Key Insights

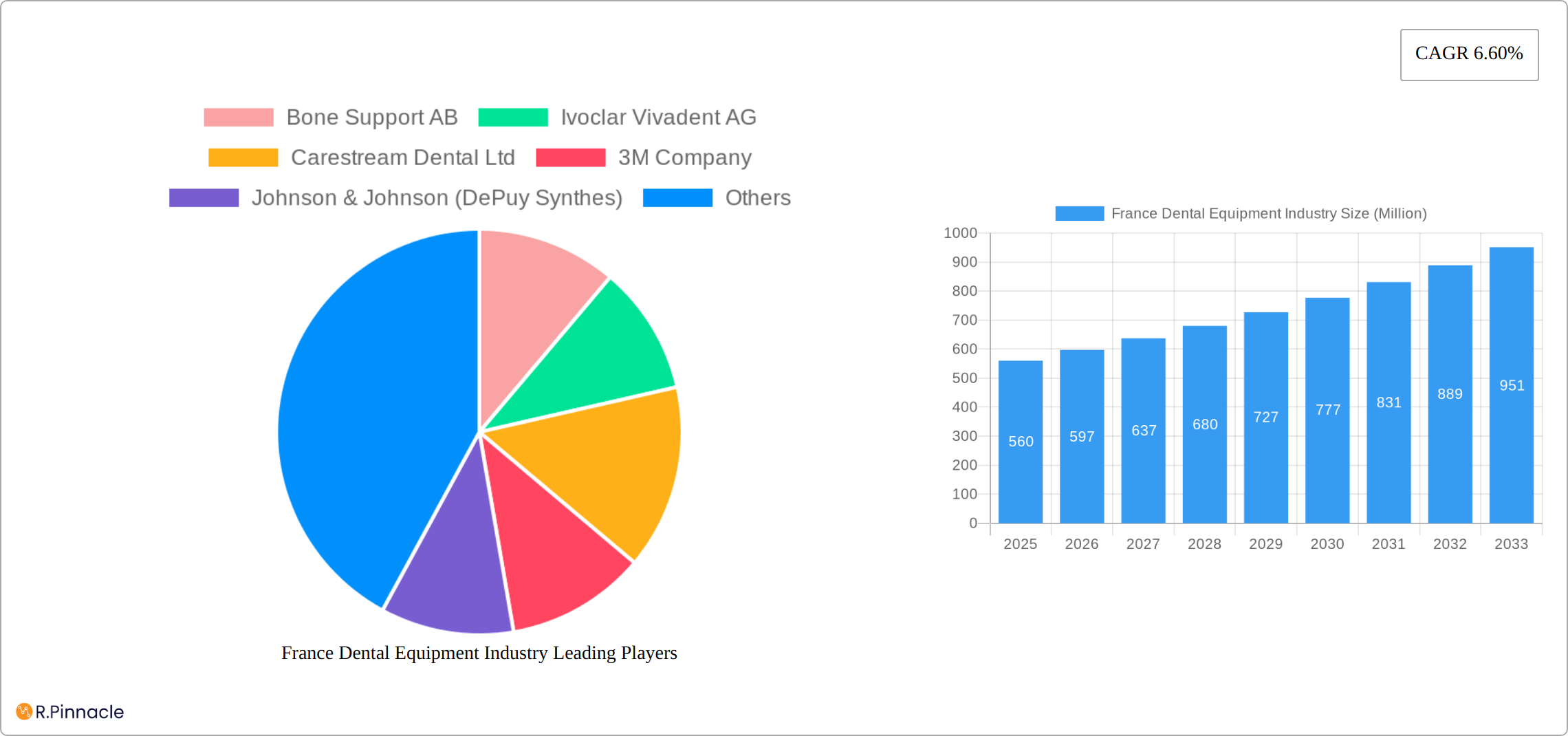

The France dental equipment market, valued at €0.56 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.60% from 2025 to 2033. This expansion is driven by several key factors. Increasing prevalence of dental diseases, a rising geriatric population requiring more extensive dental care, and growing awareness of oral hygiene are significant contributors. Furthermore, technological advancements leading to the introduction of sophisticated and minimally invasive dental equipment, such as advanced imaging systems and CAD/CAM technology for restorations, are fueling market growth. Government initiatives promoting oral health and increasing dental insurance coverage also play a crucial role in boosting market demand. The market is segmented by end-user (hospitals, clinics, and other end-users), product type (general and diagnostic equipment), and treatment type (orthodontic, endodontic, periodontic, and prosthodontic). Hospitals and clinics represent the largest end-user segments, while general equipment holds a significant share of the product market. The orthodontic segment is witnessing particularly strong growth due to rising aesthetic concerns and increasing affordability of orthodontic treatments.

Competitive forces within the French dental equipment market are intense, with both established multinational corporations like 3M Company, Johnson & Johnson (DePuy Synthes), and Straumann Holding AG, and smaller specialized companies like Bone Support AB and Miglionico s.r.l. vying for market share. The market is characterized by ongoing innovation, with companies focusing on developing technologically advanced equipment to improve treatment outcomes and efficiency. While the market enjoys strong growth drivers, potential restraints include the high cost of advanced equipment, stringent regulatory approvals, and the potential impact of economic fluctuations on healthcare spending. However, the long-term outlook remains positive, fueled by the continuous need for effective and efficient dental care. The strategic focus on innovation and technological advancements by leading players will shape the future landscape of this dynamic market.

France Dental Equipment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France dental equipment industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The report leverages extensive market research and data analysis to deliver actionable intelligence on market size, growth drivers, challenges, and future opportunities. Expect detailed segmentations by end-user (hospitals, clinics, other end-users), product type (general and diagnostics equipment), and treatment type (orthodontic, endodontic, periodontic, prosthodontic). The report also profiles key players such as Bone Support AB, Ivoclar Vivadent AG, and 3M Company, providing a competitive landscape analysis. With a projected market value exceeding xx Million by 2033, this report is an essential resource for understanding and navigating the dynamic France dental equipment market.

France Dental Equipment Industry Market Structure & Innovation Trends

The France dental equipment market exhibits a moderately concentrated structure, with a few major players holding significant market share. The industry is driven by innovation in digital dentistry, including CAD/CAM technology, 3D printing, and AI-powered diagnostics. Stringent regulatory frameworks, overseen by relevant French health authorities, influence product approvals and market entry. Substitutes, such as traditional methods or less technologically advanced equipment, pose a competitive pressure, albeit limited due to the growing preference for advanced technology. The end-user demographic is primarily composed of dental clinics and hospitals, with a growing segment of private practices.

M&A Activity:

- Significant M&A activity has shaped the market landscape. For example, the xx Million acquisition of Biotech Dental S.A.S. by Henry Schein in April 2023 expanded Henry Schein's presence in the French market, significantly boosting their market share in clear aligners and digital dental software. The overall value of M&A deals in the French dental equipment market in the period 2019-2024 is estimated at xx Million.

France Dental Equipment Industry Market Dynamics & Trends

The France dental equipment market is experiencing robust growth, driven by several key factors. Increasing prevalence of dental diseases, rising disposable incomes, and growing awareness of oral hygiene are key growth drivers. Technological advancements in digital dentistry, such as cone-beam computed tomography (CBCT) and intraoral scanners, are significantly impacting the market. Consumers increasingly prefer minimally invasive procedures and advanced technologies, boosting demand for sophisticated dental equipment. The market exhibits strong competitive dynamics, with established players vying for market share through innovation, strategic partnerships, and acquisitions. The CAGR for the period 2025-2033 is projected to be xx%, with market penetration expected to increase by xx% during the forecast period, driven mainly by the expanding adoption of digital technologies.

Dominant Regions & Segments in France Dental Equipment Industry

The Ile-de-France region (Paris region) is the dominant market segment, owing to its high concentration of dental clinics, hospitals, and research institutions. Other significant regions include Rhône-Alpes and Provence-Alpes-Côte d'Azur.

Dominant Segments:

- By End-User: Hospitals and clinics account for the largest share of the market, driven by increasing investments in dental infrastructure.

- By Product: General dental equipment, including chairs and handpieces, dominates the market, with a growing demand for diagnostics equipment such as CBCT scanners.

- By Treatment: Orthodontics and prosthodontics are the fastest-growing treatment segments, fueled by technological advancements and increasing patient demand for cosmetic dentistry.

Key Drivers:

- Strong government support for healthcare infrastructure development.

- Favorable regulatory environment promoting technological innovation.

- High concentration of dental professionals and healthcare institutions.

France Dental Equipment Industry Product Innovations

The French dental equipment market is experiencing a wave of innovation, significantly enhancing both clinical practice and patient care. Artificial intelligence (AI) is rapidly transforming diagnostics, offering faster, more accurate assessments and personalized treatment plans. Computer-aided design/computer-aided manufacturing (CAD/CAM) systems are revolutionizing the creation of dental restorations, leading to improved precision, efficiency, and reduced chair time. A strong emphasis on minimally invasive procedures and patient-centric technologies reflects a growing commitment to enhanced comfort and a positive patient experience. These advancements are driving improved treatment outcomes, shorter treatment times, and increased patient satisfaction, creating significant competitive advantages for dental professionals in France.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the France dental equipment market, segmented by key parameters to offer a granular understanding of market dynamics. The segmentation includes: end-user (hospitals, private clinics, dental labs, and other end-users); product type (restorative, preventative, general practice equipment, and diagnostic imaging systems); and treatment type (orthodontics, endodontics, periodontics, prosthodontics, implantology, and others). Each segment presents unique growth trajectories and competitive landscapes. Analysis reveals the digital diagnostics and orthodontic treatment segments as exhibiting particularly robust growth. The report projects significant overall market expansion throughout the forecast period (2025-2033), providing detailed insights into market size and growth rates for each segment.

Key Drivers of France Dental Equipment Industry Growth

Several key factors are propelling the growth of the France dental equipment industry. Significant technological advancements, particularly in AI and robotics for dental procedures, are driving demand for sophisticated and efficient equipment. A robust French economy, coupled with increased healthcare spending and a growing emphasis on preventative dental care, creates a fertile ground for market expansion. Furthermore, supportive government regulations promoting digital health solutions and telehealth initiatives are encouraging the adoption of innovative dental technologies, fostering market growth and modernization.

Challenges in the France Dental Equipment Industry Sector

Despite strong growth potential, the French dental equipment industry faces several challenges. Stringent regulatory requirements for product approvals can create significant hurdles for new market entrants and delay the introduction of innovative technologies. Supply chain vulnerabilities and potential disruptions can impact the availability of essential components, influencing production timelines and potentially increasing costs. The market also experiences intense competition among established multinational corporations and emerging players, creating pressure on pricing and profit margins. The report quantifies the estimated negative impact of these challenges on overall market growth during the forecast period (2025-2033), providing a realistic assessment of market performance.

Emerging Opportunities in France Dental Equipment Industry

Emerging opportunities lie in the growing adoption of teledentistry, offering remote diagnostic and treatment services. The integration of AI and machine learning in dental diagnostics and treatment planning presents a vast opportunity for innovation. The increasing demand for aesthetic dentistry and minimally invasive procedures fuels demand for advanced equipment in these areas.

Leading Players in the France Dental Equipment Industry Market

- Bone Support AB

- Ivoclar Vivadent AG

- Carestream Dental Ltd

- 3M Company

- Johnson & Johnson (DePuy Synthes)

- Miglionico s r l

- Straumann Holding AG

- Planmeca Oy

- Ningbo Runyes Medical Instrument Co Ltd

Key Developments in France Dental Equipment Industry Industry

- April 2023: Henry Schein, Inc. acquired a majority ownership stake in Biotech Dental S.A.S., expanding its portfolio in clear aligners, dental implants, and digital dental software. This acquisition significantly strengthened Henry Schein's position in the French market.

- January 2023: Milestone Scientific, Inc. signed a distribution agreement with Sweden & Martina, granting exclusive rights to market Milestone's STA Single Tooth Anesthesia System (STA) in France, Spain, and Portugal. This expansion into new markets is expected to boost the adoption of painless and precise injection technology.

Future Outlook for France Dental Equipment Industry Market

The future outlook for the France dental equipment market remains positive, driven by continued technological innovation, increasing healthcare spending, and a growing focus on preventive and aesthetic dentistry. Strategic partnerships, acquisitions, and investments in research and development will shape the industry's landscape, driving further growth and expansion. The market is expected to witness robust growth, fueled by the increasing adoption of digital technologies and the growing demand for advanced dental treatments.

France Dental Equipment Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

- 1.1.1. Dental Lasers

- 1.1.2. Radiology Equipment

- 1.1.3. Other Products

- 1.2. Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End-Users

France Dental Equipment Industry Segmentation By Geography

- 1. France

France Dental Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Ageing Population

- 3.2.2 and Increasing Demand for Cosmetic Dentistry; Rising Incidence of Dental Diseases; Innovation in Dental Products

- 3.3. Market Restrains

- 3.3.1. Increasing Cost of Surgeries; Lack of Proper Reimbursement of Dental Care

- 3.4. Market Trends

- 3.4.1. Prosthodontic Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Dental Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Other Products

- 5.1.2. Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bone Support AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ivoclar Vivadent AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carestream Dental Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3M Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson (DePuy Synthes)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Miglionico s r l

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Straumann Holding AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Planmeca Oy

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ningbo Runyes Medical Instrument Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bone Support AB

List of Figures

- Figure 1: France Dental Equipment Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Dental Equipment Industry Share (%) by Company 2024

List of Tables

- Table 1: France Dental Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Dental Equipment Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: France Dental Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: France Dental Equipment Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 5: France Dental Equipment Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 6: France Dental Equipment Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 7: France Dental Equipment Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: France Dental Equipment Industry Volume K Units Forecast, by End-User 2019 & 2032

- Table 9: France Dental Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: France Dental Equipment Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 11: France Dental Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: France Dental Equipment Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 13: France Dental Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: France Dental Equipment Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 15: France Dental Equipment Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 16: France Dental Equipment Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 17: France Dental Equipment Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 18: France Dental Equipment Industry Volume K Units Forecast, by End-User 2019 & 2032

- Table 19: France Dental Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: France Dental Equipment Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Dental Equipment Industry?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the France Dental Equipment Industry?

Key companies in the market include Bone Support AB, Ivoclar Vivadent AG, Carestream Dental Ltd, 3M Company, Johnson & Johnson (DePuy Synthes), Miglionico s r l, Straumann Holding AG, Planmeca Oy, Ningbo Runyes Medical Instrument Co Ltd.

3. What are the main segments of the France Dental Equipment Industry?

The market segments include Product, Treatment, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Ageing Population. and Increasing Demand for Cosmetic Dentistry; Rising Incidence of Dental Diseases; Innovation in Dental Products.

6. What are the notable trends driving market growth?

Prosthodontic Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Cost of Surgeries; Lack of Proper Reimbursement of Dental Care.

8. Can you provide examples of recent developments in the market?

April 2023: Henry Schein, Inc., a healthcare provider, acquired a majority ownership stake in Biotech Dental S.A.S., a provider of clear aligners, dental implants, and innovative digital dental software based in Salon-de-Provence, France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Dental Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Dental Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Dental Equipment Industry?

To stay informed about further developments, trends, and reports in the France Dental Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence