Key Insights

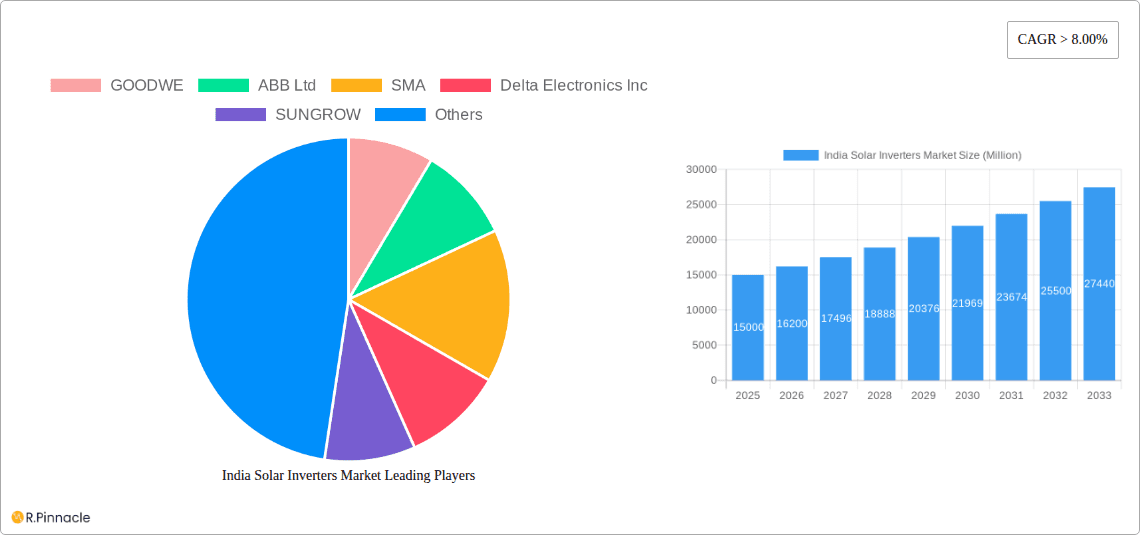

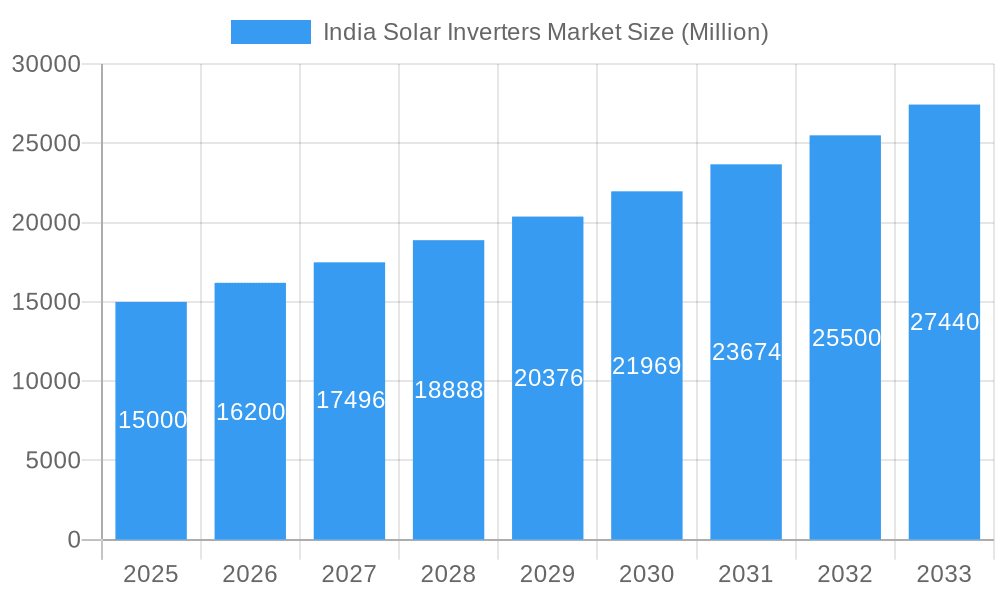

The India solar inverter market is experiencing robust expansion, propelled by the nation's ambitious renewable energy objectives and the escalating adoption of solar photovoltaic (PV) systems across residential, commercial & industrial (C&I), and utility-scale applications. The market, valued at approximately 426.9 million in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.92% between 2025 and 2033. String inverters currently lead market share, attributed to their cost-effectiveness and broad applicability. However, micro-inverters are gaining traction due to superior performance and advanced monitoring capabilities. Key growth drivers include government incentives for solar adoption, declining solar panel costs, and enhanced grid infrastructure. Nevertheless, market expansion faces challenges from regional variations in solar irradiance, complexities in land acquisition for large projects, and intermittent power supply in certain areas. Regional segmentation reveals significant potential across North, South, East, and West India, with growth influenced by local solar adoption rates and governmental support. The C&I segment shows particularly strong growth, driven by the increasing demand for dependable and sustainable power solutions in businesses and industries. Prominent players such as GoodWe, ABB, SMA, Delta, and Sungrow are actively pursuing market dominance through technological innovation and strategic alliances.

India Solar Inverters Market Market Size (In Million)

The forecast period (2025-2033) indicates sustained market expansion, fueled by the growing demand for renewable energy. A preference for more efficient and reliable inverter technologies, complemented by supportive policies and decreasing solar system costs, will continue to drive market growth. Intensifying competition among manufacturers is expected to foster innovation in inverter design and functionality. Strategic partnerships and mergers & acquisitions are also anticipated to significantly shape the Indian solar inverter market landscape. The diverse application segments and regional variations present lucrative opportunities for investment and industry expansion.

India Solar Inverters Market Company Market Share

This comprehensive report offers an in-depth analysis of the India solar inverters market, providing crucial insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a specific focus on the 2025 base year, the report dissects market dynamics, identifies key players, and forecasts future growth potential. Leveraging extensive market research and data analysis, this report delivers actionable intelligence for informed decision-making in this dynamic sector.

India Solar Inverters Market Structure & Innovation Trends

The Indian solar inverter market exhibits a moderately concentrated structure, with key players like GOODWE, ABB Ltd, SMA, Delta Electronics Inc, SUNGROW, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, TMEIC, and Fronius International GmbH holding significant market share. Market share distribution varies across inverter types and applications. Innovation is driven by increasing demand for higher efficiency, grid integration capabilities, and smart functionalities. Government regulations, including those promoting renewable energy adoption, significantly influence market growth. Product substitutes, such as battery storage systems, present both opportunities and challenges. The market has witnessed several mergers and acquisitions (M&A) in recent years, although the precise deal values for the Indian market remain partially undisclosed (estimated at xx Million). End-user demographics show a growing preference for string and micro inverters in the residential sector, while central inverters dominate the utility-scale segment.

- Market Concentration: Moderately concentrated, with top 10 players accounting for approximately xx% of market share.

- Innovation Drivers: Demand for higher efficiency, smart grid integration, and digitalization.

- Regulatory Framework: Government policies favoring renewable energy are driving market expansion.

- Product Substitutes: Battery storage systems pose a competitive threat.

- M&A Activities: Several undisclosed M&A deals impacting market consolidation (estimated value: xx Million).

- End-User Demographics: Residential sector leaning towards string and micro inverters, while utility-scale favoring central inverters.

India Solar Inverters Market Dynamics & Trends

The Indian solar inverter market is experiencing robust growth, driven by factors such as the government's ambitious renewable energy targets, increasing electricity demand, and decreasing solar energy costs. Technological advancements, particularly in areas of efficiency and smart grid integration, are accelerating market expansion. Consumer preferences are shifting towards higher efficiency, reliable, and user-friendly inverters with advanced monitoring capabilities. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of new entrants. The market is anticipated to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with a market penetration of approximately xx% by 2033.

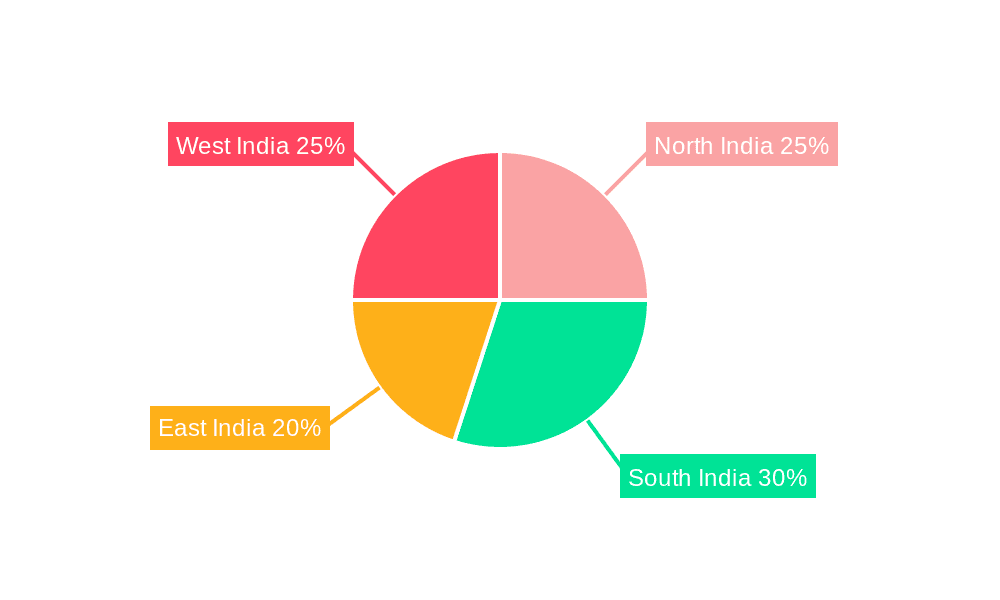

Dominant Regions & Segments in India Solar Inverters Market

The Indian solar inverter market demonstrates strong regional variations. While precise data on regional dominance is not readily available, states with higher solar irradiation and government support for renewable energy projects likely lead in adoption. For example, states such as Gujarat and Rajasthan are emerging as major players. Regarding segments, the utility-scale application currently holds the largest market share, driven by large-scale solar power plant installations. String inverters are currently the dominant inverter type, favored for their cost-effectiveness and suitability across multiple applications. However, the micro-inverter segment is predicted to experience significant growth in the forecast period.

- Key Drivers for Utility-Scale Dominance: Government initiatives promoting large-scale solar power projects, abundant solar resources in certain regions, and economies of scale.

- String Inverter Dominance Drivers: Cost-effectiveness, ease of installation, and suitability for various applications.

- Growth in Micro Inverter Segment: Increasing demand for residential applications, improved reliability, and performance monitoring.

India Solar Inverters Market Product Innovations

Recent innovations focus on enhanced efficiency, improved grid integration capabilities, and advanced monitoring features. Manufacturers are introducing inverters with higher power output, reduced size, and enhanced reliability. These technological advancements are designed to meet the evolving needs of the Indian market, characterized by a diverse range of applications and environmental conditions. For instance, Delta Electronics Inc's new M100A Flex three-phase inverter, launched in April 2022, exemplifies this trend of increased power output and efficiency.

Report Scope & Segmentation Analysis

This report comprehensively segments the India solar inverter market based on inverter type (Central Inverters, String Inverters, Micro Inverters) and application (Residential, Commercial & Industrial (C&I), Utility-scale). Each segment's market size, growth projections, and competitive dynamics are meticulously analyzed. The report projects significant growth across all segments, with the utility-scale application expected to maintain its dominance, while the micro-inverter segment is poised for rapid expansion. Competitive landscapes vary across segments, with different companies specializing in certain inverter types and applications.

Key Drivers of India Solar Inverters Market Growth

The Indian solar inverter market's growth is propelled by several key factors. Government initiatives like the National Solar Mission significantly incentivize solar energy adoption. The declining cost of solar photovoltaic (PV) systems makes solar power increasingly cost-competitive with conventional energy sources. Technological advancements in inverter technology, such as enhanced efficiency and smart grid integration, are further driving market growth. Furthermore, increasing energy demand and the need for cleaner energy sources fuel the demand for solar inverters.

Challenges in the India Solar Inverters Market Sector

Despite the considerable growth potential, the Indian solar inverter market faces some challenges. Supply chain disruptions, particularly concerning raw materials, can impact production and pricing. Regulatory complexities and bureaucratic procedures can hinder project development and deployment. Moreover, intense competition from both domestic and international players creates a competitive landscape. These challenges, if not managed effectively, could potentially impede market expansion.

Emerging Opportunities in India Solar Inverters Market

Significant opportunities exist for expansion within the residential and C&I segments, driven by the growing awareness of renewable energy and government incentives. The integration of battery storage systems with solar inverters presents a key growth opportunity. The development of advanced monitoring and control systems for solar power plants also offers potential. Lastly, exploring innovative financing mechanisms to make solar energy more accessible to a wider range of customers is crucial for growth.

Leading Players in the India Solar Inverters Market Market

Key Developments in India Solar Inverters Market Industry

- March 2022: SUNGROW inaugurated its expanded manufacturing capacity in India, aiming for a 10GW/annum capacity. This significantly boosts domestic supply and caters to growing demand.

- April 2022: Delta launched its new M100A Flex three-phase inverter (15-250kW), enhancing residential and commercial rooftop PV project capabilities. This product launch directly addresses market demand for higher efficiency and wider power range inverters.

Future Outlook for India Solar Inverters Market Market

The Indian solar inverter market is poised for sustained growth, driven by government policies, increasing energy demand, and technological advancements. The market is expected to witness a surge in demand for advanced inverters with enhanced features and improved efficiency. Strategic partnerships, technological innovations, and expansion into untapped market segments will be crucial for companies seeking to capitalize on this growth potential. The focus on smart grid integration and energy storage solutions will further propel market expansion in the coming years.

India Solar Inverters Market Segmentation

-

1. Inverter Type

- 1.1. Central Inverters

- 1.2. String Inverters

- 1.3. Micro Inverters

-

2. Application

- 2.1. Residential

- 2.2. Commercial and Industrial (C&I)

- 2.3. Utility-scale

India Solar Inverters Market Segmentation By Geography

- 1. India

India Solar Inverters Market Regional Market Share

Geographic Coverage of India Solar Inverters Market

India Solar Inverters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Need for Efficient Energy Management Systems4.; Growing Penetration of Renewable Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Privacy Concerns on the Industrial Demand Response Management Systems

- 3.4. Market Trends

- 3.4.1. Central Inverters have dominated the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Inverters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Inverter Type

- 5.1.1. Central Inverters

- 5.1.2. String Inverters

- 5.1.3. Micro Inverters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial (C&I)

- 5.2.3. Utility-scale

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Inverter Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GOODWE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SMA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Electronics Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SUNGROW

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TMEIC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fronius International GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GOODWE

List of Figures

- Figure 1: India Solar Inverters Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Solar Inverters Market Share (%) by Company 2025

List of Tables

- Table 1: India Solar Inverters Market Revenue million Forecast, by Inverter Type 2020 & 2033

- Table 2: India Solar Inverters Market Volume Gigawatt Forecast, by Inverter Type 2020 & 2033

- Table 3: India Solar Inverters Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: India Solar Inverters Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 5: India Solar Inverters Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Solar Inverters Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: India Solar Inverters Market Revenue million Forecast, by Inverter Type 2020 & 2033

- Table 8: India Solar Inverters Market Volume Gigawatt Forecast, by Inverter Type 2020 & 2033

- Table 9: India Solar Inverters Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: India Solar Inverters Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 11: India Solar Inverters Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: India Solar Inverters Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Inverters Market?

The projected CAGR is approximately 7.92%.

2. Which companies are prominent players in the India Solar Inverters Market?

Key companies in the market include GOODWE, ABB Ltd, SMA, Delta Electronics Inc, SUNGROW, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, TMEIC, Fronius International GmbH.

3. What are the main segments of the India Solar Inverters Market?

The market segments include Inverter Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 426.9 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Need for Efficient Energy Management Systems4.; Growing Penetration of Renewable Energy Sources.

6. What are the notable trends driving market growth?

Central Inverters have dominated the market.

7. Are there any restraints impacting market growth?

4.; Privacy Concerns on the Industrial Demand Response Management Systems.

8. Can you provide examples of recent developments in the market?

In March 2022, SUNGROW inaugurated its expanded scale of manufacturing capacity in India. The company established the plant in India in 2018 and, with this expansion, aims to achieve a 10GW/annum capacity. Hence, with the help of this plant, the company could to cater the rising demand for solar inverters from residential, commercial & industrial, and utility-scale Indian and global markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Inverters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Inverters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Inverters Market?

To stay informed about further developments, trends, and reports in the India Solar Inverters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence