Key Insights

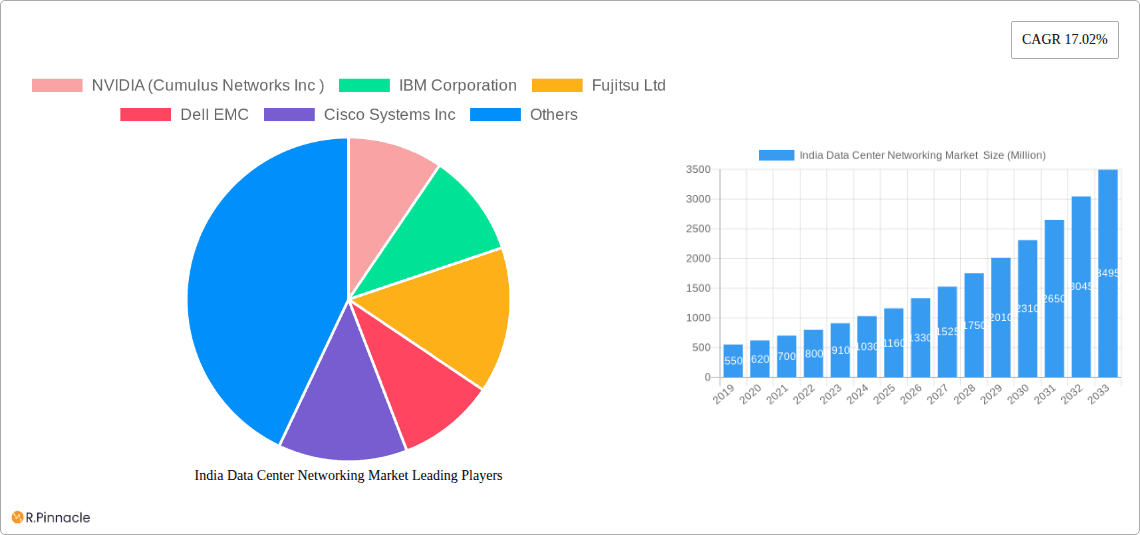

The India Data Center Networking Market is poised for remarkable expansion, projected to reach a substantial USD 1.16 Billion by 2025. This significant growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 17.02% from 2019 to 2033, underscoring a dynamic and rapidly evolving landscape. Key drivers behind this surge include the escalating demand for cloud computing services, the proliferation of big data analytics, and the increasing adoption of digital transformation initiatives across various Indian industries. Furthermore, the ongoing investments in upgrading and expanding data center infrastructure to support 5G deployment and the burgeoning IoT ecosystem are also critical contributors to this upward trajectory. The market segmentation reveals a strong demand for Ethernet Switches and Routers, which form the backbone of modern data center connectivity. Simultaneously, the growing emphasis on network security and efficient data management is propelling the adoption of Storage Area Networks (SAN) and Application Delivery Controllers (ADC). Beyond hardware, services such as Installation & Integration, Training & Consulting, and Support & Maintenance are integral to the market's growth, reflecting the need for comprehensive solutions and expert guidance in managing complex networking environments.

India Data Center Networking Market Market Size (In Million)

The BFSI, IT & Telecommunication, and Government sectors are leading the charge in data center networking adoption, driven by stringent data security regulations, the need for high-speed transaction processing, and the expansion of digital government services. Media & Entertainment is also emerging as a significant end-user, with the increasing demand for streaming services and content delivery networks. While the market is characterized by significant growth, certain restraints such as the high initial capital investment required for advanced networking solutions and the scarcity of skilled professionals capable of managing and maintaining these complex systems present challenges. However, the continuous innovation in networking technologies, including software-defined networking (SDN) and network function virtualization (NFV), alongside the government's supportive policies for digital infrastructure development, are expected to mitigate these challenges and further propel the market's growth trajectory. Leading companies like NVIDIA, IBM Corporation, Cisco Systems Inc., and Dell EMC are actively involved in shaping this market through product innovation and strategic collaborations.

India Data Center Networking Market Company Market Share

Dive deep into the thriving India Data Center Networking Market with our meticulously researched report. This analysis provides critical insights into the evolving infrastructure, technological advancements, and strategic plays shaping one of the world's fastest-growing digital economies. Optimized for industry professionals seeking actionable intelligence, this report leverages high-ranking keywords to enhance search visibility and deliver a reader-centric experience. Covering the study period from 2019 to 2033, with a base year of 2025, this comprehensive report offers an in-depth look at market dynamics, key players, and future trajectories.

India Data Center Networking Market Market Structure & Innovation Trends

The India Data Center Networking Market exhibits a dynamic structure characterized by moderate market concentration, with a few dominant players alongside a growing ecosystem of specialized vendors. Innovation is primarily driven by the escalating demand for high-speed, low-latency connectivity to support cloud computing, big data analytics, and the burgeoning artificial intelligence (AI) sector. Key innovation drivers include advancements in Ethernet switches, routers, and the integration of software-defined networking (SDN) and network function virtualization (NFV) technologies. Regulatory frameworks, while evolving, are increasingly focused on data localization and security, influencing infrastructure deployment strategies. Product substitutes are limited in core networking functionalities, but integration with broader IT solutions and managed services presents a dynamic competitive landscape. End-user demographics span a wide spectrum, from burgeoning startups to large enterprises and government agencies, each with unique networking demands. Merger and acquisition (M&A) activities are anticipated to play a significant role in market consolidation and technology acquisition, with potential deal values reaching into the hundreds of millions of dollars. The market's ability to adapt to these evolving trends will be crucial for sustained growth and competitive advantage.

India Data Center Networking Market Market Dynamics & Trends

The India Data Center Networking Market is poised for robust expansion, fueled by a confluence of powerful growth drivers. The sheer volume of data being generated and processed across various sectors, including IT & Telecommunication, BFSI, Government, and Media & Entertainment, necessitates a constant upgrade and expansion of data center infrastructure, directly translating to increased demand for sophisticated networking solutions. The rapid adoption of cloud services, both public and private, is a monumental catalyst, as organizations increasingly rely on scalable and resilient cloud environments that are underpinned by high-performance data center networks. The Indian government's push for digitalization initiatives, such as "Digital India," further accelerates the deployment of data centers and the associated networking equipment.

Technological disruptions are continuously reshaping the market. The advent of 5G technology, while still in its nascent stages of widespread deployment, promises to unlock new use cases requiring ultra-low latency and massive connectivity, compelling network upgrades. Artificial intelligence (AI) and machine learning (ML) workloads, particularly in areas like generative AI, are placing unprecedented demands on network bandwidth and efficiency, leading to the development and adoption of specialized networking hardware and software. The increasing prevalence of edge computing, where data processing occurs closer to the source of generation, also drives the need for distributed and interconnected data center networks.

Consumer preferences are shifting towards seamless, high-speed digital experiences, pushing businesses to invest in robust networking backbones to ensure uninterrupted service delivery. This includes a growing preference for Software-Defined Networking (SDN) and Network Function Virtualization (NFV) solutions, which offer greater agility, automation, and cost-efficiency compared to traditional networking architectures. The competitive dynamics within the market are intense, with established global players vying for market share against emerging local vendors. This competition fosters innovation and drives down costs, ultimately benefiting end-users. The market penetration of advanced networking solutions is projected to increase significantly, driven by a growing awareness of their benefits and the decreasing total cost of ownership over time. The Compound Annual Growth Rate (CAGR) for the India Data Center Networking Market is projected to be in the range of xx%, reflecting its strong growth trajectory.

Dominant Regions & Segments in India Data Center Networking Market

The India Data Center Networking Market's dominance is characterized by distinct regional hubs and critical segments.

Leading Region and Country Dominance

- Geographic Dominance: Metropolitan cities and emerging tech hubs are the epicenters of data center networking demand. Regions like Maharashtra (Mumbai), Karnataka (Bengaluru), National Capital Region (NCR - Delhi/Gurugram), and Tamil Nadu (Chennai) consistently lead in data center infrastructure development. This concentration is driven by several factors:

- Economic Policies: Government incentives and favorable policies for IT and data center development in these states attract significant investments.

- Infrastructure: Proximity to major power grids, connectivity hubs, and skilled talent pools makes these regions attractive for data center establishment.

- End-User Proximity: These regions house a large concentration of major enterprises across IT, BFSI, and Government sectors, creating immediate demand for localized data center services and, consequently, networking solutions.

Segment Dominance Analysis

The market's dominance is also evident across its key segments:

Component: By Product

- Ethernet Switches: This segment holds a substantial market share due to its foundational role in connecting servers, storage, and other network devices within data centers. The increasing adoption of high-speed Ethernet standards (e.g., 400GbE, 800GbE) to support data-intensive workloads drives its dominance.

- Routers: Essential for directing traffic between different networks and the internet, routers are critical for ensuring efficient data flow. The growth in network traffic and the expansion of internet connectivity contribute to the sustained demand for advanced routing solutions.

- Storage Area Network (SAN): As data volumes explode, robust and high-performance SAN solutions are paramount for efficient data storage and retrieval. The BFSI and IT & Telecommunication sectors are significant contributors to the SAN market's dominance.

- Application Delivery Controller (ADC): ADCs play a crucial role in optimizing application performance, availability, and security. Their importance is amplified by the increasing reliance on cloud-native applications and the need for seamless user experiences across diverse platforms.

- Other Networking Equipment: This category encompasses a range of specialized devices, including firewalls, load balancers, and network interface cards (NICs), which collectively contribute to the overall functionality and security of data center networks.

Component: By Services

- Installation & Integration: As complex networking solutions are deployed, the demand for expert installation and seamless integration services remains high, driving the growth of this segment.

- Support & Maintenance: The critical nature of data center operations necessitates continuous monitoring and proactive support, making this a dominant and recurring revenue stream for service providers.

- Training & Consulting: The rapid evolution of networking technologies requires ongoing upskilling of IT professionals, leading to a steady demand for training and consulting services.

End-User

- IT & Telecommunication: This segment is the largest consumer of data center networking solutions due to the inherent nature of their businesses, which heavily rely on robust, scalable, and high-performance networks to deliver their services.

- BFSI: The BFSI sector's stringent requirements for security, reliability, and low latency make it a significant driver for advanced data center networking, especially for transaction processing and data analytics.

- Government: With increasing digitalization of government services and the need for secure data storage and processing, the government sector represents a substantial and growing market for data center networking.

- Media & Entertainment: The rise of streaming services, high-definition content, and digital media creation fuels a strong demand for high-bandwidth networking solutions to manage massive data flows.

India Data Center Networking Market Product Innovations

Product innovations in the India Data Center Networking Market are driven by the relentless pursuit of higher performance, greater efficiency, and enhanced security. Key trends include the development of higher-speed Ethernet switches, such as those supporting 400GbE and beyond, to accommodate the escalating demands of AI and big data workloads. Advances in network interface cards (NICs) with integrated processing capabilities, like DPUs (Data Processing Units), are revolutionizing offload capabilities, freeing up CPU resources. The integration of AI and ML into network management and security platforms is another significant innovation, enabling proactive threat detection and automated network optimization. These advancements offer a competitive advantage by enabling data centers to handle more data, process it faster, and operate with greater resilience and security.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the India Data Center Networking Market across its key segmentation:

- Component: By Product: We delve into the market dynamics of Ethernet Switches, Routers, Storage Area Network (SAN), Application Delivery Controller (ADC), and Other Networking Equipment. Each product category is analyzed for its market size, growth projections, and competitive landscape, highlighting the drivers for its adoption within the Indian context.

- Component: By Services: The report provides an in-depth analysis of Installation & Integration, Training & Consulting, and Support & Maintenance services. We assess the market penetration, growth potential, and the value proposition of these services in supporting the deployment and operation of data center networks.

- End-User: Segmentation by End-User includes IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users. This analysis details the specific networking requirements, market size, and future growth prospects for each end-user industry, identifying key trends and competitive strategies within these sectors.

Key Drivers of India Data Center Networking Market Growth

Several pivotal factors are propelling the growth of the India Data Center Networking Market. The exponential increase in data generation and consumption across all sectors is a primary driver, necessitating robust network infrastructure. The rapid adoption of cloud computing, both public and private, mandates high-performance and scalable networking solutions. Furthermore, the Indian government's sustained push for digital transformation initiatives, including "Digital India" and investments in smart cities, is creating significant demand for data center capacity and advanced networking. The burgeoning adoption of technologies like AI, ML, and IoT further amplifies the need for high-bandwidth, low-latency networks. Finally, increasing foreign and domestic investments in building new data centers and expanding existing ones are directly fueling market expansion.

Challenges in the India Data Center Networking Market Sector

Despite the promising growth, the India Data Center Networking Market faces several hurdles. The fragmented nature of regulatory frameworks across different states can pose challenges for nationwide deployment. High upfront capital expenditure for advanced networking equipment can be a barrier, especially for smaller enterprises. Supply chain disruptions, exacerbated by global geopolitical events, can impact the availability and cost of critical networking components. Intense competition, while fostering innovation, also puts pressure on profit margins. Furthermore, a shortage of skilled network engineers and cybersecurity professionals poses a significant operational challenge for deploying and managing complex data center networks effectively.

Emerging Opportunities in India Data Center Networking Market

The India Data Center Networking Market is ripe with emerging opportunities. The growing demand for edge data centers, driven by the need for real-time data processing for IoT and 5G applications, presents a significant avenue for growth. The increasing adoption of hybrid and multi-cloud strategies by enterprises necessitates sophisticated networking solutions for seamless connectivity and data management across diverse cloud environments. The continuous evolution of AI and machine learning workloads will drive demand for specialized, high-performance networking hardware and software. Furthermore, the focus on cybersecurity and data privacy is creating opportunities for advanced security networking solutions and services. The ongoing expansion of hyperscale data centers by global cloud providers also offers substantial opportunities for networking equipment and service vendors.

Leading Players in the India Data Center Networking Market Market

- NVIDIA (Cumulus Networks Inc)

- IBM Corporation

- Fujitsu Ltd

- Dell EMC

- Cisco Systems Inc

- HP Development Company L P

- NEC Corporation

- Schneider Electric

- Keysight

- VMware Inc

Key Developments in India Data Center Networking Market Industry

- June 2023: Cisco unveiled the Cisco Nexus 9800 Series modular switches, a valuable addition to the Cisco Nexus 9000 Series portfolio. This new chassis offers support for high-speed and high-port-density line cards, enhancing the capabilities of the series.

- May 2023: Nvidia introduced a groundbreaking networking platform designed specifically for generative AI workloads. The Nvidia Spectrum-X combines the Spectrum-4 Ethernet switch with the Nvidia BlueField-3 Data Processing Unit (DPU), catering to the unique requirements of AI-driven tasks.

Future Outlook for India Data Center Networking Market Market

The future outlook for the India Data Center Networking Market is exceptionally bright, poised for sustained and accelerated growth. The ongoing digital transformation across all sectors, coupled with India's ambition to become a global digital hub, will continue to drive demand for advanced data center infrastructure and, consequently, cutting-edge networking solutions. The increasing adoption of technologies like AI, 5G, and edge computing will necessitate more sophisticated, high-performance, and intelligent networks. Strategic opportunities lie in the development of localized, sustainable, and highly secure networking solutions that cater to the specific needs of the Indian market. Collaboration between technology providers, infrastructure developers, and government bodies will be crucial in overcoming existing challenges and unlocking the full potential of this dynamic market.

India Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

India Data Center Networking Market Segmentation By Geography

- 1. India

India Data Center Networking Market Regional Market Share

Geographic Coverage of India Data Center Networking Market

India Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals is Hindering the Market Demand

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NVIDIA (Cumulus Networks Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujitsu Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HP Development Company L P

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NEC Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Keysight

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NVIDIA (Cumulus Networks Inc )

List of Figures

- Figure 1: India Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: India Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: India Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: India Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: India Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: India Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Data Center Networking Market ?

The projected CAGR is approximately 17.02%.

2. Which companies are prominent players in the India Data Center Networking Market ?

Key companies in the market include NVIDIA (Cumulus Networks Inc ), IBM Corporation, Fujitsu Ltd, Dell EMC, Cisco Systems Inc, HP Development Company L P, NEC Corporation, Schneider Electric, Keysight, VMware Inc.

3. What are the main segments of the India Data Center Networking Market ?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals is Hindering the Market Demand.

8. Can you provide examples of recent developments in the market?

June 2023: Cisco unveiled the Cisco Nexus 9800 Series modular switches, a valuable addition to the Cisco Nexus 9000 Series portfolio. This new chassis offers support for high-speed and high-port-density line cards, enhancing the capabilities of the series.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Data Center Networking Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Data Center Networking Market ?

To stay informed about further developments, trends, and reports in the India Data Center Networking Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence