Key Insights

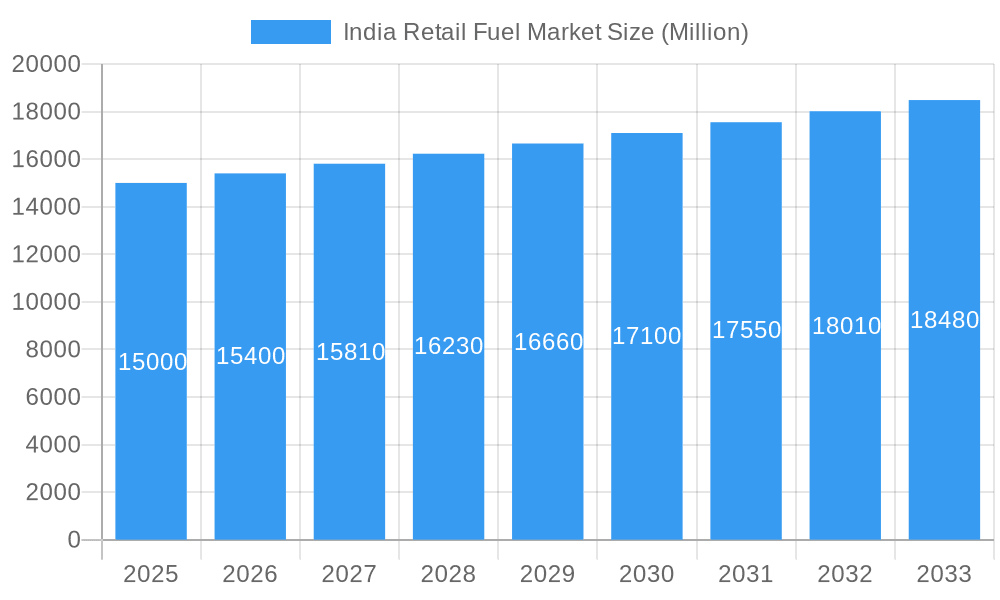

The India retail fuel market, valued at approximately ₹X million in 2025 (assuming a logical estimation based on the provided CAGR and market size), is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 2.62% from 2025 to 2033. This growth is primarily driven by India's expanding economy, increasing vehicle ownership, particularly in burgeoning middle-class segments, and rising industrial activity demanding higher fuel consumption. Government initiatives aimed at infrastructure development and improved transportation networks further contribute to this positive outlook. However, fluctuating global crude oil prices pose a significant challenge, influencing retail fuel prices and impacting consumer spending. The market is segmented by ownership (public sector undertakings and privately owned companies) and end-user (public and private sectors). Key players like Indian Oil Corporation Ltd, Bharat Petroleum Corp Ltd, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Shell PLC, TotalEnergies SA, and Nayara Energy Limited compete intensely within this dynamic landscape. Regional variations exist, with potentially higher growth in regions experiencing rapid urbanization and industrial expansion. The increasing adoption of cleaner fuels and electric vehicles, although presently limited, represents a long-term trend that could moderately influence future market growth.

India Retail Fuel Market Market Size (In Billion)

The market's competitive structure comprises both state-owned and private entities, each with their respective market strategies. Public sector undertakings (PSUs) like Indian Oil, Bharat Petroleum, and Hindustan Petroleum maintain a significant market share due to their extensive distribution networks and established brand recognition. Private players like Reliance Industries and Nayara Energy are increasingly challenging this dominance through aggressive expansion and strategic investments in infrastructure. Future market trends will be significantly impacted by government policies promoting sustainable fuels, the evolving consumer preference for cost-effective and environmentally responsible options, and the increasing penetration of electric vehicles. Analyzing these factors is crucial for stakeholders aiming for strategic planning and successful market positioning within the competitive landscape. Regional variations in growth rates necessitate a nuanced understanding of local market dynamics for effective resource allocation.

India Retail Fuel Market Company Market Share

India Retail Fuel Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India retail fuel market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant players, and future trajectory. The study utilizes a robust methodology, incorporating extensive primary and secondary research to deliver accurate and reliable market estimations. Expect detailed segmentation by ownership (Public Sector Undertakings, Private Owned) and end-user (Public Sector, Private Sector), revealing key trends and growth opportunities.

India Retail Fuel Market Structure & Innovation Trends

This section analyzes the competitive landscape, identifying key players and their market share. We examine the drivers of innovation, regulatory influences, and the role of mergers and acquisitions (M&A) in shaping the market. The report explores the impact of product substitutes and evolving end-user demographics. The analysis includes quantifiable data on market concentration, M&A deal values (in Millions), and emerging trends that redefine the retail fuel sector in India.

- Market Concentration: Analysis of market share held by key players like Indian Oil Corporation Ltd, Hindustan Petroleum Corporation Limited, Bharat Petroleum Corp Ltd, Reliance Industries Limited, Shell PLC, TotalEnergies SA, and Nayara Energy Limited. We will quantify the market share of each player based on revenue in 2024.

- Innovation Drivers: Examination of factors driving innovation, such as the push for cleaner fuels (e.g., E20), technological advancements in fuel delivery and distribution, and government regulations.

- Regulatory Framework: Detailed review of existing and upcoming regulations impacting the market, including those related to fuel quality, environmental standards, and pricing policies.

- Product Substitutes: Assessment of the impact of alternative fuels and energy sources on the traditional retail fuel market.

- End-User Demographics: Analysis of the changing demographics of fuel consumers and their impact on market demand.

- M&A Activity: Review of significant M&A deals in the sector, including deal values (in Millions) and their impact on market structure. (e.g. xx Million in deals in 2024).

India Retail Fuel Market Dynamics & Trends

This section delves into the factors driving market growth, analyzing technological advancements, consumer behavior shifts, and the competitive landscape. We examine the compound annual growth rate (CAGR) and market penetration rates for different fuel types and segments. The analysis will also include forecasts based on market projections for 2025-2033. (Expected CAGR: xx% for 2025-2033).

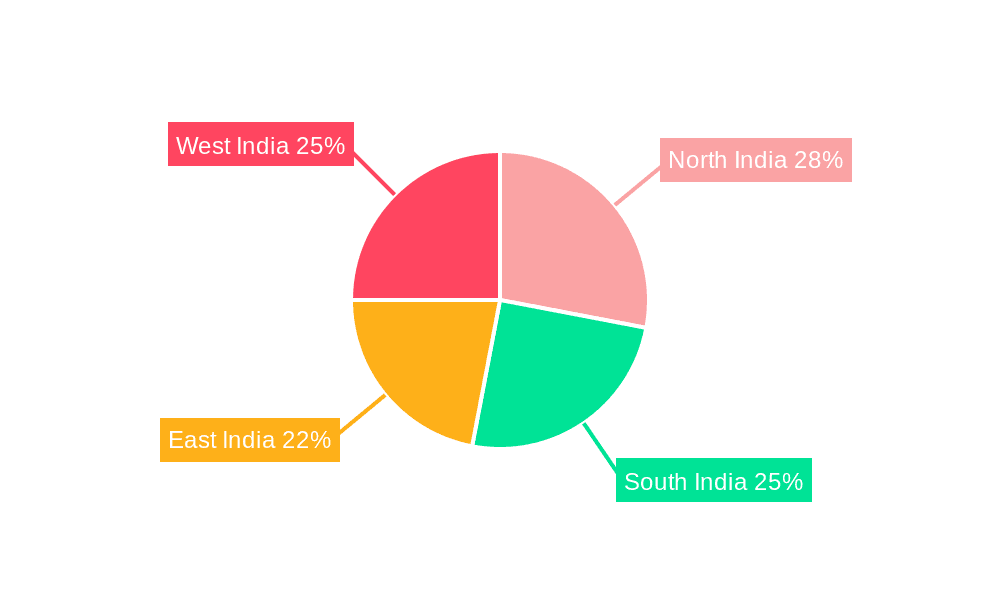

Dominant Regions & Segments in India Retail Fuel Market

This section identifies the leading regions and segments within the India retail fuel market, based on ownership (Public Sector Undertakings, Private Owned) and end-user (Public Sector, Private Sector). The analysis provides a detailed breakdown of market dominance, highlighting key drivers (e.g., economic policies, infrastructure development) contributing to the success of leading regions/segments.

- Public Sector Undertakings (Ownership): Analysis of the market share, growth trajectory, and key performance indicators for public sector companies. This will also detail government policies and infrastructure projects benefiting public-sector dominance.

- Private Owned (Ownership): Analysis of market share, competitive dynamics, and growth potential for privately owned fuel retailers, exploring factors impacting their growth, including private investments, technological adoption and market strategies.

- Public Sector (End-User): Analysis of fuel consumption patterns and market trends, focusing on factors like government procurement policies, infrastructure projects, and budget allocations.

- Private Sector (End-User): Analysis of market share, consumer behaviour, industry demands, and economic factors influencing fuel consumption in the private sector. Growth rates, projected consumption, and factors determining private sector choices will be addressed.

India Retail Fuel Market Product Innovations

This section summarizes the latest developments in fuel technology, focusing on E20 fuel and other advancements, highlighting their competitive advantages and market fit. We will analyze the technological trends impacting product development, including the transition to cleaner fuels and improved distribution technologies.

Report Scope & Segmentation Analysis

This report segments the India retail fuel market by ownership (Public Sector Undertakings and Private Owned) and end-user (Public Sector and Private Sector). Each segment's market size (in Millions), growth projections, and competitive dynamics are detailed. This includes providing projections for market size for each segment in 2025 and 2033 (xx Million in 2025 for Public Sector Undertakings ownership and xx Million in 2033, for example).

Key Drivers of India Retail Fuel Market Growth

This section outlines the key growth drivers for the India retail fuel market, focusing on technological advancements (like E20 adoption), economic factors (like rising disposable incomes), and supportive government policies, along with their impact on market expansion.

Challenges in the India Retail Fuel Market Sector

This section addresses challenges facing the India retail fuel market, including regulatory hurdles, supply chain complexities, and intense competition, analyzing their impact on market growth and profitability. Quantifiable data on the impact of these challenges will be provided where possible (e.g., percentage impact on supply chain efficiency).

Emerging Opportunities in India Retail Fuel Market

This section highlights emerging opportunities, including the growth of electric vehicles and other alternative fuels, alongside potential expansions into new geographic markets and technological advancements.

Leading Players in the India Retail Fuel Market Market

- Shell PLC

- TotalEnergies SA

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Bharat Petroleum Corp Ltd

- Nayara Energy Limited

- Indian Oil Corporation Ltd

Key Developments in India Retail Fuel Market Industry

- December 2022: Indian Oil Corporation (IOCL) partnered with Reliance Jio for SD-WAN connectivity across 7,200 sites.

- February 2023: The Government of India launched E20 fuel across 11 states and union territories, aiming for 20% ethanol blending by 2025.

- February 2023: Jio-bp commenced E20 gasoline sales at select locations.

Future Outlook for India Retail Fuel Market Market

This section provides a future outlook for the India retail fuel market, emphasizing growth potential, strategic opportunities, and the role of technological advancements and government policies in shaping the market’s future. The forecast encompasses the projected market size in 2033 (xx Million), potential for new entrants, and anticipated shifts in market share among existing players.

India Retail Fuel Market Segmentation

-

1. Ownership

- 1.1. Public Sector Undertakings

- 1.2. Private Owned

-

2. End User

- 2.1. Public Sector

- 2.2. Private Sector

India Retail Fuel Market Segmentation By Geography

- 1. India

India Retail Fuel Market Regional Market Share

Geographic Coverage of India Retail Fuel Market

India Retail Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. The Public Sector Undertakings Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Public Sector Undertakings

- 5.1.2. Private Owned

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Public Sector

- 5.2.2. Private Sector

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TotalEnergies SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hindustan Petroleum Corporation Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Reliance Industries Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bharat Petroleum Corp Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nayara Energy Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: India Retail Fuel Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Retail Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: India Retail Fuel Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 2: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2020 & 2033

- Table 3: India Retail Fuel Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2020 & 2033

- Table 5: India Retail Fuel Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: India Retail Fuel Market Volume Metric Tonns Forecast, by Region 2020 & 2033

- Table 7: India Retail Fuel Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 8: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2020 & 2033

- Table 9: India Retail Fuel Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2020 & 2033

- Table 11: India Retail Fuel Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: India Retail Fuel Market Volume Metric Tonns Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail Fuel Market?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the India Retail Fuel Market?

Key companies in the market include Shell PLC, TotalEnergies SA, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Bharat Petroleum Corp Ltd, Nayara Energy Limited, Indian Oil Corporation Ltd.

3. What are the main segments of the India Retail Fuel Market?

The market segments include Ownership, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

The Public Sector Undertakings Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

February 2023: The Government of India announced the launch of E20 fuel across 11 states and union territories at 84 retail outlets in India. The Indian government aims to achieve 20% blending of ethanol with petrol by 2025 in the country. The step was taken to control the environmental emission from conventional fuels and progress towards a greener fuel economy. Oil marketing companies (OMC), including HPCL, have set up plants to accomplish the goal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Metric Tonns.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail Fuel Market?

To stay informed about further developments, trends, and reports in the India Retail Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence