VPN Testing

- 2.1.2. Firewall Testing

- 2.1.3. Other Service Types

-

2.2. Application Security Testing

-

2.2.1. Application Type

- 2.2.1.1. Mobile Application Security Testing

- 2.2.1.2. Web Application Security Testing

- 2.2.1.3. Cloud Application Security Testing

- 2.2.1.4. Enterprise Application Security Testing

-

2.2.2. Testing Type

- 2.2.2.1. SAST

- 2.2.2.2. DAST

- 2.2.2.3. IAST

- 2.2.2.4. RASP

-

2.2.1. Application Type

-

2.1. Network Security Testing

-

3. Testing Tool

- 3.1. Web Application Testing Tool

- 3.2. Code Review Tool

- 3.3. Penetration Testing Tool

- 3.4. Software Testing Tool

- 3.5. Other Testing Tools

-

4. End-User Industry

- 4.1. Government

- 4.2. BFSI

- 4.3. Healthcare

- 4.4. Manufacturing

- 4.5. IT and Telecom

- 4.6. Retail

- 4.7. Other End-User Industries

Europe Security Testing Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Security Testing Industry Regional Market Share

Geographic Coverage of Europe Security Testing Industry

Europe Security Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Safety from Security Threats; Government Regulations Driving Security Needs

- 3.3. Market Restrains

- 3.3.1. Limited Computing Performance

- 3.4. Market Trends

- 3.4.1. Penetration Testing Tools segment is anticipated to register significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Security Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On Premise

- 5.1.2. Cloud

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Network Security Testing

- 5.2.1.1. VPN Testing

- 5.2.1.2. Firewall Testing

- 5.2.1.3. Other Service Types

- 5.2.2. Application Security Testing

- 5.2.2.1. Application Type

- 5.2.2.1.1. Mobile Application Security Testing

- 5.2.2.1.2. Web Application Security Testing

- 5.2.2.1.3. Cloud Application Security Testing

- 5.2.2.1.4. Enterprise Application Security Testing

- 5.2.2.2. Testing Type

- 5.2.2.2.1. SAST

- 5.2.2.2.2. DAST

- 5.2.2.2.3. IAST

- 5.2.2.2.4. RASP

- 5.2.2.1. Application Type

- 5.2.1. Network Security Testing

- 5.3. Market Analysis, Insights and Forecast - by Testing Tool

- 5.3.1. Web Application Testing Tool

- 5.3.2. Code Review Tool

- 5.3.3. Penetration Testing Tool

- 5.3.4. Software Testing Tool

- 5.3.5. Other Testing Tools

- 5.4. Market Analysis, Insights and Forecast - by End-User Industry

- 5.4.1. Government

- 5.4.2. BFSI

- 5.4.3. Healthcare

- 5.4.4. Manufacturing

- 5.4.5. IT and Telecom

- 5.4.6. Retail

- 5.4.7. Other End-User Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Offensive Security

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Accenture PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Core Security Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 VERACODE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ControlCase LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 McAfee LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Netcraft Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maveric Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paladion Networks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cisco Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IBM

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hewlett Packard Enterprise Development LP

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Offensive Security

List of Figures

- Figure 1: Europe Security Testing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Security Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Security Testing Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Europe Security Testing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Europe Security Testing Industry Revenue Million Forecast, by Testing Tool 2020 & 2033

- Table 4: Europe Security Testing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 5: Europe Security Testing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Security Testing Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Europe Security Testing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Security Testing Industry Revenue Million Forecast, by Testing Tool 2020 & 2033

- Table 9: Europe Security Testing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Europe Security Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Security Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Security Testing Industry?

The projected CAGR is approximately 23.00%.

2. Which companies are prominent players in the Europe Security Testing Industry?

Key companies in the market include Offensive Security, Accenture PLC, Core Security Technologies, VERACODE, ControlCase LLC, McAfee LLC, Netcraft Ltd*List Not Exhaustive, Maveric Systems, Paladion Networks, Cisco Systems Inc, IBM, Hewlett Packard Enterprise Development LP.

3. What are the main segments of the Europe Security Testing Industry?

The market segments include Deployment, Type, Testing Tool, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Safety from Security Threats; Government Regulations Driving Security Needs.

6. What are the notable trends driving market growth?

Penetration Testing Tools segment is anticipated to register significant growth.

7. Are there any restraints impacting market growth?

Limited Computing Performance.

8. Can you provide examples of recent developments in the market?

January 2022 - GrammaTech, an application security testing product, and software research service provider, announced the launch of a new version of the company's CodeSentry software supply chain security platform, which enables organizations to produce a software bill of materials (SBOM) quickly. The software enables organizations to proactively detect and address risks in commercial off-the-shelf applications and third-party software and allows development teams to ensure they are delivering secure and compliant software.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Security Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Security Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Security Testing Industry?

To stay informed about further developments, trends, and reports in the Europe Security Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence