Key Insights

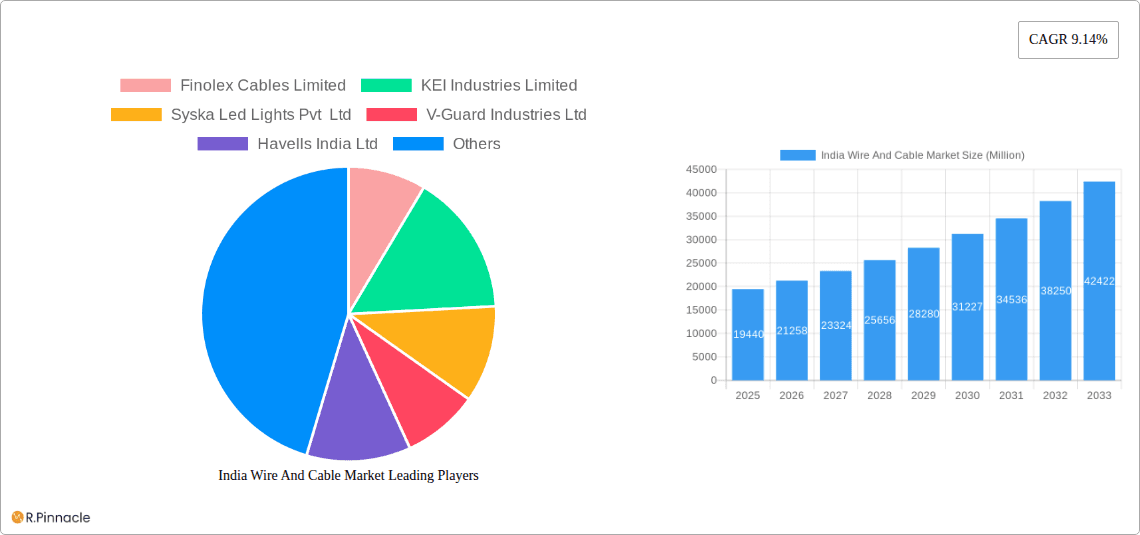

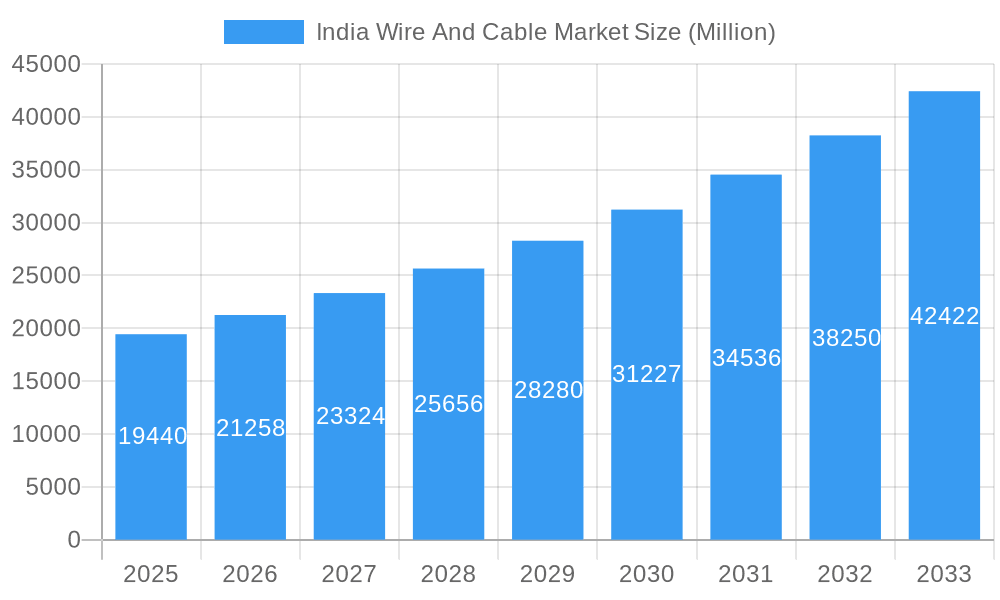

The India wire and cable market, valued at ₹19.44 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 9.14% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning construction sector, encompassing both residential and commercial projects, necessitates a substantial increase in wire and cable demand. Simultaneously, the rapid growth of India's IT and telecommunication infrastructure, coupled with the expansion of energy and power grids, significantly contributes to market growth. Government initiatives promoting infrastructure development further bolster this trend. The increasing adoption of smart homes and smart cities technologies also fuels demand for specialized cables. Segment-wise, power cables (including low, medium, high, and ultra-high voltage variants) constitute a significant portion of the market, followed by housing wires experiencing high demand in states like Maharashtra, Kerala, Gujarat, and Tamil Nadu due to robust real estate activity. The market is dominated by established players such as Finolex Cables Limited, KEI Industries Limited, and Polycab India Limited, yet opportunities remain for new entrants catering to niche segments or specialized applications.

India Wire And Cable Market Market Size (In Billion)

The competitive landscape is characterized by both domestic and international players. While large companies benefit from established distribution networks and brand recognition, smaller companies focus on regional markets or specific product segments. Challenges to market growth include fluctuations in raw material prices (copper and aluminum), stringent regulatory compliance requirements, and potential supply chain disruptions. However, the long-term outlook remains positive, driven by sustained infrastructure development and increasing electrification across various sectors. The market is expected to witness increased adoption of advanced cable technologies, such as fire-resistant and energy-efficient cables, further stimulating growth in the coming years. A focus on sustainable practices and environmentally friendly manufacturing processes will also play a crucial role in shaping the industry's trajectory.

India Wire And Cable Market Company Market Share

India Wire and Cable Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India wire and cable market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The report leverages robust data and analysis to present actionable intelligence on market segmentation, key players, and emerging trends.

India Wire and Cable Market Market Structure & Innovation Trends

The Indian wire and cable market is characterized by a moderately concentrated structure, with major players like Polycab India Limited, Havells India Ltd, Finolex Cables Limited, and KEI Industries Limited holding significant market share. However, numerous smaller players also contribute to the overall market volume. Market concentration is expected to remain relatively stable through 2033, though potential M&A activity could shift the landscape. The overall market size in 2025 is estimated at xx Million. Innovation is driven by the increasing demand for energy-efficient cables, smart grid technologies, and the growing adoption of renewable energy sources. Regulatory frameworks, such as those concerning fire safety and environmental compliance, are increasingly influential. Product substitution is primarily driven by advancements in materials science and the adoption of superior conductor materials and insulation options. End-user demographics are shifting towards increased urbanization and infrastructure development, fuelling demand. M&A activity in the recent past has involved deals valued at approximately xx Million, primarily focused on expanding market reach and product portfolios.

- Market Share: Polycab India: 20%, Havells India: 15%, Finolex Cables: 12%, KEI Industries: 10%, Others: 43% (2025 estimates)

- M&A Deal Values (2019-2024): Approximately xx Million (Average Deal Size: xx Million)

- Innovation Drivers: Energy Efficiency, Smart Grid Technologies, Renewable Energy Integration, Safety Standards.

India Wire and Cable Market Market Dynamics & Trends

The Indian wire and cable market exhibits robust growth, driven by rapid urbanization, infrastructure development, and rising industrialization. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of advanced materials (e.g., high-temperature superconductors) and smart cable technologies, are influencing market dynamics. Consumer preferences are shifting towards energy-efficient and environmentally friendly products. The competitive landscape is characterized by intense price competition and strategic partnerships. Market penetration of advanced cable technologies is increasing gradually, particularly within the commercial and industrial sectors.

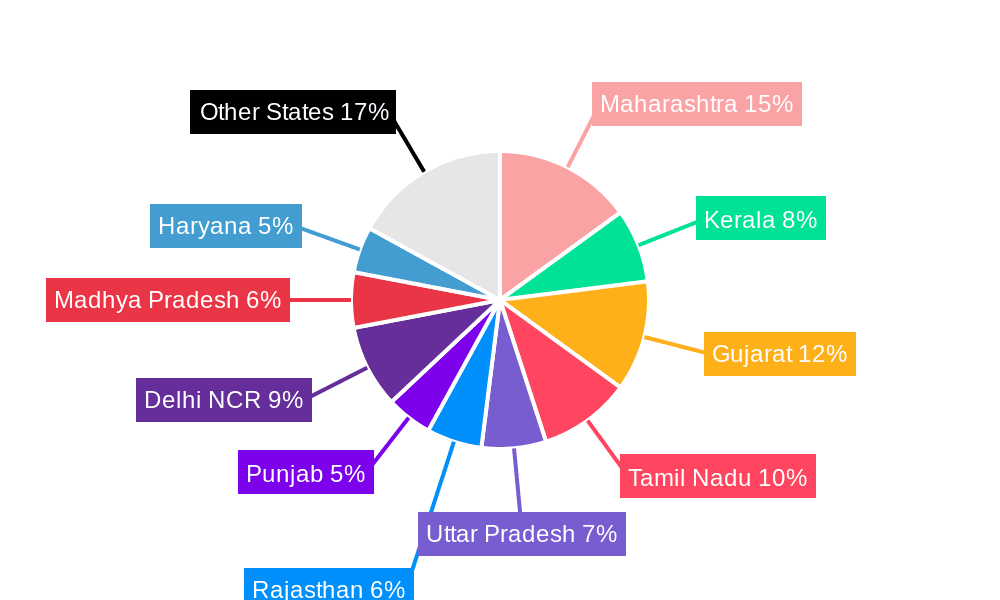

Dominant Regions & Segments in India Wire and Cable Market

The Indian wire and cable market shows significant regional variations in growth. Maharashtra, Gujarat, and Tamil Nadu are leading states in terms of market size and growth due to robust infrastructure development and industrial activity. The power cable segment, particularly Low Voltage (LV) cables, dominates overall market share. However, the demand for Medium Voltage (MV) and High Voltage (HV) cables is witnessing a steady increase with the expansion of grid infrastructure. Within the housing wire segment, 90m housing wire is the most prevalent type. The business-to-business (B2B) segment, especially the construction sector (both residential and commercial), accounts for a majority of the demand.

- Key Drivers (Maharashtra): Industrial Clusters, Infrastructure Development, Government Initiatives

- Key Drivers (Gujarat): Petrochemical Industry, Manufacturing Hubs, Growing Urbanization

- Key Drivers (Tamil Nadu): Automotive Industry, IT Sector, Infrastructure Projects

- Dominant Segment: Power Cables (LV) - xx Million (2025 estimate)

- High Growth Segment: MV and HV Cables (Driven by Grid Modernization)

India Wire and Cable Market Product Innovations

Recent innovations focus on enhancing safety, improving energy efficiency, and reducing environmental impact. Finolex Cables' FinoGreen range, featuring halogen-free and flame-retardant cables, exemplifies this trend. LAPP India's latest offerings at ELASIA 2024 showcase advanced cable technologies for power, data, and industrial ethernet applications. These product developments are tailored to meet stringent safety regulations and growing market demand for sustainable and reliable solutions. The market fit is evident in increased adoption across various end-use sectors.

Report Scope & Segmentation Analysis

This report segments the Indian wire and cable market based on cable type (Power Cables - LV, MV, HV, UHV; Housing Wires - 90m Housing Wire, Other Types; Communication Cables - Instrumentation & Control, Flexible), end-user type (Consumers (B2C), Businesses (B2B) - Construction (Residential & Commercial), IT & Telecommunication, Energy & Power, Oil & Gas, Other End-Users), and key states (Maharashtra, Kerala, Gujarat, Tamil Nadu, Uttar Pradesh, Rajasthan, Punjab, Delhi NCR, Madhya Pradesh, Haryana). Each segment’s growth projection, market size, and competitive dynamics are analyzed in detail.

Power Cables: The power cable segment is projected to grow at a CAGR of xx% during the forecast period. Housing Wires: The demand for 90m housing wire is increasing with the rise of new constructions. Communication Cables: This segment is expected to experience strong growth with the increasing penetration of IT and telecommunications infrastructure. B2B Segment: The construction segment dominates this category. State-wise: Maharashtra is expected to lead, followed by Gujarat and Tamil Nadu.

Key Drivers of India Wire and Cable Market Growth

The Indian wire and cable market’s growth is propelled by several key factors: rapid infrastructure development fueled by government initiatives such as "Make in India"; the booming real estate sector; increased industrial activity, particularly in manufacturing and energy; and rising demand for renewable energy infrastructure. Government regulations emphasizing safety and energy efficiency also contribute significantly.

Challenges in the India Wire and Cable Market Sector

The market faces challenges including intense competition leading to price wars; supply chain disruptions impacting raw material availability and cost; stringent regulatory compliance requirements; and the need for constant technological upgrades to compete effectively. These challenges can affect profit margins and overall market growth.

Emerging Opportunities in India Wire and Cable Market

Emerging opportunities lie in the expanding renewable energy sector, driving demand for specialized cables; the growing adoption of smart grid technologies; and increased demand for advanced cable solutions in infrastructure projects such as high-speed rail and smart cities. Further, the focus on eco-friendly and energy-efficient cables provides a notable opportunity for growth.

Leading Players in the India Wire and Cable Market Market

- Finolex Cables Limited

- KEI Industries Limited

- Syska Led Lights Pvt Ltd

- V-Guard Industries Ltd

- Havells India Ltd

- Polycab India Limited

- R R Kabel Ltd

- Panasonic

- Plaza Wires & Cable

Key Developments in India Wire and Cable Market Industry

- April 2024: Finolex Cables launched FinoGreen, a line of eco-friendly, halogen-free, and flame-retardant industrial cables.

- May 2024: LAPP India unveiled new offerings at ELASIA 2024, including OLFLEX, UNITRONIC, and ETHERLINE cables and accessories.

Future Outlook for India Wire and Cable Market Market

The Indian wire and cable market is poised for substantial growth, driven by sustained infrastructure development, government initiatives promoting renewable energy, and rising consumer demand for high-quality, energy-efficient cables. Strategic partnerships, technological innovation, and expansion into new market segments will be crucial for success in this dynamic market. The market is expected to maintain a healthy growth trajectory for the foreseeable future.

India Wire And Cable Market Segmentation

-

1. Cable Type

-

1.1. Power Cable (by subtypes)

- 1.1.1. Low Voltage (LV)

- 1.1.2. Medium Voltage (MV)

- 1.1.3. High Voltage (HV) and Ultra High Voltage

-

1.2. Housing Wires

- 1.2.1. 90m Housing Wire

- 1.2.2. Other Ty

-

1.3. Communic

- 1.3.1. Instrumentation and Control Cable

- 1.3.2. Flexible

-

1.1. Power Cable (by subtypes)

-

2. End-user Type

- 2.1. Consumers (B2C)

-

2.2. Businesses (B2B)

- 2.2.1. Construction (Residential and Commercial)

- 2.2.2. IT and Telecommunication

- 2.2.3. Energy and Power

- 2.2.4. Oil and Gas

- 2.2.5. Other En

-

3. India Housing Wire Market State***

- 3.1. Maharashtra

- 3.2. Kerala

- 3.3. Gujarat

- 3.4. Tamil Nadu

- 3.5. Uttar Pradesh

- 3.6. Rajasthan

- 3.7. Punjab

- 3.8. Delhi NCR

- 3.9. Madhya Pradesh

- 3.10. Haryana

India Wire And Cable Market Segmentation By Geography

- 1. India

India Wire And Cable Market Regional Market Share

Geographic Coverage of India Wire And Cable Market

India Wire And Cable Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from the Construction and Housing Sector; Increasing Demand from Renewable Power Generation Sector; Growing Adoption in the Telecommunications Industry

- 3.3. Market Restrains

- 3.3.1. Rising Demand from the Construction and Housing Sector; Increasing Demand from Renewable Power Generation Sector; Growing Adoption in the Telecommunications Industry

- 3.4. Market Trends

- 3.4.1. Growing Demand for Housing Wire in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Wire And Cable Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Power Cable (by subtypes)

- 5.1.1.1. Low Voltage (LV)

- 5.1.1.2. Medium Voltage (MV)

- 5.1.1.3. High Voltage (HV) and Ultra High Voltage

- 5.1.2. Housing Wires

- 5.1.2.1. 90m Housing Wire

- 5.1.2.2. Other Ty

- 5.1.3. Communic

- 5.1.3.1. Instrumentation and Control Cable

- 5.1.3.2. Flexible

- 5.1.1. Power Cable (by subtypes)

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Consumers (B2C)

- 5.2.2. Businesses (B2B)

- 5.2.2.1. Construction (Residential and Commercial)

- 5.2.2.2. IT and Telecommunication

- 5.2.2.3. Energy and Power

- 5.2.2.4. Oil and Gas

- 5.2.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by India Housing Wire Market State***

- 5.3.1. Maharashtra

- 5.3.2. Kerala

- 5.3.3. Gujarat

- 5.3.4. Tamil Nadu

- 5.3.5. Uttar Pradesh

- 5.3.6. Rajasthan

- 5.3.7. Punjab

- 5.3.8. Delhi NCR

- 5.3.9. Madhya Pradesh

- 5.3.10. Haryana

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Finolex Cables Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KEI Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Syska Led Lights Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 V-Guard Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Havells India Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Polycab India Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 R R Kabel Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Panasonic

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plaza Wires & Cable

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Finolex Cables Limited

List of Figures

- Figure 1: India Wire And Cable Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Wire And Cable Market Share (%) by Company 2025

List of Tables

- Table 1: India Wire And Cable Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 2: India Wire And Cable Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 3: India Wire And Cable Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 4: India Wire And Cable Market Volume Billion Forecast, by End-user Type 2020 & 2033

- Table 5: India Wire And Cable Market Revenue Million Forecast, by India Housing Wire Market State*** 2020 & 2033

- Table 6: India Wire And Cable Market Volume Billion Forecast, by India Housing Wire Market State*** 2020 & 2033

- Table 7: India Wire And Cable Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Wire And Cable Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Wire And Cable Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 10: India Wire And Cable Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 11: India Wire And Cable Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 12: India Wire And Cable Market Volume Billion Forecast, by End-user Type 2020 & 2033

- Table 13: India Wire And Cable Market Revenue Million Forecast, by India Housing Wire Market State*** 2020 & 2033

- Table 14: India Wire And Cable Market Volume Billion Forecast, by India Housing Wire Market State*** 2020 & 2033

- Table 15: India Wire And Cable Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Wire And Cable Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Wire And Cable Market?

The projected CAGR is approximately 9.14%.

2. Which companies are prominent players in the India Wire And Cable Market?

Key companies in the market include Finolex Cables Limited, KEI Industries Limited, Syska Led Lights Pvt Ltd, V-Guard Industries Ltd, Havells India Ltd, Polycab India Limited, R R Kabel Ltd, Panasonic, Plaza Wires & Cable.

3. What are the main segments of the India Wire And Cable Market?

The market segments include Cable Type, End-user Type, India Housing Wire Market State***.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from the Construction and Housing Sector; Increasing Demand from Renewable Power Generation Sector; Growing Adoption in the Telecommunications Industry.

6. What are the notable trends driving market growth?

Growing Demand for Housing Wire in India.

7. Are there any restraints impacting market growth?

Rising Demand from the Construction and Housing Sector; Increasing Demand from Renewable Power Generation Sector; Growing Adoption in the Telecommunications Industry.

8. Can you provide examples of recent developments in the market?

May 2024: LAPP India, a company that provides cable and connectivity solutions, unveiled its latest offerings at ELASIA 2024. This launch spotlights its renowned brand offerings, which include OLFLEX power and control cables, UNITRONIC data and communication cables, and ETHERLINE industrial ethernet cables. Additionally, LAPP will exhibit a range of complementary accessories, including glands, conduits, and connectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Wire And Cable Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Wire And Cable Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Wire And Cable Market?

To stay informed about further developments, trends, and reports in the India Wire And Cable Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence