Key Insights

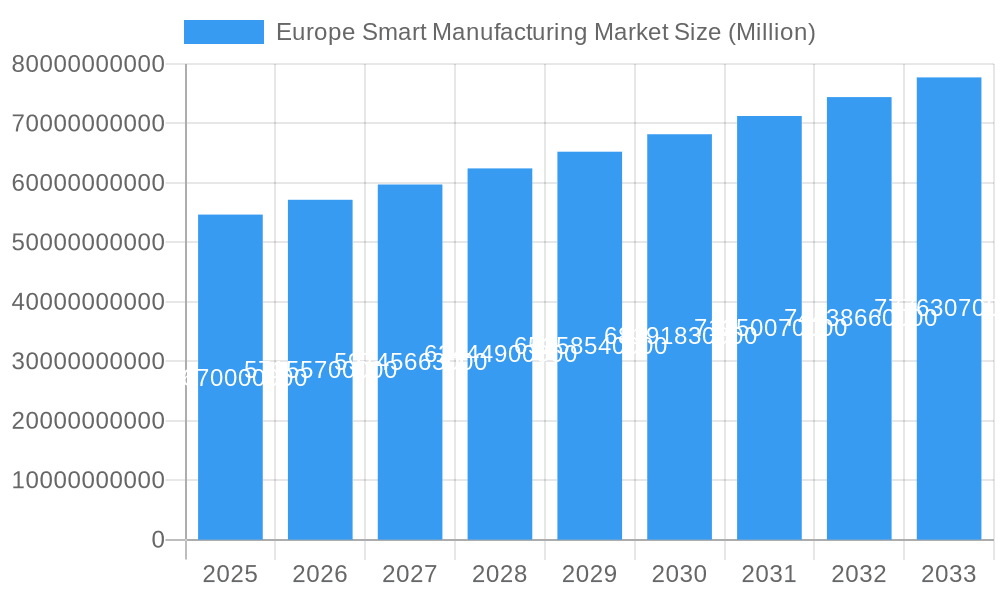

The Europe Smart Manufacturing Market is poised for significant expansion, projected to reach USD 54.67 billion by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 4.59% through 2033. This upward trajectory is fueled by the relentless pursuit of operational efficiency, enhanced productivity, and superior product quality across diverse industrial sectors. Key technological enablers driving this growth include the widespread adoption of Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) for sophisticated automation, alongside the increasing integration of Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) for seamless data flow and optimized resource management. Furthermore, the proliferation of Human Machine Interfaces (HMIs) is empowering operators with intuitive control and real-time insights, while advancements in robotics and machine vision systems are automating complex assembly and inspection processes. This pervasive integration of smart technologies is revolutionizing how goods are produced, making manufacturing smarter, more agile, and more competitive.

Europe Smart Manufacturing Market Market Size (In Billion)

The market's dynamism is further shaped by its diverse segmentation and strong end-user industry demand. The Automotive sector, a cornerstone of European manufacturing, is at the forefront of adopting smart solutions to achieve precision assembly and supply chain resilience. Similarly, the Oil & Gas, Chemical & Petrochemical, and Pharmaceutical industries are leveraging smart manufacturing to enhance safety, ensure regulatory compliance, and optimize complex production workflows. The Food & Beverage and Metals & Mining sectors are also recognizing the immense benefits of smart technologies for improving throughput, reducing waste, and maintaining stringent quality standards. The European region, specifically countries like Germany, the United Kingdom, and France, is a focal point for these advancements, benefiting from strong industrial foundations, government initiatives promoting digital transformation, and a highly skilled workforce. Addressing constraints such as initial investment costs and the need for cybersecurity enhancements will be crucial for unlocking the full potential of this burgeoning market.

Europe Smart Manufacturing Market Company Market Share

This in-depth report delivers a meticulous analysis of the Europe Smart Manufacturing Market, providing critical insights and actionable intelligence for stakeholders. Spanning the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study explores market dynamics, technological advancements, and key players shaping the future of intelligent industrial operations across Europe. Leveraging high-ranking keywords such as "smart manufacturing Europe," "Industry 4.0," "automation," "robotics," "digital transformation," and "industrial IoT," this report aims to be the definitive resource for industry professionals, investors, and strategists seeking to capitalize on this rapidly evolving sector.

Europe Smart Manufacturing Market Market Structure & Innovation Trends

The Europe Smart Manufacturing Market is characterized by a moderately concentrated structure, with established multinational corporations holding significant market shares. Innovation is primarily driven by the relentless pursuit of operational efficiency, enhanced productivity, and cost reduction through the adoption of advanced technologies. Regulatory frameworks, including GDPR and various EU directives concerning industrial safety and environmental standards, play a crucial role in shaping market development, albeit sometimes acting as a barrier to faster adoption. The emergence of new technologies and a growing awareness of their benefits mitigate the threat of product substitutes. End-user demographics are increasingly sophisticated, demanding customized solutions and real-time data insights. Mergers and Acquisitions (M&A) are a significant trend, with major players consolidating their portfolios and expanding their technological capabilities. For instance, a recent M&A deal in the industrial automation sector was valued at over €1,500 Million, indicating substantial investment in the market. Key players continue to invest heavily in R&D, with an estimated 15-20% of their revenue allocated to innovation.

- Market Concentration: Dominated by a few key players, but with growing influence of specialized solution providers.

- Innovation Drivers: Operational efficiency, cost reduction, enhanced quality, predictive maintenance, and sustainability.

- Regulatory Frameworks: EU directives on data privacy, industrial safety, and environmental impact are influential.

- Product Substitutes: Limited, as smart manufacturing solutions offer comprehensive integration.

- End-User Demographics: Increasing demand for customization, data analytics, and agile production.

- M&A Activities: Active consolidation to gain market share and acquire technological expertise. Estimated M&A deal values in the sector are in the hundreds of millions to billions of Euros.

Europe Smart Manufacturing Market Market Dynamics & Trends

The Europe Smart Manufacturing Market is experiencing robust growth, propelled by a confluence of technological advancements and evolving industrial demands. The core of this expansion lies in the increasing adoption of Industry 4.0 principles, which integrate advanced digital technologies into manufacturing processes. Key growth drivers include the imperative for enhanced productivity, the need for greater operational flexibility to adapt to dynamic market conditions, and the drive for significant cost optimization across the value chain. Technological disruptions are predominantly centered around the Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML), Big Data analytics, and advanced robotics, which collectively enable unprecedented levels of automation and data-driven decision-making. Consumer preferences are also indirectly influencing the market; as end-consumers demand faster delivery, greater customization, and sustainable products, manufacturers are compelled to adopt smarter, more agile production methods. This has led to a surge in demand for solutions like MES, ERP, and PLM systems that streamline operations and improve traceability. The competitive landscape is characterized by intense innovation and strategic partnerships, as companies vie to offer comprehensive and integrated smart manufacturing solutions. Market penetration of advanced automation technologies is steadily increasing, with an estimated CAGR of approximately 12-15% expected throughout the forecast period. The widespread implementation of AI and ML algorithms is revolutionizing predictive maintenance, significantly reducing downtime and associated costs. Furthermore, the growing emphasis on cybersecurity within manufacturing environments is driving the adoption of robust security solutions as an integral part of smart manufacturing deployments. The market penetration of IIoT devices is projected to exceed 60% by 2028.

Dominant Regions & Segments in Europe Smart Manufacturing Market

The Germany stands as the dominant region within the Europe Smart Manufacturing Market, driven by its robust industrial base, strong government support for technological innovation, and a highly skilled workforce. The country's deep-rooted manufacturing heritage, particularly in the automotive and machinery sectors, provides a fertile ground for the adoption of smart manufacturing technologies. Significant investments in Industry 4.0 initiatives, coupled with a proactive approach to digitalization, further cement Germany's leadership.

Within the technology segment, Programmable Logic Controllers (PLCs) and Manufacturing Execution Systems (MES) are currently the most dominant, forming the foundational pillars of smart manufacturing automation and operational management. PLCs are indispensable for controlling discrete manufacturing processes, while MES provides real-time visibility and control over shop-floor operations. The Automotive sector consistently leads as the primary end-user industry, demonstrating a high appetite for automation, robotics, and data-driven optimization to enhance production efficiency and product quality. The increasing complexity of vehicle manufacturing, coupled with the shift towards electric and autonomous vehicles, further amplifies the need for sophisticated smart manufacturing solutions.

- Leading Region: Germany, owing to its industrial strength and government support.

- Dominant Technology Segments:

- Programmable Logic Controller (PLC): Essential for real-time process control in discrete manufacturing.

- Manufacturing Execution System (MES): Critical for real-time shop floor management and data acquisition.

- Dominant Component Segment:

- Robotics: Integral for automating repetitive and complex tasks, enhancing precision and safety.

- Dominant End-user Industry:

- Automotive: High adoption rates driven by efficiency, quality, and customization demands.

- Key Drivers for Dominance:

- Economic Policies: Government incentives and funding for Industry 4.0 adoption.

- Infrastructure: Well-developed industrial infrastructure and connectivity.

- Technological Expertise: Availability of skilled labor and research institutions.

- Industry Demand: Strong demand from leading manufacturing sectors like automotive.

- Investment: Substantial private and public investment in smart manufacturing technologies.

Europe Smart Manufacturing Market Product Innovations

Europe is witnessing a surge in product innovations within the smart manufacturing landscape, characterized by the integration of AI, IoT, and advanced analytics into core manufacturing components. These innovations are geared towards enhancing predictive maintenance capabilities, optimizing energy consumption, and improving real-time decision-making on the shop floor. For instance, new generations of smart sensors offer unparalleled accuracy and connectivity, seamlessly feeding data into AI-powered analytics platforms. The development of collaborative robots (cobots) is also a significant trend, offering enhanced flexibility and human-robot interaction. These advancements provide manufacturers with a competitive edge by enabling greater agility, reduced downtime, and improved overall equipment effectiveness (OEE).

Report Scope & Segmentation Analysis

This report comprehensively segments the Europe Smart Manufacturing Market across various key dimensions. The Technology segment is analyzed, including Programmable Logic Controller (PLC), Supervisory Control and Data Acquisition (SCADA), Enterprise Resource Planning (ERP), Distributed Control System (DCS), Human Machine Interface (HMI), Product Lifecycle Management (PLM), and Manufacturing Execution System (MES). The Component segment covers Communication Segments, Control Devices, Machine Vision Systems, Robotics, and Sensors. The End-user Industry segmentation includes Automotive, Oil and Gas, Chemical and Petrochemical, Pharmaceutical, Food and Beverage, and Metals and Mining. Each segment is projected to experience varied growth rates, with the integration of AI and IoT driving advancements across all categories. The market for advanced robotics and machine vision systems is expected to witness a CAGR of over 15% during the forecast period.

Key Drivers of Europe Smart Manufacturing Market Growth

The Europe Smart Manufacturing Market is propelled by several critical growth drivers. Primarily, the increasing demand for operational efficiency and cost reduction across industries necessitates the adoption of smart manufacturing solutions. The proliferation of Industry 4.0 initiatives and government support for digitalization further fuels market expansion. Technological advancements in IoT, AI, ML, and robotics are enabling new levels of automation and data utilization. Moreover, a growing emphasis on sustainability and energy efficiency is driving the adoption of smart technologies that optimize resource consumption. Finally, the need for enhanced product quality and customization to meet evolving consumer demands plays a pivotal role in market growth.

- Technological Advancements: IoT, AI, ML, and robotics are enabling sophisticated automation.

- Economic Factors: Drive for operational efficiency and cost reduction.

- Regulatory Initiatives: Government support for Industry 4.0 and digital transformation.

- Consumer Demand: Need for customized products and faster delivery cycles.

- Sustainability Goals: Focus on energy efficiency and reduced environmental impact.

Challenges in the Europe Smart Manufacturing Market Sector

Despite its robust growth, the Europe Smart Manufacturing Market faces several challenges. A significant hurdle is the high initial investment cost associated with implementing smart manufacturing technologies, which can be prohibitive for small and medium-sized enterprises (SMEs). The existing skills gap, characterized by a shortage of trained personnel capable of operating and maintaining advanced automated systems, also poses a considerable restraint. Cybersecurity concerns, including the risk of data breaches and intellectual property theft, remain a persistent threat. Furthermore, the lack of standardized protocols and interoperability issues between different systems can complicate integration efforts.

- High Implementation Costs: Significant capital investment required for advanced technologies.

- Skills Gap: Shortage of qualified workforce for operating and maintaining smart systems.

- Cybersecurity Threats: Risks of data breaches and IP theft.

- Interoperability Issues: Challenges in integrating disparate systems and platforms.

- Regulatory Compliance: Navigating complex and evolving compliance standards.

Emerging Opportunities in Europe Smart Manufacturing Market

The Europe Smart Manufacturing Market is ripe with emerging opportunities. The increasing adoption of cloud-based solutions and edge computing offers enhanced data processing capabilities and scalability. The growing demand for sustainable manufacturing practices presents opportunities for smart solutions that optimize energy consumption and reduce waste. Furthermore, the expansion of the industrial IoT ecosystem, with a focus on connectivity and data analytics, opens new avenues for predictive maintenance and proactive problem-solving. The application of AI and machine learning in areas like quality control and supply chain optimization is also a significant growth area. The burgeoning market for personalized products and on-demand manufacturing is further driving the need for flexible and agile smart manufacturing systems.

- Cloud and Edge Computing: Enhanced data processing and scalability.

- Sustainable Manufacturing: Solutions for energy efficiency and waste reduction.

- Industrial IoT Ecosystem: Focus on connectivity and advanced analytics.

- AI/ML Applications: Revolutionizing quality control and supply chain management.

- Personalized Production: Demand for flexible and agile manufacturing.

Leading Players in the Europe Smart Manufacturing Market Market

- Honeywell International Inc

- ABB Ltd

- IBM Corporation

- Emerson Electric Co

- Siemens AG

- Schneider Electric SE

- Fanuc Corporation

- Rockwell Automation Inc

- General Electric Company

- Robert Bosch Gmb

Key Developments in Europe Smart Manufacturing Market Industry

- February 2021: Önusberget wind farm in northern Sweden, set to become Europe's largest single onshore wind farm with a capacity of 753 megawatts, utilizing 137 GE Cypress 5.5 MW wind turbines. This development highlights advancements in renewable energy integration and large-scale industrial projects.

- March 2021: FANUC and Rockwell Automation formed a coalition to address the manufacturing skills gap through robotics and automation apprenticeship programs. This initiative aims to upskill the workforce for advanced manufacturing roles, offering credentials in robotics and PLC operation, demonstrating a commitment to human capital development in the smart manufacturing sector.

Future Outlook for Europe Smart Manufacturing Market Market

The future outlook for the Europe Smart Manufacturing Market is exceptionally promising, driven by continuous technological innovation and increasing industry adoption. The trend towards greater automation, AI integration, and the Internet of Things will accelerate, leading to more intelligent and interconnected factories. The demand for sustainable manufacturing solutions will further propel the market, as companies seek to optimize energy consumption and reduce their environmental footprint. The ongoing digital transformation across all industrial sectors, coupled with strong government support for Industry 4.0, will ensure sustained growth. Strategic collaborations and acquisitions will continue to shape the competitive landscape, with an emphasis on end-to-end solution offerings. The market is poised to witness significant advancements in predictive analytics, digital twins, and augmented reality applications, transforming how products are designed, manufactured, and maintained, thus creating substantial strategic opportunities for market participants.

Europe Smart Manufacturing Market Segmentation

-

1. Technology

- 1.1. Programmable Logic Controller (PLC)

- 1.2. Supervis

- 1.3. Enterprise Resource and Planning (ERP)

- 1.4. Distributed Control System (DCS)

- 1.5. Human Machine Interface (HMI)

- 1.6. Product Lifecycle Management (PLM)

- 1.7. Manufacturing Execution System (MES)

-

2. Component

- 2.1. Communication Segments

- 2.2. Control Devices

- 2.3. Machine Vision Systems

- 2.4. Robotics

- 2.5. Sensors

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Oil and Gas

- 3.3. Chemical and Petrochemical

- 3.4. Pharmaceutical

- 3.5. Food and Beverage

- 3.6. Metals and Mining

Europe Smart Manufacturing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Smart Manufacturing Market Regional Market Share

Geographic Coverage of Europe Smart Manufacturing Market

Europe Smart Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Automation to Achieve Efficiency and Quality; Need for Compliance and Government Support for Digitization; Proliferation of Internet of Things

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Data Security; High Initial Installation Costs and Lack of Skilled Workforce Restricting Enterprises from Full-scale Adoption

- 3.4. Market Trends

- 3.4.1. Industrial Robotics Technology is Expected to Experience a Healthy Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Programmable Logic Controller (PLC)

- 5.1.2. Supervis

- 5.1.3. Enterprise Resource and Planning (ERP)

- 5.1.4. Distributed Control System (DCS)

- 5.1.5. Human Machine Interface (HMI)

- 5.1.6. Product Lifecycle Management (PLM)

- 5.1.7. Manufacturing Execution System (MES)

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Communication Segments

- 5.2.2. Control Devices

- 5.2.3. Machine Vision Systems

- 5.2.4. Robotics

- 5.2.5. Sensors

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Oil and Gas

- 5.3.3. Chemical and Petrochemical

- 5.3.4. Pharmaceutical

- 5.3.5. Food and Beverage

- 5.3.6. Metals and Mining

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emerson Electric Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fanuc Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rockwell Automation Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch Gmb

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Smart Manufacturing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Smart Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Smart Manufacturing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Europe Smart Manufacturing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Europe Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Smart Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Smart Manufacturing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Europe Smart Manufacturing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Europe Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Smart Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Smart Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Manufacturing Market?

The projected CAGR is approximately 4.59%.

2. Which companies are prominent players in the Europe Smart Manufacturing Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, IBM Corporation, Emerson Electric Co, Siemens AG, Schneider Electric SE, Fanuc Corporation, Rockwell Automation Inc, General Electric Company, Robert Bosch Gmb.

3. What are the main segments of the Europe Smart Manufacturing Market?

The market segments include Technology, Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Automation to Achieve Efficiency and Quality; Need for Compliance and Government Support for Digitization; Proliferation of Internet of Things.

6. What are the notable trends driving market growth?

Industrial Robotics Technology is Expected to Experience a Healthy Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

Concerns Regarding Data Security; High Initial Installation Costs and Lack of Skilled Workforce Restricting Enterprises from Full-scale Adoption.

8. Can you provide examples of recent developments in the market?

February 2021 - A remote, forested rise in northern Sweden, some 500 miles from Stockholm, is poised to become the largest single onshore wind farm in Europe. When completed, Önusberget wind farm will have the capacity to generate 753 megawatts, enough to supply the equivalent of more than 200,000 Swedish homes. Luxcara and GE Renewable Energy announced the farm would use 137 Cypress 5.5 MW wind turbines, the most powerful onshore turbines in GE's portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Manufacturing Market?

To stay informed about further developments, trends, and reports in the Europe Smart Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence