Key Insights

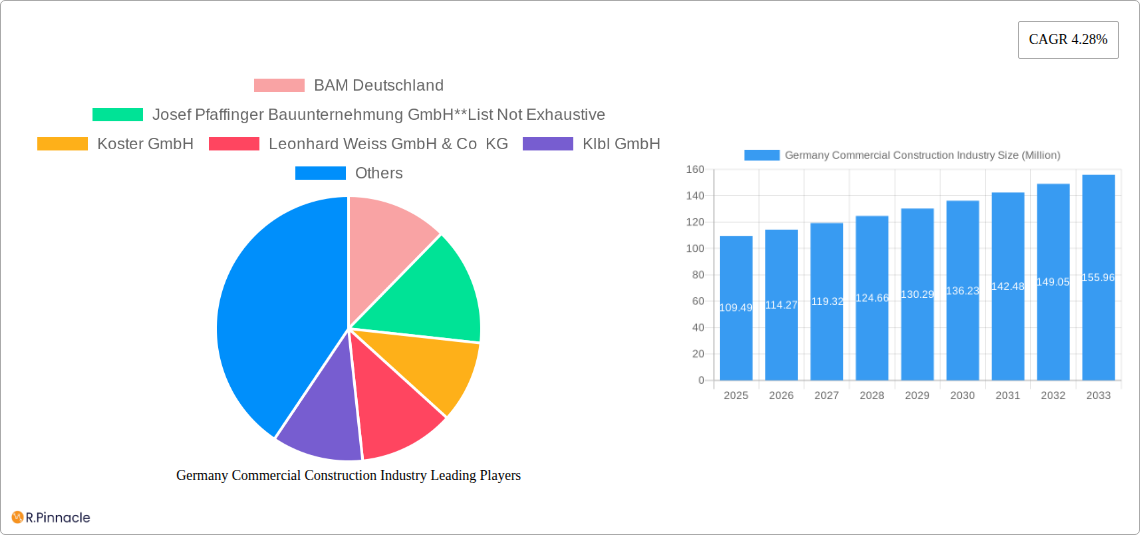

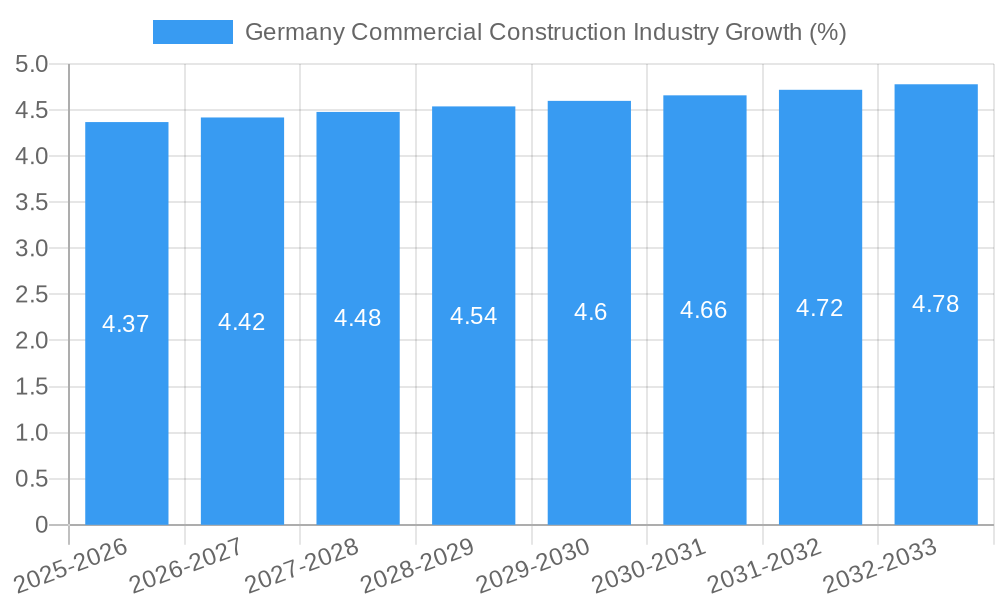

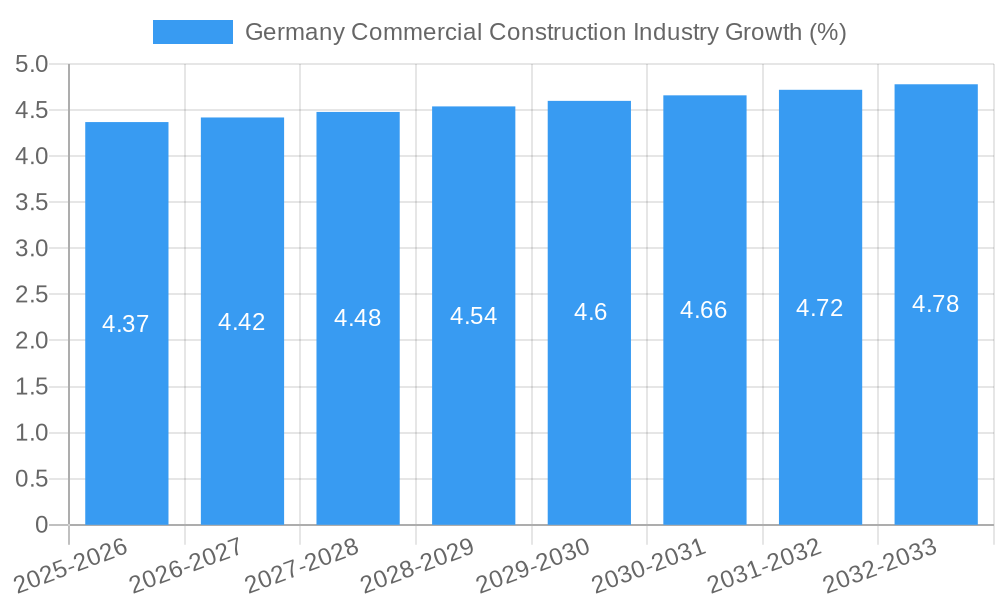

The German commercial construction industry, valued at €109.49 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.28% from 2025 to 2033. This growth is driven by several factors. Firstly, increasing urbanization and population density in major German cities like Berlin, Munich, and Frankfurt necessitate the construction of new office buildings, retail spaces, and hospitality infrastructure to accommodate the expanding population and businesses. Secondly, government initiatives promoting sustainable building practices and infrastructure development contribute positively to the market's expansion. The ongoing digitalization of businesses also fuels demand for modern, technologically equipped office spaces. Finally, a robust tourism sector in Germany, particularly in regions like Bavaria and Baden-Württemberg, continues to drive demand for new hotels and hospitality facilities. The industry is segmented by building type, with office building construction, retail construction, and hospitality construction representing significant portions of the market. Key players such as BAM Deutschland, Strabag AG, and Goldbeck Ost GmbH are actively shaping the market landscape through their construction projects and technological advancements in building techniques. However, potential restraints include fluctuations in the availability of skilled labor, rising material costs, and potential economic slowdowns that could impact investment in new construction projects.

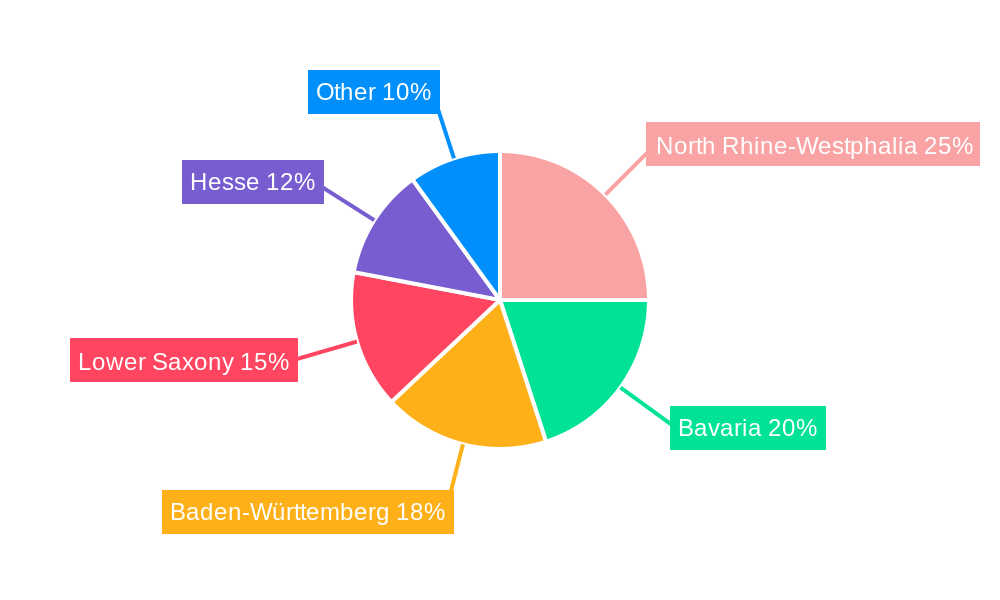

The regional distribution of the market shows strong concentration in key economic hubs. North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse are the leading regions, reflecting their high population density, industrial activity, and established commercial sectors. The forecast period (2025-2033) anticipates sustained growth, although the rate might fluctuate year-on-year depending on macroeconomic conditions. The industry's performance will be highly correlated with overall economic growth and government policies supporting construction and infrastructure development. The projected CAGR suggests a considerable increase in market value over the forecast period, providing significant opportunities for both established players and new entrants. However, strategic adaptation to changing market demands, including sustainability concerns and technological advancements, will be crucial for success in this competitive environment.

Germany Commercial Construction Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the German commercial construction industry, covering market structure, dynamics, key players, and future outlook from 2019 to 2033. Ideal for industry professionals, investors, and strategists seeking actionable insights into this dynamic market.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Germany Commercial Construction Industry Market Structure & Innovation Trends

The German commercial construction market exhibits a moderately concentrated structure, with several large players commanding significant market share. Strabag AG, BAM Deutschland, and Leonhard Weiss GmbH & Co KG are among the leading firms, collectively holding an estimated xx% market share in 2025. However, numerous smaller and mid-sized companies also contribute significantly, particularly in niche segments. Innovation is driven by factors including stringent environmental regulations, increasing demand for sustainable building materials, and advancements in construction technology (e.g., Building Information Modeling (BIM), prefabrication). The regulatory framework, while robust, can pose challenges, particularly for smaller companies navigating complex permitting processes. Product substitutes, such as modular construction and alternative building materials, are gaining traction, influencing the competitive landscape. Recent M&A activity, while not reaching the levels seen in some other European markets, is noteworthy, with deal values averaging approximately xx Million EUR per transaction in the past three years. Notable examples include Premier Inn’s hotel acquisitions (detailed below). End-user demographics demonstrate a continuing shift towards higher quality, sustainable, and technologically advanced commercial spaces.

Germany Commercial Construction Industry Market Dynamics & Trends

The German commercial construction market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by strong economic growth and steady investment in infrastructure projects. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace (projected CAGR of xx%). Key market growth drivers include increasing urbanization, robust demand for office and retail spaces in major cities, and ongoing expansion of the hospitality sector. Technological disruptions, particularly the adoption of BIM and prefabrication techniques, are enhancing efficiency and reducing construction timelines. However, fluctuations in raw material prices and labor shortages pose potential challenges. Consumer preferences are increasingly focused on environmentally friendly and energy-efficient buildings, creating demand for green building certifications and sustainable construction practices. Competitive dynamics are characterized by both intense competition among large firms and a vibrant presence of smaller specialized companies catering to niche markets. Market penetration of sustainable building materials is projected to reach xx% by 2033.

Dominant Regions & Segments in Germany Commercial Construction Industry

While construction activity is widespread across Germany, major metropolitan areas like Munich, Berlin, Frankfurt, and Hamburg dominate the commercial construction sector. These regions benefit from strong economic activity, high population density, and significant infrastructure investments.

- Key Drivers for Dominant Regions:

- High population density and strong economic growth

- Significant government and private investment in infrastructure

- Favorable regulatory environment and access to skilled labor

- Concentrated demand for office, retail, and hospitality spaces

Segment Dominance Analysis: The Office Building Construction segment is the largest segment, accounting for approximately xx% of the market in 2025, driven by sustained demand for modern and efficient workspaces. However, the Hospitality Construction segment is expected to show the highest growth rate during the forecast period (xx%), fueled by rising tourism and increasing foreign investments in the German hospitality industry. Retail Construction is also significant, although its growth is expected to moderate due to the evolving dynamics of e-commerce. Institutional Construction (schools, hospitals, etc.) maintains steady growth, driven by government spending on public infrastructure.

Germany Commercial Construction Industry Product Innovations

Recent product innovations focus on prefabricated modular construction, sustainable materials (e.g., timber, recycled materials), and smart building technologies that enhance energy efficiency and operational performance. These innovations offer competitive advantages in terms of speed, cost-effectiveness, and environmental sustainability, aligning with evolving market demands. The integration of BIM software and digital technologies is also improving project management and reducing construction errors.

Report Scope & Segmentation Analysis

This report segments the German commercial construction market by building type:

Office Building Construction: This segment is characterized by strong competition and a focus on sustainable design. Market size in 2025 is estimated at xx Million EUR, projected to grow at a CAGR of xx% to xx Million EUR by 2033.

Retail Construction: This segment faces challenges from e-commerce but continues to see growth in specialized retail spaces and urban redevelopment projects. 2025 market size: xx Million EUR; projected CAGR: xx%.

Hospitality Construction: Significant growth is anticipated, driven by increased tourism and expansion of hotel chains like Premier Inn. 2025 market size: xx Million EUR; projected CAGR: xx%.

Institutional Construction: This segment exhibits steady growth, driven by government investments and a focus on modern infrastructure. 2025 market size: xx Million EUR; projected CAGR: xx%.

Other Types: This includes various other building types like industrial and logistics facilities. 2025 market size: xx Million EUR; projected CAGR: xx%.

Key Drivers of Germany Commercial Construction Industry Growth

Several factors contribute to the German commercial construction industry’s growth. A robust economy, increasing urbanization, and supportive government policies create a favorable environment for investments. Demand for modern and sustainable building solutions, alongside technological advancements that enhance efficiency and reduce construction time, further fuel expansion. Lastly, the rising tourism sector supports significant growth in the hospitality segment.

Challenges in the Germany Commercial Construction Industry Sector

The industry faces challenges including labor shortages, rising material costs, and stringent regulations. These factors lead to project delays and increased costs, affecting profitability. Supply chain disruptions, exacerbated by geopolitical events, further complicate construction projects. The intense competition amongst firms also puts pressure on profit margins.

Emerging Opportunities in Germany Commercial Construction Industry

Emerging opportunities lie in green building technologies, smart building solutions, and the growing demand for sustainable and energy-efficient constructions. The increasing adoption of BIM and prefabrication also presents significant growth potential. Furthermore, the focus on digitalization across the industry opens up avenues for innovative solutions in project management and construction processes.

Leading Players in the Germany Commercial Construction Industry Market

- BAM Deutschland

- Josef Pfaffinger Bauunternehmung GmbH

- Koster GmbH

- Leonhard Weiss GmbH & Co KG

- Klbl GmbH

- Strabag AG

- AUG PRIEN Bauunternehmung (GmbH & Co KG)

- Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- Gottlob Brodbeck GmbH & Co KG

- Dechant hoch- und ingenieurbau gmbh

Key Developments in Germany Commercial Construction Industry Industry

August 2023: Schuttflix secures EUR 45 Million (USD 47.37 Million) in funding to enhance its technology, expand into new markets, and boost sustainability efforts. This signifies increasing investment in digitalization within the sector.

April 2023: Premier Inn acquires six hotels in Germany, adding 900 rooms and signaling significant growth in the hospitality sector. Their planned expansion of 1,000-1,500 rooms over the next year highlights the considerable market potential.

Future Outlook for Germany Commercial Construction Industry Market

The German commercial construction market is poised for continued growth, driven by long-term economic trends, urbanization, and increasing demand for modern and sustainable buildings. Opportunities exist in the adoption of innovative technologies, sustainable building practices, and strategic partnerships. The focus on efficiency and digitalization will be critical for success in the coming years.

Germany Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other Types

Germany Commercial Construction Industry Segmentation By Geography

- 1. Germany

Germany Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Green buildings is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North Rhine-Westphalia Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BAM Deutschland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koster GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leonhard Weiss GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klbl GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Strabag AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AUG PRIEN Bauunternehmung (GmbH & Co KG)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gottlob Brodbeck GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dechant hoch- und ingenieurbau gmbh

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BAM Deutschland

List of Figures

- Figure 1: Germany Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Commercial Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Commercial Construction Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Germany Commercial Construction Industry?

Key companies in the market include BAM Deutschland, Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive, Koster GmbH, Leonhard Weiss GmbH & Co KG, Klbl GmbH, Strabag AG, AUG PRIEN Bauunternehmung (GmbH & Co KG), Goldbeck Ost GmbH Niederlassung Sachsen-Plauen, Gottlob Brodbeck GmbH & Co KG, Dechant hoch- und ingenieurbau gmbh.

3. What are the main segments of the Germany Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Increasing Investments in Green buildings is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2023: Gutersloh-based Schuttflix, a German digital marketplace and delivery platform for bulk construction supplies, announced that it had secured EUR 45 million (USD 47.37 million) in a fresh round of funding. Schuttflix says it will use the funds to enhance its technology, expand into new markets, diversify services, form partnerships, attract top talent, invest in marketing, prioritize customer support, and contribute to sustainability efforts in the construction sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Germany Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence