Key Insights

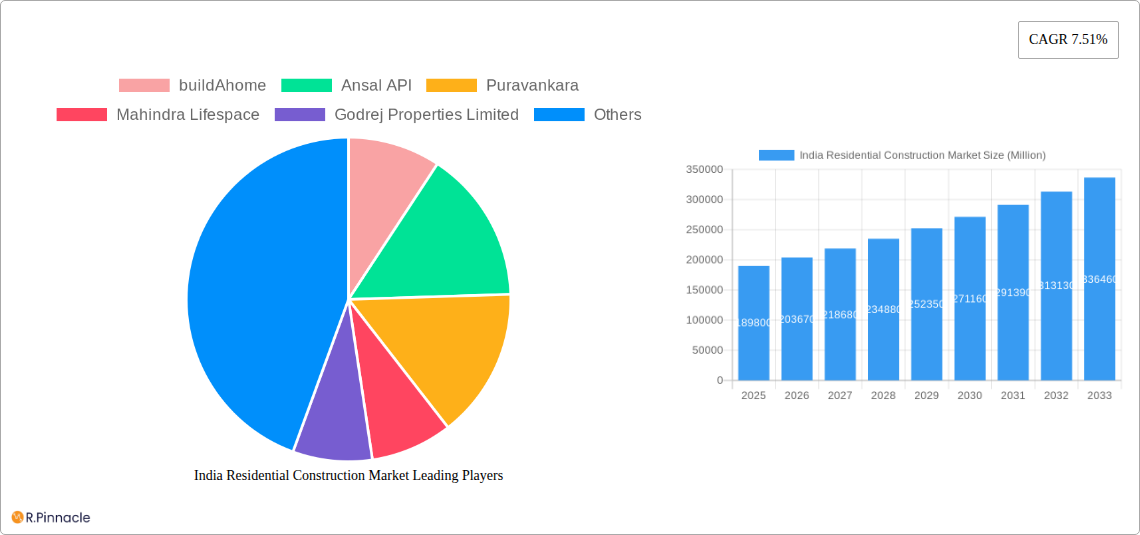

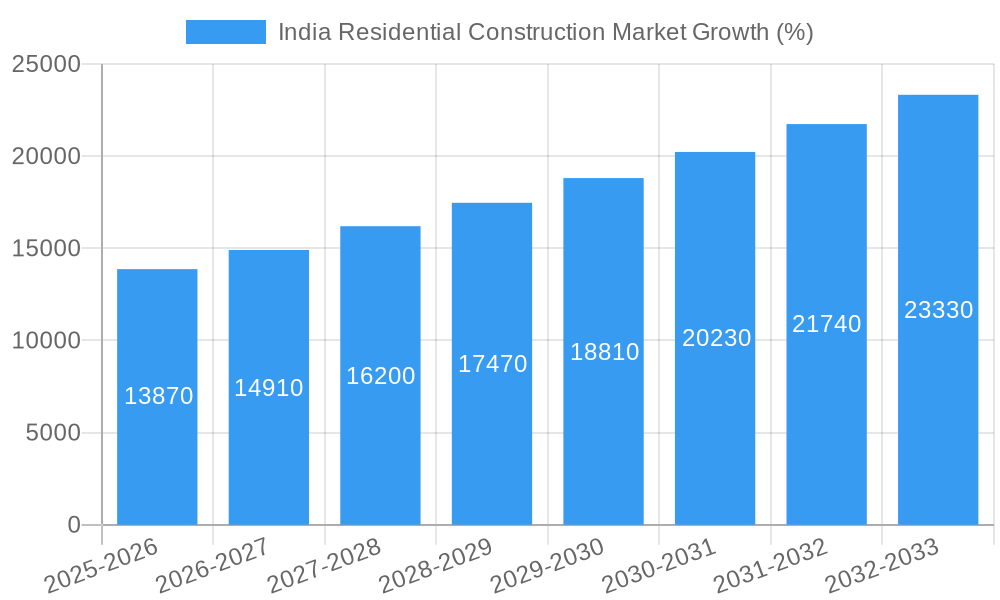

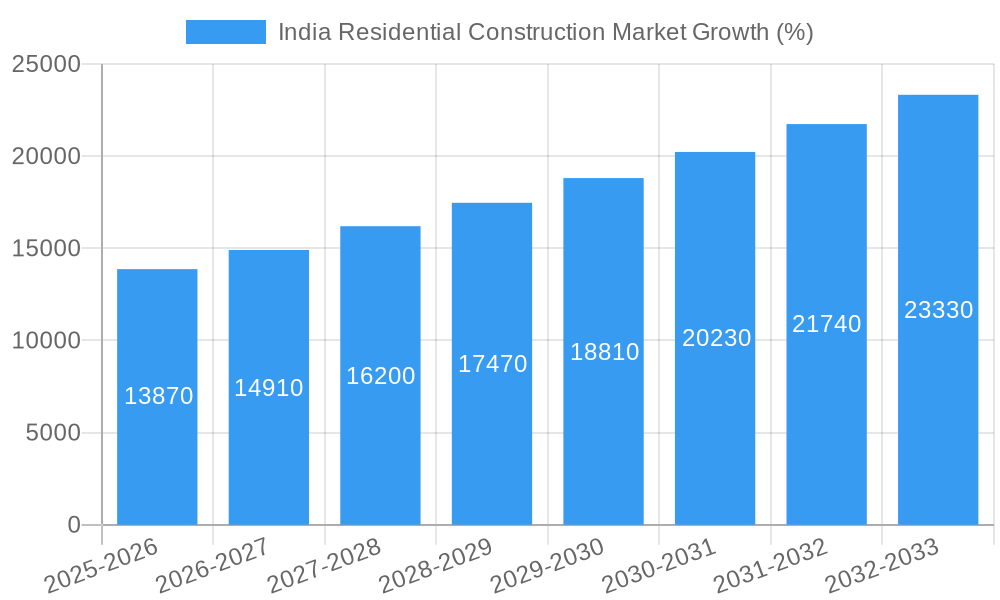

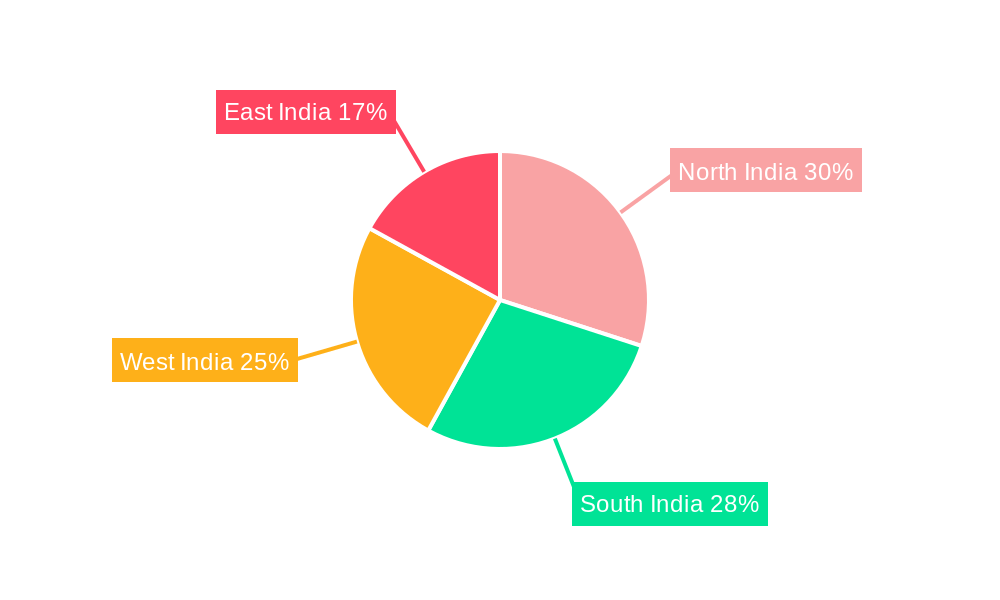

The India Residential Construction Market is experiencing robust growth, projected to reach a market size of $189.80 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.51% from 2019 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increasing disposable income is a significant factor, coupled with rapid urbanization and a persistent demand for improved housing infrastructure, particularly in expanding metropolitan areas across North, South, East, and West India. Government initiatives promoting affordable housing and infrastructure development further stimulate market growth. The market segmentation reveals a diverse landscape, with apartments and condominiums dominating the "By Type" segment, while new construction leads in the "By Construction Type" segment, indicating a strong preference for modern housing. However, the market faces certain challenges. Fluctuations in raw material prices, regulatory complexities, and land acquisition issues can act as restraints to sustained growth. Nonetheless, the long-term outlook remains positive, driven by continued economic development and evolving consumer preferences towards larger, more technologically advanced homes.

The competitive landscape is characterized by a mix of established large-scale developers such as Puravankara, Mahindra Lifespace, Godrej Properties Limited, and Prestige Group, alongside regional players and smaller builders catering to niche markets. The presence of both large and small players fosters competition and innovation, ultimately benefiting consumers. The market's performance is closely tied to broader economic indicators, such as GDP growth and interest rates. While short-term fluctuations are possible, the long-term trajectory indicates a continued upward trend, making the India Residential Construction Market an attractive sector for investment and expansion. Future growth will likely be driven by sustainable construction practices, smart home technologies, and an increasing emphasis on affordable housing solutions to address the substantial housing deficit.

India Residential Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Residential Construction Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The report leverages extensive data and analysis to provide actionable intelligence for navigating the complexities of this dynamic market. The total market size in 2025 is estimated at xx Million USD.

Keywords: India Residential Construction Market, Real Estate Market India, Housing Market India, Construction Industry India, Residential Construction Trends, Apartments India, Villas India, New Construction India, Renovation India, Market Size India, Market Share, CAGR, buildAhome, Ansal API, Puravankara, Mahindra Lifespace, Godrej Properties, StepsStone Builders, Delhi Land & Finance, Merlin Group, VGN Projects, Prestige Group.

India Residential Construction Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovative technologies driving growth, and regulatory factors impacting the Indian residential construction market. We delve into market concentration, assessing the market share of key players such as buildAhome, Ansal API, Puravankara, Mahindra Lifespace, Godrej Properties Limited, and others. The report also examines the impact of mergers and acquisitions (M&A) activities, with an estimated xx Million USD in M&A deal value during the historical period.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few large players holding significant market share, while numerous smaller players compete in niche segments.

- Innovation Drivers: Technological advancements in construction materials, prefabrication techniques, and smart home technologies are major drivers of innovation.

- Regulatory Framework: Government policies, building codes, and environmental regulations significantly influence market dynamics.

- Product Substitutes: The availability of alternative housing solutions, such as rental apartments and co-living spaces, poses a competitive challenge.

- End-User Demographics: Understanding the evolving needs and preferences of homebuyers, considering factors like income levels, family size, and lifestyle choices, is crucial.

- M&A Activities: Consolidation through M&A activity is anticipated to continue, driven by the need for scale and expansion.

India Residential Construction Market Dynamics & Trends

This section explores the factors influencing market growth, including macroeconomic indicators, technological disruptions, shifting consumer preferences, and competitive dynamics. The analysis includes projected Compound Annual Growth Rate (CAGR) and market penetration rates for various segments. For instance, the penetration of prefabricated construction methods is projected to increase significantly, driven by cost efficiencies and faster construction times. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to experience a CAGR of xx% during the forecast period (2025-2033).

Dominant Regions & Segments in India Residential Construction Market

This section identifies the leading regions and market segments within the Indian residential construction market, analyzing factors driving their dominance.

- By Type:

- Apartments and Condominiums: This segment dominates the market, driven by increasing urbanization and affordability.

- Villas: This segment shows strong growth potential, especially in tier-1 and tier-2 cities, catering to high-net-worth individuals.

- Other Types: This segment includes townhouses, row houses, and other housing options with steady growth.

- By Construction Type:

- New Construction: This segment accounts for the largest share of the market, fueled by the growing demand for housing.

- Renovation: This segment is experiencing steady growth, driven by homeowners’ desire to upgrade existing properties.

Key Drivers:

- Favorable government policies promoting affordable housing.

- Improving infrastructure in major cities and tier-2 towns.

- Rising disposable incomes and changing lifestyle preferences.

- Access to mortgage financing.

India Residential Construction Market Product Innovations

Recent innovations include the increasing adoption of sustainable building materials, prefabricated construction methods, and smart home technologies. These advancements offer competitive advantages in terms of cost efficiency, sustainability, and enhanced living experience, aligning with evolving market demands for eco-friendly and technologically advanced housing solutions.

Report Scope & Segmentation Analysis

This report segments the Indian residential construction market by type (Apartments and Condominiums, Villas, Other Types) and construction type (New Construction, Renovation). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The Apartments and Condominiums segment is projected to account for the largest market share during the forecast period. New construction will continue to dominate the construction type segment.

Key Drivers of India Residential Construction Market Growth

Several factors contribute to the growth of the India Residential Construction Market, including government initiatives promoting affordable housing, rapid urbanization, rising disposable incomes, and improving infrastructure. Technological advancements such as prefabrication and sustainable construction materials also play a role.

Challenges in the India Residential Construction Market Sector

The sector faces challenges such as land acquisition complexities, regulatory hurdles, fluctuating raw material prices, and skilled labor shortages. These factors can lead to project delays and cost overruns, impacting profitability and market growth. The impact of these challenges is estimated to reduce the overall market growth by approximately xx% annually.

Emerging Opportunities in India Residential Construction Market

Emerging opportunities exist in sustainable building practices, affordable housing projects, smart home integration, and the growth of tier-2 and tier-3 cities. The demand for green buildings and environmentally friendly construction methods presents a significant opportunity for growth.

Leading Players in the India Residential Construction Market Market

- buildAhome

- Ansal API

- Puravankara

- Mahindra Lifespace Developers

- Godrej Properties Limited

- StepsStone Builders

- Delhi Land & Finance

- Merlin Group

- VGN Projects Estates Pvt Ltd

- Prestige Group

Key Developments in India Residential Construction Market Industry

- Jan 2023: Godrej Properties announced a new luxury residential project in Mumbai.

- Mar 2023: Mahindra Lifespace signed a partnership with a technology company to integrate smart home features in new projects.

- Jul 2022: Ansal API launched a new affordable housing project in Delhi NCR. (Further details will be included in the full report)

Future Outlook for India Residential Construction Market Market

The Indian residential construction market is poised for sustained growth over the forecast period, driven by urbanization, economic growth, and government initiatives. Strategic opportunities exist for companies focused on innovation, sustainability, and affordable housing. The market is expected to witness a significant increase in the adoption of prefabricated construction methods and smart home technologies.

India Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

India Residential Construction Market Segmentation By Geography

- 1. India

India Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. Need for Affordable Housing is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 buildAhome

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ansal API

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Puravankara

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mahindra Lifespace

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Godrej Properties Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 StepsStone Builders

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Delhi Land & Finance

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Merlin Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 VGN Projects Estates Pvt Ltd **List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prestige Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 buildAhome

List of Figures

- Figure 1: India Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: India Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: India Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 12: India Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Residential Construction Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the India Residential Construction Market?

Key companies in the market include buildAhome, Ansal API, Puravankara, Mahindra Lifespace, Godrej Properties Limited, StepsStone Builders, Delhi Land & Finance, Merlin Group, VGN Projects Estates Pvt Ltd **List Not Exhaustive, Prestige Group.

3. What are the main segments of the India Residential Construction Market?

The market segments include Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 189.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Need for Affordable Housing is Driving the Market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Residential Construction Market?

To stay informed about further developments, trends, and reports in the India Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence