Key Insights

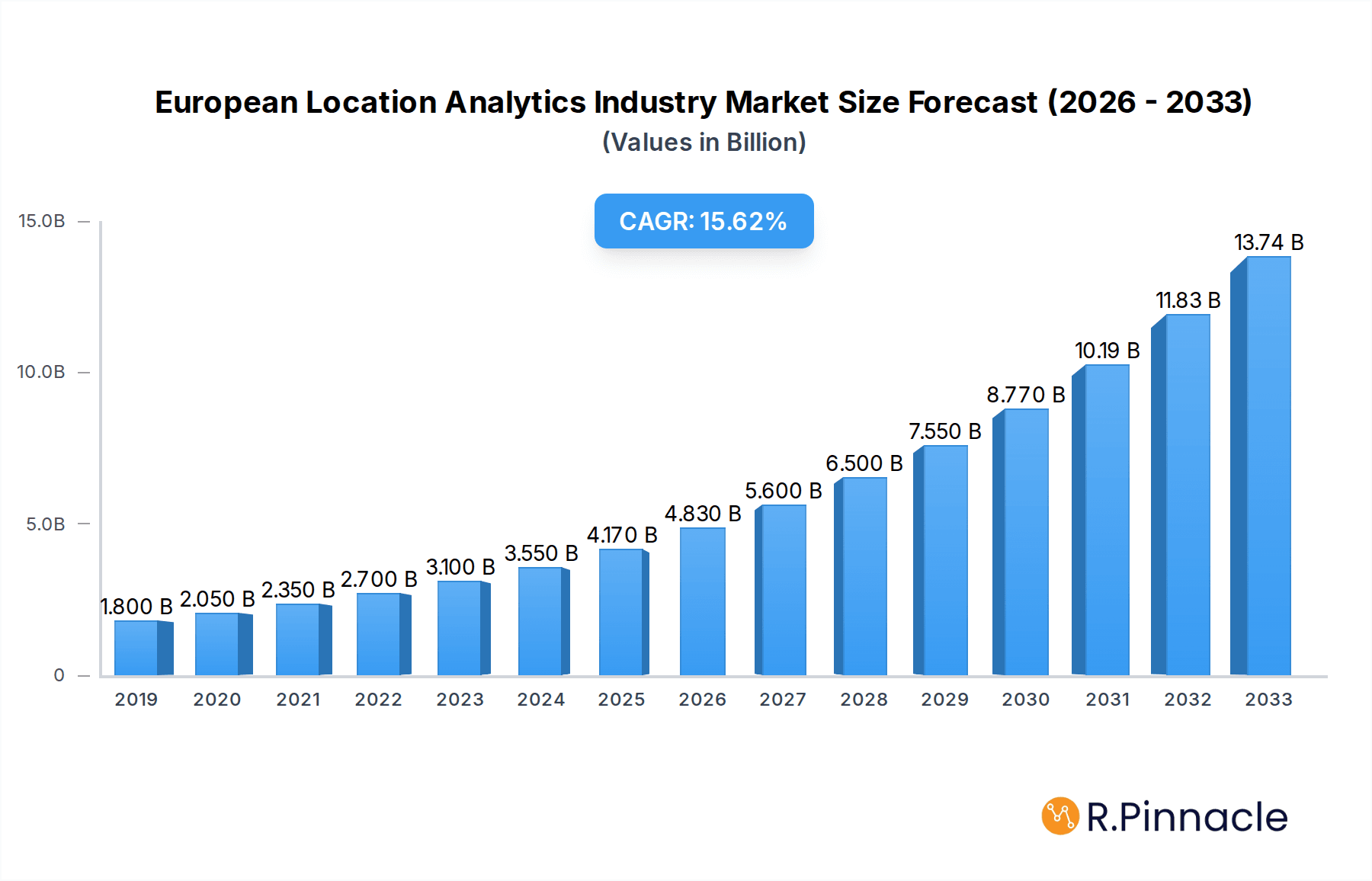

The European Location Analytics market is poised for substantial expansion, projected to reach $4.17 Million by 2025 and continue its robust growth trajectory at a Compound Annual Growth Rate (CAGR) of 15.60% through 2033. This dynamic market is primarily driven by the increasing adoption of location-aware technologies across diverse sectors, including BFSI, Retail, Transportation and Logistics, Tourism and Hospitality, and Healthcare. Businesses are leveraging location analytics to gain deeper customer insights, optimize operational efficiency, personalize marketing efforts, and enhance strategic decision-making. The surge in demand for real-time data processing and predictive analytics further fuels market growth, as organizations seek to extract actionable intelligence from geographical information. Furthermore, the growing integration of Internet of Things (IoT) devices and advancements in geospatial technologies are creating new opportunities for location analytics solutions.

European Location Analytics Industry Market Size (In Billion)

Several key trends are shaping the European Location Analytics landscape. The increasing prevalence of cloud-based deployment models offers scalability, cost-effectiveness, and accessibility, attracting a wider range of businesses, especially small and medium-sized enterprises. Conversely, on-premise solutions continue to be favored by organizations with stringent data security and regulatory compliance requirements. The market is witnessing a significant push towards sophisticated analytics capabilities, including AI and machine learning, to enable more accurate forecasting and advanced pattern recognition. While the market exhibits strong growth potential, certain restraints exist, such as data privacy concerns and the need for skilled professionals to implement and manage complex location analytics solutions. However, ongoing technological advancements and increasing awareness of the benefits of location intelligence are expected to mitigate these challenges, paving the way for sustained and significant market development across Europe.

European Location Analytics Industry Company Market Share

European Location Analytics Industry: Market Outlook, Trends, and Forecast 2025-2033

This comprehensive report delves into the dynamic European Location Analytics Industry, providing in-depth analysis and actionable insights. Spanning a study period from 2019 to 2033, with a base year of 2025, this report offers a robust forecast for the period 2025-2033, building upon historical data from 2019-2024. Discover the market structure, innovation trends, key drivers, challenges, and future outlook of this rapidly evolving sector. Leverage expert analysis to understand market segmentation, dominant regions, and the strategic moves of leading players, including SAS Institute Inc, TomTom International BV, TIBCO Software Inc, IBM Corporation, Lepton Software, Google LLC, Pitney Bowes Inc, CleverAnalytics AS, Hexagon AB, Esri Technologies Ltd, Cisco Systems Inc, Microsoft Corporation, QlikTech International AB, Tableau Software LLC (Salesforce), Alteryx Inc, SAP SE, Galigeo, and HERE Technologies.

European Location Analytics Industry Market Structure & Innovation Trends

The European Location Analytics Industry exhibits a moderately concentrated market structure, driven by significant investments in Big Data analytics and Artificial Intelligence. Key innovation drivers include the escalating demand for real-time geospatial insights, advancements in AI and machine learning for predictive analysis, and the growing adoption of IoT devices generating vast location-based data streams. Regulatory frameworks, particularly GDPR, influence data privacy and security practices, shaping product development and deployment strategies. Product substitutes, while emerging in niche areas, are largely outpaced by the integrated capabilities of dedicated location analytics platforms. End-user demographics are diversifying, with BFSI, Retail, and Transportation & Logistics leading adoption, followed by Tourism & Hospitality and Healthcare. Mergers and acquisitions (M&A) are a notable trend, with an estimated total deal value of over 5 Billion Euros in the historical period (2019-2024), as companies seek to consolidate market share and acquire complementary technologies. For example, recent strategic partnerships and acquisitions aim to integrate advanced mapping, AI-driven insights, and specialized industry solutions.

European Location Analytics Industry Market Dynamics & Trends

The European Location Analytics Industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033. This expansion is fueled by several interconnected market growth drivers. The increasing digital transformation across all sectors necessitates sophisticated data analysis, with location data proving to be a critical component for understanding customer behavior, optimizing operations, and identifying new market opportunities. Technological disruptions, such as the proliferation of 5G networks enabling faster data transmission and the advancement of edge computing for localized processing, are significantly enhancing the capabilities and applications of location analytics. Consumer preferences are shifting towards personalized experiences, which companies can deliver by leveraging location-based insights to tailor marketing, services, and product offerings. The competitive dynamics are characterized by intense innovation, with players continuously enhancing their platforms to offer more advanced features like predictive modeling, real-time tracking, and geospatial visualization. Market penetration is steadily increasing, with a projected reach of over 70% of relevant businesses across key European economies by the end of the forecast period. The demand for location intelligence is no longer confined to specific industries; it is becoming a fundamental requirement for businesses seeking a competitive edge in a data-driven economy. The ability to derive actionable insights from spatial data is crucial for optimizing supply chains, improving customer engagement, enhancing urban planning, and driving efficient resource allocation.

Dominant Regions & Segments in European Location Analytics Industry

The Outdoor location type segment is currently dominant in the European Location Analytics Industry, driven by its widespread applicability in sectors such as transportation, logistics, and urban planning. Within this, Cloud deployment models are gaining significant traction due to their scalability, cost-effectiveness, and ease of access to advanced analytics capabilities. The Transportation and Logistics end-user segment is a major contributor to market growth, benefiting from the need for route optimization, fleet management, supply chain visibility, and predictive maintenance.

Key drivers for the dominance of outdoor location analytics include:

- Infrastructure Development: Extensive road networks, public transport systems, and smart city initiatives necessitate real-time tracking and analysis of movement.

- E-commerce Growth: The surge in online retail fuels demand for efficient last-mile delivery and supply chain optimization.

- IoT Expansion: The proliferation of GPS-enabled devices and sensors in vehicles and infrastructure generates a continuous stream of outdoor location data.

The BFSI sector also demonstrates significant adoption, leveraging location analytics for fraud detection, risk assessment, customer segmentation, and branch network optimization. The Retail sector utilizes it for footfall analysis, store performance evaluation, targeted marketing, and competitive site selection.

While Indoor location analytics is a growing segment, particularly in retail for understanding in-store customer behavior and in healthcare for asset tracking and patient flow management, its market share is still smaller compared to its outdoor counterpart. Similarly, On-premise deployments, while offering greater control over data, are gradually being surpassed by cloud solutions due to their flexibility and reduced IT overhead. The growth in Tourism and Hospitality and Healthcare segments is expected to accelerate as these industries increasingly recognize the value of location intelligence for enhancing customer experiences and operational efficiency, respectively.

European Location Analytics Industry Product Innovations

Recent product innovations in the European Location Analytics Industry are focused on enhancing AI-driven insights, real-time data processing, and seamless integration with existing enterprise systems. Companies are developing advanced predictive analytics models for market forecasting and risk assessment, alongside sophisticated visualization tools that translate complex geospatial data into easily understandable dashboards. Competitive advantages are being gained through the development of specialized solutions tailored to specific industry needs, such as hyper-local marketing for retail or optimized routing for logistics. The emphasis is on providing actionable intelligence that empowers businesses to make data-informed decisions, leading to improved efficiency and profitability.

Report Scope & Segmentation Analysis

The European Location Analytics Industry report segments the market across Location Type (Indoor, Outdoor), Deployment (Cloud, On-premise), and End User (BFSI, Retail, Transportation and Logistics, Tourism and Hospitality, Healthcare, Other End User).

The Outdoor segment is projected to maintain its lead throughout the forecast period, driven by its extensive applications in logistics and transportation. The Cloud deployment model is expected to witness the highest growth rate, as businesses increasingly opt for scalable and cost-effective solutions.

The Transportation and Logistics segment is anticipated to be the largest end-user market, fueled by the ongoing demand for supply chain optimization and fleet management. The BFSI and Retail segments will continue to be significant contributors, with their adoption of location analytics for enhanced customer engagement and operational efficiency. Growth projections for Tourism and Hospitality and Healthcare indicate substantial potential as these sectors mature in their utilization of geospatial data.

Key Drivers of European Location Analytics Industry Growth

The European Location Analytics Industry is propelled by several key drivers. Technological advancements, including the widespread adoption of Big Data analytics, AI, and IoT, provide the foundational capabilities for sophisticated location intelligence. The increasing demand for data-driven decision-making across all business sectors, from optimizing supply chains to understanding customer behavior, is a significant economic factor. Furthermore, a supportive regulatory environment that, while emphasizing data privacy, also encourages innovation in data utilization, plays a crucial role. For instance, smart city initiatives across Europe are creating new avenues for location analytics applications in urban planning and traffic management.

Challenges in the European Location Analytics Industry Sector

Despite robust growth, the European Location Analytics Industry faces several challenges. Data privacy regulations, such as GDPR, pose a significant hurdle, requiring strict adherence to data collection, storage, and usage protocols, which can increase compliance costs and complexity. Integration complexities with legacy IT systems in some organizations can hinder seamless adoption of new location analytics platforms. Talent shortages in specialized data science and geospatial analytics roles also present a restraint. Furthermore, data accuracy and quality concerns, particularly with publicly available datasets, can impact the reliability of insights generated. The competitive landscape, while driving innovation, also intensifies pressure on pricing and market share.

Emerging Opportunities in European Location Analytics Industry

Emerging opportunities in the European Location Analytics Industry lie in the expanding use of AI and Machine Learning for predictive and prescriptive analytics, enabling businesses to anticipate trends and proactively address challenges. The growing adoption of IoT devices presents a rich source of real-time location data, opening avenues for enhanced operational efficiency and personalized services. The development of specialized location intelligence solutions for niche markets within healthcare, agriculture, and renewable energy offers significant growth potential. Furthermore, the increasing focus on sustainability and ESG initiatives creates demand for location analytics to optimize resource management and monitor environmental impact. The convergence of location data with other data sources like demographic and behavioral data is unlocking new levels of insight.

Leading Players in the European Location Analytics Industry Market

- SAS Institute Inc

- TomTom International BV

- TIBCO Software Inc

- IBM Corporation

- Lepton Software

- Google LLC

- Pitney Bowes Inc

- CleverAnalytics AS

- Hexagon AB

- Esri Technologies Ltd

- Cisco Systems Inc

- Microsoft Corporation

- QlikTech International AB

- Tableau Software LLC (Salesforce)

- Alteryx Inc

- SAP SE

- Galigeo

- HERE Technologies

Key Developments in European Location Analytics Industry Industry

- August 2023: Cisco and Nutanix announced a global strategic partnership to accelerate hybrid multi-cloud deployments by offering the industry's most complete hyper-converged solution for IT modernization and business transformation. This development enhances the infrastructure capabilities supporting location analytics solutions.

- July 2023: Esri partnered with Impact Observatory and released a global land-use/land-cover map of the world based on the most up-to-date 10-meter Sentinel-2 satellite data for every year from 2017. The improved AI model for classification makes the maps more temporally consistent, providing richer foundational data for various location analytics applications.

Future Outlook for European Location Analytics Industry Market

The future outlook for the European Location Analytics Industry is exceptionally bright, marked by continuous innovation and expanding market penetration. Advancements in AI and machine learning will drive more sophisticated predictive and prescriptive analytics, enabling businesses to not only understand past trends but also anticipate future outcomes with greater accuracy. The integration of real-time data from an ever-increasing number of IoT devices will further enhance the granularity and timeliness of insights. Growth accelerators include the growing demand for hyper-personalized customer experiences, the imperative for optimizing complex supply chains in an increasingly globalized yet volatile world, and the critical need for data-driven solutions in urban planning and smart city development. Strategic opportunities abound for companies that can offer integrated platforms, specialized solutions, and robust data security, positioning the industry for sustained and accelerated growth in the coming years.

European Location Analytics Industry Segmentation

-

1. Location Type

- 1.1. Indoor

- 1.2. Outdoor

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Retail

- 3.3. Transportation and Logistics

- 3.4. Tourism and Hospitality

- 3.5. Healthcare

- 3.6. Other End User

European Location Analytics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

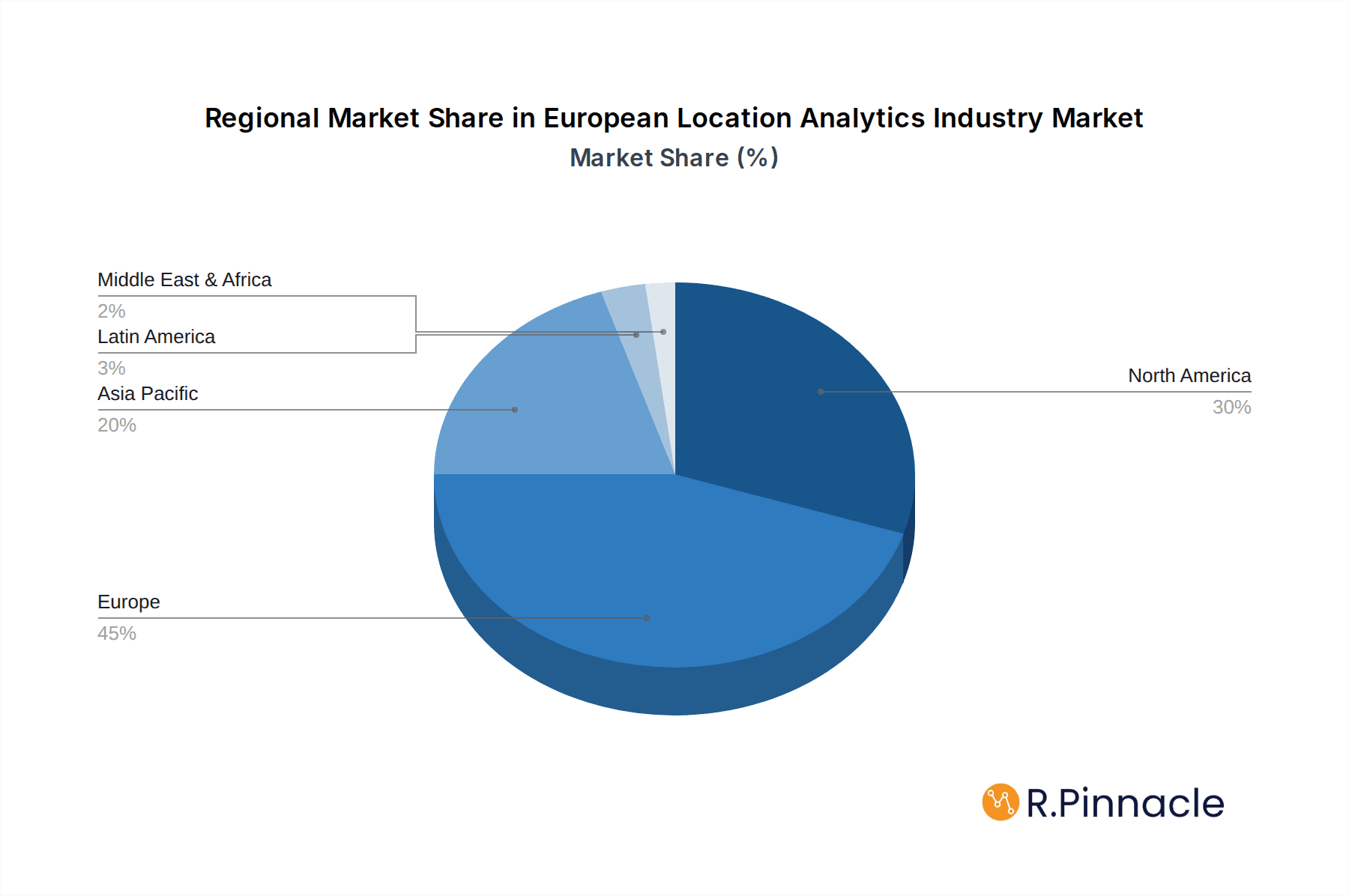

European Location Analytics Industry Regional Market Share

Geographic Coverage of European Location Analytics Industry

European Location Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Spatial Data and Analytics in Various Industries; Growing Propensity of Consumers Toward Applications that Use Location Data

- 3.3. Market Restrains

- 3.3.1. Data Privacy Issues and Growing Regulations

- 3.4. Market Trends

- 3.4.1. Cloud Segment is One of the Factors Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Location Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location Type

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Transportation and Logistics

- 5.3.4. Tourism and Hospitality

- 5.3.5. Healthcare

- 5.3.6. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Location Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TomTom International BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TIBCO Software Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lepton Softwar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Google LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pitney Bowes Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CleverAnalytics AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hexagon AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Esri Technologies Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cisco Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Microsoft Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 QlikTech International AB

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Tableau Software LLC (Salesforce)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Alteryx Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 SAP SE

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Galigeo

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 HERE Technologies

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: European Location Analytics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Location Analytics Industry Share (%) by Company 2025

List of Tables

- Table 1: European Location Analytics Industry Revenue Million Forecast, by Location Type 2020 & 2033

- Table 2: European Location Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: European Location Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: European Location Analytics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: European Location Analytics Industry Revenue Million Forecast, by Location Type 2020 & 2033

- Table 6: European Location Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: European Location Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: European Location Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark European Location Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Location Analytics Industry?

The projected CAGR is approximately 15.60%.

2. Which companies are prominent players in the European Location Analytics Industry?

Key companies in the market include SAS Institute Inc, TomTom International BV, TIBCO Software Inc, IBM Corporation, Lepton Softwar, Google LLC, Pitney Bowes Inc, CleverAnalytics AS, Hexagon AB, Esri Technologies Ltd, Cisco Systems Inc, Microsoft Corporation, QlikTech International AB, Tableau Software LLC (Salesforce), Alteryx Inc, SAP SE, Galigeo, HERE Technologies.

3. What are the main segments of the European Location Analytics Industry?

The market segments include Location Type, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Spatial Data and Analytics in Various Industries; Growing Propensity of Consumers Toward Applications that Use Location Data.

6. What are the notable trends driving market growth?

Cloud Segment is One of the Factors Driving the Market.

7. Are there any restraints impacting market growth?

Data Privacy Issues and Growing Regulations.

8. Can you provide examples of recent developments in the market?

August 2023 - Cisco, one of the leaders in enterprise networking and security, and Nutanix, Inc., a leader in hybrid multi-cloud computing, announced a global strategic partnership to accelerate hybrid multi-cloud deployments by offering the industry's most complete hyper-converged solution for IT modernization and business transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Location Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Location Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Location Analytics Industry?

To stay informed about further developments, trends, and reports in the European Location Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence