Key Insights

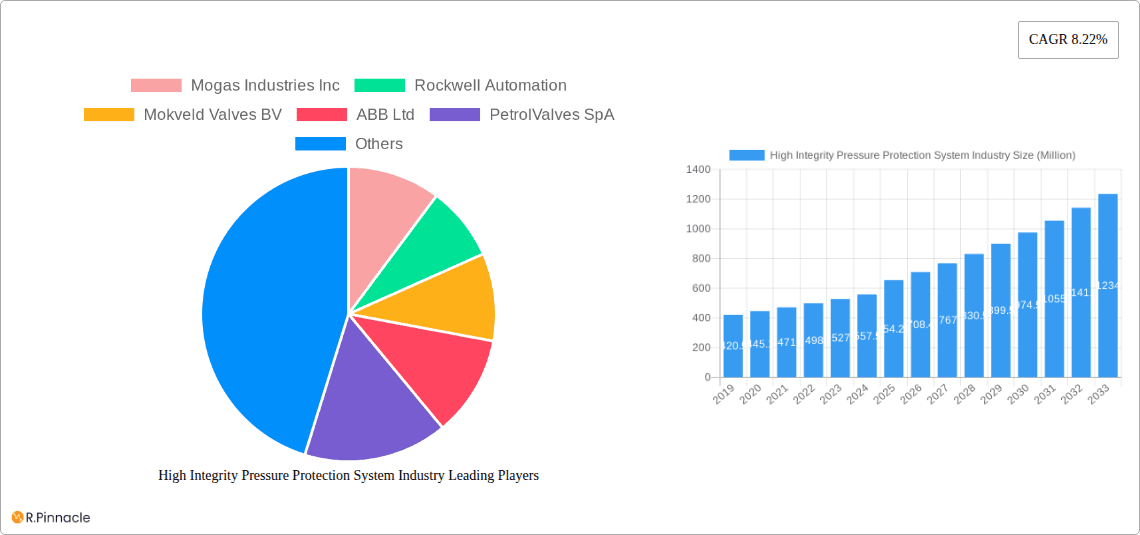

The global High Integrity Pressure Protection System (HIPPS) market is poised for robust expansion, projected to reach an impressive USD 654.24 Million by 2025. This significant valuation underscores the critical role HIPPS plays in safeguarding industrial operations against catastrophic overpressure events. Driven by an accelerating CAGR of 8.22%, the market is expected to witness sustained growth throughout the forecast period. The primary impetus for this growth stems from the increasing stringency of safety regulations across various high-risk industries, particularly in the Oil & Gas and Chemical sectors. These sectors are heavily investing in advanced safety mechanisms to prevent accidents, minimize environmental impact, and ensure operational continuity. Furthermore, the escalating complexity of industrial processes and the growing adoption of automation technologies necessitate sophisticated pressure protection solutions, further fueling market demand. The inherent value of preventing costly downtime, equipment damage, and potential human casualties positions HIPPS as an indispensable component of modern industrial infrastructure.

High Integrity Pressure Protection System Industry Market Size (In Million)

The market is segmented by Components and Services, with both areas experiencing dedicated advancements. The Oil & Gas, Chemicals, Power, Metal and Mining, and Food & Beverages industries represent the dominant end-user segments, each with unique pressure protection challenges. Emerging economies, particularly in the Asia Pacific region, are anticipated to be significant growth engines due to rapid industrialization and increased focus on industrial safety. Key players such as Siemens AG, ABB Ltd, and Emerson Electric Co. are at the forefront of innovation, developing more intelligent and integrated HIPPS solutions that offer enhanced reliability and predictive maintenance capabilities. While the market is generally strong, potential restraints could include high initial implementation costs and the need for specialized expertise in system design and maintenance. However, the undeniable benefits of enhanced safety, regulatory compliance, and long-term operational cost savings are expected to outweigh these challenges, ensuring a dynamic and growing market for HIPPS.

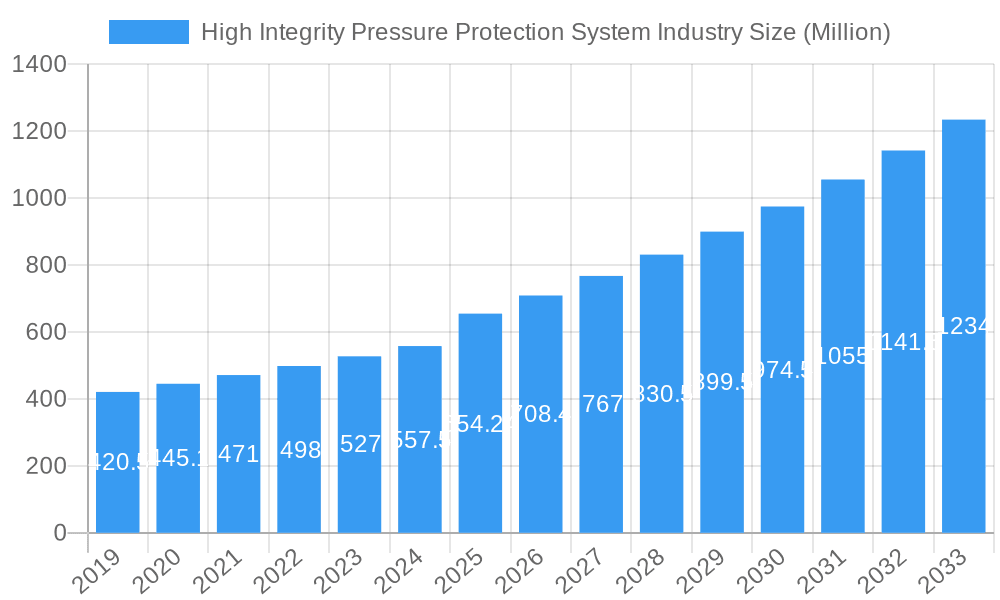

High Integrity Pressure Protection System Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global High Integrity Pressure Protection System (HIPPS) market, providing critical insights for industry stakeholders. Covering the historical period of 2019–2024, a base year of 2025, and a robust forecast period from 2025–2033, this study delves into market structure, dynamics, segmentation, and future outlook. Leverage this report to understand key growth drivers, emerging opportunities, and competitive landscapes within the critical HIPPS sector.

High Integrity Pressure Protection System Industry Market Structure & Innovation Trends

The High Integrity Pressure Protection System (HIPPS) market exhibits a moderate to high concentration, driven by specialized technological requirements and the stringent safety standards prevalent across its diverse end-user industries. Key innovation drivers include advancements in digital safety systems, smart valve technologies, and integrated control solutions designed to enhance reliability and reduce operational risks. Regulatory frameworks, such as IEC 61508 and IEC 61511, significantly influence product development and market entry, demanding rigorous certification and validation processes. While direct product substitutes are limited due to the critical safety function of HIPPS, advancements in alternative safety methodologies and integrated process control strategies can be considered indirect competitive factors. End-user demographics are primarily industrial facilities operating in high-risk environments. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating market share, acquiring specialized technology, and expanding geographical reach. While specific M&A deal values are dynamic, the trend indicates a focus on acquiring companies with proven expertise in safety instrumented systems (SIS) and critical valve manufacturing. The market share distribution among the top players is significant, reflecting the capital-intensive nature and high barrier to entry for new entrants.

- Market Concentration: Moderate to High

- Innovation Drivers: Digital safety systems, smart valves, integrated control solutions.

- Regulatory Frameworks: IEC 61508, IEC 61511.

- Product Substitutes: Limited direct substitutes; indirect competition from advanced process control.

- End-User Demographics: Industrial facilities in high-risk sectors.

- M&A Activities: Strategic consolidation, technology acquisition, geographical expansion.

High Integrity Pressure Protection System Industry Market Dynamics & Trends

The High Integrity Pressure Protection System (HIPPS) market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This upward trajectory is primarily fueled by the escalating demand for enhanced process safety across a multitude of hazardous industrial operations. The increasing stringency of global safety regulations, coupled with a growing awareness among industrial operators of the severe financial and reputational consequences of safety incidents, acts as a primary catalyst for market penetration. Technological disruptions are playing a pivotal role, with the integration of advanced digital technologies such as the Internet of Things (IoT), artificial intelligence (AI), and advanced analytics transforming the capabilities of HIPPS. These innovations enable predictive maintenance, real-time monitoring, and more sophisticated risk assessment, thereby improving the overall effectiveness and reliability of protection systems. Consumer preferences are shifting towards integrated, smart, and remotely manageable HIPPS solutions that offer greater efficiency, reduced downtime, and improved operational insights. The competitive dynamics within the market are characterized by intense competition among established global players and specialized regional providers. Key players are focusing on research and development to introduce innovative products, strategic partnerships to expand market reach, and mergers and acquisitions to strengthen their portfolio and competitive positioning. The oil and gas sector continues to be a dominant end-user, driven by the need to manage complex and high-pressure operations safely. However, significant growth is also anticipated from the chemicals, power generation, and metal and mining industries, as they increasingly adopt robust safety protocols. The ongoing digital transformation across industries is further accelerating the adoption of advanced HIPPS solutions, moving beyond traditional mechanical systems towards intelligent, interconnected safety platforms. This evolving landscape necessitates continuous innovation and adaptation from market participants to remain competitive and meet the evolving safety demands of industrial operations worldwide.

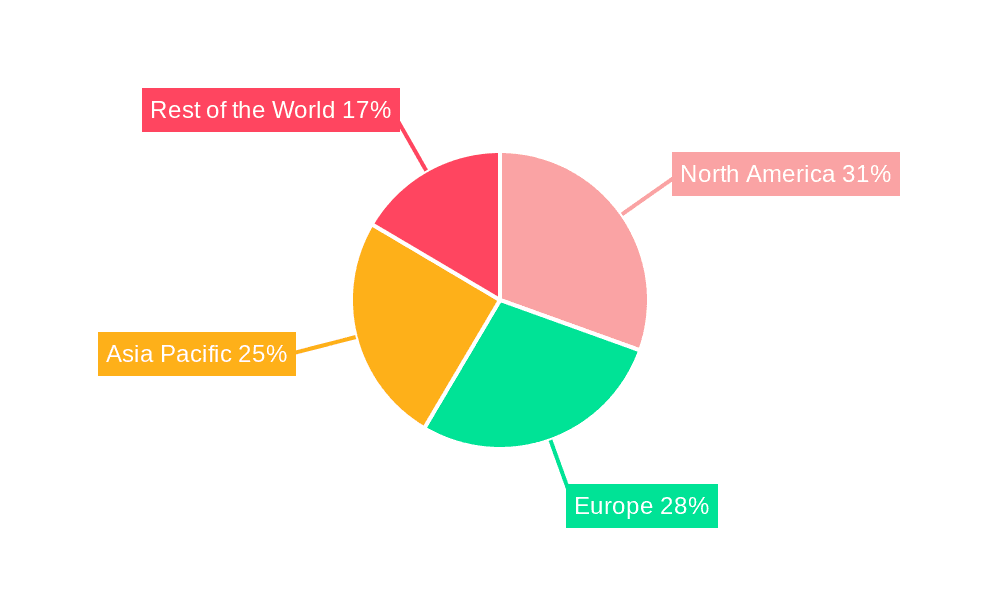

Dominant Regions & Segments in High Integrity Pressure Protection System Industry

The North America region stands out as a dominant force in the High Integrity Pressure Protection System (HIPPS) market, with the United States leading the charge in terms of market share and adoption rates. This dominance is underpinned by a robust and well-established oil and gas industry, which necessitates stringent safety measures for offshore and onshore exploration and production activities. Significant investments in upgrading aging infrastructure and the continuous pursuit of enhanced operational safety in complex petrochemical facilities further bolster the demand for HIPPS solutions in this region. Economic policies that prioritize industrial safety and environmental protection, coupled with advanced technological infrastructure, create a fertile ground for the widespread implementation of sophisticated HIPPS.

The Oil and Gas end-user industry segment is the primary driver of the HIPPS market. This is due to the inherent high-pressure and potentially hazardous nature of exploration, extraction, refining, and transportation processes. The criticality of preventing catastrophic failures and ensuring the safety of personnel and the environment in this sector makes HIPPS indispensable.

Key drivers for dominance in North America and the Oil and Gas segment include:

- Stringent Regulatory Landscape: Strict adherence to safety regulations like OSHA standards and API recommended practices.

- Mature Industrial Base: Extensive existing infrastructure in oil & gas, chemicals, and power sectors demanding advanced safety.

- Technological Advancements: High adoption rates of digital safety systems and smart valve technologies.

- Investment in Safety: Significant capital expenditure by major industrial players prioritizing risk mitigation.

- Geographic Concentration of Operations: Large-scale and complex operational sites in regions like the Gulf of Mexico.

The Chemicals segment also represents a substantial market, driven by the need to manage highly reactive and hazardous materials safely. Processes involving high temperatures and pressures in chemical manufacturing require robust protection systems to prevent accidental releases and explosions.

The Power sector is another key contributor, particularly in power plants utilizing fossil fuels or facing complex operational demands that necessitate advanced safety protocols to prevent equipment damage and ensure continuous energy supply.

While smaller in current market share compared to Oil and Gas, the Metal and Mining and Food and Beverages industries are demonstrating growing adoption of HIPPS, driven by an increasing focus on worker safety and compliance with evolving regulatory requirements. The "Other Process Industries" segment encompasses a wide array of specialized applications where process safety is paramount.

The dominance of North America is further reinforced by the presence of leading HIPPS manufacturers and service providers, fostering a competitive yet innovative ecosystem. Europe also holds a significant market share, driven by similar industrial strengths and rigorous safety standards, particularly in countries with substantial oil and gas and chemical manufacturing sectors. The Asia-Pacific region is emerging as a high-growth market, fueled by rapid industrialization and increasing investments in infrastructure and manufacturing, leading to a heightened emphasis on process safety.

High Integrity Pressure Protection System Industry Product Innovations

Recent product innovations in the High Integrity Pressure Protection System (HIPPS) industry are focused on enhancing intelligence, connectivity, and reliability. Developments include smart valves with integrated diagnostics and predictive maintenance capabilities, enabling proactive issue detection and reducing downtime. Advanced safety instrumented system (SIS) platforms are incorporating more sophisticated logic solvers and human-machine interfaces (HMIs) for improved operational oversight and faster response times. The integration of IoT sensors and data analytics allows for real-time monitoring of system performance, providing invaluable insights for risk assessment and operational optimization. These innovations offer a competitive advantage by delivering increased safety assurance, reduced total cost of ownership, and greater operational efficiency for end-users across various process industries.

Report Scope & Segmentation Analysis

This report meticulously analyzes the High Integrity Pressure Protection System (HIPPS) market across its key segments. The Components segment, encompassing safety valves, actuators, logic solvers, and sensors, forms the bedrock of HIPPS solutions and is projected to witness steady growth driven by technological advancements and the replacement of older systems. The Services segment, including installation, maintenance, calibration, and consulting, is expected to exhibit a higher growth rate due to the increasing complexity of HIPPS and the need for specialized expertise.

The End-user Industry segmentation is detailed as follows: Oil and Gas: This remains the largest segment, with continued demand for robust HIPPS in upstream, midstream, and downstream operations. Growth is driven by offshore projects and stringent safety regulations. Chemicals: A significant segment driven by the need to manage hazardous materials and high-pressure processes. Power: Includes power generation facilities, with growing demand for HIPPS in both traditional and renewable energy sectors facing operational complexities. Metal and Mining: Experiencing increasing adoption of HIPPS for safety in critical mining operations and metal processing. Food and Beverages: A developing segment with rising safety awareness and regulatory compliance needs. Other Process Industries: Encompasses diverse applications where process safety is paramount, indicating potential niche growth.

Key Drivers of High Integrity Pressure Protection System Industry Growth

The High Integrity Pressure Protection System (HIPPS) industry is propelled by several critical growth drivers. Foremost is the escalating global emphasis on industrial safety and the stringent enforcement of regulatory frameworks by governing bodies worldwide. This regulatory push mandates the implementation of robust safety systems to prevent catastrophic failures and protect personnel and the environment. Technological advancements, particularly in digital safety systems, smart sensors, and advanced analytics, are enabling more intelligent and reliable HIPPS solutions, driving adoption. Furthermore, the inherent risks associated with operating in high-pressure and hazardous environments within sectors like oil and gas, chemicals, and power necessitate substantial investments in critical safety infrastructure. The rising cost of safety incidents, both financial and reputational, also incentivizes companies to proactively invest in HIPPS to mitigate potential risks and ensure business continuity.

Challenges in the High Integrity Pressure Protection System Industry Sector

Despite robust growth, the High Integrity Pressure Protection System (HIPPS) industry faces several significant challenges. The high initial capital investment required for implementing comprehensive HIPPS solutions can be a substantial barrier for smaller companies or those in developing economies. The complexity of integrating HIPPS with existing plant infrastructure often requires specialized engineering expertise and can lead to extended project timelines. Furthermore, the stringent certification and validation processes mandated by industry standards can be time-consuming and costly, potentially delaying product deployment. Supply chain disruptions for specialized components and the global shortage of skilled personnel for installation and maintenance also pose significant challenges. Intense competition among a limited number of established players can also put pressure on pricing and profit margins.

Emerging Opportunities in High Integrity Pressure Protection System Industry

The High Integrity Pressure Protection System (HIPPS) industry is rife with emerging opportunities. The increasing adoption of digital transformation and Industry 4.0 initiatives across process industries presents a significant opportunity for smart, connected HIPPS solutions with advanced data analytics and IoT capabilities. The growing focus on sustainability and environmental protection is driving demand for HIPPS in applications related to emissions control and waste management. Emerging markets in Asia-Pacific and Latin America, with their rapidly industrializing economies and increasing safety awareness, offer substantial untapped potential. Furthermore, the development of modular and scalable HIPPS solutions tailored for smaller-scale or modular industrial operations presents a niche growth avenue. The continuous evolution of safety standards also creates opportunities for companies to innovate and offer next-generation protection systems.

Leading Players in the High Integrity Pressure Protection System Industry Market

- ABB Ltd

- ATV Hipps

- BEL Valves (British Engines Limited)

- Emerson Electric Co

- HIMA Paul Hildebrandt GmbH

- L&T Valves Limited (Larsen & Toubro Limited)

- Mogas Industries Inc

- Mokveld Valves BV

- PetrolValves SpA

- Rockwell Automation

- Schlumberger NV

- Schneider Electric

- SELLA CONTROLS Ltd

- Severn Glocon Group

- Siemens AG

- Yokogawa Electric Corporation

Key Developments in High Integrity Pressure Protection System Industry Industry

- June 2020: Bel Valves sold its Milan, Italy operations to OMB Valves SpA. The company, its business, assets, and employees are now part of the OMB Valves group, a manufacturer of valves for the energy industries. OMB is a family-owned and operated group recognised globally as a manufacturer of forged steel valves. Its manufacturing operations in Europe, North America, Asia, and the Middle East are supported by a worldwide distribution network.

- February 2020: Emerson introduced the ASCO Series 158 Gas Valve and Series 159 Motorized Actuator. Newly developed ASCO valves are explicitly designed for burner-boiler applications. The new products gave OEMs, distributors, contractors, and end-users a new combustion safety shutoff valve option that increases safety and reliability and enhances both flow and control.

Future Outlook for High Integrity Pressure Protection System Industry Market

The future outlook for the High Integrity Pressure Protection System (HIPPS) market is exceptionally positive, driven by an unwavering global commitment to industrial safety and the continuous evolution of safety technologies. The projected growth is expected to be sustained by increasing investments in critical infrastructure across developing economies and the ongoing modernization of existing facilities in mature markets. The integration of advanced digital solutions, including AI, IoT, and predictive analytics, will redefine HIPPS capabilities, offering enhanced operational efficiency and unprecedented safety assurances. Strategic partnerships and collaborations among industry players will likely intensify, fostering innovation and expanding market reach. Companies that prioritize research and development, focus on providing integrated solutions, and adeptly navigate evolving regulatory landscapes are well-positioned to capitalize on the significant growth potential in the coming years.

High Integrity Pressure Protection System Industry Segmentation

-

1. Type

- 1.1. Components

- 1.2. Services

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemicals

- 2.3. Power

- 2.4. Metal and Mining

- 2.5. Food and Beverages

- 2.6. Other Process Industries

High Integrity Pressure Protection System Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

High Integrity Pressure Protection System Industry Regional Market Share

Geographic Coverage of High Integrity Pressure Protection System Industry

High Integrity Pressure Protection System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Government Regulatory Standards to Defend Safety and Security at Industrial Plants

- 3.2.2 Owing to Increasing Accidents at Plants

- 3.3. Market Restrains

- 3.3.1. Unpredictable Maintenance Time Period

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment Holds for a Major Share Throughout the Forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Components

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemicals

- 5.2.3. Power

- 5.2.4. Metal and Mining

- 5.2.5. Food and Beverages

- 5.2.6. Other Process Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Components

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Chemicals

- 6.2.3. Power

- 6.2.4. Metal and Mining

- 6.2.5. Food and Beverages

- 6.2.6. Other Process Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Components

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Chemicals

- 7.2.3. Power

- 7.2.4. Metal and Mining

- 7.2.5. Food and Beverages

- 7.2.6. Other Process Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Components

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Chemicals

- 8.2.3. Power

- 8.2.4. Metal and Mining

- 8.2.5. Food and Beverages

- 8.2.6. Other Process Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Components

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Chemicals

- 9.2.3. Power

- 9.2.4. Metal and Mining

- 9.2.5. Food and Beverages

- 9.2.6. Other Process Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mogas Industries Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rockwell Automation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mokveld Valves BV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ABB Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PetrolValves SpA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Severn Glocon Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BEL Valves (British Engines Limited)*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Emerson Electric Co

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schlumberger NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Siemens AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Schneider Electric

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 HIMA Paul Hildebrandt GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 ATV Hipps

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Yokogawa Electric Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 SELLA CONTROLS Ltd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 L&T Valves Limited (Larsen & Toubro Limited)

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Mogas Industries Inc

List of Figures

- Figure 1: Global High Integrity Pressure Protection System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Integrity Pressure Protection System Industry?

The projected CAGR is approximately 8.22%.

2. Which companies are prominent players in the High Integrity Pressure Protection System Industry?

Key companies in the market include Mogas Industries Inc, Rockwell Automation, Mokveld Valves BV, ABB Ltd, PetrolValves SpA, Severn Glocon Group, BEL Valves (British Engines Limited)*List Not Exhaustive, Emerson Electric Co, Schlumberger NV, Siemens AG, Schneider Electric, HIMA Paul Hildebrandt GmbH, ATV Hipps, Yokogawa Electric Corporation, SELLA CONTROLS Ltd, L&T Valves Limited (Larsen & Toubro Limited).

3. What are the main segments of the High Integrity Pressure Protection System Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 654.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Regulatory Standards to Defend Safety and Security at Industrial Plants. Owing to Increasing Accidents at Plants.

6. What are the notable trends driving market growth?

Oil and Gas Segment Holds for a Major Share Throughout the Forecast period.

7. Are there any restraints impacting market growth?

Unpredictable Maintenance Time Period.

8. Can you provide examples of recent developments in the market?

June 2020 - Bel Valves sold its Milan, Italy operations to OMB Valves SpA. The company, its business, assets, and employees are now part of the OMB Valves group, a manufacturer of valves for the energy industries. OMB is a family-owned and operated group recognised globally as a manufacturer of forged steel valves. Its manufacturing operations in Europe, North America, Asia, and the Middle East are supported by a worldwide distribution network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Integrity Pressure Protection System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Integrity Pressure Protection System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Integrity Pressure Protection System Industry?

To stay informed about further developments, trends, and reports in the High Integrity Pressure Protection System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence