Key Insights

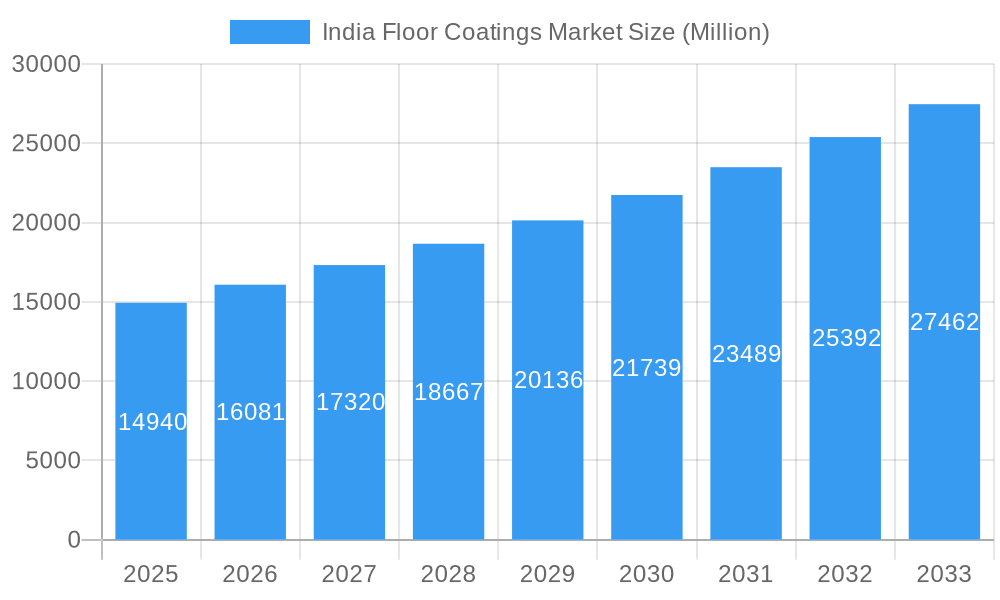

The India floor coatings market, valued at approximately ₹14940 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning construction industry, particularly in residential and commercial sectors, coupled with increasing urbanization and infrastructure development, creates significant demand for durable and aesthetically pleasing floor coatings. Furthermore, a rising preference for easy-to-maintain, hygienic, and aesthetically advanced flooring solutions among consumers is boosting market growth. The market is segmented by product type (epoxy, polyaspartic, acrylic, polyurethane, others), floor material (wood, concrete, others), and end-user industry (residential, commercial, industrial). Epoxy and polyurethane coatings dominate the product type segment due to their superior durability and resistance to wear and tear, particularly in industrial settings. Concrete remains the most prevalent floor material, given its widespread use in construction. However, the wood flooring segment is also witnessing notable growth, driven by rising disposable incomes and a preference for aesthetically appealing finishes in residential projects. While challenges such as volatile raw material prices and stringent environmental regulations exist, the overall market outlook remains positive, promising sustained growth throughout the forecast period. Competition among established players like Asian Paints, Berger Paints, Kansai Nerolac Paints, and international companies like Sherwin-Williams and Henkel is intense, leading to innovation and product diversification to cater to evolving consumer preferences.

India Floor Coatings Market Market Size (In Billion)

The growth trajectory of the India floor coatings market is anticipated to be influenced by government initiatives promoting infrastructure development and affordable housing. Technological advancements in coating formulations, focusing on enhanced durability, sustainability, and aesthetics, will further propel market expansion. The increasing adoption of eco-friendly and low-VOC coatings, driven by growing environmental awareness among consumers and stricter environmental regulations, will also shape market dynamics. While the commercial sector currently holds a significant market share, the residential segment is expected to show robust growth, fueled by rising homeownership rates and increasing disposable incomes within the Indian population. The industrial sector will continue to contribute significantly, driven by the need for durable and chemical-resistant coatings in factories and warehouses. Strategic partnerships, mergers, and acquisitions among market players are likely to intensify competition and accelerate innovation in this dynamic market.

India Floor Coatings Market Company Market Share

This in-depth report provides a comprehensive analysis of the India Floor Coatings Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a detailed study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report unravels the market's dynamics, growth drivers, and future potential. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, supporting informed business strategies and investment decisions.

India Floor Coatings Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian floor coatings market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The report delves into the market share held by key players and assesses the value of significant M&A deals.

Market Concentration: The Indian floor coatings market exhibits a moderately concentrated structure, with a few major players holding significant market share. The report analyzes the Herfindahl-Hirschman Index (HHI) to quantify this concentration. xx% of the market is controlled by the top 5 players.

Innovation Drivers: Technological advancements in coating formulations, increasing demand for sustainable and eco-friendly products, and the rising adoption of advanced application techniques are key innovation drivers.

Regulatory Framework: Government regulations concerning VOC emissions and environmental standards significantly influence the market. The report examines the impact of these regulations on product development and market growth.

Product Substitutes: The report assesses the threat from substitute products, such as tiles and other flooring materials, and their impact on market dynamics.

End-User Demographics: The report segments the market based on end-user industries (residential, commercial, industrial) and analyzes the specific needs and preferences of each segment.

M&A Activities: The report details significant mergers and acquisitions in the market, analyzing their impact on market share and competitive dynamics. For example, the xx Million acquisition of [Company X] by [Company Y] in [Year] altered the market landscape significantly.

India Floor Coatings Market Dynamics & Trends

This section explores the key factors driving market growth, including technological disruptions, evolving consumer preferences, and competitive dynamics. The analysis incorporates key metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), driven by factors such as [Specific Factor 1, e.g., growing construction activity], [Specific Factor 2, e.g., increasing disposable income], and [Specific Factor 3, e.g., government infrastructure initiatives]. Market penetration of specific product types like epoxy coatings in the commercial sector is also analyzed. Competitive dynamics are shaped by pricing strategies, product differentiation, and branding initiatives.

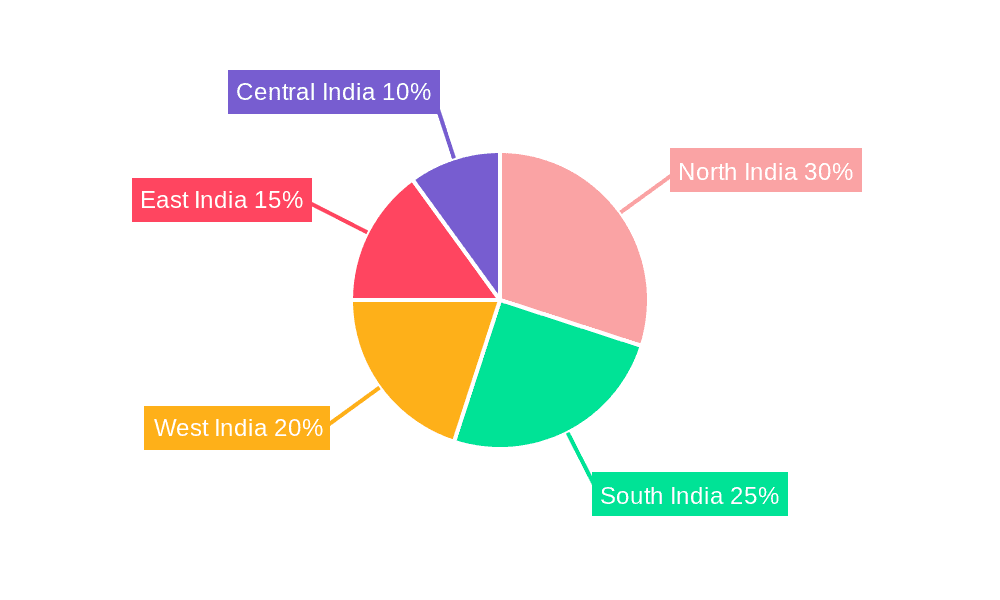

Dominant Regions & Segments in India Floor Coatings Market

This section identifies the leading regions and segments within the Indian floor coatings market, analyzing key drivers behind their dominance.

Leading Segments:

Product Type: Epoxy coatings currently dominate the market due to their durability and chemical resistance. The Polyurethane segment is also experiencing significant growth due to its versatility and aesthetic appeal.

Floor Material: Concrete remains the dominant floor material, driven by its widespread use in industrial and commercial construction.

End-user Industry: The commercial sector, including offices, retail spaces, and hospitality establishments, accounts for the largest share of the market due to the high demand for durable and aesthetically pleasing floor coatings.

Key Drivers:

Economic Policies: Government initiatives promoting infrastructure development and affordable housing significantly impact market growth.

Infrastructure Projects: Large-scale infrastructure projects, such as road construction and industrial developments, are driving demand for floor coatings.

Urbanization and Construction Boom: The rapid urbanization and construction boom in India are key factors contributing to market expansion.

India Floor Coatings Market Product Innovations

Recent product innovations focus on enhancing durability, sustainability, and aesthetic appeal. New formulations with improved chemical resistance, UV protection, and antimicrobial properties are gaining traction. The integration of nanotechnology and advanced polymers is driving the development of high-performance coatings. Market fit is assessed based on factors like price competitiveness, ease of application, and overall performance characteristics.

Report Scope & Segmentation Analysis

This report segments the India Floor Coatings market based on product type (Epoxy, Polyaspartics, Acrylic, Polyurethane, Other Product Types), floor material (Wood, Concrete, Other Floor Materials), and end-user industry (Residential, Commercial, Industrial). Each segment's growth projections, market size, and competitive dynamics are analyzed. For instance, the Epoxy segment is projected to grow at a CAGR of xx% during the forecast period, driven by its superior durability and chemical resistance. The commercial sector shows the highest growth potential due to increased construction activity.

Key Drivers of India Floor Coatings Market Growth

Growth in the Indian floor coatings market is driven by several factors: rising construction activity across residential, commercial, and industrial sectors; increasing urbanization and infrastructure development; growing demand for aesthetically pleasing and durable floor coatings; and government initiatives supporting infrastructure projects. Technological advancements in coating formulations leading to improved performance characteristics further fuel market expansion.

Challenges in the India Floor Coatings Market Sector

The market faces challenges such as fluctuating raw material prices, intense competition from both domestic and international players, and stringent environmental regulations. Supply chain disruptions can also impact market stability. These challenges impact profitability and necessitate strategic responses from market participants.

Emerging Opportunities in India Floor Coatings Market

Emerging opportunities lie in the growing demand for eco-friendly and sustainable floor coatings, the increasing adoption of advanced application techniques, and the expansion into niche segments such as specialized industrial coatings. The rising awareness of health and hygiene is driving demand for antimicrobial coatings.

Leading Players in the India Floor Coatings Market Market

- Shalimar Paints

- Henkel AG & Co KGaA

- The Sherwin-Williams Company

- Jotun

- JSW Paints

- Sheenlac Paints Ltd

- HMG Paints Limited

- Mapei

- Nippon Paint Holdings Co Ltd

- BASF SE

- Indigo Paints Ltd

- Kansai Nerolac Paints Limited

- Akzo Nobel N V

- Sto SE & Co KGaA

- Sika AG

- PPG Industries

- Asian Paints

Key Developments in India Floor Coatings Market Industry

- October 2020: Kansai Nerolac Paints announced an investment of USD 54.3 Million to add capacity by 40,000 lakh liters at its plant in Amritsar, Punjab. This expansion significantly increases the company's production capacity and strengthens its market position.

Future Outlook for India Floor Coatings Market Market

The India floor coatings market is poised for significant growth over the forecast period, driven by continued infrastructure development, rising disposable incomes, and the increasing adoption of advanced coating technologies. Strategic partnerships, product diversification, and technological innovation will be crucial for companies to succeed in this dynamic and competitive market.

India Floor Coatings Market Segmentation

-

1. Product Type

- 1.1. Epoxy

- 1.2. Polyaspartics

- 1.3. Acrylic

- 1.4. Polyurethane

- 1.5. Other Product Types

-

2. Floor Material

- 2.1. Wood

- 2.2. Concrete

- 2.3. Other Floor Materials

-

3. End-user Industry

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

India Floor Coatings Market Segmentation By Geography

- 1. India

India Floor Coatings Market Regional Market Share

Geographic Coverage of India Floor Coatings Market

India Floor Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Floor Coatings; Increasing Construction Activities in India

- 3.3. Market Restrains

- 3.3.1. Harmful Environmental Impact of Conventional Coatings

- 3.4. Market Trends

- 3.4.1. Increasing Construction Activities in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Floor Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartics

- 5.1.3. Acrylic

- 5.1.4. Polyurethane

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Floor Material

- 5.2.1. Wood

- 5.2.2. Concrete

- 5.2.3. Other Floor Materials

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shalimar Paints

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Henkel AG & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Sherwin-Williams Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JSW Paints

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sheenlac Paints Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HMG Paints Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mapei

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Paint Holdings Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indigo Paints Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kansai Nerolac Paints Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Akzo Nobel N V

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sto SE & Co KGaA

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sika AG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 PPG Industries

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Asian Paints

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Shalimar Paints

List of Figures

- Figure 1: India Floor Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Floor Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: India Floor Coatings Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Floor Coatings Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: India Floor Coatings Market Revenue Million Forecast, by Floor Material 2020 & 2033

- Table 4: India Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 5: India Floor Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: India Floor Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: India Floor Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Floor Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: India Floor Coatings Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: India Floor Coatings Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: India Floor Coatings Market Revenue Million Forecast, by Floor Material 2020 & 2033

- Table 12: India Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 13: India Floor Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: India Floor Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: India Floor Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Floor Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Floor Coatings Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the India Floor Coatings Market?

Key companies in the market include Shalimar Paints, Henkel AG & Co KGaA, The Sherwin-Williams Company*List Not Exhaustive, Jotun, JSW Paints, Sheenlac Paints Ltd, HMG Paints Limited, Mapei, Nippon Paint Holdings Co Ltd, BASF SE, Indigo Paints Ltd, Kansai Nerolac Paints Limited, Akzo Nobel N V, Sto SE & Co KGaA, Sika AG, PPG Industries, Asian Paints.

3. What are the main segments of the India Floor Coatings Market?

The market segments include Product Type, Floor Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14940 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Floor Coatings; Increasing Construction Activities in India.

6. What are the notable trends driving market growth?

Increasing Construction Activities in India.

7. Are there any restraints impacting market growth?

Harmful Environmental Impact of Conventional Coatings.

8. Can you provide examples of recent developments in the market?

October 2020: Kansai Nerolac Paints announced an investment of USD 54.3 million to add capacity by 40,000 lakh liter at its plant in Amritsar, Punjab.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Floor Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Floor Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Floor Coatings Market?

To stay informed about further developments, trends, and reports in the India Floor Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence