Key Insights

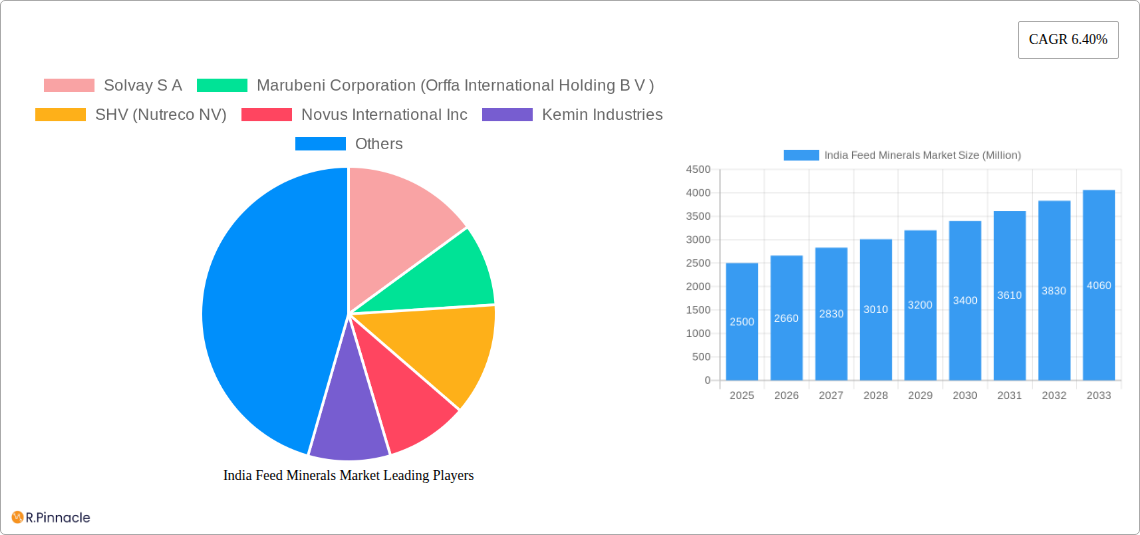

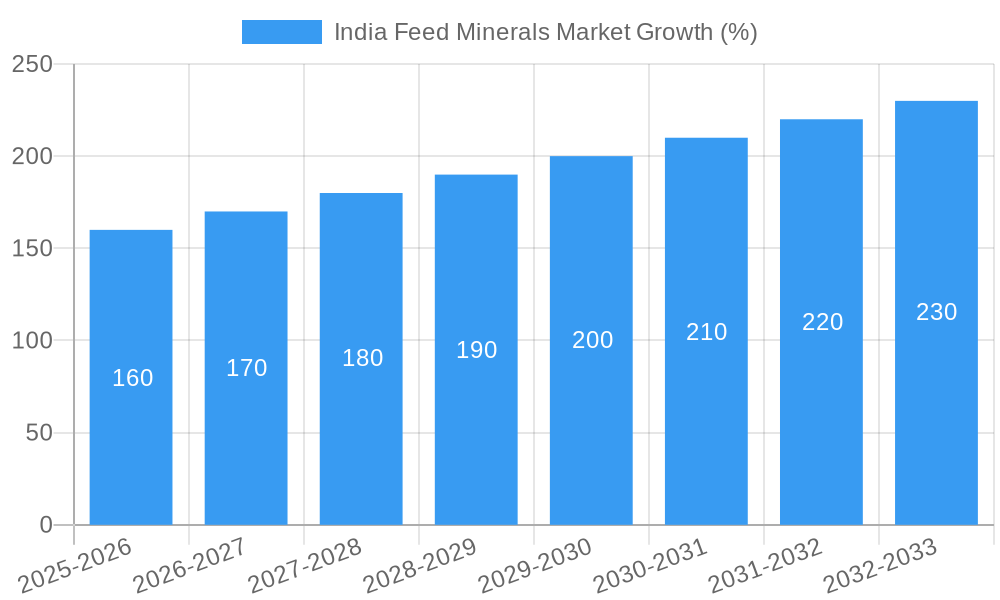

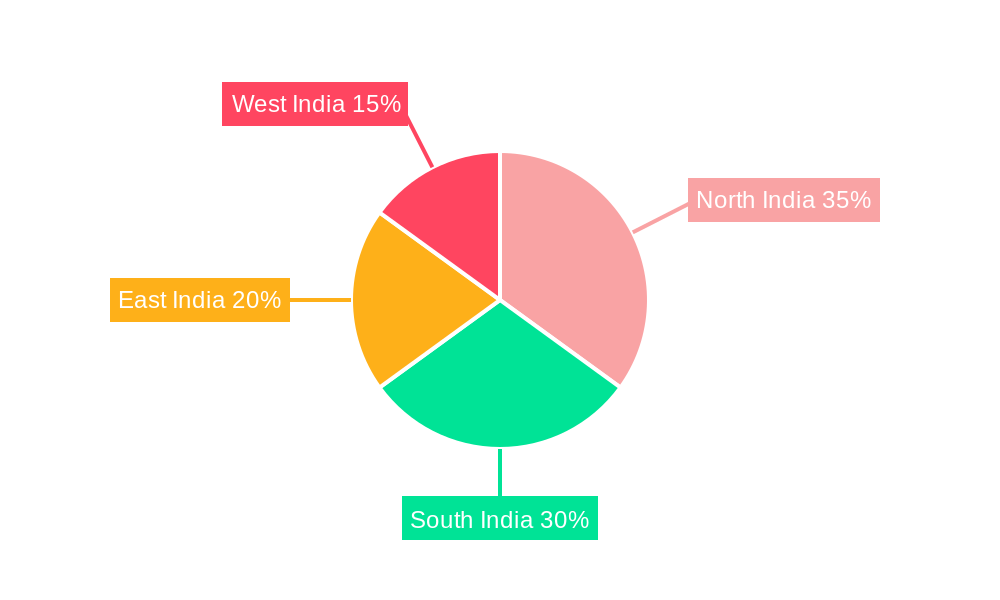

The India Feed Minerals market is experiencing robust growth, projected to reach a substantial size by 2033, driven by a burgeoning livestock population and the increasing adoption of scientifically formulated animal feeds. The market's Compound Annual Growth Rate (CAGR) of 6.40% from 2019 to 2024 indicates a consistent upward trajectory. This growth is fueled by several factors, including rising consumer demand for meat and dairy products, leading to intensified livestock farming and a greater focus on animal health and productivity. Government initiatives promoting sustainable and efficient livestock farming practices also contribute significantly to market expansion. Furthermore, the increasing awareness among farmers regarding the nutritional benefits of feed minerals and their positive impact on animal health and overall output are driving adoption. The segmental analysis reveals a strong demand for both macro and microminerals, with aquaculture and poultry emerging as key drivers within the animal feed sector. Regional variations exist, with states like Punjab, Haryana (North India) and Andhra Pradesh, Telangana (South India) showing high growth potential due to concentrated livestock farming activities. Challenges like fluctuating raw material prices and stringent regulatory norms pose potential restraints on market growth.

The competitive landscape features a mix of both multinational corporations and domestic players, with companies such as Solvay S.A., Marubeni Corporation (Orffa International Holding B.V.), and others vying for market share. Strategic collaborations, technological advancements in mineral formulation and delivery, and a focus on providing value-added services are expected to shape the future of the market. The forecast period of 2025-2033 presents numerous opportunities for market expansion, particularly in regions with high livestock densities and a growing awareness of the importance of balanced animal nutrition. Addressing the challenges effectively will be crucial for sustained growth and achieving the projected market size. Continued investment in research and development of innovative feed mineral solutions tailored to specific animal needs will be a key driver for success in this dynamic market.

India Feed Minerals Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India Feed Minerals Market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers actionable intelligence to navigate the dynamic landscape of this growing market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

India Feed Minerals Market Structure & Innovation Trends

The Indian feed minerals market is characterized by a moderately concentrated structure, with key players like Solvay S.A., Marubeni Corporation (Orffa International Holding B.V.), SHV (Nutreco NV), Novus International Inc., Kemin Industries, Archer Daniel Midland Co., BASF SE, Alltech Inc., Cargill Inc., and Adisseo holding significant market share. Market share distribution varies across segments, with some players dominating specific niches. Innovation is driven by the increasing demand for improved animal feed efficiency, enhanced animal health, and sustainable feed production practices. Regulatory frameworks, including those related to feed safety and animal health, influence product development and market access. Substitutes, such as naturally occurring minerals, pose competitive pressure but are often limited in terms of consistency and bioavailability. End-user demographics—dominated by large-scale commercial farms and increasingly, smallholder farmers—shape product demand and distribution strategies. M&A activities, such as Novus International's acquisition of Agrivida, demonstrate a trend towards consolidation and technological expansion. The value of these M&A deals in the recent past totaled approximately xx Million.

India Feed Minerals Market Dynamics & Trends

The Indian feed minerals market is experiencing significant growth fueled by several factors. The expanding livestock and aquaculture sectors, driven by rising per capita meat consumption and growing export demand, are major drivers. Technological advancements in feed formulation and mineral supplementation contribute to enhanced feed efficiency and improved animal productivity. Changing consumer preferences for healthier and sustainably produced animal products are pushing the demand for high-quality, traceable feed ingredients. Intense competition among established players and new entrants fosters innovation and drives price competitiveness. The market exhibits substantial growth potential, driven by the increasing adoption of advanced feed technologies and improvements in livestock management practices. Market penetration varies regionally, with higher adoption rates in developed states and a significant untapped potential in less-developed regions.

Dominant Regions & Segments in India Feed Minerals Market

While precise regional dominance data is unavailable, the market is projected to witness significant growth across various regions driven by diverse factors.

Key Drivers for Regional Growth:

- Economic Policies: Government initiatives promoting livestock farming and aquaculture contribute substantially to growth.

- Infrastructure Development: Improved transportation and storage facilities enhance distribution efficiency.

- Technological Advancements: Adoption of advanced farming practices and feed management systems.

- Consumer Preferences: Growing preference for meat and animal products fuels demand.

Dominant Segments: The Swine and Poultry segments are expected to witness significant growth within the Animal segment, while Macrominerals currently holds a larger market share within Sub Additives compared to Microminerals. Aquaculture presents a growing opportunity due to increased seafood consumption. Detailed dominance analysis would require further segmentation and regional specific data. The market size for each segment is currently under evaluation.

India Feed Minerals Market Product Innovations

Recent product innovations focus on improved bioavailability, targeted nutrient delivery, and environmentally friendly formulations. Companies are developing specialized mineral premixes tailored to specific animal species and dietary needs. Technological advancements include the use of nanotechnology for enhanced mineral absorption and precision feeding systems for optimized nutrient utilization. These innovations address challenges related to feed efficiency, animal health, and sustainability, offering a competitive advantage in the market.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation of the India Feed Minerals market:

Sub Additives:

- Macrominerals: This segment is characterized by xx Million market size in 2025 and is projected to grow to xx Million by 2033.

- Microminerals: This segment is characterized by xx Million market size in 2025 and is projected to grow to xx Million by 2033.

Animal:

- Aquaculture: This segment is characterized by xx Million market size in 2025 and is projected to grow to xx Million by 2033.

- Other Ruminants: This segment is characterized by xx Million market size in 2025 and is projected to grow to xx Million by 2033.

- Swine: This segment is characterized by xx Million market size in 2025 and is projected to grow to xx Million by 2033.

- Other Animals: This segment is characterized by xx Million market size in 2025 and is projected to grow to xx Million by 2033.

Competitive dynamics within each segment vary, with some players specializing in particular animal categories or mineral types.

Key Drivers of India Feed Minerals Market Growth

Several factors propel the growth of the India Feed Minerals Market: rising demand for animal protein, increasing livestock population, government support for the livestock and aquaculture industries, and technological advancements in feed formulation and mineral supplementation. Furthermore, the growing awareness of the role of balanced nutrition in animal health and productivity is driving demand for specialized mineral premixes and supplements.

Challenges in the India Feed Minerals Market Sector

The sector faces challenges such as fluctuating raw material prices, stringent regulatory requirements, and infrastructural limitations in certain regions. Supply chain disruptions can impact the availability and cost of raw materials. Competition from both domestic and international players necessitates continuous innovation and cost optimization. These factors contribute to the overall volatility and complexity of the market.

Emerging Opportunities in India Feed Minerals Market

Opportunities exist in developing customized feed solutions for specific animal breeds and production systems. The adoption of precision feeding technologies and data analytics offers potential for improved feed efficiency and reduced environmental impact. Expanding into the smallholder farmer segment presents a significant market opportunity. Further, developing organic and sustainable feed mineral solutions aligns with evolving consumer preferences.

Leading Players in the India Feed Minerals Market Market

- Solvay S.A.

- Marubeni Corporation (Orffa International Holding B.V.)

- SHV (Nutreco NV)

- Novus International Inc.

- Kemin Industries

- Archer Daniel Midland Co.

- BASF SE

- Alltech Inc.

- Cargill Inc.

- Adisseo

Key Developments in India Feed Minerals Market Industry

- December 2021: Nutreco partnered with the tech start-up Stellapps to reach three million smallholder farmers.

- April 2022: Novus International opened a new corporate office in India to improve market access.

- January 2023: Novus International acquired Agrivida to develop new feed additives.

Future Outlook for India Feed Minerals Market Market

The India Feed Minerals Market is poised for robust growth, driven by continued expansion of the livestock and aquaculture sectors, rising consumer demand for animal protein, and ongoing technological advancements. Strategic partnerships, product innovation, and efficient supply chain management will be key success factors for market players. The market presents significant opportunities for both established players and new entrants with innovative solutions.

India Feed Minerals Market Segmentation

-

1. Sub Additive

- 1.1. Macrominerals

- 1.2. Microminerals

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Dairy Cattle

- 2.3.2. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

India Feed Minerals Market Segmentation By Geography

- 1. India

India Feed Minerals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Feed Minerals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Macrominerals

- 5.1.2. Microminerals

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Dairy Cattle

- 5.2.3.2. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. North India India Feed Minerals Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Feed Minerals Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Feed Minerals Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Feed Minerals Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Solvay S A

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Marubeni Corporation (Orffa International Holding B V )

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SHV (Nutreco NV)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Novus International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kemin Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Archer Daniel Midland Co

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Alltech Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cargill Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Adisseo

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Solvay S A

List of Figures

- Figure 1: India Feed Minerals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Feed Minerals Market Share (%) by Company 2024

List of Tables

- Table 1: India Feed Minerals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Feed Minerals Market Revenue Million Forecast, by Sub Additive 2019 & 2032

- Table 3: India Feed Minerals Market Revenue Million Forecast, by Animal 2019 & 2032

- Table 4: India Feed Minerals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Feed Minerals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Feed Minerals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Feed Minerals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Feed Minerals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Feed Minerals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Feed Minerals Market Revenue Million Forecast, by Sub Additive 2019 & 2032

- Table 11: India Feed Minerals Market Revenue Million Forecast, by Animal 2019 & 2032

- Table 12: India Feed Minerals Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Feed Minerals Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the India Feed Minerals Market?

Key companies in the market include Solvay S A, Marubeni Corporation (Orffa International Holding B V ), SHV (Nutreco NV), Novus International Inc, Kemin Industries, Archer Daniel Midland Co, BASF SE, Alltech Inc, Cargill Inc, Adisseo.

3. What are the main segments of the India Feed Minerals Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives.April 2022: Novus International opened a new corporate office in India. This helps the company to improve its market and access the advantage of the location.December 2021: Nutreco partnered with the tech start-up Stellapps. This will give accessibility for the company to sell feed products, premixes, and feed additives to three million smallholder farmers using Stellapps’ technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Feed Minerals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Feed Minerals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Feed Minerals Market?

To stay informed about further developments, trends, and reports in the India Feed Minerals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence