Key Insights

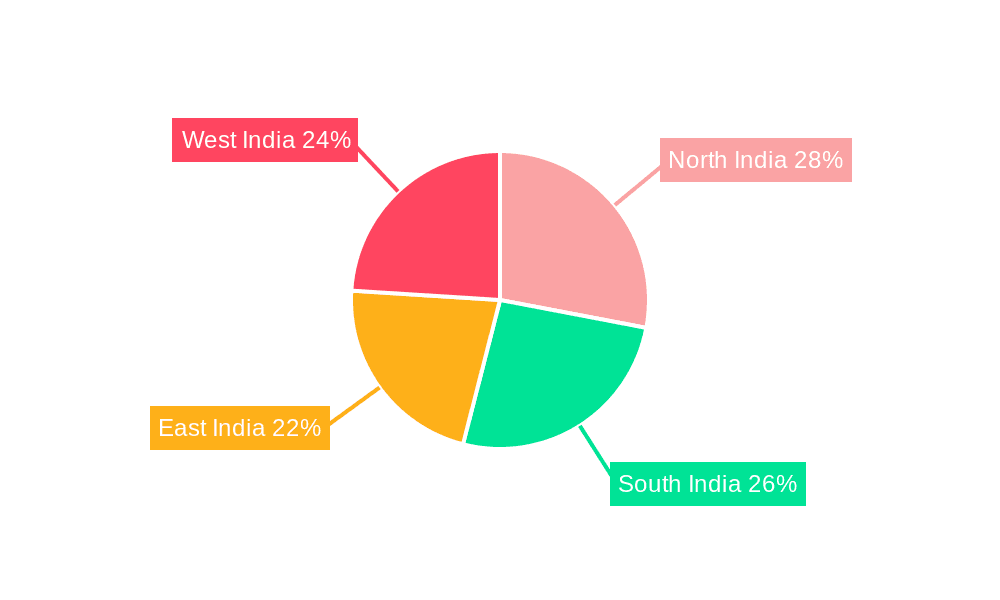

India's gas generator market is poised for substantial expansion, forecasted at $208.6 million in 2024, with a projected Compound Annual Growth Rate (CAGR) of 3.63% through 2032. This growth is primarily fueled by escalating industrialization and urbanization across India's developing regions, driving demand for dependable backup power. Increased power outages, especially in rural areas and during peak demand, underscore the critical need for gas generators in sectors like manufacturing, healthcare, and data centers. Government infrastructure development initiatives and the expansion of commercial and residential segments further bolster this growth. The market is segmented by capacity rating (under 75 kVA, 75-375 kVA, over 375 kVA) and end-user (industrial, commercial, residential), with the industrial sector currently leading due to significant power requirements. Market presence is strong across all Indian regions: North, South, East, and West, with regional variations influenced by industrial concentration and infrastructure development.

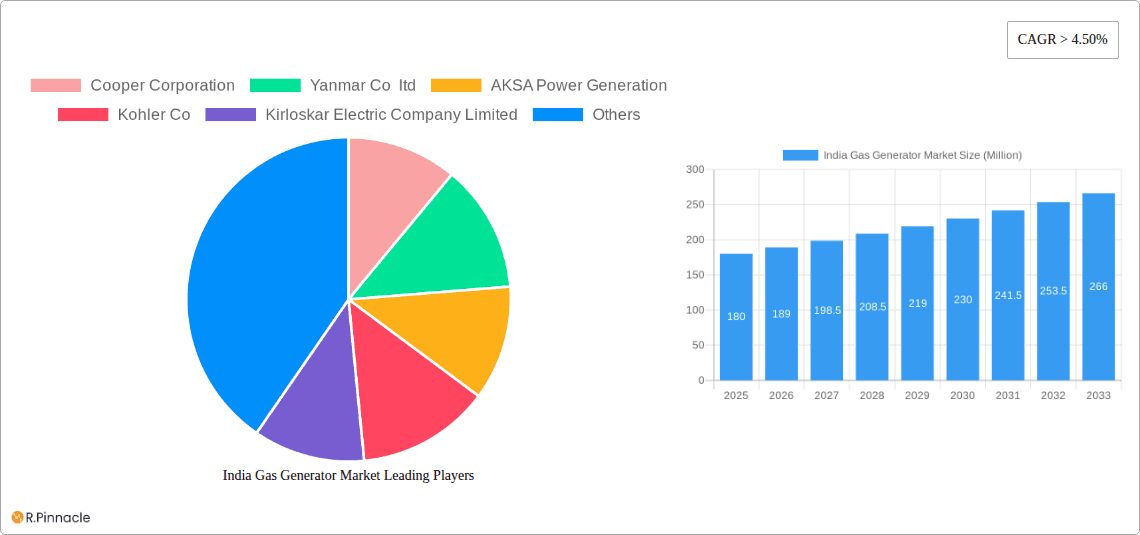

India Gas Generator Market Market Size (In Million)

Challenges to market growth include fluctuating gas prices and stringent emission regulations. However, advancements in gas generator technology emphasizing efficiency and reduced emissions are expected to address these concerns. The competitive landscape features established domestic players such as Cummins, Caterpillar, and Kirloskar Electric, alongside international firms like Kohler and Yanmar, fostering competitive pricing and innovation. The growing emphasis on sustainable energy solutions presents both opportunities and challenges as the market shifts towards cleaner, more efficient gas generator technologies. The long-term outlook for the India gas generator market remains optimistic, supported by robust economic growth and the persistent demand for reliable power backup. Strategic collaborations and R&D investments are anticipated to accelerate market expansion in the coming decade.

India Gas Generator Market Company Market Share

India Gas Generator Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Gas Generator Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market dynamics, segmentation, key players, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages extensive research and data analysis to provide a clear and actionable understanding of this rapidly evolving market. The total market size in 2025 is estimated at xx Million.

India Gas Generator Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian gas generator market, examining market concentration, innovation drivers, and regulatory influences. We explore the role of mergers and acquisitions (M&A) activity, analyzing deal values and their impact on market share. The report also considers the impact of substitute products and evolving end-user demographics.

- Market Concentration: The Indian gas generator market exhibits a moderately concentrated structure, with several major players holding significant market share. The top five players collectively account for approximately xx% of the market. Precise market share figures for individual players are detailed within the full report.

- Innovation Drivers: Key innovation drivers include the increasing demand for reliable power backup, advancements in gas generator technology (e.g., IoT integration), and government initiatives promoting energy efficiency.

- Regulatory Framework: Government regulations concerning emissions standards and energy efficiency play a significant role in shaping market dynamics. The impact of these regulations on the adoption of gas generators is thoroughly assessed.

- Product Substitutes: The market faces competition from alternative power sources, such as solar and wind power. The report evaluates the competitive pressure from these alternatives and their impact on gas generator market growth.

- End-User Demographics: The industrial sector dominates the gas generator market, followed by the commercial and residential sectors. The report offers a detailed analysis of each sector's specific needs and preferences.

- M&A Activities: Recent years have witnessed several significant M&A activities, such as the July 2022 strategic partnership between Sterling Generators and Moteurs Baudouin. The report analyzes these deals, assessing their impact on market consolidation and competition. The total value of M&A deals in the last five years is estimated at xx Million.

India Gas Generator Market Dynamics & Trends

This section delves into the key factors influencing the growth and development of the India Gas Generator Market. We analyze market growth drivers, technological advancements, evolving consumer preferences, and the competitive dynamics among key players. The report includes specific metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rate to provide a quantitative perspective on market trends. The projected CAGR for the forecast period (2025-2033) is estimated to be xx%. Market penetration is currently at xx% and projected to reach xx% by 2033. Factors contributing to market growth are detailed within the report.

Dominant Regions & Segments in India Gas Generator Market

This section identifies the leading regions and segments within the India Gas Generator Market. We analyze market performance across different capacity ratings (Less than 75 kVA, Between 75-375 kVA, Above 375 kVA) and end-user segments (Industrial, Commercial, Residential).

- Capacity Rating: The segment "Between 75-375 kVA" currently holds the largest market share, driven by strong demand from the commercial and industrial sectors.

- End-User: The Industrial sector represents the largest market segment, owing to the significant power requirements of various industrial processes.

- Key Drivers:

- Economic Growth: India's robust economic growth fuels the demand for reliable power across various sectors.

- Infrastructure Development: Ongoing infrastructure projects require substantial power backup solutions, boosting gas generator adoption.

- Government Policies: Government initiatives aimed at promoting energy efficiency and improving power infrastructure positively impact market growth.

India Gas Generator Market Product Innovations

Recent years have witnessed significant product innovations in the gas generator market. The introduction of IoT-enabled gas generators, as exemplified by Kirloskar Oil Engines' August 2022 launch, reflects a growing trend towards digitalization and remote monitoring capabilities. These advancements offer enhanced operational efficiency, predictive maintenance, and reduced downtime. The market is also seeing increased adoption of fuel-efficient technologies in response to environmental concerns and rising fuel costs.

Report Scope & Segmentation Analysis

This report covers the India Gas Generator Market comprehensively, providing detailed segmentation analysis.

- Capacity Rating: The market is segmented by capacity rating into Less than 75 kVA, Between 75-375 kVA, and Above 375 kVA. Each segment’s growth trajectory, market size, and competitive dynamics are separately analyzed.

- End-User: The end-user segments include Industrial, Commercial, and Residential sectors. Each segment's specific needs and growth prospects are thoroughly examined. Growth projections are presented for each segment throughout the forecast period.

Key Drivers of India Gas Generator Market Growth

The growth of the India Gas Generator Market is propelled by several key factors:

- Rising Energy Demand: The increasing energy demand across various sectors, particularly in industrial and commercial applications, drives the need for reliable backup power solutions.

- Power Infrastructure Gaps: Existing power infrastructure limitations and frequent power outages necessitate the use of gas generators for uninterrupted power supply.

- Technological Advancements: Innovations in gas generator technology, such as IoT integration and improved fuel efficiency, enhance market appeal.

Challenges in the India Gas Generator Market Sector

Despite significant growth potential, the India Gas Generator Market faces certain challenges:

- Stringent Emission Norms: Meeting increasingly stringent emission regulations requires manufacturers to invest in cleaner technologies, increasing costs.

- Fluctuating Fuel Prices: Fluctuations in natural gas prices can impact the overall cost-effectiveness of gas generators.

- Intense Competition: The presence of several established players and emerging competitors creates intense competition within the market.

Emerging Opportunities in India Gas Generator Market

Several emerging trends present significant opportunities for growth in the India Gas Generator Market:

- Renewable Energy Integration: The integration of gas generators with renewable energy sources to create hybrid systems is gaining traction.

- Smart Grid Technologies: The development and adoption of smart grid technologies are opening new possibilities for optimized power management.

- Rural Electrification: The increasing focus on rural electrification in India creates significant demand for cost-effective power solutions.

Leading Players in the India Gas Generator Market Market

- Cooper Corporation

- Yanmar Co ltd

- AKSA Power Generation

- Kohler Co

- Kirloskar Electric Company Limited

- Caterpillar Inc

- Cummins Inc

- General Electric Company

- Verder Ltd

Key Developments in India Gas Generator Market Industry

- August 2022: Kirloskar Oil Engines launched IoT-enabled gas generators, offering digital monitoring and cold-weather operation on PNG. This launch significantly enhances the market offering with advanced technology.

- July 2022: Sterling Generators partnered with Moteurs Baudouin, strengthening its product portfolio and market position through access to advanced engine technology. This partnership is expected to boost Sterling Generator’s market share and drive innovation.

Future Outlook for India Gas Generator Market Market

The India Gas Generator Market is poised for substantial growth in the coming years, driven by increasing energy demand, infrastructure development, and technological advancements. The continued adoption of fuel-efficient and technologically advanced gas generators will be a key factor in shaping market dynamics. The market is expected to witness significant expansion as the country continues its economic development and strives for reliable power access across all regions.

India Gas Generator Market Segmentation

-

1. Capacity Rating

- 1.1. Less than 75 kVA

- 1.2. Between 75-375 kVA

- 1.3. Above 375 kVA

-

2. End-User

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Residential

India Gas Generator Market Segmentation By Geography

- 1. India

India Gas Generator Market Regional Market Share

Geographic Coverage of India Gas Generator Market

India Gas Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Industrialization4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment

- 3.4. Market Trends

- 3.4.1. Below 75 kVA Capacity Gas Generator to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity Rating

- 5.1.1. Less than 75 kVA

- 5.1.2. Between 75-375 kVA

- 5.1.3. Above 375 kVA

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Capacity Rating

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cooper Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yanmar Co ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AKSA Power Generation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kirloskar Electric Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cummins Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verder Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cooper Corporation

List of Figures

- Figure 1: India Gas Generator Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Gas Generator Market Share (%) by Company 2025

List of Tables

- Table 1: India Gas Generator Market Revenue million Forecast, by Capacity Rating 2020 & 2033

- Table 2: India Gas Generator Market Volume K Unit Forecast, by Capacity Rating 2020 & 2033

- Table 3: India Gas Generator Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: India Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: India Gas Generator Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Gas Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Gas Generator Market Revenue million Forecast, by Capacity Rating 2020 & 2033

- Table 8: India Gas Generator Market Volume K Unit Forecast, by Capacity Rating 2020 & 2033

- Table 9: India Gas Generator Market Revenue million Forecast, by End-User 2020 & 2033

- Table 10: India Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: India Gas Generator Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: India Gas Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Gas Generator Market?

The projected CAGR is approximately 3.63%.

2. Which companies are prominent players in the India Gas Generator Market?

Key companies in the market include Cooper Corporation, Yanmar Co ltd, AKSA Power Generation, Kohler Co, Kirloskar Electric Company Limited, Caterpillar Inc, Cummins Inc, General Electric Company, Verder Ltd.

3. What are the main segments of the India Gas Generator Market?

The market segments include Capacity Rating, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 208.6 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Industrialization4.; Government Initiatives.

6. What are the notable trends driving market growth?

Below 75 kVA Capacity Gas Generator to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment.

8. Can you provide examples of recent developments in the market?

August 2022: Kirloskar Oil Engines launched a gas-powered generator. These are IoT-enabled gas generators, and not only run even in extremely cold conditions on PNG but also offer a digital monitoring system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Gas Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Gas Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Gas Generator Market?

To stay informed about further developments, trends, and reports in the India Gas Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence