Key Insights

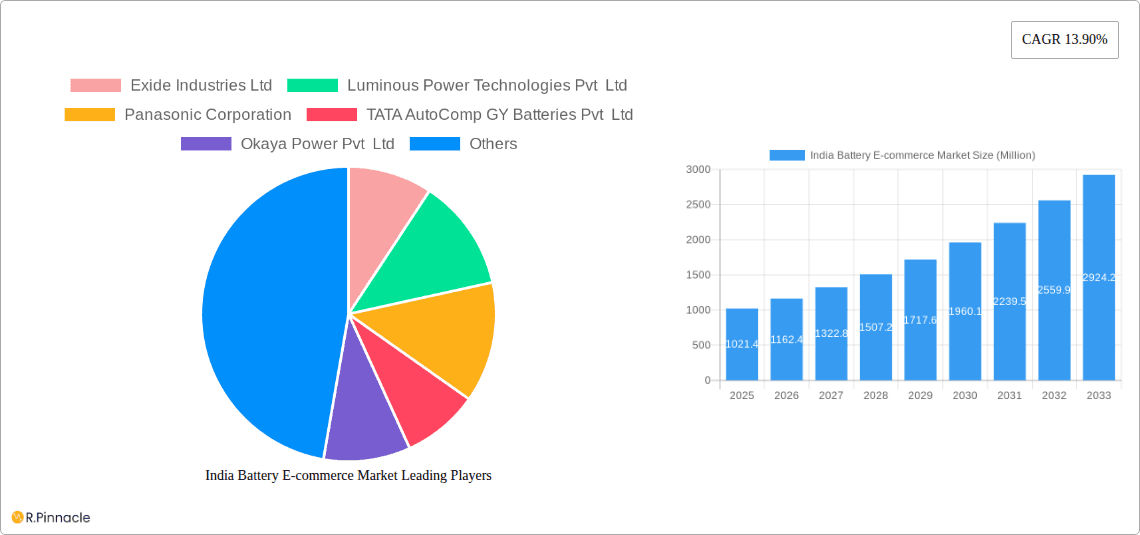

The India Battery E-commerce Market is poised for robust expansion, projected to reach approximately INR 1,021.4 million (estimating 0.97 billion USD to INR conversion at ~82 INR/USD) by 2025. This growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 13.90%, indicating a dynamic and expanding online battery retail sector. A primary driver for this surge is the increasing penetration of electric vehicles (EVs) across India, necessitating a constant demand for replacement and new batteries. Furthermore, the burgeoning e-commerce ecosystem in India, characterized by widespread internet access and evolving consumer preferences for online convenience, is a significant facilitator. Consumers are increasingly opting for the ease of comparing prices, accessing a wider variety of brands, and enjoying doorstep delivery for batteries. The market is segmented by battery type, with Lithium-Ion batteries showing exceptional growth potential due to their application in EVs and portable electronics, alongside traditional Lead-Acid batteries that continue to dominate the automotive and backup power segments.

India Battery E-commerce Market Market Size (In Billion)

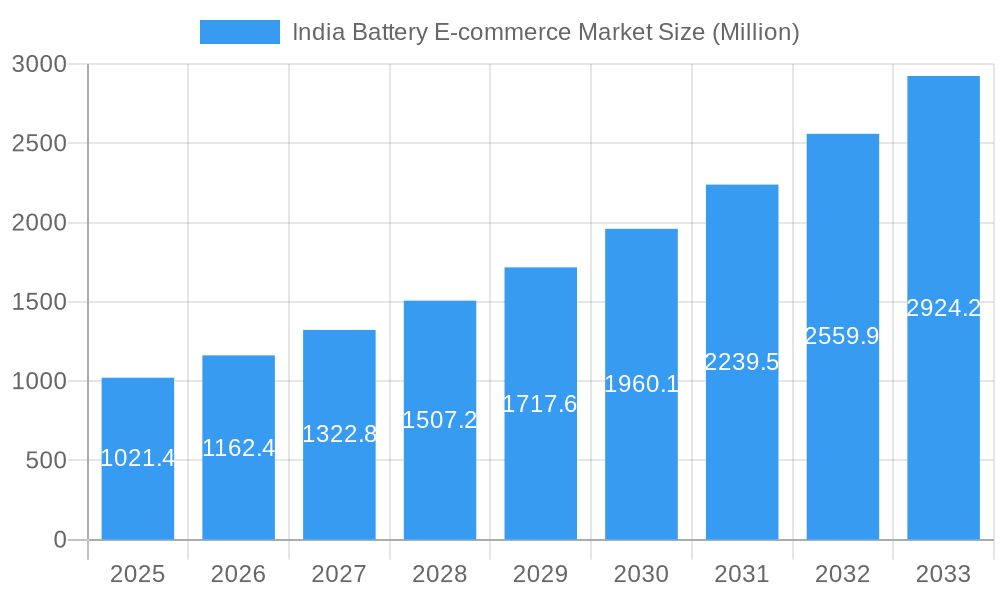

The competitive landscape features established players like Exide Industries Ltd, Luminous Power Technologies Pvt Ltd, and Panasonic Corporation, alongside emerging contenders and international giants such as LG Chem Ltd and BYD Co Ltd, all vying for market share through strategic online presence and product innovation. Key trends shaping the market include the rise of direct-to-consumer (D2C) battery brands, the integration of battery management systems (BMS) for enhanced performance and safety, and a growing emphasis on sustainable and recyclable battery solutions. While the market is characterized by significant growth opportunities, potential restraints include price sensitivity among consumers, the logistical complexities of battery transportation and handling, and the need for robust after-sales service and support, particularly for specialized battery types. The dominance of online channels is expected to continue, with e-commerce platforms playing a crucial role in democratizing access to a diverse range of battery products.

India Battery E-commerce Market Company Market Share

Unlock the dynamic landscape of India's burgeoning battery e-commerce market. This in-depth report provides critical insights into market structure, growth drivers, segmentation, and future opportunities, equipping industry leaders with actionable intelligence for strategic decision-making. Analyze key players, emerging trends, and regulatory impacts shaping the nation's battery supply chain. Examine the rapid evolution of lead-acid and lithium-ion battery markets driven by electric vehicle adoption and renewable energy integration.

India Battery E-commerce Market Market Structure & Innovation Trends

The India Battery E-commerce Market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Innovation is primarily driven by advancements in battery technology, particularly the development of higher energy density lithium-ion batteries and more efficient lead-acid solutions. Regulatory frameworks, including government initiatives promoting electric mobility and domestic manufacturing (e.g., Production Linked Incentives for battery manufacturing), are crucial influencing factors. Product substitutes, while evolving, currently see traditional batteries competing with newer technologies. End-user demographics are shifting towards younger, tech-savvy consumers seeking convenience and competitive pricing through online channels. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to consolidate market presence and gain access to new technologies and customer bases. For instance, recent large-scale investments in lithium-ion cell manufacturing by major conglomerates signify strategic moves to secure market position and reduce import dependency. The overall market share analysis is critical to understanding competitive positioning.

- Market Concentration: Moderate, with key players dominating specific segments.

- Innovation Drivers: Technological advancements in battery chemistry, charging infrastructure, and smart battery management systems.

- Regulatory Frameworks: Government policies supporting Make in India, EV adoption, and battery recycling.

- Product Substitutes: Ongoing development of solid-state batteries and advanced energy storage solutions.

- End-User Demographics: Growing online purchasing behavior, demand for cost-effectiveness, and increasing awareness of battery performance and lifespan.

- M&A Activities: Expected to rise as companies seek scale and technological integration.

India Battery E-commerce Market Market Dynamics & Trends

The India Battery E-commerce Market is poised for significant expansion, driven by a confluence of factors including the rapid growth of the electric vehicle (EV) sector, increasing demand for renewable energy storage solutions, and the burgeoning adoption of portable electronics. The market's Compound Annual Growth Rate (CAGR) is projected to be robust, indicating substantial market penetration in the coming years. Technological disruptions, such as the advancement of lithium-ion battery technology offering higher energy density, faster charging capabilities, and longer lifespans, are transforming consumer preferences and industrial applications. The e-commerce channel is facilitating greater accessibility to a wider range of battery products, from automotive and industrial batteries to specialized batteries for consumer electronics and renewable energy systems. Consumer preferences are increasingly leaning towards brands that offer a balance of performance, durability, and competitive pricing, with online reviews and convenience playing a significant role in purchasing decisions. Competitive dynamics are intensifying as both domestic manufacturers and international players vie for market dominance. The increasing focus on battery recycling and sustainable battery solutions is also emerging as a critical trend, influencing product development and consumer choice. Furthermore, government initiatives aimed at boosting domestic battery manufacturing capacity and reducing reliance on imports are creating a favorable ecosystem for market growth. The rising disposable incomes and urbanization are also contributing to an increased demand for power backup solutions, further propelling the market forward. The ongoing digital transformation across various industries necessitates reliable and efficient battery solutions, creating sustained demand.

Dominant Regions & Segments in India Battery E-commerce Market

The Lithium-Ion battery segment is emerging as a dominant force within the India Battery E-commerce Market, driven by the exponential growth of the electric vehicle (EV) industry and the increasing adoption of portable electronic devices. Economic policies favoring EV manufacturing and adoption, coupled with substantial government investments in battery gigafactories, are significantly bolstering this segment. Infrastructure development, particularly the expansion of EV charging networks, further fuels the demand for advanced lithium-ion batteries.

- Key Drivers for Lithium-Ion Dominance:

- Electric Vehicle (EV) Growth: The primary catalyst, with government targets and consumer interest in EVs escalating demand for high-performance batteries.

- Portable Electronics: Continued demand from smartphones, laptops, and wearables.

- Renewable Energy Storage: Increasing use in solar power systems for homes and businesses.

- Government Incentives: Policies promoting local manufacturing and EV adoption.

- Technological Advancements: Higher energy density, faster charging, and longer lifecycles compared to traditional batteries.

The Lead-Acid battery segment, while facing competition from lithium-ion, continues to hold a significant market share, particularly in automotive and uninterruptible power supply (UPS) applications. Its established manufacturing base, cost-effectiveness, and proven reliability make it a preferred choice for certain applications. Economic stability and the vast existing fleet of internal combustion engine (ICE) vehicles contribute to its sustained demand.

- Key Drivers for Lead-Acid Market Strength:

- Automotive Sector: Dominant in conventional vehicles and as a backup for EVs.

- Industrial Applications: Wide use in UPS systems, telecom, and material handling equipment.

- Cost-Effectiveness: Generally more affordable than lithium-ion batteries.

- Established Infrastructure: Mature recycling and manufacturing ecosystem.

The Others segment, encompassing emerging battery technologies and specialized applications, is expected to witness significant growth. This includes batteries for grid-scale energy storage, advanced industrial applications, and niche consumer electronics. Innovations in battery chemistry and material science will be crucial for the expansion of this segment.

- Key Drivers for "Others" Segment Growth:

- Emerging Technologies: Solid-state batteries, flow batteries, and advanced chemistries.

- Grid-Scale Storage: Critical for renewable energy integration and grid stability.

- Specialized Industrial Needs: High-performance batteries for demanding environments.

Geographically, Southern India is emerging as a dominant region for battery e-commerce, owing to its robust automotive manufacturing ecosystem, increasing EV adoption rates, and the presence of key technology hubs that drive innovation and demand for advanced battery solutions. The government's focus on promoting industrial growth and sustainable energy in states like Tamil Nadu and Karnataka further strengthens this regional dominance.

India Battery E-commerce Market Product Innovations

Product innovation in the India Battery E-commerce Market is centered on enhancing energy density, improving charging speeds, and extending battery lifespan across various chemistries, particularly lithium-ion. Manufacturers are focusing on developing safer battery designs with advanced thermal management systems to mitigate risks. The integration of smart battery management systems (BMS) for optimized performance and predictive maintenance is also a key competitive advantage. Furthermore, there's a growing emphasis on sustainable battery materials and efficient recycling processes to address environmental concerns and meet regulatory requirements. These innovations cater to the escalating demands of the EV sector, renewable energy storage, and the ever-growing portable electronics market, offering consumers and businesses more reliable, efficient, and eco-friendly power solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the India Battery E-commerce Market, covering the historical period from 2019–2024 and a forecast period extending from 2025–2033, with 2025 serving as the base and estimated year. The market is segmented by Battery Type, including Lead-Acid, Lithium-Ion, and Others.

The Lithium-Ion segment is projected to exhibit the highest growth rate due to the accelerating adoption of electric vehicles and portable electronics. Its market size is expected to expand significantly as battery technology becomes more affordable and efficient.

The Lead-Acid segment, while mature, will continue to hold a substantial market share, particularly in automotive and backup power applications, driven by its cost-effectiveness and established infrastructure.

The Others segment, encompassing emerging battery technologies, is anticipated to experience rapid growth as research and development lead to commercialization of advanced solutions for specialized applications like grid-scale energy storage.

Key Drivers of India Battery E-commerce Market Growth

The India Battery E-commerce Market's growth is propelled by several key drivers. The surging adoption of electric vehicles (EVs) is a primary catalyst, fueled by government incentives and environmental consciousness. The expanding renewable energy sector necessitates efficient battery storage solutions, further boosting demand. Technological advancements in battery chemistry, leading to higher energy density and faster charging, are enhancing product appeal. The increasing penetration of smartphones, laptops, and other portable electronic devices continuously fuels demand for specialized batteries. E-commerce platforms are democratizing access to a wider variety of battery products, offering convenience and competitive pricing. Government initiatives like "Make in India" and Production Linked Incentives (PLI) for battery manufacturing are encouraging domestic production and innovation.

Challenges in the India Battery E-commerce Market Sector

Despite robust growth prospects, the India Battery E-commerce Market faces several challenges. Supply chain disruptions, particularly for raw materials like lithium and cobalt, can impact production costs and availability. Intense price competition among manufacturers and the presence of counterfeit products pose risks to market integrity and consumer trust. Regulatory hurdles related to battery disposal and recycling need to be addressed effectively to ensure environmental sustainability. The upfront cost of advanced battery technologies, such as lithium-ion, can still be a barrier for some consumers, especially in price-sensitive segments. Rapid technological obsolescence requires continuous investment in R&D and manufacturing upgrades.

Emerging Opportunities in India Battery E-commerce Market

Significant emerging opportunities lie in the development and adoption of advanced battery technologies, including solid-state batteries, which promise higher safety and energy density. The burgeoning demand for battery energy storage systems (BESS) for grid stabilization and renewable energy integration presents a vast untapped market. The circular economy approach, focusing on battery recycling and second-life applications, offers new business models and revenue streams. The expansion of EV charging infrastructure will directly correlate with increased demand for automotive batteries. Furthermore, government policies promoting domestic manufacturing and export incentives can unlock substantial growth potential for Indian battery manufacturers in the global market.

Leading Players in the India Battery E-commerce Market Market

- Exide Industries Ltd

- Luminous Power Technologies Pvt Ltd

- Panasonic Corporation

- TATA AutoComp GY Batteries Pvt Ltd

- Okaya Power Pvt Ltd

- LG Chem Ltd

- Samsung SDI Co Ltd

- BYD Co Ltd

- East Penn Manufacturing Company

- Hitachi Ltd

List Not Exhaustive

Key Developments in India Battery E-commerce Market Industry

- October 2023: Ola Electric announced the establishment of a lithium-ion cell manufacturing unit, touted to be the first in India, with a fundraising of about USD 385 Million. Ola Electric has noted its plans to set up the unit at Krishnagiri, Tamil Nadu.

- June 2023: Tata Group signed an outline deal for building a lithium-ion cell factory with an investment of about USD 1.58 Billion. The EV battery plant will help the nation create its electric vehicle supply chain rather than rely on imports. The plant will be located in Gujarat and likely have an initial manufacturing capacity of 20 Gigawatt hours (GWh).

Future Outlook for India Battery E-commerce Market Market

The future outlook for the India Battery E-commerce Market is exceptionally bright, driven by the sustained momentum in electric mobility, renewable energy integration, and the increasing demand for efficient power storage solutions. Government policy support, coupled with private sector investments, will continue to foster innovation and capacity expansion, particularly in lithium-ion battery manufacturing. The growing consumer awareness regarding the benefits of e-commerce for purchasing batteries, emphasizing convenience, price competitiveness, and product variety, will further solidify the online channel's importance. Strategic collaborations and mergers are anticipated to shape a more consolidated and technologically advanced market. The focus on sustainability and the development of a robust battery recycling ecosystem will also be crucial growth accelerators, ensuring long-term market viability and environmental responsibility. Overall, the market is on a trajectory of robust expansion, offering significant opportunities for stakeholders across the value chain.

India Battery E-commerce Market Segmentation

-

1. Battery Type

- 1.1. Lead-Acid

- 1.2. Lithium-Ion

- 1.3. Others

India Battery E-commerce Market Segmentation By Geography

- 1. India

India Battery E-commerce Market Regional Market Share

Geographic Coverage of India Battery E-commerce Market

India Battery E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead-Acid

- 5.1.2. Lithium-Ion

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Exide Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luminous Power Technologies Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TATA AutoComp GY Batteries Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Okaya Power Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Chem Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung SDI Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BYD Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 East Penn Manufacturing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Exide Industries Ltd

List of Figures

- Figure 1: India Battery E-commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Battery E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: India Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: India Battery E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Battery E-commerce Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 6: India Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 7: India Battery E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Battery E-commerce Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery E-commerce Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the India Battery E-commerce Market?

Key companies in the market include Exide Industries Ltd, Luminous Power Technologies Pvt Ltd, Panasonic Corporation, TATA AutoComp GY Batteries Pvt Ltd, Okaya Power Pvt Ltd, LG Chem Ltd, Samsung SDI Co Ltd, BYD Co Ltd, East Penn Manufacturing Company, Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie.

3. What are the main segments of the India Battery E-commerce Market?

The market segments include Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.97 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

6. What are the notable trends driving market growth?

Increasing Adoption of Electric Vehicles.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

8. Can you provide examples of recent developments in the market?

October 2023: Ola Electric announced the establishment of a lithium-ion cell manufacturing unit, touted to be the first in India, with a fundraising of about USD 385 million. Ola Electric has noted its plans to set up the unit at Krishnagiri, Tamil Nadu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery E-commerce Market?

To stay informed about further developments, trends, and reports in the India Battery E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence